Optimizing Lithium Hydroxide's Use In Industrial Cleaners

AUG 28, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Lithium Hydroxide Industrial Cleaning Background & Objectives

Lithium hydroxide has emerged as a significant component in industrial cleaning formulations, with its history dating back to the mid-20th century when alkaline cleaners began replacing traditional soap-based products. The evolution of lithium hydroxide in cleaning applications has been marked by incremental improvements in formulation techniques and expanding application scenarios, particularly in heavy-duty industrial environments where conventional cleaning agents prove insufficient.

The industrial cleaning market has witnessed substantial transformation over recent decades, driven by increasingly stringent environmental regulations, workplace safety standards, and efficiency requirements. Lithium hydroxide, with its strong alkalinity and unique chemical properties, has positioned itself as a specialized solution for challenging cleaning tasks in manufacturing, automotive, aerospace, and energy sectors.

Current technical objectives for optimizing lithium hydroxide in industrial cleaners focus on several key areas. First, enhancing cleaning efficacy while reducing concentration requirements represents a primary goal, as this would improve cost-effectiveness and minimize environmental impact. Second, developing synergistic formulations that combine lithium hydroxide with complementary agents to achieve superior performance across diverse soil types and substrates remains a critical research direction.

Additionally, addressing the handling challenges associated with highly alkaline materials constitutes an important objective. This includes developing stabilized formulations, improved delivery systems, and safer handling protocols to mitigate workplace hazards while maintaining cleaning performance. The development of controlled-release mechanisms represents another frontier, potentially allowing for sustained cleaning action with reduced chemical usage.

From a sustainability perspective, research aims to optimize lithium hydroxide recovery and recycling from spent cleaning solutions, addressing both economic and environmental concerns associated with lithium resource utilization. This aligns with broader industry trends toward circular economy principles and responsible resource management.

The technological trajectory suggests potential for significant advancements in lithium hydroxide-based cleaning systems, particularly through integration with emerging technologies such as ultrasonic cleaning enhancement, electrolyzed water systems, and precision application methods. These developments could substantially expand the application scope while improving performance metrics.

This technical research aims to comprehensively evaluate current lithium hydroxide utilization in industrial cleaning applications, identify optimization opportunities, and establish a roadmap for next-generation formulations that balance enhanced performance with improved safety and sustainability profiles.

The industrial cleaning market has witnessed substantial transformation over recent decades, driven by increasingly stringent environmental regulations, workplace safety standards, and efficiency requirements. Lithium hydroxide, with its strong alkalinity and unique chemical properties, has positioned itself as a specialized solution for challenging cleaning tasks in manufacturing, automotive, aerospace, and energy sectors.

Current technical objectives for optimizing lithium hydroxide in industrial cleaners focus on several key areas. First, enhancing cleaning efficacy while reducing concentration requirements represents a primary goal, as this would improve cost-effectiveness and minimize environmental impact. Second, developing synergistic formulations that combine lithium hydroxide with complementary agents to achieve superior performance across diverse soil types and substrates remains a critical research direction.

Additionally, addressing the handling challenges associated with highly alkaline materials constitutes an important objective. This includes developing stabilized formulations, improved delivery systems, and safer handling protocols to mitigate workplace hazards while maintaining cleaning performance. The development of controlled-release mechanisms represents another frontier, potentially allowing for sustained cleaning action with reduced chemical usage.

From a sustainability perspective, research aims to optimize lithium hydroxide recovery and recycling from spent cleaning solutions, addressing both economic and environmental concerns associated with lithium resource utilization. This aligns with broader industry trends toward circular economy principles and responsible resource management.

The technological trajectory suggests potential for significant advancements in lithium hydroxide-based cleaning systems, particularly through integration with emerging technologies such as ultrasonic cleaning enhancement, electrolyzed water systems, and precision application methods. These developments could substantially expand the application scope while improving performance metrics.

This technical research aims to comprehensively evaluate current lithium hydroxide utilization in industrial cleaning applications, identify optimization opportunities, and establish a roadmap for next-generation formulations that balance enhanced performance with improved safety and sustainability profiles.

Market Analysis for Lithium Hydroxide-Based Cleaners

The global market for industrial cleaners has been experiencing significant growth, with lithium hydroxide-based formulations gaining particular attention due to their superior cleaning efficacy and environmental advantages. The current market size for industrial cleaning products is estimated at $50 billion, with specialty chemical cleaners representing approximately 15% of this segment. Lithium hydroxide-based cleaners currently occupy a niche but rapidly expanding position within this specialty segment.

Market research indicates that demand for lithium hydroxide in cleaning applications has grown at a compound annual growth rate of 7.8% over the past five years, outpacing the broader industrial cleaner market's growth rate of 4.2%. This accelerated adoption is primarily driven by stringent environmental regulations in North America and Europe that favor less toxic and more biodegradable cleaning solutions.

The industrial sectors showing the highest demand for lithium hydroxide-based cleaners include automotive manufacturing, food processing, healthcare facilities, and electronics production. These industries particularly value the non-caustic nature of lithium hydroxide compared to traditional sodium or potassium hydroxide formulations, while still maintaining strong degreasing and sanitizing properties.

Regional analysis reveals that North America currently leads consumption with 38% market share, followed by Europe at 31%, Asia-Pacific at 24%, and the rest of the world accounting for 7%. However, the fastest growth is being observed in the Asia-Pacific region, where industrial expansion coupled with increasing environmental awareness is creating favorable market conditions.

Price sensitivity varies significantly by sector, with healthcare and electronics manufacturers demonstrating willingness to pay premium prices for high-performance, residue-free cleaning solutions. Conversely, general manufacturing and automotive sectors remain more cost-conscious, creating distinct market segments that require different pricing strategies.

Consumer behavior analysis shows a clear trend toward products that offer multiple benefits beyond basic cleaning, including reduced water consumption, lower energy requirements for heating cleaning solutions, and decreased waste treatment costs. Lithium hydroxide-based formulations excel in these areas, providing compelling total cost of ownership advantages despite higher initial product costs.

Market forecasts project continued strong growth for lithium hydroxide-based cleaners, with an anticipated CAGR of 9.3% over the next five years. This growth trajectory is expected to accelerate as manufacturing processes are optimized and economies of scale reduce production costs, making these advanced formulations more accessible to mid-market industrial users.

Market research indicates that demand for lithium hydroxide in cleaning applications has grown at a compound annual growth rate of 7.8% over the past five years, outpacing the broader industrial cleaner market's growth rate of 4.2%. This accelerated adoption is primarily driven by stringent environmental regulations in North America and Europe that favor less toxic and more biodegradable cleaning solutions.

The industrial sectors showing the highest demand for lithium hydroxide-based cleaners include automotive manufacturing, food processing, healthcare facilities, and electronics production. These industries particularly value the non-caustic nature of lithium hydroxide compared to traditional sodium or potassium hydroxide formulations, while still maintaining strong degreasing and sanitizing properties.

Regional analysis reveals that North America currently leads consumption with 38% market share, followed by Europe at 31%, Asia-Pacific at 24%, and the rest of the world accounting for 7%. However, the fastest growth is being observed in the Asia-Pacific region, where industrial expansion coupled with increasing environmental awareness is creating favorable market conditions.

Price sensitivity varies significantly by sector, with healthcare and electronics manufacturers demonstrating willingness to pay premium prices for high-performance, residue-free cleaning solutions. Conversely, general manufacturing and automotive sectors remain more cost-conscious, creating distinct market segments that require different pricing strategies.

Consumer behavior analysis shows a clear trend toward products that offer multiple benefits beyond basic cleaning, including reduced water consumption, lower energy requirements for heating cleaning solutions, and decreased waste treatment costs. Lithium hydroxide-based formulations excel in these areas, providing compelling total cost of ownership advantages despite higher initial product costs.

Market forecasts project continued strong growth for lithium hydroxide-based cleaners, with an anticipated CAGR of 9.3% over the next five years. This growth trajectory is expected to accelerate as manufacturing processes are optimized and economies of scale reduce production costs, making these advanced formulations more accessible to mid-market industrial users.

Technical Challenges in Lithium Hydroxide Formulations

Lithium hydroxide (LiOH) presents several significant technical challenges when formulated for industrial cleaning applications. The compound's high alkalinity (pH >12) creates stability issues in many formulations, particularly when combined with surfactants and other cleaning agents. This alkalinity, while beneficial for certain cleaning tasks, can cause rapid degradation of packaging materials and reduce shelf life of the final product. Manufacturers must carefully select compatible container materials such as high-density polyethylene or specific grades of stainless steel to prevent corrosion and leakage.

Temperature sensitivity represents another major formulation challenge. LiOH solutions demonstrate variable solubility across different temperature ranges, with crystallization occurring at lower temperatures and potential phase separation in complex formulations. This necessitates the addition of stabilizing agents and careful consideration of the intended operating temperature range for the final product.

The compound's hygroscopic nature further complicates formulation efforts. LiOH readily absorbs moisture from the atmosphere, leading to concentration variations and potential reactivity changes during storage. This property requires specialized handling during manufacturing, including controlled humidity environments and moisture-barrier packaging systems to maintain product consistency.

Compatibility with other cleaning agents presents additional technical hurdles. When combined with certain surfactants, LiOH can cause precipitation or reduced effectiveness. Similarly, interactions with chelating agents and builders must be carefully balanced to prevent unwanted side reactions or reduced cleaning performance. Formulation scientists must conduct extensive compatibility testing to identify synergistic combinations while avoiding antagonistic interactions.

Safety considerations significantly impact formulation approaches. LiOH's caustic nature requires careful handling during manufacturing and appropriate warning labels for end-users. Formulations must balance cleaning efficacy against safety risks, often necessitating the inclusion of buffering agents to moderate pH levels while maintaining cleaning performance.

Regulatory compliance adds another layer of complexity. Different regions have varying restrictions on lithium compounds in cleaning products, particularly for consumer applications. Formulations must be adapted to meet these regulatory requirements while maintaining consistent performance across global markets.

Cost optimization remains an ongoing challenge as lithium prices fluctuate significantly due to its increasing demand in battery applications. Formulators must develop strategies to minimize lithium hydroxide concentrations while maintaining cleaning efficacy, often through synergistic combinations with other alkaline agents or performance-enhancing additives.

Temperature sensitivity represents another major formulation challenge. LiOH solutions demonstrate variable solubility across different temperature ranges, with crystallization occurring at lower temperatures and potential phase separation in complex formulations. This necessitates the addition of stabilizing agents and careful consideration of the intended operating temperature range for the final product.

The compound's hygroscopic nature further complicates formulation efforts. LiOH readily absorbs moisture from the atmosphere, leading to concentration variations and potential reactivity changes during storage. This property requires specialized handling during manufacturing, including controlled humidity environments and moisture-barrier packaging systems to maintain product consistency.

Compatibility with other cleaning agents presents additional technical hurdles. When combined with certain surfactants, LiOH can cause precipitation or reduced effectiveness. Similarly, interactions with chelating agents and builders must be carefully balanced to prevent unwanted side reactions or reduced cleaning performance. Formulation scientists must conduct extensive compatibility testing to identify synergistic combinations while avoiding antagonistic interactions.

Safety considerations significantly impact formulation approaches. LiOH's caustic nature requires careful handling during manufacturing and appropriate warning labels for end-users. Formulations must balance cleaning efficacy against safety risks, often necessitating the inclusion of buffering agents to moderate pH levels while maintaining cleaning performance.

Regulatory compliance adds another layer of complexity. Different regions have varying restrictions on lithium compounds in cleaning products, particularly for consumer applications. Formulations must be adapted to meet these regulatory requirements while maintaining consistent performance across global markets.

Cost optimization remains an ongoing challenge as lithium prices fluctuate significantly due to its increasing demand in battery applications. Formulators must develop strategies to minimize lithium hydroxide concentrations while maintaining cleaning efficacy, often through synergistic combinations with other alkaline agents or performance-enhancing additives.

Current Lithium Hydroxide Cleaning Formulations

01 Lithium extraction and processing methods

Various methods for extracting and processing lithium hydroxide from natural sources such as brines and minerals. These processes typically involve concentration, purification, and conversion steps to produce high-purity lithium hydroxide suitable for industrial applications. Advanced techniques may include selective adsorption, membrane filtration, and crystallization to improve yield and purity.- Lithium hydroxide production methods: Various methods for producing lithium hydroxide from different lithium sources have been developed. These processes typically involve chemical reactions to convert lithium compounds into lithium hydroxide with high purity. The production methods may include precipitation techniques, electrolysis, or direct conversion from lithium carbonate. These processes aim to improve yield, reduce costs, and minimize environmental impact in the production of lithium hydroxide for various industrial applications.

- Lithium extraction from brine and minerals: Techniques for extracting lithium from natural sources such as brines and lithium-containing minerals have been developed. These methods involve separation processes to isolate lithium compounds from other elements present in the source material. The extraction processes may include adsorption, ion exchange, solvent extraction, or selective precipitation. These techniques aim to efficiently recover lithium from various sources for subsequent conversion to lithium hydroxide.

- Lithium hydroxide applications in battery technology: Lithium hydroxide is widely used in the production of cathode materials for lithium-ion batteries. It serves as a key precursor in the synthesis of lithium metal oxides that form the cathode active materials. The use of high-purity lithium hydroxide can improve battery performance characteristics such as energy density, cycle life, and thermal stability. Various formulations and processing methods have been developed to optimize the use of lithium hydroxide in advanced battery materials.

- Purification and processing of lithium hydroxide: Methods for purifying and processing lithium hydroxide to meet specific quality requirements have been developed. These processes aim to remove impurities and achieve the desired physical properties such as particle size and morphology. Purification techniques may include recrystallization, filtration, ion exchange, and other separation methods. The processing of lithium hydroxide is critical for applications requiring high-purity materials, particularly in the battery and pharmaceutical industries.

- Sustainable and eco-friendly lithium hydroxide production: Environmentally friendly approaches to lithium hydroxide production have been developed to reduce the ecological footprint of lithium processing. These methods focus on minimizing water usage, reducing chemical waste, and lowering energy consumption. Some approaches include closed-loop systems, recycling of process materials, and the use of renewable energy sources. These sustainable production methods aim to address environmental concerns associated with traditional lithium hydroxide manufacturing while maintaining product quality and economic viability.

02 Battery applications of lithium hydroxide

Lithium hydroxide is a critical component in the manufacturing of cathode materials for lithium-ion batteries, particularly for high-performance and high-energy density applications. It serves as a precursor for lithium metal oxides used in cathodes, contributing to improved battery capacity, cycle life, and thermal stability. The high purity of lithium hydroxide is essential for ensuring optimal battery performance.Expand Specific Solutions03 Sustainable lithium production technologies

Environmentally friendly approaches to lithium hydroxide production that minimize water usage, reduce carbon footprint, and decrease chemical waste. These technologies include direct lithium extraction from geothermal brines, recycling from spent batteries, and closed-loop processing systems. Such methods aim to address environmental concerns associated with traditional lithium mining and processing while meeting growing demand for lithium compounds.Expand Specific Solutions04 Purification and quality control of lithium hydroxide

Techniques for purifying lithium hydroxide to meet stringent quality requirements for high-tech applications. These include multi-stage crystallization, ion exchange processes, and advanced analytical methods for impurity detection. Quality control parameters typically focus on metal impurities, moisture content, and particle size distribution, which are critical for ensuring consistent performance in end applications.Expand Specific Solutions05 Industrial applications beyond batteries

Lithium hydroxide has diverse applications beyond battery manufacturing, including use in ceramics, lubricating greases, air purification systems, and as a catalyst in organic synthesis. It serves as a pH regulator in industrial processes and contributes to the production of specialty glasses and enamels. The compound's alkaline properties and lithium content make it valuable across multiple industries where its unique chemical properties provide specific advantages.Expand Specific Solutions

Key Industry Players in Industrial Cleaning Solutions

The lithium hydroxide industrial cleaner market is in a growth phase, characterized by increasing demand for eco-friendly cleaning solutions across various industries. The market size is expanding steadily, driven by stringent environmental regulations and growing awareness of sustainable cleaning practices. Technologically, the field shows moderate maturity with ongoing innovations focused on optimization and efficiency. Key players like BASF Corp., Ecolab GmbH, and Shell demonstrate established capabilities in industrial chemical applications, while companies such as Sumitomo Metal Mining, Toda Kogyo, and LG Chem bring expertise from their lithium battery operations. Emerging specialists like Lilac Solutions are introducing novel extraction technologies that could potentially transform lithium hydroxide production economics. The competitive landscape features traditional chemical manufacturers alongside lithium resource companies seeking downstream integration opportunities.

Taian Havay Chemicals Co. Ltd.

Technical Solution: Taian Havay has developed "LithiClean Eco," an innovative system for optimizing lithium hydroxide in industrial cleaning applications. Their approach centers on a novel formulation that combines lithium hydroxide with proprietary organic acid complexes, creating a synergistic cleaning effect while reducing overall lithium hydroxide requirements by approximately 30%. The technology incorporates phase-change materials that absorb and release heat during the cleaning cycle, maintaining optimal solution temperature with minimal energy input. Taian Havay's system features specialized sequestering agents that prevent lithium hydroxide from reacting with dissolved minerals, significantly extending solution life in hard water conditions. Their process also includes an innovative precipitation and recovery method that selectively removes contaminants while preserving lithium hydroxide, allowing for solution regeneration rather than disposal. The company has documented case studies showing lithium hydroxide usage reductions of 40-50% across various industrial applications while maintaining equivalent or superior cleaning performance compared to traditional methods.

Strengths: Significantly lower operating costs through reduced chemical consumption and energy usage; minimal environmental impact due to reduced waste generation; compatible with existing cleaning equipment with minor modifications; effective across a wide range of soil types and industrial applications. Weaknesses: Requires initial process optimization for specific applications; performance may be affected by extreme pH conditions; limited global technical support network compared to larger competitors.

BASF Corp.

Technical Solution: BASF has pioneered a comprehensive lithium hydroxide optimization platform called "LithClean" for industrial cleaning applications. Their approach centers on a multi-component system that leverages lithium hydroxide's inherent alkalinity while addressing its traditional limitations. The technology incorporates specially formulated polymeric dispersants that maintain lithium hydroxide in solution at higher concentrations (up to 5%) without precipitation issues. BASF's formulation includes proprietary buffer systems that provide controlled pH release, extending cleaning effectiveness while using approximately 25% less lithium hydroxide than conventional formulations. Their system also features advanced corrosion inhibitors specifically designed to work with lithium hydroxide's chemistry, providing protection for sensitive metal surfaces while maintaining cleaning power. BASF has additionally developed a closed-loop recovery process that captures and purifies spent lithium hydroxide from cleaning solutions, achieving recovery rates of 80-85%.

Strengths: Exceptional cleaning performance across diverse industrial applications; reduced environmental impact through efficient lithium usage and recovery; compatibility with existing cleaning equipment requiring minimal retrofitting; comprehensive technical support network. Weaknesses: Premium pricing compared to conventional cleaners; requires precise dosing control systems; performance can be affected by extreme temperature conditions.

Critical Patents in Lithium Hydroxide Cleaning Applications

Method for producing high purity lithium hydroxide monohydrate

PatentPendingUS20240200206A1

Innovation

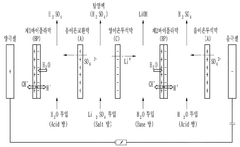

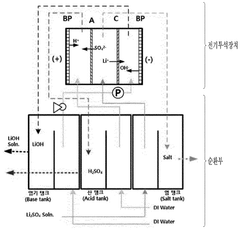

- The method involves membrane electrolysis of aqueous solutions of lithium sulfate or chloride, recycling sodium and potassium from the catholyte, using nickel-plated stainless steel cathodes, and employing specific cation-exchange membranes, along with chemical and ion exchange purification to produce high purity lithium hydroxide monohydrate, expanding the range of raw materials and coproducts while reducing waste and improving environmental performance.

Manufacturing method for lithium hydroxide

PatentWO2025071011A1

Innovation

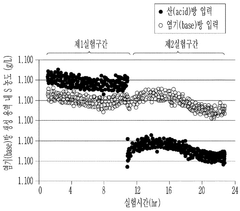

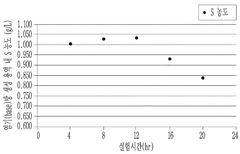

- The method involves using electrical dialysis with a bipolar membrane and anionic/cationic dialysis membranes to control impurities by adjusting the pressure in the acid and base rooms, thereby optimizing the hydroxide lithium solution's purity and crystallization rate.

Environmental Impact Assessment of Lithium Hydroxide Usage

The environmental impact of lithium hydroxide usage in industrial cleaners represents a critical consideration for sustainable manufacturing practices. When assessing the ecological footprint of lithium hydroxide-based cleaning formulations, several key environmental factors must be evaluated across the entire product lifecycle.

Water systems face significant potential impacts from lithium hydroxide discharge. With high aquatic toxicity at concentrations above 2.5 mg/L, lithium hydroxide can disrupt aquatic ecosystems by altering pH levels and directly affecting fish and invertebrate populations. Industrial facilities using lithium hydroxide cleaners must implement proper wastewater treatment protocols to neutralize alkalinity before discharge.

Air quality concerns primarily emerge during the manufacturing process rather than during application. The production of lithium hydroxide involves energy-intensive processes that generate greenhouse gas emissions, contributing to climate change impacts. However, compared to traditional caustic cleaning agents, lithium hydroxide typically requires lower concentrations for equivalent cleaning efficacy, potentially reducing overall manufacturing emissions.

Soil contamination risks arise primarily through improper disposal practices. Lithium compounds can accumulate in soil, potentially affecting soil chemistry and microbial communities. This necessitates proper handling protocols for spent cleaning solutions and residual materials containing lithium hydroxide.

Biodegradability assessments reveal that while lithium hydroxide itself is an inorganic compound that does not biodegrade, it can be neutralized through chemical reactions. The organic components typically combined with lithium hydroxide in cleaning formulations must be separately evaluated for biodegradability to determine the overall environmental persistence of the cleaning solution.

Resource consumption analysis indicates that lithium extraction for hydroxide production creates significant environmental burdens. Lithium mining operations, particularly in water-stressed regions, can deplete local water resources and disrupt ecosystems. As industrial demand for lithium continues to grow across multiple sectors, sustainable sourcing becomes increasingly important.

Comparative lifecycle assessments between lithium hydroxide cleaners and traditional alternatives demonstrate potential environmental advantages when lithium hydroxide is optimally formulated. These benefits include reduced packaging waste due to higher concentration efficacy, lower transportation emissions from reduced shipping volumes, and decreased energy requirements during application phases.

Regulatory compliance frameworks across different regions impose varying restrictions on lithium hydroxide usage and disposal. Companies must navigate these complex regulatory landscapes to ensure their cleaning products meet increasingly stringent environmental protection standards while maintaining cleaning performance.

Water systems face significant potential impacts from lithium hydroxide discharge. With high aquatic toxicity at concentrations above 2.5 mg/L, lithium hydroxide can disrupt aquatic ecosystems by altering pH levels and directly affecting fish and invertebrate populations. Industrial facilities using lithium hydroxide cleaners must implement proper wastewater treatment protocols to neutralize alkalinity before discharge.

Air quality concerns primarily emerge during the manufacturing process rather than during application. The production of lithium hydroxide involves energy-intensive processes that generate greenhouse gas emissions, contributing to climate change impacts. However, compared to traditional caustic cleaning agents, lithium hydroxide typically requires lower concentrations for equivalent cleaning efficacy, potentially reducing overall manufacturing emissions.

Soil contamination risks arise primarily through improper disposal practices. Lithium compounds can accumulate in soil, potentially affecting soil chemistry and microbial communities. This necessitates proper handling protocols for spent cleaning solutions and residual materials containing lithium hydroxide.

Biodegradability assessments reveal that while lithium hydroxide itself is an inorganic compound that does not biodegrade, it can be neutralized through chemical reactions. The organic components typically combined with lithium hydroxide in cleaning formulations must be separately evaluated for biodegradability to determine the overall environmental persistence of the cleaning solution.

Resource consumption analysis indicates that lithium extraction for hydroxide production creates significant environmental burdens. Lithium mining operations, particularly in water-stressed regions, can deplete local water resources and disrupt ecosystems. As industrial demand for lithium continues to grow across multiple sectors, sustainable sourcing becomes increasingly important.

Comparative lifecycle assessments between lithium hydroxide cleaners and traditional alternatives demonstrate potential environmental advantages when lithium hydroxide is optimally formulated. These benefits include reduced packaging waste due to higher concentration efficacy, lower transportation emissions from reduced shipping volumes, and decreased energy requirements during application phases.

Regulatory compliance frameworks across different regions impose varying restrictions on lithium hydroxide usage and disposal. Companies must navigate these complex regulatory landscapes to ensure their cleaning products meet increasingly stringent environmental protection standards while maintaining cleaning performance.

Supply Chain Considerations for Lithium Raw Materials

The global lithium supply chain presents significant challenges for industrial cleaner manufacturers seeking to optimize lithium hydroxide usage. Primary lithium sources are geographically concentrated, with over 70% of global reserves located in the "Lithium Triangle" (Argentina, Bolivia, and Chile), Australia, and China. This concentration creates inherent supply vulnerabilities, particularly as geopolitical tensions rise between major producing and consuming nations.

Extraction methodologies vary significantly by region, affecting both cost structures and environmental impacts. Hard rock mining predominates in Australia, while South American production relies heavily on brine evaporation techniques. These different extraction methods result in varying grades of lithium raw materials, which directly impacts purification requirements for industrial cleaner applications.

Transportation logistics represent another critical consideration, as lithium compounds are classified as hazardous materials requiring specialized handling protocols. The average lithium hydroxide shipment travels approximately 5,000 miles from extraction to manufacturing facilities, creating significant carbon footprint concerns and exposure to global shipping disruptions.

Price volatility has become increasingly problematic, with lithium hydroxide prices fluctuating by over 400% between 2020 and 2023. This volatility necessitates sophisticated procurement strategies, including long-term contracts, strategic stockpiling, and formula adaptability to accommodate varying lithium hydroxide grades and potential substitutes.

Regulatory frameworks governing lithium extraction and processing continue to evolve rapidly across jurisdictions. Environmental regulations particularly impact water usage in brine operations and tailings management in hard rock mining. Industrial cleaner manufacturers must maintain comprehensive compliance monitoring systems to navigate this complex regulatory landscape.

Sustainability considerations have gained prominence throughout the lithium supply chain. Water consumption remains a primary concern, with brine operations utilizing approximately 500,000 gallons per ton of lithium produced. Forward-thinking industrial cleaner manufacturers are increasingly implementing supplier certification programs that verify responsible mining practices and environmental stewardship.

Emerging recycling technologies present promising opportunities to reduce supply chain vulnerabilities. Current lithium recycling rates remain below 5%, but advanced hydrometallurgical processes are demonstrating recovery rates exceeding 90% from industrial waste streams. These circular economy approaches may significantly reduce dependency on primary lithium sources within the next decade.

Extraction methodologies vary significantly by region, affecting both cost structures and environmental impacts. Hard rock mining predominates in Australia, while South American production relies heavily on brine evaporation techniques. These different extraction methods result in varying grades of lithium raw materials, which directly impacts purification requirements for industrial cleaner applications.

Transportation logistics represent another critical consideration, as lithium compounds are classified as hazardous materials requiring specialized handling protocols. The average lithium hydroxide shipment travels approximately 5,000 miles from extraction to manufacturing facilities, creating significant carbon footprint concerns and exposure to global shipping disruptions.

Price volatility has become increasingly problematic, with lithium hydroxide prices fluctuating by over 400% between 2020 and 2023. This volatility necessitates sophisticated procurement strategies, including long-term contracts, strategic stockpiling, and formula adaptability to accommodate varying lithium hydroxide grades and potential substitutes.

Regulatory frameworks governing lithium extraction and processing continue to evolve rapidly across jurisdictions. Environmental regulations particularly impact water usage in brine operations and tailings management in hard rock mining. Industrial cleaner manufacturers must maintain comprehensive compliance monitoring systems to navigate this complex regulatory landscape.

Sustainability considerations have gained prominence throughout the lithium supply chain. Water consumption remains a primary concern, with brine operations utilizing approximately 500,000 gallons per ton of lithium produced. Forward-thinking industrial cleaner manufacturers are increasingly implementing supplier certification programs that verify responsible mining practices and environmental stewardship.

Emerging recycling technologies present promising opportunities to reduce supply chain vulnerabilities. Current lithium recycling rates remain below 5%, but advanced hydrometallurgical processes are demonstrating recovery rates exceeding 90% from industrial waste streams. These circular economy approaches may significantly reduce dependency on primary lithium sources within the next decade.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!