How Point-of-care Devices Revolutionize Blood Glucose Measures

SEP 19, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Point-of-care Glucose Monitoring Evolution and Objectives

Point-of-care (POC) glucose monitoring technology has undergone remarkable evolution since its inception in the 1960s. The journey began with rudimentary urine glucose testing strips, which provided only semi-quantitative results with limited accuracy. The 1970s marked a significant breakthrough with the introduction of the first portable blood glucose meters, though these early devices were bulky, expensive, and required relatively large blood samples.

The 1980s and 1990s witnessed rapid technological advancement with the miniaturization of devices, reduction in required blood volume, and improved accuracy. This period also saw the emergence of electrochemical sensing technologies that replaced earlier colorimetric methods, significantly enhancing precision and reliability of measurements.

The early 2000s brought revolutionary changes with the introduction of continuous glucose monitoring (CGM) systems, allowing patients to track glucose levels in real-time throughout the day. This represented a paradigm shift from discrete measurements to continuous monitoring, providing unprecedented insights into glucose fluctuations and trends.

Recent years have seen the integration of POC glucose monitoring with digital health ecosystems. Modern devices now feature wireless connectivity, smartphone integration, and cloud-based data management, enabling comprehensive diabetes management platforms that facilitate data sharing with healthcare providers and automated decision support.

The primary objectives of contemporary POC glucose monitoring technology development are multifaceted. First, there is a continued push toward non-invasive or minimally invasive monitoring methods to reduce patient discomfort and increase adherence. Second, improving accuracy and reliability across diverse patient populations and clinical scenarios remains paramount, particularly in critical care settings where precision is essential.

Another key objective is enhancing accessibility and affordability, especially in resource-limited settings and developing countries where diabetes prevalence is rising rapidly but healthcare infrastructure may be limited. The development of cost-effective, robust, and user-friendly devices suitable for these environments represents a significant focus area.

Integration with artificial intelligence and machine learning algorithms constitutes another important goal, enabling predictive analytics for hypoglycemia prevention and personalized treatment optimization. Additionally, there is growing emphasis on developing closed-loop systems that combine glucose monitoring with automated insulin delivery, moving toward the concept of an "artificial pancreas."

The ultimate aim of these technological advancements is to transform diabetes management from a reactive to a proactive approach, empowering patients with tools that not only measure glucose levels but provide actionable insights for improved health outcomes and quality of life.

The 1980s and 1990s witnessed rapid technological advancement with the miniaturization of devices, reduction in required blood volume, and improved accuracy. This period also saw the emergence of electrochemical sensing technologies that replaced earlier colorimetric methods, significantly enhancing precision and reliability of measurements.

The early 2000s brought revolutionary changes with the introduction of continuous glucose monitoring (CGM) systems, allowing patients to track glucose levels in real-time throughout the day. This represented a paradigm shift from discrete measurements to continuous monitoring, providing unprecedented insights into glucose fluctuations and trends.

Recent years have seen the integration of POC glucose monitoring with digital health ecosystems. Modern devices now feature wireless connectivity, smartphone integration, and cloud-based data management, enabling comprehensive diabetes management platforms that facilitate data sharing with healthcare providers and automated decision support.

The primary objectives of contemporary POC glucose monitoring technology development are multifaceted. First, there is a continued push toward non-invasive or minimally invasive monitoring methods to reduce patient discomfort and increase adherence. Second, improving accuracy and reliability across diverse patient populations and clinical scenarios remains paramount, particularly in critical care settings where precision is essential.

Another key objective is enhancing accessibility and affordability, especially in resource-limited settings and developing countries where diabetes prevalence is rising rapidly but healthcare infrastructure may be limited. The development of cost-effective, robust, and user-friendly devices suitable for these environments represents a significant focus area.

Integration with artificial intelligence and machine learning algorithms constitutes another important goal, enabling predictive analytics for hypoglycemia prevention and personalized treatment optimization. Additionally, there is growing emphasis on developing closed-loop systems that combine glucose monitoring with automated insulin delivery, moving toward the concept of an "artificial pancreas."

The ultimate aim of these technological advancements is to transform diabetes management from a reactive to a proactive approach, empowering patients with tools that not only measure glucose levels but provide actionable insights for improved health outcomes and quality of life.

Market Analysis of Portable Blood Glucose Monitoring Solutions

The global market for portable blood glucose monitoring solutions has experienced substantial growth over the past decade, driven primarily by the increasing prevalence of diabetes worldwide. According to the International Diabetes Federation, approximately 537 million adults were living with diabetes in 2021, with projections suggesting this number could rise to 643 million by 2030. This growing patient population creates a significant and expanding market for blood glucose monitoring technologies.

The portable blood glucose monitoring market was valued at around $15.5 billion in 2022 and is projected to reach $25.7 billion by 2028, growing at a CAGR of 8.8% during the forecast period. North America currently holds the largest market share at approximately 39%, followed by Europe at 28% and Asia-Pacific at 24%, with the latter showing the fastest growth trajectory due to increasing diabetes prevalence and improving healthcare infrastructure.

Consumer demand is increasingly shifting toward non-invasive or minimally invasive monitoring solutions that offer convenience, accuracy, and connectivity features. Market research indicates that over 70% of diabetes patients express interest in devices that reduce the pain and inconvenience associated with traditional finger-prick methods. This has spurred innovation in continuous glucose monitoring (CGM) systems, which now represent the fastest-growing segment within the portable monitoring market.

The COVID-19 pandemic has accelerated the adoption of remote patient monitoring solutions, with telehealth consultations for diabetes management increasing by over 150% since 2019. This trend has created new opportunities for connected glucose monitoring devices that can seamlessly integrate with telehealth platforms and electronic health records.

Price sensitivity remains a significant factor influencing market dynamics, particularly in emerging economies. While premium devices with advanced features command higher prices in developed markets, there is substantial demand for affordable monitoring solutions in developing regions. The average selling price of basic glucose meters has decreased by approximately 30% over the past five years due to increased competition and manufacturing efficiencies.

Reimbursement policies significantly impact market penetration rates across different regions. Countries with comprehensive coverage for diabetes management tools show adoption rates nearly three times higher than those with limited coverage. Recent policy changes in major markets like the United States, Germany, and Japan have expanded coverage for continuous monitoring systems, driving their accelerated adoption.

The competitive landscape is characterized by both established medical device manufacturers and technology-focused startups. Market consolidation has been evident, with 14 significant mergers and acquisitions occurring in this space over the past three years as companies seek to expand their product portfolios and technological capabilities.

The portable blood glucose monitoring market was valued at around $15.5 billion in 2022 and is projected to reach $25.7 billion by 2028, growing at a CAGR of 8.8% during the forecast period. North America currently holds the largest market share at approximately 39%, followed by Europe at 28% and Asia-Pacific at 24%, with the latter showing the fastest growth trajectory due to increasing diabetes prevalence and improving healthcare infrastructure.

Consumer demand is increasingly shifting toward non-invasive or minimally invasive monitoring solutions that offer convenience, accuracy, and connectivity features. Market research indicates that over 70% of diabetes patients express interest in devices that reduce the pain and inconvenience associated with traditional finger-prick methods. This has spurred innovation in continuous glucose monitoring (CGM) systems, which now represent the fastest-growing segment within the portable monitoring market.

The COVID-19 pandemic has accelerated the adoption of remote patient monitoring solutions, with telehealth consultations for diabetes management increasing by over 150% since 2019. This trend has created new opportunities for connected glucose monitoring devices that can seamlessly integrate with telehealth platforms and electronic health records.

Price sensitivity remains a significant factor influencing market dynamics, particularly in emerging economies. While premium devices with advanced features command higher prices in developed markets, there is substantial demand for affordable monitoring solutions in developing regions. The average selling price of basic glucose meters has decreased by approximately 30% over the past five years due to increased competition and manufacturing efficiencies.

Reimbursement policies significantly impact market penetration rates across different regions. Countries with comprehensive coverage for diabetes management tools show adoption rates nearly three times higher than those with limited coverage. Recent policy changes in major markets like the United States, Germany, and Japan have expanded coverage for continuous monitoring systems, driving their accelerated adoption.

The competitive landscape is characterized by both established medical device manufacturers and technology-focused startups. Market consolidation has been evident, with 14 significant mergers and acquisitions occurring in this space over the past three years as companies seek to expand their product portfolios and technological capabilities.

Current Technological Landscape and Barriers in Glucose Testing

The global blood glucose monitoring market has witnessed significant technological evolution over the past decade, transitioning from traditional laboratory-based testing to advanced point-of-care (POC) devices. Currently, the technological landscape encompasses several categories including traditional glucometers, continuous glucose monitoring (CGM) systems, non-invasive glucose monitors, and smartphone-integrated solutions. Traditional glucometers remain the most widely used technology due to their affordability and established reliability, though they require regular finger pricking which presents user compliance challenges.

CGM systems represent the cutting edge of current technology, offering real-time glucose monitoring through subcutaneous sensors that measure interstitial fluid glucose levels. Major players like Dexcom, Abbott, and Medtronic have developed systems capable of providing readings every 5-15 minutes for up to 14 days without calibration. These systems typically connect to smartphones via Bluetooth, enabling data tracking and pattern recognition.

Despite these advances, significant technological barriers persist in glucose testing. Accuracy remains a primary concern, with many POC devices still exhibiting variability in results compared to laboratory standards. Environmental factors such as temperature, humidity, and altitude can affect measurement accuracy, particularly in non-controlled settings where POC devices are typically used.

Invasiveness continues to be a major barrier to patient compliance. Even with improvements in lancet technology, the discomfort associated with blood sampling discourages regular testing. While truly non-invasive technologies are under development, including optical methods, thermal spectroscopy, and dielectric spectroscopy, none have yet achieved the reliability necessary for clinical adoption.

Battery life and device durability present additional challenges, particularly for continuous monitoring systems that must function reliably for extended periods. The miniaturization of components while maintaining accuracy and power efficiency remains technically challenging.

Data integration and interoperability issues also hinder the full potential of POC glucose devices. Many systems operate within proprietary ecosystems, limiting data sharing between healthcare providers and across different monitoring platforms. This fragmentation impedes comprehensive patient care and limits the potential for big data analytics in diabetes management.

Cost barriers remain significant, particularly for advanced technologies like CGM systems. While traditional glucometers are relatively affordable, the recurring costs of test strips create financial burden for many patients. CGM sensors, which typically require replacement every 7-14 days, represent a substantial ongoing expense that limits accessibility, especially in resource-constrained settings.

CGM systems represent the cutting edge of current technology, offering real-time glucose monitoring through subcutaneous sensors that measure interstitial fluid glucose levels. Major players like Dexcom, Abbott, and Medtronic have developed systems capable of providing readings every 5-15 minutes for up to 14 days without calibration. These systems typically connect to smartphones via Bluetooth, enabling data tracking and pattern recognition.

Despite these advances, significant technological barriers persist in glucose testing. Accuracy remains a primary concern, with many POC devices still exhibiting variability in results compared to laboratory standards. Environmental factors such as temperature, humidity, and altitude can affect measurement accuracy, particularly in non-controlled settings where POC devices are typically used.

Invasiveness continues to be a major barrier to patient compliance. Even with improvements in lancet technology, the discomfort associated with blood sampling discourages regular testing. While truly non-invasive technologies are under development, including optical methods, thermal spectroscopy, and dielectric spectroscopy, none have yet achieved the reliability necessary for clinical adoption.

Battery life and device durability present additional challenges, particularly for continuous monitoring systems that must function reliably for extended periods. The miniaturization of components while maintaining accuracy and power efficiency remains technically challenging.

Data integration and interoperability issues also hinder the full potential of POC glucose devices. Many systems operate within proprietary ecosystems, limiting data sharing between healthcare providers and across different monitoring platforms. This fragmentation impedes comprehensive patient care and limits the potential for big data analytics in diabetes management.

Cost barriers remain significant, particularly for advanced technologies like CGM systems. While traditional glucometers are relatively affordable, the recurring costs of test strips create financial burden for many patients. CGM sensors, which typically require replacement every 7-14 days, represent a substantial ongoing expense that limits accessibility, especially in resource-constrained settings.

Contemporary Point-of-care Glucose Testing Methodologies

01 Electrochemical glucose sensing technologies

These point-of-care devices utilize electrochemical principles to measure blood glucose levels. They typically involve test strips with electrodes that react with glucose in blood samples, generating electrical signals proportional to glucose concentration. These technologies offer rapid results and are commonly used in portable glucose meters for diabetic patients to monitor their blood sugar levels at home or on-the-go.- Electrochemical glucose sensing technologies: Electrochemical sensors are widely used in point-of-care blood glucose monitoring devices. These sensors utilize enzymatic reactions, typically with glucose oxidase, to generate electrical signals proportional to glucose concentration. The technology enables rapid, accurate measurements with minimal blood sample volumes, making them suitable for home use and clinical settings. Advanced electrochemical sensors incorporate error correction mechanisms and can interface with digital systems for data management.

- Optical and spectroscopic glucose measurement systems: Optical technologies for blood glucose measurement utilize light interactions with blood samples to determine glucose levels. These include colorimetric methods, infrared spectroscopy, and fluorescence techniques. Some devices use reagent strips that change color proportionally to glucose concentration, while others employ non-invasive or minimally invasive approaches using light transmission through tissue. These systems offer advantages in terms of reduced pain and infection risk compared to traditional blood sampling methods.

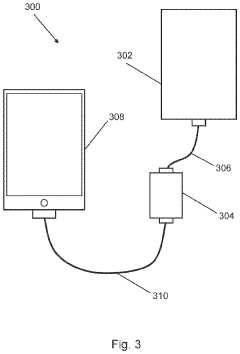

- Integrated data management and connectivity features: Modern point-of-care glucose monitoring devices incorporate advanced data management capabilities and connectivity features. These systems can wirelessly transmit measurement data to smartphones, cloud platforms, or healthcare provider systems. They enable trend analysis, alert generation for abnormal readings, and integration with electronic health records. Some devices include machine learning algorithms to predict glucose trends and provide personalized insights, improving diabetes management through continuous monitoring and data-driven interventions.

- Miniaturized and wearable glucose monitoring systems: Miniaturization technologies have enabled the development of compact, wearable, and implantable glucose monitoring systems. These devices feature microfabricated sensors, microfluidic components, and miniaturized electronics that allow for continuous or semi-continuous glucose monitoring with minimal user intervention. Wearable systems can be attached to the skin or incorporated into accessories like watches, while implantable sensors can remain in the subcutaneous tissue for extended periods, providing real-time glucose data without frequent blood sampling.

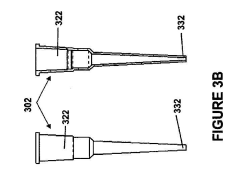

- Sample acquisition and processing innovations: Innovations in blood sample acquisition and processing have significantly improved point-of-care glucose testing. These include minimally invasive sampling techniques, microfluidic channels for precise sample handling, and advanced sample preparation methods that reduce interference from other blood components. Some systems require extremely small blood volumes (less than 1 microliter), while others incorporate alternative sampling sites or completely non-invasive approaches. These innovations enhance user comfort, improve measurement accuracy, and reduce the barriers to regular glucose monitoring.

02 Optical and spectroscopic glucose measurement systems

These systems employ various optical techniques such as infrared spectroscopy, Raman spectroscopy, or photometric analysis to measure blood glucose non-invasively or with minimal sample volumes. The technology works by analyzing how light interacts with blood or interstitial fluid, detecting changes in absorption, reflection, or scattering patterns that correlate with glucose concentration. These methods aim to reduce the pain and inconvenience associated with traditional finger-prick testing.Expand Specific Solutions03 Integrated glucose monitoring and data management solutions

These point-of-care systems combine glucose measurement capabilities with advanced data management features. They include software applications that track glucose trends over time, provide analytics, enable remote monitoring, and facilitate data sharing with healthcare providers. Some systems incorporate wireless connectivity, cloud storage, and smartphone integration to improve diabetes management through comprehensive data analysis and personalized insights.Expand Specific Solutions04 Continuous glucose monitoring (CGM) technologies

These advanced point-of-care devices provide real-time, continuous measurement of glucose levels throughout the day and night. They typically use small sensors inserted under the skin to measure glucose in interstitial fluid at regular intervals. The data is transmitted to receivers or smartphones, allowing users to track glucose trends and receive alerts for high or low levels. CGM systems reduce the need for frequent finger pricks and provide more comprehensive glucose data for improved diabetes management.Expand Specific Solutions05 Miniaturized and wearable glucose monitoring devices

These innovative point-of-care solutions focus on miniaturization and wearability to improve user convenience and compliance. They include patch-type sensors, implantable micro-sensors, and other form factors designed for discreet, continuous use. These devices often incorporate advanced materials, microfluidics, and microfabrication techniques to achieve smaller sizes while maintaining measurement accuracy. The wearable nature of these devices allows for more consistent monitoring with minimal disruption to daily activities.Expand Specific Solutions

Leading Manufacturers and Competitive Dynamics in POC Glucose Market

The point-of-care blood glucose monitoring market is currently in a mature growth phase with significant innovation momentum. The global market size is estimated to exceed $15 billion, driven by the increasing prevalence of diabetes and demand for immediate diagnostic results. Major players like F. Hoffmann-La Roche, Abbott Point of Care, and Siemens Healthcare Diagnostics dominate with established technologies, while companies such as ARKRAY and Polymer Technology Systems offer specialized solutions. Emerging competitors including ReLIA Bioengineering and Calmark Sweden are introducing disruptive innovations. The technology has reached high maturity in traditional glucose monitoring, but is evolving rapidly in continuous monitoring systems and smartphone integration. Academic institutions like Indian Institute of Science and University of Minho are contributing breakthrough research, pushing the boundaries of miniaturization, accuracy, and connectivity in next-generation devices.

F. Hoffmann-La Roche Ltd.

Technical Solution: Roche has developed the Accu-Chek line of blood glucose monitoring systems that incorporate electrochemical biosensor technology. Their latest innovations include dynamic electrochemistry that analyzes the blood sample at multiple points, compensating for environmental factors and sample variations. The systems utilize advanced test strips with gold and palladium electrodes that require minimal blood volume (as little as 0.6 μL) and provide results in approximately 5 seconds. Roche has also integrated Bluetooth connectivity in their devices, allowing seamless data transfer to smartphones and healthcare provider systems for improved diabetes management. Their continuous glucose monitoring solutions incorporate enzyme-based sensors with extended wear time (up to 14 days) and automatic calibration algorithms that reduce the need for fingerstick calibrations[1][3].

Strengths: Extensive market presence with established distribution networks; advanced electrochemical sensing technology with high accuracy; comprehensive ecosystem of connected devices and data management solutions. Weaknesses: Higher cost compared to some competitors; some models still require more blood volume than the most advanced competitors; limited integration with non-Roche insulin delivery systems.

ARKRAY, Inc.

Technical Solution: ARKRAY has pioneered the development of point-of-care glucose monitoring systems utilizing proprietary enzyme electrode technology. Their flagship devices employ a unique multi-layer test strip design that separates plasma from whole blood, eliminating interference from cellular components. ARKRAY's systems incorporate automatic environmental compensation algorithms that adjust for temperature, humidity, and altitude variations to maintain measurement accuracy. The company has developed specialized Gold-Drop technology that precisely controls the deposition of enzyme and mediator compounds on test strips, ensuring consistent electron transfer and signal generation. Their latest innovations include devices with automatic coding, strip ejection mechanisms for hygienic handling, and specialized testing modes for alternative site testing. ARKRAY has also introduced connectivity solutions that enable seamless data transfer to electronic health records and diabetes management applications[2][5].

Strengths: Specialized focus on diabetes care with strong R&D capabilities; innovative test strip manufacturing processes ensuring high consistency; devices optimized for elderly and visually impaired users with large displays and audible feedback. Weaknesses: Smaller global market share compared to industry leaders; limited product diversification beyond glucose monitoring; fewer connected device options compared to some competitors.

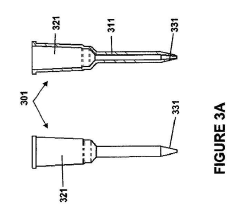

Key Innovations in Minimally Invasive Glucose Sensing

Apparatus and method for biomarker detection

PatentActiveUS20230160850A1

Innovation

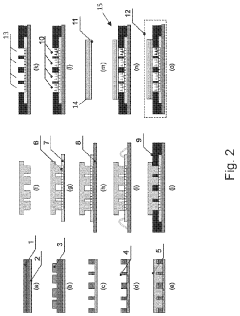

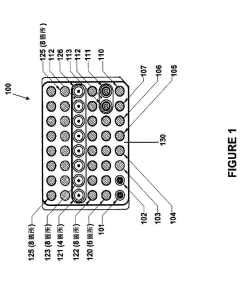

- A CMOS-based chip is used to generate independent detection signals from a reaction zone that includes a test region sensitive to biomarkers, a positive control region with a pre-loaded biomarker, and a negative control region not sensitive to biomarkers, allowing for improved detection accuracy and reliability through simultaneous analysis.

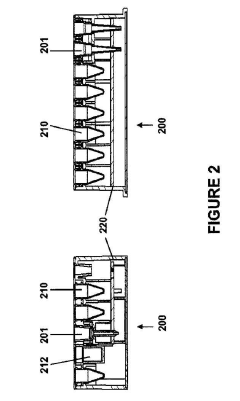

Modular point-of-care devices and uses thereof

PatentInactiveJP2023181301A

Innovation

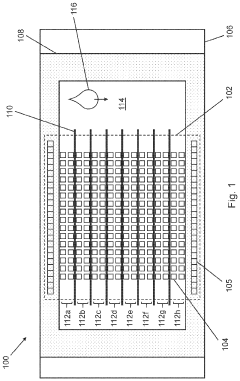

- A modular cartridge design with addressable assay and reagent units, allowing for customizable POC devices that can perform multiple assays on small sample volumes, featuring a sample collection unit, array of assay units, and reagent units that are calibrated and movable for chemical reactions, along with a fluid transfer device and detection assembly for automated analyte detection.

Regulatory Framework for Point-of-care Diagnostic Devices

The regulatory landscape for point-of-care diagnostic devices, particularly those measuring blood glucose, has evolved significantly to ensure patient safety while enabling technological innovation. In the United States, the Food and Drug Administration (FDA) classifies most blood glucose monitoring systems as Class II medical devices, requiring premarket notification (510(k)) clearance. These devices must demonstrate substantial equivalence to legally marketed devices and comply with special controls including performance standards and post-market surveillance requirements.

The European Union regulates these devices under the In Vitro Diagnostic Regulation (IVDR), which replaced the previous In Vitro Diagnostic Directive (IVDD) with a transition period ending in 2022. The IVDR introduced more stringent requirements for clinical evidence, risk classification, and post-market surveillance. Blood glucose monitoring systems typically fall under Class B or C, depending on their intended use and risk profile.

In Asia, regulatory frameworks vary significantly. Japan's Pharmaceuticals and Medical Devices Agency (PMDA) implements a classification system similar to the FDA but with unique requirements for foreign manufacturers. China's National Medical Products Administration (NMPA) has recently strengthened its regulatory oversight, requiring extensive clinical validation and local testing for imported devices.

International standards play a crucial role in harmonizing regulatory requirements across regions. ISO 15197:2013 specifically addresses requirements for blood glucose monitoring systems for self-testing, setting performance criteria for accuracy. The standard stipulates that 95% of measurements must fall within ±15 mg/dL of the reference method for glucose concentrations <100 mg/dL and within ±15% for concentrations ≥100 mg/dL.

Regulatory bodies are increasingly addressing the challenges posed by digital health integration. Connected glucose monitors that transmit data to smartphones or cloud platforms face additional regulatory scrutiny regarding cybersecurity, data privacy, and software validation. The FDA's Digital Health Innovation Action Plan and the EU's Medical Device Coordination Group (MDCG) guidance documents provide frameworks for evaluating these aspects.

Emerging regulatory considerations include the validation of artificial intelligence algorithms in glucose prediction models and interoperability standards for device communication within healthcare ecosystems. Regulatory agencies are also developing frameworks for continuous glucose monitoring systems that differ fundamentally from traditional point-of-care testing in their measurement methodologies and use patterns.

For manufacturers, navigating this complex regulatory landscape requires strategic planning and substantial resources. The average time to market varies significantly by region: approximately 3-6 months for 510(k) clearance in the US, 6-12 months under the EU's IVDR, and potentially longer in emerging markets with evolving regulatory systems.

The European Union regulates these devices under the In Vitro Diagnostic Regulation (IVDR), which replaced the previous In Vitro Diagnostic Directive (IVDD) with a transition period ending in 2022. The IVDR introduced more stringent requirements for clinical evidence, risk classification, and post-market surveillance. Blood glucose monitoring systems typically fall under Class B or C, depending on their intended use and risk profile.

In Asia, regulatory frameworks vary significantly. Japan's Pharmaceuticals and Medical Devices Agency (PMDA) implements a classification system similar to the FDA but with unique requirements for foreign manufacturers. China's National Medical Products Administration (NMPA) has recently strengthened its regulatory oversight, requiring extensive clinical validation and local testing for imported devices.

International standards play a crucial role in harmonizing regulatory requirements across regions. ISO 15197:2013 specifically addresses requirements for blood glucose monitoring systems for self-testing, setting performance criteria for accuracy. The standard stipulates that 95% of measurements must fall within ±15 mg/dL of the reference method for glucose concentrations <100 mg/dL and within ±15% for concentrations ≥100 mg/dL.

Regulatory bodies are increasingly addressing the challenges posed by digital health integration. Connected glucose monitors that transmit data to smartphones or cloud platforms face additional regulatory scrutiny regarding cybersecurity, data privacy, and software validation. The FDA's Digital Health Innovation Action Plan and the EU's Medical Device Coordination Group (MDCG) guidance documents provide frameworks for evaluating these aspects.

Emerging regulatory considerations include the validation of artificial intelligence algorithms in glucose prediction models and interoperability standards for device communication within healthcare ecosystems. Regulatory agencies are also developing frameworks for continuous glucose monitoring systems that differ fundamentally from traditional point-of-care testing in their measurement methodologies and use patterns.

For manufacturers, navigating this complex regulatory landscape requires strategic planning and substantial resources. The average time to market varies significantly by region: approximately 3-6 months for 510(k) clearance in the US, 6-12 months under the EU's IVDR, and potentially longer in emerging markets with evolving regulatory systems.

Patient-centered Design and User Experience Considerations

Patient-centered design has emerged as a critical factor in the successful adoption of point-of-care (POC) blood glucose monitoring devices. These devices have evolved significantly from early bulky models requiring large blood samples to today's sleek, minimalist designs that prioritize user comfort and accessibility. The transformation reflects a deeper understanding that medical technology effectiveness depends not only on clinical accuracy but also on how well it integrates into patients' daily lives.

User experience research indicates that patients with diabetes value devices that minimize the visibility of their condition in social settings. Modern POC glucose monitors have responded with discreet form factors, quieter operation, and faster results—allowing for more private testing in public environments. This evolution demonstrates how manufacturers have shifted from purely clinical considerations to holistic design approaches that acknowledge the psychological aspects of living with diabetes.

Ergonomic considerations play a particularly important role for elderly users and those with comorbidities like retinopathy or neuropathy. Features such as larger display screens with high contrast, tactile feedback buttons, and grip-friendly casings address the physical limitations many diabetic patients experience. The integration of voice guidance systems further enhances accessibility for visually impaired users, exemplifying inclusive design principles in medical technology.

Data visualization has undergone significant refinement, moving from simple numerical displays to intuitive color-coded systems and trend graphs that help patients interpret their readings contextually. This shift acknowledges that raw numbers alone often fail to provide actionable insights for non-medical users. Modern interfaces now emphasize pattern recognition and personalized feedback, empowering patients to make informed decisions about their health management.

The connectivity revolution has further transformed user experience, with smartphone integration becoming standard in premium POC devices. Mobile applications paired with glucose monitors offer features like automated logging, meal tagging, medication tracking, and social support networks. These digital ecosystems extend the value proposition beyond mere measurement to comprehensive diabetes management, addressing patients' holistic needs rather than isolated clinical parameters.

User testing methodologies have become increasingly sophisticated in the development pipeline, with manufacturers employing ethnographic research, contextual inquiry, and longitudinal studies to understand the lived experience of diabetes management. This research has revealed that seemingly minor design elements—like the audible click confirming a test strip is properly inserted—can significantly impact user confidence and adherence to testing regimens.

User experience research indicates that patients with diabetes value devices that minimize the visibility of their condition in social settings. Modern POC glucose monitors have responded with discreet form factors, quieter operation, and faster results—allowing for more private testing in public environments. This evolution demonstrates how manufacturers have shifted from purely clinical considerations to holistic design approaches that acknowledge the psychological aspects of living with diabetes.

Ergonomic considerations play a particularly important role for elderly users and those with comorbidities like retinopathy or neuropathy. Features such as larger display screens with high contrast, tactile feedback buttons, and grip-friendly casings address the physical limitations many diabetic patients experience. The integration of voice guidance systems further enhances accessibility for visually impaired users, exemplifying inclusive design principles in medical technology.

Data visualization has undergone significant refinement, moving from simple numerical displays to intuitive color-coded systems and trend graphs that help patients interpret their readings contextually. This shift acknowledges that raw numbers alone often fail to provide actionable insights for non-medical users. Modern interfaces now emphasize pattern recognition and personalized feedback, empowering patients to make informed decisions about their health management.

The connectivity revolution has further transformed user experience, with smartphone integration becoming standard in premium POC devices. Mobile applications paired with glucose monitors offer features like automated logging, meal tagging, medication tracking, and social support networks. These digital ecosystems extend the value proposition beyond mere measurement to comprehensive diabetes management, addressing patients' holistic needs rather than isolated clinical parameters.

User testing methodologies have become increasingly sophisticated in the development pipeline, with manufacturers employing ethnographic research, contextual inquiry, and longitudinal studies to understand the lived experience of diabetes management. This research has revealed that seemingly minor design elements—like the audible click confirming a test strip is properly inserted—can significantly impact user confidence and adherence to testing regimens.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!