Strategic Pathways in Isocyanate Application Diversity

JUL 10, 20258 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Isocyanate Evolution

Isocyanates have undergone a remarkable evolution since their initial discovery in the late 19th century. The journey began with the synthesis of the first isocyanate compound by Adolph Wurtz in 1848, marking the inception of a chemical class that would revolutionize various industries. However, it wasn't until the 1930s that the true potential of isocyanates was realized, primarily through the groundbreaking work of Otto Bayer and his team at I.G. Farben.

The 1940s and 1950s witnessed a surge in isocyanate research and development, driven by the growing demand for versatile materials in the post-war era. This period saw the emergence of polyurethanes, a class of polymers derived from the reaction between isocyanates and polyols. The discovery of these materials opened up a plethora of applications, ranging from flexible foams for furniture to rigid insulation for construction.

As the technology matured, the 1960s and 1970s brought about significant advancements in isocyanate chemistry. Researchers focused on developing new types of isocyanates with enhanced properties, such as improved reactivity, stability, and environmental compatibility. This era also saw the introduction of modified isocyanates, including blocked isocyanates and prepolymers, which expanded the application scope and processing capabilities of these versatile compounds.

The late 20th century marked a shift towards addressing environmental and health concerns associated with isocyanates. Efforts were made to develop low-emission and solvent-free systems, as well as to improve worker safety in isocyanate-related industries. This period also saw the introduction of water-based polyurethane systems, which significantly reduced volatile organic compound (VOC) emissions.

In recent years, the evolution of isocyanates has been characterized by a focus on sustainability and bio-based alternatives. Researchers are exploring the use of renewable raw materials to produce isocyanates, aiming to reduce dependence on petrochemical feedstocks. Additionally, there is growing interest in non-isocyanate polyurethanes (NIPUs) as potential alternatives in certain applications, driven by regulatory pressures and environmental considerations.

The current trajectory of isocyanate evolution is centered on developing smart and functional materials. This includes the integration of isocyanate-based polymers with nanotechnology, the creation of self-healing materials, and the exploration of stimuli-responsive systems. These advancements are opening up new possibilities in fields such as biomedicine, electronics, and advanced manufacturing.

The 1940s and 1950s witnessed a surge in isocyanate research and development, driven by the growing demand for versatile materials in the post-war era. This period saw the emergence of polyurethanes, a class of polymers derived from the reaction between isocyanates and polyols. The discovery of these materials opened up a plethora of applications, ranging from flexible foams for furniture to rigid insulation for construction.

As the technology matured, the 1960s and 1970s brought about significant advancements in isocyanate chemistry. Researchers focused on developing new types of isocyanates with enhanced properties, such as improved reactivity, stability, and environmental compatibility. This era also saw the introduction of modified isocyanates, including blocked isocyanates and prepolymers, which expanded the application scope and processing capabilities of these versatile compounds.

The late 20th century marked a shift towards addressing environmental and health concerns associated with isocyanates. Efforts were made to develop low-emission and solvent-free systems, as well as to improve worker safety in isocyanate-related industries. This period also saw the introduction of water-based polyurethane systems, which significantly reduced volatile organic compound (VOC) emissions.

In recent years, the evolution of isocyanates has been characterized by a focus on sustainability and bio-based alternatives. Researchers are exploring the use of renewable raw materials to produce isocyanates, aiming to reduce dependence on petrochemical feedstocks. Additionally, there is growing interest in non-isocyanate polyurethanes (NIPUs) as potential alternatives in certain applications, driven by regulatory pressures and environmental considerations.

The current trajectory of isocyanate evolution is centered on developing smart and functional materials. This includes the integration of isocyanate-based polymers with nanotechnology, the creation of self-healing materials, and the exploration of stimuli-responsive systems. These advancements are opening up new possibilities in fields such as biomedicine, electronics, and advanced manufacturing.

Market Demand Analysis

The isocyanate market has experienced significant growth in recent years, driven by increasing demand across various industries. The versatility of isocyanates, particularly in polyurethane production, has led to their widespread adoption in construction, automotive, furniture, and electronics sectors. The global isocyanate market size was valued at over $30 billion in 2020 and is projected to grow at a compound annual growth rate (CAGR) of around 6% from 2021 to 2028.

In the construction industry, isocyanates are crucial components in the production of rigid foam insulation, sealants, and adhesives. The growing emphasis on energy-efficient buildings and stringent building codes have boosted the demand for high-performance insulation materials, driving the isocyanate market. Additionally, the automotive sector's shift towards lightweight materials to improve fuel efficiency has increased the use of polyurethane-based components, further propelling isocyanate demand.

The furniture industry represents another significant market for isocyanates, particularly in the production of flexible foams for cushioning and mattresses. As consumer preferences evolve towards more comfortable and durable furniture, the demand for high-quality polyurethane foams continues to rise. The electronics industry also contributes to isocyanate market growth, utilizing these chemicals in the production of protective coatings and encapsulants for electronic components.

Emerging economies, particularly in Asia-Pacific, are expected to be key drivers of isocyanate market growth. Rapid industrialization, urbanization, and increasing disposable incomes in countries like China and India are fueling demand across various end-use industries. The region is anticipated to witness the highest growth rate in the coming years, with China remaining the largest consumer and producer of isocyanates globally.

However, the market faces challenges related to environmental and health concerns associated with isocyanate exposure. Stringent regulations regarding the use and handling of isocyanates, particularly in developed regions, may impact market growth. This has led to increased research and development efforts focused on developing safer alternatives and improving production processes to minimize environmental impact.

The COVID-19 pandemic initially disrupted the isocyanate market due to supply chain disruptions and reduced demand from end-use industries. However, the market has shown resilience, with a quick recovery observed in sectors such as construction and automotive. The pandemic has also highlighted the importance of isocyanates in the production of personal protective equipment and medical devices, potentially opening new avenues for market growth.

In the construction industry, isocyanates are crucial components in the production of rigid foam insulation, sealants, and adhesives. The growing emphasis on energy-efficient buildings and stringent building codes have boosted the demand for high-performance insulation materials, driving the isocyanate market. Additionally, the automotive sector's shift towards lightweight materials to improve fuel efficiency has increased the use of polyurethane-based components, further propelling isocyanate demand.

The furniture industry represents another significant market for isocyanates, particularly in the production of flexible foams for cushioning and mattresses. As consumer preferences evolve towards more comfortable and durable furniture, the demand for high-quality polyurethane foams continues to rise. The electronics industry also contributes to isocyanate market growth, utilizing these chemicals in the production of protective coatings and encapsulants for electronic components.

Emerging economies, particularly in Asia-Pacific, are expected to be key drivers of isocyanate market growth. Rapid industrialization, urbanization, and increasing disposable incomes in countries like China and India are fueling demand across various end-use industries. The region is anticipated to witness the highest growth rate in the coming years, with China remaining the largest consumer and producer of isocyanates globally.

However, the market faces challenges related to environmental and health concerns associated with isocyanate exposure. Stringent regulations regarding the use and handling of isocyanates, particularly in developed regions, may impact market growth. This has led to increased research and development efforts focused on developing safer alternatives and improving production processes to minimize environmental impact.

The COVID-19 pandemic initially disrupted the isocyanate market due to supply chain disruptions and reduced demand from end-use industries. However, the market has shown resilience, with a quick recovery observed in sectors such as construction and automotive. The pandemic has also highlighted the importance of isocyanates in the production of personal protective equipment and medical devices, potentially opening new avenues for market growth.

Technical Challenges

The isocyanate industry faces several significant technical challenges that hinder the expansion and diversification of applications. One of the primary obstacles is the high reactivity of isocyanates, which makes them difficult to handle and store safely. This reactivity also leads to potential side reactions during processing, affecting product quality and consistency. Manufacturers must invest heavily in specialized equipment and safety measures to mitigate these risks, increasing production costs and limiting accessibility for smaller-scale operations.

Another major challenge lies in the toxicity of isocyanates, particularly their potential to cause respiratory sensitization and occupational asthma. This health concern necessitates stringent safety protocols and personal protective equipment for workers, as well as sophisticated emission control systems to prevent environmental contamination. The regulatory landscape surrounding isocyanates is becoming increasingly stringent, with some regions considering bans or severe restrictions on certain compounds, forcing the industry to adapt rapidly.

The environmental impact of isocyanate production and use presents another significant hurdle. Traditional manufacturing processes often rely on fossil fuel-derived raw materials and energy-intensive reactions, contributing to a substantial carbon footprint. As global pressure mounts to reduce greenhouse gas emissions and transition to more sustainable practices, the isocyanate industry must innovate to develop greener production methods and explore bio-based alternatives.

Achieving precise control over isocyanate reactions remains a technical challenge, particularly in applications requiring complex polyurethane formulations. The kinetics of isocyanate reactions can be highly sensitive to environmental conditions, making it difficult to maintain consistent product properties across different batches or manufacturing locations. This variability can lead to quality control issues and limit the adoption of isocyanates in high-precision applications.

The development of isocyanate-free alternatives is also putting pressure on the industry to innovate. While these alternatives often do not match the performance of traditional isocyanates, they are gaining traction in certain applications due to perceived safety and environmental benefits. This competition is driving research into novel isocyanate chemistries that can offer improved safety profiles while maintaining or enhancing performance characteristics.

Lastly, the industry faces challenges in recycling and end-of-life management of isocyanate-based products, particularly polyurethanes. The cross-linked nature of many polyurethane materials makes them difficult to recycle through conventional methods, contributing to waste accumulation. Developing efficient recycling technologies and designing products for easier disassembly and material recovery are becoming increasingly important to address sustainability concerns and comply with circular economy initiatives.

Another major challenge lies in the toxicity of isocyanates, particularly their potential to cause respiratory sensitization and occupational asthma. This health concern necessitates stringent safety protocols and personal protective equipment for workers, as well as sophisticated emission control systems to prevent environmental contamination. The regulatory landscape surrounding isocyanates is becoming increasingly stringent, with some regions considering bans or severe restrictions on certain compounds, forcing the industry to adapt rapidly.

The environmental impact of isocyanate production and use presents another significant hurdle. Traditional manufacturing processes often rely on fossil fuel-derived raw materials and energy-intensive reactions, contributing to a substantial carbon footprint. As global pressure mounts to reduce greenhouse gas emissions and transition to more sustainable practices, the isocyanate industry must innovate to develop greener production methods and explore bio-based alternatives.

Achieving precise control over isocyanate reactions remains a technical challenge, particularly in applications requiring complex polyurethane formulations. The kinetics of isocyanate reactions can be highly sensitive to environmental conditions, making it difficult to maintain consistent product properties across different batches or manufacturing locations. This variability can lead to quality control issues and limit the adoption of isocyanates in high-precision applications.

The development of isocyanate-free alternatives is also putting pressure on the industry to innovate. While these alternatives often do not match the performance of traditional isocyanates, they are gaining traction in certain applications due to perceived safety and environmental benefits. This competition is driving research into novel isocyanate chemistries that can offer improved safety profiles while maintaining or enhancing performance characteristics.

Lastly, the industry faces challenges in recycling and end-of-life management of isocyanate-based products, particularly polyurethanes. The cross-linked nature of many polyurethane materials makes them difficult to recycle through conventional methods, contributing to waste accumulation. Developing efficient recycling technologies and designing products for easier disassembly and material recovery are becoming increasingly important to address sustainability concerns and comply with circular economy initiatives.

Current Solutions

01 Synthesis and production of isocyanates

Various methods and processes for synthesizing and producing isocyanates are described. These include novel catalysts, reaction conditions, and precursor materials to improve yield, purity, and efficiency in isocyanate production.- Synthesis and production of isocyanates: Various methods and processes for synthesizing and producing isocyanates are described. These include novel catalysts, reaction conditions, and precursor materials to improve yield, purity, and efficiency in isocyanate production.

- Applications of isocyanates in polymer chemistry: Isocyanates are widely used in polymer chemistry, particularly in the production of polyurethanes. The patents describe various applications, including coatings, adhesives, foams, and elastomers, as well as novel formulations and processing techniques.

- Isocyanate-based catalysts and additives: Several patents focus on the development of isocyanate-based catalysts and additives for various chemical processes. These include novel catalyst systems, stabilizers, and modifiers that enhance reaction rates, selectivity, or product properties.

- Safety and handling of isocyanates: Given the reactive nature of isocyanates, patents address safety concerns and handling procedures. This includes methods for reducing toxicity, improving storage stability, and developing safer alternatives or modified isocyanates with reduced health risks.

- Isocyanate-free alternatives and substitutes: Some patents explore alternatives to traditional isocyanates, addressing environmental and health concerns. These include bio-based substitutes, non-isocyanate polyurethanes, and alternative chemistries that provide similar functionalities without the use of isocyanates.

02 Applications of isocyanates in polymer chemistry

Isocyanates are widely used in polymer chemistry, particularly in the production of polyurethanes. The patents describe various formulations, curing methods, and applications of isocyanate-based polymers in coatings, adhesives, and foams.Expand Specific Solutions03 Isocyanate-modified compounds and materials

Several patents focus on the modification of existing compounds or materials using isocyanates. This includes the creation of isocyanate-terminated prepolymers, isocyanate-functional silanes, and other modified materials with enhanced properties.Expand Specific Solutions04 Handling and safety of isocyanates

Given the reactive nature of isocyanates, several patents address safety concerns and handling procedures. This includes methods for reducing toxicity, improving storage stability, and developing safer alternatives to traditional isocyanates.Expand Specific Solutions05 Isocyanate-based catalysts and reaction systems

Some patents describe the use of isocyanates in catalytic systems or as key components in complex reaction systems. This includes their role in polymerization reactions, cross-linking processes, and as intermediates in the synthesis of other compounds.Expand Specific Solutions

Key Industry Players

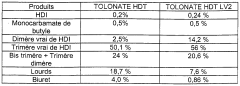

The strategic pathways in isocyanate application diversity present a competitive landscape characterized by mature market players and ongoing innovation. The industry is in a growth phase, with a global market size expected to reach significant figures in the coming years. Technological maturity varies across applications, with established players like Covestro, BASF, Wanhua Chemical, and Bayer AG leading in traditional sectors. Emerging companies such as Gevo and Butamax are exploring novel applications in biofuels, indicating potential for market expansion. The field is marked by a blend of large chemical conglomerates and specialized firms, each contributing to the diversification of isocyanate applications across industries such as automotive, construction, and electronics.

Covestro Deutschland AG

Technical Solution: Covestro has pioneered several strategic pathways in isocyanate applications. They have developed a novel process for producing aniline, a key precursor for MDI, using bio-based raw materials, significantly reducing the carbon footprint of isocyanate production[9]. Covestro has also focused on expanding the use of aliphatic isocyanates in high-performance coatings, particularly for automotive and industrial applications, offering improved UV resistance and durability[10]. Their research extends to novel polyurethane dispersions using modified isocyanates, enabling waterborne coating systems with enhanced performance characteristics[11]. Additionally, Covestro has made strides in developing isocyanate-based materials for 3D printing applications, opening new avenues for customized manufacturing[12].

Strengths: Strong innovation in sustainable isocyanate production, diverse application portfolio, and advanced R&D capabilities. Weaknesses: High dependence on automotive and construction markets, potential raw material price volatility.

BASF Corp.

Technical Solution: BASF Corp. has developed innovative isocyanate applications in various sectors. Their strategic approach includes the development of bio-based isocyanates, reducing environmental impact[1]. They have also focused on improving the performance of polyurethane systems by optimizing isocyanate formulations for enhanced durability and weather resistance[2]. BASF's research extends to novel curing technologies for isocyanate-based coatings, enabling faster processing times and improved energy efficiency in manufacturing[3]. Additionally, they have made significant strides in developing low-emission isocyanate products for automotive and construction applications, addressing growing regulatory pressures[4].

Strengths: Broad research capabilities, strong market presence, and focus on sustainable solutions. Weaknesses: Potential regulatory challenges and competition in specialized applications.

Innovative Approaches

Modified isocyanates

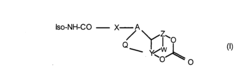

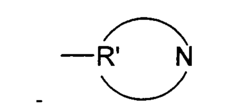

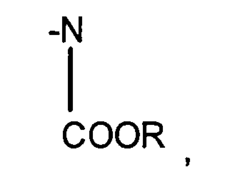

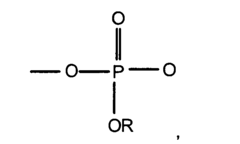

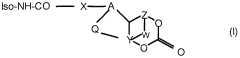

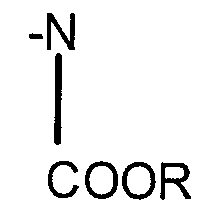

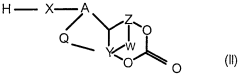

PatentInactiveEP1382626A1

Innovation

- Development of modified isocyanate derivatives with a crosslinking functional group that remains stable at low temperatures and only reacts at high temperatures, allowing for controlled crosslinking reactions without the need for masking agents, using cyclic carbonates to form stable polyisocyanates that can react with nucleophilic compounds to form coatings and polymers.

Modified isocyanates

PatentWO2000020477A1

Innovation

- Development of modified isocyanate derivatives with a crosslinking functional group that remains stable and reacts only under specific conditions, allowing for controlled crosslinking reactions without releasing isocyanate functions prematurely, using cyclic carbonates to form stable polyisocyanates that can react with nucleophilic compounds to create coatings and foams.

Regulatory Framework

The regulatory framework surrounding isocyanate applications is complex and multifaceted, reflecting the diverse uses and potential hazards associated with these compounds. At the global level, organizations such as the World Health Organization (WHO) and the International Labour Organization (ILO) provide guidelines and recommendations for the safe handling and use of isocyanates. These guidelines often serve as a basis for national and regional regulations.

In the United States, the Occupational Safety and Health Administration (OSHA) has established stringent standards for isocyanate exposure in the workplace. These include permissible exposure limits (PELs) and requirements for personal protective equipment (PPE). The Environmental Protection Agency (EPA) regulates isocyanates under the Toxic Substances Control Act (TSCA), focusing on their environmental impact and potential risks to human health.

The European Union has implemented REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) regulations, which apply to isocyanates and their derivatives. Under REACH, manufacturers and importers must register substances and provide safety data. The EU has also introduced specific restrictions on certain diisocyanates, requiring professional and industrial users to undergo training on their safe handling.

In Asia, countries like China and Japan have their own regulatory frameworks. China's Ministry of Ecology and Environment oversees the registration and management of new chemical substances, including isocyanates. Japan's Chemical Substances Control Law (CSCL) regulates the manufacture, import, and use of chemical substances, with specific provisions for isocyanates.

Industry-specific regulations also play a crucial role. For instance, in the automotive sector, regulations on volatile organic compounds (VOCs) have driven the development of low-VOC isocyanate-based coatings. In the construction industry, building codes and standards often dictate the use of isocyanate-based materials, particularly in insulation and sealants.

The regulatory landscape is continuously evolving, with a trend towards stricter controls and increased emphasis on worker safety and environmental protection. This dynamic environment necessitates ongoing compliance efforts and adaptations in isocyanate application strategies. Companies operating in this space must stay abreast of regulatory changes across different jurisdictions and proactively adjust their practices to ensure compliance and maintain market access.

In the United States, the Occupational Safety and Health Administration (OSHA) has established stringent standards for isocyanate exposure in the workplace. These include permissible exposure limits (PELs) and requirements for personal protective equipment (PPE). The Environmental Protection Agency (EPA) regulates isocyanates under the Toxic Substances Control Act (TSCA), focusing on their environmental impact and potential risks to human health.

The European Union has implemented REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) regulations, which apply to isocyanates and their derivatives. Under REACH, manufacturers and importers must register substances and provide safety data. The EU has also introduced specific restrictions on certain diisocyanates, requiring professional and industrial users to undergo training on their safe handling.

In Asia, countries like China and Japan have their own regulatory frameworks. China's Ministry of Ecology and Environment oversees the registration and management of new chemical substances, including isocyanates. Japan's Chemical Substances Control Law (CSCL) regulates the manufacture, import, and use of chemical substances, with specific provisions for isocyanates.

Industry-specific regulations also play a crucial role. For instance, in the automotive sector, regulations on volatile organic compounds (VOCs) have driven the development of low-VOC isocyanate-based coatings. In the construction industry, building codes and standards often dictate the use of isocyanate-based materials, particularly in insulation and sealants.

The regulatory landscape is continuously evolving, with a trend towards stricter controls and increased emphasis on worker safety and environmental protection. This dynamic environment necessitates ongoing compliance efforts and adaptations in isocyanate application strategies. Companies operating in this space must stay abreast of regulatory changes across different jurisdictions and proactively adjust their practices to ensure compliance and maintain market access.

Sustainability Aspects

Sustainability has become a critical consideration in the application of isocyanates across various industries. As environmental concerns grow, there is an increasing focus on developing more sustainable practices in isocyanate production and utilization. One key aspect of sustainability in this field is the reduction of volatile organic compound (VOC) emissions. Manufacturers are exploring water-based and high-solids formulations to minimize the release of harmful substances into the atmosphere during application processes.

Another significant sustainability trend is the shift towards bio-based isocyanates. Researchers are investigating renewable raw materials, such as plant-based oils and sugars, as alternatives to petroleum-based feedstocks. This approach not only reduces reliance on fossil fuels but also contributes to lowering the overall carbon footprint of isocyanate production. However, challenges remain in scaling up these bio-based processes to meet industrial demands while maintaining cost-effectiveness.

Energy efficiency in isocyanate manufacturing is another crucial sustainability aspect. Companies are investing in advanced process technologies and heat recovery systems to optimize energy consumption. Additionally, the implementation of closed-loop production systems helps minimize waste and maximize resource utilization, further enhancing the sustainability profile of isocyanate applications.

The end-of-life management of isocyanate-based products is gaining attention in the context of sustainability. Efforts are being made to improve the recyclability and biodegradability of these materials. For instance, research is ongoing to develop isocyanate-based polymers that can be more easily broken down and reprocessed, contributing to a circular economy approach.

Safety considerations are integral to the sustainability of isocyanate applications. Manufacturers are developing safer handling procedures and investing in personal protective equipment to minimize risks associated with isocyanate exposure. Furthermore, there is a growing emphasis on educating end-users about proper disposal methods to prevent environmental contamination.

Regulatory compliance plays a significant role in driving sustainability initiatives in the isocyanate industry. Stringent environmental regulations are pushing companies to adopt cleaner production methods and develop more environmentally friendly products. This regulatory pressure is accelerating innovation in sustainable isocyanate technologies and applications.

Another significant sustainability trend is the shift towards bio-based isocyanates. Researchers are investigating renewable raw materials, such as plant-based oils and sugars, as alternatives to petroleum-based feedstocks. This approach not only reduces reliance on fossil fuels but also contributes to lowering the overall carbon footprint of isocyanate production. However, challenges remain in scaling up these bio-based processes to meet industrial demands while maintaining cost-effectiveness.

Energy efficiency in isocyanate manufacturing is another crucial sustainability aspect. Companies are investing in advanced process technologies and heat recovery systems to optimize energy consumption. Additionally, the implementation of closed-loop production systems helps minimize waste and maximize resource utilization, further enhancing the sustainability profile of isocyanate applications.

The end-of-life management of isocyanate-based products is gaining attention in the context of sustainability. Efforts are being made to improve the recyclability and biodegradability of these materials. For instance, research is ongoing to develop isocyanate-based polymers that can be more easily broken down and reprocessed, contributing to a circular economy approach.

Safety considerations are integral to the sustainability of isocyanate applications. Manufacturers are developing safer handling procedures and investing in personal protective equipment to minimize risks associated with isocyanate exposure. Furthermore, there is a growing emphasis on educating end-users about proper disposal methods to prevent environmental contamination.

Regulatory compliance plays a significant role in driving sustainability initiatives in the isocyanate industry. Stringent environmental regulations are pushing companies to adopt cleaner production methods and develop more environmentally friendly products. This regulatory pressure is accelerating innovation in sustainable isocyanate technologies and applications.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!