Comparing Lithium Hydroxide Solvents In Extraction Processes

AUG 28, 202510 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Lithium Hydroxide Extraction Technology Background and Objectives

Lithium hydroxide extraction technology has evolved significantly over the past decades, driven by the exponential growth in demand for lithium-ion batteries. Initially, lithium was primarily extracted from hard rock sources such as spodumene through energy-intensive thermal processes. The 1990s marked a shift toward brine-based extraction methods, which offered lower operational costs but longer production timelines. Recent technological advancements have focused on improving extraction efficiency, reducing environmental impact, and developing more sustainable processes.

The global lithium market has witnessed a compound annual growth rate of approximately 8-10% since 2015, with projections indicating continued growth as electric vehicle adoption accelerates worldwide. This market expansion has catalyzed research into alternative extraction technologies, particularly focusing on solvent optimization for improved selectivity, reduced water consumption, and minimized chemical waste.

Current lithium hydroxide extraction processes predominantly utilize either organic or aqueous solvents, each presenting distinct advantages and limitations. Organic solvents typically offer higher selectivity and extraction rates but may pose environmental concerns and higher operational costs. Aqueous systems generally provide more environmentally friendly alternatives but often struggle with efficiency and purity challenges in complex brine compositions.

The technical objective of comparing lithium hydroxide solvents in extraction processes aims to establish comprehensive performance metrics across multiple dimensions: extraction efficiency, energy consumption, environmental impact, scalability, and economic viability. This comparison seeks to identify optimal solvent systems for specific lithium sources and operational contexts, recognizing that a universal solution may not exist given the variability in feedstock composition and regional constraints.

Recent innovations in solvent chemistry have introduced hybrid systems combining the advantages of both organic and aqueous approaches. These developments include functionalized ionic liquids, deep eutectic solvents, and polymer-supported extractants that demonstrate promising selectivity for lithium over competing ions such as sodium, magnesium, and calcium.

The trajectory of lithium hydroxide extraction technology is increasingly influenced by sustainability considerations, with growing emphasis on developing closed-loop systems that minimize waste generation and water consumption. Emerging direct lithium extraction (DLE) technologies represent a paradigm shift, potentially enabling economical extraction from low-concentration sources previously considered unviable.

This technological evolution occurs against a backdrop of geopolitical tensions surrounding critical mineral supply chains, driving national initiatives to develop domestic lithium production capabilities and reduce dependence on concentrated supply regions. The technical challenges in solvent optimization thus intersect with broader strategic imperatives related to energy security and industrial competitiveness.

The global lithium market has witnessed a compound annual growth rate of approximately 8-10% since 2015, with projections indicating continued growth as electric vehicle adoption accelerates worldwide. This market expansion has catalyzed research into alternative extraction technologies, particularly focusing on solvent optimization for improved selectivity, reduced water consumption, and minimized chemical waste.

Current lithium hydroxide extraction processes predominantly utilize either organic or aqueous solvents, each presenting distinct advantages and limitations. Organic solvents typically offer higher selectivity and extraction rates but may pose environmental concerns and higher operational costs. Aqueous systems generally provide more environmentally friendly alternatives but often struggle with efficiency and purity challenges in complex brine compositions.

The technical objective of comparing lithium hydroxide solvents in extraction processes aims to establish comprehensive performance metrics across multiple dimensions: extraction efficiency, energy consumption, environmental impact, scalability, and economic viability. This comparison seeks to identify optimal solvent systems for specific lithium sources and operational contexts, recognizing that a universal solution may not exist given the variability in feedstock composition and regional constraints.

Recent innovations in solvent chemistry have introduced hybrid systems combining the advantages of both organic and aqueous approaches. These developments include functionalized ionic liquids, deep eutectic solvents, and polymer-supported extractants that demonstrate promising selectivity for lithium over competing ions such as sodium, magnesium, and calcium.

The trajectory of lithium hydroxide extraction technology is increasingly influenced by sustainability considerations, with growing emphasis on developing closed-loop systems that minimize waste generation and water consumption. Emerging direct lithium extraction (DLE) technologies represent a paradigm shift, potentially enabling economical extraction from low-concentration sources previously considered unviable.

This technological evolution occurs against a backdrop of geopolitical tensions surrounding critical mineral supply chains, driving national initiatives to develop domestic lithium production capabilities and reduce dependence on concentrated supply regions. The technical challenges in solvent optimization thus intersect with broader strategic imperatives related to energy security and industrial competitiveness.

Market Demand Analysis for Lithium Hydroxide Solvents

The global lithium hydroxide market has experienced unprecedented growth in recent years, primarily driven by the rapid expansion of the electric vehicle (EV) industry. Market research indicates that the global demand for lithium hydroxide is projected to reach 422,000 tons by 2025, representing a compound annual growth rate (CAGR) of approximately 25% from 2020 levels. This substantial growth trajectory underscores the critical importance of efficient extraction processes and suitable solvents.

The EV battery sector currently accounts for over 60% of lithium hydroxide consumption, with high-nickel cathode materials requiring battery-grade lithium hydroxide rather than lithium carbonate. Major automotive manufacturers including Tesla, Volkswagen, and BYD have announced aggressive electrification strategies, further intensifying demand pressures on the lithium hydroxide supply chain.

Energy storage systems represent another significant growth segment, with utility-scale applications expected to increase lithium hydroxide demand by 30% between 2022 and 2027. This application requires high-purity lithium hydroxide to ensure optimal performance and longevity of storage systems.

Regional market analysis reveals that Asia-Pacific dominates consumption, with China alone accounting for 45% of global lithium hydroxide demand. European markets are showing the fastest growth rates as the region accelerates its transition to electric mobility, with demand expected to triple by 2026 compared to 2021 levels.

Price volatility has been a defining characteristic of the lithium hydroxide market, with prices surging from $14,000 per ton in early 2021 to peaks exceeding $70,000 per ton in late 2022, before moderating somewhat. This volatility has intensified interest in developing more cost-effective extraction processes and identifying optimal solvents that can reduce production costs.

Industry surveys indicate that manufacturers are prioritizing extraction processes that can achieve at least 90% recovery rates while maintaining battery-grade purity levels (99.5%+). The economic viability threshold for new extraction technologies appears to be processes that can reduce production costs by at least 15-20% compared to conventional methods.

Environmental considerations are increasingly influencing market dynamics, with regulations in key markets imposing stricter requirements on extraction processes. Water consumption, carbon footprint, and waste generation metrics are becoming important factors in technology selection, with customers showing willingness to pay premiums of 5-10% for lithium hydroxide produced through environmentally superior processes.

The comparative efficiency of different solvents in lithium hydroxide extraction processes has thus become a critical factor in addressing these market demands, with industry stakeholders actively seeking solutions that balance yield, purity, cost-effectiveness, and environmental sustainability.

The EV battery sector currently accounts for over 60% of lithium hydroxide consumption, with high-nickel cathode materials requiring battery-grade lithium hydroxide rather than lithium carbonate. Major automotive manufacturers including Tesla, Volkswagen, and BYD have announced aggressive electrification strategies, further intensifying demand pressures on the lithium hydroxide supply chain.

Energy storage systems represent another significant growth segment, with utility-scale applications expected to increase lithium hydroxide demand by 30% between 2022 and 2027. This application requires high-purity lithium hydroxide to ensure optimal performance and longevity of storage systems.

Regional market analysis reveals that Asia-Pacific dominates consumption, with China alone accounting for 45% of global lithium hydroxide demand. European markets are showing the fastest growth rates as the region accelerates its transition to electric mobility, with demand expected to triple by 2026 compared to 2021 levels.

Price volatility has been a defining characteristic of the lithium hydroxide market, with prices surging from $14,000 per ton in early 2021 to peaks exceeding $70,000 per ton in late 2022, before moderating somewhat. This volatility has intensified interest in developing more cost-effective extraction processes and identifying optimal solvents that can reduce production costs.

Industry surveys indicate that manufacturers are prioritizing extraction processes that can achieve at least 90% recovery rates while maintaining battery-grade purity levels (99.5%+). The economic viability threshold for new extraction technologies appears to be processes that can reduce production costs by at least 15-20% compared to conventional methods.

Environmental considerations are increasingly influencing market dynamics, with regulations in key markets imposing stricter requirements on extraction processes. Water consumption, carbon footprint, and waste generation metrics are becoming important factors in technology selection, with customers showing willingness to pay premiums of 5-10% for lithium hydroxide produced through environmentally superior processes.

The comparative efficiency of different solvents in lithium hydroxide extraction processes has thus become a critical factor in addressing these market demands, with industry stakeholders actively seeking solutions that balance yield, purity, cost-effectiveness, and environmental sustainability.

Current Solvent Technologies and Extraction Challenges

The lithium extraction industry currently employs several solvent technologies, each with distinct advantages and limitations. Traditional acid leaching processes utilize sulfuric acid as the primary solvent, which effectively dissolves lithium from ores but simultaneously extracts numerous impurities, necessitating extensive purification steps. This method, while established and relatively inexpensive, presents significant environmental challenges due to acid waste management and high water consumption.

Organic solvent extraction has emerged as an alternative approach, employing solvents such as kerosene modified with extractants like di-(2-ethylhexyl) phosphoric acid (D2EHPA) or tributyl phosphate (TBP). These systems demonstrate superior selectivity for lithium over competing ions but suffer from solvent degradation issues and require multiple extraction stages to achieve commercial-grade lithium hydroxide.

Water-based extraction systems utilizing specialized chelating agents have gained attention for their reduced environmental impact. However, these systems typically exhibit lower extraction efficiencies compared to organic alternatives and often require precise pH control, adding operational complexity and cost.

The direct lithium extraction (DLE) technologies represent the cutting edge, employing ion exchange resins or specialized membranes as "solvents." While promising higher recovery rates and reduced environmental footprint, these technologies face scalability challenges and higher capital expenditure requirements, limiting widespread commercial adoption.

A significant challenge across all solvent technologies is selectivity—the ability to preferentially extract lithium while rejecting similar ions like sodium, magnesium, and calcium. This challenge is particularly pronounced in brine-based extraction, where lithium concentrations are relatively low compared to competing ions.

Energy consumption presents another critical challenge, with conventional processes requiring substantial thermal energy for evaporation and concentration steps. This energy demand significantly impacts operational costs and carbon footprint, driving research toward more energy-efficient extraction methodologies.

Water consumption remains a persistent concern, particularly in arid regions where many lithium resources are located. Conventional processes can require up to 500,000 gallons of water per ton of lithium produced, creating potential conflicts with agricultural and community water needs.

Recovery efficiency varies considerably across solvent technologies, ranging from 30% to 80%, with significant economic implications for resource utilization. Technologies that can improve recovery rates while maintaining product purity represent a critical area for innovation.

Organic solvent extraction has emerged as an alternative approach, employing solvents such as kerosene modified with extractants like di-(2-ethylhexyl) phosphoric acid (D2EHPA) or tributyl phosphate (TBP). These systems demonstrate superior selectivity for lithium over competing ions but suffer from solvent degradation issues and require multiple extraction stages to achieve commercial-grade lithium hydroxide.

Water-based extraction systems utilizing specialized chelating agents have gained attention for their reduced environmental impact. However, these systems typically exhibit lower extraction efficiencies compared to organic alternatives and often require precise pH control, adding operational complexity and cost.

The direct lithium extraction (DLE) technologies represent the cutting edge, employing ion exchange resins or specialized membranes as "solvents." While promising higher recovery rates and reduced environmental footprint, these technologies face scalability challenges and higher capital expenditure requirements, limiting widespread commercial adoption.

A significant challenge across all solvent technologies is selectivity—the ability to preferentially extract lithium while rejecting similar ions like sodium, magnesium, and calcium. This challenge is particularly pronounced in brine-based extraction, where lithium concentrations are relatively low compared to competing ions.

Energy consumption presents another critical challenge, with conventional processes requiring substantial thermal energy for evaporation and concentration steps. This energy demand significantly impacts operational costs and carbon footprint, driving research toward more energy-efficient extraction methodologies.

Water consumption remains a persistent concern, particularly in arid regions where many lithium resources are located. Conventional processes can require up to 500,000 gallons of water per ton of lithium produced, creating potential conflicts with agricultural and community water needs.

Recovery efficiency varies considerably across solvent technologies, ranging from 30% to 80%, with significant economic implications for resource utilization. Technologies that can improve recovery rates while maintaining product purity represent a critical area for innovation.

Comparative Analysis of Current Solvent Solutions

01 Solvent selection for lithium hydroxide extraction

The choice of solvent significantly impacts the efficiency of lithium hydroxide extraction. Various organic and inorganic solvents have been investigated for their selectivity and extraction capacity. Factors such as solvent polarity, viscosity, and chemical compatibility with lithium compounds affect the overall extraction performance. Optimized solvent systems can enhance the separation of lithium hydroxide from other metal impurities and improve recovery rates.- Solvent selection for lithium hydroxide extraction: The choice of solvent significantly impacts the efficiency of lithium hydroxide extraction. Various organic and inorganic solvents have been investigated for their selectivity and extraction capacity. Factors such as solvent polarity, viscosity, and chemical compatibility with lithium compounds affect the overall extraction performance. Optimized solvent systems can enhance the separation of lithium hydroxide from other metal compounds and impurities, leading to higher purity products and improved process economics.

- Process parameters optimization for extraction efficiency: Extraction efficiency of lithium hydroxide is significantly influenced by various process parameters including temperature, pressure, pH, and contact time. Optimizing these parameters can lead to substantial improvements in extraction yields. Higher temperatures generally increase solubility and diffusion rates, while appropriate pH control ensures selective extraction of lithium ions. The optimization of these parameters must be balanced against energy consumption and equipment constraints to develop economically viable extraction processes.

- Novel extraction techniques for lithium hydroxide: Innovative extraction techniques have been developed to improve the efficiency of lithium hydroxide recovery. These include advanced liquid-liquid extraction methods, membrane-based separation, electrochemical processes, and supercritical fluid extraction. Such novel approaches offer advantages over conventional methods, including higher selectivity, reduced solvent consumption, lower energy requirements, and minimized environmental impact. These techniques are particularly valuable for processing low-grade lithium resources or complex brine solutions.

- Extraction from alternative lithium sources: Extraction methods have been developed for recovering lithium hydroxide from non-traditional sources such as geothermal brines, oil field brines, recycled batteries, and clay deposits. These alternative sources often require specialized extraction approaches due to their unique chemical compositions and physical properties. The efficiency of lithium hydroxide extraction from these sources depends on tailored solvent systems and process conditions that address specific challenges like competing ions, complex matrices, and variable lithium concentrations.

- Additives and modifiers to enhance extraction efficiency: Various additives and modifiers can significantly improve the efficiency of lithium hydroxide extraction processes. These include phase transfer catalysts, complexing agents, surfactants, and synergistic mixtures of extractants. Such additives can enhance the selectivity for lithium ions, improve phase separation, reduce emulsion formation, and increase extraction kinetics. The strategic use of these modifiers can optimize the overall extraction process, resulting in higher lithium recovery rates and reduced processing costs.

02 Process parameters optimization for extraction efficiency

Optimizing process parameters such as temperature, pressure, pH, and contact time is crucial for maximizing lithium hydroxide extraction efficiency. These parameters influence the solubility of lithium compounds in the selected solvents and the kinetics of the extraction process. Controlled experimental conditions can lead to significant improvements in extraction yield and purity of the final lithium hydroxide product.Expand Specific Solutions03 Novel extraction techniques and equipment

Innovative extraction techniques and specialized equipment designs have been developed to enhance lithium hydroxide recovery. These include continuous flow systems, membrane-based separation, advanced reactor designs, and multi-stage extraction processes. Such technological advancements improve mass transfer, reduce processing time, and increase the overall extraction efficiency while minimizing solvent consumption and environmental impact.Expand Specific Solutions04 Additives and modifiers for enhanced extraction

Various additives and modifiers can be incorporated into extraction systems to improve lithium hydroxide recovery. These include complexing agents, phase transfer catalysts, surfactants, and ionic liquids that facilitate the selective extraction of lithium ions. Such additives can modify the interfacial properties, enhance mass transfer rates, and improve the selectivity of the extraction process, resulting in higher purity lithium hydroxide and increased extraction efficiency.Expand Specific Solutions05 Recycling and regeneration of extraction solvents

Efficient recycling and regeneration of extraction solvents is essential for the economic viability and environmental sustainability of lithium hydroxide production processes. Various methods have been developed to purify and reuse solvents after the extraction cycle, including distillation, adsorption, membrane filtration, and chemical treatment. These approaches minimize solvent loss, reduce operational costs, and decrease the environmental footprint of lithium hydroxide extraction operations.Expand Specific Solutions

Key Industry Players in Lithium Extraction Technology

The lithium hydroxide solvent extraction market is in a growth phase, driven by increasing demand for lithium in battery technologies. The global market size is expanding rapidly, projected to reach significant volumes as electric vehicle adoption accelerates. Technologically, the field shows varying maturity levels, with companies like Eramet SA, BYD, and Energy Exploration Technologies leading innovation in direct lithium extraction processes. Established players such as Idemitsu Kosan and Saudi Aramco bring industrial-scale capabilities, while research institutions like Northwestern University and CSIR contribute fundamental advancements. International Battery Metals and Lithium Nevada are developing specialized extraction technologies, while Metso Outotec and Guangdong Bangpu focus on sustainable recycling approaches. The competitive landscape reflects a mix of established industrial giants and specialized technology innovators working to optimize extraction efficiency and environmental performance.

Energy Exploration Technologies, Inc.

Technical Solution: EnergyX has developed a proprietary Lithium Ion Transport and Separation (LiTAS) technology that utilizes a highly selective metal-organic framework (MOF) membrane system for direct lithium extraction (DLE). Their process employs specialized solvents that interact with lithium ions at the molecular level, allowing for selective extraction from brine resources with minimal water and chemical usage. The technology operates at ambient temperature and pressure, significantly reducing energy requirements compared to traditional evaporation methods. Their solvent-based approach achieves lithium recovery rates exceeding 90% in 24-48 hours versus 18+ months for conventional methods, while reducing water consumption by approximately 90%. The system is modular and scalable, enabling deployment across various brine compositions and concentrations.

Strengths: Superior selectivity for lithium over competing ions; dramatically reduced processing time; significantly lower water consumption; environmentally sustainable approach with minimal chemical waste. Weaknesses: Relatively new technology with limited large-scale commercial implementation; potential membrane fouling issues in certain brine compositions; higher initial capital investment compared to traditional methods.

Cytec Industries, Inc.

Technical Solution: Cytec Industries has developed sophisticated solvent extraction (SX) systems specifically optimized for lithium hydroxide production. Their CYANEX® series of extractants, particularly CYANEX® 936, demonstrates exceptional selectivity for lithium over competing ions in various feed solutions. The company's process employs a counter-current extraction system where organic solvents selectively complex with lithium ions, followed by stripping with water or dilute acid to produce concentrated lithium solutions. Their technology achieves separation factors exceeding 1,000 for lithium over sodium and magnesium, enabling production of high-purity lithium compounds from diverse sources including brines, clays, and recycled materials. Cytec's extraction system operates at ambient temperatures with rapid phase separation characteristics, reducing energy requirements and processing time. The company has also developed specialized diluent formulations that enhance lithium loading capacity while minimizing solvent losses through entrainment or volatilization.

Strengths: Exceptional selectivity for lithium over competing ions; versatility across multiple lithium sources; established commercial technology with proven reliability; ability to produce battery-grade lithium compounds directly. Weaknesses: Requires multiple extraction stages for highest purity; organic solvent management adds operational complexity; potential for solvent degradation requiring periodic replacement; higher chemical consumption compared to some newer technologies.

Critical Patents and Innovations in Extraction Solvents

Solvent extraction for selective lithium recovery

PatentWO2024155455A1

Innovation

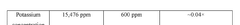

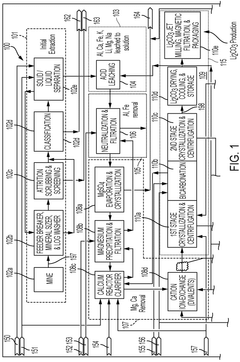

- A solvent extraction process involving a solvent extraction unit that selectively extracts lithium cations from an aqueous feed stream using an organic solvent stream with extractants, followed by stripping with an acid stream to produce a lithium-rich stream, and a waste-salt separation unit for complete separation of waste salts in a linear process, reducing the need for recycle loops and minimizing lithium loss.

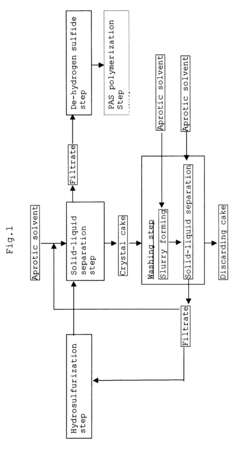

Process for separating solid compound other than lithium hydroxide

PatentInactiveUS6503473B1

Innovation

- Bubbling gaseous hydrogen sulfide through an aprotic solvent containing lithium hydroxide and non-lithium hydroxide solid compounds to convert lithium hydroxide into lithium hydrosulfide, which is soluble in the solvent, followed by solid-liquid separation and washing with the aprotic solvent to recover lithium hydrosulfide, while maintaining a suppressed de-hydrogen sulfide reaction and optimal temperature conditions to minimize lithium compound loss.

Environmental Impact Assessment of Extraction Solvents

The environmental impact of solvents used in lithium hydroxide extraction processes represents a critical consideration for sustainable mining and processing operations. Traditional extraction methods often employ organic solvents that pose significant environmental risks through emissions, waste generation, and potential contamination of water resources. These conventional solvents typically exhibit high volatility, toxicity, and persistence in the environment, contributing to air pollution, soil degradation, and potential harm to aquatic ecosystems.

Recent life cycle assessments of lithium extraction processes reveal substantial differences in environmental footprints among various solvents. Water-based systems generally demonstrate lower direct toxicity but may require extensive water resources in water-stressed regions, creating potential conflicts with local communities and ecosystems. Conversely, ionic liquids offer reduced volatility and emissions but present challenges in biodegradability and long-term environmental accumulation.

Greenhouse gas emissions associated with solvent production and use constitute another significant environmental factor. Studies indicate that conventional organic solvents like kerosene and petroleum-derived diluents generate considerably higher carbon footprints compared to emerging bio-based alternatives. The energy requirements for solvent regeneration and recycling further amplify these differences, with some advanced solvents requiring energy-intensive purification processes that offset their operational benefits.

Waste management challenges vary significantly across different solvent systems. Conventional extraction processes typically generate substantial volumes of contaminated aqueous waste and spent organic phases requiring specialized treatment. Deep eutectic solvents and supercritical CO2 systems offer promising alternatives with potentially reduced waste streams, though their implementation at industrial scale remains limited by technical and economic constraints.

Biodiversity impacts present another critical dimension for assessment. Solvent leakage or improper disposal can affect soil microbial communities, disrupt plant growth, and contaminate groundwater resources that support diverse ecosystems. Recent ecological risk assessments suggest that newer designer solvents may offer reduced acute toxicity but require further evaluation regarding their chronic effects on sensitive species and ecosystem functions.

Regulatory frameworks increasingly recognize these environmental concerns, with stricter controls emerging for volatile organic compounds, persistent pollutants, and water-intensive processes. Forward-looking companies are adopting green chemistry principles in solvent selection, prioritizing biodegradability, reduced toxicity, and improved recycling potential. This shift aligns with broader sustainability goals while potentially offering operational advantages through reduced compliance costs and improved stakeholder relations.

Recent life cycle assessments of lithium extraction processes reveal substantial differences in environmental footprints among various solvents. Water-based systems generally demonstrate lower direct toxicity but may require extensive water resources in water-stressed regions, creating potential conflicts with local communities and ecosystems. Conversely, ionic liquids offer reduced volatility and emissions but present challenges in biodegradability and long-term environmental accumulation.

Greenhouse gas emissions associated with solvent production and use constitute another significant environmental factor. Studies indicate that conventional organic solvents like kerosene and petroleum-derived diluents generate considerably higher carbon footprints compared to emerging bio-based alternatives. The energy requirements for solvent regeneration and recycling further amplify these differences, with some advanced solvents requiring energy-intensive purification processes that offset their operational benefits.

Waste management challenges vary significantly across different solvent systems. Conventional extraction processes typically generate substantial volumes of contaminated aqueous waste and spent organic phases requiring specialized treatment. Deep eutectic solvents and supercritical CO2 systems offer promising alternatives with potentially reduced waste streams, though their implementation at industrial scale remains limited by technical and economic constraints.

Biodiversity impacts present another critical dimension for assessment. Solvent leakage or improper disposal can affect soil microbial communities, disrupt plant growth, and contaminate groundwater resources that support diverse ecosystems. Recent ecological risk assessments suggest that newer designer solvents may offer reduced acute toxicity but require further evaluation regarding their chronic effects on sensitive species and ecosystem functions.

Regulatory frameworks increasingly recognize these environmental concerns, with stricter controls emerging for volatile organic compounds, persistent pollutants, and water-intensive processes. Forward-looking companies are adopting green chemistry principles in solvent selection, prioritizing biodegradability, reduced toxicity, and improved recycling potential. This shift aligns with broader sustainability goals while potentially offering operational advantages through reduced compliance costs and improved stakeholder relations.

Regulatory Framework for Lithium Extraction Processes

The regulatory landscape governing lithium extraction processes has become increasingly complex as global demand for lithium continues to surge. Different jurisdictions have established varying frameworks to address environmental concerns, resource conservation, and sustainable development principles. In the United States, lithium extraction is primarily regulated under the General Mining Act of 1872, with additional oversight from the Environmental Protection Agency (EPA) regarding chemical usage in extraction processes. The Clean Water Act and Safe Drinking Water Act impose strict limitations on solvent disposal and potential groundwater contamination from lithium hydroxide solvents.

The European Union has implemented more stringent regulations through the REACH (Registration, Evaluation, Authorization and Restriction of Chemicals) framework, which requires comprehensive safety assessments for all solvents used in lithium extraction. Additionally, the EU Battery Directive establishes specific requirements for battery manufacturers to consider the entire lifecycle of lithium products, including extraction methodologies and solvent selection.

In Australia, a major lithium producer, the National Industrial Chemicals Notification and Assessment Scheme (NICNAS) governs the registration and risk assessment of industrial chemicals, including solvents used in lithium hydroxide extraction. The Environmental Protection and Biodiversity Conservation Act provides additional oversight for projects with significant environmental impact potential.

China, as both a major producer and consumer of lithium products, has recently strengthened its regulatory framework through amendments to the Environmental Protection Law and Mineral Resources Law. These changes specifically address water usage, chemical management, and waste disposal in lithium extraction operations, with particular attention to solvent selection and handling protocols.

International standards also influence regulatory compliance for lithium extraction processes. The ISO 14001 environmental management system provides a framework for organizations to minimize environmental impacts, while the International Cyanide Management Code offers guidance for operations using cyanide-based extraction methods. The International Council on Mining and Metals (ICMM) has established principles for sustainable development that many major lithium producers have voluntarily adopted.

Emerging regulatory trends indicate a shift toward lifecycle assessment approaches, requiring companies to evaluate the environmental footprint of different solvents throughout the entire extraction process. Several jurisdictions are implementing more stringent reporting requirements for water usage, chemical consumption, and waste generation metrics specific to lithium extraction operations. This evolving regulatory landscape significantly influences solvent selection decisions, as companies must balance extraction efficiency with compliance costs and environmental performance expectations across different operating regions.

The European Union has implemented more stringent regulations through the REACH (Registration, Evaluation, Authorization and Restriction of Chemicals) framework, which requires comprehensive safety assessments for all solvents used in lithium extraction. Additionally, the EU Battery Directive establishes specific requirements for battery manufacturers to consider the entire lifecycle of lithium products, including extraction methodologies and solvent selection.

In Australia, a major lithium producer, the National Industrial Chemicals Notification and Assessment Scheme (NICNAS) governs the registration and risk assessment of industrial chemicals, including solvents used in lithium hydroxide extraction. The Environmental Protection and Biodiversity Conservation Act provides additional oversight for projects with significant environmental impact potential.

China, as both a major producer and consumer of lithium products, has recently strengthened its regulatory framework through amendments to the Environmental Protection Law and Mineral Resources Law. These changes specifically address water usage, chemical management, and waste disposal in lithium extraction operations, with particular attention to solvent selection and handling protocols.

International standards also influence regulatory compliance for lithium extraction processes. The ISO 14001 environmental management system provides a framework for organizations to minimize environmental impacts, while the International Cyanide Management Code offers guidance for operations using cyanide-based extraction methods. The International Council on Mining and Metals (ICMM) has established principles for sustainable development that many major lithium producers have voluntarily adopted.

Emerging regulatory trends indicate a shift toward lifecycle assessment approaches, requiring companies to evaluate the environmental footprint of different solvents throughout the entire extraction process. Several jurisdictions are implementing more stringent reporting requirements for water usage, chemical consumption, and waste generation metrics specific to lithium extraction operations. This evolving regulatory landscape significantly influences solvent selection decisions, as companies must balance extraction efficiency with compliance costs and environmental performance expectations across different operating regions.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!