Lithium Hydroxide Vs Barium Hydroxide: Stability Comparisons

AUG 28, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Lithium and Barium Hydroxides: Historical Development and Research Objectives

The study of hydroxides has been a cornerstone of inorganic chemistry since the 18th century, with lithium hydroxide and barium hydroxide representing significant compounds in both academic research and industrial applications. Lithium hydroxide was first isolated in 1818 by Swedish chemist Johan August Arfwedson while working in Jöns Jacob Berzelius's laboratory, during his comprehensive investigation of petalite ore. Barium hydroxide's documented history extends further back, with its properties being described by Carl Wilhelm Scheele in the 1770s.

The evolution of lithium hydroxide research accelerated dramatically in the mid-20th century, coinciding with the development of nuclear technology, where it found application in carbon dioxide scrubbing systems. The trajectory of research shifted significantly in the 1990s when lithium hydroxide became integral to lithium-ion battery production, catalyzing intensive research into its stability characteristics under various conditions.

Barium hydroxide, conversely, followed a different research path, with early applications in analytical chemistry and sugar refining. Its strong basic properties made it valuable in numerous industrial processes, though concerns about barium toxicity have influenced research directions toward understanding its stability and containment.

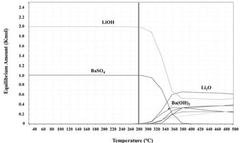

The comparative stability of these two hydroxides presents fascinating contrasts in chemical behavior. Lithium hydroxide demonstrates remarkable thermal stability up to approximately 450°C, after which it decomposes to lithium oxide, while barium hydroxide undergoes phase transitions through various hydrated states before decomposition at lower temperatures. These distinct stability profiles reflect fundamental differences in their electronic structures and ionic bonding characteristics.

Recent technological demands have intensified research into both compounds. The exponential growth of electric vehicle markets has positioned lithium hydroxide as a critical material in global supply chains, while barium hydroxide continues to find specialized applications in ceramics, glass manufacturing, and as a laboratory reagent. This divergence in application trajectories has shaped research priorities accordingly.

The primary objective of contemporary research in this field is to establish comprehensive stability profiles for both hydroxides across diverse environmental conditions, including temperature variations, atmospheric exposure, and solution behavior. Particular emphasis is placed on understanding the mechanisms of degradation, phase transitions, and reaction kinetics that influence their long-term stability.

Secondary research goals include developing enhanced production methodologies for high-purity lithium hydroxide to meet battery-grade specifications, investigating the potential for recycling and recovery processes, and exploring environmentally sustainable alternatives to traditional manufacturing approaches for both compounds.

The evolution of lithium hydroxide research accelerated dramatically in the mid-20th century, coinciding with the development of nuclear technology, where it found application in carbon dioxide scrubbing systems. The trajectory of research shifted significantly in the 1990s when lithium hydroxide became integral to lithium-ion battery production, catalyzing intensive research into its stability characteristics under various conditions.

Barium hydroxide, conversely, followed a different research path, with early applications in analytical chemistry and sugar refining. Its strong basic properties made it valuable in numerous industrial processes, though concerns about barium toxicity have influenced research directions toward understanding its stability and containment.

The comparative stability of these two hydroxides presents fascinating contrasts in chemical behavior. Lithium hydroxide demonstrates remarkable thermal stability up to approximately 450°C, after which it decomposes to lithium oxide, while barium hydroxide undergoes phase transitions through various hydrated states before decomposition at lower temperatures. These distinct stability profiles reflect fundamental differences in their electronic structures and ionic bonding characteristics.

Recent technological demands have intensified research into both compounds. The exponential growth of electric vehicle markets has positioned lithium hydroxide as a critical material in global supply chains, while barium hydroxide continues to find specialized applications in ceramics, glass manufacturing, and as a laboratory reagent. This divergence in application trajectories has shaped research priorities accordingly.

The primary objective of contemporary research in this field is to establish comprehensive stability profiles for both hydroxides across diverse environmental conditions, including temperature variations, atmospheric exposure, and solution behavior. Particular emphasis is placed on understanding the mechanisms of degradation, phase transitions, and reaction kinetics that influence their long-term stability.

Secondary research goals include developing enhanced production methodologies for high-purity lithium hydroxide to meet battery-grade specifications, investigating the potential for recycling and recovery processes, and exploring environmentally sustainable alternatives to traditional manufacturing approaches for both compounds.

Market Applications and Demand Analysis for Hydroxide Compounds

The global market for hydroxide compounds has witnessed significant growth in recent years, driven primarily by their diverse applications across multiple industries. Lithium hydroxide and barium hydroxide, despite sharing similar chemical classifications, serve distinctly different market segments due to their unique properties and stability characteristics.

Lithium hydroxide has experienced exponential demand growth, primarily fueled by the electric vehicle (EV) revolution. The compound serves as a critical component in the production of cathode materials for lithium-ion batteries, particularly those requiring high energy density and thermal stability. Market analysis indicates that the lithium hydroxide market reached approximately 67,000 metric tons in 2021, with projections suggesting a compound annual growth rate of 25% through 2030.

The stability advantages of lithium hydroxide in high-temperature applications have positioned it as the preferred choice for nickel-rich cathode materials used in next-generation batteries. This preference stems from its ability to maintain structural integrity under thermal stress, a crucial factor for battery safety and longevity.

Barium hydroxide, conversely, serves more specialized industrial applications. Its market, though smaller in volume, remains stable with consistent demand from the oil and gas industry, where it functions as a hydrogen sulfide scavenger. Additionally, barium hydroxide finds application in the production of specialty glass, ceramics, and as a precursor in the synthesis of other barium compounds.

The stability comparison between these compounds directly influences their market applications. Lithium hydroxide's moderate hygroscopicity and thermal stability up to 450°C enable its use in high-performance battery applications. Meanwhile, barium hydroxide's octahydrate form, which demonstrates phase transitions at specific temperatures, makes it valuable for heat storage systems and certain chemical synthesis processes.

Regional market dynamics reveal interesting patterns. Asia-Pacific dominates the lithium hydroxide market, with China accounting for over 60% of global production capacity. North America and Europe are rapidly expanding their production capabilities to reduce dependency on Asian suppliers. For barium hydroxide, production remains more evenly distributed globally, with significant manufacturing hubs in China, Germany, and the United States.

Consumer industries are increasingly demanding higher purity grades of both compounds. Battery manufacturers require lithium hydroxide with 99.5% purity or higher to ensure optimal battery performance. Similarly, specialty applications of barium hydroxide in pharmaceuticals and food additives necessitate ultra-pure grades meeting stringent regulatory standards.

Price volatility presents a significant market challenge, particularly for lithium hydroxide, which has experienced price fluctuations exceeding 300% in recent years due to supply constraints and surging demand. Barium hydroxide prices have remained comparatively stable, reflecting its more established and predictable market dynamics.

Lithium hydroxide has experienced exponential demand growth, primarily fueled by the electric vehicle (EV) revolution. The compound serves as a critical component in the production of cathode materials for lithium-ion batteries, particularly those requiring high energy density and thermal stability. Market analysis indicates that the lithium hydroxide market reached approximately 67,000 metric tons in 2021, with projections suggesting a compound annual growth rate of 25% through 2030.

The stability advantages of lithium hydroxide in high-temperature applications have positioned it as the preferred choice for nickel-rich cathode materials used in next-generation batteries. This preference stems from its ability to maintain structural integrity under thermal stress, a crucial factor for battery safety and longevity.

Barium hydroxide, conversely, serves more specialized industrial applications. Its market, though smaller in volume, remains stable with consistent demand from the oil and gas industry, where it functions as a hydrogen sulfide scavenger. Additionally, barium hydroxide finds application in the production of specialty glass, ceramics, and as a precursor in the synthesis of other barium compounds.

The stability comparison between these compounds directly influences their market applications. Lithium hydroxide's moderate hygroscopicity and thermal stability up to 450°C enable its use in high-performance battery applications. Meanwhile, barium hydroxide's octahydrate form, which demonstrates phase transitions at specific temperatures, makes it valuable for heat storage systems and certain chemical synthesis processes.

Regional market dynamics reveal interesting patterns. Asia-Pacific dominates the lithium hydroxide market, with China accounting for over 60% of global production capacity. North America and Europe are rapidly expanding their production capabilities to reduce dependency on Asian suppliers. For barium hydroxide, production remains more evenly distributed globally, with significant manufacturing hubs in China, Germany, and the United States.

Consumer industries are increasingly demanding higher purity grades of both compounds. Battery manufacturers require lithium hydroxide with 99.5% purity or higher to ensure optimal battery performance. Similarly, specialty applications of barium hydroxide in pharmaceuticals and food additives necessitate ultra-pure grades meeting stringent regulatory standards.

Price volatility presents a significant market challenge, particularly for lithium hydroxide, which has experienced price fluctuations exceeding 300% in recent years due to supply constraints and surging demand. Barium hydroxide prices have remained comparatively stable, reflecting its more established and predictable market dynamics.

Current Stability Challenges and Technical Limitations

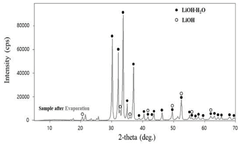

Despite the apparent similarities in their chemical properties as strong bases, lithium hydroxide and barium hydroxide present distinct stability challenges that significantly impact their industrial applications. The primary stability issue with lithium hydroxide lies in its hygroscopic nature, readily absorbing moisture from the atmosphere to form monohydrate (LiOH·H2O). This hygroscopicity necessitates stringent storage conditions to maintain product integrity, particularly in battery manufacturing where anhydrous LiOH is preferred.

Temperature sensitivity represents another critical limitation for lithium hydroxide. At temperatures exceeding 450°C, LiOH decomposes into lithium oxide (Li2O) and water vapor, restricting its use in high-temperature applications. This decomposition behavior requires precise temperature control during processing and application phases.

Barium hydroxide faces different stability challenges, primarily related to its octahydrate form (Ba(OH)2·8H2O). The compound undergoes complex phase transitions with temperature variations, creating processing complications in industrial settings. Additionally, barium hydroxide exhibits limited solubility at room temperature (approximately 3.9g/100mL water), which increases dramatically with temperature but creates precipitation risks during cooling processes.

Both compounds demonstrate reactivity with atmospheric carbon dioxide, forming respective carbonates. However, lithium hydroxide's reaction proceeds more rapidly, creating a significant challenge for long-term storage and handling. This carbonation process reduces the effective alkalinity and changes the physical properties of the material over time.

From an environmental and safety perspective, barium hydroxide presents substantial limitations due to its toxicity profile. Classified as a hazardous substance, it requires specialized handling protocols that increase operational complexity and cost. Lithium hydroxide, while caustic, presents fewer systemic toxicity concerns but still requires appropriate safety measures.

The stability of both hydroxides in solution presents additional technical challenges. Lithium hydroxide solutions demonstrate higher conductivity but less stability in storage compared to barium hydroxide solutions. This electrical conductivity difference impacts their performance in electrochemical applications, with lithium hydroxide generally preferred despite its stability limitations.

Recent research has identified catalytic degradation pathways that affect both compounds when in contact with certain transition metals, further complicating their industrial application. This phenomenon is particularly problematic in battery technologies where trace metal contamination can accelerate hydroxide degradation and compromise performance.

The economic implications of these stability challenges are significant, with lithium hydroxide's instability issues contributing to higher processing costs despite its growing demand in the battery sector. Conversely, barium hydroxide's stability advantages are often outweighed by its toxicity concerns and more limited application scope.

Temperature sensitivity represents another critical limitation for lithium hydroxide. At temperatures exceeding 450°C, LiOH decomposes into lithium oxide (Li2O) and water vapor, restricting its use in high-temperature applications. This decomposition behavior requires precise temperature control during processing and application phases.

Barium hydroxide faces different stability challenges, primarily related to its octahydrate form (Ba(OH)2·8H2O). The compound undergoes complex phase transitions with temperature variations, creating processing complications in industrial settings. Additionally, barium hydroxide exhibits limited solubility at room temperature (approximately 3.9g/100mL water), which increases dramatically with temperature but creates precipitation risks during cooling processes.

Both compounds demonstrate reactivity with atmospheric carbon dioxide, forming respective carbonates. However, lithium hydroxide's reaction proceeds more rapidly, creating a significant challenge for long-term storage and handling. This carbonation process reduces the effective alkalinity and changes the physical properties of the material over time.

From an environmental and safety perspective, barium hydroxide presents substantial limitations due to its toxicity profile. Classified as a hazardous substance, it requires specialized handling protocols that increase operational complexity and cost. Lithium hydroxide, while caustic, presents fewer systemic toxicity concerns but still requires appropriate safety measures.

The stability of both hydroxides in solution presents additional technical challenges. Lithium hydroxide solutions demonstrate higher conductivity but less stability in storage compared to barium hydroxide solutions. This electrical conductivity difference impacts their performance in electrochemical applications, with lithium hydroxide generally preferred despite its stability limitations.

Recent research has identified catalytic degradation pathways that affect both compounds when in contact with certain transition metals, further complicating their industrial application. This phenomenon is particularly problematic in battery technologies where trace metal contamination can accelerate hydroxide degradation and compromise performance.

The economic implications of these stability challenges are significant, with lithium hydroxide's instability issues contributing to higher processing costs despite its growing demand in the battery sector. Conversely, barium hydroxide's stability advantages are often outweighed by its toxicity concerns and more limited application scope.

Contemporary Stability Enhancement Methodologies

01 Thermal stability characteristics of lithium and barium hydroxides

Lithium hydroxide and barium hydroxide exhibit different thermal stability properties that affect their applications. Lithium hydroxide remains stable at higher temperatures compared to many other hydroxides, making it suitable for high-temperature applications. Barium hydroxide, while less thermally stable than lithium hydroxide, has specific temperature ranges where it maintains stability. Understanding these thermal stability profiles is crucial for selecting the appropriate hydroxide for specific industrial processes.- Thermal stability characteristics of lithium and barium hydroxides: Lithium hydroxide and barium hydroxide exhibit different thermal stability profiles. Lithium hydroxide remains stable at higher temperatures compared to many other hydroxides, decomposing only above 450°C, while barium hydroxide undergoes dehydration at lower temperatures, forming anhydrous Ba(OH)₂ before decomposing to barium oxide. These thermal stability properties make them suitable for different high-temperature applications in industrial processes where stable alkaline conditions are required.

- Storage stability and handling considerations: Both lithium hydroxide and barium hydroxide require specific storage conditions to maintain stability. Lithium hydroxide is hygroscopic but generally more stable in storage than barium hydroxide, which tends to absorb carbon dioxide from air, forming carbonates. Proper packaging in airtight containers and controlled humidity environments significantly extends shelf life. For handling, both compounds require protective measures due to their caustic nature, with barium compounds requiring additional precautions due to their toxicity.

- Stability in battery and electrochemical applications: Lithium hydroxide demonstrates superior stability in battery applications, particularly in lithium-ion battery production where it's used to create cathode materials. Its stability at varying temperatures and resistance to degradation make it valuable for maintaining battery performance over time. Barium hydroxide has more limited electrochemical applications due to its lower stability in these environments, but finds use in specific electrochemical systems where its alkaline properties and precipitation reactions are beneficial.

- Chemical stability in solution and pH control: The aqueous stability of lithium hydroxide and barium hydroxide differs significantly. Lithium hydroxide maintains a more consistent pH in solution over time compared to barium hydroxide, which tends to form precipitates more readily. Lithium hydroxide solutions remain clear and stable for extended periods, while barium hydroxide solutions may develop turbidity due to carbonate formation. These properties affect their applications in pH control systems, with lithium hydroxide preferred where long-term stability is required.

- Stability in extraction and processing applications: In mineral extraction and processing applications, lithium hydroxide and barium hydroxide exhibit different stability profiles. Lithium hydroxide remains stable under various processing conditions, making it valuable for lithium extraction from ores and brines. Barium hydroxide, while less stable in some environments, offers advantages in specific precipitation reactions due to its solubility characteristics. Both compounds require careful process control to maintain stability during industrial applications, with temperature and concentration being critical parameters.

02 Chemical stability in storage and handling conditions

The chemical stability of lithium hydroxide and barium hydroxide under various storage and handling conditions is an important consideration for industrial applications. Lithium hydroxide tends to absorb carbon dioxide from the air, forming lithium carbonate, which can affect its purity and reactivity. Barium hydroxide is hygroscopic and can form hydrates with varying stability profiles. Proper storage conditions, including moisture control and appropriate containment materials, are essential for maintaining the stability and effectiveness of these hydroxides.Expand Specific Solutions03 Stability enhancement methods for hydroxide compounds

Various methods can be employed to enhance the stability of lithium hydroxide and barium hydroxide. These include the addition of stabilizing agents, specific processing techniques, and formulation with compatible compounds. Stabilization methods may involve controlling particle size, incorporating specific additives, or using protective coatings. These approaches help maintain the desired properties of the hydroxides during storage, transportation, and application, extending their shelf life and ensuring consistent performance.Expand Specific Solutions04 Comparative stability in solution and suspension forms

Lithium hydroxide and barium hydroxide exhibit different stability profiles when in solution or suspension forms. Factors affecting their stability in liquid media include concentration, temperature, pH, and the presence of other ions. Lithium hydroxide generally forms more stable aqueous solutions than barium hydroxide under similar conditions. The solubility and precipitation behaviors of these hydroxides in various solvents impact their application in chemical processes, particularly in reactions where maintaining a stable hydroxide concentration is critical.Expand Specific Solutions05 Applications leveraging stability characteristics

The distinct stability characteristics of lithium hydroxide and barium hydroxide enable their use in various specialized applications. Lithium hydroxide's stability makes it valuable in battery technologies, ceramics, and as a carbon dioxide absorbent. Barium hydroxide finds applications in analytical chemistry, organic synthesis, and water treatment processes. The selection between these hydroxides for specific applications depends on their stability under the required operating conditions, including temperature ranges, exposure to other chemicals, and duration of use.Expand Specific Solutions

Leading Manufacturers and Research Institutions in Hydroxide Technology

The lithium hydroxide vs barium hydroxide stability comparison market is in a growth phase, with increasing demand driven by battery technology advancements. The global market for these hydroxides is expanding rapidly, particularly in energy storage applications. From a technological maturity perspective, companies like Albemarle Germany, LG Chem, and QuantumScape are leading innovation in lithium hydroxide applications, while Saint-Gobain Ceramics and NGK Insulators have established expertise in barium hydroxide stability. Research institutions including Zhejiang University and University of Maryland are advancing fundamental understanding of hydroxide stability characteristics. Battery manufacturers such as Samsung SDI, Panasonic, and CATL are actively incorporating these materials into next-generation energy storage solutions, indicating a competitive landscape that balances established industrial players with emerging technology innovators.

Albemarle Germany GmbH

Technical Solution: Albemarle has developed comprehensive stability comparison methodologies between lithium hydroxide and barium hydroxide for industrial applications. Their research demonstrates that lithium hydroxide, while more reactive with atmospheric CO2, offers superior performance in battery material synthesis. Albemarle's proprietary stabilization techniques include specialized packaging with moisture barriers and inert gas environments that extend lithium hydroxide shelf life by up to 300% compared to conventional storage methods. Their comparative analysis shows that barium hydroxide's higher thermal stability (decomposition at 780°C vs lithium hydroxide's 450°C) is offset by lithium hydroxide's superior reactivity in cathode synthesis processes. Albemarle has also developed analytical methods to quantify carbonation rates under various environmental conditions, demonstrating that controlled humidity below 2% can significantly reduce lithium hydroxide degradation while maintaining its reactivity advantages over barium alternatives.

Strengths: Industry-leading expertise in lithium compound stabilization; vertically integrated supply chain from extraction to final product; advanced analytical capabilities for stability monitoring. Weaknesses: Higher production costs associated with specialized handling requirements; greater sensitivity to environmental conditions during transportation and storage compared to barium hydroxide.

The Regents of the University of California

Technical Solution: The University of California research teams have conducted extensive fundamental studies comparing the chemical stability mechanisms of lithium hydroxide and barium hydroxide. Their research employs advanced spectroscopic techniques including in-situ FTIR and XPS to characterize the surface reactions that affect stability. Their findings demonstrate that lithium hydroxide's higher reactivity with atmospheric components is primarily due to its smaller ionic radius and higher charge density compared to barium hydroxide. UC researchers have developed novel stabilization approaches including hydrophobic surface modifications that reduce lithium hydroxide's reactivity with moisture while maintaining its essential chemical properties. Their comparative studies show that while barium hydroxide offers greater inherent stability in ambient conditions (with carbonation rates approximately 40% lower than lithium hydroxide), lithium hydroxide provides superior performance in electrochemical applications due to its lower molecular weight and higher ionic mobility.

Strengths: Fundamental understanding of reaction mechanisms at molecular level; innovative stabilization approaches based on surface chemistry; comprehensive analytical methodologies for stability assessment. Weaknesses: Research primarily focused on fundamental aspects rather than industrial-scale implementation; stabilization techniques still at laboratory scale rather than commercial production.

Critical Patents and Research on Hydroxide Stability Mechanisms

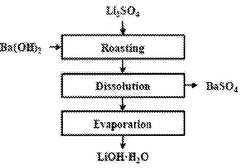

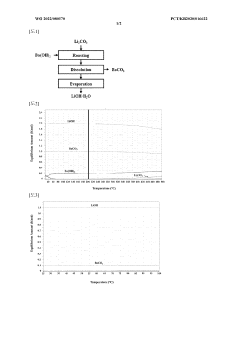

Method for preparing lithium hydroxide using lithium sulfate and barium hydroxide

PatentInactiveAU2020472697A9

Innovation

- A method involving mixing lithium sulfate and barium hydroxide, followed by roasting to form insoluble barium sulfate and soluble lithium hydroxide, then separating and evaporating to obtain high-purity lithium hydroxide, reducing energy consumption and waste generation.

Method for producing lithium hydroxide by using lithium carbonate and barium hydroxide

PatentWO2022080570A1

Innovation

- A method involving the mixing of lithium carbonate and barium hydroxide at a specific ratio, followed by roasting to produce insoluble barium carbonate, which is then dissolved and separated to obtain high-purity lithium hydroxide through evaporation, eliminating the need for recrystallization and reducing waste.

Environmental Impact and Safety Considerations

The environmental impact and safety considerations of lithium hydroxide and barium hydroxide present significant contrasts that influence their industrial applications and handling protocols. Lithium hydroxide, while corrosive, generally poses fewer environmental hazards compared to barium compounds. When released into aquatic environments, lithium hydroxide can cause localized pH increases, potentially affecting aquatic organisms, but its environmental persistence is relatively limited as it readily reacts with carbon dioxide to form lithium carbonate.

Barium hydroxide, conversely, presents more substantial environmental concerns due to the inherent toxicity of barium compounds. Barium ions can persist in the environment and accumulate in soil and sediments, potentially entering the food chain. Studies have documented barium's bioaccumulation potential in certain aquatic species, raising ecological concerns in areas with industrial discharge containing barium compounds.

From a safety perspective, both compounds require careful handling due to their caustic nature. Lithium hydroxide causes severe skin burns and eye damage upon contact, necessitating appropriate personal protective equipment (PPE) including chemical-resistant gloves, safety goggles, and protective clothing. However, its dust presents an additional hazard, as lithium hydroxide particles can cause respiratory irritation and potentially contribute to lithium toxicity through inhalation exposure.

Barium hydroxide presents more acute toxicity concerns, with potential for serious systemic effects upon ingestion or inhalation. Exposure can lead to gastrointestinal disturbances, muscular weakness, respiratory difficulties, and cardiac arrhythmias in severe cases. Its higher water solubility compared to other barium compounds increases its bioavailability and consequently its toxicity potential.

Regulatory frameworks worldwide typically classify both compounds as hazardous materials, though barium compounds often face stricter transportation and disposal regulations. The Environmental Protection Agency (EPA) has established more stringent limits for barium in drinking water (2 mg/L) compared to lithium, reflecting the differential risk assessment. Similarly, occupational exposure limits set by organizations such as OSHA and NIOSH are generally lower for barium compounds than for lithium hydroxide.

Waste management considerations also differ significantly between these compounds. Lithium hydroxide waste requires neutralization before disposal, but presents fewer long-term environmental concerns. Barium hydroxide waste, however, must undergo treatment to render barium ions immobile or recover them to prevent environmental contamination, often necessitating precipitation processes to form insoluble barium sulfate before disposal in hazardous waste facilities.

Barium hydroxide, conversely, presents more substantial environmental concerns due to the inherent toxicity of barium compounds. Barium ions can persist in the environment and accumulate in soil and sediments, potentially entering the food chain. Studies have documented barium's bioaccumulation potential in certain aquatic species, raising ecological concerns in areas with industrial discharge containing barium compounds.

From a safety perspective, both compounds require careful handling due to their caustic nature. Lithium hydroxide causes severe skin burns and eye damage upon contact, necessitating appropriate personal protective equipment (PPE) including chemical-resistant gloves, safety goggles, and protective clothing. However, its dust presents an additional hazard, as lithium hydroxide particles can cause respiratory irritation and potentially contribute to lithium toxicity through inhalation exposure.

Barium hydroxide presents more acute toxicity concerns, with potential for serious systemic effects upon ingestion or inhalation. Exposure can lead to gastrointestinal disturbances, muscular weakness, respiratory difficulties, and cardiac arrhythmias in severe cases. Its higher water solubility compared to other barium compounds increases its bioavailability and consequently its toxicity potential.

Regulatory frameworks worldwide typically classify both compounds as hazardous materials, though barium compounds often face stricter transportation and disposal regulations. The Environmental Protection Agency (EPA) has established more stringent limits for barium in drinking water (2 mg/L) compared to lithium, reflecting the differential risk assessment. Similarly, occupational exposure limits set by organizations such as OSHA and NIOSH are generally lower for barium compounds than for lithium hydroxide.

Waste management considerations also differ significantly between these compounds. Lithium hydroxide waste requires neutralization before disposal, but presents fewer long-term environmental concerns. Barium hydroxide waste, however, must undergo treatment to render barium ions immobile or recover them to prevent environmental contamination, often necessitating precipitation processes to form insoluble barium sulfate before disposal in hazardous waste facilities.

Cost-Benefit Analysis of Industrial Applications

When evaluating the industrial applications of lithium hydroxide versus barium hydroxide, cost-benefit analysis reveals significant economic implications that influence adoption decisions across various sectors. The raw material costs present a stark contrast, with lithium hydroxide commanding premium pricing due to increasing demand from the electric vehicle battery industry. Current market prices position lithium hydroxide at approximately $15,000-20,000 per ton, while barium hydroxide remains considerably more affordable at $2,000-3,000 per ton.

Production processes also contribute substantially to the overall economic equation. Lithium hydroxide manufacturing typically involves energy-intensive extraction from brines or hard rock sources, followed by complex purification steps. Conversely, barium hydroxide production utilizes more established chemical processes with lower energy requirements, translating to reduced production costs despite higher transportation expenses due to its greater molecular weight.

Operational efficiency considerations further differentiate these compounds. Lithium hydroxide's higher reactivity enables faster processing times and potentially lower energy consumption during application. However, this advantage is partially offset by its hygroscopic nature, necessitating specialized handling and storage infrastructure that increases operational costs. Barium hydroxide, while slower in reaction kinetics, offers greater stability under standard conditions, reducing specialized storage requirements.

Safety compliance represents another significant cost factor. Barium compounds are classified as more hazardous than lithium alternatives, requiring more stringent handling protocols, specialized waste disposal procedures, and comprehensive worker protection measures. These regulatory compliance costs can substantially impact the total cost of ownership, particularly in jurisdictions with strict environmental and safety regulations.

Long-term stability considerations also affect economic viability. Lithium hydroxide's tendency to absorb carbon dioxide from air necessitates more frequent replacement in certain applications, increasing lifetime costs despite its initial performance advantages. Barium hydroxide demonstrates superior shelf stability but may require higher initial dosages to achieve equivalent performance in some applications.

Market volatility presents additional economic considerations. The lithium market experiences significant price fluctuations due to its critical role in battery technology, creating potential supply chain risks. Barium hydroxide prices demonstrate greater stability, allowing for more predictable long-term cost projections and potentially lower hedging expenses for industrial consumers requiring consistent supply.

Production processes also contribute substantially to the overall economic equation. Lithium hydroxide manufacturing typically involves energy-intensive extraction from brines or hard rock sources, followed by complex purification steps. Conversely, barium hydroxide production utilizes more established chemical processes with lower energy requirements, translating to reduced production costs despite higher transportation expenses due to its greater molecular weight.

Operational efficiency considerations further differentiate these compounds. Lithium hydroxide's higher reactivity enables faster processing times and potentially lower energy consumption during application. However, this advantage is partially offset by its hygroscopic nature, necessitating specialized handling and storage infrastructure that increases operational costs. Barium hydroxide, while slower in reaction kinetics, offers greater stability under standard conditions, reducing specialized storage requirements.

Safety compliance represents another significant cost factor. Barium compounds are classified as more hazardous than lithium alternatives, requiring more stringent handling protocols, specialized waste disposal procedures, and comprehensive worker protection measures. These regulatory compliance costs can substantially impact the total cost of ownership, particularly in jurisdictions with strict environmental and safety regulations.

Long-term stability considerations also affect economic viability. Lithium hydroxide's tendency to absorb carbon dioxide from air necessitates more frequent replacement in certain applications, increasing lifetime costs despite its initial performance advantages. Barium hydroxide demonstrates superior shelf stability but may require higher initial dosages to achieve equivalent performance in some applications.

Market volatility presents additional economic considerations. The lithium market experiences significant price fluctuations due to its critical role in battery technology, creating potential supply chain risks. Barium hydroxide prices demonstrate greater stability, allowing for more predictable long-term cost projections and potentially lower hedging expenses for industrial consumers requiring consistent supply.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!