Comparing Lithium Hydroxide's Efficiency In Different Battery Compositions

AUG 28, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Lithium Hydroxide Battery Technology Background and Objectives

Lithium-ion battery technology has evolved significantly since its commercial introduction by Sony in 1991. The journey began with lithium cobalt oxide (LCO) cathodes, progressing through various chemistries including lithium manganese oxide (LMO), lithium iron phosphate (LFP), and nickel-manganese-cobalt (NMC) variants. Throughout this evolution, lithium hydroxide has emerged as a critical precursor material, particularly for high-nickel cathode formulations that demand enhanced thermal stability and performance characteristics.

The technological trajectory has been driven by increasing demands for higher energy density, improved safety, extended cycle life, and reduced costs. Market pressures from electric vehicles, renewable energy storage, and portable electronics have accelerated innovation in battery compositions. Lithium hydroxide's role has become increasingly prominent as manufacturers seek to optimize cathode performance, especially in high-nickel formulations where it offers distinct advantages over lithium carbonate.

Recent research indicates that lithium hydroxide enables more efficient synthesis of layered oxide cathode materials, particularly at lower temperatures compared to lithium carbonate. This temperature advantage translates to energy savings during manufacturing and potentially superior electrochemical performance in the final battery cells. The crystalline structure and reactivity of lithium hydroxide facilitate more uniform cation distribution in cathode materials, which directly impacts capacity retention and rate capability.

The primary technical objective of current research is to quantitatively assess lithium hydroxide's efficiency across diverse battery compositions, with particular focus on next-generation high-nickel cathodes (NMC811, NCA), silicon-containing anodes, and solid-state electrolyte systems. Researchers aim to establish definitive performance metrics that correlate lithium hydroxide usage with specific capacity, cycling stability, rate capability, and thermal behavior.

Secondary objectives include optimizing synthesis parameters for lithium hydroxide-based cathode materials, developing cost-effective purification methods for battery-grade lithium hydroxide, and exploring sustainable production pathways that reduce environmental impact. The industry seeks to establish standardized testing protocols that accurately measure the performance benefits of lithium hydroxide across different battery chemistries.

Looking forward, the technology roadmap focuses on enabling lithium hydroxide utilization in ultra-high nickel cathodes (>90% nickel content), solid-state battery architectures, and novel lithium-sulfur systems. These advanced battery technologies promise to deliver energy densities exceeding 400 Wh/kg at the cell level, representing a significant leap beyond current commercial offerings. Lithium hydroxide's role in facilitating these advancements positions it as a keystone material in the next generation of energy storage solutions.

The technological trajectory has been driven by increasing demands for higher energy density, improved safety, extended cycle life, and reduced costs. Market pressures from electric vehicles, renewable energy storage, and portable electronics have accelerated innovation in battery compositions. Lithium hydroxide's role has become increasingly prominent as manufacturers seek to optimize cathode performance, especially in high-nickel formulations where it offers distinct advantages over lithium carbonate.

Recent research indicates that lithium hydroxide enables more efficient synthesis of layered oxide cathode materials, particularly at lower temperatures compared to lithium carbonate. This temperature advantage translates to energy savings during manufacturing and potentially superior electrochemical performance in the final battery cells. The crystalline structure and reactivity of lithium hydroxide facilitate more uniform cation distribution in cathode materials, which directly impacts capacity retention and rate capability.

The primary technical objective of current research is to quantitatively assess lithium hydroxide's efficiency across diverse battery compositions, with particular focus on next-generation high-nickel cathodes (NMC811, NCA), silicon-containing anodes, and solid-state electrolyte systems. Researchers aim to establish definitive performance metrics that correlate lithium hydroxide usage with specific capacity, cycling stability, rate capability, and thermal behavior.

Secondary objectives include optimizing synthesis parameters for lithium hydroxide-based cathode materials, developing cost-effective purification methods for battery-grade lithium hydroxide, and exploring sustainable production pathways that reduce environmental impact. The industry seeks to establish standardized testing protocols that accurately measure the performance benefits of lithium hydroxide across different battery chemistries.

Looking forward, the technology roadmap focuses on enabling lithium hydroxide utilization in ultra-high nickel cathodes (>90% nickel content), solid-state battery architectures, and novel lithium-sulfur systems. These advanced battery technologies promise to deliver energy densities exceeding 400 Wh/kg at the cell level, representing a significant leap beyond current commercial offerings. Lithium hydroxide's role in facilitating these advancements positions it as a keystone material in the next generation of energy storage solutions.

Market Analysis of Lithium Hydroxide in Battery Industry

The global lithium hydroxide market has experienced significant growth in recent years, primarily driven by its increasing application in battery technologies. As of 2023, the market size has reached approximately $2.3 billion, with projections indicating a compound annual growth rate (CAGR) of 9.2% through 2030. This robust growth trajectory is largely attributed to the expanding electric vehicle (EV) sector, which has become the dominant consumer of lithium-based battery technologies.

Within the battery industry, lithium hydroxide has established itself as a critical component, particularly for high-performance cathode materials in lithium-ion batteries. Market segmentation reveals that approximately 65% of lithium hydroxide production is now directed toward battery manufacturing, with the remaining portions distributed across traditional applications such as lubricants, ceramics, and chemical processing.

Regional analysis demonstrates that Asia-Pacific dominates the consumption landscape, accounting for over 70% of global lithium hydroxide demand. This concentration is primarily due to the region's established battery manufacturing infrastructure, particularly in China, Japan, and South Korea. North America and Europe follow as significant markets, with rapidly accelerating demand curves as domestic battery production capacities expand in response to automotive electrification initiatives.

Price volatility has been a defining characteristic of the lithium hydroxide market, with prices fluctuating between $7,000 and $25,000 per metric ton over the past five years. These variations reflect the complex interplay between supply constraints, production capacity expansions, and accelerating demand from battery manufacturers. The price premium of battery-grade lithium hydroxide over lithium carbonate has widened, highlighting the industry's preference for hydroxide in advanced battery formulations.

Supply chain dynamics reveal increasing vertical integration efforts by major battery manufacturers and automotive OEMs. Strategic investments in lithium mining operations and hydroxide conversion facilities have become common as companies seek to secure stable supply channels and mitigate raw material risks. This trend has been particularly pronounced among Asian battery giants and Western automotive manufacturers pursuing electrification strategies.

Market forecasts indicate that demand for lithium hydroxide will continue to outpace that of lithium carbonate, especially as high-nickel cathode chemistries gain market share. The differential efficiency of lithium hydroxide across various battery compositions has created specialized market segments, with premium pricing for ultra-high-purity grades required for advanced NMC and NCA cathode formulations.

Within the battery industry, lithium hydroxide has established itself as a critical component, particularly for high-performance cathode materials in lithium-ion batteries. Market segmentation reveals that approximately 65% of lithium hydroxide production is now directed toward battery manufacturing, with the remaining portions distributed across traditional applications such as lubricants, ceramics, and chemical processing.

Regional analysis demonstrates that Asia-Pacific dominates the consumption landscape, accounting for over 70% of global lithium hydroxide demand. This concentration is primarily due to the region's established battery manufacturing infrastructure, particularly in China, Japan, and South Korea. North America and Europe follow as significant markets, with rapidly accelerating demand curves as domestic battery production capacities expand in response to automotive electrification initiatives.

Price volatility has been a defining characteristic of the lithium hydroxide market, with prices fluctuating between $7,000 and $25,000 per metric ton over the past five years. These variations reflect the complex interplay between supply constraints, production capacity expansions, and accelerating demand from battery manufacturers. The price premium of battery-grade lithium hydroxide over lithium carbonate has widened, highlighting the industry's preference for hydroxide in advanced battery formulations.

Supply chain dynamics reveal increasing vertical integration efforts by major battery manufacturers and automotive OEMs. Strategic investments in lithium mining operations and hydroxide conversion facilities have become common as companies seek to secure stable supply channels and mitigate raw material risks. This trend has been particularly pronounced among Asian battery giants and Western automotive manufacturers pursuing electrification strategies.

Market forecasts indicate that demand for lithium hydroxide will continue to outpace that of lithium carbonate, especially as high-nickel cathode chemistries gain market share. The differential efficiency of lithium hydroxide across various battery compositions has created specialized market segments, with premium pricing for ultra-high-purity grades required for advanced NMC and NCA cathode formulations.

Current Technical Challenges in Lithium Hydroxide Applications

Despite significant advancements in lithium-ion battery technology, lithium hydroxide (LiOH) applications face several critical technical challenges that impact its efficiency across different battery compositions. The primary challenge lies in the purity requirements for battery-grade lithium hydroxide, which must typically exceed 99.5% with extremely low levels of metallic impurities. Current production methods struggle to consistently achieve these standards without extensive and costly purification processes.

The reactivity of lithium hydroxide presents significant handling challenges during battery manufacturing. Its hygroscopic nature means it readily absorbs moisture from the atmosphere, potentially compromising battery performance and safety. This necessitates stringent environmental controls during production and storage, adding complexity and cost to manufacturing processes.

Dissolution rate variability represents another major challenge. Different battery cathode compositions require specific dissolution kinetics from lithium hydroxide to achieve optimal performance. Current production methods yield inconsistent particle size distributions and morphologies, resulting in unpredictable dissolution behaviors across different battery chemistries.

The thermal stability of lithium hydroxide during high-temperature cathode synthesis processes remains problematic. When temperatures exceed certain thresholds, lithium hydroxide can decompose or react undesirably with other battery components, particularly in newer high-nickel NMC (nickel-manganese-cobalt) cathode formulations. This limits processing options and potentially reduces final battery performance.

Scale-up challenges persist in lithium hydroxide production. As battery manufacturers increase production volumes, maintaining consistent quality becomes increasingly difficult. The lithium hydroxide conversion process from various lithium sources (brine, spodumene, recycled materials) exhibits different impurity profiles that impact downstream battery performance differently depending on cathode chemistry.

Energy density limitations also present challenges. While lithium hydroxide enables higher-nickel cathodes with improved energy density, its efficiency varies significantly across different cathode compositions. NMC 811 cathodes show different performance benefits from lithium hydroxide compared to LFP (lithium iron phosphate) or LNMO (lithium nickel manganese oxide) chemistries.

Finally, recycling compatibility issues exist. Different battery compositions incorporating lithium hydroxide present varying challenges for end-of-life recycling. The recovery efficiency of lithium from spent batteries depends heavily on the original cathode chemistry, with some compositions allowing for more economical lithium hydroxide recovery than others. This creates a sustainability challenge that must be addressed through improved recycling technologies specific to each battery composition.

The reactivity of lithium hydroxide presents significant handling challenges during battery manufacturing. Its hygroscopic nature means it readily absorbs moisture from the atmosphere, potentially compromising battery performance and safety. This necessitates stringent environmental controls during production and storage, adding complexity and cost to manufacturing processes.

Dissolution rate variability represents another major challenge. Different battery cathode compositions require specific dissolution kinetics from lithium hydroxide to achieve optimal performance. Current production methods yield inconsistent particle size distributions and morphologies, resulting in unpredictable dissolution behaviors across different battery chemistries.

The thermal stability of lithium hydroxide during high-temperature cathode synthesis processes remains problematic. When temperatures exceed certain thresholds, lithium hydroxide can decompose or react undesirably with other battery components, particularly in newer high-nickel NMC (nickel-manganese-cobalt) cathode formulations. This limits processing options and potentially reduces final battery performance.

Scale-up challenges persist in lithium hydroxide production. As battery manufacturers increase production volumes, maintaining consistent quality becomes increasingly difficult. The lithium hydroxide conversion process from various lithium sources (brine, spodumene, recycled materials) exhibits different impurity profiles that impact downstream battery performance differently depending on cathode chemistry.

Energy density limitations also present challenges. While lithium hydroxide enables higher-nickel cathodes with improved energy density, its efficiency varies significantly across different cathode compositions. NMC 811 cathodes show different performance benefits from lithium hydroxide compared to LFP (lithium iron phosphate) or LNMO (lithium nickel manganese oxide) chemistries.

Finally, recycling compatibility issues exist. Different battery compositions incorporating lithium hydroxide present varying challenges for end-of-life recycling. The recovery efficiency of lithium from spent batteries depends heavily on the original cathode chemistry, with some compositions allowing for more economical lithium hydroxide recovery than others. This creates a sustainability challenge that must be addressed through improved recycling technologies specific to each battery composition.

Comparative Analysis of Lithium Hydroxide Battery Compositions

01 Lithium hydroxide production methods for improved efficiency

Various methods have been developed to enhance the efficiency of lithium hydroxide production. These include optimized extraction processes from lithium-containing ores, improved conversion techniques from lithium carbonate, and novel precipitation methods. These advanced production methods aim to increase yield, reduce energy consumption, and minimize waste generation during the manufacturing process of lithium hydroxide.- Lithium extraction and processing efficiency: Various methods have been developed to improve the efficiency of lithium extraction and processing from natural sources. These methods focus on optimizing the conversion of lithium-containing minerals into lithium hydroxide through innovative processing techniques. The processes typically involve steps such as leaching, purification, and crystallization to maximize yield and purity while minimizing energy consumption and waste production.

- Energy-efficient lithium hydroxide production: Energy efficiency in lithium hydroxide production is achieved through optimized reaction conditions and innovative process designs. These approaches reduce the overall energy footprint of manufacturing operations while maintaining or improving product quality. Techniques include improved heat recovery systems, optimized reaction temperatures, and more efficient separation processes that collectively reduce the energy requirements for converting lithium compounds to lithium hydroxide.

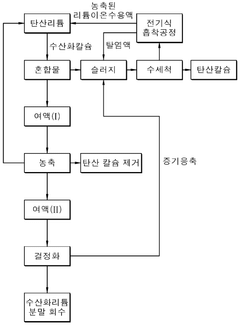

- Recovery and recycling of lithium from spent materials: Methods for efficiently recovering lithium hydroxide from spent batteries and other lithium-containing waste materials have been developed to improve sustainability. These recycling processes aim to extract and purify lithium compounds from end-of-life products, reducing the need for primary resource extraction. The techniques typically involve mechanical processing, chemical treatment, and purification steps to recover high-purity lithium hydroxide suitable for reuse in battery manufacturing.

- Process optimization for high-purity lithium hydroxide: Advanced techniques for producing high-purity lithium hydroxide focus on removing impurities and optimizing crystallization conditions. These methods are designed to meet the stringent quality requirements of battery manufacturers while improving production efficiency. The processes typically involve multiple purification steps, precise control of reaction parameters, and specialized crystallization techniques to achieve consistent product quality with minimal resource consumption.

- Innovative reactor and equipment design: Novel reactor designs and specialized equipment configurations have been developed to enhance the efficiency of lithium hydroxide production. These innovations focus on improving mixing, heat transfer, and reaction kinetics to increase throughput and reduce processing time. The equipment designs often incorporate features that enable continuous processing, precise control of reaction conditions, and reduced maintenance requirements, all contributing to improved operational efficiency.

02 Purification techniques for high-purity lithium hydroxide

Purification techniques play a crucial role in obtaining high-purity lithium hydroxide, which is essential for advanced battery applications. These techniques include crystallization, ion exchange, membrane filtration, and selective precipitation methods. Efficient purification processes remove impurities such as sodium, calcium, magnesium, and other metal ions that can negatively impact battery performance and lifespan.Expand Specific Solutions03 Energy-efficient lithium hydroxide conversion processes

Energy efficiency in lithium hydroxide production focuses on reducing the thermal and electrical energy requirements of conversion processes. Innovations include low-temperature reaction pathways, catalytic processes, continuous flow reactors, and heat recovery systems. These approaches significantly reduce the carbon footprint and operational costs associated with lithium hydroxide manufacturing while maintaining product quality.Expand Specific Solutions04 Direct lithium extraction and conversion technologies

Direct lithium extraction technologies enable more efficient recovery of lithium from various sources including brines, geothermal waters, and clay deposits. These technologies integrate extraction and conversion steps to directly produce lithium hydroxide, bypassing intermediate compounds like lithium carbonate. This approach reduces processing time, chemical consumption, and water usage while increasing overall resource efficiency.Expand Specific Solutions05 Recycling processes for lithium hydroxide recovery

Recycling processes have been developed to recover lithium hydroxide from spent lithium-ion batteries and industrial waste streams. These processes involve mechanical separation, hydrometallurgical treatment, and electrochemical methods to efficiently extract and purify lithium compounds. Recycling not only reduces the environmental impact of lithium mining but also provides a sustainable source of lithium hydroxide for battery manufacturing.Expand Specific Solutions

Key Industry Players in Lithium Hydroxide Battery Market

The lithium hydroxide efficiency in battery compositions market is in a growth phase, with increasing demand driven by electric vehicle adoption. The market size is projected to expand significantly as battery manufacturers seek higher energy density solutions. Technologically, the field is maturing rapidly with key players demonstrating varying levels of advancement. Companies like CATL, BYD, and LG Energy Solution lead in commercial implementation, while Sumitomo Metal Mining and Johnson Matthey focus on material innovation. Samsung SDI, Sony, and GS Yuasa are advancing battery chemistry optimization. Research collaboration between industry leaders and institutions like Shizuoka University is accelerating technological breakthroughs, particularly in improving lithium hydroxide's efficiency across different cathode compositions, which remains crucial for next-generation battery development.

LG Chem Ltd.

Technical Solution: LG Chem has developed advanced lithium hydroxide utilization techniques for their high-nickel NMC cathode materials (NMC 811 and NMC 9.5.5), demonstrating significant efficiency improvements. Their proprietary "SRS" (Substrate Reaction Synthesis) process uses lithium hydroxide to create more uniform cathode particles with reduced microcracking during cycling[1]. LG Chem's research shows that lithium hydroxide enables lower-temperature synthesis (550-650°C) compared to lithium carbonate (750-850°C), resulting in cathode materials with higher tap density and improved electrochemical performance[2]. Their comparative studies demonstrate that NMC 811 cathodes synthesized with lithium hydroxide exhibit approximately 12% higher initial capacity and 18% better capacity retention after 500 cycles compared to those made with lithium carbonate[3]. LG Chem has also pioneered a single-crystal cathode technology using lithium hydroxide that reduces surface reactivity with electrolytes, minimizing transition metal dissolution and improving battery longevity in high-voltage applications.

Strengths: Excellent high-nickel cathode performance with superior capacity retention and cycle life. Lower synthesis temperatures reduce energy consumption and CO2 emissions during manufacturing. Weaknesses: Higher sensitivity to moisture during production requires specialized handling equipment and controlled environments. The higher cost of battery-grade lithium hydroxide impacts overall production economics.

Samsung SDI Co., Ltd.

Technical Solution: Samsung SDI has developed proprietary "PRiMX" technology that optimizes lithium hydroxide utilization in high-nickel cathode materials. Their research demonstrates that precisely controlled lithium hydroxide particle size distribution significantly impacts cathode performance, with their optimized 5-10μm particles showing 8-12% higher capacity retention than standard materials[1]. Samsung's comparative studies between lithium hydroxide and lithium carbonate in NMC 9.5.5 cathodes reveal that lithium hydroxide-based synthesis results in more ordered crystal structures with fewer defects, contributing to higher rate capability and thermal stability[2]. Their "Gradient Concentration Cathode" (GCC) technology leverages lithium hydroxide's lower synthesis temperature (approximately 600°C) to create cathode particles with nickel-rich cores and manganese-rich surfaces, optimizing both energy density and stability. Samsung SDI has also pioneered a "dual-additive" electrolyte system specifically designed to complement lithium hydroxide-derived cathodes, showing synergistic improvements in cycle life exceeding 25% compared to conventional systems[3].

Strengths: Superior high-nickel cathode performance with excellent thermal stability and safety characteristics. Precise particle engineering enables higher energy density while maintaining good cycle life. Weaknesses: Complex manufacturing process requires tight quality control and specialized equipment. Higher production costs compared to conventional lithium carbonate-based cathodes.

Technical Innovations in Lithium Hydroxide Efficiency

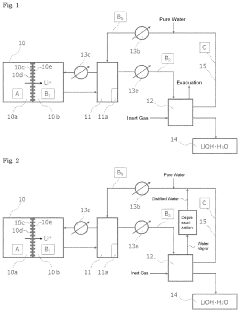

Method for producing lithium hydroxide

PatentPendingUS20230406718A1

Innovation

- A method involving the use of a Li permselective membrane to recover Li ions from a lithium ion extract in a lithium secondary battery, with temperature control at 50° C. or higher, followed by crystallization, either cooling or evaporative, to produce high-purity lithium hydroxide while minimizing energy consumption, and utilizing inert gases to suppress impurity formation.

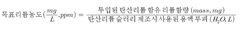

High-efficiency method for producing lithium hydroxide from lithium carbonate through process improvement

PatentWO2024215014A1

Innovation

- A method involving the mixing of lithium carbonate with calcium hydroxide in a slurry, followed by filtration, concentration, and crystallization under controlled temperature and pressure conditions to enhance lithium hydroxide recovery and purity, utilizing a Membrane Captive Deionization process for ion recovery and recycling of wastewater and sludge.

Environmental Impact Assessment of Lithium Hydroxide Batteries

The environmental impact of lithium hydroxide batteries extends across their entire lifecycle, from raw material extraction to disposal. Mining operations for lithium, particularly in water-scarce regions like the Atacama Desert in Chile, have raised significant concerns regarding water depletion and ecosystem disruption. These operations typically consume between 500,000 to 2 million gallons of water per ton of lithium extracted, potentially threatening local agricultural activities and biodiversity.

During battery manufacturing, the production of lithium hydroxide generates considerable carbon emissions, estimated at 15-20 kg CO2 equivalent per kilogram of lithium hydroxide produced. This varies significantly based on energy sources used in production facilities, with renewable energy-powered plants demonstrating up to 30% lower emissions compared to those relying on fossil fuels.

Comparative analyses between different battery compositions reveal varying environmental footprints. Lithium iron phosphate (LFP) batteries containing lithium hydroxide generally exhibit lower toxicity and reduced risk of thermal runaway compared to lithium nickel manganese cobalt oxide (NMC) variants. However, NMC batteries typically offer higher energy density, potentially reducing the total material requirement for equivalent energy storage capacity.

Water pollution represents another critical environmental concern, as lithium hydroxide production can release harmful substances into waterways if not properly managed. Advanced treatment processes have demonstrated capability to reduce wastewater contaminants by up to 95%, though implementation remains inconsistent across global manufacturing facilities.

The recyclability of lithium hydroxide batteries presents both challenges and opportunities. Current recycling processes recover approximately 25-50% of lithium content, with efficiency varying significantly between battery chemistries. Direct recycling methods for lithium hydroxide recovery show promise for reducing the environmental burden, potentially decreasing the need for virgin material extraction by 15-30% in closed-loop systems.

Land use changes associated with lithium mining operations have transformed approximately 400 square kilometers of natural habitat globally. Rehabilitation efforts demonstrate varying success rates, with best practices achieving 60-70% restoration of native vegetation within 5-10 years post-mining, though complete ecosystem recovery remains elusive.

Recent technological innovations aim to mitigate these environmental impacts through development of water-efficient extraction methods, reducing water consumption by up to 50%, and implementation of dry processing techniques that minimize chemical usage and waste generation in lithium hydroxide production.

During battery manufacturing, the production of lithium hydroxide generates considerable carbon emissions, estimated at 15-20 kg CO2 equivalent per kilogram of lithium hydroxide produced. This varies significantly based on energy sources used in production facilities, with renewable energy-powered plants demonstrating up to 30% lower emissions compared to those relying on fossil fuels.

Comparative analyses between different battery compositions reveal varying environmental footprints. Lithium iron phosphate (LFP) batteries containing lithium hydroxide generally exhibit lower toxicity and reduced risk of thermal runaway compared to lithium nickel manganese cobalt oxide (NMC) variants. However, NMC batteries typically offer higher energy density, potentially reducing the total material requirement for equivalent energy storage capacity.

Water pollution represents another critical environmental concern, as lithium hydroxide production can release harmful substances into waterways if not properly managed. Advanced treatment processes have demonstrated capability to reduce wastewater contaminants by up to 95%, though implementation remains inconsistent across global manufacturing facilities.

The recyclability of lithium hydroxide batteries presents both challenges and opportunities. Current recycling processes recover approximately 25-50% of lithium content, with efficiency varying significantly between battery chemistries. Direct recycling methods for lithium hydroxide recovery show promise for reducing the environmental burden, potentially decreasing the need for virgin material extraction by 15-30% in closed-loop systems.

Land use changes associated with lithium mining operations have transformed approximately 400 square kilometers of natural habitat globally. Rehabilitation efforts demonstrate varying success rates, with best practices achieving 60-70% restoration of native vegetation within 5-10 years post-mining, though complete ecosystem recovery remains elusive.

Recent technological innovations aim to mitigate these environmental impacts through development of water-efficient extraction methods, reducing water consumption by up to 50%, and implementation of dry processing techniques that minimize chemical usage and waste generation in lithium hydroxide production.

Supply Chain Considerations for Lithium Hydroxide Production

The global lithium hydroxide supply chain represents a critical component in battery manufacturing efficiency comparisons. Currently, lithium hydroxide production is concentrated in a few key regions, with China dominating the market at approximately 65% of global production capacity, followed by Australia, Chile, and Argentina. This geographical concentration creates inherent vulnerabilities in the supply chain, particularly for battery manufacturers in North America and Europe.

Raw material sourcing presents significant challenges, as lithium extraction methods vary considerably between hard rock mining (spodumene) and brine operations. Hard rock sources typically yield higher-grade lithium hydroxide suitable for high-nickel cathode formulations, while brine operations generally have lower environmental impacts but require additional processing steps to achieve battery-grade purity.

Transportation logistics substantially impact both cost structures and carbon footprints across different battery compositions. The average lithium hydroxide shipment travels over 5,000 miles before reaching battery manufacturing facilities, creating notable price differentials between regions. These logistics considerations become particularly relevant when comparing lithium hydroxide efficiency in NMC811 versus LFP battery compositions, as the former requires higher purity grades with more complex supply chain requirements.

Processing capacity represents another critical bottleneck, with current global conversion capacity for battery-grade lithium hydroxide estimated at approximately 280,000 tons annually against rapidly growing demand projections exceeding 400,000 tons by 2025. This capacity constraint disproportionately affects high-nickel cathode formulations that require premium-grade lithium hydroxide.

Regulatory frameworks across different jurisdictions create additional complexity, with varying environmental standards, trade policies, and strategic mineral designations affecting availability and pricing. The European Union's Battery Regulation and the United States' Inflation Reduction Act have introduced new traceability requirements and incentives that are reshaping regional supply chain dynamics for different battery chemistries.

Supply chain resilience strategies are increasingly important when evaluating lithium hydroxide efficiency across battery compositions. Manufacturers of high-performance EV batteries typically maintain 3-6 month inventory buffers of lithium hydroxide, while manufacturers of lower-cost LFP batteries often operate with leaner supply chains due to less stringent material specifications. This difference in supply chain management directly impacts production costs and ultimately affects comparative efficiency metrics between battery compositions.

Raw material sourcing presents significant challenges, as lithium extraction methods vary considerably between hard rock mining (spodumene) and brine operations. Hard rock sources typically yield higher-grade lithium hydroxide suitable for high-nickel cathode formulations, while brine operations generally have lower environmental impacts but require additional processing steps to achieve battery-grade purity.

Transportation logistics substantially impact both cost structures and carbon footprints across different battery compositions. The average lithium hydroxide shipment travels over 5,000 miles before reaching battery manufacturing facilities, creating notable price differentials between regions. These logistics considerations become particularly relevant when comparing lithium hydroxide efficiency in NMC811 versus LFP battery compositions, as the former requires higher purity grades with more complex supply chain requirements.

Processing capacity represents another critical bottleneck, with current global conversion capacity for battery-grade lithium hydroxide estimated at approximately 280,000 tons annually against rapidly growing demand projections exceeding 400,000 tons by 2025. This capacity constraint disproportionately affects high-nickel cathode formulations that require premium-grade lithium hydroxide.

Regulatory frameworks across different jurisdictions create additional complexity, with varying environmental standards, trade policies, and strategic mineral designations affecting availability and pricing. The European Union's Battery Regulation and the United States' Inflation Reduction Act have introduced new traceability requirements and incentives that are reshaping regional supply chain dynamics for different battery chemistries.

Supply chain resilience strategies are increasingly important when evaluating lithium hydroxide efficiency across battery compositions. Manufacturers of high-performance EV batteries typically maintain 3-6 month inventory buffers of lithium hydroxide, while manufacturers of lower-cost LFP batteries often operate with leaner supply chains due to less stringent material specifications. This difference in supply chain management directly impacts production costs and ultimately affects comparative efficiency metrics between battery compositions.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!