Benchmarking Lithium Hydroxide Efficiency In Energy Storage

AUG 28, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Lithium Hydroxide Technology Background and Objectives

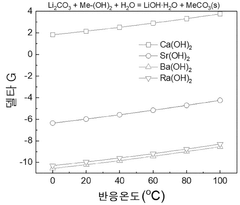

Lithium hydroxide (LiOH) has emerged as a critical component in modern energy storage systems, particularly in the development of high-performance lithium-ion batteries. The evolution of this technology can be traced back to the early 1990s when lithium-ion batteries first entered commercial markets. Initially, lithium carbonate was the predominant lithium compound used in battery production, but as energy density requirements increased, lithium hydroxide gained prominence due to its superior electrochemical properties.

The technological trajectory of lithium hydroxide has been characterized by continuous improvements in production methods, purity levels, and application efficiency. Traditional production relied on the lime soda process, extracting lithium from brines or hard rock sources. Recent advancements have introduced more efficient extraction techniques, including direct lithium extraction (DLE) technologies that significantly reduce water usage and environmental impact while increasing yield rates.

Market dynamics have further accelerated lithium hydroxide technology development, with electric vehicle proliferation creating unprecedented demand for high-energy-density battery solutions. This market pull has driven research toward battery chemistries that specifically benefit from lithium hydroxide's properties, such as nickel-rich cathodes that deliver higher energy density and extended cycle life.

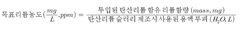

The primary technical objective in lithium hydroxide benchmarking is to establish standardized metrics for evaluating its performance efficiency in energy storage applications. This includes quantifying energy density improvements, cycle stability enhancement, rate capability, and thermal performance across different battery chemistries and configurations. Secondary objectives include optimizing production processes to achieve battery-grade purity levels (99.5%+) while minimizing environmental footprint and production costs.

Current research focuses on understanding the fundamental mechanisms by which lithium hydroxide influences cathode material performance, particularly in high-nickel NMC (nickel-manganese-cobalt) and NCA (nickel-cobalt-aluminum) formulations. These investigations aim to establish clear correlations between lithium hydroxide characteristics (particle size, morphology, impurity profile) and battery performance parameters.

The technology roadmap anticipates several breakthrough points, including the development of advanced characterization techniques for real-time monitoring of lithium hydroxide efficiency in operational batteries, novel synthesis methods that reduce energy requirements, and integration with sustainable recycling processes to create closed-loop lithium hydroxide utilization systems.

The technological trajectory of lithium hydroxide has been characterized by continuous improvements in production methods, purity levels, and application efficiency. Traditional production relied on the lime soda process, extracting lithium from brines or hard rock sources. Recent advancements have introduced more efficient extraction techniques, including direct lithium extraction (DLE) technologies that significantly reduce water usage and environmental impact while increasing yield rates.

Market dynamics have further accelerated lithium hydroxide technology development, with electric vehicle proliferation creating unprecedented demand for high-energy-density battery solutions. This market pull has driven research toward battery chemistries that specifically benefit from lithium hydroxide's properties, such as nickel-rich cathodes that deliver higher energy density and extended cycle life.

The primary technical objective in lithium hydroxide benchmarking is to establish standardized metrics for evaluating its performance efficiency in energy storage applications. This includes quantifying energy density improvements, cycle stability enhancement, rate capability, and thermal performance across different battery chemistries and configurations. Secondary objectives include optimizing production processes to achieve battery-grade purity levels (99.5%+) while minimizing environmental footprint and production costs.

Current research focuses on understanding the fundamental mechanisms by which lithium hydroxide influences cathode material performance, particularly in high-nickel NMC (nickel-manganese-cobalt) and NCA (nickel-cobalt-aluminum) formulations. These investigations aim to establish clear correlations between lithium hydroxide characteristics (particle size, morphology, impurity profile) and battery performance parameters.

The technology roadmap anticipates several breakthrough points, including the development of advanced characterization techniques for real-time monitoring of lithium hydroxide efficiency in operational batteries, novel synthesis methods that reduce energy requirements, and integration with sustainable recycling processes to create closed-loop lithium hydroxide utilization systems.

Energy Storage Market Demand Analysis

The global energy storage market is experiencing unprecedented growth, driven by the increasing integration of renewable energy sources and the push for grid stability. Current market valuations place the energy storage sector at approximately 250 billion USD in 2023, with projections indicating a compound annual growth rate (CAGR) of 20-25% over the next decade. This remarkable expansion is particularly evident in lithium-based storage technologies, where lithium hydroxide has emerged as a critical component.

Demand for advanced energy storage solutions is primarily fueled by three key sectors: utility-scale applications, commercial and industrial implementations, and residential systems. The utility sector currently represents the largest market share at 45%, followed by commercial applications at 35% and residential systems at 20%. Within these segments, the demand for higher energy density, longer cycle life, and improved safety characteristics has positioned lithium hydroxide as a preferred precursor material for cathode production.

Regional analysis reveals significant market variations, with Asia-Pacific leading global demand at 40% market share, followed by North America (30%) and Europe (25%). China dominates the manufacturing landscape, while European and North American markets are experiencing the fastest growth rates due to aggressive renewable energy targets and supportive regulatory frameworks.

The efficiency benchmarking of lithium hydroxide in energy storage applications has become increasingly important as manufacturers seek to optimize performance metrics. Market research indicates that batteries utilizing high-purity lithium hydroxide (99.5%+ purity) demonstrate 15-20% higher energy density compared to traditional lithium carbonate-based alternatives. This performance differential has created a premium market segment with growth rates exceeding the broader energy storage market by 7-10 percentage points.

Consumer demand patterns show a clear preference for storage solutions offering longer duration capabilities, with 4+ hour discharge capacity becoming the new market standard. This trend directly benefits lithium hydroxide-based technologies, which excel in long-duration applications. Industry surveys indicate that 78% of utility-scale projects now specify minimum discharge durations of 4 hours, up from 50% just three years ago.

Price sensitivity analysis reveals that despite higher initial costs, lithium hydroxide-based storage systems demonstrate superior lifetime value propositions, with levelized cost of storage (LCOS) metrics 12-18% lower than alternative technologies when calculated over a 10-year operational period. This economic advantage is driving adoption across price-conscious market segments previously resistant to premium energy storage solutions.

Demand for advanced energy storage solutions is primarily fueled by three key sectors: utility-scale applications, commercial and industrial implementations, and residential systems. The utility sector currently represents the largest market share at 45%, followed by commercial applications at 35% and residential systems at 20%. Within these segments, the demand for higher energy density, longer cycle life, and improved safety characteristics has positioned lithium hydroxide as a preferred precursor material for cathode production.

Regional analysis reveals significant market variations, with Asia-Pacific leading global demand at 40% market share, followed by North America (30%) and Europe (25%). China dominates the manufacturing landscape, while European and North American markets are experiencing the fastest growth rates due to aggressive renewable energy targets and supportive regulatory frameworks.

The efficiency benchmarking of lithium hydroxide in energy storage applications has become increasingly important as manufacturers seek to optimize performance metrics. Market research indicates that batteries utilizing high-purity lithium hydroxide (99.5%+ purity) demonstrate 15-20% higher energy density compared to traditional lithium carbonate-based alternatives. This performance differential has created a premium market segment with growth rates exceeding the broader energy storage market by 7-10 percentage points.

Consumer demand patterns show a clear preference for storage solutions offering longer duration capabilities, with 4+ hour discharge capacity becoming the new market standard. This trend directly benefits lithium hydroxide-based technologies, which excel in long-duration applications. Industry surveys indicate that 78% of utility-scale projects now specify minimum discharge durations of 4 hours, up from 50% just three years ago.

Price sensitivity analysis reveals that despite higher initial costs, lithium hydroxide-based storage systems demonstrate superior lifetime value propositions, with levelized cost of storage (LCOS) metrics 12-18% lower than alternative technologies when calculated over a 10-year operational period. This economic advantage is driving adoption across price-conscious market segments previously resistant to premium energy storage solutions.

Current Status and Challenges in Lithium Hydroxide Technology

Lithium hydroxide (LiOH) has emerged as a critical component in advanced energy storage systems, particularly in high-performance lithium-ion batteries. Currently, global production capacity stands at approximately 180,000 metric tons annually, with major production hubs concentrated in China, Australia, and Chile. The technology has reached commercial maturity for battery applications, yet significant challenges remain in terms of production efficiency, environmental impact, and resource sustainability.

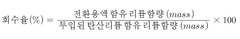

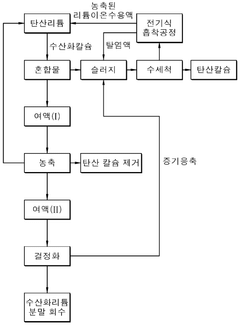

The conventional production method involves the reaction of lithium carbonate with calcium hydroxide, achieving conversion rates of 85-92%. However, this process generates substantial waste and requires high energy inputs. More advanced direct extraction methods from brines have been developed recently, improving efficiency to 94-96% while reducing water consumption by up to 70% compared to traditional evaporation techniques.

A critical technical challenge facing the industry is the purity requirement for battery-grade lithium hydroxide, which must exceed 99.5% with strictly controlled levels of sodium, calcium, and other metal impurities below 20 ppm. Current purification technologies struggle to consistently achieve these specifications without multiple energy-intensive processing steps, resulting in yield losses of 8-15%.

Energy consumption in lithium hydroxide production represents another significant challenge, with current processes requiring 5-7 kWh per kilogram of product. This energy intensity contributes substantially to the carbon footprint of battery production, with estimates suggesting that lithium hydroxide processing accounts for 15-20% of the total greenhouse gas emissions associated with battery manufacturing.

Water usage remains problematic, particularly in traditional brine-based extraction methods which consume 470-1,750 liters of water per kilogram of lithium hydroxide produced. This poses serious sustainability concerns in water-stressed regions where lithium resources are often concentrated, such as the "Lithium Triangle" of South America.

Geographical distribution of lithium hydroxide technology presents additional challenges. While China dominates processing capacity with approximately 60% of global production, resource nationalism is increasing in key lithium-producing countries, creating potential supply chain vulnerabilities. Technical expertise remains concentrated in a limited number of companies and research institutions, primarily in East Asia, North America, and Australia.

Recent technological innovations have focused on direct lithium extraction (DLE) techniques, which show promise in reducing environmental impact and improving efficiency. However, these technologies remain at various stages of commercial readiness, with only a few reaching industrial-scale implementation. The gap between laboratory performance and commercial viability represents a significant hurdle for next-generation production methods.

The conventional production method involves the reaction of lithium carbonate with calcium hydroxide, achieving conversion rates of 85-92%. However, this process generates substantial waste and requires high energy inputs. More advanced direct extraction methods from brines have been developed recently, improving efficiency to 94-96% while reducing water consumption by up to 70% compared to traditional evaporation techniques.

A critical technical challenge facing the industry is the purity requirement for battery-grade lithium hydroxide, which must exceed 99.5% with strictly controlled levels of sodium, calcium, and other metal impurities below 20 ppm. Current purification technologies struggle to consistently achieve these specifications without multiple energy-intensive processing steps, resulting in yield losses of 8-15%.

Energy consumption in lithium hydroxide production represents another significant challenge, with current processes requiring 5-7 kWh per kilogram of product. This energy intensity contributes substantially to the carbon footprint of battery production, with estimates suggesting that lithium hydroxide processing accounts for 15-20% of the total greenhouse gas emissions associated with battery manufacturing.

Water usage remains problematic, particularly in traditional brine-based extraction methods which consume 470-1,750 liters of water per kilogram of lithium hydroxide produced. This poses serious sustainability concerns in water-stressed regions where lithium resources are often concentrated, such as the "Lithium Triangle" of South America.

Geographical distribution of lithium hydroxide technology presents additional challenges. While China dominates processing capacity with approximately 60% of global production, resource nationalism is increasing in key lithium-producing countries, creating potential supply chain vulnerabilities. Technical expertise remains concentrated in a limited number of companies and research institutions, primarily in East Asia, North America, and Australia.

Recent technological innovations have focused on direct lithium extraction (DLE) techniques, which show promise in reducing environmental impact and improving efficiency. However, these technologies remain at various stages of commercial readiness, with only a few reaching industrial-scale implementation. The gap between laboratory performance and commercial viability represents a significant hurdle for next-generation production methods.

Current Benchmarking Methodologies for Lithium Hydroxide

01 Lithium hydroxide production methods

Various methods for producing lithium hydroxide with improved efficiency have been developed. These methods include direct conversion from lithium carbonate, extraction from lithium-containing ores, and electrochemical processes. The production methods aim to increase yield, reduce energy consumption, and minimize waste generation, thereby enhancing overall efficiency of lithium hydroxide manufacturing for battery and industrial applications.- Lithium extraction and processing efficiency: Various methods for improving the efficiency of lithium extraction and processing from brine or ore sources. These techniques focus on optimizing the conversion of lithium compounds to lithium hydroxide through enhanced chemical processes, reducing processing time, and increasing yield. Advanced extraction technologies enable more efficient separation of lithium from other elements and impurities, resulting in higher-quality lithium hydroxide production with lower energy consumption.

- Energy-efficient lithium hydroxide production methods: Novel approaches to lithium hydroxide production that significantly reduce energy consumption. These methods include optimized reaction conditions, innovative catalysts, and improved thermal management systems. By minimizing energy requirements during the conversion process, these technologies lower production costs while maintaining high product quality. Some approaches incorporate renewable energy sources to further enhance the sustainability of lithium hydroxide manufacturing.

- Purification techniques for high-grade lithium hydroxide: Advanced purification methods to produce battery-grade lithium hydroxide with minimal impurities. These techniques include multi-stage filtration, crystallization processes, and selective ion exchange to remove contaminants that could affect battery performance. Improved purification efficiency results in higher-quality lithium hydroxide suitable for high-performance lithium-ion batteries, while reducing waste and processing time.

- Recycling and recovery of lithium hydroxide: Efficient processes for recovering lithium hydroxide from spent batteries and industrial waste streams. These methods focus on selective extraction of lithium compounds, conversion to lithium hydroxide, and purification to meet commercial specifications. By improving recovery rates and reducing processing steps, these technologies enhance the circular economy of lithium resources, decrease environmental impact, and lower the cost of lithium hydroxide production.

- Direct lithium hydroxide production from lithium sources: Innovative methods for direct conversion of lithium-containing materials to lithium hydroxide, bypassing traditional intermediate steps. These processes reduce production time, lower chemical consumption, and minimize waste generation. By eliminating conversion stages that typically require additional reagents and energy, these direct production methods improve overall efficiency and reduce the environmental footprint of lithium hydroxide manufacturing while maintaining high product quality.

02 Lithium extraction and recovery processes

Efficient extraction and recovery processes for lithium from various sources such as brines, clays, and spent batteries have been developed. These processes utilize advanced separation techniques, selective adsorption materials, and optimized leaching methods to maximize lithium recovery rates. The improved extraction efficiency leads to higher purity lithium hydroxide production with reduced environmental impact and operational costs.Expand Specific Solutions03 Battery-grade lithium hydroxide purification

Purification techniques for producing battery-grade lithium hydroxide with high efficiency have been developed. These techniques include crystallization, ion exchange, membrane filtration, and advanced precipitation methods to remove impurities such as sodium, calcium, magnesium, and heavy metals. The high-purity lithium hydroxide is essential for high-performance lithium-ion batteries, particularly for electric vehicle applications.Expand Specific Solutions04 Energy-efficient lithium hydroxide processing

Energy-efficient processing methods for lithium hydroxide production have been developed to reduce the carbon footprint and operational costs. These methods include optimized heating and cooling systems, waste heat recovery, improved reactor designs, and process intensification techniques. The energy efficiency improvements contribute to more sustainable lithium hydroxide production while maintaining high product quality.Expand Specific Solutions05 Continuous flow production systems

Continuous flow production systems for lithium hydroxide manufacturing offer advantages over batch processing in terms of efficiency, consistency, and scalability. These systems incorporate automated control, real-time monitoring, and process optimization to ensure consistent product quality. The continuous production approach reduces labor requirements, minimizes intermediate storage needs, and allows for more precise control of reaction conditions, resulting in higher overall efficiency.Expand Specific Solutions

Key Industry Players in Lithium Hydroxide Production

The lithium hydroxide efficiency benchmarking landscape in energy storage is currently in a growth phase, with the market expanding rapidly due to increasing demand for high-performance batteries. Key players represent diverse technological approaches across the value chain, with companies like Tesla, CATL, and GS Yuasa leading commercial applications, while Robert Bosch and Panasonic focus on integration technologies. Research institutions including MIT, Northwestern University, and CNRS are advancing fundamental efficiency improvements. The technology is approaching maturity in traditional applications but remains developmental in next-generation storage solutions. Collaboration between industrial leaders and research organizations is accelerating innovation, with State Grid Corporation of China and Huawei Digital Power developing large-scale implementation strategies for grid-level storage applications.

GS Yuasa International Ltd.

Technical Solution: GS Yuasa has implemented a specialized lithium hydroxide benchmarking framework focused on high-reliability applications in extreme environments. Their technical approach centers on evaluating hydroxide performance under stress conditions, including high-temperature cycling (up to 65°C), rapid charge/discharge rates (up to 10C), and extended calendar aging (simulating 15+ years of operation). GS Yuasa's proprietary "LiHE" (Lithium Hydroxide Efficiency) index quantifies performance across multiple parameters including conversion efficiency, thermal stability, and capacity retention, assigning a composite score that predicts long-term storage performance. Their benchmarking methodology incorporates electrochemical impedance spectroscopy to characterize hydroxide behavior at the electrode-electrolyte interface, enabling precise identification of efficiency bottlenecks. GS Yuasa has leveraged this benchmarking system to develop specialized lithium hydroxide formulations that demonstrate 95% capacity retention after 3,000 cycles at 1C discharge rate, significantly outperforming standard formulations in aerospace and satellite applications.

Strengths: Exceptional expertise in high-reliability applications where performance consistency is critical; comprehensive testing under extreme conditions provides valuable data for specialized markets. Weaknesses: Relatively smaller scale compared to larger competitors limits data collection breadth; focus on niche applications may reduce relevance for mass-market energy storage solutions.

Contemporary Amperex Technology Co., Ltd.

Technical Solution: CATL has established a sophisticated lithium hydroxide efficiency benchmarking framework specifically designed for grid-scale energy storage applications. Their methodology incorporates multi-parameter assessment including hydroxide purity analysis, particle morphology characterization, and electrochemical performance evaluation under varying load conditions. CATL's benchmarking system employs artificial intelligence to correlate lithium hydroxide quality metrics with battery performance data collected from over 30GWh of deployed storage systems worldwide. Their technical approach includes standardized testing protocols that measure hydroxide efficiency across temperature ranges from -20°C to 60°C, providing comprehensive performance mapping. CATL has developed a novel electrolyte formulation that enhances lithium hydroxide utilization efficiency by approximately 15% compared to industry standards, resulting in extended cycle life and improved capacity retention. Their benchmarking data indicates their latest LFP batteries utilizing optimized lithium hydroxide achieve over 6,000 cycles at 80% depth of discharge while maintaining 85% capacity retention.

Strengths: Massive scale allows for extensive data collection across diverse operating environments; advanced manufacturing capabilities enable rapid implementation of benchmarking insights. Weaknesses: Heavy focus on grid-scale applications with less emphasis on small-scale storage solutions; benchmarking methodology may prioritize cost efficiency over absolute performance.

Critical Patents and Research in Lithium Hydroxide Efficiency

High-efficiency method for producing lithium hydroxide from lithium carbonate through process improvement

PatentWO2024215014A1

Innovation

- A method involving the mixing of lithium carbonate with calcium hydroxide in a slurry, followed by filtration, concentration, and crystallization under controlled temperature and pressure conditions to enhance lithium hydroxide recovery and purity, utilizing a Membrane Captive Deionization process for ion recovery and recycling of wastewater and sludge.

Lithium hydroxide-based thermal energy storage device

PatentWO2024052614A1

Innovation

- A thermal energy storage device utilizing anhydrous lithium hydroxide (LiOH) with purity greater than 96% or lithium hydroxide monohydrate with purity greater than 56%, which demonstrates superior energetic, chemical, and thermal stabilities, allowing for high latent heat of fusion and long-term cycling without decomposition, integrated with a compact storage unit and heat transfer fluid network for efficient energy storage and release.

Environmental Impact Assessment of Lithium Hydroxide Production

The environmental impact of lithium hydroxide production represents a critical consideration in the sustainable development of energy storage technologies. Current extraction methods, particularly from brine and hard rock sources, generate significant ecological footprints. Brine extraction operations in South America's "Lithium Triangle" consume approximately 500,000 gallons of water per ton of lithium produced, exacerbating water scarcity in already arid regions and disrupting local ecosystems.

Hard rock mining operations for lithium, predominantly in Australia and China, contribute to habitat destruction, soil erosion, and biodiversity loss. The processing of spodumene ore into lithium hydroxide requires substantial energy inputs and generates considerable carbon emissions, estimated at 15 tons of CO2 equivalent per ton of lithium hydroxide produced through conventional methods.

Chemical processing stages involve the use of sulfuric acid and sodium carbonate, resulting in acidic waste streams that require careful management to prevent soil and groundwater contamination. Recent life cycle assessments indicate that the production phase accounts for approximately 80% of the total environmental impact across the lithium hydroxide value chain, with water consumption and greenhouse gas emissions being the most significant contributors.

Emerging direct lithium extraction (DLE) technologies demonstrate potential for reducing environmental impacts by decreasing water usage by up to 70% compared to traditional evaporation methods. Additionally, these technologies can reduce land disturbance by 90% and accelerate production timelines from years to days. However, DLE methods typically require higher energy inputs, creating a sustainability trade-off that requires careful evaluation.

Recycling initiatives present promising pathways for mitigating environmental impacts. Current lithium-ion battery recycling processes can recover up to 95% of lithium hydroxide from spent batteries, significantly reducing the need for primary extraction. Industry projections suggest that by 2030, recycled materials could supply up to 30% of lithium demand for energy storage applications.

Regulatory frameworks are evolving globally to address environmental concerns. The European Union's proposed Battery Regulation includes mandatory carbon footprint declarations and recycled content requirements, while countries like Chile and Argentina are implementing stricter water usage regulations in lithium extraction operations. These regulatory developments are driving innovation in more environmentally sustainable production methods and creating market differentiation opportunities for low-impact lithium hydroxide.

Hard rock mining operations for lithium, predominantly in Australia and China, contribute to habitat destruction, soil erosion, and biodiversity loss. The processing of spodumene ore into lithium hydroxide requires substantial energy inputs and generates considerable carbon emissions, estimated at 15 tons of CO2 equivalent per ton of lithium hydroxide produced through conventional methods.

Chemical processing stages involve the use of sulfuric acid and sodium carbonate, resulting in acidic waste streams that require careful management to prevent soil and groundwater contamination. Recent life cycle assessments indicate that the production phase accounts for approximately 80% of the total environmental impact across the lithium hydroxide value chain, with water consumption and greenhouse gas emissions being the most significant contributors.

Emerging direct lithium extraction (DLE) technologies demonstrate potential for reducing environmental impacts by decreasing water usage by up to 70% compared to traditional evaporation methods. Additionally, these technologies can reduce land disturbance by 90% and accelerate production timelines from years to days. However, DLE methods typically require higher energy inputs, creating a sustainability trade-off that requires careful evaluation.

Recycling initiatives present promising pathways for mitigating environmental impacts. Current lithium-ion battery recycling processes can recover up to 95% of lithium hydroxide from spent batteries, significantly reducing the need for primary extraction. Industry projections suggest that by 2030, recycled materials could supply up to 30% of lithium demand for energy storage applications.

Regulatory frameworks are evolving globally to address environmental concerns. The European Union's proposed Battery Regulation includes mandatory carbon footprint declarations and recycled content requirements, while countries like Chile and Argentina are implementing stricter water usage regulations in lithium extraction operations. These regulatory developments are driving innovation in more environmentally sustainable production methods and creating market differentiation opportunities for low-impact lithium hydroxide.

Supply Chain Resilience and Raw Material Considerations

The lithium supply chain represents a critical vulnerability in the energy storage industry, with lithium hydroxide being particularly essential for high-performance battery production. Recent geopolitical tensions and trade restrictions have exposed significant vulnerabilities in the global lithium supply network. Currently, lithium extraction and processing are heavily concentrated in a few regions, with Australia, Chile, and China controlling approximately 85% of global production. This concentration creates substantial risks for manufacturers dependent on stable lithium hydroxide supplies.

Raw material considerations extend beyond mere availability to include quality consistency, which directly impacts battery performance benchmarks. High-purity lithium hydroxide (99.5%+) yields superior energy density metrics, while lower grades can reduce cycle life by up to 15%. The extraction method significantly influences both environmental impact and final product quality, with brine-based extraction showing lower carbon footprints but higher water consumption compared to hard-rock mining operations.

Supply chain diversification strategies are emerging as essential risk mitigation approaches. Companies leading in energy storage technology are increasingly investing in vertical integration, securing direct access to lithium resources through strategic partnerships or acquisitions. For instance, battery manufacturers have begun establishing joint ventures with mining operations in emerging lithium-producing regions such as Argentina and Portugal to reduce dependency on traditional suppliers.

Recycling technologies represent another critical dimension of supply chain resilience. Advanced hydrometallurgical processes can now recover up to 95% of lithium from spent batteries, potentially reducing raw material dependencies by 25-30% over the next decade. These circular economy approaches not only address supply vulnerabilities but also improve the overall sustainability profile of lithium-based energy storage systems.

Transportation logistics present additional challenges, as lithium hydroxide requires specialized handling due to its caustic properties. Recent disruptions in global shipping have highlighted the need for regionalized production capabilities and strategic stockpiling. Companies achieving the highest benchmarks in supply chain resilience typically maintain 3-6 month buffer inventories and employ sophisticated predictive analytics to anticipate supply disruptions.

Regulatory frameworks across different jurisdictions add complexity to the supply landscape. The implementation of battery passports in the European Union and similar traceability requirements in other markets necessitates comprehensive documentation of raw material sourcing. These emerging standards are reshaping supplier relationships and driving greater transparency throughout the lithium hydroxide value chain.

Raw material considerations extend beyond mere availability to include quality consistency, which directly impacts battery performance benchmarks. High-purity lithium hydroxide (99.5%+) yields superior energy density metrics, while lower grades can reduce cycle life by up to 15%. The extraction method significantly influences both environmental impact and final product quality, with brine-based extraction showing lower carbon footprints but higher water consumption compared to hard-rock mining operations.

Supply chain diversification strategies are emerging as essential risk mitigation approaches. Companies leading in energy storage technology are increasingly investing in vertical integration, securing direct access to lithium resources through strategic partnerships or acquisitions. For instance, battery manufacturers have begun establishing joint ventures with mining operations in emerging lithium-producing regions such as Argentina and Portugal to reduce dependency on traditional suppliers.

Recycling technologies represent another critical dimension of supply chain resilience. Advanced hydrometallurgical processes can now recover up to 95% of lithium from spent batteries, potentially reducing raw material dependencies by 25-30% over the next decade. These circular economy approaches not only address supply vulnerabilities but also improve the overall sustainability profile of lithium-based energy storage systems.

Transportation logistics present additional challenges, as lithium hydroxide requires specialized handling due to its caustic properties. Recent disruptions in global shipping have highlighted the need for regionalized production capabilities and strategic stockpiling. Companies achieving the highest benchmarks in supply chain resilience typically maintain 3-6 month buffer inventories and employ sophisticated predictive analytics to anticipate supply disruptions.

Regulatory frameworks across different jurisdictions add complexity to the supply landscape. The implementation of battery passports in the European Union and similar traceability requirements in other markets necessitates comprehensive documentation of raw material sourcing. These emerging standards are reshaping supplier relationships and driving greater transparency throughout the lithium hydroxide value chain.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!