Impact of AMOLED on emerging display ecosystems.

JUL 17, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

AMOLED Technology Evolution and Objectives

AMOLED (Active-Matrix Organic Light-Emitting Diode) technology has revolutionized the display industry since its inception in the late 1990s. This innovative display technology has undergone significant evolution, driven by the increasing demand for high-quality, energy-efficient displays in various electronic devices.

The primary objective of AMOLED technology development has been to overcome the limitations of traditional LCD displays, offering superior image quality, faster response times, and improved power efficiency. As the technology progressed, researchers and manufacturers focused on enhancing color accuracy, brightness, and contrast ratios while simultaneously addressing challenges such as screen burn-in and manufacturing costs.

One of the key milestones in AMOLED evolution was the introduction of flexible and foldable displays. This breakthrough opened up new possibilities for device form factors and user experiences, particularly in the smartphone and wearable technology sectors. The ability to create curved and bendable screens has become a significant driver for innovation in the consumer electronics market.

Another crucial aspect of AMOLED technology evolution has been the continuous improvement in pixel density and resolution. The push towards higher pixel-per-inch (PPI) counts has resulted in increasingly sharp and detailed displays, meeting the growing consumer demand for ultra-high-definition content consumption on mobile devices and televisions.

Energy efficiency has remained a central objective throughout AMOLED's development. Manufacturers have made substantial progress in reducing power consumption while maintaining or improving display performance. This focus on energy efficiency aligns with the broader trend towards more sustainable and environmentally friendly technologies.

The evolution of AMOLED has also seen advancements in manufacturing processes, leading to increased yield rates and reduced production costs. These improvements have been crucial in making AMOLED technology more accessible and widespread across various product categories, from high-end smartphones to mainstream consumer electronics.

Looking ahead, the objectives for AMOLED technology continue to evolve. Current research focuses on further enhancing display quality, including efforts to improve color gamut, peak brightness, and HDR performance. Additionally, there is a growing emphasis on developing more durable and longer-lasting AMOLED panels to address concerns about longevity and reliability.

Emerging display ecosystems are significantly impacted by these AMOLED advancements. The technology's ability to offer thin, lightweight, and flexible displays is reshaping product design across multiple industries. From automotive displays to augmented and virtual reality devices, AMOLED is enabling new form factors and user interfaces that were previously unattainable with traditional display technologies.

The primary objective of AMOLED technology development has been to overcome the limitations of traditional LCD displays, offering superior image quality, faster response times, and improved power efficiency. As the technology progressed, researchers and manufacturers focused on enhancing color accuracy, brightness, and contrast ratios while simultaneously addressing challenges such as screen burn-in and manufacturing costs.

One of the key milestones in AMOLED evolution was the introduction of flexible and foldable displays. This breakthrough opened up new possibilities for device form factors and user experiences, particularly in the smartphone and wearable technology sectors. The ability to create curved and bendable screens has become a significant driver for innovation in the consumer electronics market.

Another crucial aspect of AMOLED technology evolution has been the continuous improvement in pixel density and resolution. The push towards higher pixel-per-inch (PPI) counts has resulted in increasingly sharp and detailed displays, meeting the growing consumer demand for ultra-high-definition content consumption on mobile devices and televisions.

Energy efficiency has remained a central objective throughout AMOLED's development. Manufacturers have made substantial progress in reducing power consumption while maintaining or improving display performance. This focus on energy efficiency aligns with the broader trend towards more sustainable and environmentally friendly technologies.

The evolution of AMOLED has also seen advancements in manufacturing processes, leading to increased yield rates and reduced production costs. These improvements have been crucial in making AMOLED technology more accessible and widespread across various product categories, from high-end smartphones to mainstream consumer electronics.

Looking ahead, the objectives for AMOLED technology continue to evolve. Current research focuses on further enhancing display quality, including efforts to improve color gamut, peak brightness, and HDR performance. Additionally, there is a growing emphasis on developing more durable and longer-lasting AMOLED panels to address concerns about longevity and reliability.

Emerging display ecosystems are significantly impacted by these AMOLED advancements. The technology's ability to offer thin, lightweight, and flexible displays is reshaping product design across multiple industries. From automotive displays to augmented and virtual reality devices, AMOLED is enabling new form factors and user interfaces that were previously unattainable with traditional display technologies.

AMOLED Market Demand Analysis

The AMOLED (Active-Matrix Organic Light-Emitting Diode) display technology has witnessed a surge in market demand across various sectors, particularly in consumer electronics. This growth is primarily driven by the technology's superior visual performance, energy efficiency, and design flexibility compared to traditional LCD displays.

In the smartphone market, AMOLED displays have become increasingly prevalent, with major manufacturers adopting this technology for their flagship devices. The demand for AMOLED screens in smartphones is expected to continue its upward trajectory, as consumers seek devices with vibrant colors, high contrast ratios, and improved power efficiency. This trend is further reinforced by the growing popularity of foldable and flexible smartphones, which rely heavily on AMOLED technology.

The television industry has also embraced AMOLED technology, particularly in the high-end segment. OLED TVs, which utilize AMOLED panels, have gained significant market share due to their ability to deliver superior picture quality, perfect blacks, and wide viewing angles. As production costs decrease and manufacturing processes improve, AMOLED TVs are expected to penetrate mid-range markets, further expanding their consumer base.

Wearable devices, such as smartwatches and fitness trackers, represent another rapidly growing market for AMOLED displays. The technology's low power consumption and thin form factor make it ideal for these compact devices, where battery life and design aesthetics are crucial factors. As the wearable market continues to expand, the demand for AMOLED displays in this sector is projected to increase significantly.

The automotive industry is emerging as a promising new frontier for AMOLED technology. Advanced driver-assistance systems (ADAS) and in-vehicle infotainment systems are increasingly incorporating AMOLED displays due to their superior visibility, even in bright sunlight, and their ability to conform to curved surfaces within vehicle interiors. This trend is expected to accelerate as the automotive industry shifts towards more connected and autonomous vehicles.

In the commercial and industrial sectors, AMOLED displays are finding applications in digital signage, interactive kiosks, and control panels. The technology's high brightness, wide color gamut, and potential for transparent displays make it attractive for these applications, where visual impact and durability are essential.

Despite the growing demand, challenges remain in the AMOLED market. These include the need for further cost reductions in manufacturing, addressing concerns about long-term durability and burn-in issues, and competition from emerging display technologies. However, ongoing research and development efforts are focused on overcoming these challenges, which is likely to further boost market demand in the coming years.

In the smartphone market, AMOLED displays have become increasingly prevalent, with major manufacturers adopting this technology for their flagship devices. The demand for AMOLED screens in smartphones is expected to continue its upward trajectory, as consumers seek devices with vibrant colors, high contrast ratios, and improved power efficiency. This trend is further reinforced by the growing popularity of foldable and flexible smartphones, which rely heavily on AMOLED technology.

The television industry has also embraced AMOLED technology, particularly in the high-end segment. OLED TVs, which utilize AMOLED panels, have gained significant market share due to their ability to deliver superior picture quality, perfect blacks, and wide viewing angles. As production costs decrease and manufacturing processes improve, AMOLED TVs are expected to penetrate mid-range markets, further expanding their consumer base.

Wearable devices, such as smartwatches and fitness trackers, represent another rapidly growing market for AMOLED displays. The technology's low power consumption and thin form factor make it ideal for these compact devices, where battery life and design aesthetics are crucial factors. As the wearable market continues to expand, the demand for AMOLED displays in this sector is projected to increase significantly.

The automotive industry is emerging as a promising new frontier for AMOLED technology. Advanced driver-assistance systems (ADAS) and in-vehicle infotainment systems are increasingly incorporating AMOLED displays due to their superior visibility, even in bright sunlight, and their ability to conform to curved surfaces within vehicle interiors. This trend is expected to accelerate as the automotive industry shifts towards more connected and autonomous vehicles.

In the commercial and industrial sectors, AMOLED displays are finding applications in digital signage, interactive kiosks, and control panels. The technology's high brightness, wide color gamut, and potential for transparent displays make it attractive for these applications, where visual impact and durability are essential.

Despite the growing demand, challenges remain in the AMOLED market. These include the need for further cost reductions in manufacturing, addressing concerns about long-term durability and burn-in issues, and competition from emerging display technologies. However, ongoing research and development efforts are focused on overcoming these challenges, which is likely to further boost market demand in the coming years.

AMOLED Technical Challenges

AMOLED technology, while revolutionary in many aspects, faces several significant technical challenges that impact its widespread adoption and further development. One of the primary issues is the differential aging of organic materials used in AMOLED displays. The organic compounds degrade at different rates depending on their color and usage, leading to uneven wear and potential color shifts over time. This phenomenon, known as burn-in, is particularly problematic for static elements like status bars or logos in smartphones and televisions.

Another critical challenge is the complexity and cost of manufacturing AMOLED panels. The production process requires precise deposition of multiple organic layers, each only a few nanometers thick. This level of precision demands highly specialized equipment and clean room environments, significantly increasing production costs compared to traditional LCD technology. The yield rates for AMOLED panels, especially for larger sizes, remain lower than those for LCDs, further contributing to higher costs.

Power consumption is an ongoing concern for AMOLED displays, particularly in mobile devices. While AMOLEDs can be more energy-efficient than LCDs when displaying darker content, they tend to consume more power when displaying bright or white images. This variability in power consumption poses challenges for device manufacturers in optimizing battery life across different usage scenarios.

The blue OLED emitter continues to be a weak link in AMOLED technology. Blue OLEDs typically have shorter lifespans compared to red and green emitters, leading to potential color balance issues over time. Researchers are actively working on developing more stable blue OLED materials, but achieving long-term stability remains a significant hurdle.

Water and oxygen sensitivity of OLED materials presents another technical challenge. AMOLED displays require robust encapsulation to protect the organic layers from moisture and oxygen, which can rapidly degrade the display's performance. While thin-film encapsulation technologies have improved, achieving perfect, long-lasting barriers remains challenging, especially for flexible AMOLED displays.

Scaling up AMOLED technology for larger displays, such as televisions and monitors, introduces additional complexities. Maintaining uniform brightness and color across larger areas becomes more difficult, and the increased number of pixels exacerbates issues related to manufacturing yield and cost. These challenges have slowed the adoption of AMOLED in larger display formats compared to its success in smartphones.

Another critical challenge is the complexity and cost of manufacturing AMOLED panels. The production process requires precise deposition of multiple organic layers, each only a few nanometers thick. This level of precision demands highly specialized equipment and clean room environments, significantly increasing production costs compared to traditional LCD technology. The yield rates for AMOLED panels, especially for larger sizes, remain lower than those for LCDs, further contributing to higher costs.

Power consumption is an ongoing concern for AMOLED displays, particularly in mobile devices. While AMOLEDs can be more energy-efficient than LCDs when displaying darker content, they tend to consume more power when displaying bright or white images. This variability in power consumption poses challenges for device manufacturers in optimizing battery life across different usage scenarios.

The blue OLED emitter continues to be a weak link in AMOLED technology. Blue OLEDs typically have shorter lifespans compared to red and green emitters, leading to potential color balance issues over time. Researchers are actively working on developing more stable blue OLED materials, but achieving long-term stability remains a significant hurdle.

Water and oxygen sensitivity of OLED materials presents another technical challenge. AMOLED displays require robust encapsulation to protect the organic layers from moisture and oxygen, which can rapidly degrade the display's performance. While thin-film encapsulation technologies have improved, achieving perfect, long-lasting barriers remains challenging, especially for flexible AMOLED displays.

Scaling up AMOLED technology for larger displays, such as televisions and monitors, introduces additional complexities. Maintaining uniform brightness and color across larger areas becomes more difficult, and the increased number of pixels exacerbates issues related to manufacturing yield and cost. These challenges have slowed the adoption of AMOLED in larger display formats compared to its success in smartphones.

Current AMOLED Display Solutions

01 AMOLED display driving techniques

Various driving techniques are employed to improve the performance of AMOLED displays. These include methods for controlling pixel brightness, reducing power consumption, and enhancing image quality. Advanced driving schemes can compensate for variations in OLED characteristics and optimize display performance across different operating conditions.- AMOLED display driving techniques: Various methods for driving AMOLED displays, including pixel compensation, current control, and voltage programming techniques. These approaches aim to improve display uniformity, reduce power consumption, and enhance overall image quality.

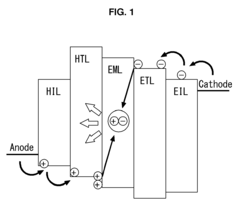

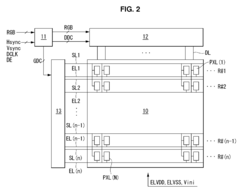

- AMOLED panel structure and fabrication: Innovations in AMOLED panel design and manufacturing processes, focusing on improving pixel structures, electrode configurations, and thin-film transistor (TFT) arrangements. These advancements contribute to better display performance and increased production efficiency.

- AMOLED power management and efficiency: Techniques for optimizing power consumption in AMOLED displays, including adaptive brightness control, selective pixel activation, and efficient voltage regulation. These methods aim to extend battery life in mobile devices while maintaining display quality.

- AMOLED color management and calibration: Methods for improving color accuracy, gamut, and consistency in AMOLED displays. This includes color compensation algorithms, gamma correction techniques, and adaptive color management systems to enhance visual performance across various viewing conditions.

- AMOLED integration with other technologies: Approaches for combining AMOLED technology with other display innovations, such as touch sensors, fingerprint recognition, and flexible substrates. These integrations aim to create more versatile and feature-rich display solutions for various applications.

02 AMOLED pixel circuit designs

Innovative pixel circuit designs are crucial for AMOLED displays. These circuits aim to improve uniformity, reduce color shift, and enhance overall display quality. Advanced pixel architectures can incorporate compensation mechanisms for threshold voltage variations and address issues like image retention and burn-in.Expand Specific Solutions03 AMOLED panel structure and fabrication

The structure and fabrication processes of AMOLED panels are continually evolving. Innovations in this area focus on improving panel efficiency, increasing resolution, and enhancing durability. Advanced materials and manufacturing techniques are employed to create thinner, more flexible, and more robust AMOLED displays.Expand Specific Solutions04 AMOLED power management and efficiency

Power management is a critical aspect of AMOLED technology. Techniques are developed to reduce power consumption while maintaining display quality. This includes optimizing voltage levels, implementing dynamic power schemes, and developing energy-efficient driving methods for different content types and ambient conditions.Expand Specific Solutions05 AMOLED touch integration and sensing

Integration of touch functionality with AMOLED displays is an important area of development. This includes on-cell and in-cell touch solutions, as well as advanced sensing capabilities such as fingerprint recognition and pressure sensitivity. These integrated solutions aim to improve user interaction while maintaining the display's visual quality.Expand Specific Solutions

Key AMOLED Industry Players

The AMOLED technology is significantly impacting the emerging display ecosystems, with the market in a growth phase. The global AMOLED market is expanding rapidly, driven by increasing adoption in smartphones, televisions, and wearable devices. Technologically, AMOLED is maturing but still evolving, with companies like BOE Technology, TCL China Star Optoelectronics, and LG Display leading innovation. These firms are investing heavily in R&D to overcome challenges such as production costs and longevity. The competitive landscape is intensifying as more players enter the market, with Chinese manufacturers like Tianma Microelectronics and Visionox emerging as strong contenders alongside established Korean and Japanese companies.

BOE Technology Group Co., Ltd.

Technical Solution: BOE has made significant strides in AMOLED technology, developing flexible and foldable AMOLED displays. Their approach involves using low-temperature polycrystalline oxide (LTPO) backplanes, which allow for variable refresh rates, reducing power consumption by up to 20% compared to traditional AMOLED displays[1]. BOE has also introduced a 6th generation flexible AMOLED production line, capable of producing screens with a pixel density of up to 700 PPI, suitable for various applications including smartphones, tablets, and wearable devices[2]. The company has invested in advanced vapor deposition techniques for OLED materials, improving color accuracy and extending the lifespan of their AMOLED panels[3].

Strengths: Large-scale production capability, advanced LTPO technology, high pixel density. Weaknesses: Relatively new entrant in high-end AMOLED market, still catching up with Korean manufacturers in some aspects of quality.

TCL China Star Optoelectronics Technology Co., Ltd.

Technical Solution: TCL CSOT has made significant progress in AMOLED technology, focusing on both mobile and large-format displays. They have developed a proprietary AMOLED technology called H-AMOLED, which combines the advantages of LTPS and Oxide TFT technologies, resulting in improved electron mobility and reduced power consumption[7]. TCL CSOT has also introduced inkjet-printed AMOLED displays, potentially reducing manufacturing costs by up to 20% compared to traditional evaporation methods[8]. Their latest AMOLED panels feature a 10-bit color depth, supporting over 1 billion colors, and incorporate advanced features such as under-display fingerprint sensors and punch-hole designs for front-facing cameras[9].

Strengths: Innovative H-AMOLED technology, cost-effective inkjet printing process, advanced panel features. Weaknesses: Still building brand recognition in the global AMOLED market, limited market share compared to larger competitors.

AMOLED Core Patents and Innovations

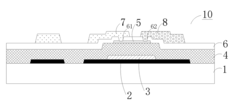

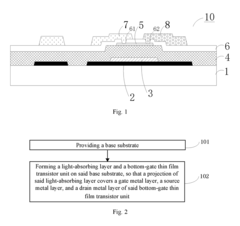

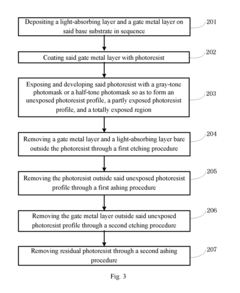

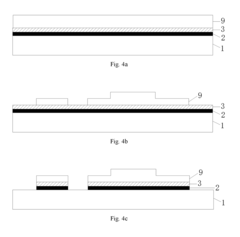

Array substrate, display device, and method for manufacturing array substrate

PatentActiveUS20170148862A1

Innovation

- An array substrate with a light-absorbing layer covering the gate, source, and drain metal layers of a bottom-gate thin film transistor unit, preventing ambient light irradiation while allowing useful light to pass through.

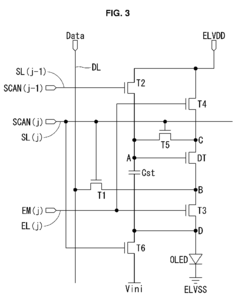

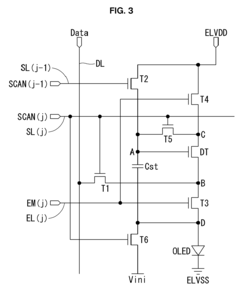

Organic light emitting display and circuit thereof

PatentActiveEP3098805A1

Innovation

- The implementation of a pixel structure with a capacitor and multiple transistors that sample and compensate for the threshold voltage of driving transistors, reducing power consumption by eliminating the need for a reference voltage and minimizing the effect of mobile charges through efficient voltage management and transistor design.

AMOLED Supply Chain Analysis

The AMOLED supply chain plays a crucial role in shaping the emerging display ecosystems. As AMOLED technology continues to gain prominence in various applications, the supply chain has evolved to meet the growing demand and technological advancements.

At the core of the AMOLED supply chain are the panel manufacturers, who are responsible for producing the display panels. Key players in this segment include Samsung Display, LG Display, and BOE Technology. These companies have invested heavily in AMOLED production facilities to increase capacity and improve yield rates.

The supply of raw materials is another critical component of the AMOLED ecosystem. Organic materials, such as emitters and host materials, are essential for AMOLED displays. Companies like Universal Display Corporation (UDC) and Idemitsu Kosan are major suppliers of these materials, continuously developing new compounds to enhance display performance and efficiency.

Semiconductor manufacturers also play a vital role in the AMOLED supply chain. They provide the thin-film transistor (TFT) backplanes that drive the OLED pixels. Companies like Samsung Electronics, LG Electronics, and TSMC are key players in this segment, developing advanced TFT technologies to support higher resolution and lower power consumption.

The production equipment used in AMOLED manufacturing is another crucial element of the supply chain. Firms like Applied Materials, Canon Tokki, and Coherent provide specialized deposition and encapsulation equipment necessary for OLED panel production. These companies continue to innovate, developing new tools to improve production efficiency and panel quality.

As AMOLED technology expands into new applications, such as foldable and rollable displays, the supply chain is adapting to meet these challenges. New players are entering the market, particularly in areas like flexible substrate production and advanced encapsulation technologies. This diversification is creating opportunities for innovation and collaboration across the supply chain.

The geographical distribution of the AMOLED supply chain is also evolving. While South Korea and Japan have traditionally dominated the industry, Chinese manufacturers are rapidly expanding their presence. This shift is leading to increased competition and potential changes in the global supply dynamics.

In conclusion, the AMOLED supply chain is a complex and dynamic ecosystem that is continuously evolving to meet the demands of emerging display technologies. The interplay between panel manufacturers, material suppliers, equipment providers, and semiconductor companies is driving innovation and shaping the future of display technology.

At the core of the AMOLED supply chain are the panel manufacturers, who are responsible for producing the display panels. Key players in this segment include Samsung Display, LG Display, and BOE Technology. These companies have invested heavily in AMOLED production facilities to increase capacity and improve yield rates.

The supply of raw materials is another critical component of the AMOLED ecosystem. Organic materials, such as emitters and host materials, are essential for AMOLED displays. Companies like Universal Display Corporation (UDC) and Idemitsu Kosan are major suppliers of these materials, continuously developing new compounds to enhance display performance and efficiency.

Semiconductor manufacturers also play a vital role in the AMOLED supply chain. They provide the thin-film transistor (TFT) backplanes that drive the OLED pixels. Companies like Samsung Electronics, LG Electronics, and TSMC are key players in this segment, developing advanced TFT technologies to support higher resolution and lower power consumption.

The production equipment used in AMOLED manufacturing is another crucial element of the supply chain. Firms like Applied Materials, Canon Tokki, and Coherent provide specialized deposition and encapsulation equipment necessary for OLED panel production. These companies continue to innovate, developing new tools to improve production efficiency and panel quality.

As AMOLED technology expands into new applications, such as foldable and rollable displays, the supply chain is adapting to meet these challenges. New players are entering the market, particularly in areas like flexible substrate production and advanced encapsulation technologies. This diversification is creating opportunities for innovation and collaboration across the supply chain.

The geographical distribution of the AMOLED supply chain is also evolving. While South Korea and Japan have traditionally dominated the industry, Chinese manufacturers are rapidly expanding their presence. This shift is leading to increased competition and potential changes in the global supply dynamics.

In conclusion, the AMOLED supply chain is a complex and dynamic ecosystem that is continuously evolving to meet the demands of emerging display technologies. The interplay between panel manufacturers, material suppliers, equipment providers, and semiconductor companies is driving innovation and shaping the future of display technology.

Environmental Impact of AMOLED Technology

The environmental impact of AMOLED technology is a critical consideration in the emerging display ecosystem. AMOLED displays offer several advantages in terms of energy efficiency and resource utilization compared to traditional LCD technology. The self-emitting nature of AMOLED pixels eliminates the need for a backlight, resulting in lower power consumption, especially when displaying darker content. This energy efficiency translates to reduced carbon emissions over the lifecycle of devices incorporating AMOLED displays.

Manufacturing processes for AMOLED panels have become increasingly optimized, leading to improved material utilization and reduced waste generation. The thin-film deposition techniques used in AMOLED production allow for precise control over material usage, minimizing excess material consumption. Additionally, the simplified structure of AMOLED displays, with fewer layers compared to LCDs, potentially reduces the overall material footprint of the final product.

However, challenges remain in the environmental sustainability of AMOLED technology. The production of organic materials used in AMOLED displays often involves complex chemical processes, which may have associated environmental impacts. The extraction and processing of rare earth elements, such as indium, used in transparent electrodes, also raise concerns about resource depletion and environmental degradation in mining regions.

End-of-life management for AMOLED displays presents both opportunities and challenges. The organic nature of the emissive materials in AMOLEDs may facilitate easier biodegradation compared to inorganic alternatives. However, the complex layered structure of these displays can make recycling and material recovery more difficult, potentially leading to increased e-waste if not properly managed.

Advancements in AMOLED technology are addressing some of these environmental concerns. Research into more sustainable organic materials and alternative electrode compositions aims to reduce the reliance on scarce resources. Improved manufacturing techniques, such as solution-based processing, promise to further reduce energy consumption and waste in production. Additionally, efforts to enhance the lifespan of AMOLED displays contribute to overall sustainability by reducing the frequency of device replacements.

As AMOLED technology continues to evolve, its environmental impact is likely to improve further. Ongoing research into bio-based and recyclable organic materials holds promise for creating more environmentally friendly displays. The development of efficient recycling processes tailored to AMOLED panels will be crucial in minimizing the technology's end-of-life environmental footprint. As the display industry increasingly prioritizes sustainability, AMOLED technology is poised to play a significant role in creating more eco-friendly electronic devices.

Manufacturing processes for AMOLED panels have become increasingly optimized, leading to improved material utilization and reduced waste generation. The thin-film deposition techniques used in AMOLED production allow for precise control over material usage, minimizing excess material consumption. Additionally, the simplified structure of AMOLED displays, with fewer layers compared to LCDs, potentially reduces the overall material footprint of the final product.

However, challenges remain in the environmental sustainability of AMOLED technology. The production of organic materials used in AMOLED displays often involves complex chemical processes, which may have associated environmental impacts. The extraction and processing of rare earth elements, such as indium, used in transparent electrodes, also raise concerns about resource depletion and environmental degradation in mining regions.

End-of-life management for AMOLED displays presents both opportunities and challenges. The organic nature of the emissive materials in AMOLEDs may facilitate easier biodegradation compared to inorganic alternatives. However, the complex layered structure of these displays can make recycling and material recovery more difficult, potentially leading to increased e-waste if not properly managed.

Advancements in AMOLED technology are addressing some of these environmental concerns. Research into more sustainable organic materials and alternative electrode compositions aims to reduce the reliance on scarce resources. Improved manufacturing techniques, such as solution-based processing, promise to further reduce energy consumption and waste in production. Additionally, efforts to enhance the lifespan of AMOLED displays contribute to overall sustainability by reducing the frequency of device replacements.

As AMOLED technology continues to evolve, its environmental impact is likely to improve further. Ongoing research into bio-based and recyclable organic materials holds promise for creating more environmentally friendly displays. The development of efficient recycling processes tailored to AMOLED panels will be crucial in minimizing the technology's end-of-life environmental footprint. As the display industry increasingly prioritizes sustainability, AMOLED technology is poised to play a significant role in creating more eco-friendly electronic devices.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!