How Policy Changes Influence Vehicle-to-Grid Technology

SEP 23, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

V2G Technology Background and Objectives

Vehicle-to-Grid (V2G) technology represents a transformative approach to energy management that has evolved significantly over the past decade. The concept emerged in the late 1990s but gained substantial momentum after 2010 as electric vehicle (EV) adoption increased globally. V2G technology enables bidirectional power flow between EVs and the electrical grid, allowing vehicles to serve not only as transportation assets but also as distributed energy resources that can provide grid services.

The evolution of V2G technology has been closely tied to advancements in battery technology, power electronics, and smart grid infrastructure. Early implementations focused primarily on unidirectional charging (grid-to-vehicle), while modern systems emphasize bidirectional capabilities that enable vehicles to discharge power back to the grid during peak demand periods or grid emergencies.

Current technological trends indicate a shift toward more sophisticated V2G systems with enhanced communication protocols, improved power conversion efficiency, and reduced degradation impacts on vehicle batteries. The integration of artificial intelligence and machine learning algorithms is enabling more predictive and responsive V2G operations, optimizing both grid stability and vehicle owner benefits.

The primary technical objectives of V2G technology development include maximizing grid support capabilities while minimizing battery degradation, reducing implementation costs, standardizing communication protocols, and ensuring seamless integration with existing grid infrastructure. Additionally, there is significant focus on developing user-friendly interfaces that encourage EV owner participation in V2G programs.

Policy frameworks play a crucial role in shaping V2G technology development and deployment. Historically, regulatory environments have often lagged behind technological capabilities, creating barriers to widespread V2G adoption. However, recent policy shifts in various regions have begun to recognize the value of V2G services, establishing mechanisms for compensating vehicle owners for grid support and creating technical standards for interconnection.

The technical goals for V2G technology are increasingly aligned with broader energy transition objectives, including grid decarbonization, renewable energy integration, and resilience enhancement. As intermittent renewable energy sources like wind and solar comprise a larger portion of the generation mix, V2G technology aims to provide flexible storage capacity that can help balance supply and demand fluctuations.

Looking forward, V2G technology development is expected to focus on enhancing scalability, improving cybersecurity measures, reducing latency in grid response, and developing more sophisticated aggregation platforms that can manage large fleets of vehicles as virtual power plants.

The evolution of V2G technology has been closely tied to advancements in battery technology, power electronics, and smart grid infrastructure. Early implementations focused primarily on unidirectional charging (grid-to-vehicle), while modern systems emphasize bidirectional capabilities that enable vehicles to discharge power back to the grid during peak demand periods or grid emergencies.

Current technological trends indicate a shift toward more sophisticated V2G systems with enhanced communication protocols, improved power conversion efficiency, and reduced degradation impacts on vehicle batteries. The integration of artificial intelligence and machine learning algorithms is enabling more predictive and responsive V2G operations, optimizing both grid stability and vehicle owner benefits.

The primary technical objectives of V2G technology development include maximizing grid support capabilities while minimizing battery degradation, reducing implementation costs, standardizing communication protocols, and ensuring seamless integration with existing grid infrastructure. Additionally, there is significant focus on developing user-friendly interfaces that encourage EV owner participation in V2G programs.

Policy frameworks play a crucial role in shaping V2G technology development and deployment. Historically, regulatory environments have often lagged behind technological capabilities, creating barriers to widespread V2G adoption. However, recent policy shifts in various regions have begun to recognize the value of V2G services, establishing mechanisms for compensating vehicle owners for grid support and creating technical standards for interconnection.

The technical goals for V2G technology are increasingly aligned with broader energy transition objectives, including grid decarbonization, renewable energy integration, and resilience enhancement. As intermittent renewable energy sources like wind and solar comprise a larger portion of the generation mix, V2G technology aims to provide flexible storage capacity that can help balance supply and demand fluctuations.

Looking forward, V2G technology development is expected to focus on enhancing scalability, improving cybersecurity measures, reducing latency in grid response, and developing more sophisticated aggregation platforms that can manage large fleets of vehicles as virtual power plants.

Market Demand Analysis for V2G Solutions

The Vehicle-to-Grid (V2G) market is experiencing significant growth driven by the convergence of renewable energy integration, grid stability concerns, and electric vehicle (EV) adoption. Current market analysis indicates that the global V2G technology market is projected to reach $17.4 billion by 2027, growing at a compound annual growth rate of approximately 48% from 2020. This exceptional growth trajectory is primarily fueled by increasing governmental commitments to carbon neutrality and the subsequent policy frameworks being established worldwide.

Consumer demand for V2G solutions is closely tied to EV adoption rates, which have seen remarkable acceleration in recent years. In 2022, global EV sales surpassed 10 million units, representing a 55% increase compared to the previous year. This expanding EV fleet creates a substantial potential resource for V2G implementation, with each vehicle essentially functioning as a mobile energy storage unit.

Utility companies are emerging as significant stakeholders in the V2G market, recognizing the technology's potential to address peak demand challenges and integrate intermittent renewable energy sources. Market research indicates that 78% of utility executives now view V2G as a critical component of future grid management strategies, compared to just 34% five years ago. This shift represents a fundamental change in how grid operators perceive distributed energy resources.

Commercial fleet operators constitute another major market segment, with logistics companies, ride-sharing services, and municipal vehicle fleets increasingly exploring V2G as both a revenue stream and sustainability initiative. The potential for reduced total cost of ownership through V2G participation is estimated to improve fleet economics by 15-25%, depending on regional electricity market structures and policy incentives.

Regional market analysis reveals significant variations in V2G demand patterns. European markets, particularly in the Netherlands, Denmark, and the UK, show the highest immediate demand due to progressive regulatory frameworks and high electricity costs. North American markets demonstrate strong growth potential but face regulatory fragmentation across different states and provinces. Asia-Pacific markets, led by Japan and South Korea, are rapidly developing V2G pilot programs with strong governmental support.

The market demand for V2G is highly sensitive to policy interventions, with demand elasticity studies suggesting that supportive policies can accelerate market adoption by 3-5 years compared to baseline scenarios. Key policy levers influencing market demand include feed-in tariffs for V2G services, standardization of grid connection requirements, tax incentives for V2G-capable vehicles, and regulatory frameworks that enable vehicle owners to participate in energy markets.

Consumer demand for V2G solutions is closely tied to EV adoption rates, which have seen remarkable acceleration in recent years. In 2022, global EV sales surpassed 10 million units, representing a 55% increase compared to the previous year. This expanding EV fleet creates a substantial potential resource for V2G implementation, with each vehicle essentially functioning as a mobile energy storage unit.

Utility companies are emerging as significant stakeholders in the V2G market, recognizing the technology's potential to address peak demand challenges and integrate intermittent renewable energy sources. Market research indicates that 78% of utility executives now view V2G as a critical component of future grid management strategies, compared to just 34% five years ago. This shift represents a fundamental change in how grid operators perceive distributed energy resources.

Commercial fleet operators constitute another major market segment, with logistics companies, ride-sharing services, and municipal vehicle fleets increasingly exploring V2G as both a revenue stream and sustainability initiative. The potential for reduced total cost of ownership through V2G participation is estimated to improve fleet economics by 15-25%, depending on regional electricity market structures and policy incentives.

Regional market analysis reveals significant variations in V2G demand patterns. European markets, particularly in the Netherlands, Denmark, and the UK, show the highest immediate demand due to progressive regulatory frameworks and high electricity costs. North American markets demonstrate strong growth potential but face regulatory fragmentation across different states and provinces. Asia-Pacific markets, led by Japan and South Korea, are rapidly developing V2G pilot programs with strong governmental support.

The market demand for V2G is highly sensitive to policy interventions, with demand elasticity studies suggesting that supportive policies can accelerate market adoption by 3-5 years compared to baseline scenarios. Key policy levers influencing market demand include feed-in tariffs for V2G services, standardization of grid connection requirements, tax incentives for V2G-capable vehicles, and regulatory frameworks that enable vehicle owners to participate in energy markets.

V2G Technical Challenges and Global Status

Vehicle-to-Grid (V2G) technology faces numerous technical challenges that vary across different global regions. One of the primary obstacles is the bidirectional charging infrastructure, which requires sophisticated power electronics capable of managing electricity flow in both directions while maintaining grid stability. Current charging systems predominantly support unidirectional power flow, making widespread V2G implementation technically complex and costly.

Battery degradation presents another significant challenge. The additional charging and discharging cycles imposed by V2G operations can potentially accelerate battery wear, reducing the overall lifespan of electric vehicle batteries. This concern has prompted extensive research into battery management systems that can optimize V2G participation while minimizing degradation effects.

Communication protocols and standardization issues further complicate V2G deployment. Different regions have adopted varying technical standards for grid interaction, creating interoperability problems across international markets. The lack of unified protocols for vehicle-to-grid communication hampers seamless integration between vehicles, charging infrastructure, and grid management systems.

Globally, V2G technology development shows distinct regional patterns. Europe leads in pilot projects and regulatory frameworks, with countries like Denmark, the Netherlands, and the UK hosting significant demonstration initiatives. The European Union has established the most comprehensive policy environment supporting V2G through directives on electricity market design and renewable energy integration.

In North America, V2G development has been more fragmented, with California and some northeastern states leading implementation efforts through utility-sponsored programs. The regulatory approach tends to be more market-driven, with less centralized policy coordination than in Europe.

Asia presents a mixed landscape, with Japan and South Korea demonstrating advanced V2G capabilities through manufacturer-led initiatives. China, despite being the world's largest EV market, has focused more on unidirectional smart charging rather than full bidirectional V2G systems, though recent policy shifts indicate growing interest in V2G technology.

Grid readiness varies significantly worldwide, with some regions facing fundamental infrastructure limitations. Many electrical grids were not designed to accommodate distributed energy resources like V2G, requiring substantial modernization of transmission and distribution systems. Advanced markets have begun implementing smart grid technologies essential for V2G, while developing regions often lack the necessary grid management capabilities.

Cybersecurity concerns have emerged as a critical challenge as V2G systems create new potential vulnerabilities in critical infrastructure. The complex network of connected vehicles, charging stations, and grid systems presents an expanded attack surface requiring robust security protocols and regulatory oversight.

Battery degradation presents another significant challenge. The additional charging and discharging cycles imposed by V2G operations can potentially accelerate battery wear, reducing the overall lifespan of electric vehicle batteries. This concern has prompted extensive research into battery management systems that can optimize V2G participation while minimizing degradation effects.

Communication protocols and standardization issues further complicate V2G deployment. Different regions have adopted varying technical standards for grid interaction, creating interoperability problems across international markets. The lack of unified protocols for vehicle-to-grid communication hampers seamless integration between vehicles, charging infrastructure, and grid management systems.

Globally, V2G technology development shows distinct regional patterns. Europe leads in pilot projects and regulatory frameworks, with countries like Denmark, the Netherlands, and the UK hosting significant demonstration initiatives. The European Union has established the most comprehensive policy environment supporting V2G through directives on electricity market design and renewable energy integration.

In North America, V2G development has been more fragmented, with California and some northeastern states leading implementation efforts through utility-sponsored programs. The regulatory approach tends to be more market-driven, with less centralized policy coordination than in Europe.

Asia presents a mixed landscape, with Japan and South Korea demonstrating advanced V2G capabilities through manufacturer-led initiatives. China, despite being the world's largest EV market, has focused more on unidirectional smart charging rather than full bidirectional V2G systems, though recent policy shifts indicate growing interest in V2G technology.

Grid readiness varies significantly worldwide, with some regions facing fundamental infrastructure limitations. Many electrical grids were not designed to accommodate distributed energy resources like V2G, requiring substantial modernization of transmission and distribution systems. Advanced markets have begun implementing smart grid technologies essential for V2G, while developing regions often lack the necessary grid management capabilities.

Cybersecurity concerns have emerged as a critical challenge as V2G systems create new potential vulnerabilities in critical infrastructure. The complex network of connected vehicles, charging stations, and grid systems presents an expanded attack surface requiring robust security protocols and regulatory oversight.

Current V2G Implementation Approaches

01 Bidirectional charging systems for V2G integration

Bidirectional charging systems enable electric vehicles to not only draw power from the grid but also feed power back when needed. These systems include specialized hardware and software components that manage the flow of electricity between the vehicle battery and the electrical grid. The technology allows for smart charging based on grid demands, electricity pricing, and user preferences, creating a more flexible and resilient energy ecosystem.- Bidirectional charging systems for V2G integration: Bidirectional charging systems enable electric vehicles to not only draw power from the grid but also feed power back when needed. These systems include specialized hardware and control algorithms that manage the flow of electricity between the vehicle battery and the power grid. The technology allows for optimal energy management, grid stabilization, and potential revenue generation for EV owners through participation in energy markets.

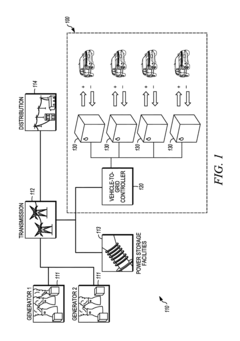

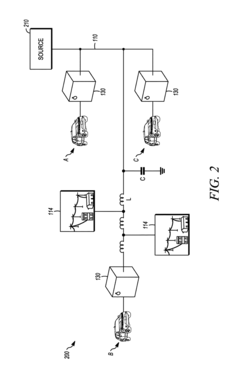

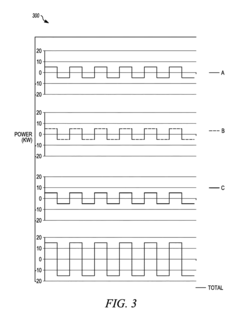

- Grid management and load balancing solutions: Vehicle-to-Grid technology incorporates advanced grid management systems that help balance electricity demand and supply. These solutions include predictive algorithms that anticipate grid needs, smart charging scheduling, and demand response capabilities. By coordinating the charging and discharging of multiple electric vehicles, these systems can reduce peak loads, prevent grid overloads, and improve overall grid stability and efficiency.

- Communication protocols and interfaces for V2G systems: Effective Vehicle-to-Grid implementation requires robust communication protocols and interfaces between vehicles, charging infrastructure, and grid operators. These technologies enable real-time data exchange about battery status, grid conditions, energy pricing, and user preferences. Standardized communication frameworks ensure interoperability between different vehicle models, charging stations, and utility systems, facilitating seamless integration of EVs into the energy ecosystem.

- Energy market participation and monetization frameworks: Vehicle-to-Grid technology includes systems that enable EV owners to participate in energy markets and monetize their vehicle's battery capacity. These frameworks incorporate automated trading algorithms, pricing mechanisms, and settlement systems that allow vehicles to provide grid services such as frequency regulation, voltage support, and peak shaving. The technology optimizes when to buy, store, and sell electricity based on market conditions and user preferences.

- Smart charging infrastructure with V2G capabilities: Advanced charging infrastructure designed specifically for Vehicle-to-Grid applications includes smart charging stations with bidirectional power flow capabilities. These systems feature integrated power electronics, thermal management, safety mechanisms, and user interfaces that support both charging and discharging operations. The infrastructure can be deployed in various settings including residential, commercial, and public locations to create a comprehensive V2G ecosystem.

02 Grid stabilization and demand response through V2G

Vehicle-to-Grid technology enables electric vehicles to participate in grid stabilization and demand response programs. By aggregating multiple vehicles, the system can provide significant power reserves that help balance supply and demand fluctuations, reduce peak loads, and integrate renewable energy sources. This capability transforms electric vehicles from mere transportation assets into distributed energy resources that contribute to grid reliability and efficiency.Expand Specific Solutions03 V2G communication protocols and management systems

Advanced communication protocols and management systems are essential for effective Vehicle-to-Grid implementation. These systems coordinate between vehicle batteries, charging infrastructure, and grid operators to optimize energy flows. They include real-time data exchange, authentication mechanisms, transaction processing, and user interfaces that allow vehicle owners to set preferences and monitor their participation in grid services while ensuring grid security and stability.Expand Specific Solutions04 Economic models and incentive structures for V2G adoption

Various economic models and incentive structures have been developed to encourage V2G adoption. These include payment schemes for grid services provided by vehicle owners, reduced electricity rates, battery degradation compensation, and tax benefits. The financial frameworks aim to create win-win situations where vehicle owners receive compensation for making their battery capacity available to the grid while utilities benefit from additional flexibility and reduced infrastructure costs.Expand Specific Solutions05 V2G integration with renewable energy and microgrids

Vehicle-to-Grid technology can be integrated with renewable energy sources and microgrids to create more sustainable and resilient energy systems. Electric vehicles can store excess renewable energy when production exceeds demand and release it during peak hours or when renewable generation is low. In microgrid applications, V2G-enabled vehicles can provide emergency backup power during outages and help isolated communities reduce dependence on fossil fuels by maximizing the utilization of local renewable resources.Expand Specific Solutions

Key Industry Players in V2G Ecosystem

Vehicle-to-Grid (V2G) technology is currently in the early growth phase, with a global market expected to reach $17.4 billion by 2027. The competitive landscape features traditional automakers (Ford, Toyota, GM, Hyundai-Kia) investing heavily in V2G capabilities, while technology companies like Qualcomm and energy specialists such as CATL are developing supporting infrastructure. Policy changes significantly impact adoption rates, with regulatory frameworks around grid integration, energy market participation, and carbon pricing directly influencing investment decisions. Companies like NIO and Aulton are pioneering battery-swap models that complement V2G systems, while academic institutions like University of California collaborate with industry to address technical challenges. The technology's maturity varies regionally, with more advanced implementation in markets with supportive regulatory environments.

Ford Global Technologies LLC

Technical Solution: Ford has developed an integrated Vehicle-to-Grid (V2G) system that enables bidirectional power flow between electric vehicles and the grid. Their technology incorporates intelligent charging algorithms that respond to utility price signals and grid demands in real-time. Ford's system includes a proprietary Home Integration System that allows homeowners to power their homes during outages while optimizing energy costs based on time-of-use rates. Their Cloud-Connected Charge Management platform enables fleet operators to participate in demand response programs while ensuring vehicles maintain sufficient charge for operational needs. Ford has also partnered with utilities across multiple states to pilot V2G programs that provide grid services while generating revenue for vehicle owners [1][3]. Their Intelligent Power Management System adjusts charging patterns based on renewable energy availability, helping to balance grid loads during peak demand periods.

Strengths: Ford's system offers seamless integration with existing home energy management systems and utility infrastructure. Their cloud platform provides scalable solutions for both individual consumers and fleet operators. Weaknesses: Implementation requires significant infrastructure investment and faces regulatory hurdles in markets without supportive policies for grid services compensation.

NIO Technology (Anhui) Co. Ltd.

Technical Solution: NIO has pioneered an innovative Vehicle-to-Grid system centered around their Battery-as-a-Service (BaaS) model and battery swapping infrastructure. Their technology enables bidirectional power flow between vehicles, battery swap stations, and the grid, creating a flexible energy ecosystem. NIO's V2G platform incorporates their Cloud-Based Energy Management System that optimizes battery charging/discharging based on grid conditions, electricity pricing, and user needs. Their system features intelligent algorithms that respond to policy incentives and grid signals, enabling participation in demand response programs and energy markets. NIO has implemented a comprehensive V2G solution across their swap stations in China, which function as distributed energy resources with significant storage capacity (each station containing 13 batteries with combined capacity exceeding 1MWh) [6][8]. Their technology includes Vehicle-to-Everything (V2X) capabilities that allow power export to various loads beyond just grid integration. NIO's approach uniquely addresses battery degradation concerns by managing battery assets centrally through their swap infrastructure, enabling more aggressive grid services without impacting individual vehicle owners.

Strengths: NIO's battery swap infrastructure provides unique advantages for V2G implementation by separating battery ownership from vehicle ownership and enabling centralized battery management. Their system offers exceptional flexibility for grid services without compromising vehicle availability. Weaknesses: The infrastructure-intensive approach requires significant capital investment and faces challenges with standardization across different markets with varying policy frameworks for both battery swapping and grid services.

Critical V2G Patents and Technical Innovations

Vehicle-to-grid system with power loss compensation

PatentInactiveUS9630511B2

Innovation

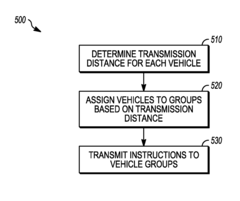

- A vehicle-to-grid system with a controller that assigns vehicles to different groups based on transmission distance, instructing the first group to supply power at a nominal frequency and adjusted amplitude, and the second group to supply power at an adjusted frequency different from the nominal frequency and nominal amplitude, thereby optimizing power delivery and reducing losses.

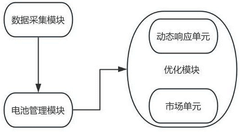

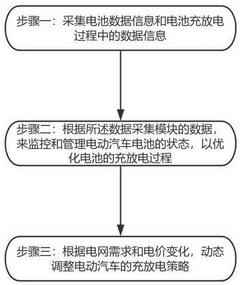

A dynamic regulation system and method for electric vehicles participating in power grid based on V2G technology

PatentActiveCN118651117B

Innovation

- 采用数据采集模块监控电池状态,电池管理模块根据综合评估值和电价变化动态调整充放电策略,优化模块包括动态响应单元和市场单元,预测维护单元和充放电调整因子,实现智能充放电管理和经济激励。

Policy Framework Impact on V2G Adoption

Policy frameworks across different regions have emerged as critical determinants in the adoption trajectory of Vehicle-to-Grid (V2G) technology. The regulatory landscape directly shapes market incentives, technical standards, and operational parameters that either accelerate or impede V2G implementation. In the United States, the Federal Energy Regulatory Commission (FERC) Order 2222 represents a watershed moment, enabling distributed energy resources, including electric vehicles with V2G capability, to participate in wholesale electricity markets. This regulatory shift has created new revenue streams for V2G operators and enhanced the economic viability of the technology.

The European Union has established a more comprehensive policy approach through its Clean Energy Package, which explicitly recognizes energy storage services provided by electric vehicles. Countries like Denmark and the Netherlands have pioneered regulatory sandboxes that allow V2G projects to operate under modified regulatory conditions, facilitating real-world testing while protecting the broader energy system. These experimental frameworks have proven instrumental in identifying and addressing regulatory barriers before widespread deployment.

Tax incentives and subsidies form another crucial policy lever influencing V2G adoption. Japan's Green Investment Tax Incentive provides significant tax benefits for businesses investing in V2G infrastructure, while the UK's Vehicle-to-Grid Innovation Competition has allocated £30 million to support demonstration projects. These financial mechanisms help offset the higher initial costs associated with V2G-capable charging equipment and vehicle modifications.

Grid interconnection policies represent a particularly complex aspect of the regulatory landscape. Technical standards for grid connection, such as IEEE 1547 in the United States and IEC 61851 internationally, determine how V2G systems interact with the electrical grid. Streamlined interconnection procedures in regions like California have significantly reduced administrative barriers, allowing faster deployment of V2G systems compared to areas with more cumbersome approval processes.

Data privacy and cybersecurity regulations also substantially impact V2G adoption. The bidirectional flow of both electricity and data in V2G systems creates unique security challenges that must be addressed through appropriate regulatory frameworks. The EU's General Data Protection Regulation (GDPR) has established strict requirements for handling vehicle and energy consumption data, necessitating additional compliance measures for V2G operators in European markets.

Market structure policies determine how V2G services are valued and compensated. Regions with capacity markets and ancillary service markets that recognize fast-responding distributed resources tend to offer more favorable economic conditions for V2G deployment. For instance, PJM Interconnection's frequency regulation market in the eastern United States has created significant revenue opportunities for V2G projects due to its pay-for-performance structure that rewards rapid response capabilities.

The European Union has established a more comprehensive policy approach through its Clean Energy Package, which explicitly recognizes energy storage services provided by electric vehicles. Countries like Denmark and the Netherlands have pioneered regulatory sandboxes that allow V2G projects to operate under modified regulatory conditions, facilitating real-world testing while protecting the broader energy system. These experimental frameworks have proven instrumental in identifying and addressing regulatory barriers before widespread deployment.

Tax incentives and subsidies form another crucial policy lever influencing V2G adoption. Japan's Green Investment Tax Incentive provides significant tax benefits for businesses investing in V2G infrastructure, while the UK's Vehicle-to-Grid Innovation Competition has allocated £30 million to support demonstration projects. These financial mechanisms help offset the higher initial costs associated with V2G-capable charging equipment and vehicle modifications.

Grid interconnection policies represent a particularly complex aspect of the regulatory landscape. Technical standards for grid connection, such as IEEE 1547 in the United States and IEC 61851 internationally, determine how V2G systems interact with the electrical grid. Streamlined interconnection procedures in regions like California have significantly reduced administrative barriers, allowing faster deployment of V2G systems compared to areas with more cumbersome approval processes.

Data privacy and cybersecurity regulations also substantially impact V2G adoption. The bidirectional flow of both electricity and data in V2G systems creates unique security challenges that must be addressed through appropriate regulatory frameworks. The EU's General Data Protection Regulation (GDPR) has established strict requirements for handling vehicle and energy consumption data, necessitating additional compliance measures for V2G operators in European markets.

Market structure policies determine how V2G services are valued and compensated. Regions with capacity markets and ancillary service markets that recognize fast-responding distributed resources tend to offer more favorable economic conditions for V2G deployment. For instance, PJM Interconnection's frequency regulation market in the eastern United States has created significant revenue opportunities for V2G projects due to its pay-for-performance structure that rewards rapid response capabilities.

Economic Incentives and Business Models

The economic landscape surrounding Vehicle-to-Grid (V2G) technology is heavily influenced by policy frameworks that create financial incentives and enable innovative business models. Current V2G economic incentives primarily revolve around grid services compensation, where electric vehicle owners receive payments for providing services such as frequency regulation, demand response, and peak shaving. These compensation structures vary significantly across jurisdictions, with some markets offering capacity payments while others focus on energy-based remuneration.

Policy-driven feed-in tariffs specifically designed for V2G have emerged in several European countries, creating predictable revenue streams that enhance the economic viability of V2G investments. These tariffs typically guarantee fixed payments for electricity fed back to the grid from vehicles during specific time periods, reducing investment uncertainty and accelerating adoption rates.

Tax incentives represent another critical economic lever influenced by policy changes. Several jurisdictions have implemented tax credits, rebates, or accelerated depreciation schedules for V2G-enabled infrastructure. These fiscal tools effectively lower the initial capital expenditure barrier and improve the return on investment timeline for both individual and commercial adopters.

The business models enabled by supportive V2G policies fall into several distinct categories. The aggregator model has gained significant traction, where third-party entities manage fleets of electric vehicles to provide grid services at scale. This model benefits from economies of scale and sophisticated optimization algorithms that maximize revenue while minimizing battery degradation costs.

Utility-led business models have also emerged, where power companies directly integrate V2G capabilities into their grid management strategies. These models often feature time-of-use rate structures that incentivize vehicle owners to charge during off-peak periods and discharge during peak demand. Some utilities have pioneered "V2G-as-a-service" offerings that eliminate upfront costs for consumers in exchange for grid access rights.

Corporate fleet models represent a rapidly growing segment, particularly as organizations seek to monetize their vehicle assets during idle periods. Policy frameworks that enable fleet operators to participate in wholesale electricity markets have proven particularly effective in accelerating adoption in this sector.

The economic viability of these business models remains highly sensitive to policy stability. Markets with clear, long-term regulatory frameworks consistently demonstrate higher V2G investment levels compared to regions with uncertain or frequently changing policies. This underscores the critical importance of policy predictability in fostering sustainable V2G economic ecosystems.

Policy-driven feed-in tariffs specifically designed for V2G have emerged in several European countries, creating predictable revenue streams that enhance the economic viability of V2G investments. These tariffs typically guarantee fixed payments for electricity fed back to the grid from vehicles during specific time periods, reducing investment uncertainty and accelerating adoption rates.

Tax incentives represent another critical economic lever influenced by policy changes. Several jurisdictions have implemented tax credits, rebates, or accelerated depreciation schedules for V2G-enabled infrastructure. These fiscal tools effectively lower the initial capital expenditure barrier and improve the return on investment timeline for both individual and commercial adopters.

The business models enabled by supportive V2G policies fall into several distinct categories. The aggregator model has gained significant traction, where third-party entities manage fleets of electric vehicles to provide grid services at scale. This model benefits from economies of scale and sophisticated optimization algorithms that maximize revenue while minimizing battery degradation costs.

Utility-led business models have also emerged, where power companies directly integrate V2G capabilities into their grid management strategies. These models often feature time-of-use rate structures that incentivize vehicle owners to charge during off-peak periods and discharge during peak demand. Some utilities have pioneered "V2G-as-a-service" offerings that eliminate upfront costs for consumers in exchange for grid access rights.

Corporate fleet models represent a rapidly growing segment, particularly as organizations seek to monetize their vehicle assets during idle periods. Policy frameworks that enable fleet operators to participate in wholesale electricity markets have proven particularly effective in accelerating adoption in this sector.

The economic viability of these business models remains highly sensitive to policy stability. Markets with clear, long-term regulatory frameworks consistently demonstrate higher V2G investment levels compared to regions with uncertain or frequently changing policies. This underscores the critical importance of policy predictability in fostering sustainable V2G economic ecosystems.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!