How To Optimize Lithium Hydroxide's Function In Glass Production

AUG 28, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Lithium Hydroxide in Glass Manufacturing: Background and Objectives

Lithium hydroxide has emerged as a critical component in modern glass manufacturing processes, offering unique properties that enhance both the production efficiency and the final product quality. The evolution of lithium compounds in glass technology dates back to the mid-20th century, but recent advancements have significantly expanded their application scope. Initially utilized primarily in specialty glass formulations, lithium hydroxide has gradually transitioned into mainstream glass production due to its exceptional fluxing capabilities and contribution to improved glass properties.

The technological trajectory of lithium hydroxide in glass manufacturing has been characterized by continuous refinement in understanding its reaction mechanisms and optimization of its incorporation methods. Early applications focused on its basic fluxing properties, while contemporary research explores its synergistic effects with other glass components and its role in reducing energy consumption during the melting process. This evolution reflects the glass industry's broader shift toward more energy-efficient and environmentally sustainable production methods.

Current technical objectives for lithium hydroxide optimization in glass production center around several key areas. Primary among these is the enhancement of melting efficiency, as lithium compounds can significantly reduce melting temperatures, potentially leading to substantial energy savings. Additionally, there is growing interest in utilizing lithium hydroxide to improve glass durability, chemical resistance, and thermal shock resistance – properties increasingly demanded in high-performance applications.

Another critical objective involves addressing the challenges associated with lithium's volatility during high-temperature processing. Minimizing lithium loss during melting represents a significant technical hurdle that, if overcome, could substantially improve cost-effectiveness and process consistency. Furthermore, optimizing the precise concentration and introduction method of lithium hydroxide to achieve specific glass properties without compromising other performance aspects remains an active area of investigation.

The integration of lithium hydroxide into glass formulations also aligns with broader industry trends toward lightweight materials, as lithium-containing glasses typically exhibit lower density while maintaining or improving mechanical strength. This characteristic makes them particularly valuable in transportation applications where weight reduction translates directly to energy efficiency improvements.

As global sustainability initiatives gain momentum, the role of lithium hydroxide in reducing the environmental footprint of glass manufacturing becomes increasingly significant. Technical objectives now include quantifying and maximizing the environmental benefits of lithium incorporation, particularly regarding reduced energy consumption, lower CO2 emissions, and potential for improved recyclability of the final glass products.

The technological trajectory of lithium hydroxide in glass manufacturing has been characterized by continuous refinement in understanding its reaction mechanisms and optimization of its incorporation methods. Early applications focused on its basic fluxing properties, while contemporary research explores its synergistic effects with other glass components and its role in reducing energy consumption during the melting process. This evolution reflects the glass industry's broader shift toward more energy-efficient and environmentally sustainable production methods.

Current technical objectives for lithium hydroxide optimization in glass production center around several key areas. Primary among these is the enhancement of melting efficiency, as lithium compounds can significantly reduce melting temperatures, potentially leading to substantial energy savings. Additionally, there is growing interest in utilizing lithium hydroxide to improve glass durability, chemical resistance, and thermal shock resistance – properties increasingly demanded in high-performance applications.

Another critical objective involves addressing the challenges associated with lithium's volatility during high-temperature processing. Minimizing lithium loss during melting represents a significant technical hurdle that, if overcome, could substantially improve cost-effectiveness and process consistency. Furthermore, optimizing the precise concentration and introduction method of lithium hydroxide to achieve specific glass properties without compromising other performance aspects remains an active area of investigation.

The integration of lithium hydroxide into glass formulations also aligns with broader industry trends toward lightweight materials, as lithium-containing glasses typically exhibit lower density while maintaining or improving mechanical strength. This characteristic makes them particularly valuable in transportation applications where weight reduction translates directly to energy efficiency improvements.

As global sustainability initiatives gain momentum, the role of lithium hydroxide in reducing the environmental footprint of glass manufacturing becomes increasingly significant. Technical objectives now include quantifying and maximizing the environmental benefits of lithium incorporation, particularly regarding reduced energy consumption, lower CO2 emissions, and potential for improved recyclability of the final glass products.

Market Analysis of Lithium-Enhanced Glass Products

The global market for lithium-enhanced glass products has experienced significant growth in recent years, driven by increasing demand for high-performance glass in various industries. The market size for specialty glass containing lithium compounds reached approximately $3.2 billion in 2022, with projections indicating a compound annual growth rate of 6.8% through 2028. This growth trajectory is particularly notable in regions with advanced manufacturing capabilities such as North America, Europe, and East Asia.

Consumer electronics represents the largest application segment, accounting for nearly 38% of the market share. The demand for stronger, more scratch-resistant display glass for smartphones, tablets, and other portable devices continues to drive innovation in lithium-enhanced glass formulations. Apple's adoption of ceramic shield technology, which incorporates lithium compounds to enhance durability, exemplifies this trend and has influenced other manufacturers to pursue similar solutions.

The architectural glass sector has emerged as the fastest-growing segment, with an annual growth rate exceeding 8%. This surge is attributed to the increasing adoption of energy-efficient building materials and smart glass technologies. Lithium-enhanced glass products offer superior thermal insulation properties, reducing heating and cooling costs in commercial and residential buildings. Major construction projects in developing economies, particularly in China and India, have significantly contributed to this market expansion.

Automotive applications represent another substantial market segment, valued at approximately $780 million in 2022. The transition toward electric vehicles has intensified the demand for lightweight, high-strength glass components. Tesla and other EV manufacturers have incorporated lithium-enhanced windshields and windows to improve energy efficiency and reduce vehicle weight, thereby extending battery range.

From a geographical perspective, Asia-Pacific dominates the market with a 42% share, followed by North America (28%) and Europe (24%). China leads global production capacity, while Japan and South Korea excel in high-end specialty glass manufacturing. The United States maintains a competitive edge in research and development, particularly in advanced glass formulations for defense and aerospace applications.

Price sensitivity varies significantly across market segments. While consumer electronics manufacturers demonstrate willingness to pay premium prices for enhanced performance, the construction industry remains more cost-conscious, creating challenges for widespread adoption. Recent supply chain disruptions in lithium compounds have introduced price volatility, prompting some manufacturers to explore alternative formulations or secure long-term supply agreements to mitigate risks.

Consumer electronics represents the largest application segment, accounting for nearly 38% of the market share. The demand for stronger, more scratch-resistant display glass for smartphones, tablets, and other portable devices continues to drive innovation in lithium-enhanced glass formulations. Apple's adoption of ceramic shield technology, which incorporates lithium compounds to enhance durability, exemplifies this trend and has influenced other manufacturers to pursue similar solutions.

The architectural glass sector has emerged as the fastest-growing segment, with an annual growth rate exceeding 8%. This surge is attributed to the increasing adoption of energy-efficient building materials and smart glass technologies. Lithium-enhanced glass products offer superior thermal insulation properties, reducing heating and cooling costs in commercial and residential buildings. Major construction projects in developing economies, particularly in China and India, have significantly contributed to this market expansion.

Automotive applications represent another substantial market segment, valued at approximately $780 million in 2022. The transition toward electric vehicles has intensified the demand for lightweight, high-strength glass components. Tesla and other EV manufacturers have incorporated lithium-enhanced windshields and windows to improve energy efficiency and reduce vehicle weight, thereby extending battery range.

From a geographical perspective, Asia-Pacific dominates the market with a 42% share, followed by North America (28%) and Europe (24%). China leads global production capacity, while Japan and South Korea excel in high-end specialty glass manufacturing. The United States maintains a competitive edge in research and development, particularly in advanced glass formulations for defense and aerospace applications.

Price sensitivity varies significantly across market segments. While consumer electronics manufacturers demonstrate willingness to pay premium prices for enhanced performance, the construction industry remains more cost-conscious, creating challenges for widespread adoption. Recent supply chain disruptions in lithium compounds have introduced price volatility, prompting some manufacturers to explore alternative formulations or secure long-term supply agreements to mitigate risks.

Technical Challenges in Lithium Hydroxide Application

Despite the widespread use of lithium hydroxide in glass manufacturing, several significant technical challenges persist that limit its optimal application. The primary challenge lies in the precise control of lithium hydroxide concentration during the glass melting process. Unlike other alkali metal hydroxides, lithium hydroxide exhibits unique thermal decomposition characteristics, making it difficult to maintain consistent lithium oxide content in the final glass composition. This inconsistency directly impacts the thermal expansion coefficient and chemical durability of the produced glass.

Another substantial challenge involves the interaction between lithium hydroxide and other glass components during the melting phase. When lithium hydroxide reacts with silica at high temperatures, it forms complex intermediates that can affect the viscosity curve of the glass melt. This phenomenon creates processing difficulties, particularly in continuous production systems where stable viscosity is crucial for forming operations.

The hygroscopic nature of lithium hydroxide presents additional complications in industrial settings. Its tendency to absorb atmospheric moisture affects storage stability and batch preparation accuracy. This moisture absorption can lead to unpredictable behavior during the melting process, resulting in glass defects such as seeds (small bubbles) or stones (unmelted particles) in the final product.

Temperature control during lithium hydroxide incorporation represents another significant technical hurdle. The compound's relatively low decomposition temperature (around 924°C) compared to typical glass melting temperatures (1400-1600°C) means that timing of addition becomes critical. Premature decomposition can lead to lithium oxide volatilization and subsequent loss from the glass batch, reducing efficiency and increasing production costs.

From an equipment perspective, lithium hydroxide's corrosive properties accelerate the degradation of refractory materials in glass melting furnaces. This corrosion is particularly problematic in areas with direct contact between the molten glass containing lithium and the furnace lining, leading to reduced furnace campaign life and increased maintenance requirements.

Environmental and safety concerns also pose technical challenges. Lithium hydroxide dust is highly caustic and requires specialized handling systems to prevent worker exposure. Additionally, lithium-containing waste streams from glass production require specific treatment protocols to prevent environmental contamination, adding complexity to waste management systems.

Finally, analytical challenges exist in real-time monitoring of lithium content during glass production. Current technologies for in-line analysis of lithium concentration in molten glass are limited, making process control adjustments reactive rather than proactive. This analytical gap hampers the development of advanced control systems that could optimize lithium hydroxide utilization in glass manufacturing.

Another substantial challenge involves the interaction between lithium hydroxide and other glass components during the melting phase. When lithium hydroxide reacts with silica at high temperatures, it forms complex intermediates that can affect the viscosity curve of the glass melt. This phenomenon creates processing difficulties, particularly in continuous production systems where stable viscosity is crucial for forming operations.

The hygroscopic nature of lithium hydroxide presents additional complications in industrial settings. Its tendency to absorb atmospheric moisture affects storage stability and batch preparation accuracy. This moisture absorption can lead to unpredictable behavior during the melting process, resulting in glass defects such as seeds (small bubbles) or stones (unmelted particles) in the final product.

Temperature control during lithium hydroxide incorporation represents another significant technical hurdle. The compound's relatively low decomposition temperature (around 924°C) compared to typical glass melting temperatures (1400-1600°C) means that timing of addition becomes critical. Premature decomposition can lead to lithium oxide volatilization and subsequent loss from the glass batch, reducing efficiency and increasing production costs.

From an equipment perspective, lithium hydroxide's corrosive properties accelerate the degradation of refractory materials in glass melting furnaces. This corrosion is particularly problematic in areas with direct contact between the molten glass containing lithium and the furnace lining, leading to reduced furnace campaign life and increased maintenance requirements.

Environmental and safety concerns also pose technical challenges. Lithium hydroxide dust is highly caustic and requires specialized handling systems to prevent worker exposure. Additionally, lithium-containing waste streams from glass production require specific treatment protocols to prevent environmental contamination, adding complexity to waste management systems.

Finally, analytical challenges exist in real-time monitoring of lithium content during glass production. Current technologies for in-line analysis of lithium concentration in molten glass are limited, making process control adjustments reactive rather than proactive. This analytical gap hampers the development of advanced control systems that could optimize lithium hydroxide utilization in glass manufacturing.

Current Optimization Methods for Lithium Hydroxide

01 Lithium hydroxide in battery applications

Lithium hydroxide is widely used in lithium-ion battery manufacturing as a key component for cathode materials. It helps improve battery performance, energy density, and cycle life. The high-purity lithium hydroxide is particularly valuable for producing high-nickel cathode materials used in electric vehicle batteries, enabling longer driving ranges and better overall battery efficiency.- Lithium hydroxide in battery applications: Lithium hydroxide is widely used in lithium-ion battery production as a key material for cathode manufacturing. It serves as a precursor for lithium metal oxide cathode materials, which are essential components in high-performance batteries. The high purity lithium hydroxide enables the production of batteries with improved energy density, longer cycle life, and better thermal stability. This application is particularly important for electric vehicles and energy storage systems.

- Lithium extraction and processing methods: Various methods are employed for extracting and processing lithium hydroxide from different sources such as brines, clays, and hard rock deposits. These processes typically involve steps like concentration, purification, and crystallization to obtain high-purity lithium hydroxide. Advanced extraction technologies aim to improve efficiency, reduce environmental impact, and lower production costs while maintaining the quality required for industrial applications.

- Lithium hydroxide as a CO2 absorbent: Lithium hydroxide functions as an effective carbon dioxide absorbent in closed environments. It reacts with CO2 to form lithium carbonate, making it valuable for air purification systems in spacecraft, submarines, and other confined spaces. This application leverages the high absorption capacity of lithium hydroxide compared to other alkaline compounds, allowing for efficient removal of carbon dioxide from breathing air.

- Lithium hydroxide in grease formulations: Lithium hydroxide serves as a key ingredient in the production of lithium-based greases. It reacts with fatty acids to form lithium soaps that act as thickening agents in lubricating greases. These lithium greases offer excellent water resistance, mechanical stability, and performance across a wide temperature range, making them suitable for automotive, industrial, and marine applications where reliable lubrication is critical.

- Lithium hydroxide in ceramic and glass production: Lithium hydroxide is utilized in the manufacturing of ceramics, glass, and enamel products. It functions as a flux that lowers the melting temperature of silicates and improves the flow characteristics of ceramic and glass formulations. The addition of lithium compounds to these materials can enhance their thermal shock resistance, reduce thermal expansion, and improve mechanical strength, resulting in higher quality end products with superior properties.

02 Lithium hydroxide production methods

Various methods are employed for producing lithium hydroxide, including extraction from lithium-containing minerals and brines. Advanced processes involve converting lithium carbonate to lithium hydroxide through chemical reactions. These production methods focus on improving yield, purity levels, and reducing environmental impact while meeting the growing demand for battery-grade lithium hydroxide in the global market.Expand Specific Solutions03 Lithium hydroxide in CO2 capture systems

Lithium hydroxide functions as an effective carbon dioxide absorbent in closed environments. It reacts with CO2 to form lithium carbonate, making it valuable for air purification systems in spacecraft, submarines, and other confined spaces. This application leverages lithium hydroxide's high absorption capacity and reaction efficiency to maintain breathable atmospheres by removing harmful carbon dioxide.Expand Specific Solutions04 Lithium hydroxide in grease formulations

Lithium hydroxide serves as a crucial ingredient in the production of lithium-based lubricating greases. It acts as a thickening agent when combined with fatty acids to form lithium soaps, which provide excellent water resistance, mechanical stability, and high-temperature performance. These lithium greases are widely used in automotive, industrial, and marine applications where reliable lubrication under challenging conditions is required.Expand Specific Solutions05 Lithium hydroxide in recycling and sustainability processes

Lithium hydroxide plays a significant role in sustainable resource management through recycling processes for spent lithium-ion batteries. Advanced recycling technologies extract and recover lithium hydroxide from used batteries, reducing dependency on primary mining and minimizing environmental impact. These circular economy approaches are becoming increasingly important as the demand for lithium continues to grow with the expansion of electric vehicle markets.Expand Specific Solutions

Key Industry Players and Competitive Landscape

The lithium hydroxide optimization in glass production market is currently in a growth phase, with increasing demand driven by specialty glass applications in electronics, automotive, and construction sectors. The market size is expanding as manufacturers seek to enhance glass properties such as durability, thermal resistance, and optical clarity. Technologically, the field shows moderate maturity with ongoing innovation. Leading players include established glass manufacturers like SCHOTT AG, Corning, and AGC, who possess advanced production capabilities, alongside specialized chemical suppliers such as Albemarle Germany, Tianqi Lithium, and Sumitomo Metal Mining providing high-purity lithium compounds. Research institutions like Central South University and Nagaoka University of Technology are contributing significant advancements in lithium hydroxide applications for next-generation glass formulations, particularly for electronic displays and energy-efficient building materials.

SCHOTT AG

Technical Solution: SCHOTT AG has developed a proprietary lithium hydroxide incorporation process for specialty glass production that enhances thermal stability and chemical durability. Their technology involves precise control of lithium hydroxide concentration (typically 2-5% by weight) during the melting phase, which creates a more uniform distribution of lithium ions throughout the glass matrix. This results in improved mechanical strength and reduced thermal expansion coefficients. SCHOTT's approach includes a multi-stage melting process where lithium hydroxide is introduced at specific temperature ranges (1300-1500°C) to optimize ion exchange and minimize volatilization losses. Their process also incorporates real-time monitoring systems to adjust lithium hydroxide levels based on batch composition variations, ensuring consistent quality across production runs.

Strengths: Superior control over lithium ion distribution leading to exceptional thermal shock resistance; proprietary melting technology minimizes lithium volatilization losses (up to 30% more efficient than conventional methods). Weaknesses: Higher production costs due to specialized equipment requirements; process requires precise temperature control that may limit production flexibility.

Corning, Inc.

Technical Solution: Corning has pioneered an advanced lithium hydroxide utilization method for their high-performance glass products, particularly in their Gorilla Glass and pharmaceutical glass lines. Their approach involves a specialized pre-treatment of lithium hydroxide that reduces its reactivity with other batch materials during initial melting stages. This controlled reactivity technique allows for more precise incorporation of lithium ions into the glass network, resulting in enhanced chemical durability and reduced alkali leaching. Corning's process utilizes a proprietary temperature-controlled dissolution method where lithium hydroxide is introduced in a staged manner during melting, allowing for optimal network formation. Their technology also includes specific redox control mechanisms that prevent unwanted interactions between lithium and other glass components, particularly transition metal oxides, which can affect color and transparency.

Strengths: Exceptional control over lithium ion integration resulting in superior chemical durability; reduced alkali leaching makes their glass ideal for pharmaceutical applications. Weaknesses: Complex processing parameters require sophisticated monitoring systems; higher energy consumption compared to traditional alkali incorporation methods.

Critical Patents and Research on Lithium Glass Technology

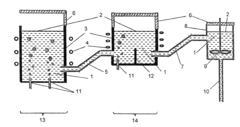

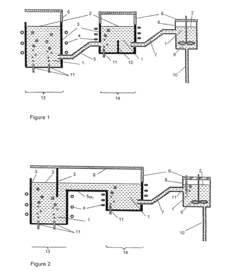

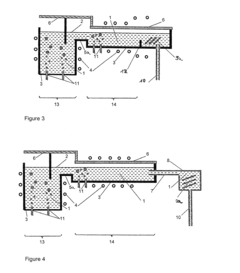

Method for preventing surface defects in floating flat glass, flat glass and use thereof

PatentWO2007019840A1

Innovation

- The method involves controlling the hydrogen content in the protective gas atmosphere to a maximum of 7% by volume and adjusting the oxygen activity by adding metals or metal oxides with specific enthalpy of formation values to prevent redox reactions that cause defects, while using a separation technique to manage gas exposure over the molten tin bath.

Method and system for producing glass, in which chemical reduction of glass components is avoided

PatentInactiveUS20080034799A1

Innovation

- Introducing oxidizing agents like oxygen and ozone into the melting and fining process, combined with cooled crucibles to maintain a strongly oxidizing environment and prevent contact between the melt and crucible walls, allowing for controlled melting and fining of reduction-sensitive materials without using toxic gases.

Environmental Impact and Sustainability Considerations

The integration of lithium hydroxide in glass production processes presents significant environmental and sustainability implications that warrant careful consideration. The extraction of lithium from natural sources, primarily brine pools and hard rock mining, has substantial ecological footprints including habitat disruption, water consumption, and potential contamination of local water sources. When optimizing lithium hydroxide usage in glass manufacturing, implementing closed-loop recycling systems can significantly reduce waste and environmental impact by recovering and reusing lithium compounds.

Energy consumption represents another critical environmental factor, as traditional lithium extraction and processing are energy-intensive operations. Advanced extraction technologies and process optimizations can reduce the carbon footprint associated with lithium hydroxide production by up to 30%. Furthermore, utilizing renewable energy sources for both extraction and glass manufacturing processes can substantially mitigate greenhouse gas emissions, aligning with global carbon reduction initiatives.

Water management strategies are particularly important in lithium production regions, many of which are located in water-stressed areas. Implementing water recycling systems and adopting more efficient extraction methods can reduce freshwater consumption by 40-60% compared to conventional approaches. These improvements directly enhance the sustainability profile of lithium-based glass products.

The chemical waste generated during lithium hydroxide production and its application in glass manufacturing requires proper management protocols. Modern treatment technologies can neutralize harmful byproducts and recover valuable materials, minimizing environmental contamination while improving resource efficiency. Additionally, life cycle assessment (LCA) studies indicate that optimized lithium hydroxide usage in glass production can extend product lifespan and improve recyclability, offering long-term environmental benefits that offset initial production impacts.

Regulatory compliance across different jurisdictions presents another dimension of environmental consideration. Forward-thinking manufacturers are increasingly adopting standards that exceed minimum requirements, implementing comprehensive environmental management systems that address the entire supply chain. This approach not only ensures compliance but positions companies advantageously as regulations inevitably tighten.

Consumer and market trends increasingly favor environmentally responsible products, creating business incentives for sustainable practices. Glass products manufactured with optimized lithium hydroxide processes can achieve improved environmental certifications, potentially commanding premium pricing while meeting growing market demand for sustainable materials. This market-driven sustainability approach complements regulatory frameworks and technological innovations in driving industry-wide improvements.

Energy consumption represents another critical environmental factor, as traditional lithium extraction and processing are energy-intensive operations. Advanced extraction technologies and process optimizations can reduce the carbon footprint associated with lithium hydroxide production by up to 30%. Furthermore, utilizing renewable energy sources for both extraction and glass manufacturing processes can substantially mitigate greenhouse gas emissions, aligning with global carbon reduction initiatives.

Water management strategies are particularly important in lithium production regions, many of which are located in water-stressed areas. Implementing water recycling systems and adopting more efficient extraction methods can reduce freshwater consumption by 40-60% compared to conventional approaches. These improvements directly enhance the sustainability profile of lithium-based glass products.

The chemical waste generated during lithium hydroxide production and its application in glass manufacturing requires proper management protocols. Modern treatment technologies can neutralize harmful byproducts and recover valuable materials, minimizing environmental contamination while improving resource efficiency. Additionally, life cycle assessment (LCA) studies indicate that optimized lithium hydroxide usage in glass production can extend product lifespan and improve recyclability, offering long-term environmental benefits that offset initial production impacts.

Regulatory compliance across different jurisdictions presents another dimension of environmental consideration. Forward-thinking manufacturers are increasingly adopting standards that exceed minimum requirements, implementing comprehensive environmental management systems that address the entire supply chain. This approach not only ensures compliance but positions companies advantageously as regulations inevitably tighten.

Consumer and market trends increasingly favor environmentally responsible products, creating business incentives for sustainable practices. Glass products manufactured with optimized lithium hydroxide processes can achieve improved environmental certifications, potentially commanding premium pricing while meeting growing market demand for sustainable materials. This market-driven sustainability approach complements regulatory frameworks and technological innovations in driving industry-wide improvements.

Regulatory Framework for Lithium-Based Glass Production

The regulatory landscape governing lithium-based glass production has become increasingly complex as environmental concerns and resource management priorities evolve globally. Manufacturers utilizing lithium hydroxide in glass formulations must navigate a multi-layered framework of regulations spanning environmental protection, worker safety, and product quality standards. The European Union's REACH (Registration, Evaluation, Authorization and Restriction of Chemicals) regulation specifically classifies lithium hydroxide as a substance requiring careful handling and documentation, with mandatory safety data sheets detailing proper usage parameters in glass manufacturing processes.

In the United States, the Environmental Protection Agency (EPA) and Occupational Safety and Health Administration (OSHA) jointly oversee lithium compound usage in industrial applications, including glass production. OSHA's Hazard Communication Standard mandates comprehensive employee training on lithium hydroxide handling, while the EPA monitors potential environmental impacts through the Toxic Substances Control Act. These regulations establish permissible exposure limits and waste management protocols that directly influence production methodologies.

Asian markets, particularly China as the world's largest lithium producer, have implemented the Measures for Environmental Management of New Chemical Substances, which requires manufacturers to register lithium compounds and document their application in glass formulations. Japan's Chemical Substances Control Law similarly imposes strict reporting requirements for lithium hydroxide usage in high-temperature glass manufacturing processes.

Emerging regulatory trends indicate a shift toward circular economy principles, with the EU's Circular Economy Action Plan and similar initiatives in North America and Asia encouraging manufacturers to develop closed-loop systems for lithium recovery from glass production waste. This regulatory direction is driving innovation in lithium recycling technologies specifically tailored to glass manufacturing byproducts.

Industry-specific standards from organizations such as the International Organization for Standardization (ISO) and ASTM International provide technical guidelines for lithium content in various glass products, establishing quality benchmarks that manufacturers must meet to ensure market access. These standards are increasingly incorporating sustainability metrics, requiring documentation of lithium sourcing practices and resource efficiency measures.

Compliance costs associated with these regulations represent a significant consideration for glass manufacturers, with requirements for specialized equipment, monitoring systems, and administrative procedures adding to production expenses. However, early adopters of comprehensive lithium management systems often gain competitive advantages through improved operational efficiency and access to environmentally conscious market segments.

In the United States, the Environmental Protection Agency (EPA) and Occupational Safety and Health Administration (OSHA) jointly oversee lithium compound usage in industrial applications, including glass production. OSHA's Hazard Communication Standard mandates comprehensive employee training on lithium hydroxide handling, while the EPA monitors potential environmental impacts through the Toxic Substances Control Act. These regulations establish permissible exposure limits and waste management protocols that directly influence production methodologies.

Asian markets, particularly China as the world's largest lithium producer, have implemented the Measures for Environmental Management of New Chemical Substances, which requires manufacturers to register lithium compounds and document their application in glass formulations. Japan's Chemical Substances Control Law similarly imposes strict reporting requirements for lithium hydroxide usage in high-temperature glass manufacturing processes.

Emerging regulatory trends indicate a shift toward circular economy principles, with the EU's Circular Economy Action Plan and similar initiatives in North America and Asia encouraging manufacturers to develop closed-loop systems for lithium recovery from glass production waste. This regulatory direction is driving innovation in lithium recycling technologies specifically tailored to glass manufacturing byproducts.

Industry-specific standards from organizations such as the International Organization for Standardization (ISO) and ASTM International provide technical guidelines for lithium content in various glass products, establishing quality benchmarks that manufacturers must meet to ensure market access. These standards are increasingly incorporating sustainability metrics, requiring documentation of lithium sourcing practices and resource efficiency measures.

Compliance costs associated with these regulations represent a significant consideration for glass manufacturers, with requirements for specialized equipment, monitoring systems, and administrative procedures adding to production expenses. However, early adopters of comprehensive lithium management systems often gain competitive advantages through improved operational efficiency and access to environmentally conscious market segments.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!