Comparing Lithium Hydroxide And Lithium Carbonate In Solvent Systems

AUG 28, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Lithium Compounds Background and Research Objectives

Lithium compounds have emerged as critical materials in the global energy transition, with lithium hydroxide (LiOH) and lithium carbonate (Li₂CO₃) standing as the two primary commercial forms of lithium. The historical development of these compounds traces back to the early 20th century, initially finding applications in ceramics, glass, and lubricants before their revolutionary role in energy storage was recognized.

The evolution of lithium compound utilization has accelerated dramatically over the past two decades, driven primarily by the exponential growth of lithium-ion battery technologies. This growth trajectory has been further amplified by the global push toward electrification and renewable energy integration, positioning lithium compounds at the center of modern energy systems.

Understanding the fundamental differences between lithium hydroxide and lithium carbonate in various solvent systems has become increasingly crucial as battery technologies advance. These compounds exhibit distinct solubility profiles, reaction kinetics, and electrochemical behaviors depending on the solvent environment, directly impacting battery performance metrics including energy density, charging rates, and cycle life.

The technical evolution of lithium processing has seen significant innovations in extraction methodologies, from traditional brine evaporation to more advanced direct lithium extraction (DLE) technologies. These developments have been accompanied by parallel advancements in purification techniques, with solvent systems playing a pivotal role in achieving battery-grade lithium compounds.

Current research trends indicate a growing focus on sustainable processing routes, with particular emphasis on water conservation, reduced chemical consumption, and energy-efficient separation technologies. The interplay between lithium compounds and solvent systems represents a critical frontier in this sustainability-driven innovation landscape.

This technical research aims to comprehensively evaluate the comparative behavior of lithium hydroxide and lithium carbonate across diverse solvent systems, with specific objectives including: quantifying solubility parameters across temperature gradients; characterizing reaction mechanisms and kinetics; assessing impurity profiles and their impact on downstream applications; and identifying optimal solvent systems for specific battery chemistry requirements.

Additionally, this research seeks to establish correlations between solvent-lithium interactions and the resulting electrochemical performance in battery applications, potentially unlocking new pathways for enhanced energy storage solutions. The findings are expected to inform process optimization strategies for lithium refinement and battery material synthesis, contributing to the broader goal of advancing sustainable energy technologies.

The evolution of lithium compound utilization has accelerated dramatically over the past two decades, driven primarily by the exponential growth of lithium-ion battery technologies. This growth trajectory has been further amplified by the global push toward electrification and renewable energy integration, positioning lithium compounds at the center of modern energy systems.

Understanding the fundamental differences between lithium hydroxide and lithium carbonate in various solvent systems has become increasingly crucial as battery technologies advance. These compounds exhibit distinct solubility profiles, reaction kinetics, and electrochemical behaviors depending on the solvent environment, directly impacting battery performance metrics including energy density, charging rates, and cycle life.

The technical evolution of lithium processing has seen significant innovations in extraction methodologies, from traditional brine evaporation to more advanced direct lithium extraction (DLE) technologies. These developments have been accompanied by parallel advancements in purification techniques, with solvent systems playing a pivotal role in achieving battery-grade lithium compounds.

Current research trends indicate a growing focus on sustainable processing routes, with particular emphasis on water conservation, reduced chemical consumption, and energy-efficient separation technologies. The interplay between lithium compounds and solvent systems represents a critical frontier in this sustainability-driven innovation landscape.

This technical research aims to comprehensively evaluate the comparative behavior of lithium hydroxide and lithium carbonate across diverse solvent systems, with specific objectives including: quantifying solubility parameters across temperature gradients; characterizing reaction mechanisms and kinetics; assessing impurity profiles and their impact on downstream applications; and identifying optimal solvent systems for specific battery chemistry requirements.

Additionally, this research seeks to establish correlations between solvent-lithium interactions and the resulting electrochemical performance in battery applications, potentially unlocking new pathways for enhanced energy storage solutions. The findings are expected to inform process optimization strategies for lithium refinement and battery material synthesis, contributing to the broader goal of advancing sustainable energy technologies.

Market Analysis of Lithium Hydroxide and Carbonate Applications

The global lithium market has experienced significant growth in recent years, primarily driven by the expanding electric vehicle (EV) industry and renewable energy storage systems. Within this market, lithium hydroxide and lithium carbonate serve as critical components, each with distinct applications and market dynamics that influence their demand and pricing structures.

Lithium carbonate has traditionally dominated the market, accounting for approximately 65% of lithium compound production globally. Its primary applications include use in glass and ceramics manufacturing, aluminum production, and lithium-ion batteries with lithium iron phosphate (LFP) cathodes. The market for lithium carbonate reached $7.5 billion in 2022, with an annual growth rate of 14.8% projected through 2030.

Lithium hydroxide, meanwhile, has seen accelerated demand growth due to its superior performance in high-nickel content cathode materials used in long-range electric vehicles. The market value for lithium hydroxide stood at $5.3 billion in 2022, but is growing at a faster rate of 18.2% annually, potentially overtaking lithium carbonate in market share by 2028.

Regional market distribution shows China dominating both production and consumption, controlling nearly 60% of global lithium processing capacity. Australia leads in lithium mining operations, while South American countries like Chile and Argentina possess significant brine-based lithium resources. North America and Europe are rapidly developing domestic supply chains to reduce dependency on Asian markets.

Price trends between these compounds have shown interesting divergence. Historically, lithium hydroxide commanded a 15-20% premium over lithium carbonate due to more complex production processes. However, this price differential has fluctuated dramatically in recent years, with periods where lithium carbonate prices temporarily exceeded hydroxide prices due to supply constraints and shifting demand patterns.

The solvent system applications for both compounds create distinct market segments. Lithium hydroxide demonstrates superior solubility in polar organic solvents, making it preferred in specialized chemical synthesis and certain battery electrolyte formulations. This has created a premium niche market estimated at $1.2 billion annually with higher profit margins than standard applications.

Market forecasts indicate that technological developments in battery chemistry will continue to shape demand patterns. The growing adoption of high-nickel NMC and NCA cathodes favors lithium hydroxide, while advancements in LFP technology sustain demand for lithium carbonate. The relative market shares will likely be determined by which battery chemistries achieve dominance in the rapidly evolving EV sector.

Lithium carbonate has traditionally dominated the market, accounting for approximately 65% of lithium compound production globally. Its primary applications include use in glass and ceramics manufacturing, aluminum production, and lithium-ion batteries with lithium iron phosphate (LFP) cathodes. The market for lithium carbonate reached $7.5 billion in 2022, with an annual growth rate of 14.8% projected through 2030.

Lithium hydroxide, meanwhile, has seen accelerated demand growth due to its superior performance in high-nickel content cathode materials used in long-range electric vehicles. The market value for lithium hydroxide stood at $5.3 billion in 2022, but is growing at a faster rate of 18.2% annually, potentially overtaking lithium carbonate in market share by 2028.

Regional market distribution shows China dominating both production and consumption, controlling nearly 60% of global lithium processing capacity. Australia leads in lithium mining operations, while South American countries like Chile and Argentina possess significant brine-based lithium resources. North America and Europe are rapidly developing domestic supply chains to reduce dependency on Asian markets.

Price trends between these compounds have shown interesting divergence. Historically, lithium hydroxide commanded a 15-20% premium over lithium carbonate due to more complex production processes. However, this price differential has fluctuated dramatically in recent years, with periods where lithium carbonate prices temporarily exceeded hydroxide prices due to supply constraints and shifting demand patterns.

The solvent system applications for both compounds create distinct market segments. Lithium hydroxide demonstrates superior solubility in polar organic solvents, making it preferred in specialized chemical synthesis and certain battery electrolyte formulations. This has created a premium niche market estimated at $1.2 billion annually with higher profit margins than standard applications.

Market forecasts indicate that technological developments in battery chemistry will continue to shape demand patterns. The growing adoption of high-nickel NMC and NCA cathodes favors lithium hydroxide, while advancements in LFP technology sustain demand for lithium carbonate. The relative market shares will likely be determined by which battery chemistries achieve dominance in the rapidly evolving EV sector.

Current Challenges in Lithium Compound Solvent Systems

The lithium battery industry faces significant challenges in solvent systems when working with lithium hydroxide and lithium carbonate. Current production methods for both compounds involve complex solvent interactions that present technical hurdles affecting efficiency, cost, and environmental impact. These challenges have become increasingly critical as global demand for lithium batteries continues to surge.

Solubility disparities between lithium hydroxide and lithium carbonate create substantial processing complications. Lithium hydroxide exhibits higher solubility in water (12.8g/100g at 20°C) compared to lithium carbonate (1.3g/100g at 20°C), necessitating different solvent systems for optimal extraction and purification. This fundamental difference impacts downstream processing parameters and equipment requirements.

Temperature sensitivity presents another significant challenge. Lithium carbonate's solubility decreases with increasing temperature in most solvent systems—an unusual inverse solubility relationship. Conversely, lithium hydroxide follows conventional solubility patterns. These contrasting behaviors complicate process design and control, particularly in operations requiring temperature modulation.

Impurity profiles differ markedly between the two compounds when processed in various solvents. Lithium hydroxide tends to co-precipitate with magnesium impurities in aqueous systems, while lithium carbonate struggles with calcium contamination. These impurity challenges necessitate additional purification steps, increasing production costs and reducing yield efficiency.

Water consumption represents a critical environmental and economic concern. Current lithium hydroxide production methods typically require 50-70 cubic meters of water per ton of product, while lithium carbonate processing demands 30-50 cubic meters. This substantial water footprint is particularly problematic in water-scarce lithium-producing regions like Chile's Atacama Desert and Argentina's salt flats.

Energy intensity varies significantly between processing routes. Converting spodumene to lithium hydroxide via conventional solvent systems requires approximately 8-10 GJ/ton, whereas lithium carbonate production consumes 6-8 GJ/ton. This energy differential impacts both production costs and carbon footprints across the supply chain.

Solvent toxicity and recovery efficiency remain persistent challenges. Many current processes employ organic solvents like methanol and ethanol, which present environmental hazards and require sophisticated recovery systems. Recovery rates typically range from 85-95%, meaning 5-15% of solvents are lost during processing, creating both economic and environmental liabilities.

Scaling limitations affect industrial implementation of novel solvent systems. Laboratory-scale successes with ionic liquids and deep eutectic solvents have proven difficult to scale economically, creating a gap between research advancements and industrial application. This scaling challenge particularly impacts emerging direct lithium extraction technologies targeting lithium hydroxide production.

Solubility disparities between lithium hydroxide and lithium carbonate create substantial processing complications. Lithium hydroxide exhibits higher solubility in water (12.8g/100g at 20°C) compared to lithium carbonate (1.3g/100g at 20°C), necessitating different solvent systems for optimal extraction and purification. This fundamental difference impacts downstream processing parameters and equipment requirements.

Temperature sensitivity presents another significant challenge. Lithium carbonate's solubility decreases with increasing temperature in most solvent systems—an unusual inverse solubility relationship. Conversely, lithium hydroxide follows conventional solubility patterns. These contrasting behaviors complicate process design and control, particularly in operations requiring temperature modulation.

Impurity profiles differ markedly between the two compounds when processed in various solvents. Lithium hydroxide tends to co-precipitate with magnesium impurities in aqueous systems, while lithium carbonate struggles with calcium contamination. These impurity challenges necessitate additional purification steps, increasing production costs and reducing yield efficiency.

Water consumption represents a critical environmental and economic concern. Current lithium hydroxide production methods typically require 50-70 cubic meters of water per ton of product, while lithium carbonate processing demands 30-50 cubic meters. This substantial water footprint is particularly problematic in water-scarce lithium-producing regions like Chile's Atacama Desert and Argentina's salt flats.

Energy intensity varies significantly between processing routes. Converting spodumene to lithium hydroxide via conventional solvent systems requires approximately 8-10 GJ/ton, whereas lithium carbonate production consumes 6-8 GJ/ton. This energy differential impacts both production costs and carbon footprints across the supply chain.

Solvent toxicity and recovery efficiency remain persistent challenges. Many current processes employ organic solvents like methanol and ethanol, which present environmental hazards and require sophisticated recovery systems. Recovery rates typically range from 85-95%, meaning 5-15% of solvents are lost during processing, creating both economic and environmental liabilities.

Scaling limitations affect industrial implementation of novel solvent systems. Laboratory-scale successes with ionic liquids and deep eutectic solvents have proven difficult to scale economically, creating a gap between research advancements and industrial application. This scaling challenge particularly impacts emerging direct lithium extraction technologies targeting lithium hydroxide production.

Comparative Solubility Solutions for Lithium Compounds

01 Solubility characteristics of lithium hydroxide and lithium carbonate

Lithium hydroxide and lithium carbonate have distinct solubility profiles in water. Lithium hydroxide is generally more soluble in water than lithium carbonate, especially at lower temperatures. The solubility of lithium carbonate decreases with increasing temperature, while lithium hydroxide's solubility increases. These solubility differences are important in various industrial processes, particularly in lithium extraction and purification methods where selective precipitation or dissolution is utilized.- Solubility characteristics of lithium hydroxide and lithium carbonate: Lithium hydroxide and lithium carbonate exhibit different solubility profiles in water, with lithium hydroxide being more soluble than lithium carbonate. The solubility of both compounds is temperature-dependent, increasing with higher temperatures. These solubility differences are important in various industrial processes, particularly in lithium extraction and purification methods. Understanding these solubility characteristics is crucial for optimizing separation techniques and improving process efficiency in lithium production.

- Reactivity of lithium compounds in extraction processes: Lithium hydroxide and lithium carbonate demonstrate distinct reactivity patterns in extraction processes. Lithium carbonate typically requires more aggressive conditions for dissolution and reaction compared to lithium hydroxide. These reactivity differences influence process design in lithium recovery from various sources such as brines and ores. The selective reactivity of these compounds can be leveraged to develop more efficient separation methods and improve the purity of final lithium products.

- Conversion processes between lithium hydroxide and lithium carbonate: Various methods exist for converting between lithium hydroxide and lithium carbonate, which are essential in lithium processing. Lithium carbonate can be converted to lithium hydroxide through reaction with calcium hydroxide, while lithium hydroxide can be transformed to lithium carbonate through carbonation processes. These conversion techniques are critical in lithium refinement and production of battery-grade materials. The efficiency of these conversion processes significantly impacts the economics and environmental footprint of lithium production.

- Impact of impurities on lithium compound properties: Impurities significantly affect the solubility and reactivity of lithium hydroxide and lithium carbonate. Common impurities include sodium, calcium, and magnesium compounds, which can alter dissolution rates and reaction kinetics. Purification methods such as recrystallization and ion exchange are employed to remove these impurities and improve the performance of lithium compounds in various applications. The presence of impurities can also impact the stability and shelf-life of lithium products.

- Applications leveraging solubility and reactivity differences: The distinct solubility and reactivity profiles of lithium hydroxide and lithium carbonate are exploited in various industrial applications. Lithium hydroxide is preferred in high-performance battery cathode materials due to its reactivity advantages, while lithium carbonate finds use in ceramics and glass manufacturing. These compounds are also utilized differently in pharmaceutical formulations and air purification systems based on their solubility characteristics. Understanding these differences enables optimization of lithium compound selection for specific applications.

02 Conversion processes between lithium hydroxide and lithium carbonate

Various methods exist for converting between lithium hydroxide and lithium carbonate. Lithium carbonate can be converted to lithium hydroxide through reaction with calcium hydroxide or sodium hydroxide. Conversely, lithium hydroxide can be converted to lithium carbonate by reaction with carbon dioxide or carbonate salts. These conversion processes are critical in lithium processing industries and often involve considerations of reaction kinetics, temperature control, and impurity management to achieve high purity products.Expand Specific Solutions03 Reactivity with acids and bases

Lithium hydroxide is a strong base that readily reacts with acids to form lithium salts and water. Lithium carbonate reacts with strong acids to release carbon dioxide gas and form corresponding lithium salts. In alkaline conditions, lithium carbonate remains relatively stable, while lithium hydroxide maintains its basic properties. These reactivity characteristics are important in applications such as battery production, pharmaceuticals, and various chemical synthesis processes where pH control and specific lithium compounds are required.Expand Specific Solutions04 Temperature effects on stability and reactivity

Temperature significantly affects the stability and reactivity of both lithium hydroxide and lithium carbonate. At elevated temperatures, lithium carbonate can decompose to form lithium oxide and carbon dioxide. Lithium hydroxide monohydrate dehydrates at higher temperatures to form anhydrous lithium hydroxide. These temperature-dependent behaviors influence processing conditions in industrial applications, particularly in high-temperature operations such as glass manufacturing, ceramic production, and certain metallurgical processes.Expand Specific Solutions05 Applications based on solubility and reactivity properties

The distinct solubility and reactivity properties of lithium hydroxide and lithium carbonate determine their specific applications. Lithium hydroxide is preferred in applications requiring high alkalinity or where carbon dioxide formation must be avoided, such as in certain battery cathode materials. Lithium carbonate is used in applications where lower solubility is advantageous, such as in certain pharmaceutical formulations and glass manufacturing. The selection between these compounds often depends on their chemical behavior in specific application environments, including considerations of pH stability, reaction with other components, and processing conditions.Expand Specific Solutions

Key Industry Players in Lithium Chemical Production

The lithium hydroxide and lithium carbonate solvent systems market is in a growth phase, driven by expanding electric vehicle battery demand. The market is projected to reach significant scale as companies invest heavily in production technologies. Leading players like POSCO Holdings, LG Energy Solution, and Contemporary Amperex Technology are advancing commercial-scale production, while Samsung SDI, Toyota, and Nemaska Lithium focus on process optimization. Research institutions including RIST and the Institute of Process Engineering (CAS) are developing next-generation extraction methods. The technology is approaching maturity with companies like International Battery Metals and Watercycle Technologies introducing innovative direct lithium extraction processes, though challenges in scalability and environmental impact remain.

Samsung SDI Co., Ltd.

Technical Solution: Samsung SDI has developed advanced solvent extraction systems for lithium processing that compare lithium hydroxide and lithium carbonate production pathways. Their technology utilizes a proprietary mixed solvent system combining alcohol-based and ether-based solvents to selectively extract lithium from brine resources. This approach allows for direct production of battery-grade lithium hydroxide without the intermediate carbonate conversion step traditionally required. The process employs temperature-controlled crystallization techniques to achieve high purity (99.5%+) lithium hydroxide with minimal impurities. Samsung's system incorporates continuous flow reactors with precise pH control mechanisms that optimize the conversion efficiency between lithium forms. Their research demonstrates that hydroxide-based extraction in their solvent system reduces water consumption by approximately 30% compared to conventional carbonate processing methods, while also decreasing processing time by up to 40%.

Strengths: Direct production of battery-grade lithium hydroxide without intermediate conversion steps, reducing processing time and energy requirements. Higher extraction efficiency with proprietary solvent mixtures. Weaknesses: Requires specialized equipment and precise process control, potentially increasing capital costs. Some solvents used may present environmental concerns requiring additional handling protocols.

Nemaska Lithium, Inc.

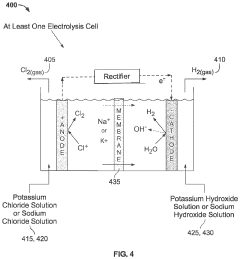

Technical Solution: Nemaska Lithium has pioneered a proprietary electrochemical process for converting lithium sulfate into lithium hydroxide using membrane electrolysis technology. Their approach directly compares with traditional lithium carbonate pathways by eliminating the carbonate intermediate step entirely. The process utilizes a specialized solvent system that maintains lithium ion stability during electrolysis while preventing unwanted side reactions. Nemaska's technology employs a series of membrane-separated cells where lithium ions migrate through selective ion-exchange membranes in a carefully controlled solvent environment. This method produces battery-grade lithium hydroxide with purity exceeding 99.5%, suitable for high-performance lithium-ion batteries. Their research indicates that the direct electrochemical route consumes approximately 25% less energy than conventional carbonate-to-hydroxide conversion processes. The company has also developed specific solvent formulations that enhance lithium selectivity while minimizing sodium and magnesium contamination, which are common challenges in lithium processing.

Strengths: Direct electrochemical conversion eliminates multiple processing steps, reducing energy consumption and chemical reagent usage. Produces very high purity lithium hydroxide suitable for premium battery applications. Weaknesses: Requires significant electrical power input and specialized membrane technology that may increase operational complexity. Process is sensitive to feed solution impurities that can damage membranes or reduce efficiency.

Critical Patents in Lithium Compound Solvent Interactions

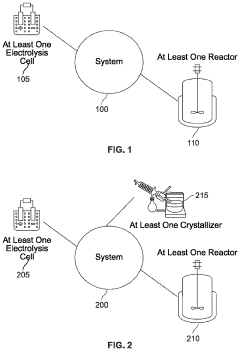

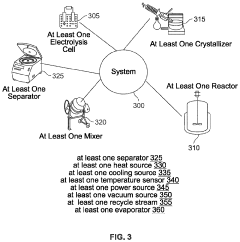

Production of lithium hydroxide and lithium carbonate

PatentActiveUS11931701B2

Innovation

- The method involves electrolyzing a potassium chloride solution to produce a potassium hydroxide solution, which is then reacted with a lithium chloride solution to form a reciprocal salt system, allowing for the precipitation of lithium hydroxide crystals and potassium chloride crystals, with subsequent purification and recycling of potassium chloride to replenish the system, thereby reducing waste and reagent costs.

Method for producing lithium hydroxide

PatentWO2021015378A1

Innovation

- A method involving the reaction of lithium carbonate and calcium hydroxide at room temperature to produce a lithium hydroxide solution, followed by concentration and filtration to separate solid lithium hydroxide, with subsequent recovery of lithium from filtrates using carbonate or phosphate materials to minimize energy consumption and lithium loss.

Environmental Impact Assessment of Lithium Processing

The environmental impact of lithium processing varies significantly between lithium hydroxide and lithium carbonate production methods, particularly when considering different solvent systems. Traditional lithium carbonate production typically involves extensive evaporation ponds that require large land areas and substantial water consumption—approximately 500,000 gallons per ton of lithium. These operations, predominantly located in the "Lithium Triangle" of South America, have faced criticism for depleting local water resources in already arid regions, affecting indigenous communities and fragile ecosystems.

In contrast, lithium hydroxide production, especially when utilizing direct lithium extraction (DLE) technologies with advanced solvent systems, demonstrates potential for reduced environmental footprint. These methods can decrease water usage by up to 70% compared to traditional evaporation techniques and significantly reduce land disturbance. However, they often require higher energy inputs and utilize chemical solvents that present their own environmental challenges.

Carbon emissions represent another critical environmental consideration. The carbon footprint of lithium carbonate production through conventional methods is estimated at 15-20 tons of CO2 equivalent per ton of lithium carbonate. Lithium hydroxide production directly from spodumene using hydrometallurgical processes with optimized solvent systems can potentially reduce this to 5-15 tons CO2e, though actual emissions vary widely based on energy sources and process efficiencies.

Waste management presents distinct challenges for both pathways. Lithium carbonate production generates substantial volumes of salt waste and depleted brine that must be managed carefully to prevent soil and groundwater contamination. Lithium hydroxide production, particularly from hard rock sources, produces significant quantities of mineral tailings but may offer better opportunities for valorization of co-products when appropriate solvent systems are employed.

Recent life cycle assessments indicate that solvent selection significantly influences environmental outcomes. Organic solvent systems used in lithium hydroxide production can achieve higher extraction efficiencies but may introduce toxicity concerns if not properly managed. Water-based systems for lithium carbonate generally have lower direct toxicity but greater consumption volumes. Emerging green solvent technologies, including bio-based solvents and ionic liquids, show promise for reducing environmental impacts across both production pathways.

Regulatory frameworks are increasingly addressing these environmental concerns, with jurisdictions like the EU implementing carbon footprint disclosure requirements for battery materials. This regulatory pressure is driving innovation in more sustainable processing technologies, particularly in solvent systems that minimize environmental impacts while maintaining economic viability.

In contrast, lithium hydroxide production, especially when utilizing direct lithium extraction (DLE) technologies with advanced solvent systems, demonstrates potential for reduced environmental footprint. These methods can decrease water usage by up to 70% compared to traditional evaporation techniques and significantly reduce land disturbance. However, they often require higher energy inputs and utilize chemical solvents that present their own environmental challenges.

Carbon emissions represent another critical environmental consideration. The carbon footprint of lithium carbonate production through conventional methods is estimated at 15-20 tons of CO2 equivalent per ton of lithium carbonate. Lithium hydroxide production directly from spodumene using hydrometallurgical processes with optimized solvent systems can potentially reduce this to 5-15 tons CO2e, though actual emissions vary widely based on energy sources and process efficiencies.

Waste management presents distinct challenges for both pathways. Lithium carbonate production generates substantial volumes of salt waste and depleted brine that must be managed carefully to prevent soil and groundwater contamination. Lithium hydroxide production, particularly from hard rock sources, produces significant quantities of mineral tailings but may offer better opportunities for valorization of co-products when appropriate solvent systems are employed.

Recent life cycle assessments indicate that solvent selection significantly influences environmental outcomes. Organic solvent systems used in lithium hydroxide production can achieve higher extraction efficiencies but may introduce toxicity concerns if not properly managed. Water-based systems for lithium carbonate generally have lower direct toxicity but greater consumption volumes. Emerging green solvent technologies, including bio-based solvents and ionic liquids, show promise for reducing environmental impacts across both production pathways.

Regulatory frameworks are increasingly addressing these environmental concerns, with jurisdictions like the EU implementing carbon footprint disclosure requirements for battery materials. This regulatory pressure is driving innovation in more sustainable processing technologies, particularly in solvent systems that minimize environmental impacts while maintaining economic viability.

Safety Protocols for Lithium Compound Handling

The handling of lithium compounds in laboratory and industrial settings requires stringent safety protocols due to their reactive nature and potential health hazards. When comparing lithium hydroxide and lithium carbonate in solvent systems, specific safety considerations must be addressed for each compound based on their unique properties.

Lithium hydroxide presents significant safety challenges due to its strong alkalinity (pH >14), which can cause severe chemical burns upon contact with skin, eyes, or mucous membranes. Personnel working with lithium hydroxide must utilize full-face shields, chemical-resistant gloves (preferably butyl rubber or neoprene), and lab coats or chemical-resistant coveralls. Respiratory protection with appropriate filters is essential when handling powdered forms to prevent inhalation of caustic dust.

Lithium carbonate, while less caustic than lithium hydroxide, still requires careful handling. Its lower alkalinity (pH ~11) presents reduced immediate skin hazard, but proper personal protective equipment remains necessary, including safety glasses with side shields, nitrile gloves, and standard laboratory attire. Respiratory protection should be employed when handling significant quantities of the powdered form.

Storage protocols differ between these compounds. Lithium hydroxide must be kept in tightly sealed containers made of compatible materials such as high-density polyethylene, stored in cool, dry locations away from acids, metals, and moisture. Lithium carbonate requires similar dry storage but has fewer material compatibility concerns.

When incorporating either compound into solvent systems, additional precautions become necessary. For lithium hydroxide, the exothermic dissolution reaction requires controlled addition to prevent dangerous heat generation and potential splashing. Addition should always occur with stirring and temperature monitoring, particularly in protic solvents like water or alcohols.

Emergency response protocols must address specific hazards. Lithium hydroxide spills require neutralization with dilute acidic solutions (typically 5% acetic acid) before cleanup, while ensuring adequate ventilation. Lithium carbonate spills can be collected directly if dry, or absorbed with inert materials if in solution.

Waste disposal regulations classify lithium hydroxide as hazardous waste requiring specialized handling, while lithium carbonate may be subject to less stringent disposal requirements depending on local regulations. Both compounds should be segregated from incompatible materials throughout the waste stream.

Training programs for laboratory personnel must emphasize the different hazard profiles of these compounds, particularly highlighting the more severe caustic nature of lithium hydroxide and the appropriate emergency response procedures for each compound when used in various solvent systems.

Lithium hydroxide presents significant safety challenges due to its strong alkalinity (pH >14), which can cause severe chemical burns upon contact with skin, eyes, or mucous membranes. Personnel working with lithium hydroxide must utilize full-face shields, chemical-resistant gloves (preferably butyl rubber or neoprene), and lab coats or chemical-resistant coveralls. Respiratory protection with appropriate filters is essential when handling powdered forms to prevent inhalation of caustic dust.

Lithium carbonate, while less caustic than lithium hydroxide, still requires careful handling. Its lower alkalinity (pH ~11) presents reduced immediate skin hazard, but proper personal protective equipment remains necessary, including safety glasses with side shields, nitrile gloves, and standard laboratory attire. Respiratory protection should be employed when handling significant quantities of the powdered form.

Storage protocols differ between these compounds. Lithium hydroxide must be kept in tightly sealed containers made of compatible materials such as high-density polyethylene, stored in cool, dry locations away from acids, metals, and moisture. Lithium carbonate requires similar dry storage but has fewer material compatibility concerns.

When incorporating either compound into solvent systems, additional precautions become necessary. For lithium hydroxide, the exothermic dissolution reaction requires controlled addition to prevent dangerous heat generation and potential splashing. Addition should always occur with stirring and temperature monitoring, particularly in protic solvents like water or alcohols.

Emergency response protocols must address specific hazards. Lithium hydroxide spills require neutralization with dilute acidic solutions (typically 5% acetic acid) before cleanup, while ensuring adequate ventilation. Lithium carbonate spills can be collected directly if dry, or absorbed with inert materials if in solution.

Waste disposal regulations classify lithium hydroxide as hazardous waste requiring specialized handling, while lithium carbonate may be subject to less stringent disposal requirements depending on local regulations. Both compounds should be segregated from incompatible materials throughout the waste stream.

Training programs for laboratory personnel must emphasize the different hazard profiles of these compounds, particularly highlighting the more severe caustic nature of lithium hydroxide and the appropriate emergency response procedures for each compound when used in various solvent systems.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!