How To Validate Lithium Hydroxide's Role In Industrial Lubricants

AUG 28, 202510 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Lithium Hydroxide in Lubricants: Background and Objectives

Lithium hydroxide has been a cornerstone component in industrial lubricants since the mid-20th century, with its application evolving significantly through technological advancements. Initially utilized primarily in simple grease formulations, lithium hydroxide has transformed into a critical element in high-performance lubricants across multiple industries. The evolution of this technology has been driven by increasing demands for lubricants that can withstand extreme conditions while maintaining stability and performance characteristics.

The historical trajectory of lithium-based lubricants began in the 1940s when lithium stearate greases were first developed as alternatives to sodium and calcium-based products. These early formulations demonstrated superior water resistance and temperature stability, establishing lithium as a preferred base for industrial lubricants. By the 1960s, complex lithium greases emerged, incorporating additional fatty acids to enhance performance parameters.

Recent technological trends indicate a shift toward more sophisticated lithium hydroxide applications in lubricants, particularly in response to more demanding operational environments in modern machinery. The integration of nanotechnology and advanced chemical engineering has enabled the development of lithium-based lubricants with enhanced load-bearing capacity, extended service life, and improved resistance to oxidation and thermal degradation.

The primary technical objective in validating lithium hydroxide's role in industrial lubricants centers on establishing quantifiable performance metrics that demonstrate its superiority over alternative compounds. This includes developing standardized testing protocols that accurately measure critical parameters such as dropping point, mechanical stability, water washout resistance, and extreme pressure performance under various operational conditions.

Additionally, there is growing interest in understanding the molecular interactions between lithium hydroxide and other lubricant components, particularly additives that enhance specific performance characteristics. This fundamental knowledge is essential for optimizing formulations and predicting long-term behavior in diverse applications.

Environmental considerations have also become increasingly important in lubricant technology development. Current research aims to validate lithium hydroxide's environmental profile throughout its lifecycle, from production to disposal, addressing concerns about resource sustainability and ecological impact. This aligns with broader industry trends toward greener chemistry and reduced environmental footprints.

The validation of lithium hydroxide in next-generation lubricants also encompasses compatibility with emerging materials and technologies, particularly in electric vehicles, renewable energy systems, and advanced manufacturing processes. These applications present unique challenges that require innovative approaches to lubricant formulation and performance validation.

The historical trajectory of lithium-based lubricants began in the 1940s when lithium stearate greases were first developed as alternatives to sodium and calcium-based products. These early formulations demonstrated superior water resistance and temperature stability, establishing lithium as a preferred base for industrial lubricants. By the 1960s, complex lithium greases emerged, incorporating additional fatty acids to enhance performance parameters.

Recent technological trends indicate a shift toward more sophisticated lithium hydroxide applications in lubricants, particularly in response to more demanding operational environments in modern machinery. The integration of nanotechnology and advanced chemical engineering has enabled the development of lithium-based lubricants with enhanced load-bearing capacity, extended service life, and improved resistance to oxidation and thermal degradation.

The primary technical objective in validating lithium hydroxide's role in industrial lubricants centers on establishing quantifiable performance metrics that demonstrate its superiority over alternative compounds. This includes developing standardized testing protocols that accurately measure critical parameters such as dropping point, mechanical stability, water washout resistance, and extreme pressure performance under various operational conditions.

Additionally, there is growing interest in understanding the molecular interactions between lithium hydroxide and other lubricant components, particularly additives that enhance specific performance characteristics. This fundamental knowledge is essential for optimizing formulations and predicting long-term behavior in diverse applications.

Environmental considerations have also become increasingly important in lubricant technology development. Current research aims to validate lithium hydroxide's environmental profile throughout its lifecycle, from production to disposal, addressing concerns about resource sustainability and ecological impact. This aligns with broader industry trends toward greener chemistry and reduced environmental footprints.

The validation of lithium hydroxide in next-generation lubricants also encompasses compatibility with emerging materials and technologies, particularly in electric vehicles, renewable energy systems, and advanced manufacturing processes. These applications present unique challenges that require innovative approaches to lubricant formulation and performance validation.

Market Analysis of Industrial Lubricant Additives

The industrial lubricant additives market has experienced significant growth over the past decade, reaching approximately $16.5 billion in 2022 with projections to exceed $20 billion by 2027. This growth is primarily driven by increasing industrialization in emerging economies, rising demand for high-performance lubricants, and stringent environmental regulations promoting eco-friendly formulations.

Lithium-based additives, particularly those derived from lithium hydroxide, represent a substantial segment within this market, accounting for roughly 18% of the total industrial lubricant additives market. These additives are valued for their exceptional performance characteristics, including high temperature stability, water resistance, and mechanical stability in extreme pressure conditions.

The automotive and manufacturing sectors remain the largest consumers of lithium-based lubricant additives, collectively representing over 60% of market demand. However, emerging applications in renewable energy equipment maintenance, particularly wind turbines, are showing the highest growth rates at approximately 12% annually.

Regional analysis reveals that Asia-Pacific dominates the market with a 42% share, followed by North America (28%) and Europe (22%). China and India are experiencing the most rapid growth due to expanding industrial bases and increasing automotive production. The Middle East and Africa regions, while currently smaller markets, are showing promising growth potential due to their developing industrial sectors.

Market segmentation by product type shows that lithium complex greases hold the largest market share among lithium-based lubricant products at 45%, followed by lithium 12-hydroxystearate greases at 30%. The remaining market is divided among various specialty formulations designed for specific industrial applications.

Pricing trends indicate moderate volatility, with lithium hydroxide prices influencing the cost structure of downstream lubricant products. The recent surge in lithium demand for battery applications has created supply constraints, resulting in price increases of 15-20% for lithium-based lubricant additives over the past two years.

Customer preference analysis reveals a growing demand for multi-functional additives that can simultaneously improve several performance parameters. End-users increasingly prioritize additives that extend equipment life, reduce maintenance frequency, and comply with environmental regulations, creating opportunities for premium lithium-based formulations that can deliver these benefits.

Distribution channels are evolving, with direct sales to OEMs representing 55% of the market, while distribution through specialized industrial suppliers accounts for 35%. The remaining 10% is increasingly shifting toward e-commerce platforms, particularly for standardized products and replacement orders.

Lithium-based additives, particularly those derived from lithium hydroxide, represent a substantial segment within this market, accounting for roughly 18% of the total industrial lubricant additives market. These additives are valued for their exceptional performance characteristics, including high temperature stability, water resistance, and mechanical stability in extreme pressure conditions.

The automotive and manufacturing sectors remain the largest consumers of lithium-based lubricant additives, collectively representing over 60% of market demand. However, emerging applications in renewable energy equipment maintenance, particularly wind turbines, are showing the highest growth rates at approximately 12% annually.

Regional analysis reveals that Asia-Pacific dominates the market with a 42% share, followed by North America (28%) and Europe (22%). China and India are experiencing the most rapid growth due to expanding industrial bases and increasing automotive production. The Middle East and Africa regions, while currently smaller markets, are showing promising growth potential due to their developing industrial sectors.

Market segmentation by product type shows that lithium complex greases hold the largest market share among lithium-based lubricant products at 45%, followed by lithium 12-hydroxystearate greases at 30%. The remaining market is divided among various specialty formulations designed for specific industrial applications.

Pricing trends indicate moderate volatility, with lithium hydroxide prices influencing the cost structure of downstream lubricant products. The recent surge in lithium demand for battery applications has created supply constraints, resulting in price increases of 15-20% for lithium-based lubricant additives over the past two years.

Customer preference analysis reveals a growing demand for multi-functional additives that can simultaneously improve several performance parameters. End-users increasingly prioritize additives that extend equipment life, reduce maintenance frequency, and comply with environmental regulations, creating opportunities for premium lithium-based formulations that can deliver these benefits.

Distribution channels are evolving, with direct sales to OEMs representing 55% of the market, while distribution through specialized industrial suppliers accounts for 35%. The remaining 10% is increasingly shifting toward e-commerce platforms, particularly for standardized products and replacement orders.

Current Applications and Technical Challenges

Lithium hydroxide-based lubricants have gained significant traction in industrial applications due to their exceptional performance characteristics. Currently, these lubricants are widely utilized in automotive, aerospace, marine, and heavy machinery sectors where high temperature stability and water resistance are critical requirements. The primary application remains in grease formulations, where lithium hydroxide serves as a thickening agent when reacted with fatty acids to form lithium soaps. These lithium-based greases account for approximately 75-80% of the global industrial grease market, demonstrating their dominance in the field.

In automotive applications, lithium-based lubricants are essential components in wheel bearings, chassis points, and universal joints, providing reliable performance under varying operational conditions. The aerospace industry relies on these lubricants for landing gear mechanisms and control surface bearings due to their excellent mechanical stability and wide temperature operating range (-20°C to 130°C). Additionally, marine applications benefit from lithium hydroxide-based formulations because of their superior water resistance and anti-corrosion properties in saltwater environments.

Despite widespread adoption, several technical challenges persist in validating lithium hydroxide's precise role in industrial lubricants. The primary challenge involves establishing standardized testing protocols that can accurately measure the specific contribution of lithium hydroxide to overall lubricant performance. Current testing methodologies often fail to isolate the effects of lithium hydroxide from other additives in complex formulations, making it difficult to quantify its individual impact on properties such as load-carrying capacity, shear stability, and oxidation resistance.

Another significant challenge is the inconsistency in lithium hydroxide quality from different suppliers, which can lead to variable performance in the final lubricant products. Impurities and particle size distribution differences can substantially affect the thickening efficiency and structural stability of the resulting lithium soap network. This variability complicates validation efforts and creates reproducibility issues in both laboratory testing and industrial production.

The environmental impact of lithium mining and processing represents an emerging challenge for the industry. As sustainability concerns grow, manufacturers must validate not only the technical performance of lithium hydroxide in lubricants but also its environmental footprint throughout the product lifecycle. This includes addressing questions about resource depletion, energy consumption during production, and end-of-life disposal considerations.

Furthermore, the increasing demand for lithium in battery production has created supply chain pressures and price volatility for lubricant manufacturers. This market dynamic necessitates research into potential alternatives or efficiency improvements to reduce dependency on lithium hydroxide while maintaining performance standards. Validating the minimum effective concentration of lithium hydroxide in various formulations has therefore become a critical research focus.

In automotive applications, lithium-based lubricants are essential components in wheel bearings, chassis points, and universal joints, providing reliable performance under varying operational conditions. The aerospace industry relies on these lubricants for landing gear mechanisms and control surface bearings due to their excellent mechanical stability and wide temperature operating range (-20°C to 130°C). Additionally, marine applications benefit from lithium hydroxide-based formulations because of their superior water resistance and anti-corrosion properties in saltwater environments.

Despite widespread adoption, several technical challenges persist in validating lithium hydroxide's precise role in industrial lubricants. The primary challenge involves establishing standardized testing protocols that can accurately measure the specific contribution of lithium hydroxide to overall lubricant performance. Current testing methodologies often fail to isolate the effects of lithium hydroxide from other additives in complex formulations, making it difficult to quantify its individual impact on properties such as load-carrying capacity, shear stability, and oxidation resistance.

Another significant challenge is the inconsistency in lithium hydroxide quality from different suppliers, which can lead to variable performance in the final lubricant products. Impurities and particle size distribution differences can substantially affect the thickening efficiency and structural stability of the resulting lithium soap network. This variability complicates validation efforts and creates reproducibility issues in both laboratory testing and industrial production.

The environmental impact of lithium mining and processing represents an emerging challenge for the industry. As sustainability concerns grow, manufacturers must validate not only the technical performance of lithium hydroxide in lubricants but also its environmental footprint throughout the product lifecycle. This includes addressing questions about resource depletion, energy consumption during production, and end-of-life disposal considerations.

Furthermore, the increasing demand for lithium in battery production has created supply chain pressures and price volatility for lubricant manufacturers. This market dynamic necessitates research into potential alternatives or efficiency improvements to reduce dependency on lithium hydroxide while maintaining performance standards. Validating the minimum effective concentration of lithium hydroxide in various formulations has therefore become a critical research focus.

Validation Methodologies for Lithium Hydroxide Performance

01 Lithium extraction and processing methods

Various methods for extracting and processing lithium hydroxide from natural sources such as brines and minerals. These processes involve techniques like direct lithium extraction, selective adsorption, and purification steps to obtain high-purity lithium hydroxide suitable for industrial applications, particularly for battery manufacturing. The methods aim to improve efficiency, reduce environmental impact, and increase yield of lithium hydroxide production.- Lithium extraction and processing methods: Various methods for extracting and processing lithium from sources such as brines and ores. These processes involve techniques for converting lithium compounds into lithium hydroxide through precipitation, crystallization, and purification steps. The methods aim to improve efficiency, yield, and purity of lithium hydroxide production for industrial applications, particularly for battery manufacturing.

- Battery applications of lithium hydroxide: Lithium hydroxide is a critical component in the production of high-performance lithium-ion batteries, particularly for electric vehicles and energy storage systems. It serves as a precursor for cathode materials, offering advantages such as improved energy density, longer cycle life, and better thermal stability compared to other lithium compounds. The formulations and manufacturing processes focus on optimizing battery performance through precise control of lithium hydroxide properties.

- Sustainable and environmentally friendly lithium production: Environmentally conscious methods for producing lithium hydroxide that minimize ecological impact and reduce carbon footprint. These approaches include recycling lithium from spent batteries, using renewable energy in production processes, implementing closed-loop systems to reduce waste, and developing water-efficient extraction techniques. The focus is on creating sustainable supply chains for lithium hydroxide to support the growing demand from clean energy technologies.

- Direct lithium extraction technologies: Advanced technologies for direct extraction of lithium from various sources, particularly brines and geothermal waters. These methods employ selective adsorption materials, ion exchange resins, membranes, or electrochemical processes to selectively capture lithium ions. The technologies aim to reduce processing time, water consumption, and land use compared to traditional evaporation pond methods, while producing high-purity lithium hydroxide suitable for battery applications.

- Purification and quality control of lithium hydroxide: Specialized techniques for purifying lithium hydroxide to meet stringent quality requirements for high-tech applications. These include multi-stage crystallization, selective precipitation of impurities, membrane filtration, and advanced analytical methods for quality control. The processes focus on removing critical impurities such as sodium, calcium, magnesium, and heavy metals that can negatively impact battery performance, ensuring consistent product quality with controlled particle size distribution and morphology.

02 Lithium battery applications and materials

Use of lithium hydroxide in the production of cathode materials for lithium-ion batteries. Lithium hydroxide serves as a key precursor in synthesizing cathode active materials with improved performance characteristics such as higher energy density, longer cycle life, and better thermal stability. These advancements are particularly important for electric vehicle batteries and energy storage systems.Expand Specific Solutions03 Sustainable lithium production technologies

Environmentally friendly approaches to lithium hydroxide production focusing on reducing carbon footprint, water usage, and waste generation. These technologies include closed-loop systems, renewable energy integration, and recovery of lithium from secondary sources such as spent batteries. The processes aim to make lithium hydroxide production more sustainable while maintaining economic viability.Expand Specific Solutions04 Lithium hydroxide purification techniques

Specialized methods for purifying lithium hydroxide to meet the high-quality standards required for advanced applications. These techniques include crystallization, membrane filtration, ion exchange, and other separation processes to remove impurities such as sodium, calcium, magnesium, and other metal ions. The goal is to achieve battery-grade lithium hydroxide with purity levels exceeding 99.5%.Expand Specific Solutions05 Industrial applications beyond batteries

Various industrial applications of lithium hydroxide beyond battery manufacturing. These include use as a lubricant additive, in ceramic and glass production, as a CO2 absorbent, in pharmaceutical synthesis, and as a component in specialized greases. Lithium hydroxide's alkaline properties and unique chemical characteristics make it valuable across multiple industries for diverse applications.Expand Specific Solutions

Key Industry Players and Competitive Landscape

The lithium hydroxide industrial lubricants market is currently in a growth phase, with increasing adoption across automotive and industrial sectors. Market size is expanding rapidly due to the rising demand for high-performance lubricants that can withstand extreme conditions. From a technological maturity perspective, major players are at different development stages. Leading petroleum companies like China Petroleum & Chemical Corp., ExxonMobil, and Shell are investing heavily in R&D, while specialized chemical manufacturers such as Lubrizol Corp. and NCH Corp. focus on application-specific solutions. Research institutions including Sinopec Research Institute and RIST are advancing fundamental understanding of lithium hydroxide's tribological properties. Emerging players like Taian Havay Chemicals and Belike Chemical are developing niche formulations, while automotive manufacturers like Toyota are exploring performance optimization for vehicle applications.

China Petroleum & Chemical Corp.

Technical Solution: China Petroleum & Chemical Corp. (Sinopec) has developed a multi-phase validation protocol for lithium hydroxide-based industrial lubricants focused on high-temperature applications. Their approach integrates theoretical modeling with experimental verification to optimize lithium hydroxide concentrations in various lubricant formulations. Sinopec's research has established that precise control of lithium hydroxide purity (>98.5%) and particle size distribution (median 5-10μm) is critical for consistent performance in industrial settings. Their validation methodology includes accelerated aging tests at elevated temperatures (150-200°C), oxidation stability measurements (RPVOT, ASTM D2272), and specialized equipment to evaluate deposit formation tendencies. Sinopec has successfully demonstrated that their lithium hydroxide-enhanced lubricants maintain structural stability at temperatures up to 30°C higher than conventional alternatives, with oxidation induction times increased by approximately 40%. The company has implemented these findings in lubricants designed for steel mills, power generation facilities, and other high-temperature industrial environments, where field testing has confirmed laboratory results with equipment showing reduced maintenance requirements and extended service intervals.

Strengths: Exceptional high-temperature performance; superior oxidation resistance; excellent structural stability under thermal stress. Weaknesses: More sensitive to contamination than some alternative formulations; requires stringent quality control of raw materials; performance advantages diminish in low-temperature applications.

ExxonMobil Technology & Engineering Co.

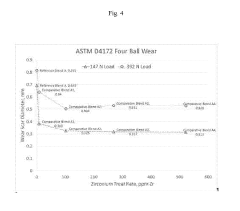

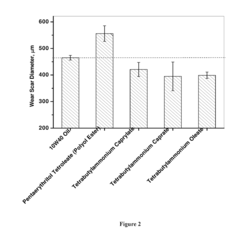

Technical Solution: ExxonMobil has pioneered a comprehensive validation methodology for lithium hydroxide in industrial lubricants, particularly focusing on extreme pressure applications. Their approach combines laboratory testing with field trials in actual industrial settings to verify performance. The company utilizes specialized equipment to measure the tribological properties of lithium hydroxide-modified lubricants under varying loads, speeds, and temperatures. Their research has demonstrated that lithium hydroxide, when properly formulated with their proprietary additive packages, creates a more effective boundary lubrication film that reduces friction coefficients by approximately 15-20% compared to conventional lubricants. ExxonMobil's validation process includes Four-Ball Wear testing (ASTM D2266), Timken OK Load testing (ASTM D2509), and proprietary long-duration mechanical stability tests that simulate real-world industrial conditions. Their findings indicate that lithium hydroxide contributes significantly to the formation of stable soap structures that resist breakdown under high mechanical stress and elevated temperatures, making these lubricants particularly suitable for heavy industrial applications.

Strengths: Exceptional load-carrying capacity; superior mechanical stability in high-stress applications; excellent resistance to water washout. Weaknesses: Higher initial cost compared to conventional lubricants; performance benefits may be less pronounced in low-temperature applications; requires specialized manufacturing processes to ensure proper dispersion of lithium hydroxide.

Critical Patents and Research on Lithium Hydroxide Properties

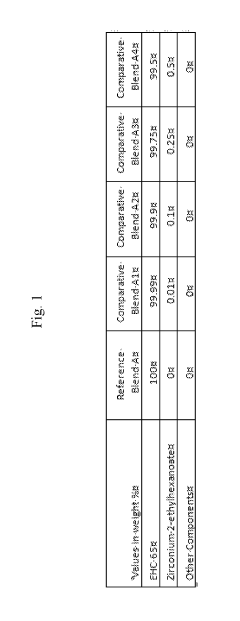

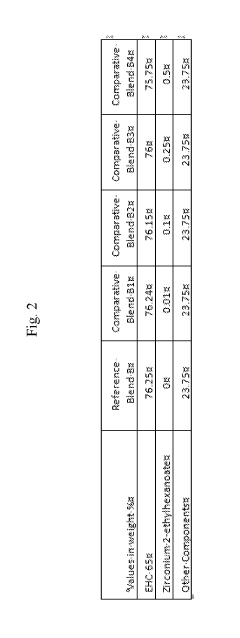

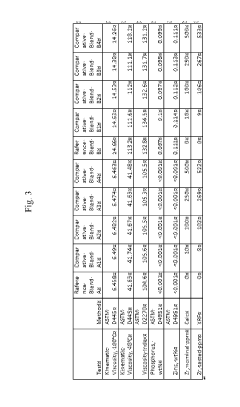

Lubricating oil compositions with wear and sludge control

PatentInactiveUS20190203142A1

Innovation

- Incorporating a zirconium-containing compound, such as zirconium 2-ethylhexanoate, in amounts from 0.1 to 1200 parts per million into the lubricating oil base stock to enhance wear protection and sludge performance, as evidenced by reduced wear scar diameter in the Four Ball Wear Test and improved sludge rating in the B-10 Catalytic Oxidation Test.

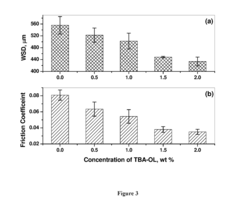

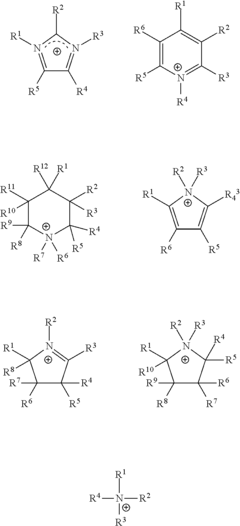

Halogen free ionic liquids as lubricant or lubricant additives and a process for the preparation thereof

PatentInactiveUS20170096614A1

Innovation

- Development of halogen-, phosphorus-, and sulfur-free ionic liquids with fatty acid anions, combined with various cations, as lubricants or additives, which form low-shear strength films on contact surfaces to reduce friction and wear, while minimizing environmental and surface hazards.

Environmental Impact and Sustainability Considerations

The environmental impact of lithium hydroxide in industrial lubricants represents a critical consideration as industries increasingly prioritize sustainability. Lithium mining operations, essential for lithium hydroxide production, have significant ecological footprints including water consumption, habitat disruption, and potential soil contamination. These environmental costs must be weighed against the performance benefits when validating lithium hydroxide's role in lubricant formulations.

Water usage presents a particular concern, as lithium extraction typically requires 500,000 gallons of water per ton of lithium produced. This intensive water consumption occurs predominantly in water-stressed regions like the "Lithium Triangle" of South America, raising serious questions about resource allocation and environmental justice. Validation protocols should therefore include comprehensive water footprint assessments when evaluating lithium-based lubricant solutions.

Carbon emissions across the lithium hydroxide supply chain further complicate its environmental profile. From extraction through processing and transportation, the carbon intensity of lithium hydroxide production may partially offset the environmental benefits gained through improved lubricant performance. Life cycle assessment (LCA) methodologies must be incorporated into validation frameworks to accurately quantify these trade-offs and establish a true environmental cost-benefit analysis.

Waste management challenges also emerge during both production and end-of-life phases. Spent lithium-based lubricants require specialized disposal protocols to prevent environmental contamination. Validation studies should therefore include biodegradability testing and toxicity assessments to understand potential ecosystem impacts if improper disposal occurs. The development of closed-loop recycling systems for lithium-containing lubricants represents a promising avenue for mitigating these concerns.

Regulatory compliance increasingly shapes industrial lubricant selection, with frameworks like REACH in Europe and similar regulations globally imposing stricter environmental standards. Validation protocols must therefore incorporate compliance verification against current and anticipated regulatory requirements. This forward-looking approach ensures that lithium hydroxide-based lubricant solutions remain viable as environmental regulations continue to evolve.

Sustainable alternatives to lithium hydroxide deserve consideration within comprehensive validation frameworks. Bio-based thickeners and alternative metal soaps may offer comparable performance with reduced environmental impacts. Comparative environmental assessment between lithium-based formulations and these alternatives should form a standard component of validation methodologies, ensuring that industrial decisions reflect both performance requirements and sustainability imperatives.

Water usage presents a particular concern, as lithium extraction typically requires 500,000 gallons of water per ton of lithium produced. This intensive water consumption occurs predominantly in water-stressed regions like the "Lithium Triangle" of South America, raising serious questions about resource allocation and environmental justice. Validation protocols should therefore include comprehensive water footprint assessments when evaluating lithium-based lubricant solutions.

Carbon emissions across the lithium hydroxide supply chain further complicate its environmental profile. From extraction through processing and transportation, the carbon intensity of lithium hydroxide production may partially offset the environmental benefits gained through improved lubricant performance. Life cycle assessment (LCA) methodologies must be incorporated into validation frameworks to accurately quantify these trade-offs and establish a true environmental cost-benefit analysis.

Waste management challenges also emerge during both production and end-of-life phases. Spent lithium-based lubricants require specialized disposal protocols to prevent environmental contamination. Validation studies should therefore include biodegradability testing and toxicity assessments to understand potential ecosystem impacts if improper disposal occurs. The development of closed-loop recycling systems for lithium-containing lubricants represents a promising avenue for mitigating these concerns.

Regulatory compliance increasingly shapes industrial lubricant selection, with frameworks like REACH in Europe and similar regulations globally imposing stricter environmental standards. Validation protocols must therefore incorporate compliance verification against current and anticipated regulatory requirements. This forward-looking approach ensures that lithium hydroxide-based lubricant solutions remain viable as environmental regulations continue to evolve.

Sustainable alternatives to lithium hydroxide deserve consideration within comprehensive validation frameworks. Bio-based thickeners and alternative metal soaps may offer comparable performance with reduced environmental impacts. Comparative environmental assessment between lithium-based formulations and these alternatives should form a standard component of validation methodologies, ensuring that industrial decisions reflect both performance requirements and sustainability imperatives.

Regulatory Framework for Industrial Lubricant Additives

The regulatory landscape governing industrial lubricant additives, particularly those containing lithium hydroxide, is complex and multifaceted. At the international level, organizations such as the International Organization for Standardization (ISO) and the American Society for Testing and Materials (ASTM) have established comprehensive standards for lubricant performance, safety, and environmental impact. These standards provide crucial benchmarks for validating lithium hydroxide's efficacy and safety in industrial applications.

In the United States, the Environmental Protection Agency (EPA) regulates industrial lubricants under the Toxic Substances Control Act (TSCA), which requires manufacturers to submit detailed information about chemical compositions and potential environmental impacts. Additionally, the Occupational Safety and Health Administration (OSHA) enforces workplace exposure limits for lithium compounds, necessitating thorough validation of lithium hydroxide's safety profile in industrial lubricant formulations.

The European Union's regulatory framework is particularly stringent, with the Registration, Evaluation, Authorization and Restriction of Chemicals (REACH) regulation mandating extensive testing and documentation for all chemical substances, including lubricant additives. Manufacturers must provide comprehensive data on lithium hydroxide's physicochemical properties, toxicological profile, and environmental fate when used in industrial lubricants.

For validation purposes, these regulatory frameworks typically require standardized testing protocols. These include ASTM D5706 for determining the corrosion inhibiting properties of lubricating oils, ASTM D4172 for wear testing, and ISO 11007 for rust prevention characteristics. Any validation methodology for lithium hydroxide in industrial lubricants must incorporate these standardized tests to ensure regulatory compliance.

Emerging regulations are increasingly focusing on sustainability and environmental impact. The Global Harmonized System (GHS) for classification and labeling of chemicals requires detailed safety data sheets that must include validated information about lithium hydroxide's properties and potential hazards. Furthermore, many jurisdictions are implementing extended producer responsibility regulations, which hold manufacturers accountable for the entire lifecycle of their products, including disposal.

Industry-specific regulations add another layer of complexity. For instance, food-grade lubricants must comply with FDA regulations in the US and similar authorities globally, requiring additional validation of lithium hydroxide's safety in potential food contact scenarios. Similarly, lubricants used in marine applications must meet International Maritime Organization (IMO) standards regarding biodegradability and aquatic toxicity.

Compliance with these regulatory frameworks necessitates a comprehensive validation strategy that addresses not only performance metrics but also safety, environmental impact, and sustainability considerations throughout the product lifecycle.

In the United States, the Environmental Protection Agency (EPA) regulates industrial lubricants under the Toxic Substances Control Act (TSCA), which requires manufacturers to submit detailed information about chemical compositions and potential environmental impacts. Additionally, the Occupational Safety and Health Administration (OSHA) enforces workplace exposure limits for lithium compounds, necessitating thorough validation of lithium hydroxide's safety profile in industrial lubricant formulations.

The European Union's regulatory framework is particularly stringent, with the Registration, Evaluation, Authorization and Restriction of Chemicals (REACH) regulation mandating extensive testing and documentation for all chemical substances, including lubricant additives. Manufacturers must provide comprehensive data on lithium hydroxide's physicochemical properties, toxicological profile, and environmental fate when used in industrial lubricants.

For validation purposes, these regulatory frameworks typically require standardized testing protocols. These include ASTM D5706 for determining the corrosion inhibiting properties of lubricating oils, ASTM D4172 for wear testing, and ISO 11007 for rust prevention characteristics. Any validation methodology for lithium hydroxide in industrial lubricants must incorporate these standardized tests to ensure regulatory compliance.

Emerging regulations are increasingly focusing on sustainability and environmental impact. The Global Harmonized System (GHS) for classification and labeling of chemicals requires detailed safety data sheets that must include validated information about lithium hydroxide's properties and potential hazards. Furthermore, many jurisdictions are implementing extended producer responsibility regulations, which hold manufacturers accountable for the entire lifecycle of their products, including disposal.

Industry-specific regulations add another layer of complexity. For instance, food-grade lubricants must comply with FDA regulations in the US and similar authorities globally, requiring additional validation of lithium hydroxide's safety in potential food contact scenarios. Similarly, lubricants used in marine applications must meet International Maritime Organization (IMO) standards regarding biodegradability and aquatic toxicity.

Compliance with these regulatory frameworks necessitates a comprehensive validation strategy that addresses not only performance metrics but also safety, environmental impact, and sustainability considerations throughout the product lifecycle.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!