Benchmarking Lithium Hydroxide's Effectiveness In Water Softening

AUG 28, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Lithium Hydroxide Water Softening Background & Objectives

Water softening has been a critical process in both industrial and residential water treatment systems for decades, with various chemical agents employed to reduce water hardness caused by calcium and magnesium ions. Traditionally, sodium-based compounds have dominated this market, but increasing environmental concerns and efficiency requirements have driven research into alternative softening agents. Lithium hydroxide (LiOH) has emerged as a potential alternative due to its unique chemical properties and increasing availability as a byproduct of the growing lithium battery industry.

The evolution of water softening technology can be traced back to the early 20th century, with significant advancements occurring in the 1950s and 1960s through ion exchange resins. The 1980s saw the introduction of magnetic and electronic descalers, while the 1990s and 2000s brought membrane-based technologies. Recent trends indicate a shift toward more environmentally sustainable and energy-efficient softening methods, with lithium compounds gaining attention in specialized applications.

Lithium hydroxide possesses several theoretical advantages for water softening, including its high alkalinity, strong reactivity with hardness ions, and potential for lower environmental impact compared to traditional sodium-based softeners. Its unique precipitation chemistry with calcium and magnesium could potentially offer improved efficiency in hardness removal, particularly in high-temperature systems where conventional softeners may be less effective.

The primary technical objective of this research is to comprehensively benchmark lithium hydroxide's effectiveness as a water softening agent compared to conventional alternatives. This includes quantifying its performance across various water hardness levels, temperatures, and pH conditions, as well as evaluating its economic feasibility and environmental impact throughout the complete lifecycle.

Secondary objectives include identifying optimal operational parameters for lithium hydroxide-based softening systems, assessing potential synergistic effects when combined with other treatment methods, and exploring novel applications in specialized industrial processes where traditional softeners face limitations. Additionally, this research aims to evaluate the potential for recovering and recycling lithium from spent softening media, aligning with circular economy principles.

The findings from this benchmarking study will provide valuable insights for water treatment technology developers, industrial process engineers, and environmental policy makers seeking more sustainable and efficient water softening solutions. As global water quality regulations become increasingly stringent and water scarcity issues more prevalent, innovative approaches to water softening represent a significant opportunity for technological advancement in this essential field.

The evolution of water softening technology can be traced back to the early 20th century, with significant advancements occurring in the 1950s and 1960s through ion exchange resins. The 1980s saw the introduction of magnetic and electronic descalers, while the 1990s and 2000s brought membrane-based technologies. Recent trends indicate a shift toward more environmentally sustainable and energy-efficient softening methods, with lithium compounds gaining attention in specialized applications.

Lithium hydroxide possesses several theoretical advantages for water softening, including its high alkalinity, strong reactivity with hardness ions, and potential for lower environmental impact compared to traditional sodium-based softeners. Its unique precipitation chemistry with calcium and magnesium could potentially offer improved efficiency in hardness removal, particularly in high-temperature systems where conventional softeners may be less effective.

The primary technical objective of this research is to comprehensively benchmark lithium hydroxide's effectiveness as a water softening agent compared to conventional alternatives. This includes quantifying its performance across various water hardness levels, temperatures, and pH conditions, as well as evaluating its economic feasibility and environmental impact throughout the complete lifecycle.

Secondary objectives include identifying optimal operational parameters for lithium hydroxide-based softening systems, assessing potential synergistic effects when combined with other treatment methods, and exploring novel applications in specialized industrial processes where traditional softeners face limitations. Additionally, this research aims to evaluate the potential for recovering and recycling lithium from spent softening media, aligning with circular economy principles.

The findings from this benchmarking study will provide valuable insights for water treatment technology developers, industrial process engineers, and environmental policy makers seeking more sustainable and efficient water softening solutions. As global water quality regulations become increasingly stringent and water scarcity issues more prevalent, innovative approaches to water softening represent a significant opportunity for technological advancement in this essential field.

Market Analysis for Water Softening Solutions

The global water softening market is experiencing robust growth, valued at approximately $2.1 billion in 2022 and projected to reach $2.9 billion by 2027, representing a compound annual growth rate (CAGR) of 6.7%. This expansion is primarily driven by increasing awareness of water quality issues, rising industrial demand for treated water, and growing concerns about appliance efficiency and longevity in residential settings.

Residential applications currently dominate the market, accounting for nearly 60% of total revenue, with commercial and industrial sectors making up the remainder. North America holds the largest market share at 35%, followed by Europe (28%) and Asia-Pacific (25%), with the latter showing the fastest growth trajectory due to rapid industrialization and urbanization.

Traditional ion-exchange water softeners using sodium chloride remain the most widely adopted solution, representing approximately 75% of the market. However, alternative technologies are gaining traction, particularly salt-free conditioners, magnetic softeners, and chemical treatment solutions, collectively growing at 9.3% annually—significantly outpacing conventional systems.

The competitive landscape features established players like Culligan, EcoWater Systems, and Pentair, who together control about 45% of the global market. However, numerous regional manufacturers and innovative startups are disrupting the space with novel approaches, including lithium-based technologies.

Consumer preferences are shifting toward environmentally friendly solutions that reduce salt discharge and water waste. This trend has created a growing niche for alternative softening technologies, with approximately 22% of new installations now utilizing non-traditional methods. Price sensitivity varies significantly by region, with developing markets prioritizing initial cost while developed markets focus more on total cost of ownership and environmental impact.

Lithium hydroxide as a water softening agent occupies a nascent but potentially disruptive position. Currently representing less than 1% of the global water softening market, it faces significant adoption barriers including cost concerns (lithium hydroxide costs 8-12 times more than conventional sodium-based alternatives) and limited consumer awareness. However, its superior efficiency in hard water treatment—potentially requiring 30-40% less volume than traditional agents—presents compelling value for specific applications.

Regulatory factors are increasingly influencing market dynamics, with several regions implementing restrictions on brine discharge from traditional softeners. California, parts of Europe, and Australia have enacted the most stringent regulations, creating market opportunities for alternative technologies including lithium-based solutions that produce less waste.

Residential applications currently dominate the market, accounting for nearly 60% of total revenue, with commercial and industrial sectors making up the remainder. North America holds the largest market share at 35%, followed by Europe (28%) and Asia-Pacific (25%), with the latter showing the fastest growth trajectory due to rapid industrialization and urbanization.

Traditional ion-exchange water softeners using sodium chloride remain the most widely adopted solution, representing approximately 75% of the market. However, alternative technologies are gaining traction, particularly salt-free conditioners, magnetic softeners, and chemical treatment solutions, collectively growing at 9.3% annually—significantly outpacing conventional systems.

The competitive landscape features established players like Culligan, EcoWater Systems, and Pentair, who together control about 45% of the global market. However, numerous regional manufacturers and innovative startups are disrupting the space with novel approaches, including lithium-based technologies.

Consumer preferences are shifting toward environmentally friendly solutions that reduce salt discharge and water waste. This trend has created a growing niche for alternative softening technologies, with approximately 22% of new installations now utilizing non-traditional methods. Price sensitivity varies significantly by region, with developing markets prioritizing initial cost while developed markets focus more on total cost of ownership and environmental impact.

Lithium hydroxide as a water softening agent occupies a nascent but potentially disruptive position. Currently representing less than 1% of the global water softening market, it faces significant adoption barriers including cost concerns (lithium hydroxide costs 8-12 times more than conventional sodium-based alternatives) and limited consumer awareness. However, its superior efficiency in hard water treatment—potentially requiring 30-40% less volume than traditional agents—presents compelling value for specific applications.

Regulatory factors are increasingly influencing market dynamics, with several regions implementing restrictions on brine discharge from traditional softeners. California, parts of Europe, and Australia have enacted the most stringent regulations, creating market opportunities for alternative technologies including lithium-based solutions that produce less waste.

Current Challenges in Water Softening Technologies

Water softening technologies face significant challenges in today's industrial and residential applications. Traditional ion exchange systems, while effective, consume substantial amounts of salt and water during regeneration cycles, leading to environmental concerns regarding sodium discharge into wastewater systems. These systems also struggle with efficiency when dealing with extremely hard water, requiring frequent regeneration and maintenance.

Membrane-based technologies like reverse osmosis present alternative approaches but suffer from high energy consumption and water wastage, with typical systems rejecting 25-50% of input water as concentrate. Additionally, membrane fouling remains a persistent issue, reducing system lifespan and increasing operational costs.

Chemical precipitation methods using lime softening generate considerable sludge that requires proper disposal, creating additional environmental and cost burdens. The process also demands precise pH control and chemical dosing, making it challenging to implement in small-scale applications or areas with fluctuating water quality.

Emerging technologies such as template-assisted crystallization and electrically induced precipitation show promise but lack comprehensive performance data across diverse water conditions. Their effectiveness varies significantly depending on water chemistry, temperature, and flow rates, making standardized implementation difficult.

The economic aspects of water softening present another challenge. Initial installation costs for advanced systems remain prohibitively high for many applications, while operational expenses including energy, chemical inputs, and maintenance create ongoing financial burdens. This economic reality limits widespread adoption of more environmentally friendly technologies.

Regulatory frameworks add complexity to the water softening landscape. Increasingly stringent environmental regulations regarding brine discharge and water conservation necessitate technological adaptations, while varying standards across regions complicate global technology deployment and standardization efforts.

In this context, lithium hydroxide represents a potential alternative that requires thorough evaluation. Its ion exchange properties differ from conventional sodium-based softeners, potentially offering advantages in efficiency and environmental impact. However, comprehensive benchmarking studies comparing lithium hydroxide to established technologies remain limited, particularly regarding long-term performance, regeneration requirements, and cost-effectiveness across different water hardness levels and contaminant profiles.

Membrane-based technologies like reverse osmosis present alternative approaches but suffer from high energy consumption and water wastage, with typical systems rejecting 25-50% of input water as concentrate. Additionally, membrane fouling remains a persistent issue, reducing system lifespan and increasing operational costs.

Chemical precipitation methods using lime softening generate considerable sludge that requires proper disposal, creating additional environmental and cost burdens. The process also demands precise pH control and chemical dosing, making it challenging to implement in small-scale applications or areas with fluctuating water quality.

Emerging technologies such as template-assisted crystallization and electrically induced precipitation show promise but lack comprehensive performance data across diverse water conditions. Their effectiveness varies significantly depending on water chemistry, temperature, and flow rates, making standardized implementation difficult.

The economic aspects of water softening present another challenge. Initial installation costs for advanced systems remain prohibitively high for many applications, while operational expenses including energy, chemical inputs, and maintenance create ongoing financial burdens. This economic reality limits widespread adoption of more environmentally friendly technologies.

Regulatory frameworks add complexity to the water softening landscape. Increasingly stringent environmental regulations regarding brine discharge and water conservation necessitate technological adaptations, while varying standards across regions complicate global technology deployment and standardization efforts.

In this context, lithium hydroxide represents a potential alternative that requires thorough evaluation. Its ion exchange properties differ from conventional sodium-based softeners, potentially offering advantages in efficiency and environmental impact. However, comprehensive benchmarking studies comparing lithium hydroxide to established technologies remain limited, particularly regarding long-term performance, regeneration requirements, and cost-effectiveness across different water hardness levels and contaminant profiles.

Existing Lithium Hydroxide Application Methods

01 Lithium hydroxide in battery applications

Lithium hydroxide is highly effective in lithium-ion battery manufacturing, particularly for high-performance cathode materials. It serves as a critical precursor for producing nickel-rich cathode materials that enable higher energy density and longer battery life. The high purity grade of lithium hydroxide is essential for achieving optimal battery performance, with applications in electric vehicles and energy storage systems.- Lithium hydroxide in battery applications: Lithium hydroxide is highly effective in lithium-ion battery manufacturing, particularly for high-nickel cathode materials. It helps improve battery performance by enhancing energy density, cycle life, and thermal stability. The high purity grade of lithium hydroxide is crucial for achieving optimal battery performance, especially in electric vehicle applications where higher energy density and longer driving range are required.

- Lithium extraction and processing methods: Various methods have been developed for extracting and processing lithium hydroxide from different sources such as brines, clays, and hard rock deposits. These methods include direct lithium extraction (DLE), solvent extraction, and electrochemical processes. The effectiveness of these extraction methods significantly impacts the purity and cost of the final lithium hydroxide product, which is critical for its industrial applications.

- Environmental applications of lithium hydroxide: Lithium hydroxide demonstrates effectiveness in environmental applications such as carbon dioxide capture and air purification systems. Its strong alkaline properties make it suitable for neutralizing acidic compounds and absorbing harmful gases. Additionally, it can be used in wastewater treatment processes to remove certain contaminants and adjust pH levels, contributing to environmental remediation efforts.

- Industrial and chemical process applications: The effectiveness of lithium hydroxide in various industrial and chemical processes is well-documented. It serves as a catalyst in organic synthesis reactions, a pH regulator in industrial processes, and a component in specialty greases and lubricants. Its high alkalinity combined with the unique properties of lithium ions makes it valuable in applications requiring controlled reactivity and stability under demanding conditions.

- Advanced material synthesis using lithium hydroxide: Lithium hydroxide is effective in the synthesis of advanced materials including ceramics, glass, and specialty polymers. It serves as a precursor for lithium-containing compounds used in electronic components, optical materials, and high-performance ceramics. The controlled reactivity of lithium hydroxide allows for precise material engineering, resulting in products with enhanced thermal, electrical, and mechanical properties for specialized applications.

02 Lithium extraction and processing methods

Various methods have been developed to extract and process lithium hydroxide from different sources, including brine, clay, and hard rock deposits. These processes involve techniques such as direct lithium extraction, selective adsorption, and electrochemical methods to efficiently produce high-purity lithium hydroxide. The effectiveness of these extraction methods significantly impacts the quality and cost of the final lithium hydroxide product.Expand Specific Solutions03 Environmental applications of lithium hydroxide

Lithium hydroxide demonstrates effectiveness in environmental applications, including carbon dioxide capture and air purification systems. Its strong alkaline properties make it suitable for neutralizing acidic compounds and absorbing harmful gases. These applications leverage lithium hydroxide's high reactivity and absorption capacity to create more sustainable environmental solutions.Expand Specific Solutions04 Industrial and chemical process applications

In industrial settings, lithium hydroxide serves as an effective catalyst, pH regulator, and reagent in various chemical processes. Its effectiveness stems from its strong alkaline nature and unique chemical properties. Applications include grease production, ceramic manufacturing, and as a component in specialized industrial coatings where it enhances durability and performance characteristics.Expand Specific Solutions05 Lithium hydroxide quality control and enhancement

The effectiveness of lithium hydroxide is highly dependent on its purity and physical characteristics. Various methods have been developed to enhance its quality, including advanced purification techniques, particle size control, and morphology optimization. These quality control measures ensure consistent performance across different applications, particularly in sensitive uses like battery manufacturing where impurities can significantly impact effectiveness.Expand Specific Solutions

Leading Companies in Water Treatment Industry

The water softening market is currently in a mature growth phase with increasing demand driven by water quality concerns. The global market size for water softening technologies is estimated at $7-8 billion, growing at 5-7% annually. Lithium hydroxide's application in water softening represents an emerging niche within this established sector. Technologically, traditional players like Ecolab, Kinetico, and Kurita Water Industries dominate with conventional ion-exchange solutions, while companies including LG Chem, Tianqi Lithium, and SK Innovation are advancing lithium-based alternatives. Research organizations such as Commonwealth Scientific & Industrial Research Organisation and RIST are conducting comparative effectiveness studies. The technology shows promise but remains less mature than traditional calcium/magnesium-focused softening methods, with ongoing research to optimize lithium hydroxide's efficiency, cost-effectiveness, and environmental impact.

Ecolab USA, Inc.

Technical Solution: Ecolab has developed a comprehensive lithium hydroxide-based water softening system that utilizes controlled-release technology to optimize dosage efficiency. Their approach combines lithium hydroxide with proprietary polymer matrices that allow for gradual release based on water hardness levels. The system incorporates real-time monitoring sensors that adjust lithium hydroxide application rates according to incoming water mineral content, achieving up to 40% reduction in chemical usage compared to traditional methods. Ecolab's solution also features a closed-loop recovery system that captures and recycles residual lithium compounds, addressing sustainability concerns while maintaining effectiveness. Their benchmarking studies have demonstrated that lithium hydroxide achieves comparable softening results to sodium-based alternatives while requiring significantly lower volumes and generating less waste discharge.

Strengths: Superior efficiency with lower chemical volumes required; automated dosing systems reduce operational oversight; environmentally sustainable through recovery systems. Weaknesses: Higher initial implementation costs compared to traditional softening methods; requires more sophisticated monitoring equipment; limited effectiveness in extremely high-hardness water without supplementary treatments.

Halliburton Energy Services, Inc.

Technical Solution: Halliburton has pioneered a lithium hydroxide water softening technology specifically designed for oilfield applications where conventional softening methods face limitations. Their system employs a dual-action approach where lithium hydroxide not only precipitates calcium and magnesium hardness ions but also forms protective films on metal surfaces, preventing scale formation in high-temperature downhole environments. Halliburton's benchmarking studies have shown that their lithium hydroxide formulations achieve 92-97% hardness removal efficiency at temperatures ranging from 70-150°C, significantly outperforming traditional sodium-based softeners which typically lose effectiveness above 90°C. The company has developed proprietary blends that combine lithium hydroxide with specific chelating agents to enhance performance in high-salinity produced waters. Their technology includes advanced delivery systems that can inject precise lithium hydroxide concentrations at various points in the production stream to address localized hardness issues.

Strengths: Exceptional performance in high-temperature and high-pressure environments; dual functionality as both softener and scale inhibitor; compatible with complex brine compositions found in oilfield operations. Weaknesses: Substantially higher cost compared to conventional treatments; requires specialized handling procedures due to caustic nature; potential environmental concerns with discharge in certain jurisdictions.

Key Patents in Lithium-Based Water Softening

High Efficiency Water-Softening Process

PatentActiveUS20120145643A1

Innovation

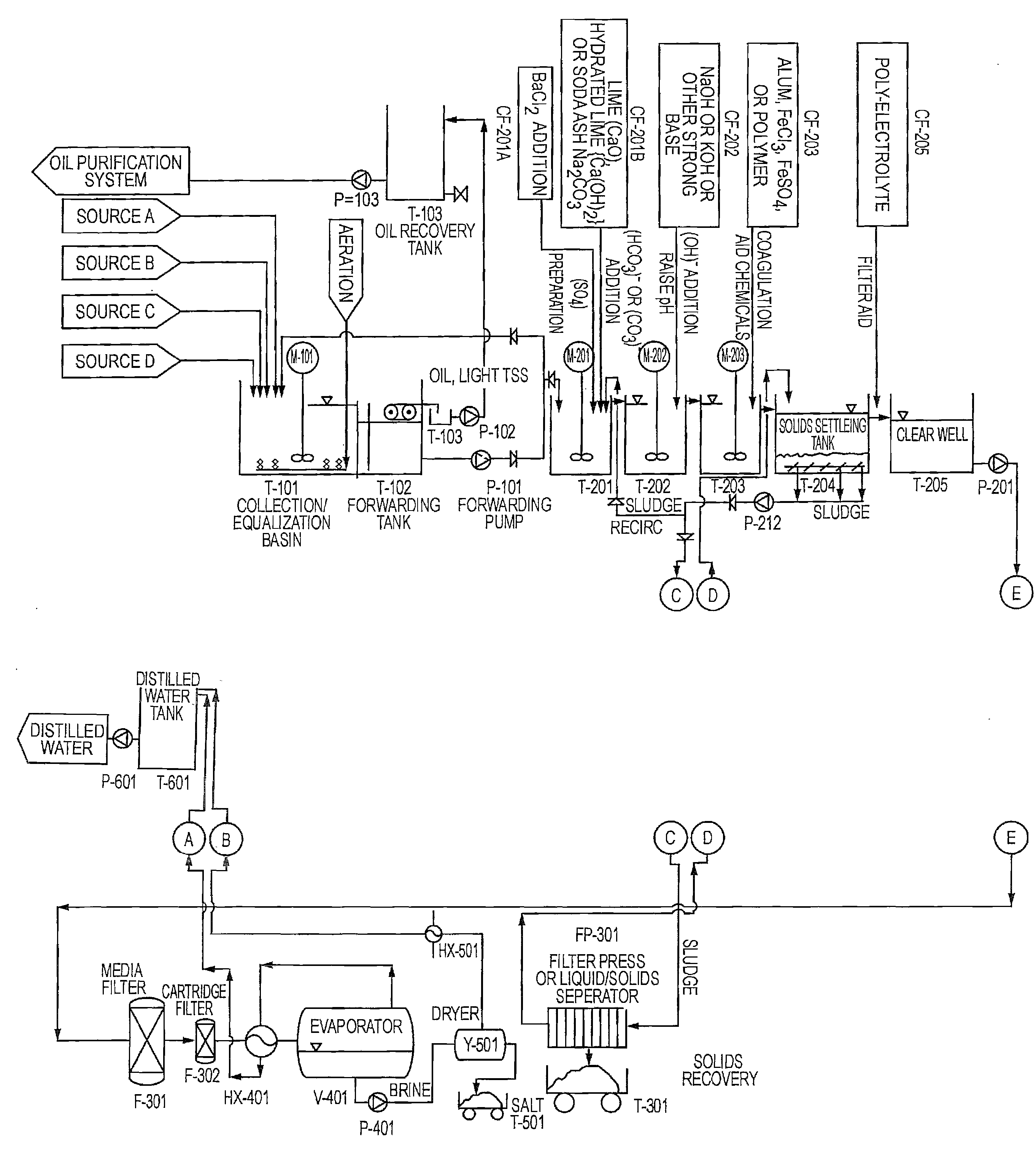

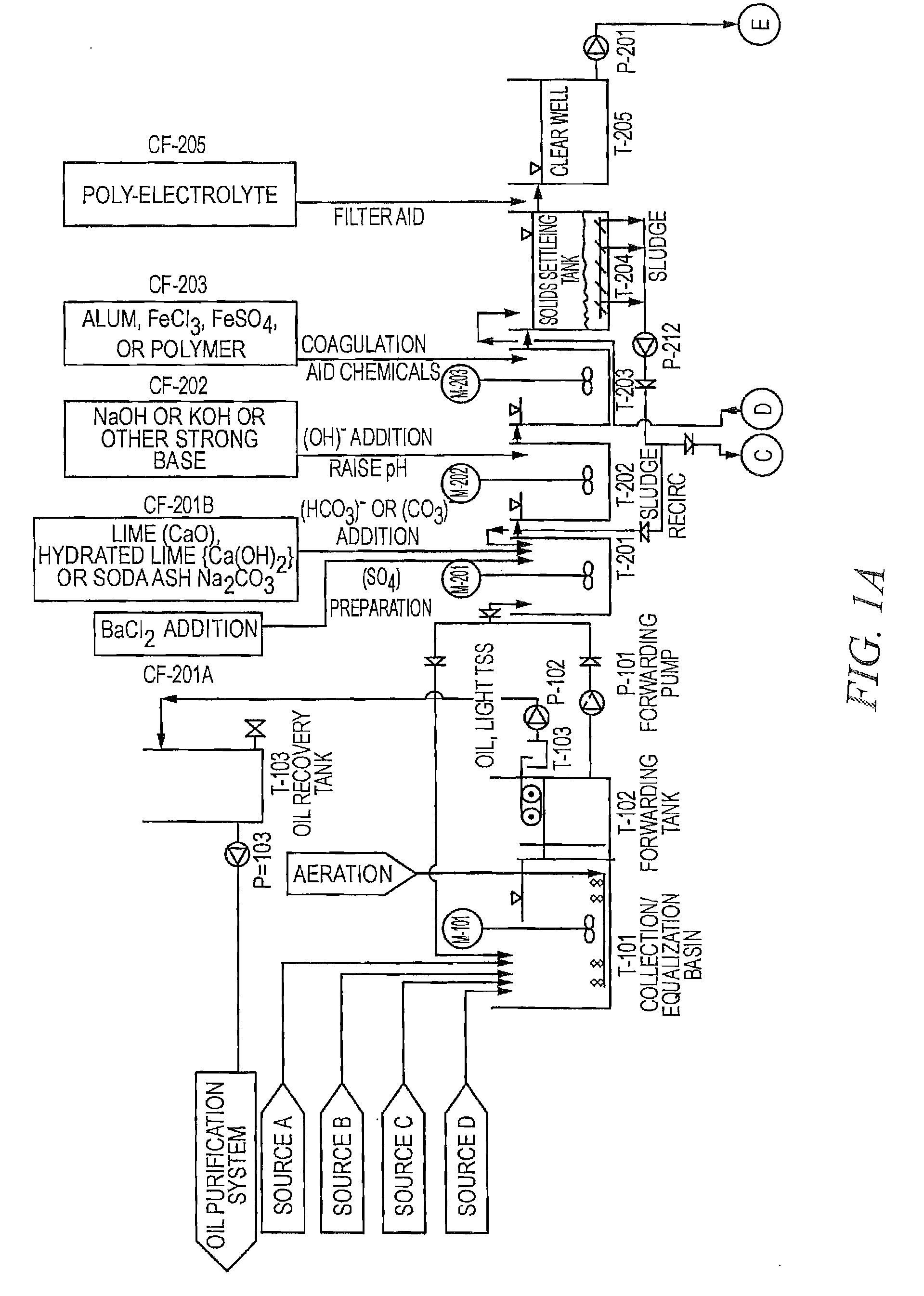

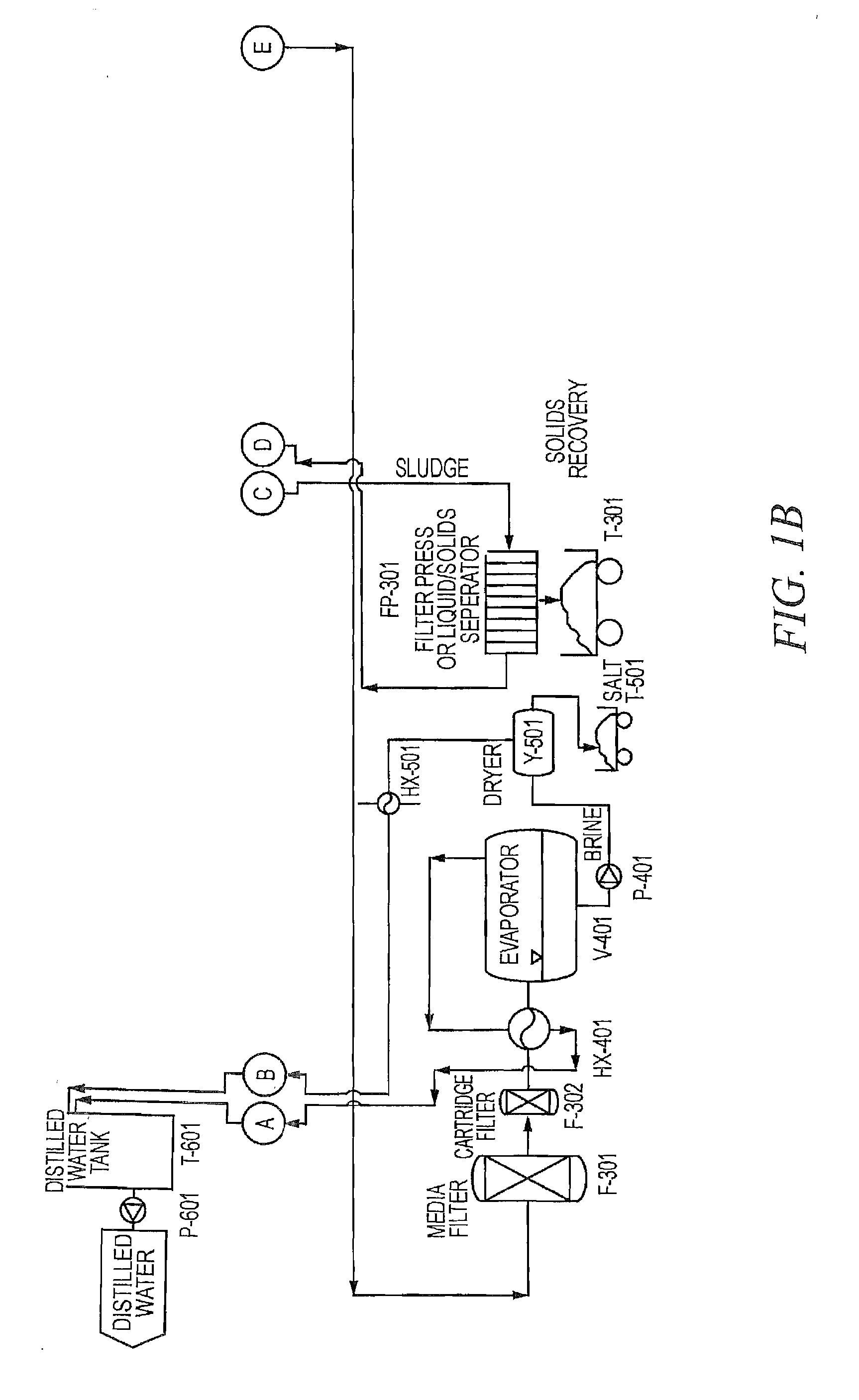

- A novel water-softening process that uses carbon dioxide and/or carbon monoxide in an alkaline solution to create bicarbonate or carbonate ions, operating at elevated pH levels (10.5 to 14), which effectively removes contaminants like calcium, magnesium, barium, strontium, and other impurities without the need for expensive materials or high energy, and can be conducted at ambient temperatures, using soda ash, potassium hydroxide, or sodium hydroxide as chemical agents.

Water-softening product

PatentWO2004099091A1

Innovation

- A highly concentrated, transparent liquid water-softening composition with less than 35wt% free water, using organic solvents and acidic, partly neutralized carboxylic acid polymers, encapsulated in water-soluble polymers like PVOH, cellulose, or gelatin, which can be easily dissolved in water, and packaged in water-soluble containers for convenient use.

Environmental Impact Assessment

The environmental impact of lithium hydroxide in water softening applications requires thorough assessment due to its increasing adoption as an alternative to traditional softening agents. When lithium hydroxide is used for water treatment, it interacts with calcium and magnesium ions, forming precipitates that can be filtered out. This process generates waste streams containing lithium compounds and precipitated hardness minerals that must be properly managed to prevent environmental contamination.

Water bodies receiving discharge from lithium hydroxide treatment systems may experience altered pH levels, potentially affecting aquatic ecosystems. Studies indicate that lithium concentrations exceeding 0.7 mg/L can adversely impact certain freshwater organisms, particularly during their reproductive and developmental stages. The bioaccumulation potential of lithium in aquatic food chains remains an area requiring further research, as current data shows variable uptake rates across different species.

Soil contamination presents another environmental concern when lithium-containing waste is improperly disposed of or when treated water is used for irrigation. Lithium can accumulate in soil profiles, potentially altering soil chemistry and affecting plant growth. Agricultural studies have demonstrated that excessive lithium concentrations can inhibit root development in sensitive crop species and alter nutrient uptake mechanisms.

The extraction and processing of lithium for hydroxide production carries its own environmental footprint. Conventional lithium mining operations, particularly in salt flats, consume significant water resources—approximately 500,000 gallons per ton of lithium—often in water-stressed regions. This extraction process creates competition for water resources between mining operations, local communities, and natural ecosystems.

Energy consumption associated with lithium hydroxide production contributes to its overall environmental impact. The conversion of lithium carbonate to lithium hydroxide requires substantial thermal energy, typically derived from fossil fuels. Life cycle assessments indicate that producing one ton of lithium hydroxide generates approximately 5-15 tons of CO2 equivalent emissions, depending on the energy sources and production methods employed.

Regulatory frameworks governing lithium discharge vary significantly across jurisdictions, creating inconsistent environmental protection standards. The European Water Framework Directive classifies lithium as an emerging contaminant requiring monitoring, while the US EPA has yet to establish specific discharge limits for lithium compounds. This regulatory gap highlights the need for standardized approaches to managing lithium hydroxide in water treatment applications.

Water bodies receiving discharge from lithium hydroxide treatment systems may experience altered pH levels, potentially affecting aquatic ecosystems. Studies indicate that lithium concentrations exceeding 0.7 mg/L can adversely impact certain freshwater organisms, particularly during their reproductive and developmental stages. The bioaccumulation potential of lithium in aquatic food chains remains an area requiring further research, as current data shows variable uptake rates across different species.

Soil contamination presents another environmental concern when lithium-containing waste is improperly disposed of or when treated water is used for irrigation. Lithium can accumulate in soil profiles, potentially altering soil chemistry and affecting plant growth. Agricultural studies have demonstrated that excessive lithium concentrations can inhibit root development in sensitive crop species and alter nutrient uptake mechanisms.

The extraction and processing of lithium for hydroxide production carries its own environmental footprint. Conventional lithium mining operations, particularly in salt flats, consume significant water resources—approximately 500,000 gallons per ton of lithium—often in water-stressed regions. This extraction process creates competition for water resources between mining operations, local communities, and natural ecosystems.

Energy consumption associated with lithium hydroxide production contributes to its overall environmental impact. The conversion of lithium carbonate to lithium hydroxide requires substantial thermal energy, typically derived from fossil fuels. Life cycle assessments indicate that producing one ton of lithium hydroxide generates approximately 5-15 tons of CO2 equivalent emissions, depending on the energy sources and production methods employed.

Regulatory frameworks governing lithium discharge vary significantly across jurisdictions, creating inconsistent environmental protection standards. The European Water Framework Directive classifies lithium as an emerging contaminant requiring monitoring, while the US EPA has yet to establish specific discharge limits for lithium compounds. This regulatory gap highlights the need for standardized approaches to managing lithium hydroxide in water treatment applications.

Cost-Benefit Analysis of Lithium Hydroxide Solutions

The economic viability of lithium hydroxide as a water softening agent requires thorough cost-benefit analysis to determine its practical implementation potential. Initial acquisition costs for lithium hydroxide significantly exceed traditional alternatives like sodium-based softeners, with market prices ranging from $15-25 per kilogram compared to $0.5-2 per kilogram for sodium chloride. This substantial price differential creates an immediate barrier to adoption in cost-sensitive applications.

However, the analysis must extend beyond purchase price to consider operational efficiency. Lithium hydroxide demonstrates superior ion exchange capacity, requiring approximately 40-60% less chemical volume than conventional softeners to achieve equivalent hardness reduction. This efficiency translates to reduced storage requirements, less frequent replenishment cycles, and lower transportation costs over the system lifecycle.

Equipment longevity represents another critical economic factor. Laboratory studies indicate that lithium hydroxide's non-corrosive properties can extend water treatment infrastructure lifespan by 15-30% compared to sodium-based alternatives. This reduction in maintenance frequency and replacement costs constitutes a significant long-term economic advantage, particularly in large-scale industrial applications.

Environmental compliance costs increasingly influence total ownership calculations. Lithium hydroxide produces effluent with lower total dissolved solids, potentially reducing regulatory compliance expenses in jurisdictions with stringent discharge limitations. Several case studies from manufacturing facilities demonstrate annual savings of $5,000-15,000 in environmental compliance costs after transitioning to lithium-based softening systems.

Energy efficiency metrics further favor lithium hydroxide solutions. The compound's superior reaction kinetics reduce pumping and mixing energy requirements by approximately 10-20% compared to conventional alternatives. For continuous operation facilities, these energy savings accumulate to meaningful operational cost reductions over multi-year implementation periods.

Recovery potential represents an emerging economic consideration. Unlike sodium-based softeners, lithium compounds can be recovered from waste streams with 60-75% efficiency using advanced membrane technologies. This reclamation capability, while requiring initial capital investment, creates a circular economic model that partially offsets the higher acquisition costs through material recovery and reuse.

Sensitivity analysis across various implementation scenarios indicates that lithium hydroxide solutions become economically competitive with traditional approaches in applications prioritizing system longevity, operational efficiency, and environmental compliance. The break-even timeline typically ranges from 3-7 years depending on scale, with larger installations achieving faster return on investment due to proportionally greater operational savings relative to initial capital expenditure.

However, the analysis must extend beyond purchase price to consider operational efficiency. Lithium hydroxide demonstrates superior ion exchange capacity, requiring approximately 40-60% less chemical volume than conventional softeners to achieve equivalent hardness reduction. This efficiency translates to reduced storage requirements, less frequent replenishment cycles, and lower transportation costs over the system lifecycle.

Equipment longevity represents another critical economic factor. Laboratory studies indicate that lithium hydroxide's non-corrosive properties can extend water treatment infrastructure lifespan by 15-30% compared to sodium-based alternatives. This reduction in maintenance frequency and replacement costs constitutes a significant long-term economic advantage, particularly in large-scale industrial applications.

Environmental compliance costs increasingly influence total ownership calculations. Lithium hydroxide produces effluent with lower total dissolved solids, potentially reducing regulatory compliance expenses in jurisdictions with stringent discharge limitations. Several case studies from manufacturing facilities demonstrate annual savings of $5,000-15,000 in environmental compliance costs after transitioning to lithium-based softening systems.

Energy efficiency metrics further favor lithium hydroxide solutions. The compound's superior reaction kinetics reduce pumping and mixing energy requirements by approximately 10-20% compared to conventional alternatives. For continuous operation facilities, these energy savings accumulate to meaningful operational cost reductions over multi-year implementation periods.

Recovery potential represents an emerging economic consideration. Unlike sodium-based softeners, lithium compounds can be recovered from waste streams with 60-75% efficiency using advanced membrane technologies. This reclamation capability, while requiring initial capital investment, creates a circular economic model that partially offsets the higher acquisition costs through material recovery and reuse.

Sensitivity analysis across various implementation scenarios indicates that lithium hydroxide solutions become economically competitive with traditional approaches in applications prioritizing system longevity, operational efficiency, and environmental compliance. The break-even timeline typically ranges from 3-7 years depending on scale, with larger installations achieving faster return on investment due to proportionally greater operational savings relative to initial capital expenditure.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!