Isocyanates in Fintech: Expanding Material Applications

JUL 10, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Isocyanate Tech Evolution

Isocyanates have undergone a remarkable evolution in their applications within the fintech industry, transforming from traditional industrial uses to innovative financial technology solutions. The journey began in the mid-20th century when isocyanates were primarily used in polyurethane production for various industrial applications. However, as technology advanced and the financial sector embraced digital transformation, isocyanates found new purposes in fintech.

In the early 2000s, researchers began exploring the potential of isocyanate-based materials in electronic components, particularly in the manufacturing of circuit boards and protective coatings for financial hardware. This marked the initial intersection between isocyanates and fintech, laying the groundwork for future innovations.

The next significant milestone occurred in the late 2000s when isocyanate-derived materials were incorporated into the production of smart cards and contactless payment devices. These applications leveraged the durability and flexibility of isocyanate-based polymers to enhance the longevity and performance of financial transaction tools.

As mobile banking and digital payments gained prominence in the 2010s, isocyanates played a crucial role in developing protective coatings for smartphones and tablets. These coatings not only improved device durability but also incorporated antimicrobial properties, addressing hygiene concerns in shared financial devices.

The mid-2010s saw a surge in biometric authentication technologies, where isocyanate-based materials found applications in fingerprint sensors and facial recognition hardware. Their unique properties allowed for the creation of more accurate and reliable biometric systems, enhancing security in financial transactions.

In recent years, the focus has shifted towards sustainable and eco-friendly solutions in fintech. Researchers have been developing bio-based isocyanates and exploring their potential in creating environmentally friendly financial products, such as biodegradable payment cards and recyclable ATM components.

The latest frontier in isocyanate technology for fintech involves their integration with Internet of Things (IoT) devices and wearable financial technologies. Isocyanate-based materials are being used to create flexible, durable, and secure casings for these devices, enabling seamless integration of financial services into everyday objects.

Looking ahead, the evolution of isocyanates in fintech is expected to continue, with potential applications in quantum computing hardware for financial systems and advanced data storage solutions. As the financial industry continues to innovate, isocyanates are poised to play an increasingly important role in shaping the future of financial technology materials and applications.

In the early 2000s, researchers began exploring the potential of isocyanate-based materials in electronic components, particularly in the manufacturing of circuit boards and protective coatings for financial hardware. This marked the initial intersection between isocyanates and fintech, laying the groundwork for future innovations.

The next significant milestone occurred in the late 2000s when isocyanate-derived materials were incorporated into the production of smart cards and contactless payment devices. These applications leveraged the durability and flexibility of isocyanate-based polymers to enhance the longevity and performance of financial transaction tools.

As mobile banking and digital payments gained prominence in the 2010s, isocyanates played a crucial role in developing protective coatings for smartphones and tablets. These coatings not only improved device durability but also incorporated antimicrobial properties, addressing hygiene concerns in shared financial devices.

The mid-2010s saw a surge in biometric authentication technologies, where isocyanate-based materials found applications in fingerprint sensors and facial recognition hardware. Their unique properties allowed for the creation of more accurate and reliable biometric systems, enhancing security in financial transactions.

In recent years, the focus has shifted towards sustainable and eco-friendly solutions in fintech. Researchers have been developing bio-based isocyanates and exploring their potential in creating environmentally friendly financial products, such as biodegradable payment cards and recyclable ATM components.

The latest frontier in isocyanate technology for fintech involves their integration with Internet of Things (IoT) devices and wearable financial technologies. Isocyanate-based materials are being used to create flexible, durable, and secure casings for these devices, enabling seamless integration of financial services into everyday objects.

Looking ahead, the evolution of isocyanates in fintech is expected to continue, with potential applications in quantum computing hardware for financial systems and advanced data storage solutions. As the financial industry continues to innovate, isocyanates are poised to play an increasingly important role in shaping the future of financial technology materials and applications.

Fintech Material Demands

The fintech industry is experiencing a growing demand for innovative materials that can enhance the functionality, durability, and security of financial technology products. As traditional financial services increasingly merge with digital technologies, the need for advanced materials in fintech applications has become more pronounced. This demand is driven by several factors, including the need for improved security features in payment cards, the development of wearable payment devices, and the integration of biometric authentication systems.

One of the primary areas of material demand in fintech is in the production of smart cards and contactless payment devices. These products require materials that can withstand frequent use, resist wear and tear, and incorporate advanced security features such as RFID-blocking capabilities. Additionally, there is a growing interest in biodegradable and environmentally friendly materials for these applications, as sustainability becomes a key concern for both consumers and financial institutions.

Wearable payment devices, such as smartwatches and fitness trackers with integrated payment capabilities, are another area driving material innovation in fintech. These devices require materials that are not only durable and water-resistant but also comfortable for extended wear. There is a particular focus on developing flexible and stretchable materials that can accommodate various form factors while maintaining the integrity of embedded electronic components.

The rise of biometric authentication in financial services has also created new demands for specialized materials. Fingerprint sensors, facial recognition cameras, and other biometric devices require materials that can provide high sensitivity and accuracy while being resistant to environmental factors such as moisture and temperature fluctuations. This has led to increased research into advanced polymers and composites that can meet these stringent requirements.

Cybersecurity concerns have further fueled the demand for materials with enhanced protective properties. There is a growing need for materials that can shield electronic components from electromagnetic interference and prevent unauthorized access to sensitive financial data. This has led to the development of specialized coatings and encapsulation materials designed to protect fintech devices from physical tampering and electronic eavesdropping.

As the Internet of Things (IoT) continues to expand into the financial sector, there is an increasing demand for materials that can support the integration of sensors and communication modules into everyday objects. This includes the development of conductive inks and printable electronics that can turn ordinary items into smart financial tools, such as payment-enabled clothing or accessories.

One of the primary areas of material demand in fintech is in the production of smart cards and contactless payment devices. These products require materials that can withstand frequent use, resist wear and tear, and incorporate advanced security features such as RFID-blocking capabilities. Additionally, there is a growing interest in biodegradable and environmentally friendly materials for these applications, as sustainability becomes a key concern for both consumers and financial institutions.

Wearable payment devices, such as smartwatches and fitness trackers with integrated payment capabilities, are another area driving material innovation in fintech. These devices require materials that are not only durable and water-resistant but also comfortable for extended wear. There is a particular focus on developing flexible and stretchable materials that can accommodate various form factors while maintaining the integrity of embedded electronic components.

The rise of biometric authentication in financial services has also created new demands for specialized materials. Fingerprint sensors, facial recognition cameras, and other biometric devices require materials that can provide high sensitivity and accuracy while being resistant to environmental factors such as moisture and temperature fluctuations. This has led to increased research into advanced polymers and composites that can meet these stringent requirements.

Cybersecurity concerns have further fueled the demand for materials with enhanced protective properties. There is a growing need for materials that can shield electronic components from electromagnetic interference and prevent unauthorized access to sensitive financial data. This has led to the development of specialized coatings and encapsulation materials designed to protect fintech devices from physical tampering and electronic eavesdropping.

As the Internet of Things (IoT) continues to expand into the financial sector, there is an increasing demand for materials that can support the integration of sensors and communication modules into everyday objects. This includes the development of conductive inks and printable electronics that can turn ordinary items into smart financial tools, such as payment-enabled clothing or accessories.

Isocyanate Challenges

Despite the widespread use of isocyanates in various industries, their application in fintech materials faces several significant challenges. One of the primary concerns is the high reactivity of isocyanates, which can lead to stability issues in fintech products. This reactivity, while beneficial for certain applications, can result in unwanted side reactions or degradation of the material over time, potentially compromising the integrity and longevity of fintech devices or components.

Another major challenge is the toxicity associated with isocyanates, particularly in their unreacted form. This poses significant health and safety risks during the manufacturing process and requires stringent safety measures and handling protocols. The potential for exposure to isocyanate vapors or residues in finished products also raises concerns about long-term user safety, especially in close-contact fintech applications such as wearable devices or biometric sensors.

Environmental considerations present additional hurdles for isocyanate use in fintech materials. The production and disposal of isocyanate-based products can have negative environmental impacts, including the release of volatile organic compounds (VOCs) and the generation of non-biodegradable waste. As the fintech industry increasingly prioritizes sustainability and eco-friendly solutions, finding ways to mitigate these environmental issues becomes crucial.

The cost factor also poses a challenge, particularly for mass-market fintech applications. High-quality isocyanates and the specialized equipment required for their safe handling and processing can be expensive, potentially limiting their adoption in cost-sensitive fintech products. Balancing performance benefits with economic viability remains a key consideration for manufacturers.

Regulatory compliance adds another layer of complexity to isocyanate use in fintech materials. Stringent regulations governing the use of isocyanates, particularly in consumer products, necessitate extensive testing and documentation. This can lead to prolonged development cycles and increased costs, potentially slowing down innovation in the fast-paced fintech sector.

Lastly, the challenge of achieving consistent quality and performance across different batches and production runs is significant. The sensitive nature of isocyanate chemistry means that slight variations in processing conditions can lead to substantial differences in the final product properties. Ensuring uniformity and reliability in fintech applications, where precision and consistency are often critical, requires sophisticated quality control measures and may limit scalability.

Another major challenge is the toxicity associated with isocyanates, particularly in their unreacted form. This poses significant health and safety risks during the manufacturing process and requires stringent safety measures and handling protocols. The potential for exposure to isocyanate vapors or residues in finished products also raises concerns about long-term user safety, especially in close-contact fintech applications such as wearable devices or biometric sensors.

Environmental considerations present additional hurdles for isocyanate use in fintech materials. The production and disposal of isocyanate-based products can have negative environmental impacts, including the release of volatile organic compounds (VOCs) and the generation of non-biodegradable waste. As the fintech industry increasingly prioritizes sustainability and eco-friendly solutions, finding ways to mitigate these environmental issues becomes crucial.

The cost factor also poses a challenge, particularly for mass-market fintech applications. High-quality isocyanates and the specialized equipment required for their safe handling and processing can be expensive, potentially limiting their adoption in cost-sensitive fintech products. Balancing performance benefits with economic viability remains a key consideration for manufacturers.

Regulatory compliance adds another layer of complexity to isocyanate use in fintech materials. Stringent regulations governing the use of isocyanates, particularly in consumer products, necessitate extensive testing and documentation. This can lead to prolonged development cycles and increased costs, potentially slowing down innovation in the fast-paced fintech sector.

Lastly, the challenge of achieving consistent quality and performance across different batches and production runs is significant. The sensitive nature of isocyanate chemistry means that slight variations in processing conditions can lead to substantial differences in the final product properties. Ensuring uniformity and reliability in fintech applications, where precision and consistency are often critical, requires sophisticated quality control measures and may limit scalability.

Current Isocyanate Apps

01 Synthesis and production of isocyanates

Various methods and processes for synthesizing and producing isocyanates are described. These include novel catalysts, reaction conditions, and precursor materials to improve yield, purity, and efficiency in isocyanate production.- Synthesis and production of isocyanates: Various methods and processes for synthesizing and producing isocyanates are described. These include novel reaction pathways, catalysts, and production techniques to improve yield, purity, and efficiency in isocyanate manufacturing.

- Applications of isocyanates in polymer chemistry: Isocyanates are widely used in polymer chemistry, particularly in the production of polyurethanes. The patents describe various applications, including coatings, adhesives, foams, and elastomers, as well as novel polymer formulations incorporating isocyanates.

- Isocyanate-based catalysts and reaction modifiers: Several patents focus on the development of catalysts and reaction modifiers based on or incorporating isocyanates. These innovations aim to enhance reaction rates, selectivity, and overall performance in various chemical processes.

- Safety and handling of isocyanates: Given the reactive nature of isocyanates, patents in this category address safety concerns and handling procedures. This includes methods for reducing toxicity, improving storage stability, and developing safer formulations for industrial use.

- Isocyanate-free alternatives and substitutes: Some patents focus on developing alternatives or substitutes for isocyanates in various applications. This includes novel chemistries and formulations that aim to provide similar functionalities while addressing environmental and health concerns associated with traditional isocyanates.

02 Applications of isocyanates in polymer chemistry

Isocyanates are widely used in polymer chemistry, particularly in the production of polyurethanes. The patents describe various applications, including coatings, adhesives, foams, and elastomers, as well as novel formulations and processing techniques.Expand Specific Solutions03 Isocyanate-based catalysts and additives

Some patents focus on the use of isocyanates as catalysts or additives in various chemical processes. These include their application in polymerization reactions, curing agents, and as modifiers for other materials to enhance specific properties.Expand Specific Solutions04 Safety and handling of isocyanates

Given the reactive nature of isocyanates, several patents address safety concerns and improved handling methods. These include storage techniques, exposure prevention, and the development of less hazardous isocyanate derivatives for specific applications.Expand Specific Solutions05 Isocyanate-free alternatives and substitutes

Some patents explore alternatives to traditional isocyanates, aiming to address environmental and health concerns. These include the development of isocyanate-free polyurethanes, bio-based alternatives, and novel chemistries that mimic isocyanate reactivity without the associated risks.Expand Specific Solutions

Key Isocyanate Players

The isocyanates market in fintech is experiencing rapid growth, driven by expanding material applications across industries. Currently in an early growth stage, the market shows significant potential for innovation and diversification. Key players like Eastman Chemical, Dow Global Technologies, and Covestro Deutschland are investing heavily in R&D to develop novel isocyanate-based solutions for fintech applications. The technology's maturity varies, with established companies like BASF and Wanhua Chemical Group leading in traditional uses, while newer entrants like Evonik Operations and Johnson Matthey are exploring cutting-edge applications. As the market evolves, collaborations between chemical manufacturers and fintech firms are expected to accelerate technological advancements and market expansion.

Dow Global Technologies LLC

Technical Solution: Dow has developed innovative isocyanate-based materials for fintech applications, focusing on durability and flexibility. Their technology incorporates modified polyurethane coatings with enhanced scratch resistance and self-healing properties[1]. These coatings are particularly suitable for high-touch surfaces in financial institutions, such as ATMs and point-of-sale terminals. Dow's approach also includes the development of isocyanate-free alternatives to address environmental concerns, utilizing bio-based raw materials to create sustainable solutions for fintech hardware[2]. The company has further expanded its research into conductive polymers derived from isocyanates, potentially revolutionizing the manufacturing of secure, chip-enabled credit cards[3].

Strengths: Advanced material science expertise, focus on sustainability, and broad application range. Weaknesses: Potential regulatory challenges due to isocyanate use, and competition from isocyanate-free alternatives.

Covestro Deutschland AG

Technical Solution: Covestro has pioneered the use of aliphatic isocyanates in fintech applications, particularly in the development of high-performance coatings for electronic devices and payment terminals. Their proprietary technology, TPU (Thermoplastic Polyurethane) Flex, incorporates isocyanate-based materials to create flexible, durable, and chemical-resistant surfaces ideal for wearable payment devices and smart cards[4]. Covestro has also developed a novel isocyanate-based adhesive system specifically designed for bonding components in fintech hardware, ensuring long-term reliability in various environmental conditions[5]. Additionally, the company is exploring the integration of isocyanate-derived materials with antimicrobial properties, addressing hygiene concerns in high-traffic financial environments[6].

Strengths: Specialized in high-performance materials, strong focus on fintech applications, and innovative product portfolio. Weaknesses: Dependency on petrochemical feedstocks and potential environmental concerns associated with isocyanate production.

Core Isocyanate Patents

Isocyanate composition and its use in the preparation of expanded polyurethane with improved physico-mechanical properties

PatentInactiveEP1385894A1

Innovation

- Development of MDI-based isocyanate compositions that use water as the sole expanding agent, combining methylene diphenyl isocyanate with specific polyether polyols and polymeric methylene diphenyl isocyanate to create flexible expanded polyurethanes with improved properties, including high elongation and dynamic fatigue resistance.

Isocyanate composition

PatentPendingKR1020240031040A

Innovation

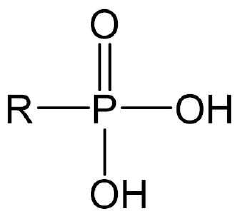

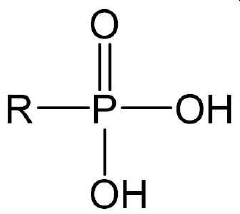

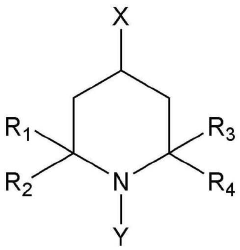

- An isocyanate composition comprising an isocyanate-based compound and a phosphonic acid-based compound, along with optional polythiol, polyhydric alcohol, or polyhydric episulfide compounds, to suppress oligomerization and improve storage stability and workability.

Regulatory Compliance

The regulatory landscape for isocyanates in the fintech sector is complex and evolving, reflecting the intersection of material science, financial technology, and environmental safety concerns. As isocyanates find expanding applications in fintech products, such as smart cards, biometric devices, and wearable payment technologies, regulatory bodies are increasingly focusing on their use and potential impacts.

Key regulatory frameworks governing isocyanates in fintech applications include occupational health and safety regulations, environmental protection laws, and product safety standards. In the United States, the Occupational Safety and Health Administration (OSHA) has established strict exposure limits and handling protocols for isocyanates in manufacturing processes. Similarly, the European Union's REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) regulation imposes stringent requirements on the use of isocyanates in consumer products, including those in the fintech sector.

Financial institutions and fintech companies must navigate a web of compliance requirements when incorporating isocyanate-based materials into their products. This includes adhering to the European Union's Restriction of Hazardous Substances (RoHS) Directive, which limits the use of certain hazardous substances in electrical and electronic equipment. As smart financial devices often fall under this category, manufacturers must ensure their isocyanate-containing components meet RoHS standards.

The growing emphasis on sustainability and environmental responsibility in the financial sector has led to increased scrutiny of materials used in fintech products. Regulatory bodies are pushing for more environmentally friendly alternatives to traditional isocyanate-based materials. This has spurred innovation in bio-based isocyanates and other sustainable alternatives, which are subject to their own set of regulatory approvals and certifications.

Data protection and privacy regulations also intersect with the use of isocyanates in fintech applications, particularly in the production of secure payment cards and biometric devices. Compliance with standards such as the Payment Card Industry Data Security Standard (PCI DSS) and the General Data Protection Regulation (GDPR) is crucial when developing new materials and technologies that incorporate isocyanates.

As the fintech industry continues to innovate, regulatory bodies are likely to introduce new guidelines and standards specific to the use of advanced materials like isocyanates in financial technologies. Companies operating in this space must stay abreast of these developments and proactively engage with regulators to ensure compliance and foster responsible innovation.

Key regulatory frameworks governing isocyanates in fintech applications include occupational health and safety regulations, environmental protection laws, and product safety standards. In the United States, the Occupational Safety and Health Administration (OSHA) has established strict exposure limits and handling protocols for isocyanates in manufacturing processes. Similarly, the European Union's REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) regulation imposes stringent requirements on the use of isocyanates in consumer products, including those in the fintech sector.

Financial institutions and fintech companies must navigate a web of compliance requirements when incorporating isocyanate-based materials into their products. This includes adhering to the European Union's Restriction of Hazardous Substances (RoHS) Directive, which limits the use of certain hazardous substances in electrical and electronic equipment. As smart financial devices often fall under this category, manufacturers must ensure their isocyanate-containing components meet RoHS standards.

The growing emphasis on sustainability and environmental responsibility in the financial sector has led to increased scrutiny of materials used in fintech products. Regulatory bodies are pushing for more environmentally friendly alternatives to traditional isocyanate-based materials. This has spurred innovation in bio-based isocyanates and other sustainable alternatives, which are subject to their own set of regulatory approvals and certifications.

Data protection and privacy regulations also intersect with the use of isocyanates in fintech applications, particularly in the production of secure payment cards and biometric devices. Compliance with standards such as the Payment Card Industry Data Security Standard (PCI DSS) and the General Data Protection Regulation (GDPR) is crucial when developing new materials and technologies that incorporate isocyanates.

As the fintech industry continues to innovate, regulatory bodies are likely to introduce new guidelines and standards specific to the use of advanced materials like isocyanates in financial technologies. Companies operating in this space must stay abreast of these developments and proactively engage with regulators to ensure compliance and foster responsible innovation.

Environmental Impact

The environmental impact of isocyanates in fintech applications is a critical consideration as these materials expand their presence in the industry. Isocyanates, primarily used in the production of polyurethanes, have traditionally been associated with various industrial sectors. However, their integration into fintech products and services raises new environmental concerns that warrant careful examination.

One of the primary environmental issues surrounding isocyanates is their potential for air pollution. During the manufacturing process and application of isocyanate-based materials, volatile organic compounds (VOCs) can be released into the atmosphere. These emissions contribute to the formation of ground-level ozone and smog, which can have detrimental effects on air quality and human health. As fintech applications increasingly incorporate isocyanate-based materials, there is a growing need to implement stringent emission control measures and adopt cleaner production technologies.

Water pollution is another significant environmental concern associated with isocyanates. If not properly managed, these chemicals can contaminate water sources through industrial runoff or improper disposal. In aquatic environments, isocyanates can react with water to form potentially harmful byproducts, impacting ecosystems and biodiversity. The fintech industry must prioritize responsible waste management practices and invest in advanced water treatment technologies to mitigate these risks.

The production and disposal of isocyanate-containing products also contribute to the broader issue of plastic waste. As fintech solutions increasingly rely on durable, lightweight materials for devices and infrastructure, the end-of-life management of these products becomes crucial. Improper disposal can lead to the accumulation of non-biodegradable waste in landfills or marine environments, exacerbating the global plastic pollution crisis.

Energy consumption and greenhouse gas emissions associated with isocyanate production and processing present additional environmental challenges. The energy-intensive nature of these processes contributes to carbon footprints, aligning with broader concerns about climate change. As the fintech sector expands its use of isocyanate-based materials, there is a growing imperative to transition towards more sustainable energy sources and improve production efficiencies to minimize environmental impact.

To address these environmental concerns, the fintech industry must adopt a proactive approach. This includes investing in research and development of eco-friendly alternatives, implementing closed-loop recycling systems, and embracing green chemistry principles in material design and production. Additionally, collaboration with environmental agencies and adherence to stringent regulations will be essential in mitigating the potential negative impacts of isocyanates on the environment as their applications in fintech continue to expand.

One of the primary environmental issues surrounding isocyanates is their potential for air pollution. During the manufacturing process and application of isocyanate-based materials, volatile organic compounds (VOCs) can be released into the atmosphere. These emissions contribute to the formation of ground-level ozone and smog, which can have detrimental effects on air quality and human health. As fintech applications increasingly incorporate isocyanate-based materials, there is a growing need to implement stringent emission control measures and adopt cleaner production technologies.

Water pollution is another significant environmental concern associated with isocyanates. If not properly managed, these chemicals can contaminate water sources through industrial runoff or improper disposal. In aquatic environments, isocyanates can react with water to form potentially harmful byproducts, impacting ecosystems and biodiversity. The fintech industry must prioritize responsible waste management practices and invest in advanced water treatment technologies to mitigate these risks.

The production and disposal of isocyanate-containing products also contribute to the broader issue of plastic waste. As fintech solutions increasingly rely on durable, lightweight materials for devices and infrastructure, the end-of-life management of these products becomes crucial. Improper disposal can lead to the accumulation of non-biodegradable waste in landfills or marine environments, exacerbating the global plastic pollution crisis.

Energy consumption and greenhouse gas emissions associated with isocyanate production and processing present additional environmental challenges. The energy-intensive nature of these processes contributes to carbon footprints, aligning with broader concerns about climate change. As the fintech sector expands its use of isocyanate-based materials, there is a growing imperative to transition towards more sustainable energy sources and improve production efficiencies to minimize environmental impact.

To address these environmental concerns, the fintech industry must adopt a proactive approach. This includes investing in research and development of eco-friendly alternatives, implementing closed-loop recycling systems, and embracing green chemistry principles in material design and production. Additionally, collaboration with environmental agencies and adherence to stringent regulations will be essential in mitigating the potential negative impacts of isocyanates on the environment as their applications in fintech continue to expand.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!