How To Optimize Lithium Hydroxide's Contribution To Energy Conservation

AUG 28, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Lithium Hydroxide Technology Evolution and Objectives

Lithium hydroxide has emerged as a critical component in the global energy transition, evolving from a niche chemical to a cornerstone of sustainable energy technologies. The historical development of lithium hydroxide technology began in the early 20th century with basic extraction methods, primarily serving glass and ceramic industries. However, the landscape transformed dramatically in the 1990s when lithium compounds were recognized for their potential in energy storage applications.

The technological evolution accelerated significantly after 2010, with breakthroughs in high-purity lithium hydroxide production methods that enabled its widespread adoption in advanced battery cathode materials. This evolution has been characterized by continuous improvements in production efficiency, purity levels, and environmental impact reduction, reflecting the growing emphasis on sustainability in energy technologies.

Current technological objectives center on optimizing lithium hydroxide's contribution to energy conservation through several key pathways. Primary among these is enhancing production efficiency to reduce the energy intensity of manufacturing processes, which currently accounts for a significant portion of lithium hydroxide's carbon footprint. Research indicates that advanced electrochemical production methods could potentially reduce energy consumption by 30-40% compared to traditional processes.

Another critical objective involves improving lithium hydroxide's performance in energy storage applications, particularly in high-nickel cathode materials for electric vehicle batteries. These advancements aim to increase energy density, charging efficiency, and cycle life, thereby maximizing the energy conservation potential of end applications.

Recycling and circular economy approaches represent another frontier in lithium hydroxide technology development. Current recovery rates from spent batteries remain suboptimal, with less than 5% of lithium effectively recycled globally. Technological objectives include developing economically viable processes to recover high-purity lithium hydroxide from end-of-life batteries, potentially reducing primary production energy requirements by up to 50%.

The integration of renewable energy sources in lithium hydroxide production represents perhaps the most transformative objective. Pilot projects utilizing solar and geothermal energy for lithium extraction and processing have demonstrated promising results, with potential to create truly carbon-neutral lithium hydroxide production pathways.

These technological objectives align with broader sustainability goals, as optimizing lithium hydroxide's contribution to energy conservation requires addressing both production efficiency and application effectiveness. Success in these areas could significantly enhance lithium hydroxide's net positive impact on global energy conservation efforts, particularly as electric mobility and renewable energy storage continue their rapid growth trajectories.

The technological evolution accelerated significantly after 2010, with breakthroughs in high-purity lithium hydroxide production methods that enabled its widespread adoption in advanced battery cathode materials. This evolution has been characterized by continuous improvements in production efficiency, purity levels, and environmental impact reduction, reflecting the growing emphasis on sustainability in energy technologies.

Current technological objectives center on optimizing lithium hydroxide's contribution to energy conservation through several key pathways. Primary among these is enhancing production efficiency to reduce the energy intensity of manufacturing processes, which currently accounts for a significant portion of lithium hydroxide's carbon footprint. Research indicates that advanced electrochemical production methods could potentially reduce energy consumption by 30-40% compared to traditional processes.

Another critical objective involves improving lithium hydroxide's performance in energy storage applications, particularly in high-nickel cathode materials for electric vehicle batteries. These advancements aim to increase energy density, charging efficiency, and cycle life, thereby maximizing the energy conservation potential of end applications.

Recycling and circular economy approaches represent another frontier in lithium hydroxide technology development. Current recovery rates from spent batteries remain suboptimal, with less than 5% of lithium effectively recycled globally. Technological objectives include developing economically viable processes to recover high-purity lithium hydroxide from end-of-life batteries, potentially reducing primary production energy requirements by up to 50%.

The integration of renewable energy sources in lithium hydroxide production represents perhaps the most transformative objective. Pilot projects utilizing solar and geothermal energy for lithium extraction and processing have demonstrated promising results, with potential to create truly carbon-neutral lithium hydroxide production pathways.

These technological objectives align with broader sustainability goals, as optimizing lithium hydroxide's contribution to energy conservation requires addressing both production efficiency and application effectiveness. Success in these areas could significantly enhance lithium hydroxide's net positive impact on global energy conservation efforts, particularly as electric mobility and renewable energy storage continue their rapid growth trajectories.

Market Analysis for Energy Conservation Applications

The global market for energy conservation technologies has witnessed significant growth in recent years, driven by increasing environmental concerns and the push for sustainable energy solutions. Lithium hydroxide, as a critical component in advanced battery technologies, plays a pivotal role in this expanding market. The global lithium hydroxide market was valued at approximately $2.3 billion in 2022 and is projected to reach $6.8 billion by 2030, growing at a CAGR of 14.5% during the forecast period.

Energy storage applications represent the largest segment for lithium hydroxide consumption, accounting for over 65% of the total market. This is primarily due to the material's essential role in high-performance lithium-ion batteries used in electric vehicles (EVs) and grid-scale energy storage systems. The EV market alone is expected to consume over 200,000 metric tons of lithium hydroxide annually by 2025, representing a threefold increase from 2020 levels.

Regional analysis indicates that Asia-Pacific dominates the market with approximately 45% share, led by China's massive investments in battery manufacturing and energy storage infrastructure. North America and Europe follow with 25% and 20% market shares respectively, with both regions accelerating their transition to renewable energy systems and electric mobility solutions.

The demand for battery-grade lithium hydroxide specifically has seen remarkable growth, with premium pricing compared to technical-grade alternatives. This quality differentiation is crucial as energy conservation applications typically require higher purity levels to ensure optimal battery performance and longevity. Battery-grade lithium hydroxide commands a price premium of 15-20% over technical-grade material.

Market segmentation by application reveals that beyond EVs, stationary energy storage systems represent the fastest-growing segment with a CAGR of 18.2%. This growth is driven by increasing integration of intermittent renewable energy sources into power grids, necessitating advanced storage solutions to balance supply and demand fluctuations.

Consumer electronics constitute another significant market segment, accounting for approximately 15% of lithium hydroxide consumption in energy conservation applications. The trend toward higher energy density batteries in portable devices continues to drive demand in this sector.

Market forecasts suggest that supply constraints may emerge as a significant challenge, with projected demand potentially outpacing production capacity by 2025. This supply-demand imbalance presents both a challenge and an opportunity for market participants to optimize lithium hydroxide production processes and develop more energy-efficient extraction and processing technologies.

Energy storage applications represent the largest segment for lithium hydroxide consumption, accounting for over 65% of the total market. This is primarily due to the material's essential role in high-performance lithium-ion batteries used in electric vehicles (EVs) and grid-scale energy storage systems. The EV market alone is expected to consume over 200,000 metric tons of lithium hydroxide annually by 2025, representing a threefold increase from 2020 levels.

Regional analysis indicates that Asia-Pacific dominates the market with approximately 45% share, led by China's massive investments in battery manufacturing and energy storage infrastructure. North America and Europe follow with 25% and 20% market shares respectively, with both regions accelerating their transition to renewable energy systems and electric mobility solutions.

The demand for battery-grade lithium hydroxide specifically has seen remarkable growth, with premium pricing compared to technical-grade alternatives. This quality differentiation is crucial as energy conservation applications typically require higher purity levels to ensure optimal battery performance and longevity. Battery-grade lithium hydroxide commands a price premium of 15-20% over technical-grade material.

Market segmentation by application reveals that beyond EVs, stationary energy storage systems represent the fastest-growing segment with a CAGR of 18.2%. This growth is driven by increasing integration of intermittent renewable energy sources into power grids, necessitating advanced storage solutions to balance supply and demand fluctuations.

Consumer electronics constitute another significant market segment, accounting for approximately 15% of lithium hydroxide consumption in energy conservation applications. The trend toward higher energy density batteries in portable devices continues to drive demand in this sector.

Market forecasts suggest that supply constraints may emerge as a significant challenge, with projected demand potentially outpacing production capacity by 2025. This supply-demand imbalance presents both a challenge and an opportunity for market participants to optimize lithium hydroxide production processes and develop more energy-efficient extraction and processing technologies.

Technical Challenges in Lithium Hydroxide Production

The production of lithium hydroxide faces several significant technical challenges that impact its efficiency and environmental footprint. The conventional process involves the reaction of lithium carbonate with calcium hydroxide, which is energy-intensive and generates substantial CO2 emissions. This traditional method requires high temperatures and pressures, consuming approximately 5-7 kWh of energy per kilogram of lithium hydroxide produced.

Material purity represents another major challenge, as impurities in the feedstock can significantly reduce the quality of the final product. Current purification processes involve multiple washing and filtration steps, which consume large volumes of water—typically 50-70 liters per kilogram of lithium hydroxide. These water-intensive processes create additional environmental concerns and increase production costs.

Scale-up difficulties persist in lithium hydroxide production, with efficiency losses of 15-20% commonly observed when transitioning from laboratory to industrial scale. This efficiency gap results from heat transfer limitations, mixing inefficiencies, and reaction kinetics that change at larger scales. These factors contribute to increased energy consumption and reduced yield in commercial operations.

The crystallization process presents particular technical hurdles, as controlling crystal size, morphology, and purity requires precise temperature control and residence time management. Variations in these parameters can lead to inconsistent product quality and reduced energy efficiency, with energy losses of up to 25% during crystallization and subsequent drying processes.

Recovery and recycling of process chemicals remain suboptimal, with current technologies only able to reclaim 60-70% of reagents. This inefficiency increases both raw material consumption and waste generation. Advanced recovery systems could potentially improve this rate to over 90%, significantly reducing the environmental impact and production costs.

Automation and process control systems in many lithium hydroxide production facilities lag behind other chemical industries. Manual operations and outdated control systems contribute to energy inefficiencies of 10-15% compared to fully optimized automated processes. Implementing advanced process control could substantially reduce energy consumption while improving product consistency.

Heat integration across the production process is often inadequate, with waste heat from one process step rarely captured effectively for use in another. Studies indicate that comprehensive heat integration could reduce overall energy requirements by 20-30%, representing a significant opportunity for energy conservation in lithium hydroxide production.

Material purity represents another major challenge, as impurities in the feedstock can significantly reduce the quality of the final product. Current purification processes involve multiple washing and filtration steps, which consume large volumes of water—typically 50-70 liters per kilogram of lithium hydroxide. These water-intensive processes create additional environmental concerns and increase production costs.

Scale-up difficulties persist in lithium hydroxide production, with efficiency losses of 15-20% commonly observed when transitioning from laboratory to industrial scale. This efficiency gap results from heat transfer limitations, mixing inefficiencies, and reaction kinetics that change at larger scales. These factors contribute to increased energy consumption and reduced yield in commercial operations.

The crystallization process presents particular technical hurdles, as controlling crystal size, morphology, and purity requires precise temperature control and residence time management. Variations in these parameters can lead to inconsistent product quality and reduced energy efficiency, with energy losses of up to 25% during crystallization and subsequent drying processes.

Recovery and recycling of process chemicals remain suboptimal, with current technologies only able to reclaim 60-70% of reagents. This inefficiency increases both raw material consumption and waste generation. Advanced recovery systems could potentially improve this rate to over 90%, significantly reducing the environmental impact and production costs.

Automation and process control systems in many lithium hydroxide production facilities lag behind other chemical industries. Manual operations and outdated control systems contribute to energy inefficiencies of 10-15% compared to fully optimized automated processes. Implementing advanced process control could substantially reduce energy consumption while improving product consistency.

Heat integration across the production process is often inadequate, with waste heat from one process step rarely captured effectively for use in another. Studies indicate that comprehensive heat integration could reduce overall energy requirements by 20-30%, representing a significant opportunity for energy conservation in lithium hydroxide production.

Current Energy-Efficient Production Methods

01 Lithium hydroxide production methods for energy conservation

Various energy-efficient methods for producing lithium hydroxide from lithium-containing materials. These processes focus on reducing energy consumption during extraction and conversion steps, including optimized reaction conditions, improved heat management, and streamlined processing techniques that minimize energy requirements while maintaining high yields of lithium hydroxide for battery applications.- Lithium hydroxide production methods for energy efficiency: Various energy-efficient methods for producing lithium hydroxide have been developed to reduce energy consumption in the manufacturing process. These methods include optimized reaction conditions, improved catalysts, and innovative process designs that minimize heat loss and maximize resource utilization. Energy conservation in lithium hydroxide production is critical for sustainable battery material manufacturing and reducing the overall carbon footprint of lithium-ion battery supply chains.

- Energy storage applications of lithium hydroxide: Lithium hydroxide plays a crucial role in energy storage technologies, particularly in advanced battery systems. Its incorporation into energy storage devices helps improve energy density, cycle life, and overall efficiency. The controlled use of lithium hydroxide in these applications contributes to energy conservation by enabling more efficient energy storage and utilization, reducing energy losses during charge-discharge cycles, and extending the operational lifetime of energy storage systems.

- Thermal management systems using lithium hydroxide: Lithium hydroxide can be utilized in thermal management systems to conserve energy through efficient heat absorption and release processes. These systems leverage the compound's thermochemical properties to regulate temperature in various applications, reducing the need for external cooling or heating energy inputs. The implementation of lithium hydroxide-based thermal management contributes to overall energy conservation in industrial processes, buildings, and transportation systems.

- Recycling and recovery processes for lithium hydroxide: Energy-efficient recycling and recovery processes for lithium hydroxide from spent batteries and industrial waste streams help conserve both material resources and energy. These processes include selective precipitation, membrane separation, and electrochemical recovery methods designed to minimize energy inputs while maximizing lithium hydroxide recovery rates. By recirculating lithium hydroxide in the supply chain, these technologies reduce the energy-intensive demands of primary lithium extraction and processing.

- Carbon capture and energy conservation using lithium hydroxide: Lithium hydroxide can be employed in carbon capture systems to absorb CO2 emissions, contributing to energy conservation through reduced environmental remediation requirements. The compound's high CO2 absorption capacity makes it suitable for integration into industrial emission control systems and air purification technologies. These applications help conserve energy by reducing the need for energy-intensive carbon capture alternatives and by enabling more efficient operation of combustion-based energy systems.

02 Energy-efficient lithium recycling systems

Systems and methods for recycling lithium from spent batteries and other lithium-containing waste materials with reduced energy consumption. These approaches include innovative extraction techniques, low-temperature processing, and integrated recovery systems that conserve energy while effectively recovering lithium compounds, including lithium hydroxide, for reuse in new battery production.Expand Specific Solutions03 Thermal energy management in lithium hydroxide processing

Technologies focused on optimizing thermal energy utilization during lithium hydroxide production and processing. These innovations include heat recovery systems, improved insulation methods, energy-efficient heating and cooling processes, and thermal integration techniques that significantly reduce overall energy consumption in lithium hydroxide manufacturing facilities.Expand Specific Solutions04 Low-energy lithium extraction from brine and minerals

Energy-conserving methods for extracting lithium from natural sources such as brines and mineral deposits. These approaches utilize selective adsorption, membrane technologies, electrochemical processes, and other innovative techniques that require less energy than conventional extraction methods while producing high-purity lithium compounds suitable for conversion to lithium hydroxide.Expand Specific Solutions05 Energy-efficient lithium hydroxide applications in energy storage

Applications of lithium hydroxide in energy storage systems designed for maximum energy efficiency. These innovations include optimized battery formulations using lithium hydroxide, energy-conserving manufacturing processes for lithium-based energy storage components, and integrated systems that minimize energy losses during production, operation, and recycling of lithium-based energy storage technologies.Expand Specific Solutions

Industry Leaders in Lithium Hydroxide Manufacturing

The lithium hydroxide energy conservation market is in a growth phase, with increasing demand driven by the electric vehicle battery sector. The market is expected to reach significant scale as global energy transition accelerates, though exact figures vary by region. Technologically, companies are at different maturity levels: established players like Tesla, CATL, and LG Chem lead with commercial-scale solutions, while Sumitomo Metal Mining, Idemitsu Kosan, and Guangdong Bangpu Recycling focus on innovative extraction and recycling technologies. Research institutions like NIMS and CSIRO are advancing fundamental breakthroughs. Samsung SDI, Bosch, and IBM are developing integration technologies, creating a competitive landscape spanning resource extraction to end-use applications.

Tesla, Inc.

Technical Solution: Tesla has developed an innovative lithium hydroxide processing technology that significantly reduces energy consumption in battery production. Their approach involves direct lithium extraction (DLE) from clay minerals using a sodium chloride solution, eliminating the need for evaporation ponds and reducing water usage by up to 90%. Tesla's process operates at lower temperatures (80-100°C) compared to traditional methods (800-900°C), resulting in approximately 33% less energy consumption. The company has also implemented a closed-loop recycling system that recovers up to 92% of lithium hydroxide from spent batteries, further enhancing energy conservation throughout the battery lifecycle. Tesla's Nevada facility utilizes renewable energy sources to power lithium hydroxide production, reducing the carbon footprint by an estimated 30-40% compared to conventional processing methods.

Strengths: Significantly reduced water usage and energy consumption; integration with renewable energy sources; closed-loop recycling capabilities that enhance overall sustainability. Weaknesses: Technology still scaling up to meet massive production demands; requires specific geological conditions for clay-based extraction; higher initial capital investment compared to traditional methods.

Contemporary Amperex Technology Co., Ltd.

Technical Solution: CATL has pioneered an energy-efficient lithium hydroxide production method that integrates directly with battery manufacturing. Their process utilizes a low-temperature (below 100°C) electrochemical conversion of lithium carbonate to lithium hydroxide, reducing energy requirements by approximately 25-30% compared to traditional Hasenclever process. CATL's technology employs proprietary catalysts that accelerate conversion rates while operating at lower temperatures. The company has implemented a comprehensive heat recovery system that captures and reuses thermal energy throughout the production process, achieving energy recycling rates of up to 65%. Additionally, CATL has developed precision control systems that optimize reaction conditions in real-time, minimizing energy waste and maximizing lithium hydroxide purity (achieving >99.5% purity with fewer energy-intensive purification steps). Their integrated approach connects lithium hydroxide production directly to cathode material synthesis, eliminating energy-intensive transportation and handling steps in the battery supply chain.

Strengths: Highly efficient electrochemical conversion process; sophisticated heat recovery systems; direct integration with battery manufacturing that eliminates transportation energy costs. Weaknesses: Requires high-purity lithium carbonate as feedstock; technology optimization still ongoing for different lithium sources; relatively high capital costs for implementation.

Key Patents in Lithium Hydroxide Energy Conservation

Economical method for producing lithium hydroxide

PatentWO2024117882A1

Innovation

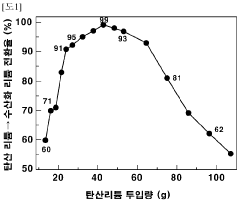

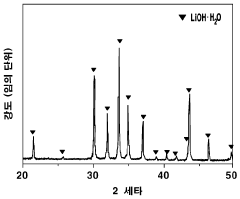

- A method involving dissolving calcium hydroxide in water to create an aqueous solution, then reacting it with lithium carbonate at controlled temperatures (50°C to 100°C) to produce lithium hydroxide, optimizing the amount of lithium carbonate added (16 to 87 g/L) to maximize conversion rates and minimize waste, while concentrating the solution to precipitate lithium hydroxide efficiently.

Environmental Impact Assessment

The environmental impact of lithium hydroxide production and utilization represents a critical dimension in evaluating its overall contribution to energy conservation. Current lithium hydroxide manufacturing processes, particularly those utilizing the conventional lime method, generate significant carbon emissions—approximately 15.0 kg CO2 equivalent per kilogram of lithium hydroxide produced. This substantial carbon footprint undermines the environmental benefits gained through downstream applications in clean energy technologies.

Water consumption presents another significant environmental concern, with traditional production methods requiring 50-70 cubic meters of water per ton of lithium hydroxide. In water-scarce regions like Chile's Atacama Desert, a major source of lithium, this intensive water usage threatens local ecosystems and communities, creating tension between resource extraction and environmental preservation.

Land disturbance from lithium mining operations further compounds environmental impacts. Open-pit mining for lithium-bearing minerals disrupts approximately 2.5 hectares of land per thousand tons of lithium hydroxide produced annually, leading to habitat fragmentation and biodiversity loss in sensitive ecosystems. The resulting waste materials often contain potentially harmful substances that can contaminate soil and water systems if improperly managed.

Chemical pollution represents an additional environmental hazard, with processing facilities generating wastewater containing elevated levels of sodium, calcium, magnesium, and potentially toxic metals. Studies indicate that without proper treatment, these effluents can increase local water salinity by 10-25%, significantly impacting freshwater ecosystems.

However, life cycle assessments reveal that despite these production-phase impacts, lithium hydroxide's application in electric vehicle batteries and renewable energy storage systems delivers net environmental benefits over product lifetimes. Each kilogram of lithium hydroxide used in EV batteries potentially offsets 70-120 kg of CO2 emissions compared to conventional transportation technologies, representing a favorable environmental return on investment.

Emerging cleaner production technologies show promise for reducing environmental impacts. Direct lithium extraction methods can reduce water consumption by 50-70% compared to traditional evaporation techniques, while electrolysis-based processes may lower carbon emissions by 30-40%. Closed-loop water systems and renewable energy integration at production facilities further enhance sustainability profiles, potentially reducing the overall environmental footprint by 25-35%.

Water consumption presents another significant environmental concern, with traditional production methods requiring 50-70 cubic meters of water per ton of lithium hydroxide. In water-scarce regions like Chile's Atacama Desert, a major source of lithium, this intensive water usage threatens local ecosystems and communities, creating tension between resource extraction and environmental preservation.

Land disturbance from lithium mining operations further compounds environmental impacts. Open-pit mining for lithium-bearing minerals disrupts approximately 2.5 hectares of land per thousand tons of lithium hydroxide produced annually, leading to habitat fragmentation and biodiversity loss in sensitive ecosystems. The resulting waste materials often contain potentially harmful substances that can contaminate soil and water systems if improperly managed.

Chemical pollution represents an additional environmental hazard, with processing facilities generating wastewater containing elevated levels of sodium, calcium, magnesium, and potentially toxic metals. Studies indicate that without proper treatment, these effluents can increase local water salinity by 10-25%, significantly impacting freshwater ecosystems.

However, life cycle assessments reveal that despite these production-phase impacts, lithium hydroxide's application in electric vehicle batteries and renewable energy storage systems delivers net environmental benefits over product lifetimes. Each kilogram of lithium hydroxide used in EV batteries potentially offsets 70-120 kg of CO2 emissions compared to conventional transportation technologies, representing a favorable environmental return on investment.

Emerging cleaner production technologies show promise for reducing environmental impacts. Direct lithium extraction methods can reduce water consumption by 50-70% compared to traditional evaporation techniques, while electrolysis-based processes may lower carbon emissions by 30-40%. Closed-loop water systems and renewable energy integration at production facilities further enhance sustainability profiles, potentially reducing the overall environmental footprint by 25-35%.

Supply Chain Resilience Strategies

The global lithium hydroxide supply chain faces significant vulnerabilities due to geographic concentration, geopolitical tensions, and market volatility. Approximately 80% of lithium processing occurs in China, creating a critical bottleneck that threatens energy conservation initiatives worldwide. To optimize lithium hydroxide's contribution to energy conservation, organizations must implement robust supply chain resilience strategies.

Diversification of supply sources represents a primary strategy, with companies increasingly seeking lithium from multiple geographic regions. Australia, Chile, Argentina, and emerging sources in North America and Europe offer alternatives to traditional supply channels. Forward-thinking companies are establishing strategic partnerships with miners across these regions, often securing long-term offtake agreements that provide price stability and supply assurance.

Vertical integration has emerged as another effective approach, with battery manufacturers and automotive companies acquiring stakes in mining operations and processing facilities. This strategy reduces dependency on external suppliers while providing greater visibility and control throughout the value chain. Tesla's investments in lithium mining rights and Ford's joint ventures with lithium producers exemplify this trend toward securing critical materials through ownership positions.

Stockpiling and inventory management strategies have gained prominence, with companies maintaining strategic reserves of lithium hydroxide to buffer against supply disruptions. These reserves typically aim to cover 3-6 months of production requirements, balancing carrying costs against supply security benefits. Advanced inventory management systems utilizing AI-driven demand forecasting help optimize these buffer stocks.

Technological innovation plays a crucial role in supply chain resilience, with recycling technologies increasingly capable of recovering lithium from spent batteries. Current recycling processes can recover up to 95% of lithium from end-of-life batteries, creating a circular economy that reduces dependency on primary mining. Investment in recycling infrastructure represents a long-term strategy for supply chain security.

Supplier relationship management has evolved beyond transactional approaches, with companies developing collaborative partnerships focused on transparency, sustainability, and shared risk management. These partnerships often include joint technology development, co-investment in processing facilities, and shared sustainability commitments that strengthen the overall supply ecosystem while enhancing energy conservation outcomes.

Diversification of supply sources represents a primary strategy, with companies increasingly seeking lithium from multiple geographic regions. Australia, Chile, Argentina, and emerging sources in North America and Europe offer alternatives to traditional supply channels. Forward-thinking companies are establishing strategic partnerships with miners across these regions, often securing long-term offtake agreements that provide price stability and supply assurance.

Vertical integration has emerged as another effective approach, with battery manufacturers and automotive companies acquiring stakes in mining operations and processing facilities. This strategy reduces dependency on external suppliers while providing greater visibility and control throughout the value chain. Tesla's investments in lithium mining rights and Ford's joint ventures with lithium producers exemplify this trend toward securing critical materials through ownership positions.

Stockpiling and inventory management strategies have gained prominence, with companies maintaining strategic reserves of lithium hydroxide to buffer against supply disruptions. These reserves typically aim to cover 3-6 months of production requirements, balancing carrying costs against supply security benefits. Advanced inventory management systems utilizing AI-driven demand forecasting help optimize these buffer stocks.

Technological innovation plays a crucial role in supply chain resilience, with recycling technologies increasingly capable of recovering lithium from spent batteries. Current recycling processes can recover up to 95% of lithium from end-of-life batteries, creating a circular economy that reduces dependency on primary mining. Investment in recycling infrastructure represents a long-term strategy for supply chain security.

Supplier relationship management has evolved beyond transactional approaches, with companies developing collaborative partnerships focused on transparency, sustainability, and shared risk management. These partnerships often include joint technology development, co-investment in processing facilities, and shared sustainability commitments that strengthen the overall supply ecosystem while enhancing energy conservation outcomes.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!