Point-of-care Devices in Remote Monitoring of Cardiovascular Health

SEP 19, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Cardiovascular Remote Monitoring Technology Evolution

The evolution of cardiovascular remote monitoring technology has undergone significant transformation over the past decades, moving from simple telephonic monitoring to sophisticated wearable and implantable devices. In the 1960s, the first remote cardiac monitoring systems emerged, primarily focusing on basic electrocardiogram (ECG) transmission via telephone lines for patients with suspected arrhythmias. These early systems required bulky equipment and offered limited functionality.

The 1970s and 1980s witnessed the development of Holter monitors, allowing continuous ECG recording for 24-48 hours, though data analysis remained retrospective rather than real-time. The true breakthrough came in the 1990s with the introduction of transtelephonic monitoring, enabling periodic transmission of cardiac data to healthcare providers, significantly improving the management of patients with pacemakers and implantable cardioverter-defibrillators (ICDs).

The early 2000s marked the beginning of the digital health revolution in cardiac monitoring. Wireless technologies facilitated the development of mobile cardiac telemetry systems capable of continuous monitoring and automatic arrhythmia detection. Simultaneously, implantable loop recorders became smaller and more sophisticated, allowing for long-term monitoring of patients with unexplained syncope or suspected arrhythmias.

Between 2010 and 2015, smartphone-connected ECG devices emerged, democratizing access to cardiac monitoring. Devices like AliveCor's Kardia and similar products enabled patients to record single-lead ECGs using their smartphones, representing a significant step toward consumer-oriented point-of-care cardiovascular monitoring.

The period from 2015 to 2020 saw the rise of advanced wearable technology. Smartwatches and fitness trackers incorporated photoplethysmography (PPG) sensors capable of continuous heart rate monitoring and preliminary arrhythmia detection. Apple's introduction of ECG functionality in its smartwatch in 2018 represented a landmark moment, blurring the line between consumer electronics and medical devices.

Recent developments (2020-present) have focused on multiparameter monitoring, artificial intelligence integration, and improved form factors. Modern point-of-care cardiovascular monitoring devices can now track multiple vital signs simultaneously, including blood pressure, oxygen saturation, and even preliminary indicators of heart failure such as thoracic impedance. Machine learning algorithms have significantly enhanced the accuracy of arrhythmia detection and risk stratification.

The miniaturization of sensors has enabled the development of patch-based monitors that can be worn comfortably for extended periods, while improvements in battery technology and power management have extended device longevity. Concurrently, cloud-based platforms have evolved to handle the massive data streams generated by these devices, enabling sophisticated analytics and integration with electronic health records.

The 1970s and 1980s witnessed the development of Holter monitors, allowing continuous ECG recording for 24-48 hours, though data analysis remained retrospective rather than real-time. The true breakthrough came in the 1990s with the introduction of transtelephonic monitoring, enabling periodic transmission of cardiac data to healthcare providers, significantly improving the management of patients with pacemakers and implantable cardioverter-defibrillators (ICDs).

The early 2000s marked the beginning of the digital health revolution in cardiac monitoring. Wireless technologies facilitated the development of mobile cardiac telemetry systems capable of continuous monitoring and automatic arrhythmia detection. Simultaneously, implantable loop recorders became smaller and more sophisticated, allowing for long-term monitoring of patients with unexplained syncope or suspected arrhythmias.

Between 2010 and 2015, smartphone-connected ECG devices emerged, democratizing access to cardiac monitoring. Devices like AliveCor's Kardia and similar products enabled patients to record single-lead ECGs using their smartphones, representing a significant step toward consumer-oriented point-of-care cardiovascular monitoring.

The period from 2015 to 2020 saw the rise of advanced wearable technology. Smartwatches and fitness trackers incorporated photoplethysmography (PPG) sensors capable of continuous heart rate monitoring and preliminary arrhythmia detection. Apple's introduction of ECG functionality in its smartwatch in 2018 represented a landmark moment, blurring the line between consumer electronics and medical devices.

Recent developments (2020-present) have focused on multiparameter monitoring, artificial intelligence integration, and improved form factors. Modern point-of-care cardiovascular monitoring devices can now track multiple vital signs simultaneously, including blood pressure, oxygen saturation, and even preliminary indicators of heart failure such as thoracic impedance. Machine learning algorithms have significantly enhanced the accuracy of arrhythmia detection and risk stratification.

The miniaturization of sensors has enabled the development of patch-based monitors that can be worn comfortably for extended periods, while improvements in battery technology and power management have extended device longevity. Concurrently, cloud-based platforms have evolved to handle the massive data streams generated by these devices, enabling sophisticated analytics and integration with electronic health records.

Market Analysis for Point-of-care Cardiac Devices

The global market for point-of-care cardiac devices is experiencing robust growth, driven by the increasing prevalence of cardiovascular diseases and the growing demand for remote monitoring solutions. The market was valued at approximately 1.2 billion USD in 2022 and is projected to reach 2.5 billion USD by 2028, representing a compound annual growth rate (CAGR) of 12.8% during the forecast period.

North America currently dominates the market, accounting for nearly 40% of the global share, followed by Europe at 30% and Asia-Pacific at 20%. This regional distribution reflects the advanced healthcare infrastructure and higher adoption rates of innovative medical technologies in developed economies. However, emerging markets in Asia-Pacific, particularly China and India, are expected to witness the fastest growth due to improving healthcare access and rising healthcare expenditure.

The market segmentation reveals distinct categories within point-of-care cardiac devices. Blood pressure monitors hold the largest market share at 35%, followed by ECG monitors at 25%, cardiac markers at 20%, and other devices at 20%. The portable/wearable segment is growing particularly fast, with a CAGR of 15.3%, outpacing traditional stationary devices.

Key market drivers include the aging global population, with individuals over 65 being the primary users of these devices. The increasing incidence of lifestyle-related cardiovascular conditions among younger demographics is also expanding the potential user base. Additionally, healthcare cost containment measures are pushing providers toward remote monitoring solutions that reduce hospitalization rates and emergency department visits.

Consumer behavior analysis indicates a growing preference for user-friendly interfaces and seamless data integration with smartphones and other personal devices. Approximately 65% of patients report higher satisfaction with remote monitoring compared to traditional in-clinic follow-ups, particularly for chronic condition management.

Reimbursement policies significantly impact market adoption, with regions having favorable coverage showing 30% higher utilization rates. The COVID-19 pandemic has accelerated market growth by approximately 18% as healthcare systems worldwide embraced telehealth solutions to maintain continuity of care while minimizing infection risks.

Market challenges include data security concerns, interoperability issues between different healthcare systems, and varying regulatory requirements across regions. Despite these challenges, the point-of-care cardiac devices market presents substantial opportunities for manufacturers who can address unmet needs in remote cardiovascular monitoring while ensuring regulatory compliance and data security.

North America currently dominates the market, accounting for nearly 40% of the global share, followed by Europe at 30% and Asia-Pacific at 20%. This regional distribution reflects the advanced healthcare infrastructure and higher adoption rates of innovative medical technologies in developed economies. However, emerging markets in Asia-Pacific, particularly China and India, are expected to witness the fastest growth due to improving healthcare access and rising healthcare expenditure.

The market segmentation reveals distinct categories within point-of-care cardiac devices. Blood pressure monitors hold the largest market share at 35%, followed by ECG monitors at 25%, cardiac markers at 20%, and other devices at 20%. The portable/wearable segment is growing particularly fast, with a CAGR of 15.3%, outpacing traditional stationary devices.

Key market drivers include the aging global population, with individuals over 65 being the primary users of these devices. The increasing incidence of lifestyle-related cardiovascular conditions among younger demographics is also expanding the potential user base. Additionally, healthcare cost containment measures are pushing providers toward remote monitoring solutions that reduce hospitalization rates and emergency department visits.

Consumer behavior analysis indicates a growing preference for user-friendly interfaces and seamless data integration with smartphones and other personal devices. Approximately 65% of patients report higher satisfaction with remote monitoring compared to traditional in-clinic follow-ups, particularly for chronic condition management.

Reimbursement policies significantly impact market adoption, with regions having favorable coverage showing 30% higher utilization rates. The COVID-19 pandemic has accelerated market growth by approximately 18% as healthcare systems worldwide embraced telehealth solutions to maintain continuity of care while minimizing infection risks.

Market challenges include data security concerns, interoperability issues between different healthcare systems, and varying regulatory requirements across regions. Despite these challenges, the point-of-care cardiac devices market presents substantial opportunities for manufacturers who can address unmet needs in remote cardiovascular monitoring while ensuring regulatory compliance and data security.

Technical Barriers in Remote Cardiac Monitoring

Despite significant advancements in remote cardiac monitoring technologies, several technical barriers continue to impede widespread implementation and optimal functionality of point-of-care devices for cardiovascular health monitoring. These challenges span hardware limitations, data management issues, and integration complexities that collectively hinder the full potential of remote monitoring solutions.

Signal quality and reliability represent primary technical obstacles. Wearable ECG monitors and other cardiovascular sensors often struggle to maintain consistent signal quality during patient movement or daily activities. Motion artifacts, electrode displacement, and environmental interference can compromise data integrity, leading to false alarms or missed cardiac events. This is particularly problematic for continuous monitoring applications where uninterrupted high-quality data streams are essential for accurate diagnosis.

Power management remains another significant challenge. Most remote cardiac monitoring devices require frequent recharging or battery replacement, creating user inconvenience and potential monitoring gaps. The fundamental trade-off between device size, battery capacity, and monitoring duration continues to constrain design options, especially for implantable or long-term wearable solutions.

Data transmission infrastructure presents additional barriers. Many remote areas lack reliable high-speed internet connectivity necessary for real-time data transmission. Bluetooth, cellular, and Wi-Fi technologies each have limitations regarding range, power consumption, and security that affect their suitability for different monitoring scenarios. The intermittent connectivity in rural or underserved regions can delay critical data transmission, potentially compromising patient safety.

Interoperability challenges further complicate implementation. The lack of standardized communication protocols and data formats across different manufacturers' devices creates integration difficulties with electronic health record systems and other healthcare IT infrastructure. This fragmentation impedes seamless data flow between monitoring devices and clinical decision support systems.

Algorithmic limitations also persist in automated arrhythmia detection and cardiovascular event classification. Current algorithms still generate significant false positives, creating alert fatigue among healthcare providers. The balance between sensitivity and specificity remains difficult to optimize, particularly for detecting subtle or rare cardiac abnormalities.

Cybersecurity vulnerabilities constitute an emerging barrier as remote monitoring devices become increasingly connected. Protecting patient data during transmission and storage while ensuring device integrity against potential hacking attempts requires sophisticated security measures that add complexity and cost to system design.

Miniaturization constraints affect the development of comprehensive monitoring solutions. Integrating multiple sensing modalities (ECG, blood pressure, oxygen saturation) into compact, comfortable wearable devices presents significant engineering challenges, often requiring compromises in functionality or form factor.

Signal quality and reliability represent primary technical obstacles. Wearable ECG monitors and other cardiovascular sensors often struggle to maintain consistent signal quality during patient movement or daily activities. Motion artifacts, electrode displacement, and environmental interference can compromise data integrity, leading to false alarms or missed cardiac events. This is particularly problematic for continuous monitoring applications where uninterrupted high-quality data streams are essential for accurate diagnosis.

Power management remains another significant challenge. Most remote cardiac monitoring devices require frequent recharging or battery replacement, creating user inconvenience and potential monitoring gaps. The fundamental trade-off between device size, battery capacity, and monitoring duration continues to constrain design options, especially for implantable or long-term wearable solutions.

Data transmission infrastructure presents additional barriers. Many remote areas lack reliable high-speed internet connectivity necessary for real-time data transmission. Bluetooth, cellular, and Wi-Fi technologies each have limitations regarding range, power consumption, and security that affect their suitability for different monitoring scenarios. The intermittent connectivity in rural or underserved regions can delay critical data transmission, potentially compromising patient safety.

Interoperability challenges further complicate implementation. The lack of standardized communication protocols and data formats across different manufacturers' devices creates integration difficulties with electronic health record systems and other healthcare IT infrastructure. This fragmentation impedes seamless data flow between monitoring devices and clinical decision support systems.

Algorithmic limitations also persist in automated arrhythmia detection and cardiovascular event classification. Current algorithms still generate significant false positives, creating alert fatigue among healthcare providers. The balance between sensitivity and specificity remains difficult to optimize, particularly for detecting subtle or rare cardiac abnormalities.

Cybersecurity vulnerabilities constitute an emerging barrier as remote monitoring devices become increasingly connected. Protecting patient data during transmission and storage while ensuring device integrity against potential hacking attempts requires sophisticated security measures that add complexity and cost to system design.

Miniaturization constraints affect the development of comprehensive monitoring solutions. Integrating multiple sensing modalities (ECG, blood pressure, oxygen saturation) into compact, comfortable wearable devices presents significant engineering challenges, often requiring compromises in functionality or form factor.

Current Point-of-care Solutions for Heart Health

01 Wearable point-of-care monitoring systems

Wearable devices that enable continuous health monitoring at the point of care, allowing for real-time data collection and transmission to healthcare providers. These devices can monitor vital signs, activity levels, and other health parameters without requiring the patient to be in a clinical setting. The wearable nature of these devices enhances patient mobility while maintaining continuous monitoring capabilities for improved healthcare outcomes.- Wearable point-of-care monitoring systems: Wearable devices that enable continuous health monitoring at the point of care, allowing for real-time data collection and transmission to healthcare providers. These devices can monitor vital signs, activity levels, and other health parameters without restricting patient mobility, facilitating remote patient monitoring outside traditional healthcare settings.

- Telemedicine and remote patient management platforms: Integrated software platforms that enable healthcare providers to remotely monitor, diagnose, and manage patients. These systems facilitate virtual consultations, data analysis, and treatment adjustments without requiring in-person visits, improving access to healthcare especially for patients in remote areas or with mobility limitations.

- IoT-enabled medical devices for remote monitoring: Medical devices equipped with Internet of Things (IoT) technology that can collect, process, and transmit patient data to healthcare providers in real-time. These devices enable continuous monitoring of chronic conditions and early detection of health deterioration, allowing for timely interventions and reducing hospital readmissions.

- Mobile health applications and smartphone-based diagnostics: Mobile applications and smartphone attachments that transform consumer devices into point-of-care diagnostic tools. These solutions leverage smartphone cameras, sensors, and processing capabilities to perform medical tests, analyze results, and share data with healthcare providers, making healthcare more accessible and affordable.

- AI and machine learning for remote health monitoring: Artificial intelligence and machine learning algorithms that analyze data from point-of-care devices to identify patterns, predict health events, and provide personalized recommendations. These technologies enhance the capabilities of remote monitoring systems by automating data interpretation, reducing false alarms, and enabling predictive healthcare interventions.

02 Telemedicine and remote patient management platforms

Integrated platforms that facilitate remote consultations between healthcare providers and patients, enabling diagnosis and treatment recommendations without in-person visits. These systems incorporate secure communication channels, electronic health records access, and remote monitoring data integration to provide comprehensive telehealth services. The platforms support various clinical workflows and can be adapted to different medical specialties for widespread healthcare delivery.Expand Specific Solutions03 IoT-enabled medical devices for remote monitoring

Medical devices equipped with Internet of Things (IoT) technology that collect and transmit patient data to cloud-based platforms for remote monitoring by healthcare professionals. These devices include smart glucose monitors, blood pressure devices, and other diagnostic tools that can automatically share readings with clinical systems. The integration of IoT technology enables automated alerts for abnormal readings and facilitates timely interventions based on real-time health data.Expand Specific Solutions04 AI-powered diagnostic and monitoring solutions

Point-of-care systems that incorporate artificial intelligence algorithms to analyze patient data, identify patterns, and provide diagnostic support or predictive insights. These solutions can process complex health information from multiple sources to assist healthcare providers in making informed clinical decisions. AI capabilities enhance the accuracy of remote monitoring by filtering noise from significant health events and prioritizing patients who require immediate attention.Expand Specific Solutions05 Mobile health applications and patient engagement tools

Smartphone and tablet applications that connect to point-of-care devices, enabling patients to track their health metrics, receive medication reminders, and communicate with healthcare providers. These applications often include educational resources, symptom trackers, and behavioral modification tools to promote patient engagement in self-management. The mobile nature of these solutions allows for healthcare monitoring regardless of patient location while improving treatment adherence and health outcomes.Expand Specific Solutions

Leading Companies in Cardiovascular Remote Monitoring

The point-of-care cardiovascular remote monitoring market is in a growth phase, with an expanding ecosystem of established medical device manufacturers and innovative digital health startups. Companies like Philips, Medtronic, and Roche Diagnostics dominate with comprehensive monitoring solutions, while emerging players such as Eko Health, Cloud DX, and iAssay are disrupting the space with AI-enabled devices and mobile platforms. The market is characterized by increasing technological maturity, with solutions ranging from traditional cardiac monitoring devices to smartphone-integrated systems. The convergence of IoT connectivity, AI analytics, and miniaturized sensors is accelerating adoption, particularly as healthcare systems worldwide seek cost-effective solutions for managing chronic cardiovascular conditions remotely, creating a projected market value exceeding $4 billion by 2027.

Koninklijke Philips NV

Technical Solution: Philips has developed an integrated ecosystem of point-of-care cardiovascular monitoring solutions that combine wearable sensors, mobile applications, and cloud-based analytics platforms. Their technology enables continuous monitoring of vital parameters including heart rate, blood pressure, ECG, and oxygen saturation. The system employs AI algorithms to analyze data patterns and detect anomalies before they become critical events. Philips' remote patient monitoring solutions feature the HeartModel A.I. technology for automated cardiac measurements and their ePatch extended wear holter monitor that provides up to 14 days of continuous cardiac rhythm monitoring[1]. Their IntelliVue Guardian Solution with Early Warning Scoring helps identify deteriorating patients earlier by automatically calculating risk scores based on vital signs collected at the point of care. The company has also integrated telehealth capabilities allowing for virtual consultations between patients and healthcare providers based on the collected cardiovascular data[3].

Strengths: Comprehensive ecosystem integration allowing seamless data flow between devices and healthcare systems; strong AI capabilities for predictive analytics; established global presence with extensive clinical validation. Weaknesses: Higher cost compared to some competitors; complex implementation requiring significant healthcare IT infrastructure; potential interoperability challenges with non-Philips systems.

Medtronic, Inc.

Technical Solution: Medtronic has pioneered implantable cardiac monitoring devices with remote monitoring capabilities through their Reveal LINQ Insertable Cardiac Monitor (ICM) system. This miniaturized implantable device continuously monitors heart rhythms for up to three years, automatically detecting and wirelessly transmitting data on cardiac events to physicians. Their CareLink Network serves as the connectivity backbone, allowing for remote monitoring of over one million patients globally with implanted cardiac devices[2]. Medtronic's technology includes MyCareLink Heart mobile app that enables patients to transmit data from their implanted cardiac devices directly to their healthcare providers using a smartphone. The company has also developed the CardioInsight non-invasive 3D mapping system that creates electroanatomic maps of the heart to help physicians identify the sources of irregular heart rhythms. Their remote monitoring solutions incorporate machine learning algorithms that analyze cardiac data to predict potential adverse events and optimize device settings without requiring in-person visits[4].

Strengths: Unparalleled expertise in implantable cardiac monitoring technology; extensive clinical evidence supporting efficacy; sophisticated data analytics for predictive monitoring; global service infrastructure. Weaknesses: Invasive nature of some solutions requiring surgical procedures; higher upfront costs; dependency on specialized medical expertise for implementation and management.

Key Patents in Remote Cardiac Monitoring Technology

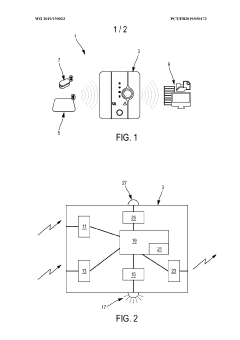

A device to measure vital parameters for remote diagnostics

PatentInactiveIN202221072417A

Innovation

- A portable, non-invasive single-point health care device that measures vital parameters like ECG, Heart Rate, SpO2, PPG, and Blood Pressure, using a camera for visual assessments, connected via a mobile app for real-time data collection and analysis, enabling first-hand diagnosis by medical professionals.

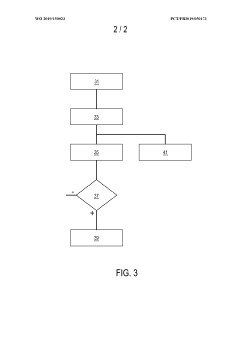

Device for remotely monitoring a patient with chronic heart failure, and associated system and method

PatentWO2019150023A1

Innovation

- A remote monitoring device that combines a scale, oximeter, and alert transmission interface with a computer algorithm to collect and analyze weight, heart rate, and blood oxygen saturation data, using predefined thresholds to reliably detect probable incipient cardiac decompensation, minimizing false alarms and ensuring relevant alerts.

Data Security in Remote Health Monitoring

Data security represents a critical concern in the implementation of point-of-care devices for remote cardiovascular health monitoring. As these devices collect, process, and transmit sensitive patient health information across networks, they become potential targets for data breaches and unauthorized access. The healthcare sector has witnessed a 55% increase in cybersecurity incidents targeting medical devices over the past three years, with cardiovascular monitoring systems being particularly vulnerable due to their continuous data transmission requirements.

The regulatory landscape governing data security in remote health monitoring continues to evolve, with frameworks such as HIPAA in the United States, GDPR in Europe, and various national healthcare data protection regulations establishing compliance requirements. These regulations mandate encryption of patient data, secure authentication protocols, and comprehensive audit trails for all data access events.

Current security implementations in cardiovascular monitoring devices typically employ a multi-layered approach. At the device level, hardware security modules (HSMs) provide secure storage for encryption keys and perform cryptographic operations. Data transmission security relies on TLS/SSL protocols with certificate-based authentication, while end-to-end encryption ensures that data remains protected throughout its lifecycle from collection to storage and analysis.

Biometric authentication mechanisms are increasingly being integrated into point-of-care cardiovascular devices, allowing for secure patient identification through fingerprint recognition, facial scanning, or ECG pattern matching. This approach not only enhances security but also improves user experience by eliminating the need for complex passwords.

Cloud security architectures supporting these devices implement role-based access control (RBAC), data tokenization, and advanced threat detection systems. Major cloud providers have developed specialized healthcare security frameworks that maintain HIPAA compliance while enabling the scalability required for large-scale remote monitoring programs.

Emerging security challenges include the vulnerability of Bluetooth Low Energy (BLE) connections commonly used in cardiovascular monitoring devices, with researchers identifying potential attack vectors through signal jamming and man-in-the-middle exploits. Additionally, the integration of AI algorithms for predictive analytics introduces new security considerations regarding model integrity and potential adversarial attacks designed to manipulate diagnostic outcomes.

Industry consortiums such as the Medical Device Innovation Consortium (MDIC) and the Healthcare Information and Management Systems Society (HIMSS) have established working groups focused specifically on developing security standards for remote cardiovascular monitoring. These collaborative efforts aim to create standardized security frameworks that balance robust protection with clinical functionality and user accessibility.

The regulatory landscape governing data security in remote health monitoring continues to evolve, with frameworks such as HIPAA in the United States, GDPR in Europe, and various national healthcare data protection regulations establishing compliance requirements. These regulations mandate encryption of patient data, secure authentication protocols, and comprehensive audit trails for all data access events.

Current security implementations in cardiovascular monitoring devices typically employ a multi-layered approach. At the device level, hardware security modules (HSMs) provide secure storage for encryption keys and perform cryptographic operations. Data transmission security relies on TLS/SSL protocols with certificate-based authentication, while end-to-end encryption ensures that data remains protected throughout its lifecycle from collection to storage and analysis.

Biometric authentication mechanisms are increasingly being integrated into point-of-care cardiovascular devices, allowing for secure patient identification through fingerprint recognition, facial scanning, or ECG pattern matching. This approach not only enhances security but also improves user experience by eliminating the need for complex passwords.

Cloud security architectures supporting these devices implement role-based access control (RBAC), data tokenization, and advanced threat detection systems. Major cloud providers have developed specialized healthcare security frameworks that maintain HIPAA compliance while enabling the scalability required for large-scale remote monitoring programs.

Emerging security challenges include the vulnerability of Bluetooth Low Energy (BLE) connections commonly used in cardiovascular monitoring devices, with researchers identifying potential attack vectors through signal jamming and man-in-the-middle exploits. Additionally, the integration of AI algorithms for predictive analytics introduces new security considerations regarding model integrity and potential adversarial attacks designed to manipulate diagnostic outcomes.

Industry consortiums such as the Medical Device Innovation Consortium (MDIC) and the Healthcare Information and Management Systems Society (HIMSS) have established working groups focused specifically on developing security standards for remote cardiovascular monitoring. These collaborative efforts aim to create standardized security frameworks that balance robust protection with clinical functionality and user accessibility.

Reimbursement Models for Remote Cardiac Care

The reimbursement landscape for remote cardiac monitoring technologies has evolved significantly in recent years, driven by the growing recognition of their clinical value and cost-effectiveness. Traditional fee-for-service models have been gradually supplemented by value-based care approaches, creating a hybrid reimbursement environment that varies considerably across different healthcare systems and geographical regions.

In the United States, the Centers for Medicare & Medicaid Services (CMS) has established specific Current Procedural Terminology (CPT) codes for remote cardiac monitoring services, including codes for device setup, patient education, data transmission, and physician interpretation. These codes have facilitated broader adoption by providing clear pathways for reimbursement, though reimbursement rates continue to vary by state and payer.

Private insurers have increasingly developed their own reimbursement frameworks for remote cardiac monitoring, often incorporating elements of both fee-for-service and value-based care. Some innovative models include bundled payments that cover the entire episode of care, including the device, monitoring services, and follow-up interventions when necessary.

Globally, reimbursement approaches differ substantially. The European Union has implemented various models across member states, with countries like Germany and France offering more comprehensive coverage through their national health systems. The UK's National Health Service has piloted several reimbursement schemes focused on outcomes-based payment for remote cardiac monitoring, particularly for high-risk patient populations.

Emerging economies present a different landscape, where out-of-pocket payments often dominate due to limited insurance coverage. In these markets, subscription-based models and microfinancing options are gaining traction as alternatives to traditional reimbursement structures.

A significant trend is the movement toward risk-sharing arrangements between device manufacturers, healthcare providers, and payers. Under these models, payment is partially contingent on achieving predetermined clinical outcomes or cost-saving metrics, aligning financial incentives with patient health improvements.

Telehealth parity laws, enacted in numerous jurisdictions, have further supported reimbursement for remote cardiac monitoring by requiring insurers to cover virtual care services at rates comparable to in-person visits. However, implementation remains inconsistent, creating challenges for providers operating across multiple regions.

For point-of-care cardiac monitoring devices to achieve sustainable market penetration, stakeholders must navigate this complex reimbursement landscape while demonstrating clear value propositions that resonate with both payers and providers. Future reimbursement models will likely continue to evolve toward more sophisticated approaches that reward improvements in patient outcomes while controlling overall healthcare expenditures.

In the United States, the Centers for Medicare & Medicaid Services (CMS) has established specific Current Procedural Terminology (CPT) codes for remote cardiac monitoring services, including codes for device setup, patient education, data transmission, and physician interpretation. These codes have facilitated broader adoption by providing clear pathways for reimbursement, though reimbursement rates continue to vary by state and payer.

Private insurers have increasingly developed their own reimbursement frameworks for remote cardiac monitoring, often incorporating elements of both fee-for-service and value-based care. Some innovative models include bundled payments that cover the entire episode of care, including the device, monitoring services, and follow-up interventions when necessary.

Globally, reimbursement approaches differ substantially. The European Union has implemented various models across member states, with countries like Germany and France offering more comprehensive coverage through their national health systems. The UK's National Health Service has piloted several reimbursement schemes focused on outcomes-based payment for remote cardiac monitoring, particularly for high-risk patient populations.

Emerging economies present a different landscape, where out-of-pocket payments often dominate due to limited insurance coverage. In these markets, subscription-based models and microfinancing options are gaining traction as alternatives to traditional reimbursement structures.

A significant trend is the movement toward risk-sharing arrangements between device manufacturers, healthcare providers, and payers. Under these models, payment is partially contingent on achieving predetermined clinical outcomes or cost-saving metrics, aligning financial incentives with patient health improvements.

Telehealth parity laws, enacted in numerous jurisdictions, have further supported reimbursement for remote cardiac monitoring by requiring insurers to cover virtual care services at rates comparable to in-person visits. However, implementation remains inconsistent, creating challenges for providers operating across multiple regions.

For point-of-care cardiac monitoring devices to achieve sustainable market penetration, stakeholders must navigate this complex reimbursement landscape while demonstrating clear value propositions that resonate with both payers and providers. Future reimbursement models will likely continue to evolve toward more sophisticated approaches that reward improvements in patient outcomes while controlling overall healthcare expenditures.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!