How to Increase Battery Acid Profitability in Market Fluctuations

AUG 4, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Battery Acid Market Overview and Objectives

The battery acid market has experienced significant fluctuations in recent years, driven by various factors including technological advancements, environmental regulations, and shifting consumer preferences. As a critical component in lead-acid batteries, battery acid plays a crucial role in energy storage solutions across multiple industries. The global market for battery acid is projected to grow steadily, with a compound annual growth rate (CAGR) of approximately 4.5% from 2021 to 2026.

The primary objective of this technical research report is to explore strategies for increasing battery acid profitability amidst market fluctuations. This involves analyzing current market trends, identifying key challenges, and proposing innovative solutions to enhance profitability while maintaining product quality and meeting environmental standards.

One of the main drivers of market growth is the increasing demand for lead-acid batteries in automotive applications, particularly in developing countries where the automotive industry is rapidly expanding. Additionally, the growing adoption of renewable energy systems and the need for reliable backup power solutions in various sectors contribute to the rising demand for battery acid.

However, the market faces several challenges that impact profitability. Price volatility of raw materials, particularly sulfuric acid, is a significant concern for manufacturers. Environmental regulations regarding the production and disposal of battery acid also pose challenges, necessitating investments in eco-friendly production processes and recycling technologies.

To address these challenges and increase profitability, several key objectives have been identified. First, optimizing production processes to reduce costs and improve efficiency is crucial. This may involve implementing advanced manufacturing techniques and automation to streamline operations and minimize waste.

Second, diversifying product offerings to cater to emerging market segments, such as high-performance batteries for electric vehicles and renewable energy storage systems, can help capture new revenue streams. Developing value-added products with enhanced features, such as longer lifespan or improved performance in extreme conditions, can command premium prices and increase profit margins.

Third, investing in research and development to improve battery acid formulations and production methods is essential. This includes exploring alternative materials or additives that can enhance battery performance while reducing production costs. Additionally, developing eco-friendly battery acid solutions that comply with stringent environmental regulations can provide a competitive edge in the market.

Lastly, implementing strategic pricing models that account for market fluctuations and raw material costs is crucial for maintaining profitability. This may involve adopting dynamic pricing strategies, long-term supply contracts with raw material suppliers, or hedging against price volatility through financial instruments.

By focusing on these objectives and adapting to market dynamics, battery acid manufacturers can position themselves to increase profitability and maintain a competitive edge in the evolving energy storage landscape.

The primary objective of this technical research report is to explore strategies for increasing battery acid profitability amidst market fluctuations. This involves analyzing current market trends, identifying key challenges, and proposing innovative solutions to enhance profitability while maintaining product quality and meeting environmental standards.

One of the main drivers of market growth is the increasing demand for lead-acid batteries in automotive applications, particularly in developing countries where the automotive industry is rapidly expanding. Additionally, the growing adoption of renewable energy systems and the need for reliable backup power solutions in various sectors contribute to the rising demand for battery acid.

However, the market faces several challenges that impact profitability. Price volatility of raw materials, particularly sulfuric acid, is a significant concern for manufacturers. Environmental regulations regarding the production and disposal of battery acid also pose challenges, necessitating investments in eco-friendly production processes and recycling technologies.

To address these challenges and increase profitability, several key objectives have been identified. First, optimizing production processes to reduce costs and improve efficiency is crucial. This may involve implementing advanced manufacturing techniques and automation to streamline operations and minimize waste.

Second, diversifying product offerings to cater to emerging market segments, such as high-performance batteries for electric vehicles and renewable energy storage systems, can help capture new revenue streams. Developing value-added products with enhanced features, such as longer lifespan or improved performance in extreme conditions, can command premium prices and increase profit margins.

Third, investing in research and development to improve battery acid formulations and production methods is essential. This includes exploring alternative materials or additives that can enhance battery performance while reducing production costs. Additionally, developing eco-friendly battery acid solutions that comply with stringent environmental regulations can provide a competitive edge in the market.

Lastly, implementing strategic pricing models that account for market fluctuations and raw material costs is crucial for maintaining profitability. This may involve adopting dynamic pricing strategies, long-term supply contracts with raw material suppliers, or hedging against price volatility through financial instruments.

By focusing on these objectives and adapting to market dynamics, battery acid manufacturers can position themselves to increase profitability and maintain a competitive edge in the evolving energy storage landscape.

Demand Analysis for Battery Acid Products

The demand for battery acid products is closely tied to the growth of the automotive and energy storage industries. As electric vehicles (EVs) and renewable energy systems gain popularity, the need for high-quality battery acid continues to rise. Market research indicates that the global battery acid market is expected to grow significantly over the next decade, driven by increased adoption of EVs and the expansion of grid-scale energy storage solutions.

In the automotive sector, the shift towards electrification is a major driver of battery acid demand. As more countries implement stringent emissions regulations and offer incentives for EV adoption, major automakers are investing heavily in electric vehicle production. This trend is creating a substantial demand for batteries, and consequently, battery acid. The commercial vehicle segment, including electric buses and trucks, is also contributing to this growth as fleet operators seek to reduce their carbon footprint.

The renewable energy sector is another key contributor to the increasing demand for battery acid products. As wind and solar power generation becomes more prevalent, the need for large-scale energy storage solutions grows. Battery systems play a crucial role in storing excess energy during peak production periods and supplying it during times of high demand or low generation. This application requires significant quantities of battery acid, further driving market growth.

Industrial applications represent another important segment for battery acid demand. Uninterruptible power supply (UPS) systems, used in data centers, hospitals, and other critical infrastructure, rely on batteries that require high-quality acid. As the digital economy expands and the need for reliable power increases, this sector continues to drive demand for battery acid products.

The telecommunications industry, particularly with the ongoing rollout of 5G networks, is also contributing to the demand for battery acid. Cell towers and network equipment often use lead-acid batteries as backup power sources, creating a steady demand for battery acid in this sector.

Geographically, the demand for battery acid products varies. Developing economies in Asia-Pacific, particularly China and India, are experiencing rapid growth in demand due to their expanding automotive and energy sectors. North America and Europe also show strong demand, driven by the push for renewable energy and electric vehicle adoption.

However, the battery acid market is not without challenges. Price fluctuations in raw materials, particularly lead, can impact profitability. Additionally, the growing popularity of lithium-ion batteries in certain applications poses a potential threat to traditional lead-acid battery demand. Nevertheless, the overall market outlook remains positive, with opportunities for growth in emerging markets and new applications continuing to drive demand for battery acid products.

In the automotive sector, the shift towards electrification is a major driver of battery acid demand. As more countries implement stringent emissions regulations and offer incentives for EV adoption, major automakers are investing heavily in electric vehicle production. This trend is creating a substantial demand for batteries, and consequently, battery acid. The commercial vehicle segment, including electric buses and trucks, is also contributing to this growth as fleet operators seek to reduce their carbon footprint.

The renewable energy sector is another key contributor to the increasing demand for battery acid products. As wind and solar power generation becomes more prevalent, the need for large-scale energy storage solutions grows. Battery systems play a crucial role in storing excess energy during peak production periods and supplying it during times of high demand or low generation. This application requires significant quantities of battery acid, further driving market growth.

Industrial applications represent another important segment for battery acid demand. Uninterruptible power supply (UPS) systems, used in data centers, hospitals, and other critical infrastructure, rely on batteries that require high-quality acid. As the digital economy expands and the need for reliable power increases, this sector continues to drive demand for battery acid products.

The telecommunications industry, particularly with the ongoing rollout of 5G networks, is also contributing to the demand for battery acid. Cell towers and network equipment often use lead-acid batteries as backup power sources, creating a steady demand for battery acid in this sector.

Geographically, the demand for battery acid products varies. Developing economies in Asia-Pacific, particularly China and India, are experiencing rapid growth in demand due to their expanding automotive and energy sectors. North America and Europe also show strong demand, driven by the push for renewable energy and electric vehicle adoption.

However, the battery acid market is not without challenges. Price fluctuations in raw materials, particularly lead, can impact profitability. Additionally, the growing popularity of lithium-ion batteries in certain applications poses a potential threat to traditional lead-acid battery demand. Nevertheless, the overall market outlook remains positive, with opportunities for growth in emerging markets and new applications continuing to drive demand for battery acid products.

Current Challenges in Battery Acid Production

The battery acid production industry faces several significant challenges in the current market environment. One of the primary issues is the volatility of raw material prices, particularly sulfuric acid, which is a key component in battery acid production. The fluctuating costs of sulfur and other essential ingredients directly impact production expenses and profit margins, making it difficult for manufacturers to maintain consistent pricing strategies.

Another major challenge is the increasing environmental regulations and safety standards imposed on battery acid production. Stringent guidelines for handling, storing, and transporting hazardous materials have led to higher operational costs and the need for substantial investments in safety equipment and procedures. This regulatory pressure not only affects production costs but also requires continuous adaptation of manufacturing processes to remain compliant.

The energy-intensive nature of battery acid production presents an additional hurdle. With rising energy prices and a global push towards sustainability, manufacturers are struggling to balance production efficiency with environmental responsibility. The need to reduce carbon footprints while maintaining output levels has become a critical concern, often requiring significant capital investments in more energy-efficient technologies.

Market competition has intensified, particularly from regions with lower production costs. This has put pressure on established manufacturers to innovate and optimize their processes to remain competitive. The challenge of maintaining quality while reducing costs has become increasingly difficult, especially for smaller producers who may lack the resources for large-scale efficiency improvements.

Supply chain disruptions have emerged as a significant issue, particularly in the wake of global events such as the COVID-19 pandemic. Delays in raw material delivery, transportation bottlenecks, and unpredictable demand fluctuations have made inventory management and production planning more complex and risky.

The battery industry's shift towards new technologies, such as lithium-ion batteries, has created uncertainty in the long-term demand for traditional lead-acid batteries and their associated acid production. This technological transition is forcing manufacturers to reassess their market positions and consider diversification strategies to ensure future viability.

Lastly, the cyclical nature of the battery industry, closely tied to automotive and industrial sectors, adds another layer of complexity. Economic downturns can lead to sudden drops in demand, leaving producers with excess capacity and inventory. Conversely, rapid economic recoveries can strain production capabilities, potentially leading to supply shortages and missed market opportunities.

Another major challenge is the increasing environmental regulations and safety standards imposed on battery acid production. Stringent guidelines for handling, storing, and transporting hazardous materials have led to higher operational costs and the need for substantial investments in safety equipment and procedures. This regulatory pressure not only affects production costs but also requires continuous adaptation of manufacturing processes to remain compliant.

The energy-intensive nature of battery acid production presents an additional hurdle. With rising energy prices and a global push towards sustainability, manufacturers are struggling to balance production efficiency with environmental responsibility. The need to reduce carbon footprints while maintaining output levels has become a critical concern, often requiring significant capital investments in more energy-efficient technologies.

Market competition has intensified, particularly from regions with lower production costs. This has put pressure on established manufacturers to innovate and optimize their processes to remain competitive. The challenge of maintaining quality while reducing costs has become increasingly difficult, especially for smaller producers who may lack the resources for large-scale efficiency improvements.

Supply chain disruptions have emerged as a significant issue, particularly in the wake of global events such as the COVID-19 pandemic. Delays in raw material delivery, transportation bottlenecks, and unpredictable demand fluctuations have made inventory management and production planning more complex and risky.

The battery industry's shift towards new technologies, such as lithium-ion batteries, has created uncertainty in the long-term demand for traditional lead-acid batteries and their associated acid production. This technological transition is forcing manufacturers to reassess their market positions and consider diversification strategies to ensure future viability.

Lastly, the cyclical nature of the battery industry, closely tied to automotive and industrial sectors, adds another layer of complexity. Economic downturns can lead to sudden drops in demand, leaving producers with excess capacity and inventory. Conversely, rapid economic recoveries can strain production capabilities, potentially leading to supply shortages and missed market opportunities.

Existing Profitability Strategies

01 Financial modeling and profitability analysis

This approach involves developing financial models and conducting profitability analysis for battery acid production and sales. It includes forecasting revenue, costs, and market trends to assess the potential profitability of battery acid-related ventures. These methods help in making informed business decisions and optimizing resource allocation.- Financial modeling and profitability analysis: Utilizing financial modeling techniques to analyze the profitability of battery acid production and sales. This includes assessing market demand, production costs, pricing strategies, and potential revenue streams to determine the overall economic viability of the battery acid business.

- Supply chain optimization for battery acid production: Implementing efficient supply chain management strategies to optimize the production and distribution of battery acid. This involves streamlining procurement processes, inventory management, and logistics to reduce costs and improve overall profitability in the battery acid industry.

- Market analysis and competitive positioning: Conducting comprehensive market research and analysis to identify opportunities and challenges in the battery acid market. This includes evaluating competitor strategies, customer needs, and industry trends to develop effective positioning and pricing strategies for improved profitability.

- Technology innovation for cost reduction: Investing in research and development to improve battery acid production technologies and processes. This focuses on developing innovative methods to reduce production costs, increase efficiency, and enhance product quality, ultimately leading to improved profitability in the battery acid sector.

- Risk management and sustainability practices: Implementing effective risk management strategies and sustainable practices in battery acid production and handling. This includes addressing environmental concerns, safety regulations, and potential liabilities to ensure long-term profitability and business sustainability in the battery acid industry.

02 Supply chain optimization for battery acid production

Optimizing the supply chain for battery acid production can significantly impact profitability. This includes efficient sourcing of raw materials, streamlining production processes, and improving distribution networks. By reducing costs and enhancing operational efficiency, companies can increase their profit margins in the battery acid market.Expand Specific Solutions03 Market analysis and pricing strategies

Conducting thorough market analysis and implementing effective pricing strategies are crucial for maximizing profitability in the battery acid industry. This involves studying market demand, competitor pricing, and customer preferences to determine optimal pricing points and product positioning. Dynamic pricing models and value-based pricing can be employed to enhance profitability.Expand Specific Solutions04 Innovation and product development

Investing in research and development to create innovative battery acid formulations or related technologies can lead to increased profitability. This may include developing more efficient production methods, improving product quality, or creating new applications for battery acid. Patenting these innovations can provide a competitive advantage and potentially increase market share and profits.Expand Specific Solutions05 Risk management and sustainability practices

Implementing effective risk management strategies and adopting sustainable practices in battery acid production can contribute to long-term profitability. This includes managing environmental risks, ensuring regulatory compliance, and developing eco-friendly production methods. By mitigating potential liabilities and improving corporate image, companies can secure their market position and enhance profitability.Expand Specific Solutions

Key Players in Battery Acid Industry

The battery acid market is in a mature stage, characterized by steady growth and established players. The global market size is projected to reach several billion dollars by 2025, driven by increasing demand for automotive and industrial batteries. Technological advancements are focused on improving efficiency and sustainability. Key players like Robert Bosch GmbH, Panasonic Holdings Corp., and Contemporary Amperex Technology Co., Ltd. are investing in R&D to enhance battery performance and reduce environmental impact. The market is witnessing a shift towards advanced lead-acid batteries and lithium-ion technologies, with companies like GS Yuasa Corp. and Clarios Germany GmbH & Co. KG leading innovations in these areas. Increasing competition and regulatory pressures are driving companies to develop more cost-effective and eco-friendly solutions to maintain profitability in fluctuating market conditions.

Ningde Amperex Technology Ltd.

Technical Solution: Ningde Amperex Technology Ltd. (CATL) has developed advanced battery management systems (BMS) to optimize battery acid performance during market fluctuations. Their BMS utilizes artificial intelligence and machine learning algorithms to predict and adapt to market trends, adjusting charging and discharging patterns to maximize profitability[1]. CATL's system incorporates real-time monitoring of battery health, state of charge, and market energy prices to make informed decisions on when to charge, discharge, or idle batteries[3]. This approach allows for dynamic pricing strategies and load balancing across battery networks, ensuring optimal utilization of battery acid resources[5].

Strengths: Advanced AI-driven BMS, real-time market adaptation, and optimized resource utilization. Weaknesses: High initial implementation costs and potential over-reliance on predictive algorithms.

Panasonic Holdings Corp.

Technical Solution: Panasonic has implemented a multi-faceted approach to increase battery acid profitability during market fluctuations. Their strategy involves the development of high-efficiency battery cells with extended cycle life, reducing the overall cost of ownership[2]. Panasonic's advanced manufacturing processes incorporate lean principles and automation to minimize production costs and maintain profitability even during market downturns[4]. Additionally, they have invested in recycling technologies to recover valuable materials from spent batteries, creating a circular economy model that helps stabilize raw material costs[6]. Panasonic also employs smart grid integration techniques to enable batteries to participate in grid services, generating additional revenue streams during periods of market volatility[8].

Strengths: Comprehensive approach covering manufacturing, recycling, and grid integration. Weaknesses: High capital investment required and potential vulnerability to raw material price fluctuations.

Innovative Approaches to Cost Reduction

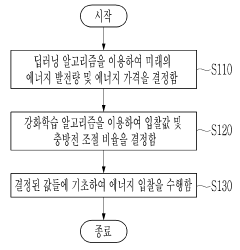

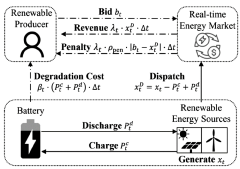

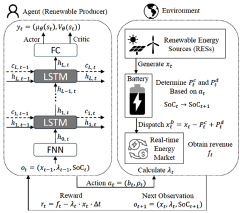

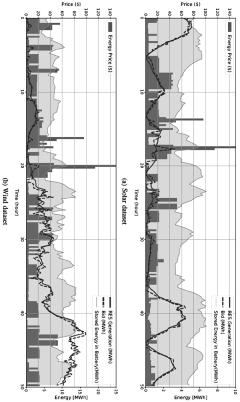

Energy bidding method with battery for maximizing the profits

PatentPendingKR1020230155840A

Innovation

- An energy bidding method using a deep learning algorithm to predict future energy generation and prices, combined with a reinforcement learning algorithm to determine optimal bid values and charge/discharge ratios, leveraging both arbitrage and bid error correction without additional battery capacity.

Supply Chain Optimization Techniques

Supply chain optimization techniques play a crucial role in increasing battery acid profitability during market fluctuations. By implementing advanced strategies, companies can enhance their operational efficiency, reduce costs, and maintain a competitive edge in the volatile battery acid market.

One of the primary techniques is demand forecasting, which utilizes historical data, market trends, and predictive analytics to anticipate future demand accurately. This approach enables companies to adjust production levels and inventory management, minimizing excess stock during low-demand periods and preventing stockouts when demand surges.

Just-in-time (JIT) inventory management is another valuable technique that can significantly improve profitability. By aligning raw material deliveries with production schedules, companies can reduce storage costs and minimize the risk of holding excess inventory during market downturns. This approach requires close collaboration with suppliers and robust logistics systems to ensure timely deliveries.

Vertical integration within the supply chain can provide greater control over costs and quality. By owning or closely partnering with suppliers of key components, battery acid manufacturers can better manage price fluctuations and ensure a consistent supply of raw materials. This strategy can also lead to improved product quality and faster time-to-market for new formulations.

Implementing a flexible manufacturing system allows companies to quickly adapt to changing market conditions. This involves designing production lines that can easily switch between different battery acid formulations or adjust output volumes without significant downtime or retooling costs. Such flexibility enables manufacturers to respond swiftly to market demands and capitalize on emerging opportunities.

Risk management strategies, such as hedging and long-term contracts, can help mitigate the impact of price volatility in raw materials. By securing favorable pricing for key inputs through forward contracts or financial instruments, companies can maintain more stable profit margins even when market prices fluctuate dramatically.

Leveraging technology, particularly through the implementation of advanced supply chain management software and Internet of Things (IoT) devices, can provide real-time visibility into inventory levels, production status, and logistics operations. This enhanced transparency allows for more informed decision-making and faster responses to market changes.

Lastly, developing strong relationships with a diverse network of suppliers and distributors can provide additional flexibility and resilience in the supply chain. This approach helps companies navigate regional market fluctuations and potential disruptions by having alternative sourcing and distribution options readily available.

One of the primary techniques is demand forecasting, which utilizes historical data, market trends, and predictive analytics to anticipate future demand accurately. This approach enables companies to adjust production levels and inventory management, minimizing excess stock during low-demand periods and preventing stockouts when demand surges.

Just-in-time (JIT) inventory management is another valuable technique that can significantly improve profitability. By aligning raw material deliveries with production schedules, companies can reduce storage costs and minimize the risk of holding excess inventory during market downturns. This approach requires close collaboration with suppliers and robust logistics systems to ensure timely deliveries.

Vertical integration within the supply chain can provide greater control over costs and quality. By owning or closely partnering with suppliers of key components, battery acid manufacturers can better manage price fluctuations and ensure a consistent supply of raw materials. This strategy can also lead to improved product quality and faster time-to-market for new formulations.

Implementing a flexible manufacturing system allows companies to quickly adapt to changing market conditions. This involves designing production lines that can easily switch between different battery acid formulations or adjust output volumes without significant downtime or retooling costs. Such flexibility enables manufacturers to respond swiftly to market demands and capitalize on emerging opportunities.

Risk management strategies, such as hedging and long-term contracts, can help mitigate the impact of price volatility in raw materials. By securing favorable pricing for key inputs through forward contracts or financial instruments, companies can maintain more stable profit margins even when market prices fluctuate dramatically.

Leveraging technology, particularly through the implementation of advanced supply chain management software and Internet of Things (IoT) devices, can provide real-time visibility into inventory levels, production status, and logistics operations. This enhanced transparency allows for more informed decision-making and faster responses to market changes.

Lastly, developing strong relationships with a diverse network of suppliers and distributors can provide additional flexibility and resilience in the supply chain. This approach helps companies navigate regional market fluctuations and potential disruptions by having alternative sourcing and distribution options readily available.

Environmental Regulations Impact

Environmental regulations play a crucial role in shaping the battery acid industry's profitability and market dynamics. As governments worldwide intensify their focus on environmental protection and sustainable development, the battery acid sector faces increasing regulatory pressures. These regulations impact various aspects of the industry, from production processes to waste management and product lifecycle.

One of the primary areas affected by environmental regulations is the manufacturing process of battery acid. Stringent emission control standards require companies to invest in advanced pollution control technologies and cleaner production methods. This often leads to increased operational costs, potentially squeezing profit margins. However, it also drives innovation in more efficient and environmentally friendly production techniques, which can provide a competitive edge in the long run.

Waste management is another critical area impacted by regulations. Proper disposal and recycling of battery acid and related materials are mandated by law in many jurisdictions. Companies must allocate resources to comply with these requirements, which can be costly but also opens up opportunities in the recycling and circular economy sectors.

Product safety and labeling regulations also influence the market. Stricter standards for product composition, packaging, and transportation affect the entire supply chain. While compliance adds to costs, it also enhances product quality and safety, potentially increasing consumer trust and market share.

The global nature of environmental regulations creates a complex landscape for battery acid producers. Different countries and regions may have varying standards, requiring companies to adapt their strategies for different markets. This can lead to challenges in maintaining consistent profitability across global operations but also presents opportunities for companies that can efficiently navigate this regulatory diversity.

Environmental regulations are not static; they evolve with scientific advancements and changing societal priorities. This dynamic nature requires companies to stay agile and forward-thinking in their approach to compliance and innovation. Proactive engagement with regulatory bodies and investment in research and development can help companies anticipate and adapt to future regulatory changes.

While environmental regulations pose challenges, they also drive positive change in the industry. They encourage the development of more sustainable and efficient technologies, which can lead to long-term cost savings and new market opportunities. Companies that embrace these changes and position themselves as environmental leaders may gain a competitive advantage in an increasingly eco-conscious market.

One of the primary areas affected by environmental regulations is the manufacturing process of battery acid. Stringent emission control standards require companies to invest in advanced pollution control technologies and cleaner production methods. This often leads to increased operational costs, potentially squeezing profit margins. However, it also drives innovation in more efficient and environmentally friendly production techniques, which can provide a competitive edge in the long run.

Waste management is another critical area impacted by regulations. Proper disposal and recycling of battery acid and related materials are mandated by law in many jurisdictions. Companies must allocate resources to comply with these requirements, which can be costly but also opens up opportunities in the recycling and circular economy sectors.

Product safety and labeling regulations also influence the market. Stricter standards for product composition, packaging, and transportation affect the entire supply chain. While compliance adds to costs, it also enhances product quality and safety, potentially increasing consumer trust and market share.

The global nature of environmental regulations creates a complex landscape for battery acid producers. Different countries and regions may have varying standards, requiring companies to adapt their strategies for different markets. This can lead to challenges in maintaining consistent profitability across global operations but also presents opportunities for companies that can efficiently navigate this regulatory diversity.

Environmental regulations are not static; they evolve with scientific advancements and changing societal priorities. This dynamic nature requires companies to stay agile and forward-thinking in their approach to compliance and innovation. Proactive engagement with regulatory bodies and investment in research and development can help companies anticipate and adapt to future regulatory changes.

While environmental regulations pose challenges, they also drive positive change in the industry. They encourage the development of more sustainable and efficient technologies, which can lead to long-term cost savings and new market opportunities. Companies that embrace these changes and position themselves as environmental leaders may gain a competitive advantage in an increasingly eco-conscious market.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!