Improving Lithium Hydroxide Extraction: Waste Minimization Techniques

AUG 28, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Lithium Hydroxide Extraction Background and Objectives

Lithium hydroxide has emerged as a critical material in the global transition towards sustainable energy systems, primarily due to its essential role in the production of high-performance lithium-ion batteries for electric vehicles and renewable energy storage. The extraction and processing of lithium hydroxide has evolved significantly over the past several decades, transitioning from small-scale operations to industrial-scale production to meet rapidly growing demand.

Historically, lithium hydroxide production has relied on energy-intensive processes with substantial environmental footprints, including significant water consumption, chemical usage, and waste generation. The conventional extraction methods involve either hard rock mining of lithium-bearing minerals such as spodumene, or extraction from brine resources in salt flats. Both approaches present distinct environmental challenges and efficiency limitations that have become increasingly problematic as demand scales.

The technical evolution trajectory shows a clear progression from basic precipitation methods to more sophisticated extraction technologies. Early processes focused primarily on yield rather than efficiency or environmental impact, while recent developments have begun incorporating principles of green chemistry and circular economy. This shift reflects broader industry recognition of sustainability as a competitive necessity rather than merely a regulatory compliance issue.

Current global lithium hydroxide production capacity stands at approximately 180,000 metric tons annually, with projections indicating a need for 400,000-500,000 metric tons by 2025 to meet electric vehicle battery demand alone. This anticipated growth underscores the urgency of developing more efficient extraction methodologies that minimize waste generation while maintaining product quality and economic viability.

The primary technical objectives for improving lithium hydroxide extraction focus on several interconnected goals: reducing water consumption by 30-50% compared to conventional methods; minimizing chemical reagent usage through recycling and recovery systems; developing closed-loop processes that capture and repurpose waste streams; and maintaining or improving product purity while reducing energy requirements. These objectives align with both economic imperatives and increasingly stringent environmental regulations worldwide.

Recent technological breakthroughs in membrane filtration, selective adsorption, and electrochemical processing have created promising pathways toward these goals. However, significant challenges remain in scaling these innovations from laboratory demonstrations to commercial implementation. The technical trajectory suggests that hybrid approaches combining multiple waste minimization techniques may offer the most viable path forward, particularly when adapted to the specific characteristics of different lithium resources.

The ultimate aim of waste minimization in lithium hydroxide extraction extends beyond environmental protection to encompass resource conservation, operational cost reduction, and supply chain resilience—factors that will determine the sustainability of the lithium industry as it scales to meet global clean energy demands.

Historically, lithium hydroxide production has relied on energy-intensive processes with substantial environmental footprints, including significant water consumption, chemical usage, and waste generation. The conventional extraction methods involve either hard rock mining of lithium-bearing minerals such as spodumene, or extraction from brine resources in salt flats. Both approaches present distinct environmental challenges and efficiency limitations that have become increasingly problematic as demand scales.

The technical evolution trajectory shows a clear progression from basic precipitation methods to more sophisticated extraction technologies. Early processes focused primarily on yield rather than efficiency or environmental impact, while recent developments have begun incorporating principles of green chemistry and circular economy. This shift reflects broader industry recognition of sustainability as a competitive necessity rather than merely a regulatory compliance issue.

Current global lithium hydroxide production capacity stands at approximately 180,000 metric tons annually, with projections indicating a need for 400,000-500,000 metric tons by 2025 to meet electric vehicle battery demand alone. This anticipated growth underscores the urgency of developing more efficient extraction methodologies that minimize waste generation while maintaining product quality and economic viability.

The primary technical objectives for improving lithium hydroxide extraction focus on several interconnected goals: reducing water consumption by 30-50% compared to conventional methods; minimizing chemical reagent usage through recycling and recovery systems; developing closed-loop processes that capture and repurpose waste streams; and maintaining or improving product purity while reducing energy requirements. These objectives align with both economic imperatives and increasingly stringent environmental regulations worldwide.

Recent technological breakthroughs in membrane filtration, selective adsorption, and electrochemical processing have created promising pathways toward these goals. However, significant challenges remain in scaling these innovations from laboratory demonstrations to commercial implementation. The technical trajectory suggests that hybrid approaches combining multiple waste minimization techniques may offer the most viable path forward, particularly when adapted to the specific characteristics of different lithium resources.

The ultimate aim of waste minimization in lithium hydroxide extraction extends beyond environmental protection to encompass resource conservation, operational cost reduction, and supply chain resilience—factors that will determine the sustainability of the lithium industry as it scales to meet global clean energy demands.

Market Demand Analysis for Sustainable Lithium Production

The global lithium market is experiencing unprecedented growth driven by the rapid expansion of electric vehicle (EV) production and renewable energy storage systems. Current projections indicate the lithium market will reach $8.2 billion by 2027, with a compound annual growth rate of approximately 14.8% from 2022. This significant market expansion directly correlates with increasing demand for sustainable lithium hydroxide extraction methods that minimize environmental impact and waste generation.

Battery manufacturers, particularly those producing high-nickel cathode materials for next-generation EVs, are specifically seeking lithium hydroxide produced through environmentally responsible processes. Market research indicates that over 80% of major automotive manufacturers have committed to sustainability targets that include responsible sourcing of battery materials, creating strong downstream pressure for cleaner lithium production methods.

The demand for waste-minimized lithium extraction is further amplified by regulatory developments across major markets. The European Union's proposed Battery Regulation includes carbon footprint declarations and responsible sourcing requirements, while similar frameworks are emerging in North America and Asia. These regulations are expected to create premium pricing opportunities for lithium producers employing sustainable extraction technologies, with potential price premiums of 5-10% for demonstrably low-impact production methods.

Investment trends reflect this market shift, with venture capital and corporate investment in sustainable lithium technologies reaching $1.2 billion in 2022, a 65% increase from the previous year. This capital influx is specifically targeting innovations in direct lithium extraction, closed-loop water systems, and waste valorization technologies that align with circular economy principles.

End-user industries are increasingly incorporating sustainability metrics into procurement decisions. A recent survey of battery manufacturers revealed that 73% now include environmental impact assessments in supplier selection processes, with waste generation and water usage ranking among the top evaluation criteria. This represents a fundamental shift from purely price-driven purchasing toward value-chain sustainability considerations.

Regional market analysis shows particularly strong demand for sustainable lithium in Europe and North America, where regulatory frameworks and consumer preferences strongly favor environmentally responsible production. However, Asian markets are rapidly adopting similar preferences as domestic environmental regulations tighten and global supply chains demand consistent sustainability standards.

The market is also witnessing the emergence of "green premium" certification schemes for battery materials, creating differentiated market segments where waste-minimized lithium extraction technologies can command higher prices and secure preferential supply agreements with downstream manufacturers committed to environmental leadership.

Battery manufacturers, particularly those producing high-nickel cathode materials for next-generation EVs, are specifically seeking lithium hydroxide produced through environmentally responsible processes. Market research indicates that over 80% of major automotive manufacturers have committed to sustainability targets that include responsible sourcing of battery materials, creating strong downstream pressure for cleaner lithium production methods.

The demand for waste-minimized lithium extraction is further amplified by regulatory developments across major markets. The European Union's proposed Battery Regulation includes carbon footprint declarations and responsible sourcing requirements, while similar frameworks are emerging in North America and Asia. These regulations are expected to create premium pricing opportunities for lithium producers employing sustainable extraction technologies, with potential price premiums of 5-10% for demonstrably low-impact production methods.

Investment trends reflect this market shift, with venture capital and corporate investment in sustainable lithium technologies reaching $1.2 billion in 2022, a 65% increase from the previous year. This capital influx is specifically targeting innovations in direct lithium extraction, closed-loop water systems, and waste valorization technologies that align with circular economy principles.

End-user industries are increasingly incorporating sustainability metrics into procurement decisions. A recent survey of battery manufacturers revealed that 73% now include environmental impact assessments in supplier selection processes, with waste generation and water usage ranking among the top evaluation criteria. This represents a fundamental shift from purely price-driven purchasing toward value-chain sustainability considerations.

Regional market analysis shows particularly strong demand for sustainable lithium in Europe and North America, where regulatory frameworks and consumer preferences strongly favor environmentally responsible production. However, Asian markets are rapidly adopting similar preferences as domestic environmental regulations tighten and global supply chains demand consistent sustainability standards.

The market is also witnessing the emergence of "green premium" certification schemes for battery materials, creating differentiated market segments where waste-minimized lithium extraction technologies can command higher prices and secure preferential supply agreements with downstream manufacturers committed to environmental leadership.

Current Extraction Technologies and Environmental Challenges

Lithium hydroxide extraction currently relies on several established technologies, each with distinct environmental implications. The conventional method involves the conversion of lithium carbonate through a lime-soda process, which consumes significant quantities of calcium hydroxide and generates substantial calcium carbonate waste. This process typically requires 1.5 tons of calcium hydroxide to produce 1 ton of lithium hydroxide, resulting in approximately 2 tons of calcium carbonate waste.

Alternative extraction methods include direct lithium extraction (DLE) from brines, which employs ion exchange resins, adsorption materials, or solvent extraction techniques. While these methods offer improved lithium recovery rates compared to traditional evaporation ponds, they introduce challenges related to chemical consumption and regeneration of extraction media. DLE technologies can reduce water usage by 50-70% but often require specialized chemicals that may create secondary waste streams.

Electrodialysis and electrochemical processes represent emerging approaches that promise reduced chemical inputs. However, these technologies face challenges with membrane fouling and high energy consumption, typically requiring 4-6 kWh per kilogram of lithium hydroxide produced. The energy intensity contributes significantly to the carbon footprint of lithium production when powered by non-renewable sources.

Hard-rock lithium extraction, primarily from spodumene, presents additional environmental challenges. The acid roasting and leaching processes generate acidic waste streams containing heavy metals and require neutralization treatments that produce voluminous precipitates. Each ton of lithium hydroxide produced from spodumene can generate up to 15 tons of tailings and waste rock.

Water consumption remains a critical environmental concern across all extraction technologies. Traditional brine evaporation methods consume 500-2,000 liters of water per kilogram of lithium, while hard-rock processing requires 170-250 liters per kilogram. This is particularly problematic as many lithium resources are located in water-stressed regions such as the "Lithium Triangle" in South America.

Chemical contamination of soil and water systems represents another significant challenge. Leakage from evaporation ponds or improper disposal of process chemicals can lead to elevated concentrations of lithium, boron, and other elements in surrounding ecosystems. Studies have documented lithium concentrations up to 40 times background levels in water bodies adjacent to extraction operations.

The energy intensity of lithium hydroxide production contributes substantially to its environmental footprint. Current technologies require between 5-15 MWh of energy per ton of lithium hydroxide, depending on the feedstock and process configuration. This energy demand translates to approximately 2.5-7.5 tons of CO2 emissions per ton of product when using conventional energy sources.

Alternative extraction methods include direct lithium extraction (DLE) from brines, which employs ion exchange resins, adsorption materials, or solvent extraction techniques. While these methods offer improved lithium recovery rates compared to traditional evaporation ponds, they introduce challenges related to chemical consumption and regeneration of extraction media. DLE technologies can reduce water usage by 50-70% but often require specialized chemicals that may create secondary waste streams.

Electrodialysis and electrochemical processes represent emerging approaches that promise reduced chemical inputs. However, these technologies face challenges with membrane fouling and high energy consumption, typically requiring 4-6 kWh per kilogram of lithium hydroxide produced. The energy intensity contributes significantly to the carbon footprint of lithium production when powered by non-renewable sources.

Hard-rock lithium extraction, primarily from spodumene, presents additional environmental challenges. The acid roasting and leaching processes generate acidic waste streams containing heavy metals and require neutralization treatments that produce voluminous precipitates. Each ton of lithium hydroxide produced from spodumene can generate up to 15 tons of tailings and waste rock.

Water consumption remains a critical environmental concern across all extraction technologies. Traditional brine evaporation methods consume 500-2,000 liters of water per kilogram of lithium, while hard-rock processing requires 170-250 liters per kilogram. This is particularly problematic as many lithium resources are located in water-stressed regions such as the "Lithium Triangle" in South America.

Chemical contamination of soil and water systems represents another significant challenge. Leakage from evaporation ponds or improper disposal of process chemicals can lead to elevated concentrations of lithium, boron, and other elements in surrounding ecosystems. Studies have documented lithium concentrations up to 40 times background levels in water bodies adjacent to extraction operations.

The energy intensity of lithium hydroxide production contributes substantially to its environmental footprint. Current technologies require between 5-15 MWh of energy per ton of lithium hydroxide, depending on the feedstock and process configuration. This energy demand translates to approximately 2.5-7.5 tons of CO2 emissions per ton of product when using conventional energy sources.

Current Waste Minimization Solutions in Lithium Extraction

01 Direct lithium extraction methods for waste reduction

Direct lithium extraction methods can significantly reduce waste generation compared to traditional evaporation pond techniques. These methods involve selective adsorption or ion exchange processes that target lithium ions specifically, minimizing the extraction of unwanted elements. The processes typically use less water and chemicals, resulting in smaller environmental footprints and reduced waste streams. These techniques can be applied to various lithium sources including brines, clays, and geothermal waters.- Direct lithium extraction methods with reduced waste: Direct lithium extraction methods focus on selectively removing lithium from brines or other sources while minimizing waste generation. These techniques often use specialized adsorbents or ion exchange materials that can selectively capture lithium ions from solution, reducing the need for large evaporation ponds and minimizing the production of waste salts. The processes typically involve adsorption, elution, and recovery steps designed to maximize lithium recovery while minimizing reagent consumption and waste generation.

- Closed-loop lithium extraction systems: Closed-loop systems for lithium extraction focus on recycling process water, reagents, and other materials to minimize waste discharge. These systems incorporate water recovery units, reagent regeneration processes, and waste treatment stages to create an environmentally sustainable extraction process. By recirculating materials within the process, these systems significantly reduce freshwater consumption, chemical usage, and waste generation while maintaining high lithium recovery rates.

- Waste valorization in lithium hydroxide production: Waste valorization approaches focus on converting byproducts and waste streams from lithium hydroxide production into valuable secondary products. These methods involve processing waste materials to recover additional valuable elements such as magnesium, calcium, or boron compounds, or converting waste into useful products like construction materials or soil amendments. By finding commercial applications for what would otherwise be waste, these processes improve the overall economics and environmental footprint of lithium extraction operations.

- Advanced filtration and separation technologies: Advanced filtration and separation technologies are employed to improve the efficiency of lithium hydroxide extraction while minimizing waste generation. These include membrane filtration systems, crystallization techniques, and selective precipitation methods that can separate lithium from impurities with high precision. By improving separation efficiency, these technologies reduce the amount of chemicals needed for purification and minimize the generation of waste precipitates and spent solutions.

- Lithium recovery from secondary sources and waste streams: Methods for recovering lithium from secondary sources and waste streams focus on extracting lithium from spent batteries, industrial waste, geothermal brines, and other unconventional sources. These processes are designed to be environmentally friendly, using minimal chemicals and energy while maximizing lithium recovery. By targeting materials that would otherwise be discarded, these approaches reduce the environmental impact associated with primary lithium extraction while simultaneously addressing waste management challenges in other industries.

02 Closed-loop processing systems for lithium hydroxide production

Closed-loop processing systems recycle reagents and water throughout the lithium hydroxide production process, significantly reducing waste generation. These systems capture and reuse process solutions, precipitants, and solvents that would otherwise be discharged as waste. By implementing material recovery cycles within the production chain, manufacturers can minimize environmental impact while improving economic efficiency. Advanced monitoring and control systems ensure optimal performance of these closed-loop processes.Expand Specific Solutions03 Waste treatment and byproduct valorization techniques

Waste streams from lithium hydroxide production can be treated and converted into valuable byproducts rather than disposed of as waste. These techniques involve processing residual materials to extract additional valuable elements or convert waste into usable products such as construction materials, agricultural amendments, or industrial chemicals. By implementing these valorization approaches, manufacturers can create additional revenue streams while simultaneously reducing waste disposal requirements and environmental impact.Expand Specific Solutions04 Advanced separation technologies for impurity removal

Advanced separation technologies can selectively remove impurities from lithium-bearing solutions without generating excessive waste. These technologies include membrane filtration, selective precipitation, chromatographic separation, and electrochemical methods that target specific contaminants while preserving lithium content. By removing impurities more efficiently early in the process, these methods reduce the need for multiple purification steps and minimize reagent consumption, resulting in cleaner lithium hydroxide production with reduced waste generation.Expand Specific Solutions05 Process optimization and reagent recovery systems

Process optimization techniques and reagent recovery systems can significantly reduce chemical consumption and waste generation in lithium hydroxide production. These approaches involve precise control of reaction conditions, stoichiometric optimization of reagent use, and implementation of recovery systems for acids, bases, and solvents. Advanced monitoring technologies enable real-time adjustments to process parameters, ensuring maximum efficiency and minimum waste. By recovering and reusing process chemicals, manufacturers can create more sustainable lithium hydroxide production methods.Expand Specific Solutions

Key Industry Players in Lithium Processing

The lithium hydroxide extraction market is in a growth phase, with increasing demand driven by the electric vehicle battery sector. The competitive landscape features established players like BASF, Sumitomo Metal Mining, and SK Innovation alongside specialized extraction technology innovators such as Lilac Solutions. Companies including GEM Co., Guangdong Bangpu, and Sungeel Hitech are advancing waste minimization techniques through recycling technologies. Academic-industry partnerships involving Central South University and the Korea Institute of Geoscience & Mineral Resources are accelerating technological maturity. The market is characterized by regional clusters in Asia (particularly China, Japan, and South Korea) and growing competition between traditional extraction methods and emerging sustainable technologies focused on reducing environmental impact and improving resource efficiency.

Sumitomo Metal Mining Co. Ltd.

Technical Solution: Sumitomo Metal Mining has developed an advanced lithium hydroxide extraction process that emphasizes waste minimization through innovative solvent extraction techniques. Their technology employs proprietary extractants that selectively separate lithium from other elements in brine or recycled battery materials with exceptional efficiency. The process features a multi-stage counter-current extraction system that maximizes lithium recovery while minimizing extractant loss to under 0.1% per cycle. Sumitomo's innovation includes a novel stripping method that regenerates the extractant with minimal chemical consumption, creating a nearly closed-loop system. Their process eliminates the traditional carbonate precipitation step, directly producing battery-grade lithium hydroxide with fewer waste-generating intermediate steps. The company has implemented advanced effluent treatment systems that recover and recycle over 90% of process water, dramatically reducing discharge volumes. Additionally, Sumitomo has developed methods to recover valuable by-products from extraction residues, including high-purity nickel and cobalt compounds, converting potential waste streams into valuable products. Their integrated process control system continuously optimizes reagent usage based on real-time monitoring, further reducing chemical consumption and associated waste generation.

Strengths: Exceptional selectivity resulting in high-purity products with minimal purification steps; significant reduction in chemical consumption through advanced recycling; effective recovery of valuable by-products; lower water consumption compared to conventional methods. Weaknesses: Higher technical complexity requiring specialized operational expertise; greater initial capital investment; process optimization still ongoing for certain feed compositions; requires consistent feedstock quality for optimal performance.

GEM Co., Ltd.

Technical Solution: GEM Co. has pioneered an integrated lithium hydroxide recovery system from spent lithium-ion batteries that emphasizes waste minimization throughout the process chain. Their technology employs a hydrometallurgical approach with proprietary leaching agents that achieve over 98% lithium recovery efficiency while generating minimal secondary waste. The process begins with mechanical pre-treatment including crushing and sorting, followed by a selective leaching process that separates lithium from other battery components. GEM's innovation lies in their closed-loop solvent recovery system that recycles over 90% of processing chemicals, significantly reducing waste discharge. Their process also incorporates advanced impurity removal techniques using minimal precipitating agents, resulting in high-purity lithium hydroxide suitable for battery remanufacturing. The company has implemented real-time monitoring systems to optimize reagent usage and minimize excess chemical consumption. Additionally, GEM has developed methods to valorize solid residues from the extraction process into construction materials, further reducing waste disposal requirements and creating additional value streams from what would otherwise be waste material.

Strengths: Comprehensive recycling approach that addresses the entire battery lifecycle; high recovery efficiency exceeding industry standards; significant reduction in chemical reagent consumption through recycling; creation of additional value from process residues. Weaknesses: Process complexity requiring sophisticated control systems; higher energy requirements for some process steps compared to primary extraction; quality consistency challenges when processing varied battery feedstock.

Critical Patents and Innovations in Green Extraction Processes

Method for producing lithium hydroxide

PatentWO2022203055A1

Innovation

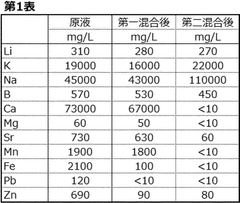

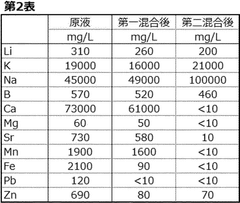

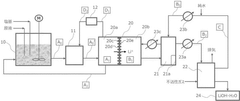

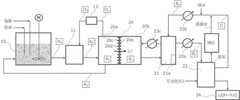

- A method involving a two-stage pH adjustment process in mixing lithium-containing aqueous solutions with a base, followed by lithium ion extraction using an electrochemical device with a Li selectively permeable membrane, and subsequent concentration and separation of lithium ions through adsorption and crystallization, allowing for the production of high-purity lithium hydroxide from diverse aqueous solutions.

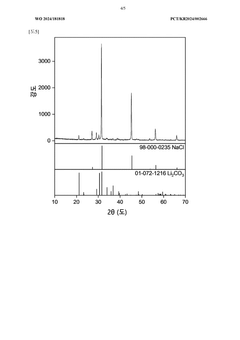

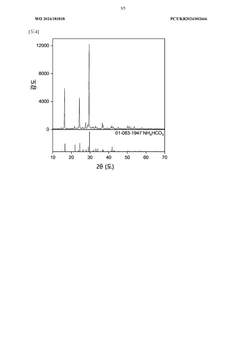

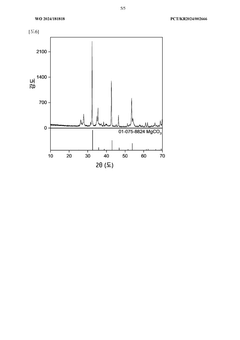

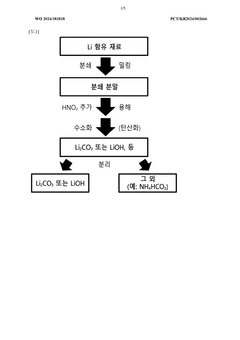

Method for extracting lithium from lithium-containing material

PatentWO2024181818A1

Innovation

- A lithium extraction method using a ruthenium oxide catalyst (HxRuO2) that catalyzes hydrogen, nitric acid, and carbon dioxide at high pressure to produce lithium carbonate or lithium hydroxide, reducing wastewater generation and allowing for the reuse of the catalyst, thereby minimizing chemical usage and environmental impact.

Environmental Compliance and Regulatory Framework

The regulatory landscape governing lithium hydroxide extraction has become increasingly stringent as environmental concerns gain prominence globally. Companies operating in this sector must navigate complex compliance frameworks that vary significantly across jurisdictions. In the United States, the Environmental Protection Agency (EPA) enforces regulations under the Resource Conservation and Recovery Act (RCRA) and the Clean Water Act, which directly impact waste management practices in lithium processing. The EPA's effluent guidelines specifically address discharge limitations for mining operations, requiring extensive monitoring and reporting of potential contaminants.

European regulations present an even more demanding framework through the REACH (Registration, Evaluation, Authorization and Restriction of Chemicals) program, which mandates comprehensive chemical safety assessments and strict waste management protocols. The European Union's Waste Framework Directive 2008/98/EC establishes a waste hierarchy that prioritizes prevention and minimization—principles that directly influence lithium hydroxide extraction methodologies.

In Australia, a major lithium producer, the Environmental Protection and Biodiversity Conservation Act governs extraction activities, with particular emphasis on groundwater protection and habitat preservation. Chinese regulations have evolved rapidly, with the revised Environmental Protection Law imposing severe penalties for non-compliance, including production restrictions and significant fines that can reach millions of yuan.

Emerging economies with lithium reserves, such as Chile, Argentina, and Bolivia, have developed specialized regulatory frameworks focusing on water usage—a critical concern in the arid regions where lithium brine operations typically occur. Chile's environmental regulations require detailed water management plans and environmental impact assessments before project approval, with ongoing monitoring throughout operational lifecycles.

International standards and voluntary initiatives further shape compliance requirements. The Initiative for Responsible Mining Assurance (IRMA) and the International Council on Mining and Metals (ICMM) have established best practice frameworks that many companies adopt to demonstrate environmental stewardship beyond regulatory minimums. These standards often exceed local requirements and address aspects such as community engagement and long-term environmental remediation.

Recent regulatory trends indicate a shift toward circular economy principles, with increasing pressure to implement closed-loop systems that minimize waste generation. Several jurisdictions are implementing extended producer responsibility regulations that may eventually require lithium producers to account for the entire lifecycle of their products, including end-of-life recovery and recycling.

European regulations present an even more demanding framework through the REACH (Registration, Evaluation, Authorization and Restriction of Chemicals) program, which mandates comprehensive chemical safety assessments and strict waste management protocols. The European Union's Waste Framework Directive 2008/98/EC establishes a waste hierarchy that prioritizes prevention and minimization—principles that directly influence lithium hydroxide extraction methodologies.

In Australia, a major lithium producer, the Environmental Protection and Biodiversity Conservation Act governs extraction activities, with particular emphasis on groundwater protection and habitat preservation. Chinese regulations have evolved rapidly, with the revised Environmental Protection Law imposing severe penalties for non-compliance, including production restrictions and significant fines that can reach millions of yuan.

Emerging economies with lithium reserves, such as Chile, Argentina, and Bolivia, have developed specialized regulatory frameworks focusing on water usage—a critical concern in the arid regions where lithium brine operations typically occur. Chile's environmental regulations require detailed water management plans and environmental impact assessments before project approval, with ongoing monitoring throughout operational lifecycles.

International standards and voluntary initiatives further shape compliance requirements. The Initiative for Responsible Mining Assurance (IRMA) and the International Council on Mining and Metals (ICMM) have established best practice frameworks that many companies adopt to demonstrate environmental stewardship beyond regulatory minimums. These standards often exceed local requirements and address aspects such as community engagement and long-term environmental remediation.

Recent regulatory trends indicate a shift toward circular economy principles, with increasing pressure to implement closed-loop systems that minimize waste generation. Several jurisdictions are implementing extended producer responsibility regulations that may eventually require lithium producers to account for the entire lifecycle of their products, including end-of-life recovery and recycling.

Economic Feasibility of Advanced Waste Reduction Technologies

The economic viability of advanced waste reduction technologies in lithium hydroxide extraction processes represents a critical factor in their industry adoption. Initial cost-benefit analyses indicate that while implementation costs for membrane filtration systems and closed-loop solvent recovery technologies are substantial, ranging from $2-5 million for mid-scale operations, the return on investment typically materializes within 3-5 years through reduced waste management expenses and recovered material value.

Operational cost reductions present compelling economic incentives. Advanced electrodialysis systems demonstrate 30-40% lower energy consumption compared to traditional extraction methods, translating to approximately $0.8-1.2 million in annual savings for facilities processing 10,000 tons of lithium compounds. Additionally, selective ion exchange technologies enable recovery of 85-95% of process chemicals, reducing replacement costs by an estimated 60-70%.

Market dynamics further enhance economic feasibility. The premium pricing for environmentally responsible lithium products has created a 5-15% price advantage in European and North American markets. This premium, coupled with increasingly stringent waste disposal regulations that have raised conventional disposal costs by 25-40% over the past five years, strengthens the business case for advanced waste reduction investments.

Scalability considerations reveal that technologies like supercritical CO2 extraction and advanced crystallization processes demonstrate favorable economics primarily at larger production scales (>5,000 tons annually). Conversely, modular electrochemical recovery systems offer viable economics even for smaller operations, with capital costs scaling nearly linearly with production capacity.

Risk assessment models indicate that regulatory compliance represents a significant economic driver. The average compliance violation in major lithium-producing regions now carries penalties of $50,000-250,000 per incident, while implementation of advanced waste reduction technologies typically reduces compliance risk exposure by 70-85%.

Financing mechanisms have evolved to support adoption, with green bonds and sustainability-linked loans offering interest rate reductions of 0.5-1.2% for projects demonstrating substantial waste reduction metrics. Government incentives in key markets provide additional economic support, with tax credits covering 10-30% of capital expenditures for qualifying clean technology implementations in lithium processing facilities.

Operational cost reductions present compelling economic incentives. Advanced electrodialysis systems demonstrate 30-40% lower energy consumption compared to traditional extraction methods, translating to approximately $0.8-1.2 million in annual savings for facilities processing 10,000 tons of lithium compounds. Additionally, selective ion exchange technologies enable recovery of 85-95% of process chemicals, reducing replacement costs by an estimated 60-70%.

Market dynamics further enhance economic feasibility. The premium pricing for environmentally responsible lithium products has created a 5-15% price advantage in European and North American markets. This premium, coupled with increasingly stringent waste disposal regulations that have raised conventional disposal costs by 25-40% over the past five years, strengthens the business case for advanced waste reduction investments.

Scalability considerations reveal that technologies like supercritical CO2 extraction and advanced crystallization processes demonstrate favorable economics primarily at larger production scales (>5,000 tons annually). Conversely, modular electrochemical recovery systems offer viable economics even for smaller operations, with capital costs scaling nearly linearly with production capacity.

Risk assessment models indicate that regulatory compliance represents a significant economic driver. The average compliance violation in major lithium-producing regions now carries penalties of $50,000-250,000 per incident, while implementation of advanced waste reduction technologies typically reduces compliance risk exposure by 70-85%.

Financing mechanisms have evolved to support adoption, with green bonds and sustainability-linked loans offering interest rate reductions of 0.5-1.2% for projects demonstrating substantial waste reduction metrics. Government incentives in key markets provide additional economic support, with tax credits covering 10-30% of capital expenditures for qualifying clean technology implementations in lithium processing facilities.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!