How To Optimize Lithium Hydroxide Purity For EV Batteries

AUG 28, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Lithium Hydroxide Purification Background and Objectives

Lithium hydroxide has emerged as a critical component in the production of high-performance lithium-ion batteries for electric vehicles (EVs). The evolution of this technology can be traced back to the early 1990s when lithium-ion batteries first gained commercial traction. Initially, lithium carbonate was the predominant lithium compound used in battery cathodes. However, as EV technology advanced, the demand for higher energy density, longer range, and faster charging capabilities necessitated a shift toward lithium hydroxide, particularly for nickel-rich cathode materials.

The technical evolution of lithium hydroxide purification has progressed through several key phases. Traditional methods relied on simple precipitation and crystallization techniques, which often resulted in product with significant impurity levels. The mid-2000s saw the introduction of more sophisticated multi-stage purification processes, incorporating advanced filtration and ion exchange technologies. Recent developments have focused on novel extraction methods, including direct lithium extraction (DLE) from brines and improved hydrometallurgical processes for hard rock sources.

Current industry standards typically require battery-grade lithium hydroxide with purity levels of 99.5% or higher. However, as EV battery technology continues to advance, particularly with the development of solid-state batteries and higher nickel-content cathodes, there is growing pressure to achieve ultra-high purity levels exceeding 99.9%. Impurities such as sodium, potassium, calcium, and transition metals, even at parts-per-million levels, can significantly impact battery performance, safety, and longevity.

The primary technical objective of lithium hydroxide purification research is to develop economically viable processes that can consistently produce ultra-high purity material at industrial scale. This includes minimizing energy consumption, reducing water usage, and decreasing chemical waste generation while maintaining stringent quality control. Secondary objectives include developing real-time monitoring techniques for impurity detection and implementing adaptive process control systems to ensure consistent product quality.

Global lithium demand is projected to increase by over 40% annually through 2030, driven primarily by EV battery production. This growth trajectory presents both challenges and opportunities for lithium hydroxide purification technology. The industry must balance the need for rapid capacity expansion with increasingly stringent purity requirements and sustainability considerations.

Research indicates that even minor improvements in lithium hydroxide purity can translate to significant enhancements in battery performance metrics, including cycle life, energy density, and fast-charging capability. Therefore, optimizing purification processes represents a critical pathway to advancing EV adoption and addressing range anxiety concerns among consumers.

The technical evolution of lithium hydroxide purification has progressed through several key phases. Traditional methods relied on simple precipitation and crystallization techniques, which often resulted in product with significant impurity levels. The mid-2000s saw the introduction of more sophisticated multi-stage purification processes, incorporating advanced filtration and ion exchange technologies. Recent developments have focused on novel extraction methods, including direct lithium extraction (DLE) from brines and improved hydrometallurgical processes for hard rock sources.

Current industry standards typically require battery-grade lithium hydroxide with purity levels of 99.5% or higher. However, as EV battery technology continues to advance, particularly with the development of solid-state batteries and higher nickel-content cathodes, there is growing pressure to achieve ultra-high purity levels exceeding 99.9%. Impurities such as sodium, potassium, calcium, and transition metals, even at parts-per-million levels, can significantly impact battery performance, safety, and longevity.

The primary technical objective of lithium hydroxide purification research is to develop economically viable processes that can consistently produce ultra-high purity material at industrial scale. This includes minimizing energy consumption, reducing water usage, and decreasing chemical waste generation while maintaining stringent quality control. Secondary objectives include developing real-time monitoring techniques for impurity detection and implementing adaptive process control systems to ensure consistent product quality.

Global lithium demand is projected to increase by over 40% annually through 2030, driven primarily by EV battery production. This growth trajectory presents both challenges and opportunities for lithium hydroxide purification technology. The industry must balance the need for rapid capacity expansion with increasingly stringent purity requirements and sustainability considerations.

Research indicates that even minor improvements in lithium hydroxide purity can translate to significant enhancements in battery performance metrics, including cycle life, energy density, and fast-charging capability. Therefore, optimizing purification processes represents a critical pathway to advancing EV adoption and addressing range anxiety concerns among consumers.

EV Battery Market Demand Analysis

The electric vehicle (EV) battery market is experiencing unprecedented growth, driven by global shifts towards sustainable transportation and stringent environmental regulations. Current market projections indicate that the global EV battery market will reach approximately $127 billion by 2027, with a compound annual growth rate exceeding 18% from 2022. This remarkable expansion directly correlates with increasing demand for high-purity lithium hydroxide, a critical component in cathode materials for high-performance EV batteries.

Consumer preferences are evolving rapidly, with range anxiety remaining a primary concern among potential EV adopters. Market research reveals that consumers consistently prioritize vehicles offering ranges exceeding 300 miles on a single charge, necessitating batteries with higher energy density. This consumer demand has catalyzed manufacturers to pursue advanced battery chemistries that require higher purity lithium hydroxide.

The shift from lithium carbonate to lithium hydroxide in battery production represents a significant market trend. Nickel-rich cathode materials (NCM 811, NCA) are becoming industry standard for premium EVs, requiring battery-grade lithium hydroxide with purity levels exceeding 99.5%. Market analysis indicates that demand for high-purity lithium hydroxide is growing at nearly twice the rate of standard-grade material, creating a premium segment with higher profit margins.

Regulatory frameworks worldwide are accelerating this market transformation. The European Union's Battery Directive, China's dual-credit policy, and California's zero-emission vehicle mandate collectively establish stringent performance and sustainability requirements that indirectly drive demand for higher purity battery materials. These regulations are expected to tighten further, potentially requiring battery manufacturers to document material purity and provenance.

Regional market analysis reveals significant variations in demand patterns. While China remains the largest consumer of lithium hydroxide, accounting for approximately 51% of global demand, European markets are showing the fastest growth rates as automotive manufacturers rapidly electrify their fleets. North American demand is accelerating following recent legislative initiatives supporting domestic battery production.

Price sensitivity analysis indicates that despite higher costs for ultra-high purity lithium hydroxide (99.9%+), battery manufacturers are increasingly willing to absorb premium pricing to achieve performance differentiation. This trend is particularly evident in the luxury EV segment, where battery performance directly impacts brand positioning and consumer perception.

Market forecasts suggest that by 2025, approximately 80% of new EV models will utilize cathode chemistries requiring high-purity lithium hydroxide, creating sustained demand growth for optimized production processes that can deliver consistent purity levels while managing production costs.

Consumer preferences are evolving rapidly, with range anxiety remaining a primary concern among potential EV adopters. Market research reveals that consumers consistently prioritize vehicles offering ranges exceeding 300 miles on a single charge, necessitating batteries with higher energy density. This consumer demand has catalyzed manufacturers to pursue advanced battery chemistries that require higher purity lithium hydroxide.

The shift from lithium carbonate to lithium hydroxide in battery production represents a significant market trend. Nickel-rich cathode materials (NCM 811, NCA) are becoming industry standard for premium EVs, requiring battery-grade lithium hydroxide with purity levels exceeding 99.5%. Market analysis indicates that demand for high-purity lithium hydroxide is growing at nearly twice the rate of standard-grade material, creating a premium segment with higher profit margins.

Regulatory frameworks worldwide are accelerating this market transformation. The European Union's Battery Directive, China's dual-credit policy, and California's zero-emission vehicle mandate collectively establish stringent performance and sustainability requirements that indirectly drive demand for higher purity battery materials. These regulations are expected to tighten further, potentially requiring battery manufacturers to document material purity and provenance.

Regional market analysis reveals significant variations in demand patterns. While China remains the largest consumer of lithium hydroxide, accounting for approximately 51% of global demand, European markets are showing the fastest growth rates as automotive manufacturers rapidly electrify their fleets. North American demand is accelerating following recent legislative initiatives supporting domestic battery production.

Price sensitivity analysis indicates that despite higher costs for ultra-high purity lithium hydroxide (99.9%+), battery manufacturers are increasingly willing to absorb premium pricing to achieve performance differentiation. This trend is particularly evident in the luxury EV segment, where battery performance directly impacts brand positioning and consumer perception.

Market forecasts suggest that by 2025, approximately 80% of new EV models will utilize cathode chemistries requiring high-purity lithium hydroxide, creating sustained demand growth for optimized production processes that can deliver consistent purity levels while managing production costs.

Current Purification Technologies and Challenges

The lithium hydroxide purification landscape for EV batteries currently employs several established technologies, each with specific advantages and limitations. Conventional purification methods include precipitation, ion exchange, solvent extraction, and membrane filtration. Precipitation techniques utilize chemical reagents to selectively precipitate impurities from lithium-rich solutions, but often struggle with complete removal of elements like sodium, potassium, and calcium that share similar chemical properties with lithium.

Ion exchange technologies have gained prominence for their ability to achieve high purity levels by selectively removing metal impurities. However, these systems face challenges with resin degradation over multiple regeneration cycles and require significant quantities of chemicals for regeneration, raising both cost and environmental concerns.

Solvent extraction methods offer excellent selectivity for certain impurities but typically involve organic solvents that present environmental hazards and require complex recovery systems. The capital investment and operational complexity of these systems often limit their implementation to large-scale operations.

Membrane-based separation technologies, including nanofiltration and electrodialysis, represent more recent innovations in the field. While these approaches offer reduced chemical consumption and potentially lower environmental impact, they face challenges with membrane fouling and limited selectivity for certain critical impurities like magnesium and calcium.

A significant technical challenge across all purification methods is achieving the increasingly stringent purity requirements for advanced battery applications. Modern EV batteries demand lithium hydroxide with impurity levels below 10 ppm for elements like sodium, potassium, calcium, and magnesium, which exceeds the capabilities of many conventional single-step purification processes.

Energy consumption presents another major challenge, as most purification technologies require substantial thermal energy for evaporation and crystallization steps. This energy demand not only increases production costs but also contradicts the sustainability goals of the EV industry.

Scale-up challenges persist as laboratory-proven technologies often encounter unforeseen complications when implemented at industrial scale. Variations in feedstock composition from different lithium sources further complicate process design and optimization, requiring flexible purification systems capable of handling fluctuating impurity profiles.

Water consumption remains a critical concern, particularly as many lithium production facilities operate in water-stressed regions. Advanced recycling of process water and development of more water-efficient purification technologies represent important areas for innovation to ensure sustainable production scaling.

Ion exchange technologies have gained prominence for their ability to achieve high purity levels by selectively removing metal impurities. However, these systems face challenges with resin degradation over multiple regeneration cycles and require significant quantities of chemicals for regeneration, raising both cost and environmental concerns.

Solvent extraction methods offer excellent selectivity for certain impurities but typically involve organic solvents that present environmental hazards and require complex recovery systems. The capital investment and operational complexity of these systems often limit their implementation to large-scale operations.

Membrane-based separation technologies, including nanofiltration and electrodialysis, represent more recent innovations in the field. While these approaches offer reduced chemical consumption and potentially lower environmental impact, they face challenges with membrane fouling and limited selectivity for certain critical impurities like magnesium and calcium.

A significant technical challenge across all purification methods is achieving the increasingly stringent purity requirements for advanced battery applications. Modern EV batteries demand lithium hydroxide with impurity levels below 10 ppm for elements like sodium, potassium, calcium, and magnesium, which exceeds the capabilities of many conventional single-step purification processes.

Energy consumption presents another major challenge, as most purification technologies require substantial thermal energy for evaporation and crystallization steps. This energy demand not only increases production costs but also contradicts the sustainability goals of the EV industry.

Scale-up challenges persist as laboratory-proven technologies often encounter unforeseen complications when implemented at industrial scale. Variations in feedstock composition from different lithium sources further complicate process design and optimization, requiring flexible purification systems capable of handling fluctuating impurity profiles.

Water consumption remains a critical concern, particularly as many lithium production facilities operate in water-stressed regions. Advanced recycling of process water and development of more water-efficient purification technologies represent important areas for innovation to ensure sustainable production scaling.

Established Purification Solutions and Techniques

01 Purification methods for high-purity lithium hydroxide

Various purification methods are employed to obtain high-purity lithium hydroxide, including crystallization, ion exchange, and membrane separation techniques. These processes remove impurities such as sodium, potassium, calcium, and magnesium ions to achieve battery-grade purity levels. Advanced purification methods can produce lithium hydroxide with purity exceeding 99.5%, which is essential for high-performance lithium-ion batteries.- Purification methods for lithium hydroxide: Various methods are employed to purify lithium hydroxide to achieve high purity levels. These include crystallization, filtration, ion exchange, and chemical precipitation techniques. The purification processes often involve multiple steps to remove impurities such as sodium, potassium, calcium, and other metal ions that can affect the quality of lithium hydroxide for battery and industrial applications.

- High-purity lithium hydroxide for battery applications: High-purity lithium hydroxide is critical for lithium-ion battery production, particularly for cathode materials. Battery-grade lithium hydroxide typically requires purity levels exceeding 99.5%, with strict limits on impurities like sodium, calcium, and heavy metals. Advanced purification techniques are developed specifically to meet the stringent requirements of the battery industry, as impurities can significantly impact battery performance, safety, and lifespan.

- Analytical methods for determining lithium hydroxide purity: Various analytical techniques are used to determine the purity of lithium hydroxide and identify impurities. These include atomic absorption spectroscopy, inductively coupled plasma mass spectrometry (ICP-MS), X-ray fluorescence, and titration methods. These analytical approaches help ensure quality control in lithium hydroxide production and verify that the material meets the required specifications for different applications.

- Production of high-purity lithium hydroxide from lithium resources: Methods for producing high-purity lithium hydroxide directly from various lithium resources such as brines, spodumene, and other lithium-containing minerals. These processes often involve extraction, conversion, and purification steps designed to maximize purity while minimizing environmental impact. Innovations in this area focus on improving efficiency, reducing energy consumption, and developing more sustainable production methods.

- Purity standards and specifications for lithium hydroxide: Industry standards and specifications define different grades of lithium hydroxide purity for various applications. These standards typically specify maximum allowable levels of impurities such as sodium, potassium, chloride, sulfate, and heavy metals. Compliance with these standards is essential for ensuring consistent quality and performance in applications ranging from battery production to industrial processes and pharmaceuticals.

02 Production of battery-grade lithium hydroxide from lithium sources

Battery-grade lithium hydroxide can be produced from various lithium sources including lithium carbonate, lithium chloride, and lithium-containing minerals. The production processes typically involve conversion reactions, followed by purification steps to remove impurities. These methods focus on achieving the high purity levels required for lithium-ion battery applications, with specifications often requiring 99.9% purity with strict limits on specific metal impurities.Expand Specific Solutions03 Analytical methods for determining lithium hydroxide purity

Various analytical techniques are used to determine the purity of lithium hydroxide, including inductively coupled plasma mass spectrometry (ICP-MS), atomic absorption spectroscopy (AAS), and titration methods. These techniques can detect and quantify trace impurities at parts per million (ppm) levels. Quality control protocols often include multiple analytical methods to ensure comprehensive purity assessment for battery and industrial applications.Expand Specific Solutions04 Purity standards and specifications for different applications

Different applications require specific purity standards for lithium hydroxide. Battery-grade typically requires 99.5-99.9% purity with strict limits on transition metal impurities. Industrial-grade may have lower purity requirements (95-99%). The specifications often include maximum allowable concentrations for specific impurities such as sodium, potassium, calcium, chloride, and sulfate. These standards are critical for ensuring consistent performance in end applications.Expand Specific Solutions05 Impact of impurities on lithium-ion battery performance

Impurities in lithium hydroxide can significantly impact lithium-ion battery performance. Metal impurities like iron, copper, and nickel can cause side reactions, reduce battery capacity, and shorten battery life. Alkaline metal impurities can affect the intercalation process and reduce cycling efficiency. Moisture content and particle size distribution also influence battery manufacturing processes and final product quality. Higher purity lithium hydroxide generally leads to better battery performance and longer cycle life.Expand Specific Solutions

Key Industry Players in Battery-Grade Lithium Production

The lithium hydroxide market for EV batteries is in a growth phase, with increasing demand driven by the expanding electric vehicle sector. The market is characterized by a mix of established players and emerging competitors. Companies like LG Energy Solution, LG Chem, and SVOLT Energy Technology are advancing battery technology, while resource companies such as Sumitomo Metal Mining, Mitsubishi Materials, and Korea Zinc focus on securing raw materials. Chemical specialists including BASF, Chemetall, and Alkeemia are developing purification processes. The technology is maturing rapidly with significant R&D investment from both private companies and research institutions like University of Kentucky Research Foundation and RIST, focusing on improving purity levels, reducing production costs, and developing sustainable extraction methods.

LG Energy Solution Ltd.

Technical Solution: LG Energy Solution has developed a comprehensive lithium hydroxide quality control system called "TraceSpec" that focuses on identifying and eliminating trace contaminants that affect battery performance. Their approach begins with raw material qualification using advanced analytical techniques including glow discharge mass spectrometry (GDMS) to detect impurities down to sub-ppm levels. The company employs a proprietary selective adsorption technology that targets specific harmful elements like iron, aluminum, and silicon that can trigger unwanted side reactions in high-nickel cathodes. Their purification process incorporates ultrasonic-assisted crystallization that produces lithium hydroxide monohydrate with uniform morphology and controlled particle size (5-15μm), optimized for their NCM and NCA cathode production lines. LG Energy Solution has also implemented an AI-driven quality prediction system that correlates specific impurity profiles with battery performance metrics, allowing them to establish customized purity specifications for different cathode chemistries. Their most recent innovation includes a closed-loop recycling system that recovers lithium from production waste and end-of-life batteries while maintaining ultra-high purity standards.

Strengths: Highly sophisticated analytical capabilities allow for detection and control of trace elements that other manufacturers might miss. Their AI-driven approach enables optimization of lithium hydroxide specifications for specific battery chemistries rather than using generic purity targets. Weaknesses: The extensive testing and quality control processes add significant cost to the final product. The system requires highly specialized equipment and expertise that is difficult to scale across multiple production facilities.

Nemaska Lithium, Inc.

Technical Solution: Nemaska Lithium has developed a proprietary process for producing battery-grade lithium hydroxide directly from spodumene concentrate. Their patented technology involves a thermal treatment process that converts alpha-spodumene to beta-spodumene, followed by acid leaching to extract lithium into solution. The company then employs membrane electrolysis to produce high-purity lithium hydroxide without the intermediate lithium carbonate step used in conventional processes. This direct conversion method achieves 99.99% purity levels (4N) consistently, which exceeds the requirements for premium EV battery cathode materials. Their process includes multiple purification stages with ion-exchange technology to remove specific impurities like calcium, magnesium, and sodium that are particularly detrimental to battery performance. The Whabouchi project combines both mining operations and electrochemical processing to ensure complete control over the supply chain and quality parameters.

Strengths: Direct conversion from spodumene to lithium hydroxide eliminates intermediate steps, reducing production costs by approximately 30% and minimizing contamination risks. Their process consumes significantly less reagents and energy compared to traditional methods. Weaknesses: The technology requires substantial initial capital investment and has faced commercialization delays due to financing challenges. The process is also highly sensitive to feed material quality, requiring consistent spodumene concentrate specifications.

Critical Patents and Innovations in Lithium Purification

Method for producing lithium hydroxide

PatentPendingUS20240375971A1

Innovation

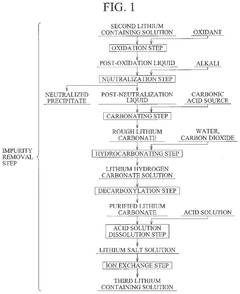

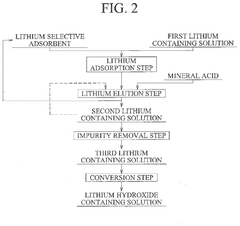

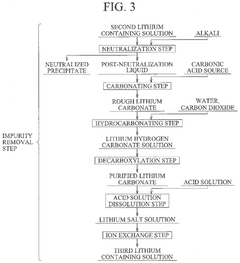

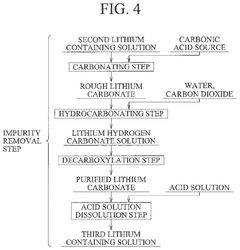

- A method involving lithium adsorption, elution, impurity removal steps including carbonation, neutralization, and ion exchange, followed by conversion to produce high-purity lithium hydroxide, which includes specific steps like oxidation, acid solution dissolution, and crystallization to enhance purity and reduce facility costs.

Manufacturing method for lithium hydroxide

PatentWO2025071011A1

Innovation

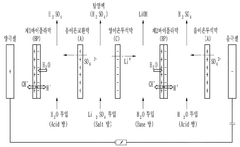

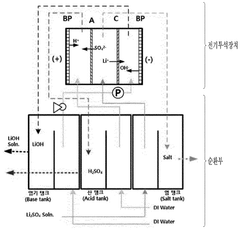

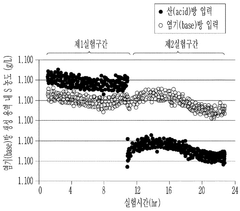

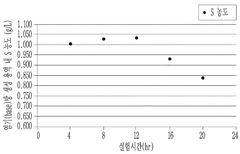

- The method involves using electrical dialysis with a bipolar membrane and anionic/cationic dialysis membranes to control impurities by adjusting the pressure in the acid and base rooms, thereby optimizing the hydroxide lithium solution's purity and crystallization rate.

Environmental Impact of Lithium Processing Methods

The production of high-purity lithium hydroxide for EV batteries involves various processing methods, each with distinct environmental implications. Traditional extraction techniques, particularly those utilizing evaporation ponds in salt flats, consume enormous quantities of water—up to 2 million liters per ton of lithium produced. This poses severe ecological challenges in water-scarce regions like Chile's Atacama Desert, where lithium operations have been linked to groundwater depletion and ecosystem disruption.

Chemical processing methods employing sulfuric acid leaching generate significant quantities of waste materials and acidic byproducts. These residues require careful management to prevent soil contamination and water pollution. The neutralization processes necessary for treating these acidic wastes further increase the environmental footprint through additional chemical consumption and energy requirements.

Energy consumption represents another critical environmental factor in lithium hydroxide production. Conventional methods require substantial thermal energy for evaporation and crystallization processes, contributing to greenhouse gas emissions when fossil fuels power these operations. Recent life cycle assessments indicate that the carbon footprint of battery-grade lithium hydroxide production can range from 5 to 15 tons of CO2 equivalent per ton of product, depending on the energy sources and processing efficiency.

Water recycling technologies have emerged as promising solutions to reduce the environmental impact of lithium processing. Advanced membrane filtration systems can recover up to 85% of process water, significantly reducing freshwater withdrawal requirements. Similarly, closed-loop chemical systems minimize effluent discharge by continuously recycling reagents and process solutions, though these systems require additional energy inputs for maintenance.

Direct lithium extraction (DLE) technologies represent a potentially transformative approach with reduced environmental footprint. These methods can decrease water consumption by 50-90% compared to evaporation techniques while occupying substantially less land area. However, the energy intensity of some DLE processes may offset these benefits if not powered by renewable sources.

Waste valorization strategies are gaining traction as means to mitigate environmental impacts. The recovery of valuable byproducts such as potassium, magnesium, and boron from lithium processing waste streams can transform liability into asset while reducing disposal requirements. Additionally, the development of biodegradable reagents and environmentally benign extraction chemicals shows promise for minimizing the toxicity of process residues.

Chemical processing methods employing sulfuric acid leaching generate significant quantities of waste materials and acidic byproducts. These residues require careful management to prevent soil contamination and water pollution. The neutralization processes necessary for treating these acidic wastes further increase the environmental footprint through additional chemical consumption and energy requirements.

Energy consumption represents another critical environmental factor in lithium hydroxide production. Conventional methods require substantial thermal energy for evaporation and crystallization processes, contributing to greenhouse gas emissions when fossil fuels power these operations. Recent life cycle assessments indicate that the carbon footprint of battery-grade lithium hydroxide production can range from 5 to 15 tons of CO2 equivalent per ton of product, depending on the energy sources and processing efficiency.

Water recycling technologies have emerged as promising solutions to reduce the environmental impact of lithium processing. Advanced membrane filtration systems can recover up to 85% of process water, significantly reducing freshwater withdrawal requirements. Similarly, closed-loop chemical systems minimize effluent discharge by continuously recycling reagents and process solutions, though these systems require additional energy inputs for maintenance.

Direct lithium extraction (DLE) technologies represent a potentially transformative approach with reduced environmental footprint. These methods can decrease water consumption by 50-90% compared to evaporation techniques while occupying substantially less land area. However, the energy intensity of some DLE processes may offset these benefits if not powered by renewable sources.

Waste valorization strategies are gaining traction as means to mitigate environmental impacts. The recovery of valuable byproducts such as potassium, magnesium, and boron from lithium processing waste streams can transform liability into asset while reducing disposal requirements. Additionally, the development of biodegradable reagents and environmentally benign extraction chemicals shows promise for minimizing the toxicity of process residues.

Supply Chain Security for Battery-Grade Lithium Materials

The security of the lithium supply chain represents a critical factor in the optimization of lithium hydroxide purity for electric vehicle batteries. As global demand for high-purity battery materials continues to surge, manufacturers face increasing vulnerabilities in their material sourcing strategies. Currently, the lithium supply chain exhibits significant geographic concentration, with over 75% of lithium processing capacity located in China, creating potential bottlenecks and geopolitical risks for battery manufacturers worldwide.

Ensuring consistent access to battery-grade lithium materials requires robust supply chain management practices that address both upstream and downstream vulnerabilities. Primary producers of lithium hydroxide must implement rigorous quality control protocols at extraction sites, while establishing diversified sourcing strategies to mitigate regional disruption risks. The purity requirements for EV battery applications typically demand 99.5% or higher lithium hydroxide content, with strict limitations on metallic impurities such as sodium, potassium, and calcium.

Recent supply chain disruptions during the COVID-19 pandemic highlighted the fragility of just-in-time delivery systems for critical battery materials. Companies that maintained strategic reserves of high-purity lithium compounds gained significant competitive advantages during periods of market volatility. This experience has accelerated the development of more resilient supply chain models, including increased vertical integration among major battery manufacturers and automotive OEMs.

Traceability systems represent another crucial element in securing the lithium supply chain. Advanced tracking technologies, including blockchain-based verification platforms, are being deployed to authenticate material origins and validate purity specifications throughout the value chain. These systems help prevent contamination incidents and ensure compliance with increasingly stringent battery performance requirements.

The recycling of lithium materials is emerging as a complementary strategy to enhance supply security. Closed-loop systems that recover lithium compounds from end-of-life batteries can provide manufacturers with secondary material streams that reduce dependence on primary extraction. Current recycling technologies can achieve recovery rates exceeding 90% for lithium compounds, though the economics remain challenging without supportive regulatory frameworks.

Strategic partnerships between battery manufacturers and lithium producers are becoming increasingly common as a means to secure long-term access to high-purity materials. These agreements often include joint investments in purification technologies and quality control systems to ensure consistent material specifications. Such vertical collaboration helps stabilize supply chains while driving continuous improvements in lithium hydroxide purity levels.

Ensuring consistent access to battery-grade lithium materials requires robust supply chain management practices that address both upstream and downstream vulnerabilities. Primary producers of lithium hydroxide must implement rigorous quality control protocols at extraction sites, while establishing diversified sourcing strategies to mitigate regional disruption risks. The purity requirements for EV battery applications typically demand 99.5% or higher lithium hydroxide content, with strict limitations on metallic impurities such as sodium, potassium, and calcium.

Recent supply chain disruptions during the COVID-19 pandemic highlighted the fragility of just-in-time delivery systems for critical battery materials. Companies that maintained strategic reserves of high-purity lithium compounds gained significant competitive advantages during periods of market volatility. This experience has accelerated the development of more resilient supply chain models, including increased vertical integration among major battery manufacturers and automotive OEMs.

Traceability systems represent another crucial element in securing the lithium supply chain. Advanced tracking technologies, including blockchain-based verification platforms, are being deployed to authenticate material origins and validate purity specifications throughout the value chain. These systems help prevent contamination incidents and ensure compliance with increasingly stringent battery performance requirements.

The recycling of lithium materials is emerging as a complementary strategy to enhance supply security. Closed-loop systems that recover lithium compounds from end-of-life batteries can provide manufacturers with secondary material streams that reduce dependence on primary extraction. Current recycling technologies can achieve recovery rates exceeding 90% for lithium compounds, though the economics remain challenging without supportive regulatory frameworks.

Strategic partnerships between battery manufacturers and lithium producers are becoming increasingly common as a means to secure long-term access to high-purity materials. These agreements often include joint investments in purification technologies and quality control systems to ensure consistent material specifications. Such vertical collaboration helps stabilize supply chains while driving continuous improvements in lithium hydroxide purity levels.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!