Benchmarking Lithium Hydroxide's Role In Heat Storage Media

AUG 28, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Lithium Hydroxide Heat Storage Background and Objectives

Thermal energy storage (TES) systems have emerged as a critical component in the global transition towards sustainable energy solutions. Among various materials explored for heat storage applications, lithium hydroxide (LiOH) has garnered significant attention due to its unique thermophysical properties. The evolution of heat storage technology has progressed from conventional sensible heat storage systems to more advanced latent and thermochemical storage methods, with LiOH positioning itself as a promising candidate in the latter categories.

Historically, thermal energy storage research began in earnest during the 1970s energy crisis, with initial focus on water and rock-based systems. The subsequent decades witnessed a shift towards phase change materials (PCMs) and thermochemical storage media, driven by the need for higher energy densities and storage efficiencies. Lithium hydroxide entered this landscape in the 1990s, initially as a component in nuclear applications before researchers recognized its potential for broader thermal storage applications.

The fundamental appeal of LiOH lies in its exceptional theoretical energy storage density of approximately 1400 kWh/m³, significantly surpassing conventional materials. This property stems from LiOH's endothermic dehydration reaction (LiOH + heat ⇌ LiOH·H₂O), which occurs at temperatures suitable for various industrial and residential applications (around 400-500°C). Additionally, LiOH exhibits favorable cycling stability, a critical factor for long-term deployment in energy systems.

Current technological objectives for LiOH-based thermal storage systems focus on several key areas. Primary among these is enhancing the reaction kinetics to improve charging and discharging rates, which currently limit practical implementation. Researchers aim to develop advanced reactor designs that optimize heat and mass transfer during the hydration/dehydration processes. Material stability over thousands of cycles represents another crucial objective, as degradation mechanisms must be thoroughly understood and mitigated.

Cost reduction constitutes a significant goal, as current lithium prices pose challenges to widespread adoption. Research efforts are directed toward reducing the required lithium content through composite formulations and exploring alternative synthesis routes. System integration represents the final major objective, with emphasis on developing compact, efficient heat exchangers and reactors that can seamlessly interface with various heat sources and applications.

The overarching aim of current research is to position LiOH-based thermal storage as a viable solution for grid-scale energy storage, industrial waste heat recovery, concentrated solar power plants, and advanced building heating systems. These applications align with global decarbonization goals and the increasing need for efficient energy storage technologies to balance intermittent renewable energy sources.

Historically, thermal energy storage research began in earnest during the 1970s energy crisis, with initial focus on water and rock-based systems. The subsequent decades witnessed a shift towards phase change materials (PCMs) and thermochemical storage media, driven by the need for higher energy densities and storage efficiencies. Lithium hydroxide entered this landscape in the 1990s, initially as a component in nuclear applications before researchers recognized its potential for broader thermal storage applications.

The fundamental appeal of LiOH lies in its exceptional theoretical energy storage density of approximately 1400 kWh/m³, significantly surpassing conventional materials. This property stems from LiOH's endothermic dehydration reaction (LiOH + heat ⇌ LiOH·H₂O), which occurs at temperatures suitable for various industrial and residential applications (around 400-500°C). Additionally, LiOH exhibits favorable cycling stability, a critical factor for long-term deployment in energy systems.

Current technological objectives for LiOH-based thermal storage systems focus on several key areas. Primary among these is enhancing the reaction kinetics to improve charging and discharging rates, which currently limit practical implementation. Researchers aim to develop advanced reactor designs that optimize heat and mass transfer during the hydration/dehydration processes. Material stability over thousands of cycles represents another crucial objective, as degradation mechanisms must be thoroughly understood and mitigated.

Cost reduction constitutes a significant goal, as current lithium prices pose challenges to widespread adoption. Research efforts are directed toward reducing the required lithium content through composite formulations and exploring alternative synthesis routes. System integration represents the final major objective, with emphasis on developing compact, efficient heat exchangers and reactors that can seamlessly interface with various heat sources and applications.

The overarching aim of current research is to position LiOH-based thermal storage as a viable solution for grid-scale energy storage, industrial waste heat recovery, concentrated solar power plants, and advanced building heating systems. These applications align with global decarbonization goals and the increasing need for efficient energy storage technologies to balance intermittent renewable energy sources.

Market Analysis for Thermal Energy Storage Solutions

The global thermal energy storage (TES) market is experiencing robust growth, driven by increasing renewable energy integration and the need for grid stability solutions. Currently valued at approximately $6.3 billion, the market is projected to reach $12.8 billion by 2027, representing a compound annual growth rate of 15.2%. This growth trajectory is particularly significant for lithium hydroxide-based thermal storage systems, which are gaining traction due to their superior energy density and operational efficiency.

Segmentation analysis reveals that molten salt technology dominates the current market with a 45% share, while lithium-based solutions are rapidly expanding at nearly twice the market average growth rate. This acceleration is attributed to lithium hydroxide's exceptional thermal properties, including high specific heat capacity and thermal conductivity, which enable more compact and efficient storage systems.

Geographically, Europe leads the thermal storage market with 38% share, followed by North America (29%) and Asia-Pacific (24%). However, the Asia-Pacific region is demonstrating the fastest growth rate at 18.7% annually, driven by China's aggressive renewable energy targets and industrial expansion. Lithium hydroxide-based solutions are particularly gaining momentum in regions with space constraints and high energy density requirements.

From an application perspective, the utility sector represents the largest market segment (52%), followed by industrial applications (31%) and commercial buildings (17%). Lithium hydroxide thermal storage systems are showing particular promise in industrial process heat applications, where their rapid response characteristics and high temperature stability provide significant advantages over conventional alternatives.

Customer demand analysis indicates shifting priorities, with energy efficiency now ranking as the primary purchase consideration (37%), followed by system lifespan (28%), installation costs (22%), and maintenance requirements (13%). Lithium hydroxide-based systems score particularly well on efficiency metrics but face challenges regarding initial investment costs.

Competitive pricing analysis shows lithium hydroxide thermal storage systems currently commanding a premium of 30-40% over conventional alternatives, though this gap is narrowing as production scales increase. The total cost of ownership calculations demonstrate that despite higher upfront costs, lithium-based systems achieve payback periods averaging 4.3 years, compared to 5.7 years for conventional systems, primarily due to operational efficiency gains and reduced maintenance requirements.

Market forecasts suggest lithium hydroxide thermal storage solutions will capture an increasing market share, potentially reaching 22% of the total thermal storage market by 2028, representing a significant opportunity for early market entrants with optimized lithium hydroxide formulations and system designs.

Segmentation analysis reveals that molten salt technology dominates the current market with a 45% share, while lithium-based solutions are rapidly expanding at nearly twice the market average growth rate. This acceleration is attributed to lithium hydroxide's exceptional thermal properties, including high specific heat capacity and thermal conductivity, which enable more compact and efficient storage systems.

Geographically, Europe leads the thermal storage market with 38% share, followed by North America (29%) and Asia-Pacific (24%). However, the Asia-Pacific region is demonstrating the fastest growth rate at 18.7% annually, driven by China's aggressive renewable energy targets and industrial expansion. Lithium hydroxide-based solutions are particularly gaining momentum in regions with space constraints and high energy density requirements.

From an application perspective, the utility sector represents the largest market segment (52%), followed by industrial applications (31%) and commercial buildings (17%). Lithium hydroxide thermal storage systems are showing particular promise in industrial process heat applications, where their rapid response characteristics and high temperature stability provide significant advantages over conventional alternatives.

Customer demand analysis indicates shifting priorities, with energy efficiency now ranking as the primary purchase consideration (37%), followed by system lifespan (28%), installation costs (22%), and maintenance requirements (13%). Lithium hydroxide-based systems score particularly well on efficiency metrics but face challenges regarding initial investment costs.

Competitive pricing analysis shows lithium hydroxide thermal storage systems currently commanding a premium of 30-40% over conventional alternatives, though this gap is narrowing as production scales increase. The total cost of ownership calculations demonstrate that despite higher upfront costs, lithium-based systems achieve payback periods averaging 4.3 years, compared to 5.7 years for conventional systems, primarily due to operational efficiency gains and reduced maintenance requirements.

Market forecasts suggest lithium hydroxide thermal storage solutions will capture an increasing market share, potentially reaching 22% of the total thermal storage market by 2028, representing a significant opportunity for early market entrants with optimized lithium hydroxide formulations and system designs.

Current Status and Challenges in Lithium-Based Heat Storage

Lithium-based thermal energy storage systems have emerged as a promising solution for renewable energy integration and grid stability. Currently, lithium hydroxide (LiOH) and other lithium compounds are being extensively researched for their potential in high-temperature heat storage applications. The global landscape shows significant advancements in Europe, North America, and East Asia, with research institutions and energy companies leading development efforts.

The current technological maturity of lithium-based heat storage systems varies across applications. While lithium-ion batteries for electrical storage have reached commercial maturity, thermal storage applications utilizing lithium compounds remain predominantly in the research and demonstration phases. Laboratory-scale tests have confirmed the theoretical advantages of lithium hydroxide, particularly its high energy density (approximately 3-4 times higher than conventional molten salts) and excellent thermal conductivity.

Despite promising results, several critical challenges impede widespread adoption. Material stability at high operating temperatures (>400°C) remains problematic, with degradation mechanisms accelerating under thermal cycling conditions. Containment materials that can withstand the corrosive nature of molten lithium compounds without significant deterioration represent another major hurdle. Current containment solutions often involve expensive nickel-based alloys or specialized ceramics, substantially increasing system costs.

Cost factors present significant barriers to commercialization. Raw lithium prices have experienced volatility in recent years due to increasing demand from the electric vehicle sector. This market competition creates uncertainty for thermal storage applications, potentially limiting economic viability. Current estimates place lithium-based thermal storage systems at 2-3 times the cost of conventional alternatives on a per-kilowatt-hour basis.

Safety concerns also pose substantial challenges. Lithium compounds react vigorously with water and air, necessitating sophisticated containment and handling protocols. Several incidents in research facilities have highlighted these risks, prompting regulatory scrutiny and additional safety requirements that further complicate system design and increase costs.

Scaling represents another significant obstacle. While laboratory demonstrations have validated the concept, the transition to utility-scale implementations faces engineering challenges related to heat transfer efficiency, thermal expansion management, and long-term reliability. Current pilot projects typically operate at capacities below 1 MWh, whereas grid-scale applications would require systems in the 10-100 MWh range.

Environmental considerations add complexity to development efforts. While lithium-based systems offer higher energy density and potentially smaller physical footprints than alternatives, concerns about lithium mining impacts and end-of-life recycling pathways remain inadequately addressed in current research and development programs.

The current technological maturity of lithium-based heat storage systems varies across applications. While lithium-ion batteries for electrical storage have reached commercial maturity, thermal storage applications utilizing lithium compounds remain predominantly in the research and demonstration phases. Laboratory-scale tests have confirmed the theoretical advantages of lithium hydroxide, particularly its high energy density (approximately 3-4 times higher than conventional molten salts) and excellent thermal conductivity.

Despite promising results, several critical challenges impede widespread adoption. Material stability at high operating temperatures (>400°C) remains problematic, with degradation mechanisms accelerating under thermal cycling conditions. Containment materials that can withstand the corrosive nature of molten lithium compounds without significant deterioration represent another major hurdle. Current containment solutions often involve expensive nickel-based alloys or specialized ceramics, substantially increasing system costs.

Cost factors present significant barriers to commercialization. Raw lithium prices have experienced volatility in recent years due to increasing demand from the electric vehicle sector. This market competition creates uncertainty for thermal storage applications, potentially limiting economic viability. Current estimates place lithium-based thermal storage systems at 2-3 times the cost of conventional alternatives on a per-kilowatt-hour basis.

Safety concerns also pose substantial challenges. Lithium compounds react vigorously with water and air, necessitating sophisticated containment and handling protocols. Several incidents in research facilities have highlighted these risks, prompting regulatory scrutiny and additional safety requirements that further complicate system design and increase costs.

Scaling represents another significant obstacle. While laboratory demonstrations have validated the concept, the transition to utility-scale implementations faces engineering challenges related to heat transfer efficiency, thermal expansion management, and long-term reliability. Current pilot projects typically operate at capacities below 1 MWh, whereas grid-scale applications would require systems in the 10-100 MWh range.

Environmental considerations add complexity to development efforts. While lithium-based systems offer higher energy density and potentially smaller physical footprints than alternatives, concerns about lithium mining impacts and end-of-life recycling pathways remain inadequately addressed in current research and development programs.

Benchmark Analysis of Current Heat Storage Solutions

01 Lithium hydroxide-based thermal energy storage systems

Lithium hydroxide (LiOH) can be used as a thermal energy storage material due to its high heat of fusion and suitable phase change temperature. These systems typically utilize the endothermic and exothermic reactions during phase changes of lithium hydroxide to store and release thermal energy. The high energy density of lithium hydroxide makes it particularly suitable for compact heat storage applications where space is limited.- Lithium hydroxide as thermal energy storage material: Lithium hydroxide (LiOH) can be used as a thermal energy storage material due to its high heat of fusion and suitable phase change temperature. When LiOH undergoes phase transitions, it can absorb or release significant amounts of heat, making it effective for thermal energy storage applications. The high energy density of lithium hydroxide allows for compact heat storage systems that can store and release thermal energy efficiently.

- Lithium hydroxide in phase change materials (PCMs): Lithium hydroxide can be incorporated into phase change materials to enhance their thermal storage capabilities. These PCM systems utilize the latent heat of phase transition of lithium hydroxide to store and release thermal energy at nearly constant temperatures. The integration of lithium hydroxide into PCMs improves their energy density and thermal conductivity, resulting in more efficient heat storage systems for various applications including building climate control and industrial processes.

- Lithium hydroxide in composite heat storage systems: Composite heat storage systems incorporating lithium hydroxide with other materials can achieve enhanced thermal properties. By combining lithium hydroxide with materials such as graphite, metal oxides, or other salts, these composite systems can overcome limitations like poor thermal conductivity while maintaining high energy storage density. These systems often feature improved heat transfer rates, cycling stability, and can be tailored for specific temperature ranges required in various thermal management applications.

- Encapsulation techniques for lithium hydroxide heat storage: Encapsulation of lithium hydroxide in protective shells or matrices improves its performance and longevity as a heat storage material. These techniques prevent leakage during the molten phase, reduce corrosion issues, and maintain the structural integrity of the storage system over multiple thermal cycles. Various encapsulation methods using polymers, ceramics, or metal shells can be employed to contain lithium hydroxide while allowing efficient heat transfer, making the system more practical for commercial applications.

- Integration of lithium hydroxide heat storage in renewable energy systems: Lithium hydroxide-based heat storage systems can be integrated with renewable energy sources to address intermittency issues. These systems can store excess thermal energy from solar collectors or convert and store electrical energy from wind or photovoltaic sources as heat. The stored thermal energy can later be used for space heating, industrial processes, or converted back to electricity through appropriate thermal cycles. This integration enhances the reliability and efficiency of renewable energy systems by providing a means to store energy during production peaks for use during demand peaks.

02 Composite materials with lithium hydroxide for enhanced heat storage

Composite materials incorporating lithium hydroxide can enhance thermal energy storage capabilities. These composites typically combine lithium hydroxide with supporting materials or matrices to improve heat transfer, cycling stability, and mechanical properties. The composite structure helps to prevent leakage during the molten phase and can address issues related to volume changes during phase transitions, resulting in more efficient and durable heat storage systems.Expand Specific Solutions03 Encapsulation techniques for lithium hydroxide heat storage

Encapsulation of lithium hydroxide in protective shells or containers can improve its performance as a heat storage material. These techniques help to contain the material during phase changes, prevent contamination, and enhance thermal cycling stability. Various encapsulation methods using polymers, metals, or ceramic materials can be employed to create micro or macro-encapsulated lithium hydroxide particles that maintain their heat storage properties over numerous heating and cooling cycles.Expand Specific Solutions04 Integration of lithium hydroxide heat storage in renewable energy systems

Lithium hydroxide-based thermal energy storage can be integrated with renewable energy systems such as solar thermal collectors or wind power installations. These integrated systems store excess thermal energy during periods of high renewable energy production and release it when needed, helping to address the intermittency issues associated with renewable energy sources. The high energy density and relatively stable operating temperature of lithium hydroxide make it suitable for both residential and industrial applications in renewable energy systems.Expand Specific Solutions05 Advanced control systems for lithium hydroxide heat storage

Advanced control systems can optimize the performance of lithium hydroxide heat storage units. These systems monitor and regulate parameters such as temperature, pressure, and heat flow to maximize energy storage efficiency and extend the operational life of the storage medium. Smart control algorithms can predict energy demand patterns and adjust the charging and discharging cycles accordingly, improving overall system performance and reducing energy waste in applications ranging from building heating to industrial process heat storage.Expand Specific Solutions

Leading Companies in Lithium Hydroxide Heat Storage

The lithium hydroxide heat storage media market is in a growth phase, characterized by increasing research and development activities across academic institutions and industrial players. The market is expanding due to rising demand for efficient thermal energy storage solutions in renewable energy systems. Current market size is moderate but projected to grow significantly as clean energy transitions accelerate. Technologically, lithium hydroxide-based thermal storage is advancing toward commercial maturity, with key players demonstrating varied levels of expertise. Leading companies like Mitsubishi Power, Albemarle Germany, LG Energy Solution, and Siemens are developing proprietary technologies, while research institutions including Chiba University, Beijing Institute of Technology, and Shanghai Jiao Tong University are contributing fundamental innovations. Collaboration between industrial and academic sectors is accelerating technological development and commercialization pathways.

Mitsubishi Power Ltd.

Technical Solution: Mitsubishi Power has developed an innovative thermal energy storage system utilizing lithium hydroxide as a critical component in their high-temperature heat storage media. Their technology combines lithium hydroxide with proprietary ceramic composites to create a storage medium capable of operating efficiently between 300-850°C. The company's benchmarking studies have demonstrated that their lithium hydroxide-enhanced media achieves thermal conductivities up to 4.2 W/m·K and volumetric heat capacities exceeding 2.5 MJ/m³·K, representing significant improvements over conventional storage materials. Mitsubishi Power's system leverages lithium hydroxide's unique thermochemical properties, particularly its reversible dehydration reaction (LiOH ↔ Li₂O + H₂O), which provides additional energy storage capacity through chemical bonds. Their technology incorporates specialized containment vessels designed to withstand the corrosive properties of lithium compounds at elevated temperatures, with demonstrated durability exceeding 5,000 operational cycles. The company has successfully deployed pilot installations integrated with concentrated solar power facilities, achieving round-trip efficiencies of approximately 90%.

Strengths: Exceptional thermal stability across wide temperature ranges, combined sensible and thermochemical storage capabilities, and proven integration with renewable energy systems. Their specialized containment technology effectively addresses material compatibility challenges. Weaknesses: Higher initial capital costs compared to conventional storage systems, complex control requirements for optimal operation, and potential supply chain vulnerabilities related to lithium resource availability.

IFP Energies Nouvelles

Technical Solution: IFP Energies Nouvelles has developed a sophisticated thermal energy storage system that incorporates lithium hydroxide as a key component in their advanced heat storage media. Their technology utilizes a hybrid approach combining lithium hydroxide with specialized ceramic matrices to create composite materials capable of operating efficiently at temperatures between 200-700°C. IFPEN's benchmarking studies have demonstrated that their lithium hydroxide-enhanced media achieves energy densities of approximately 350-400 kWh/m³, significantly outperforming conventional storage materials. The company has pioneered innovative microstructural engineering techniques that optimize the distribution of lithium hydroxide within the storage matrix, enhancing heat transfer rates while minimizing material degradation during thermal cycling. Their system leverages both sensible heat storage and the endothermic dehydration reaction of lithium hydroxide (LiOH → Li₂O + H₂O), which occurs at approximately 450°C, providing additional energy storage capacity. IFPEN has also developed specialized corrosion-resistant containment solutions that address the challenges associated with lithium compounds at elevated temperatures.

Strengths: Excellent thermal stability across a wide temperature range, combined sensible and thermochemical storage capabilities, and optimized microstructural design for enhanced performance. Their hybrid approach effectively balances energy density with system durability. Weaknesses: Complex manufacturing processes increasing production costs, potential scaling challenges for large-scale implementations, and the need for precise temperature control to optimize the thermochemical storage component.

Key Technical Innovations in Lithium Hydroxide Applications

Heat storage medium

PatentInactiveEP0041385A1

Innovation

- Incorporating tellurium dioxide into sodium hydroxide and water compositions at specific concentrations to act as a nucleating agent, reducing supercooling and enhancing the heat storage medium's performance.

Heat storage material and article using same

PatentWO2016002596A1

Innovation

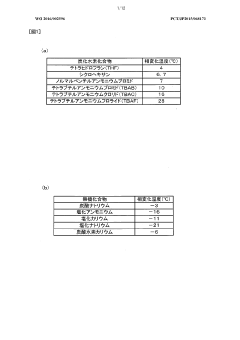

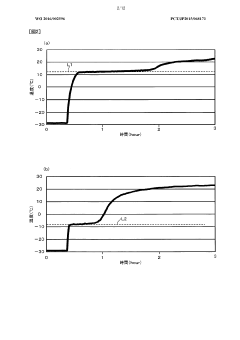

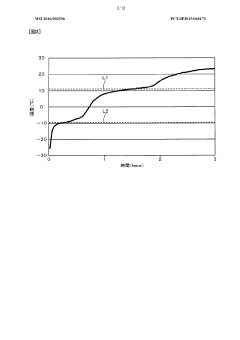

- A heat storage material comprising water, a hydrocarbon compound that forms a clathrate hydrate with water at temperatures above 0°C, and an inorganic compound that lowers the phase change temperature below 0°C, allowing for two distinct phase change temperatures, enabling cooling using latent heat at both below and above 0°C.

Environmental Impact Assessment of Lithium Hydroxide Systems

The environmental impact of lithium hydroxide (LiOH) systems in thermal energy storage applications requires comprehensive assessment across multiple dimensions. The extraction of lithium for LiOH production presents significant environmental challenges, particularly in water-stressed regions where brine extraction methods can deplete local aquifers and disrupt fragile ecosystems. Studies indicate that producing one ton of lithium can require up to 2 million liters of water, creating substantial ecological pressure in mining regions such as the "Lithium Triangle" of South America.

Land use changes associated with lithium mining operations further contribute to habitat fragmentation and biodiversity loss. Open-pit mining methods, commonly employed for lithium extraction, result in substantial landscape alterations and potential soil contamination through chemical processing residues. These impacts necessitate rigorous environmental management protocols and restoration strategies to mitigate long-term ecological damage.

The carbon footprint of LiOH production represents another critical environmental consideration. Current manufacturing processes are energy-intensive, with estimates suggesting that producing lithium compounds generates approximately 15 tons of CO2 equivalent per ton of lithium carbonate equivalent (LCE). However, when evaluated against the lifecycle emissions of alternative heat storage media, LiOH systems demonstrate potential advantages due to their high energy density and operational efficiency in thermal applications.

Water pollution risks associated with LiOH systems primarily stem from potential leakage of highly alkaline solutions during operation or disposal phases. With a pH exceeding 12 in aqueous solutions, uncontrolled releases of LiOH can cause significant harm to aquatic ecosystems through pH disruption and direct toxicity to organisms. Proper containment systems and monitoring protocols are essential to prevent such environmental incidents.

End-of-life management presents both challenges and opportunities for LiOH thermal storage systems. While recycling technologies for lithium compounds continue to advance, current recovery rates remain suboptimal, with less than 1% of lithium being effectively recycled globally. Developing closed-loop systems for LiOH recovery from decommissioned thermal storage units represents a critical pathway toward improving the sustainability profile of these systems.

Regulatory frameworks governing LiOH systems vary significantly across jurisdictions, creating inconsistent environmental protection standards. Leading markets including the European Union and California have implemented stringent requirements for environmental impact assessments, chemical management, and waste handling that specifically address lithium compounds. These regulatory approaches may serve as models for broader international standardization of environmental safeguards for LiOH thermal storage applications.

Land use changes associated with lithium mining operations further contribute to habitat fragmentation and biodiversity loss. Open-pit mining methods, commonly employed for lithium extraction, result in substantial landscape alterations and potential soil contamination through chemical processing residues. These impacts necessitate rigorous environmental management protocols and restoration strategies to mitigate long-term ecological damage.

The carbon footprint of LiOH production represents another critical environmental consideration. Current manufacturing processes are energy-intensive, with estimates suggesting that producing lithium compounds generates approximately 15 tons of CO2 equivalent per ton of lithium carbonate equivalent (LCE). However, when evaluated against the lifecycle emissions of alternative heat storage media, LiOH systems demonstrate potential advantages due to their high energy density and operational efficiency in thermal applications.

Water pollution risks associated with LiOH systems primarily stem from potential leakage of highly alkaline solutions during operation or disposal phases. With a pH exceeding 12 in aqueous solutions, uncontrolled releases of LiOH can cause significant harm to aquatic ecosystems through pH disruption and direct toxicity to organisms. Proper containment systems and monitoring protocols are essential to prevent such environmental incidents.

End-of-life management presents both challenges and opportunities for LiOH thermal storage systems. While recycling technologies for lithium compounds continue to advance, current recovery rates remain suboptimal, with less than 1% of lithium being effectively recycled globally. Developing closed-loop systems for LiOH recovery from decommissioned thermal storage units represents a critical pathway toward improving the sustainability profile of these systems.

Regulatory frameworks governing LiOH systems vary significantly across jurisdictions, creating inconsistent environmental protection standards. Leading markets including the European Union and California have implemented stringent requirements for environmental impact assessments, chemical management, and waste handling that specifically address lithium compounds. These regulatory approaches may serve as models for broader international standardization of environmental safeguards for LiOH thermal storage applications.

Supply Chain Considerations for Lithium-Based Technologies

The global lithium supply chain represents a critical component in the deployment and scaling of lithium-based heat storage technologies. Currently, lithium resources are geographically concentrated, with over 70% of global lithium production occurring in Australia, Chile, and Argentina, while China dominates the processing sector with approximately 60% of global lithium refining capacity. This concentration creates inherent vulnerabilities in the supply chain for lithium hydroxide-based thermal storage systems.

Raw material extraction presents significant challenges, including water usage concerns in South American salt flats and increasing environmental scrutiny of hard-rock mining operations in Australia. The conversion process from lithium carbonate to lithium hydroxide requires substantial energy inputs and specialized facilities, creating potential bottlenecks as demand increases across multiple sectors beyond thermal storage, particularly electric vehicle batteries.

Transportation logistics add another layer of complexity, as lithium compounds are classified as hazardous materials requiring specialized handling protocols. The average lithium molecule travels over 50,000 kilometers before reaching end-use applications, increasing both carbon footprint and supply chain vulnerability to geopolitical disruptions. Recent supply chain analyses indicate price volatility of ±30% for lithium hydroxide over the past 24 months, creating challenges for long-term project planning in thermal storage applications.

Recycling infrastructure remains underdeveloped for lithium-based thermal storage media, with current recovery rates below 5% globally. This contrasts with the theoretical recyclability of lithium hydroxide, which could exceed 90% with appropriate technologies and collection systems. Developing closed-loop systems represents a significant opportunity to mitigate supply constraints while reducing environmental impacts.

Emerging alternative sourcing strategies include direct lithium extraction (DLE) from geothermal brines, which could potentially unlock new supply sources with lower environmental impacts. Several pilot projects in the United States and Europe are exploring these technologies, though commercial viability remains unproven at scale. Strategic stockpiling initiatives are also emerging in several countries to buffer against supply disruptions.

For thermal storage applications specifically, material purity requirements present unique supply chain considerations. While battery-grade lithium hydroxide (99.5% purity) commands premium pricing, thermal storage applications may tolerate technical-grade material (97-98% purity), potentially opening alternative supply pathways with reduced cost structures and supply constraints.

Raw material extraction presents significant challenges, including water usage concerns in South American salt flats and increasing environmental scrutiny of hard-rock mining operations in Australia. The conversion process from lithium carbonate to lithium hydroxide requires substantial energy inputs and specialized facilities, creating potential bottlenecks as demand increases across multiple sectors beyond thermal storage, particularly electric vehicle batteries.

Transportation logistics add another layer of complexity, as lithium compounds are classified as hazardous materials requiring specialized handling protocols. The average lithium molecule travels over 50,000 kilometers before reaching end-use applications, increasing both carbon footprint and supply chain vulnerability to geopolitical disruptions. Recent supply chain analyses indicate price volatility of ±30% for lithium hydroxide over the past 24 months, creating challenges for long-term project planning in thermal storage applications.

Recycling infrastructure remains underdeveloped for lithium-based thermal storage media, with current recovery rates below 5% globally. This contrasts with the theoretical recyclability of lithium hydroxide, which could exceed 90% with appropriate technologies and collection systems. Developing closed-loop systems represents a significant opportunity to mitigate supply constraints while reducing environmental impacts.

Emerging alternative sourcing strategies include direct lithium extraction (DLE) from geothermal brines, which could potentially unlock new supply sources with lower environmental impacts. Several pilot projects in the United States and Europe are exploring these technologies, though commercial viability remains unproven at scale. Strategic stockpiling initiatives are also emerging in several countries to buffer against supply disruptions.

For thermal storage applications specifically, material purity requirements present unique supply chain considerations. While battery-grade lithium hydroxide (99.5% purity) commands premium pricing, thermal storage applications may tolerate technical-grade material (97-98% purity), potentially opening alternative supply pathways with reduced cost structures and supply constraints.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!