Optimizing Lithium Hydroxide Supply Chain For Cost Savings

AUG 28, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Lithium Hydroxide Industry Background and Objectives

Lithium hydroxide has emerged as a critical component in the global energy transition, particularly for its role in high-performance lithium-ion batteries that power electric vehicles (EVs). The evolution of this industry has been marked by significant technological advancements and shifting market dynamics over the past decade. Initially dominated by traditional industrial applications, lithium hydroxide demand has experienced exponential growth driven primarily by the EV revolution, with annual growth rates exceeding 20% since 2015.

The global lithium hydroxide market has transformed from a niche chemical sector to a strategic resource industry, with production capacity expanding from approximately 50,000 metric tons in 2010 to over 300,000 metric tons by 2022. This rapid expansion has been accompanied by substantial volatility in pricing structures, with prices fluctuating between $7,000 and $80,000 per ton in recent years, creating significant challenges for supply chain stability and cost management.

Current production methodologies predominantly rely on two pathways: the traditional route from lithium carbonate conversion and the newer direct extraction from spodumene concentrate. The efficiency and cost-effectiveness of these processes vary significantly based on raw material quality, processing technology, and regional factors such as energy costs and environmental regulations.

The primary objective of optimizing the lithium hydroxide supply chain is to achieve sustainable cost reductions while maintaining product quality and reliability. This involves addressing several interconnected challenges: reducing energy intensity in production processes, minimizing chemical reagent consumption, optimizing logistics networks, and developing more efficient recycling technologies to create circular material flows.

Additionally, the industry aims to diversify supply sources beyond the current geographical concentration in Australia, Chile, and China, which accounts for over 85% of global production. This diversification strategy seeks to mitigate geopolitical risks and reduce transportation-related carbon emissions and costs.

Technical innovation targets include developing more efficient extraction technologies that can process lower-grade lithium resources economically, advancing process automation to reduce operational costs, and implementing real-time quality control systems to minimize waste and rework. The industry is also exploring standardization initiatives to improve interoperability across the supply chain and reduce compliance-related overhead costs.

Understanding these background elements and objectives provides the foundation for a comprehensive approach to optimizing the lithium hydroxide supply chain, with potential cost savings estimated between 15-30% through systematic improvements across the value chain.

The global lithium hydroxide market has transformed from a niche chemical sector to a strategic resource industry, with production capacity expanding from approximately 50,000 metric tons in 2010 to over 300,000 metric tons by 2022. This rapid expansion has been accompanied by substantial volatility in pricing structures, with prices fluctuating between $7,000 and $80,000 per ton in recent years, creating significant challenges for supply chain stability and cost management.

Current production methodologies predominantly rely on two pathways: the traditional route from lithium carbonate conversion and the newer direct extraction from spodumene concentrate. The efficiency and cost-effectiveness of these processes vary significantly based on raw material quality, processing technology, and regional factors such as energy costs and environmental regulations.

The primary objective of optimizing the lithium hydroxide supply chain is to achieve sustainable cost reductions while maintaining product quality and reliability. This involves addressing several interconnected challenges: reducing energy intensity in production processes, minimizing chemical reagent consumption, optimizing logistics networks, and developing more efficient recycling technologies to create circular material flows.

Additionally, the industry aims to diversify supply sources beyond the current geographical concentration in Australia, Chile, and China, which accounts for over 85% of global production. This diversification strategy seeks to mitigate geopolitical risks and reduce transportation-related carbon emissions and costs.

Technical innovation targets include developing more efficient extraction technologies that can process lower-grade lithium resources economically, advancing process automation to reduce operational costs, and implementing real-time quality control systems to minimize waste and rework. The industry is also exploring standardization initiatives to improve interoperability across the supply chain and reduce compliance-related overhead costs.

Understanding these background elements and objectives provides the foundation for a comprehensive approach to optimizing the lithium hydroxide supply chain, with potential cost savings estimated between 15-30% through systematic improvements across the value chain.

Market Demand Analysis for Lithium Hydroxide

The lithium hydroxide market has experienced unprecedented growth in recent years, primarily driven by the rapid expansion of the electric vehicle (EV) industry. Global demand for lithium hydroxide reached approximately 100,000 metric tons in 2022, with projections indicating a compound annual growth rate (CAGR) of 25-30% through 2030. This exponential growth trajectory is reshaping supply chain dynamics and creating both opportunities and challenges for market participants.

The EV battery sector represents the dominant demand driver, accounting for over 80% of lithium hydroxide consumption. Battery-grade lithium hydroxide is particularly crucial for high-nickel cathode materials used in long-range electric vehicles, where energy density requirements are most stringent. Major automakers have announced ambitious electrification targets, with many planning to achieve 50-100% electric vehicle production by 2030-2035, further accelerating demand.

Regional demand patterns reveal significant concentration in Asia, particularly China, South Korea, and Japan, where most battery manufacturing capacity is located. However, recent geopolitical tensions and supply chain vulnerabilities have accelerated efforts to develop regional battery supply chains in North America and Europe, creating new demand centers and complicating supply chain optimization efforts.

Price volatility has been a defining characteristic of the lithium hydroxide market, with prices fluctuating between $7,000 and $80,000 per metric ton over the past five years. This extreme volatility creates significant challenges for supply chain planning and cost management. Forward contracts and strategic partnerships between producers and consumers are emerging as critical risk management strategies.

Beyond EVs, industrial applications including ceramics, lubricants, and specialty chemicals constitute approximately 15-20% of demand. These sectors have more stable growth trajectories but face increasing competition for supply as the EV sector expands. The pharmaceutical and aerospace industries represent smaller but premium market segments with stringent quality requirements.

Supply constraints remain a persistent concern, with current production capacity struggling to keep pace with demand growth. The typical timeframe from lithium project identification to full production spans 5-7 years, creating a structural lag in supply response. This supply-demand imbalance is expected to persist through at least mid-decade, maintaining upward pressure on prices despite significant announced capacity expansions.

Environmental and social governance (ESG) considerations are increasingly influencing market dynamics, with consumers and regulators demanding more sustainable and ethically sourced materials. This trend is driving investment in direct lithium extraction technologies and recycling infrastructure, which may reshape supply chains in the coming decade.

The EV battery sector represents the dominant demand driver, accounting for over 80% of lithium hydroxide consumption. Battery-grade lithium hydroxide is particularly crucial for high-nickel cathode materials used in long-range electric vehicles, where energy density requirements are most stringent. Major automakers have announced ambitious electrification targets, with many planning to achieve 50-100% electric vehicle production by 2030-2035, further accelerating demand.

Regional demand patterns reveal significant concentration in Asia, particularly China, South Korea, and Japan, where most battery manufacturing capacity is located. However, recent geopolitical tensions and supply chain vulnerabilities have accelerated efforts to develop regional battery supply chains in North America and Europe, creating new demand centers and complicating supply chain optimization efforts.

Price volatility has been a defining characteristic of the lithium hydroxide market, with prices fluctuating between $7,000 and $80,000 per metric ton over the past five years. This extreme volatility creates significant challenges for supply chain planning and cost management. Forward contracts and strategic partnerships between producers and consumers are emerging as critical risk management strategies.

Beyond EVs, industrial applications including ceramics, lubricants, and specialty chemicals constitute approximately 15-20% of demand. These sectors have more stable growth trajectories but face increasing competition for supply as the EV sector expands. The pharmaceutical and aerospace industries represent smaller but premium market segments with stringent quality requirements.

Supply constraints remain a persistent concern, with current production capacity struggling to keep pace with demand growth. The typical timeframe from lithium project identification to full production spans 5-7 years, creating a structural lag in supply response. This supply-demand imbalance is expected to persist through at least mid-decade, maintaining upward pressure on prices despite significant announced capacity expansions.

Environmental and social governance (ESG) considerations are increasingly influencing market dynamics, with consumers and regulators demanding more sustainable and ethically sourced materials. This trend is driving investment in direct lithium extraction technologies and recycling infrastructure, which may reshape supply chains in the coming decade.

Global Supply Chain Challenges and Constraints

The lithium hydroxide supply chain faces significant global challenges that impact cost optimization efforts. Geopolitical tensions have created supply vulnerabilities, particularly with China controlling approximately 60% of lithium processing capacity worldwide. This concentration presents risks of supply disruptions during international conflicts or trade disputes, as evidenced by recent export restrictions on critical minerals from major producing countries.

Resource nationalism has emerged as another constraint, with lithium-rich nations increasingly implementing policies to retain greater economic benefits from their natural resources. Countries like Chile, Argentina, and Bolivia have introduced higher royalty rates, mandatory local processing requirements, and state participation in mining projects, adding complexity and costs to supply chain management.

Transportation logistics present substantial challenges due to the hazardous classification of lithium compounds. Specialized containers, strict regulatory compliance, and limited carrier options significantly increase shipping costs and lead times. The geographic disconnect between major lithium sources (Australia, South America) and processing facilities (predominantly in China) necessitates long-distance transportation, further exacerbating these issues.

Regulatory compliance across different jurisdictions creates additional complexity. Companies must navigate varying environmental standards, permitting processes, and safety regulations that differ substantially between regions. The inconsistent regulatory landscape increases compliance costs and creates operational inefficiencies throughout the supply chain.

Market volatility represents another significant constraint, with lithium hydroxide prices experiencing dramatic fluctuations—over 300% price swings observed between 2021 and 2023. This volatility complicates long-term supply agreements and investment planning, forcing companies to develop sophisticated hedging strategies or accept higher risk premiums.

Infrastructure limitations in key lithium-producing regions further constrain supply chain optimization. Many lithium resources are located in remote areas with underdeveloped transportation networks, unreliable energy supplies, and insufficient water resources for processing operations. These infrastructure gaps necessitate significant capital investments that impact overall cost structures.

Labor challenges, including skilled workforce shortages in mining and chemical processing sectors, create bottlenecks in production capacity expansion. The specialized knowledge required for lithium hydroxide production cannot be quickly developed, leading to wage inflation and productivity constraints that affect operational costs throughout the supply chain.

Resource nationalism has emerged as another constraint, with lithium-rich nations increasingly implementing policies to retain greater economic benefits from their natural resources. Countries like Chile, Argentina, and Bolivia have introduced higher royalty rates, mandatory local processing requirements, and state participation in mining projects, adding complexity and costs to supply chain management.

Transportation logistics present substantial challenges due to the hazardous classification of lithium compounds. Specialized containers, strict regulatory compliance, and limited carrier options significantly increase shipping costs and lead times. The geographic disconnect between major lithium sources (Australia, South America) and processing facilities (predominantly in China) necessitates long-distance transportation, further exacerbating these issues.

Regulatory compliance across different jurisdictions creates additional complexity. Companies must navigate varying environmental standards, permitting processes, and safety regulations that differ substantially between regions. The inconsistent regulatory landscape increases compliance costs and creates operational inefficiencies throughout the supply chain.

Market volatility represents another significant constraint, with lithium hydroxide prices experiencing dramatic fluctuations—over 300% price swings observed between 2021 and 2023. This volatility complicates long-term supply agreements and investment planning, forcing companies to develop sophisticated hedging strategies or accept higher risk premiums.

Infrastructure limitations in key lithium-producing regions further constrain supply chain optimization. Many lithium resources are located in remote areas with underdeveloped transportation networks, unreliable energy supplies, and insufficient water resources for processing operations. These infrastructure gaps necessitate significant capital investments that impact overall cost structures.

Labor challenges, including skilled workforce shortages in mining and chemical processing sectors, create bottlenecks in production capacity expansion. The specialized knowledge required for lithium hydroxide production cannot be quickly developed, leading to wage inflation and productivity constraints that affect operational costs throughout the supply chain.

Current Supply Chain Optimization Strategies

01 Optimization of lithium hydroxide production processes

Various methods to optimize the production processes of lithium hydroxide can lead to significant cost savings in the supply chain. These optimizations include improved extraction techniques, more efficient conversion processes, and reduced energy consumption during manufacturing. By implementing these process improvements, companies can reduce production costs while maintaining or enhancing product quality.- Optimization of lithium hydroxide production processes: Various methods to optimize the production processes of lithium hydroxide can lead to significant cost savings in the supply chain. These optimizations include improved extraction techniques, more efficient conversion processes, and reduced energy consumption during manufacturing. By implementing these process improvements, companies can reduce production costs while maintaining or enhancing product quality.

- Supply chain management and logistics optimization: Effective supply chain management strategies specifically tailored for lithium hydroxide can reduce costs throughout the value chain. This includes optimizing transportation routes, implementing just-in-time inventory systems, reducing warehousing costs, and improving coordination between suppliers and manufacturers. Advanced logistics planning and digital tracking systems help minimize delays and reduce overall supply chain expenses.

- Recycling and circular economy approaches: Implementing recycling processes and circular economy principles in the lithium hydroxide supply chain can generate substantial cost savings. By recovering lithium from spent batteries and industrial waste streams, companies can reduce their dependence on primary raw materials. These recycling technologies help create a more sustainable supply chain while simultaneously lowering material acquisition costs.

- Strategic sourcing and supplier relationships: Strategic approaches to sourcing lithium materials and developing strong supplier relationships can lead to cost reductions in the lithium hydroxide supply chain. This includes long-term contracts with favorable terms, vertical integration strategies, diversification of supply sources, and collaborative development initiatives with key suppliers. These approaches help secure stable supply at competitive prices.

- Technology integration and automation: Integration of advanced technologies and automation throughout the lithium hydroxide supply chain can drive significant cost savings. This includes implementing AI-driven demand forecasting, blockchain for supply chain transparency, IoT for real-time monitoring, and automated production and quality control systems. These technological solutions reduce labor costs, minimize errors, and improve overall operational efficiency.

02 Supply chain management and logistics optimization

Effective supply chain management strategies specifically for lithium hydroxide can reduce costs through improved logistics, inventory management, and distribution networks. This includes optimizing transportation routes, reducing storage costs, implementing just-in-time delivery systems, and developing strategic partnerships with suppliers and distributors to minimize expenses throughout the supply chain.Expand Specific Solutions03 Recycling and circular economy approaches

Implementing recycling processes and circular economy principles in the lithium hydroxide supply chain can lead to substantial cost savings. These approaches include recovering lithium from spent batteries, reprocessing manufacturing waste, and developing closed-loop systems that minimize resource inputs and waste outputs, thereby reducing dependency on primary raw materials and lowering overall production costs.Expand Specific Solutions04 Alternative sourcing and production methods

Exploring alternative sources and production methods for lithium hydroxide can lead to cost reductions in the supply chain. This includes developing new extraction technologies from non-traditional sources, direct lithium extraction from brines, and innovative conversion processes that require fewer steps or reagents, resulting in lower production costs and reduced environmental impact.Expand Specific Solutions05 Digital transformation and technology integration

Implementing digital technologies and advanced analytics in the lithium hydroxide supply chain can drive cost savings through improved efficiency and decision-making. Technologies such as artificial intelligence, blockchain for traceability, Internet of Things for real-time monitoring, and predictive maintenance can optimize operations, reduce downtime, prevent quality issues, and enable more accurate demand forecasting, all contributing to lower overall costs.Expand Specific Solutions

Critical Technologies for Cost Reduction

Method for manufacturing lithium hydroxide

PatentWO2023136195A1

Innovation

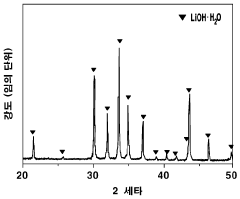

- A method involving electrochemical membrane separation, crystallization, carbonation, and sulfate concentration processes is employed to recycle lithium and remove impurities, optimizing the yield of lithium hydroxide while minimizing waste and impurity content.

Economical method for producing lithium hydroxide

PatentWO2024117882A1

Innovation

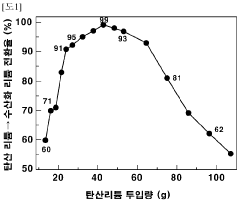

- A method involving dissolving calcium hydroxide in water to create an aqueous solution, then reacting it with lithium carbonate at controlled temperatures (50°C to 100°C) to produce lithium hydroxide, optimizing the amount of lithium carbonate added (16 to 87 g/L) to maximize conversion rates and minimize waste, while concentrating the solution to precipitate lithium hydroxide efficiently.

Raw Material Sourcing and Sustainability Considerations

The sourcing of raw materials for lithium hydroxide production represents a critical factor in supply chain optimization and cost reduction strategies. Currently, lithium is primarily extracted from two sources: hard rock mining (spodumene) and brine operations. Each source presents distinct cost structures, environmental impacts, and supply reliability considerations. Spodumene mining, concentrated in Australia, offers more stable pricing but higher extraction costs, while brine operations in South America provide lower operational costs but face increasing environmental scrutiny and water usage concerns.

Strategic diversification of supply sources has emerged as a key approach to mitigate supply chain vulnerabilities. Companies leading in cost optimization have established relationships with multiple suppliers across different geographical regions, reducing exposure to regional disruptions, political instability, or natural disasters. This multi-sourcing strategy, while requiring more complex logistics management, provides significant protection against supply shortages and price volatility.

Sustainability considerations have become increasingly intertwined with economic factors in lithium hydroxide supply chains. The water-intensive nature of brine operations, particularly in water-stressed regions of Chile and Argentina, has prompted regulatory changes that directly impact operational costs and production capacity. Forward-thinking organizations are investing in water recycling technologies and more efficient extraction methods that simultaneously reduce environmental impact and operational expenses.

The carbon footprint associated with lithium processing and transportation represents another critical sustainability consideration with direct cost implications. As carbon pricing mechanisms expand globally, companies with carbon-intensive supply chains face increasing financial penalties. Proximity to end-use manufacturing facilities has therefore become a significant factor in sourcing decisions, with some battery manufacturers establishing integrated supply chains to minimize transportation distances and associated emissions.

Recycling initiatives are gaining momentum as both sustainability measures and cost-reduction strategies. Current lithium recycling technologies can recover up to 95% of lithium from spent batteries, potentially providing a significant secondary supply source. While recycling infrastructure remains underdeveloped, companies investing in these capabilities now are positioning themselves advantageously for future regulatory requirements and potential raw material shortages.

Traceability and ethical sourcing have emerged as essential components of sustainable lithium supply chains. Blockchain-based tracking systems and third-party certification programs are being implemented to verify responsible mining practices and fair labor conditions. These systems, while requiring initial investment, help mitigate reputational risks and ensure compliance with increasingly stringent international regulations regarding mineral sourcing.

Strategic diversification of supply sources has emerged as a key approach to mitigate supply chain vulnerabilities. Companies leading in cost optimization have established relationships with multiple suppliers across different geographical regions, reducing exposure to regional disruptions, political instability, or natural disasters. This multi-sourcing strategy, while requiring more complex logistics management, provides significant protection against supply shortages and price volatility.

Sustainability considerations have become increasingly intertwined with economic factors in lithium hydroxide supply chains. The water-intensive nature of brine operations, particularly in water-stressed regions of Chile and Argentina, has prompted regulatory changes that directly impact operational costs and production capacity. Forward-thinking organizations are investing in water recycling technologies and more efficient extraction methods that simultaneously reduce environmental impact and operational expenses.

The carbon footprint associated with lithium processing and transportation represents another critical sustainability consideration with direct cost implications. As carbon pricing mechanisms expand globally, companies with carbon-intensive supply chains face increasing financial penalties. Proximity to end-use manufacturing facilities has therefore become a significant factor in sourcing decisions, with some battery manufacturers establishing integrated supply chains to minimize transportation distances and associated emissions.

Recycling initiatives are gaining momentum as both sustainability measures and cost-reduction strategies. Current lithium recycling technologies can recover up to 95% of lithium from spent batteries, potentially providing a significant secondary supply source. While recycling infrastructure remains underdeveloped, companies investing in these capabilities now are positioning themselves advantageously for future regulatory requirements and potential raw material shortages.

Traceability and ethical sourcing have emerged as essential components of sustainable lithium supply chains. Blockchain-based tracking systems and third-party certification programs are being implemented to verify responsible mining practices and fair labor conditions. These systems, while requiring initial investment, help mitigate reputational risks and ensure compliance with increasingly stringent international regulations regarding mineral sourcing.

Geopolitical Factors Affecting Lithium Supply Security

The geopolitical landscape significantly impacts the security and stability of lithium supply chains, which directly affects cost optimization strategies for lithium hydroxide production. The concentration of lithium resources in the "Lithium Triangle" of South America (Argentina, Bolivia, and Chile) and Australia creates inherent geopolitical vulnerabilities. These regions account for approximately 75% of the world's known lithium reserves, making any political instability or policy changes in these areas critical to global supply security.

Trade tensions between major economies have increasingly affected lithium markets. The United States-China trade disputes have disrupted established supply chains, with tariffs on lithium compounds forcing companies to reconsider sourcing strategies and manufacturing locations. Chinese companies have secured significant lithium assets globally, particularly in South America and Africa, giving China considerable influence over the global lithium supply chain despite having limited domestic reserves.

National resource policies present another layer of complexity. Countries like Chile and Argentina have implemented stricter regulations on lithium extraction, including production quotas, higher royalties, and environmental requirements. Bolivia, despite possessing substantial lithium resources, has historically restricted foreign investment, limiting the development of its reserves. These policy decisions directly impact availability and pricing in the lithium hydroxide market.

Resource nationalism is emerging as a significant trend, with lithium-rich countries increasingly viewing their reserves as strategic assets. This has manifested in various forms, from increased state participation in mining projects to export restrictions designed to develop domestic processing capabilities. Such policies can create supply uncertainties and price volatility in international markets.

The COVID-19 pandemic exposed the vulnerability of global supply chains, prompting many countries to reassess their critical mineral strategies. Several nations, including the United States, European Union members, and Japan, have designated lithium as a critical mineral and developed strategies to secure supplies through diplomatic initiatives, strategic partnerships, and domestic resource development.

Climate policies worldwide are accelerating the transition to electric vehicles, dramatically increasing projected lithium demand. This creates a complex dynamic where countries must balance environmental protection with resource development. Nations with strong environmental regulations may face challenges in developing domestic lithium resources, potentially increasing dependence on imports from regions with less stringent oversight.

Water security issues compound these challenges, as traditional lithium extraction is water-intensive and often occurs in arid regions. Conflicts over water rights between mining operations and local communities have emerged as significant political issues in countries like Chile, potentially constraining production and affecting global supply.

Trade tensions between major economies have increasingly affected lithium markets. The United States-China trade disputes have disrupted established supply chains, with tariffs on lithium compounds forcing companies to reconsider sourcing strategies and manufacturing locations. Chinese companies have secured significant lithium assets globally, particularly in South America and Africa, giving China considerable influence over the global lithium supply chain despite having limited domestic reserves.

National resource policies present another layer of complexity. Countries like Chile and Argentina have implemented stricter regulations on lithium extraction, including production quotas, higher royalties, and environmental requirements. Bolivia, despite possessing substantial lithium resources, has historically restricted foreign investment, limiting the development of its reserves. These policy decisions directly impact availability and pricing in the lithium hydroxide market.

Resource nationalism is emerging as a significant trend, with lithium-rich countries increasingly viewing their reserves as strategic assets. This has manifested in various forms, from increased state participation in mining projects to export restrictions designed to develop domestic processing capabilities. Such policies can create supply uncertainties and price volatility in international markets.

The COVID-19 pandemic exposed the vulnerability of global supply chains, prompting many countries to reassess their critical mineral strategies. Several nations, including the United States, European Union members, and Japan, have designated lithium as a critical mineral and developed strategies to secure supplies through diplomatic initiatives, strategic partnerships, and domestic resource development.

Climate policies worldwide are accelerating the transition to electric vehicles, dramatically increasing projected lithium demand. This creates a complex dynamic where countries must balance environmental protection with resource development. Nations with strong environmental regulations may face challenges in developing domestic lithium resources, potentially increasing dependence on imports from regions with less stringent oversight.

Water security issues compound these challenges, as traditional lithium extraction is water-intensive and often occurs in arid regions. Conflicts over water rights between mining operations and local communities have emerged as significant political issues in countries like Chile, potentially constraining production and affecting global supply.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!