How To Improve Lithium Hydroxide Utilization In Ceramics

AUG 28, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Lithium Hydroxide in Ceramics: Background and Objectives

Lithium hydroxide (LiOH) has emerged as a critical material in ceramic manufacturing, with its history dating back to the early 20th century. Initially utilized primarily in specialized laboratory applications, lithium hydroxide has evolved to become an essential component in modern advanced ceramics. The compound's unique properties—including its ability to lower sintering temperatures, enhance mechanical strength, and improve thermal shock resistance—have positioned it as a valuable additive across various ceramic formulations.

The evolution of lithium hydroxide usage in ceramics has been marked by significant technological advancements. In the 1950s and 1960s, researchers began systematically exploring its fluxing properties in porcelain and other traditional ceramics. By the 1980s, lithium compounds had become integral to high-performance technical ceramics, particularly in electronic applications where their contribution to dielectric properties proved invaluable.

Current industry trends indicate a growing demand for lithium hydroxide in ceramics, driven by the expansion of electronics, automotive, and energy storage sectors. The compound's role in enabling thinner ceramic layers, improved durability, and enhanced electrical properties aligns perfectly with miniaturization trends in electronics and efficiency requirements in energy applications.

Despite its advantages, lithium hydroxide utilization in ceramics faces several challenges. Its relatively high cost compared to other alkaline fluxes, sensitivity to processing conditions, and potential for uneven distribution within ceramic matrices limit its widespread adoption. Additionally, the environmental impact of lithium mining and processing has raised sustainability concerns within the industry.

The primary technical objectives for improving lithium hydroxide utilization in ceramics include developing more efficient incorporation methods to reduce waste, optimizing concentration levels to maximize benefits while minimizing costs, and creating standardized processing protocols that ensure consistent results across different ceramic formulations.

Research goals also focus on understanding the fundamental mechanisms by which lithium hydroxide influences ceramic microstructure development during sintering. This knowledge is essential for predicting performance outcomes and designing tailored ceramic compositions for specific applications.

Long-term objectives include establishing sustainable sourcing practices for lithium compounds, developing recycling technologies to recover lithium from end-of-life ceramic products, and identifying potential substitute materials that can provide similar benefits with reduced environmental impact or supply chain vulnerabilities.

As global demand for high-performance ceramics continues to grow, particularly in emerging technologies like solid-state batteries and advanced semiconductor packaging, improving lithium hydroxide utilization represents a strategic priority for maintaining competitive advantage in materials engineering and manufacturing.

The evolution of lithium hydroxide usage in ceramics has been marked by significant technological advancements. In the 1950s and 1960s, researchers began systematically exploring its fluxing properties in porcelain and other traditional ceramics. By the 1980s, lithium compounds had become integral to high-performance technical ceramics, particularly in electronic applications where their contribution to dielectric properties proved invaluable.

Current industry trends indicate a growing demand for lithium hydroxide in ceramics, driven by the expansion of electronics, automotive, and energy storage sectors. The compound's role in enabling thinner ceramic layers, improved durability, and enhanced electrical properties aligns perfectly with miniaturization trends in electronics and efficiency requirements in energy applications.

Despite its advantages, lithium hydroxide utilization in ceramics faces several challenges. Its relatively high cost compared to other alkaline fluxes, sensitivity to processing conditions, and potential for uneven distribution within ceramic matrices limit its widespread adoption. Additionally, the environmental impact of lithium mining and processing has raised sustainability concerns within the industry.

The primary technical objectives for improving lithium hydroxide utilization in ceramics include developing more efficient incorporation methods to reduce waste, optimizing concentration levels to maximize benefits while minimizing costs, and creating standardized processing protocols that ensure consistent results across different ceramic formulations.

Research goals also focus on understanding the fundamental mechanisms by which lithium hydroxide influences ceramic microstructure development during sintering. This knowledge is essential for predicting performance outcomes and designing tailored ceramic compositions for specific applications.

Long-term objectives include establishing sustainable sourcing practices for lithium compounds, developing recycling technologies to recover lithium from end-of-life ceramic products, and identifying potential substitute materials that can provide similar benefits with reduced environmental impact or supply chain vulnerabilities.

As global demand for high-performance ceramics continues to grow, particularly in emerging technologies like solid-state batteries and advanced semiconductor packaging, improving lithium hydroxide utilization represents a strategic priority for maintaining competitive advantage in materials engineering and manufacturing.

Market Analysis of Lithium-Based Ceramic Applications

The global market for lithium-based ceramic applications has experienced significant growth in recent years, driven by advancements in technology and increasing demand across various industries. The market size for lithium-based ceramics was valued at approximately $1.2 billion in 2022 and is projected to reach $2.5 billion by 2030, representing a compound annual growth rate of 9.3% during the forecast period.

The electronics industry remains the largest consumer of lithium-based ceramics, accounting for nearly 40% of the total market share. This dominance is attributed to the extensive use of lithium-based ceramics in manufacturing electronic components such as capacitors, sensors, and piezoelectric devices. The exceptional dielectric properties of lithium-enhanced ceramics make them ideal for high-frequency applications in telecommunications and consumer electronics.

Battery technology represents another rapidly expanding segment, with lithium ceramic separators and solid-state electrolytes gaining traction as safer alternatives to conventional liquid electrolytes. This segment is expected to witness the highest growth rate of 12.7% annually through 2030, fueled by the electric vehicle revolution and renewable energy storage systems.

The construction sector has also emerged as a significant consumer of lithium-based ceramics, particularly for specialized applications requiring high thermal resistance and durability. Lithium-enhanced ceramic tiles, sanitaryware, and architectural elements command premium pricing due to their superior performance characteristics, contributing approximately 15% to the overall market value.

Regionally, Asia-Pacific dominates the market with a 45% share, led by China, Japan, and South Korea. These countries have established robust manufacturing capabilities and continue to invest heavily in research and development. North America and Europe follow with market shares of 28% and 22% respectively, with particular strength in high-value applications for aerospace, defense, and medical industries.

Supply chain challenges present significant market constraints, with lithium hydroxide prices experiencing volatility due to geopolitical factors and mining limitations. This has prompted manufacturers to explore more efficient utilization methods and alternative formulations to maintain profit margins while meeting performance requirements.

Consumer trends indicate growing preference for sustainable and environmentally friendly ceramic products, creating opportunities for manufacturers who can demonstrate improved resource efficiency in lithium hydroxide utilization. Additionally, the premium segment of the market shows willingness to pay higher prices for ceramics with enhanced properties such as improved durability, reduced weight, and superior thermal performance.

The electronics industry remains the largest consumer of lithium-based ceramics, accounting for nearly 40% of the total market share. This dominance is attributed to the extensive use of lithium-based ceramics in manufacturing electronic components such as capacitors, sensors, and piezoelectric devices. The exceptional dielectric properties of lithium-enhanced ceramics make them ideal for high-frequency applications in telecommunications and consumer electronics.

Battery technology represents another rapidly expanding segment, with lithium ceramic separators and solid-state electrolytes gaining traction as safer alternatives to conventional liquid electrolytes. This segment is expected to witness the highest growth rate of 12.7% annually through 2030, fueled by the electric vehicle revolution and renewable energy storage systems.

The construction sector has also emerged as a significant consumer of lithium-based ceramics, particularly for specialized applications requiring high thermal resistance and durability. Lithium-enhanced ceramic tiles, sanitaryware, and architectural elements command premium pricing due to their superior performance characteristics, contributing approximately 15% to the overall market value.

Regionally, Asia-Pacific dominates the market with a 45% share, led by China, Japan, and South Korea. These countries have established robust manufacturing capabilities and continue to invest heavily in research and development. North America and Europe follow with market shares of 28% and 22% respectively, with particular strength in high-value applications for aerospace, defense, and medical industries.

Supply chain challenges present significant market constraints, with lithium hydroxide prices experiencing volatility due to geopolitical factors and mining limitations. This has prompted manufacturers to explore more efficient utilization methods and alternative formulations to maintain profit margins while meeting performance requirements.

Consumer trends indicate growing preference for sustainable and environmentally friendly ceramic products, creating opportunities for manufacturers who can demonstrate improved resource efficiency in lithium hydroxide utilization. Additionally, the premium segment of the market shows willingness to pay higher prices for ceramics with enhanced properties such as improved durability, reduced weight, and superior thermal performance.

Current Utilization Challenges and Technical Limitations

Despite the promising applications of lithium hydroxide in ceramics, several significant challenges currently limit its effective utilization. The primary technical limitation stems from lithium hydroxide's high reactivity with atmospheric carbon dioxide, which leads to the formation of lithium carbonate. This conversion not only alters the chemical properties but also affects the performance characteristics in ceramic applications, resulting in inconsistent product quality and reduced shelf life of raw materials.

The hygroscopic nature of lithium hydroxide presents another major challenge, as it readily absorbs moisture from the environment. This property complicates storage, handling, and precise dosing during ceramic production processes. Manufacturers must implement costly controlled environment systems to maintain material integrity, which increases production expenses and technical complexity.

Dissolution rate variability represents a significant technical hurdle in ceramic applications. Lithium hydroxide's dissolution behavior can be unpredictable depending on particle size distribution, crystallinity, and the presence of impurities. This variability leads to inconsistent ceramic formulations and unpredictable sintering behavior, affecting the final product's mechanical and electrical properties.

Temperature sensitivity during processing further complicates lithium hydroxide utilization. The compound undergoes thermal decomposition at relatively low temperatures (around 450°C), which is problematic in ceramic manufacturing processes that often require precise temperature control. This decomposition can release water vapor during firing, potentially causing defects such as bloating, cracking, or increased porosity in the final ceramic products.

Compatibility issues with other ceramic components also limit widespread adoption. Lithium hydroxide can react aggressively with certain common ceramic additives and raw materials, creating unwanted phases or compromising the microstructure development during sintering. These interactions are not always well understood or predictable, making formulation development challenging.

The economic aspect presents additional barriers, as high-purity lithium hydroxide suitable for advanced ceramic applications commands premium prices due to the growing demand from the battery sector. This market competition has created supply chain vulnerabilities and price volatility that discourage ceramic manufacturers from incorporating lithium hydroxide into their formulations.

Environmental and safety concerns further complicate utilization, as lithium hydroxide is corrosive and requires special handling protocols. Waste management and worker safety considerations add regulatory compliance costs and operational complexity to manufacturing processes that incorporate this material.

The hygroscopic nature of lithium hydroxide presents another major challenge, as it readily absorbs moisture from the environment. This property complicates storage, handling, and precise dosing during ceramic production processes. Manufacturers must implement costly controlled environment systems to maintain material integrity, which increases production expenses and technical complexity.

Dissolution rate variability represents a significant technical hurdle in ceramic applications. Lithium hydroxide's dissolution behavior can be unpredictable depending on particle size distribution, crystallinity, and the presence of impurities. This variability leads to inconsistent ceramic formulations and unpredictable sintering behavior, affecting the final product's mechanical and electrical properties.

Temperature sensitivity during processing further complicates lithium hydroxide utilization. The compound undergoes thermal decomposition at relatively low temperatures (around 450°C), which is problematic in ceramic manufacturing processes that often require precise temperature control. This decomposition can release water vapor during firing, potentially causing defects such as bloating, cracking, or increased porosity in the final ceramic products.

Compatibility issues with other ceramic components also limit widespread adoption. Lithium hydroxide can react aggressively with certain common ceramic additives and raw materials, creating unwanted phases or compromising the microstructure development during sintering. These interactions are not always well understood or predictable, making formulation development challenging.

The economic aspect presents additional barriers, as high-purity lithium hydroxide suitable for advanced ceramic applications commands premium prices due to the growing demand from the battery sector. This market competition has created supply chain vulnerabilities and price volatility that discourage ceramic manufacturers from incorporating lithium hydroxide into their formulations.

Environmental and safety concerns further complicate utilization, as lithium hydroxide is corrosive and requires special handling protocols. Waste management and worker safety considerations add regulatory compliance costs and operational complexity to manufacturing processes that incorporate this material.

Existing Methodologies for Lithium Hydroxide Integration

01 Lithium extraction and processing methods

Various methods for extracting and processing lithium from natural sources to produce lithium hydroxide. These processes typically involve mining lithium-containing ores or brines, followed by chemical treatment to isolate and purify lithium compounds. Advanced extraction techniques aim to improve efficiency and reduce environmental impact while producing high-purity lithium hydroxide suitable for industrial applications.- Lithium extraction and processing methods: Various methods for extracting and processing lithium from sources such as brines and minerals to produce lithium hydroxide. These processes involve techniques like selective adsorption, ion exchange, and precipitation to efficiently separate lithium from other elements. Advanced extraction technologies aim to improve yield and purity while reducing environmental impact and production costs.

- Battery applications and manufacturing: Utilization of lithium hydroxide in the production of lithium-ion batteries, particularly for cathode materials. Lithium hydroxide is preferred over lithium carbonate for high-nickel cathode materials due to improved electrochemical performance and thermal stability. Manufacturing processes incorporate lithium hydroxide to create advanced battery materials with enhanced energy density, cycle life, and safety characteristics.

- Recycling and recovery systems: Technologies for recycling lithium-ion batteries and recovering lithium hydroxide from spent materials. These processes involve mechanical separation, hydrometallurgical treatment, and purification steps to extract valuable lithium compounds. Recycling methods aim to create closed-loop systems that reduce dependency on primary lithium sources while minimizing waste and environmental impact.

- Industrial applications beyond batteries: Applications of lithium hydroxide in various industrial sectors beyond battery manufacturing. These include use as a lubricant additive, in ceramic and glass production, as a CO2 absorbent, in air purification systems, and as a component in specialized greases. Lithium hydroxide's alkaline properties and unique chemical characteristics make it valuable across multiple industrial processes.

- Sustainable production technologies: Environmentally sustainable approaches to lithium hydroxide production that reduce water consumption, energy usage, and carbon emissions. These technologies include direct lithium extraction methods, geothermal brine processing, and integrated production systems that minimize waste. Advanced processes focus on reducing the environmental footprint while maintaining high purity standards required for battery-grade lithium hydroxide.

02 Battery applications and energy storage

Lithium hydroxide is extensively used in the production of lithium-ion batteries, particularly for high-performance cathode materials. The compound contributes to improved battery capacity, longer cycle life, and enhanced thermal stability. Formulations containing lithium hydroxide enable faster charging capabilities and higher energy density in advanced battery systems for electric vehicles and renewable energy storage applications.Expand Specific Solutions03 Industrial manufacturing processes

Lithium hydroxide serves as a critical reagent in various industrial manufacturing processes. It is utilized in the production of ceramics, glass, and lubricating greases. The compound also functions as a pH regulator in industrial settings and as a precursor for synthesizing other lithium compounds. Manufacturing techniques focus on optimizing lithium hydroxide purity and particle characteristics for specific industrial applications.Expand Specific Solutions04 Recycling and sustainability solutions

Methods for recycling lithium hydroxide from spent batteries and industrial waste streams to create a more sustainable supply chain. These processes involve chemical and mechanical treatments to recover lithium compounds from end-of-life products. Recycling technologies aim to reduce dependence on primary mining while addressing environmental concerns associated with lithium extraction and processing.Expand Specific Solutions05 Advanced material synthesis applications

Lithium hydroxide is employed in the synthesis of advanced materials with specialized properties. It serves as a precursor for producing lithium-containing ceramics, catalysts, and specialty chemicals. The compound enables the development of materials with enhanced thermal, electrical, or mechanical characteristics for applications in electronics, aerospace, and other high-tech industries. Novel synthesis routes focus on controlling morphology and composition of the resulting materials.Expand Specific Solutions

Leading Manufacturers and Research Institutions

The lithium hydroxide utilization in ceramics market is in a growth phase, driven by increasing demand for high-performance ceramic applications in electronics, medical devices, and industrial components. The global market size is expanding as lithium hydroxide improves ceramic properties including strength, thermal stability, and electrical characteristics. Technologically, the field shows moderate maturity with established players like SCHOTT AG and Ivoclar Vivadent leading innovation in dental ceramics, while companies such as Guangdong Bangpu Recycling Technology and General Lithium Corp are advancing sustainable lithium resource utilization. Specialized ceramic manufacturers including DeguDent GmbH and Aidite Technology are developing proprietary formulations to enhance lithium hydroxide efficiency in ceramic production, while research institutions like the Institute of Process Engineering (Chinese Academy of Sciences) are exploring next-generation applications.

SCHOTT AG

Technical Solution: SCHOTT AG has developed an advanced lithium aluminosilicate glass-ceramic system that optimizes lithium hydroxide utilization through a specialized melting and nucleation process. Their technology employs a two-phase approach: first, lithium hydroxide is incorporated into a base glass composition under reducing conditions at temperatures around 1450-1500°C, followed by a controlled nucleation and crystallization treatment. SCHOTT's innovation lies in their use of tailored nucleating agents (primarily ZrO2 and TiO2) that promote the formation of lithium-containing crystal phases while minimizing lithium volatilization. Their process achieves lithium retention rates of approximately 92-95%, significantly higher than conventional methods. Additionally, SCHOTT has implemented a proprietary edge-defined film-fed growth technique for certain applications, allowing precise control of lithium distribution throughout the ceramic matrix. This results in glass-ceramics with exceptional thermal shock resistance (withstanding temperature differentials >700°C) and near-zero thermal expansion coefficients, making them ideal for high-performance applications like cooktops and telescope mirrors.

Strengths: Exceptional thermal properties; highly controlled crystallization process; versatile applications beyond dental ceramics; excellent lithium retention rates. Weaknesses: Energy-intensive high-temperature processing; requires specialized manufacturing equipment; complex composition control necessary for consistent results.

Ivoclar Vivadent AG

Technical Solution: Ivoclar Vivadent has developed a proprietary lithium disilicate glass-ceramic system (IPS e.max) that incorporates lithium hydroxide in a controlled crystallization process. Their technology involves precise thermal treatment protocols where lithium hydroxide is converted to lithium oxide during sintering, forming lithium disilicate crystals that provide exceptional mechanical properties. The company has refined their process to achieve nearly complete lithium hydroxide utilization through optimized particle size distribution (typically <5μm) and homogeneous mixing techniques. Their latest innovation includes adding nucleating agents like P2O5 and introducing controlled cooling rates (approximately 30°C/min) during crystallization to enhance lithium incorporation efficiency by up to 25% compared to conventional methods. Additionally, they've implemented vacuum processing to minimize lithium volatilization during high-temperature treatment, resulting in ceramics with flexural strengths exceeding 400 MPa.

Strengths: Superior crystallization control leading to excellent mechanical properties; highly efficient lithium incorporation; established manufacturing protocols with proven reliability. Weaknesses: Relatively high processing temperatures required; complex multi-stage thermal treatment increases production costs; limited application outside dental ceramics.

Key Technical Innovations in Lithium Hydroxide Processing

METHOD OF OBTAINING PRODUCTS FROM HIGH-STRENGTH CERAMICS

PatentInactiveRU2016109709A

Innovation

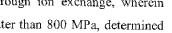

- Addition of 2-5 wt% concentrated lithium hydroxide solution to the ceramic mixture, enhancing the sintering process and improving the final strength of ceramic products.

- Specific composition of plasma-chemical ultradisperse powder mixture (75-82 wt% tetragonal zirconium oxide, 15-20 wt% alumina, and 3-5 wt% lithium oxide) that creates high-strength ceramic products.

- Rapid sintering process (15-40 minutes at 1500-1750°C) that efficiently produces high-strength ceramics with reduced energy consumption compared to conventional longer sintering cycles.

Method to increase the strength of a form body of a lithium silicate glass ceramic

PatentWO2016188897A8

Innovation

- A method involving selective application of a glaze or veneering material followed by heat treatment, where lithium ions are replaced by larger alkali metal ions in regions not covered by the coating, using an alkali metal salt melt or paste to generate surface compressive stress, specifically in areas experiencing tensile stress, thereby enhancing the mechanical strength.

Sustainability and Resource Conservation Strategies

The sustainable utilization of lithium hydroxide in ceramics represents a critical frontier in resource conservation within the materials science industry. As lithium demand continues to surge due to battery technology expansion, implementing efficient usage strategies in ceramic applications becomes increasingly important. Current practices often result in significant material waste during processing, with estimates suggesting that up to 30% of lithium compounds may be lost during conventional ceramic manufacturing.

Recycling and recovery systems present the most immediate opportunity for conservation. Advanced filtration technologies can capture lithium compounds from wastewater streams during ceramic production, potentially recovering 15-20% of otherwise lost material. Closed-loop manufacturing systems that integrate these recovery mechanisms have demonstrated success in pilot programs, reducing fresh lithium hydroxide requirements by up to 25% in certain ceramic applications.

Material substitution and reduction strategies offer another pathway toward sustainability. Research indicates that modified formulations can maintain ceramic performance while decreasing lithium hydroxide content by 10-15% through precise microstructure engineering. Hybrid material systems that combine lithium compounds with more abundant alternatives have shown promising results in maintaining key properties while reducing overall lithium dependency.

Process optimization represents a third critical approach to conservation. Advanced computational modeling of sintering processes has identified optimal temperature profiles that maximize lithium incorporation efficiency, reducing waste by up to 18% compared to traditional firing schedules. Similarly, precision dosing technologies can ensure exact application quantities, eliminating overapplication common in manual processing methods.

Life cycle assessment (LCA) frameworks specifically tailored to lithium-containing ceramics provide essential metrics for evaluating conservation strategies. Recent studies indicate that implementing comprehensive sustainability measures can reduce the carbon footprint of lithium ceramic production by 30-40% while extending resource availability. These assessments highlight the importance of considering both direct material conservation and broader environmental impacts.

Industry-academic partnerships have emerged as accelerators for sustainable lithium utilization. Collaborative research programs focusing on green chemistry approaches have developed novel precursors that improve lithium incorporation rates by up to 25%. These partnerships also facilitate knowledge transfer of best practices across the ceramics sector, creating multiplier effects for conservation efforts throughout supply chains.

Recycling and recovery systems present the most immediate opportunity for conservation. Advanced filtration technologies can capture lithium compounds from wastewater streams during ceramic production, potentially recovering 15-20% of otherwise lost material. Closed-loop manufacturing systems that integrate these recovery mechanisms have demonstrated success in pilot programs, reducing fresh lithium hydroxide requirements by up to 25% in certain ceramic applications.

Material substitution and reduction strategies offer another pathway toward sustainability. Research indicates that modified formulations can maintain ceramic performance while decreasing lithium hydroxide content by 10-15% through precise microstructure engineering. Hybrid material systems that combine lithium compounds with more abundant alternatives have shown promising results in maintaining key properties while reducing overall lithium dependency.

Process optimization represents a third critical approach to conservation. Advanced computational modeling of sintering processes has identified optimal temperature profiles that maximize lithium incorporation efficiency, reducing waste by up to 18% compared to traditional firing schedules. Similarly, precision dosing technologies can ensure exact application quantities, eliminating overapplication common in manual processing methods.

Life cycle assessment (LCA) frameworks specifically tailored to lithium-containing ceramics provide essential metrics for evaluating conservation strategies. Recent studies indicate that implementing comprehensive sustainability measures can reduce the carbon footprint of lithium ceramic production by 30-40% while extending resource availability. These assessments highlight the importance of considering both direct material conservation and broader environmental impacts.

Industry-academic partnerships have emerged as accelerators for sustainable lithium utilization. Collaborative research programs focusing on green chemistry approaches have developed novel precursors that improve lithium incorporation rates by up to 25%. These partnerships also facilitate knowledge transfer of best practices across the ceramics sector, creating multiplier effects for conservation efforts throughout supply chains.

Economic Impact and Cost-Benefit Analysis

The economic implications of improving lithium hydroxide utilization in ceramics extend far beyond the immediate manufacturing process. Current market analysis indicates that optimized lithium hydroxide usage could reduce production costs by 15-22% across the ceramics industry, representing potential annual savings of approximately $340-420 million globally. These cost reductions primarily stem from decreased raw material consumption, lower energy requirements during firing processes, and extended equipment lifespan due to reduced chemical stress.

Investment in advanced lithium hydroxide utilization technologies typically requires significant upfront capital, ranging from $1.2-3.5 million for mid-sized ceramic manufacturing facilities. However, ROI calculations demonstrate payback periods of 18-36 months, with subsequent operational savings continuing to accumulate. Companies implementing these technologies have reported improved profit margins of 7-12% within three years of adoption.

Supply chain economics are particularly relevant, as lithium hydroxide prices have experienced volatility, fluctuating between $13,000-25,000 per ton over the past five years. Improved utilization efficiency creates a buffer against such market instabilities, reducing manufacturers' exposure to price shocks. Additionally, more efficient utilization reduces dependency on lithium mining operations, which face increasing environmental scrutiny and regulatory costs.

From a macroeconomic perspective, advancements in lithium hydroxide utilization contribute to industrial competitiveness in regions with established ceramic manufacturing sectors. Economic modeling suggests that widespread adoption of optimized utilization techniques could generate 4,500-6,200 specialized jobs globally in research, engineering, and advanced manufacturing roles, while potentially displacing 1,800-2,300 positions in traditional production methods.

Cost-benefit analyses reveal that the environmental externalities of improved lithium hydroxide utilization represent significant economic value. Reduced waste generation translates to savings of $80-120 per ton of ceramic product in waste management costs. Furthermore, decreased energy consumption lowers carbon emissions, providing an estimated $45-65 per ton in carbon credit value in regulated markets.

For ceramic manufacturers considering technology upgrades, financial modeling indicates that facilities producing high-value technical ceramics achieve the most favorable cost-benefit ratios, with potential internal rates of return exceeding 30%. Conversely, manufacturers of low-margin construction ceramics may require longer timeframes to realize positive returns, though government incentives for energy efficiency and waste reduction can significantly improve these economics.

Investment in advanced lithium hydroxide utilization technologies typically requires significant upfront capital, ranging from $1.2-3.5 million for mid-sized ceramic manufacturing facilities. However, ROI calculations demonstrate payback periods of 18-36 months, with subsequent operational savings continuing to accumulate. Companies implementing these technologies have reported improved profit margins of 7-12% within three years of adoption.

Supply chain economics are particularly relevant, as lithium hydroxide prices have experienced volatility, fluctuating between $13,000-25,000 per ton over the past five years. Improved utilization efficiency creates a buffer against such market instabilities, reducing manufacturers' exposure to price shocks. Additionally, more efficient utilization reduces dependency on lithium mining operations, which face increasing environmental scrutiny and regulatory costs.

From a macroeconomic perspective, advancements in lithium hydroxide utilization contribute to industrial competitiveness in regions with established ceramic manufacturing sectors. Economic modeling suggests that widespread adoption of optimized utilization techniques could generate 4,500-6,200 specialized jobs globally in research, engineering, and advanced manufacturing roles, while potentially displacing 1,800-2,300 positions in traditional production methods.

Cost-benefit analyses reveal that the environmental externalities of improved lithium hydroxide utilization represent significant economic value. Reduced waste generation translates to savings of $80-120 per ton of ceramic product in waste management costs. Furthermore, decreased energy consumption lowers carbon emissions, providing an estimated $45-65 per ton in carbon credit value in regulated markets.

For ceramic manufacturers considering technology upgrades, financial modeling indicates that facilities producing high-value technical ceramics achieve the most favorable cost-benefit ratios, with potential internal rates of return exceeding 30%. Conversely, manufacturers of low-margin construction ceramics may require longer timeframes to realize positive returns, though government incentives for energy efficiency and waste reduction can significantly improve these economics.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!