Isocyanate Market Dynamics Amid Global Challenges

JUL 10, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Isocyanate Industry Overview and Objectives

Isocyanates, a crucial component in the production of polyurethanes, have been a cornerstone of various industries for decades. The global isocyanate market has experienced significant growth and transformation, driven by the increasing demand for polyurethane-based products across automotive, construction, furniture, and electronics sectors. However, recent years have witnessed unprecedented challenges that have reshaped the industry landscape and market dynamics.

The primary objective of this technical research report is to provide a comprehensive analysis of the isocyanate market in the face of global challenges. We aim to explore the current state of the industry, identify key trends, and assess the impact of various factors on market growth and stability. This analysis will serve as a foundation for strategic decision-making and future planning within the isocyanate sector.

One of the most significant challenges facing the isocyanate industry is the volatility in raw material prices, particularly for key feedstocks such as benzene and toluene. These fluctuations have led to unpredictable production costs and margin pressures for manufacturers. Additionally, the industry has been grappling with stringent environmental regulations and increasing concerns over the health impacts of isocyanates, necessitating investments in safer production processes and alternative formulations.

The COVID-19 pandemic has further complicated the market dynamics, causing disruptions in supply chains and fluctuations in demand across various end-use industries. While some sectors, such as medical equipment and packaging, saw increased demand, others like automotive and construction experienced significant downturns. This has led to a reevaluation of production capacities and market strategies among key players in the isocyanate industry.

Technological advancements and innovation have become critical factors in addressing these challenges. The industry is witnessing a shift towards more sustainable and eco-friendly production methods, as well as the development of bio-based isocyanates. These innovations aim to reduce environmental impact and meet the growing consumer demand for greener products.

Geopolitical tensions and trade disputes have also played a role in shaping the isocyanate market. Tariffs and trade barriers have affected global supply chains, leading to shifts in production locations and market focus. As a result, regional market dynamics have evolved, with some areas experiencing increased local production to mitigate supply risks.

Looking ahead, the isocyanate industry faces both challenges and opportunities. The push for sustainability, coupled with ongoing research and development efforts, is expected to drive innovation in product formulations and applications. Meanwhile, the industry must navigate regulatory pressures, market uncertainties, and the ongoing effects of global economic fluctuations.

The primary objective of this technical research report is to provide a comprehensive analysis of the isocyanate market in the face of global challenges. We aim to explore the current state of the industry, identify key trends, and assess the impact of various factors on market growth and stability. This analysis will serve as a foundation for strategic decision-making and future planning within the isocyanate sector.

One of the most significant challenges facing the isocyanate industry is the volatility in raw material prices, particularly for key feedstocks such as benzene and toluene. These fluctuations have led to unpredictable production costs and margin pressures for manufacturers. Additionally, the industry has been grappling with stringent environmental regulations and increasing concerns over the health impacts of isocyanates, necessitating investments in safer production processes and alternative formulations.

The COVID-19 pandemic has further complicated the market dynamics, causing disruptions in supply chains and fluctuations in demand across various end-use industries. While some sectors, such as medical equipment and packaging, saw increased demand, others like automotive and construction experienced significant downturns. This has led to a reevaluation of production capacities and market strategies among key players in the isocyanate industry.

Technological advancements and innovation have become critical factors in addressing these challenges. The industry is witnessing a shift towards more sustainable and eco-friendly production methods, as well as the development of bio-based isocyanates. These innovations aim to reduce environmental impact and meet the growing consumer demand for greener products.

Geopolitical tensions and trade disputes have also played a role in shaping the isocyanate market. Tariffs and trade barriers have affected global supply chains, leading to shifts in production locations and market focus. As a result, regional market dynamics have evolved, with some areas experiencing increased local production to mitigate supply risks.

Looking ahead, the isocyanate industry faces both challenges and opportunities. The push for sustainability, coupled with ongoing research and development efforts, is expected to drive innovation in product formulations and applications. Meanwhile, the industry must navigate regulatory pressures, market uncertainties, and the ongoing effects of global economic fluctuations.

Global Demand Analysis for Isocyanates

The global demand for isocyanates has been experiencing significant fluctuations in recent years, driven by various factors including economic conditions, industrial growth, and environmental regulations. Isocyanates, primarily used in the production of polyurethanes, find applications across diverse sectors such as construction, automotive, furniture, and electronics.

In the construction industry, the demand for isocyanates has been steadily increasing due to the growing use of polyurethane-based insulation materials and coatings. The push for energy-efficient buildings and stringent building codes has further boosted this demand. The automotive sector, another major consumer of isocyanates, has shown a mixed trend. While the overall automotive production has faced challenges in some regions, the increasing use of lightweight materials and comfort-enhancing components in vehicles has sustained the demand for isocyanates.

The furniture industry has been a consistent consumer of isocyanates, particularly in the production of flexible and rigid foams for cushioning and insulation. The growth in this sector is closely tied to urbanization trends and consumer spending patterns. In the electronics industry, the demand for isocyanates has been rising, driven by the production of protective coatings and encapsulants for electronic components.

Regionally, Asia-Pacific has emerged as the largest consumer of isocyanates, with China leading the demand. The rapid industrialization and urbanization in this region have been key drivers. North America and Europe, while mature markets, continue to show steady demand, particularly in high-performance applications and specialty products.

The global isocyanate market has also been influenced by environmental concerns and regulatory pressures. There is a growing emphasis on developing eco-friendly alternatives and reducing the environmental impact of isocyanate production and use. This has led to innovations in bio-based isocyanates and low-emission formulations, which are gradually gaining market share.

Supply chain disruptions and raw material price volatility have been significant challenges affecting the global demand dynamics. The isocyanate market is closely linked to the petrochemical industry, making it susceptible to oil price fluctuations. Additionally, geopolitical tensions and trade disputes have impacted international trade flows of isocyanates and their raw materials.

Looking ahead, the global demand for isocyanates is expected to continue growing, albeit at a moderated pace. Emerging applications in sectors such as healthcare, packaging, and renewable energy are likely to open new avenues for isocyanate consumption. However, this growth will be tempered by ongoing efforts to find sustainable alternatives and the increasing focus on circular economy principles in major end-use industries.

In the construction industry, the demand for isocyanates has been steadily increasing due to the growing use of polyurethane-based insulation materials and coatings. The push for energy-efficient buildings and stringent building codes has further boosted this demand. The automotive sector, another major consumer of isocyanates, has shown a mixed trend. While the overall automotive production has faced challenges in some regions, the increasing use of lightweight materials and comfort-enhancing components in vehicles has sustained the demand for isocyanates.

The furniture industry has been a consistent consumer of isocyanates, particularly in the production of flexible and rigid foams for cushioning and insulation. The growth in this sector is closely tied to urbanization trends and consumer spending patterns. In the electronics industry, the demand for isocyanates has been rising, driven by the production of protective coatings and encapsulants for electronic components.

Regionally, Asia-Pacific has emerged as the largest consumer of isocyanates, with China leading the demand. The rapid industrialization and urbanization in this region have been key drivers. North America and Europe, while mature markets, continue to show steady demand, particularly in high-performance applications and specialty products.

The global isocyanate market has also been influenced by environmental concerns and regulatory pressures. There is a growing emphasis on developing eco-friendly alternatives and reducing the environmental impact of isocyanate production and use. This has led to innovations in bio-based isocyanates and low-emission formulations, which are gradually gaining market share.

Supply chain disruptions and raw material price volatility have been significant challenges affecting the global demand dynamics. The isocyanate market is closely linked to the petrochemical industry, making it susceptible to oil price fluctuations. Additionally, geopolitical tensions and trade disputes have impacted international trade flows of isocyanates and their raw materials.

Looking ahead, the global demand for isocyanates is expected to continue growing, albeit at a moderated pace. Emerging applications in sectors such as healthcare, packaging, and renewable energy are likely to open new avenues for isocyanate consumption. However, this growth will be tempered by ongoing efforts to find sustainable alternatives and the increasing focus on circular economy principles in major end-use industries.

Technical Challenges in Isocyanate Production

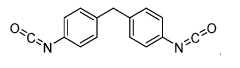

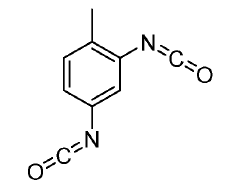

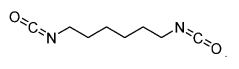

The production of isocyanates faces several technical challenges that impact market dynamics and global supply chains. One of the primary issues is the high energy consumption required in the manufacturing process. The synthesis of isocyanates, particularly methylene diphenyl diisocyanate (MDI) and toluene diisocyanate (TDI), involves multiple energy-intensive steps, including phosgenation and distillation. This energy demand not only increases production costs but also raises environmental concerns due to associated carbon emissions.

Another significant challenge is the handling and storage of raw materials, especially phosgene, which is highly toxic and reactive. Stringent safety protocols and specialized equipment are necessary to manage phosgene, adding complexity and cost to the production process. Additionally, the transportation and storage of finished isocyanate products require careful temperature control and moisture prevention to maintain product quality and prevent unwanted reactions.

The industry also grapples with the issue of by-product management. The production of isocyanates generates various by-products, some of which are hazardous or difficult to dispose of. Developing efficient recycling methods or finding alternative uses for these by-products remains an ongoing challenge for manufacturers.

Furthermore, the volatility of raw material prices, particularly for benzene and toluene, introduces uncertainty in production costs. This volatility can significantly impact profit margins and makes long-term planning challenging for isocyanate producers.

Regulatory compliance presents another hurdle, as environmental and safety regulations become increasingly stringent worldwide. Manufacturers must continually adapt their processes and invest in new technologies to meet evolving standards, which can be both technically challenging and financially burdensome.

Lastly, the industry faces the challenge of developing more sustainable production methods. There is growing pressure to reduce the environmental footprint of isocyanate production, including efforts to decrease energy consumption, minimize waste generation, and explore bio-based alternatives. However, achieving these goals while maintaining product quality and economic viability remains a significant technical challenge for the industry.

Another significant challenge is the handling and storage of raw materials, especially phosgene, which is highly toxic and reactive. Stringent safety protocols and specialized equipment are necessary to manage phosgene, adding complexity and cost to the production process. Additionally, the transportation and storage of finished isocyanate products require careful temperature control and moisture prevention to maintain product quality and prevent unwanted reactions.

The industry also grapples with the issue of by-product management. The production of isocyanates generates various by-products, some of which are hazardous or difficult to dispose of. Developing efficient recycling methods or finding alternative uses for these by-products remains an ongoing challenge for manufacturers.

Furthermore, the volatility of raw material prices, particularly for benzene and toluene, introduces uncertainty in production costs. This volatility can significantly impact profit margins and makes long-term planning challenging for isocyanate producers.

Regulatory compliance presents another hurdle, as environmental and safety regulations become increasingly stringent worldwide. Manufacturers must continually adapt their processes and invest in new technologies to meet evolving standards, which can be both technically challenging and financially burdensome.

Lastly, the industry faces the challenge of developing more sustainable production methods. There is growing pressure to reduce the environmental footprint of isocyanate production, including efforts to decrease energy consumption, minimize waste generation, and explore bio-based alternatives. However, achieving these goals while maintaining product quality and economic viability remains a significant technical challenge for the industry.

Current Isocyanate Production Methods

01 Market analysis and forecasting

The isocyanate market dynamics involve comprehensive analysis and forecasting techniques. This includes studying market trends, consumer behavior, and economic factors to predict future demand and supply. Advanced algorithms and data analytics are used to generate accurate market projections, helping businesses make informed decisions in the isocyanate industry.- Market analysis and forecasting: Advanced analytics and forecasting techniques are used to analyze the isocyanate market dynamics. These methods help in predicting market trends, demand fluctuations, and potential growth opportunities. The analysis considers various factors such as economic indicators, industry trends, and consumer behavior to provide accurate market insights.

- Supply chain optimization: Efficient supply chain management is crucial in the isocyanate market. This involves optimizing inventory levels, streamlining distribution networks, and improving logistics to meet market demands. Advanced technologies and data-driven approaches are employed to enhance supply chain efficiency and reduce costs.

- Pricing strategies and risk management: Developing effective pricing strategies is essential in the dynamic isocyanate market. This includes implementing risk management techniques to mitigate market volatility and price fluctuations. Advanced algorithms and financial models are used to optimize pricing decisions and manage market risks.

- Regulatory compliance and environmental considerations: The isocyanate market is subject to various regulations and environmental standards. Market participants must ensure compliance with these regulations while adapting to changing environmental policies. This involves implementing sustainable practices, monitoring emissions, and developing eco-friendly products to meet market demands and regulatory requirements.

- Innovation and product development: Continuous innovation and product development are crucial for staying competitive in the isocyanate market. This includes researching new applications, improving product performance, and developing novel formulations. Market players invest in R&D to create value-added products and address evolving customer needs.

02 Supply chain optimization

Optimizing the supply chain is crucial in the isocyanate market. This involves streamlining production processes, improving logistics, and managing inventory efficiently. Advanced technologies are employed to track and manage the flow of raw materials and finished products, reducing costs and enhancing overall market performance.Expand Specific Solutions03 Pricing strategies and risk management

Developing effective pricing strategies and managing risks are essential aspects of isocyanate market dynamics. This includes implementing dynamic pricing models, hedging against market volatility, and utilizing financial instruments to mitigate risks associated with price fluctuations and market uncertainties.Expand Specific Solutions04 Regulatory compliance and environmental considerations

The isocyanate market is subject to various regulations and environmental considerations. Market participants must navigate complex regulatory landscapes, ensure compliance with safety standards, and address environmental concerns. This includes developing eco-friendly production methods and adhering to sustainability practices to meet market demands and regulatory requirements.Expand Specific Solutions05 Technological advancements and product innovation

Continuous technological advancements and product innovation play a crucial role in shaping isocyanate market dynamics. This involves developing new applications, improving product quality, and enhancing production efficiency. Research and development efforts focus on creating novel isocyanate-based products to meet evolving industry needs and consumer preferences.Expand Specific Solutions

Key Isocyanate Manufacturers and Market Landscape

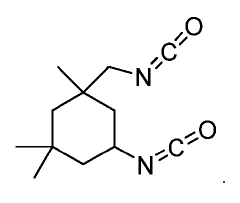

The isocyanate market is currently in a mature stage, characterized by steady growth and established players. The global market size is estimated to be in the billions of dollars, driven by demand from various end-use industries such as automotive, construction, and furniture. Technologically, the field is well-developed but continues to evolve, with companies like Wanhua Chemical, BASF, and Covestro leading innovation. These firms, along with others like Asahi Kasei and Mitsui Chemicals, are investing in research and development to improve product performance, sustainability, and cost-effectiveness. The competitive landscape is intense, with players focusing on expanding production capacities and developing eco-friendly alternatives to address environmental concerns and regulatory pressures.

Wanhua Chemical Group Co., Ltd.

Technical Solution: Wanhua Chemical has developed advanced isocyanate production technologies, focusing on methylene diphenyl diisocyanate (MDI) and toluene diisocyanate (TDI). Their innovative gas-phase phosgenation process for MDI production has significantly improved efficiency and reduced environmental impact[1]. The company has also invested in bio-based polyols for polyurethane production, aiming to reduce reliance on fossil-based raw materials[2]. Wanhua's continuous research in catalyst technology has led to improved selectivity and yield in isocyanate synthesis, contributing to cost reduction and product quality enhancement[3].

Strengths: Leading global capacity, advanced production technology, and strong R&D capabilities. Weaknesses: High dependence on raw material prices and potential overcapacity risks in the market.

BASF Corp.

Technical Solution: BASF has developed a novel, phosgene-free route for isocyanate production, utilizing carbamates as intermediates. This process significantly reduces environmental and safety risks associated with traditional phosgene-based methods[4]. The company has also made strides in developing bio-based isocyanates, using renewable raw materials to create more sustainable polyurethane products[5]. BASF's focus on process intensification has led to the implementation of microreactor technology for isocyanate synthesis, improving reaction control and product quality[6].

Strengths: Innovative phosgene-free technology, strong focus on sustainability, and extensive global presence. Weaknesses: Higher production costs for novel technologies and potential challenges in scaling up new processes.

Innovative Isocyanate Synthesis Approaches

Measurement of total reactive isocyanate groups in samples using bifunctional nucleophiles such as 1,8-diaminonaphthalene (DAN)

PatentInactiveEP1579207A2

Innovation

- A method using 1,8-diaminonaphthalene (DAN) as a bifunctional nucleophilic isocyanate derivatizing agent that reacts with isocyanates to form a cyclic reaction product, allowing for the detection and quantification of total isocyanate groups regardless of the specific species present, using a two-step process of derivatization and cyclization.

Flow chemistry synthesis of isocyanates

PatentWO2021119606A1

Innovation

- A continuous flow process involving the mixing of acyl hydrazides with nitrous acid to form acyl azides, followed by heating in the presence of an organic solvent to produce isocyanates through Curtius rearrangement, offering a safer and more scalable method for isocyanate synthesis.

Environmental Regulations Impact on Isocyanate Industry

Environmental regulations have become a significant factor shaping the isocyanate industry in recent years. The production and use of isocyanates, key components in polyurethane manufacturing, are subject to increasingly stringent environmental controls worldwide. These regulations aim to mitigate the potential environmental and health risks associated with isocyanate exposure.

In the United States, the Environmental Protection Agency (EPA) has implemented strict guidelines for isocyanate handling and emissions under the Clean Air Act. The Occupational Safety and Health Administration (OSHA) has also set permissible exposure limits for various isocyanates in workplace settings. Similarly, the European Union has enacted REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) regulations, which require extensive safety data and risk assessments for isocyanate production and use.

These regulatory frameworks have led to significant changes in isocyanate manufacturing processes. Companies are investing in advanced emission control technologies and closed-loop production systems to minimize environmental impact. The industry has also seen a shift towards the development of low-VOC (volatile organic compound) and water-based polyurethane systems, which reduce the release of harmful substances during application.

The regulatory landscape has spurred innovation in alternative, more environmentally friendly isocyanate formulations. Bio-based isocyanates derived from renewable resources are gaining traction as sustainable alternatives to traditional petroleum-based products. This trend aligns with the growing demand for eco-friendly materials across various end-use industries.

However, compliance with these regulations presents challenges for isocyanate manufacturers. The costs associated with implementing new technologies and processes to meet environmental standards can be substantial. Smaller companies, in particular, may struggle to adapt to these regulatory demands, potentially leading to industry consolidation.

The global nature of the isocyanate market adds another layer of complexity to regulatory compliance. Manufacturers must navigate varying environmental standards across different regions, which can impact production strategies and supply chain management. This has led to increased focus on harmonizing international standards to create a more level playing field for global trade.

Despite these challenges, the regulatory push for environmental protection is driving positive change in the isocyanate industry. It is fostering a culture of innovation and sustainability, encouraging companies to invest in cleaner technologies and more efficient production methods. As the industry continues to evolve, those companies that can effectively balance regulatory compliance with product performance and cost-effectiveness are likely to emerge as leaders in the global isocyanate market.

In the United States, the Environmental Protection Agency (EPA) has implemented strict guidelines for isocyanate handling and emissions under the Clean Air Act. The Occupational Safety and Health Administration (OSHA) has also set permissible exposure limits for various isocyanates in workplace settings. Similarly, the European Union has enacted REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) regulations, which require extensive safety data and risk assessments for isocyanate production and use.

These regulatory frameworks have led to significant changes in isocyanate manufacturing processes. Companies are investing in advanced emission control technologies and closed-loop production systems to minimize environmental impact. The industry has also seen a shift towards the development of low-VOC (volatile organic compound) and water-based polyurethane systems, which reduce the release of harmful substances during application.

The regulatory landscape has spurred innovation in alternative, more environmentally friendly isocyanate formulations. Bio-based isocyanates derived from renewable resources are gaining traction as sustainable alternatives to traditional petroleum-based products. This trend aligns with the growing demand for eco-friendly materials across various end-use industries.

However, compliance with these regulations presents challenges for isocyanate manufacturers. The costs associated with implementing new technologies and processes to meet environmental standards can be substantial. Smaller companies, in particular, may struggle to adapt to these regulatory demands, potentially leading to industry consolidation.

The global nature of the isocyanate market adds another layer of complexity to regulatory compliance. Manufacturers must navigate varying environmental standards across different regions, which can impact production strategies and supply chain management. This has led to increased focus on harmonizing international standards to create a more level playing field for global trade.

Despite these challenges, the regulatory push for environmental protection is driving positive change in the isocyanate industry. It is fostering a culture of innovation and sustainability, encouraging companies to invest in cleaner technologies and more efficient production methods. As the industry continues to evolve, those companies that can effectively balance regulatory compliance with product performance and cost-effectiveness are likely to emerge as leaders in the global isocyanate market.

Sustainability Initiatives in Isocyanate Production

The isocyanate industry is increasingly recognizing the importance of sustainability in its production processes. As global challenges such as climate change and resource scarcity become more pressing, companies are implementing various initiatives to reduce their environmental footprint and improve overall sustainability.

One key area of focus is energy efficiency. Many isocyanate producers are investing in advanced process technologies and equipment upgrades to minimize energy consumption. This includes the implementation of heat recovery systems, improved insulation, and more efficient reactors. Some facilities have reported energy savings of up to 30% through these measures, significantly reducing both costs and carbon emissions.

Water management is another critical aspect of sustainability in isocyanate production. Companies are developing closed-loop water systems and implementing advanced wastewater treatment technologies to minimize water usage and reduce the discharge of pollutants. These efforts not only conserve water resources but also help meet increasingly stringent environmental regulations.

Raw material efficiency is also being addressed through innovative approaches. Some producers are exploring bio-based feedstocks as alternatives to petroleum-derived raw materials, potentially reducing the industry's reliance on fossil fuels. Additionally, improved catalysts and reaction processes are being developed to increase yield and reduce waste generation.

Waste reduction and recycling initiatives are gaining traction across the industry. Companies are implementing strategies to recover and reuse solvents, catalysts, and other materials within the production process. Some facilities have achieved near-zero waste to landfill through comprehensive recycling programs and the conversion of waste streams into valuable by-products.

Carbon capture and utilization technologies are being explored as a means to reduce greenhouse gas emissions from isocyanate production. While still in the early stages, some companies are piloting projects to capture CO2 emissions and convert them into useful products or safely sequester them underground.

Collaboration within the industry and with external partners is playing a crucial role in advancing sustainability initiatives. Many isocyanate producers are participating in industry-wide sustainability programs, sharing best practices, and working with research institutions to develop innovative solutions.

As the isocyanate market continues to face global challenges, these sustainability initiatives are becoming increasingly important. They not only help mitigate environmental impacts but also contribute to long-term business resilience by reducing costs, improving resource efficiency, and meeting evolving stakeholder expectations. The industry's commitment to sustainability is likely to drive further innovation and shape the future of isocyanate production.

One key area of focus is energy efficiency. Many isocyanate producers are investing in advanced process technologies and equipment upgrades to minimize energy consumption. This includes the implementation of heat recovery systems, improved insulation, and more efficient reactors. Some facilities have reported energy savings of up to 30% through these measures, significantly reducing both costs and carbon emissions.

Water management is another critical aspect of sustainability in isocyanate production. Companies are developing closed-loop water systems and implementing advanced wastewater treatment technologies to minimize water usage and reduce the discharge of pollutants. These efforts not only conserve water resources but also help meet increasingly stringent environmental regulations.

Raw material efficiency is also being addressed through innovative approaches. Some producers are exploring bio-based feedstocks as alternatives to petroleum-derived raw materials, potentially reducing the industry's reliance on fossil fuels. Additionally, improved catalysts and reaction processes are being developed to increase yield and reduce waste generation.

Waste reduction and recycling initiatives are gaining traction across the industry. Companies are implementing strategies to recover and reuse solvents, catalysts, and other materials within the production process. Some facilities have achieved near-zero waste to landfill through comprehensive recycling programs and the conversion of waste streams into valuable by-products.

Carbon capture and utilization technologies are being explored as a means to reduce greenhouse gas emissions from isocyanate production. While still in the early stages, some companies are piloting projects to capture CO2 emissions and convert them into useful products or safely sequester them underground.

Collaboration within the industry and with external partners is playing a crucial role in advancing sustainability initiatives. Many isocyanate producers are participating in industry-wide sustainability programs, sharing best practices, and working with research institutions to develop innovative solutions.

As the isocyanate market continues to face global challenges, these sustainability initiatives are becoming increasingly important. They not only help mitigate environmental impacts but also contribute to long-term business resilience by reducing costs, improving resource efficiency, and meeting evolving stakeholder expectations. The industry's commitment to sustainability is likely to drive further innovation and shape the future of isocyanate production.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!