How Isocyanates Navigate Market Fragmentations?

JUL 10, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Isocyanate Evolution

The evolution of isocyanates has been marked by significant technological advancements and market adaptations. Initially developed in the 1930s, isocyanates quickly gained prominence due to their versatile chemical properties and wide-ranging applications. The early stages of isocyanate development focused primarily on toluene diisocyanate (TDI) and methylene diphenyl diisocyanate (MDI), which remain key players in the market today.

Throughout the 1950s and 1960s, the isocyanate industry experienced rapid growth, driven by the expanding automotive and construction sectors. This period saw the introduction of polyurethane foams, which revolutionized insulation and cushioning materials. The 1970s brought about increased environmental awareness, leading to the development of more eco-friendly isocyanate formulations and production processes.

The 1980s and 1990s witnessed a shift towards specialization, with manufacturers focusing on tailored isocyanate products for specific applications. This trend was accompanied by advancements in production technologies, resulting in improved yields and reduced environmental impact. During this time, aliphatic isocyanates gained traction in the coatings industry due to their superior weathering properties.

The turn of the millennium marked a new era for isocyanates, characterized by globalization and market fragmentation. As emerging economies entered the market, production centers shifted, and new players emerged, challenging established manufacturers. This period also saw increased regulatory scrutiny, particularly in Europe and North America, leading to the development of low-emission and low-toxicity isocyanate variants.

In recent years, the isocyanate industry has faced growing pressure to address sustainability concerns. This has led to innovations in bio-based isocyanates and recycling technologies for polyurethane products. Additionally, the industry has seen a trend towards consolidation, with major players acquiring smaller, specialized manufacturers to diversify their product portfolios and navigate market fragmentations.

The current landscape of the isocyanate market is characterized by a delicate balance between commodity and specialty products. While TDI and MDI continue to dominate in terms of volume, there is an increasing focus on high-value, niche applications. This evolution has necessitated a more agile approach to production and marketing, with manufacturers developing flexible production systems capable of producing a wide range of isocyanate products to meet diverse market demands.

Looking forward, the isocyanate industry is poised for further evolution, driven by advancements in green chemistry, digitalization, and changing consumer preferences. The development of novel catalysts and process technologies is expected to enable more efficient and sustainable isocyanate production. Furthermore, the integration of Industry 4.0 concepts is likely to revolutionize manufacturing processes, allowing for greater customization and responsiveness to market fluctuations.

Throughout the 1950s and 1960s, the isocyanate industry experienced rapid growth, driven by the expanding automotive and construction sectors. This period saw the introduction of polyurethane foams, which revolutionized insulation and cushioning materials. The 1970s brought about increased environmental awareness, leading to the development of more eco-friendly isocyanate formulations and production processes.

The 1980s and 1990s witnessed a shift towards specialization, with manufacturers focusing on tailored isocyanate products for specific applications. This trend was accompanied by advancements in production technologies, resulting in improved yields and reduced environmental impact. During this time, aliphatic isocyanates gained traction in the coatings industry due to their superior weathering properties.

The turn of the millennium marked a new era for isocyanates, characterized by globalization and market fragmentation. As emerging economies entered the market, production centers shifted, and new players emerged, challenging established manufacturers. This period also saw increased regulatory scrutiny, particularly in Europe and North America, leading to the development of low-emission and low-toxicity isocyanate variants.

In recent years, the isocyanate industry has faced growing pressure to address sustainability concerns. This has led to innovations in bio-based isocyanates and recycling technologies for polyurethane products. Additionally, the industry has seen a trend towards consolidation, with major players acquiring smaller, specialized manufacturers to diversify their product portfolios and navigate market fragmentations.

The current landscape of the isocyanate market is characterized by a delicate balance between commodity and specialty products. While TDI and MDI continue to dominate in terms of volume, there is an increasing focus on high-value, niche applications. This evolution has necessitated a more agile approach to production and marketing, with manufacturers developing flexible production systems capable of producing a wide range of isocyanate products to meet diverse market demands.

Looking forward, the isocyanate industry is poised for further evolution, driven by advancements in green chemistry, digitalization, and changing consumer preferences. The development of novel catalysts and process technologies is expected to enable more efficient and sustainable isocyanate production. Furthermore, the integration of Industry 4.0 concepts is likely to revolutionize manufacturing processes, allowing for greater customization and responsiveness to market fluctuations.

Market Fragmentation

The isocyanates market is characterized by significant fragmentation, driven by diverse end-use applications and regional demand variations. This fragmentation presents both challenges and opportunities for industry players navigating the complex landscape.

One of the primary factors contributing to market fragmentation is the wide range of applications for isocyanates. These versatile chemicals are used in various industries, including automotive, construction, furniture, and electronics. Each sector has unique requirements and specifications, leading to the development of specialized isocyanate products tailored to specific applications. This diversification results in a fragmented market with numerous niche segments.

Regional differences in demand and regulatory environments further contribute to market fragmentation. Developed economies, such as North America and Western Europe, have mature markets with stringent environmental regulations, driving demand for eco-friendly isocyanate alternatives. In contrast, emerging economies in Asia-Pacific and Latin America are experiencing rapid industrialization, fueling demand for traditional isocyanate products in construction and automotive sectors.

The fragmented nature of the isocyanates market has led to the emergence of specialized producers catering to specific segments or regions. While global chemical giants dominate the overall market, smaller players have found success by focusing on niche applications or local markets. This fragmentation has intensified competition and driven innovation as companies strive to differentiate their offerings.

To navigate this fragmented landscape, isocyanate manufacturers are adopting various strategies. Many are pursuing vertical integration to secure raw material supplies and enhance control over the value chain. Others are focusing on developing eco-friendly alternatives to address growing environmental concerns and regulatory pressures in certain regions.

Consolidation through mergers and acquisitions has become a common strategy for companies seeking to expand their market presence and product portfolios. By acquiring smaller, specialized producers, larger companies can quickly gain access to niche markets and technologies, helping them navigate the fragmented landscape more effectively.

The fragmentation of the isocyanates market also presents opportunities for innovation and product differentiation. Companies are investing in research and development to create novel formulations that address specific customer needs or regulatory requirements. This focus on tailored solutions has led to the development of high-performance isocyanates with improved properties, such as enhanced durability, flexibility, or environmental sustainability.

One of the primary factors contributing to market fragmentation is the wide range of applications for isocyanates. These versatile chemicals are used in various industries, including automotive, construction, furniture, and electronics. Each sector has unique requirements and specifications, leading to the development of specialized isocyanate products tailored to specific applications. This diversification results in a fragmented market with numerous niche segments.

Regional differences in demand and regulatory environments further contribute to market fragmentation. Developed economies, such as North America and Western Europe, have mature markets with stringent environmental regulations, driving demand for eco-friendly isocyanate alternatives. In contrast, emerging economies in Asia-Pacific and Latin America are experiencing rapid industrialization, fueling demand for traditional isocyanate products in construction and automotive sectors.

The fragmented nature of the isocyanates market has led to the emergence of specialized producers catering to specific segments or regions. While global chemical giants dominate the overall market, smaller players have found success by focusing on niche applications or local markets. This fragmentation has intensified competition and driven innovation as companies strive to differentiate their offerings.

To navigate this fragmented landscape, isocyanate manufacturers are adopting various strategies. Many are pursuing vertical integration to secure raw material supplies and enhance control over the value chain. Others are focusing on developing eco-friendly alternatives to address growing environmental concerns and regulatory pressures in certain regions.

Consolidation through mergers and acquisitions has become a common strategy for companies seeking to expand their market presence and product portfolios. By acquiring smaller, specialized producers, larger companies can quickly gain access to niche markets and technologies, helping them navigate the fragmented landscape more effectively.

The fragmentation of the isocyanates market also presents opportunities for innovation and product differentiation. Companies are investing in research and development to create novel formulations that address specific customer needs or regulatory requirements. This focus on tailored solutions has led to the development of high-performance isocyanates with improved properties, such as enhanced durability, flexibility, or environmental sustainability.

Technical Challenges

The isocyanate market faces several significant technical challenges that impact its ability to navigate market fragmentations effectively. One of the primary hurdles is the inherent reactivity of isocyanates, which makes them highly sensitive to moisture and prone to degradation during storage and transportation. This characteristic necessitates specialized handling and storage conditions, increasing operational costs and complexity for manufacturers and distributors.

Another major challenge lies in the toxicity of isocyanates, particularly their potential to cause respiratory sensitization and occupational asthma. This health concern has led to stringent regulatory requirements and safety measures across different regions, creating a complex compliance landscape for companies operating in multiple markets. The varying regulations between countries and even states within countries contribute to market fragmentation and necessitate adaptable production and distribution strategies.

The environmental impact of isocyanate production and use presents an additional technical challenge. Traditional manufacturing processes often involve the use of phosgene, a highly toxic substance, which has raised environmental concerns and prompted the search for more sustainable alternatives. Developing eco-friendly production methods that maintain product quality while reducing environmental footprint is a significant technical hurdle facing the industry.

Furthermore, the diverse applications of isocyanates across multiple industries, including automotive, construction, and furniture, require tailored formulations and properties. This demand for customization creates technical challenges in maintaining consistent quality and performance across different product lines while also addressing the specific needs of fragmented market segments.

The ongoing shift towards bio-based and renewable raw materials presents both an opportunity and a challenge for the isocyanate industry. Developing bio-based isocyanates that match or exceed the performance of traditional petrochemical-derived products requires significant research and development efforts. This transition also involves overcoming technical barriers related to scalability, cost-effectiveness, and maintaining the desired chemical properties.

Lastly, the global nature of the isocyanate market introduces logistical and supply chain challenges. Ensuring product stability during long-distance transportation, managing inventory across diverse climatic conditions, and maintaining product quality in different storage environments all present technical hurdles that companies must address to effectively serve fragmented markets worldwide.

Another major challenge lies in the toxicity of isocyanates, particularly their potential to cause respiratory sensitization and occupational asthma. This health concern has led to stringent regulatory requirements and safety measures across different regions, creating a complex compliance landscape for companies operating in multiple markets. The varying regulations between countries and even states within countries contribute to market fragmentation and necessitate adaptable production and distribution strategies.

The environmental impact of isocyanate production and use presents an additional technical challenge. Traditional manufacturing processes often involve the use of phosgene, a highly toxic substance, which has raised environmental concerns and prompted the search for more sustainable alternatives. Developing eco-friendly production methods that maintain product quality while reducing environmental footprint is a significant technical hurdle facing the industry.

Furthermore, the diverse applications of isocyanates across multiple industries, including automotive, construction, and furniture, require tailored formulations and properties. This demand for customization creates technical challenges in maintaining consistent quality and performance across different product lines while also addressing the specific needs of fragmented market segments.

The ongoing shift towards bio-based and renewable raw materials presents both an opportunity and a challenge for the isocyanate industry. Developing bio-based isocyanates that match or exceed the performance of traditional petrochemical-derived products requires significant research and development efforts. This transition also involves overcoming technical barriers related to scalability, cost-effectiveness, and maintaining the desired chemical properties.

Lastly, the global nature of the isocyanate market introduces logistical and supply chain challenges. Ensuring product stability during long-distance transportation, managing inventory across diverse climatic conditions, and maintaining product quality in different storage environments all present technical hurdles that companies must address to effectively serve fragmented markets worldwide.

Current Solutions

01 Synthesis and production of isocyanates

Various methods and processes for synthesizing and producing isocyanates are described. These include novel catalysts, reaction conditions, and precursor materials to improve yield, purity, and efficiency in isocyanate production.- Synthesis and production of isocyanates: Various methods and processes for synthesizing and producing isocyanates are described. These include novel reaction pathways, catalysts, and production techniques to improve yield, purity, and efficiency in isocyanate manufacturing.

- Applications of isocyanates in polymer chemistry: Isocyanates are widely used in polymer chemistry, particularly in the production of polyurethanes. The patents discuss various applications, including foam production, coatings, adhesives, and elastomers, as well as novel polymer formulations incorporating isocyanates.

- Isocyanate-based catalysts and reaction modifiers: Several patents focus on the use of isocyanates as catalysts or reaction modifiers in various chemical processes. This includes their role in polymerization reactions, cross-linking agents, and as components in complex catalyst systems.

- Safety and handling of isocyanates: Given the reactive nature of isocyanates, several patents address safety concerns and handling procedures. This includes methods for reducing toxicity, improving storage stability, and developing safer formulations for industrial use.

- Isocyanate derivatives and modified compounds: Patents in this category describe the development of various isocyanate derivatives and modified compounds. These include blocked isocyanates, isocyanate prepolymers, and novel isocyanate-containing molecules with enhanced properties or specific functionalities.

02 Applications of isocyanates in polymer chemistry

Isocyanates are widely used in polymer chemistry, particularly in the production of polyurethanes. The patents discuss different formulations, curing methods, and applications of isocyanate-based polymers in various industries.Expand Specific Solutions03 Isocyanate-based coatings and adhesives

The use of isocyanates in coatings and adhesives is explored, including formulations for improved durability, adhesion, and chemical resistance. Various curing mechanisms and additives are discussed to enhance performance.Expand Specific Solutions04 Safety and handling of isocyanates

Given the reactive nature of isocyanates, several patents focus on improved safety measures, handling techniques, and storage methods. This includes the development of less hazardous alternatives and methods to reduce exposure risks.Expand Specific Solutions05 Isocyanate-free alternatives and modifications

Research into isocyanate-free alternatives and modified isocyanates with improved properties is presented. This includes the development of new compounds that mimic isocyanate reactivity while addressing environmental and health concerns.Expand Specific Solutions

Industry Leaders

The isocyanates market is in a mature growth stage, characterized by steady demand and established applications across various industries. The global market size is substantial, estimated to be in the billions of dollars, driven by robust consumption in polyurethane production, coatings, and adhesives. Technologically, isocyanates are well-developed, with companies like Wanhua Chemical Group, BASF, Covestro, and Bayer leading innovation. These key players are focusing on improving product efficiency, sustainability, and exploring new applications. Emerging trends include bio-based isocyanates and low-emission formulations, reflecting the industry's response to environmental concerns and regulatory pressures.

Wanhua Chemical Group Co., Ltd.

Technical Solution: Wanhua Chemical Group has developed a comprehensive isocyanate product portfolio, including MDI, TDI, and ADI. Their innovative approach focuses on tailoring isocyanate solutions for specific market segments. They have implemented a vertical integration strategy, controlling the entire value chain from raw materials to end products. This allows them to navigate market fragmentations by offering customized solutions for various industries such as automotive, construction, and furniture. Wanhua has also invested in eco-friendly isocyanate technologies, developing water-based polyurethane dispersions and bio-based isocyanates to address environmental concerns[1][3]. Their global expansion strategy includes establishing production facilities in key markets, enabling them to respond quickly to regional demand fluctuations and regulatory changes.

Strengths: Vertical integration, diverse product portfolio, and global presence. Weaknesses: Potential overreliance on Chinese market and exposure to raw material price fluctuations.

BASF Corp.

Technical Solution: BASF has developed a strategic approach to navigate the fragmented isocyanate market by focusing on innovation and sustainability. They have introduced a range of low-emission isocyanate products, such as their Lupranate® series, which addresses increasing environmental regulations across different regions. BASF's isocyanate portfolio includes specialized grades for various applications, allowing them to cater to diverse market segments. They have also invested in digitalization and automation of their production processes, improving efficiency and enabling more flexible responses to market demands. BASF's global network of technical centers facilitates close collaboration with customers, allowing for rapid development of tailored solutions for specific regional needs[2][4]. Additionally, they have explored alternative raw material sources for isocyanates, including bio-based feedstocks, to mitigate supply chain risks and address sustainability concerns.

Strengths: Strong R&D capabilities, global presence, and focus on sustainability. Weaknesses: Complex organizational structure may slow decision-making in rapidly changing markets.

Key Innovations

Modified isocyanates

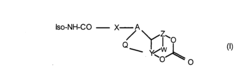

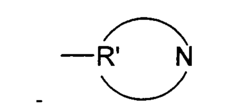

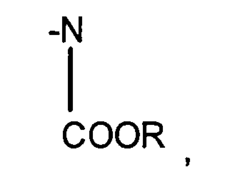

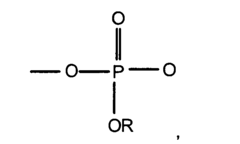

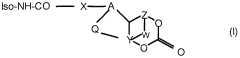

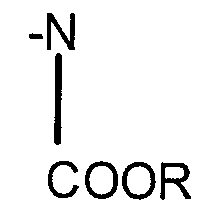

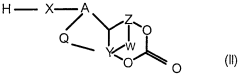

PatentInactiveEP1382626A1

Innovation

- Development of modified isocyanate derivatives with a crosslinking functional group that remains stable at low temperatures and only reacts at high temperatures, allowing for controlled crosslinking reactions without the need for masking agents, using cyclic carbonates to form stable polyisocyanates that can react with nucleophilic compounds to form coatings and polymers.

Modified isocyanates

PatentWO2000020477A1

Innovation

- Development of modified isocyanate derivatives with a crosslinking functional group that remains stable and reacts only under specific conditions, allowing for controlled crosslinking reactions without releasing isocyanate functions prematurely, using cyclic carbonates to form stable polyisocyanates that can react with nucleophilic compounds to create coatings and foams.

Regulatory Landscape

The regulatory landscape for isocyanates is complex and multifaceted, reflecting the diverse applications and potential hazards associated with these chemicals. Globally, regulations governing isocyanates vary significantly, creating a fragmented market that companies must navigate carefully.

In the United States, the Occupational Safety and Health Administration (OSHA) has established stringent exposure limits for isocyanates in workplace environments. The permissible exposure limit (PEL) for most isocyanates is set at 0.02 parts per million (ppm) for an 8-hour time-weighted average. Additionally, the Environmental Protection Agency (EPA) regulates isocyanates under the Toxic Substances Control Act (TSCA), requiring manufacturers to report production volumes, uses, and potential risks.

The European Union has implemented REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) regulations, which mandate extensive safety data for isocyanates. Under REACH, isocyanates are classified as substances of very high concern (SVHC) due to their respiratory sensitizing properties. This classification imposes strict requirements on manufacturers, importers, and downstream users, including the need for authorization for certain uses.

In Asia, regulatory approaches vary widely. Japan has established occupational exposure limits similar to those in the United States, while China has implemented the Measures for Environmental Management of New Chemical Substances, which requires registration and risk assessment for isocyanates. South Korea's Act on the Registration and Evaluation of Chemicals (K-REACH) also imposes registration requirements for isocyanate manufacturers and importers.

The fragmented regulatory landscape presents both challenges and opportunities for isocyanate manufacturers and users. Companies must invest significant resources in compliance efforts, often tailoring their approaches to different markets. This fragmentation can create barriers to entry for smaller firms and may lead to regional disparities in product availability and pricing.

However, the diverse regulatory environment also drives innovation in safer alternatives and improved handling practices. Companies that can effectively navigate these regulations and develop compliant, high-performance products may gain a competitive advantage in the global market.

As sustainability concerns grow, many jurisdictions are implementing or considering stricter regulations on isocyanates, particularly regarding their environmental impact and potential health effects. This evolving regulatory landscape is likely to continue shaping the isocyanate market, influencing product development, manufacturing processes, and global trade patterns in the coming years.

In the United States, the Occupational Safety and Health Administration (OSHA) has established stringent exposure limits for isocyanates in workplace environments. The permissible exposure limit (PEL) for most isocyanates is set at 0.02 parts per million (ppm) for an 8-hour time-weighted average. Additionally, the Environmental Protection Agency (EPA) regulates isocyanates under the Toxic Substances Control Act (TSCA), requiring manufacturers to report production volumes, uses, and potential risks.

The European Union has implemented REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) regulations, which mandate extensive safety data for isocyanates. Under REACH, isocyanates are classified as substances of very high concern (SVHC) due to their respiratory sensitizing properties. This classification imposes strict requirements on manufacturers, importers, and downstream users, including the need for authorization for certain uses.

In Asia, regulatory approaches vary widely. Japan has established occupational exposure limits similar to those in the United States, while China has implemented the Measures for Environmental Management of New Chemical Substances, which requires registration and risk assessment for isocyanates. South Korea's Act on the Registration and Evaluation of Chemicals (K-REACH) also imposes registration requirements for isocyanate manufacturers and importers.

The fragmented regulatory landscape presents both challenges and opportunities for isocyanate manufacturers and users. Companies must invest significant resources in compliance efforts, often tailoring their approaches to different markets. This fragmentation can create barriers to entry for smaller firms and may lead to regional disparities in product availability and pricing.

However, the diverse regulatory environment also drives innovation in safer alternatives and improved handling practices. Companies that can effectively navigate these regulations and develop compliant, high-performance products may gain a competitive advantage in the global market.

As sustainability concerns grow, many jurisdictions are implementing or considering stricter regulations on isocyanates, particularly regarding their environmental impact and potential health effects. This evolving regulatory landscape is likely to continue shaping the isocyanate market, influencing product development, manufacturing processes, and global trade patterns in the coming years.

Environmental Impact

Isocyanates, widely used in the production of polyurethanes, have significant environmental implications that warrant careful consideration. The production, use, and disposal of isocyanate-containing products contribute to various environmental concerns, necessitating a comprehensive approach to mitigate their impact.

One of the primary environmental issues associated with isocyanates is their potential for air pollution. During manufacturing processes and product application, volatile organic compounds (VOCs) are released, contributing to smog formation and degradation of air quality. This is particularly problematic in urban areas with high industrial activity, where cumulative emissions can exacerbate existing air quality issues.

Water contamination is another critical environmental concern. Improper disposal of isocyanate-containing products or industrial effluents can lead to the leaching of these chemicals into groundwater and surface water bodies. This poses risks to aquatic ecosystems and potentially to human health if contaminated water sources are used for drinking or irrigation.

The persistence of isocyanates in the environment is a growing concern. While they typically react quickly with water to form inert compounds, certain isocyanates can persist under specific environmental conditions. This persistence can lead to long-term ecological impacts, affecting soil quality and biodiversity in affected areas.

In terms of waste management, the disposal of isocyanate-containing products presents challenges. Many polyurethane products are not easily recyclable, contributing to landfill waste. The incineration of these materials, if not properly controlled, can release toxic substances into the atmosphere, further compounding environmental issues.

The environmental impact of isocyanates extends to their role in climate change. The production of isocyanates is energy-intensive, often relying on fossil fuel-based processes. This contributes to greenhouse gas emissions, aligning the industry with broader concerns about industrial contributions to global warming.

To address these environmental challenges, the isocyanate industry is increasingly focusing on sustainable practices. This includes developing bio-based alternatives, improving production efficiency to reduce emissions, and implementing more effective waste management strategies. Additionally, there is a growing emphasis on life cycle assessments to comprehensively evaluate the environmental footprint of isocyanate-based products from production to disposal.

One of the primary environmental issues associated with isocyanates is their potential for air pollution. During manufacturing processes and product application, volatile organic compounds (VOCs) are released, contributing to smog formation and degradation of air quality. This is particularly problematic in urban areas with high industrial activity, where cumulative emissions can exacerbate existing air quality issues.

Water contamination is another critical environmental concern. Improper disposal of isocyanate-containing products or industrial effluents can lead to the leaching of these chemicals into groundwater and surface water bodies. This poses risks to aquatic ecosystems and potentially to human health if contaminated water sources are used for drinking or irrigation.

The persistence of isocyanates in the environment is a growing concern. While they typically react quickly with water to form inert compounds, certain isocyanates can persist under specific environmental conditions. This persistence can lead to long-term ecological impacts, affecting soil quality and biodiversity in affected areas.

In terms of waste management, the disposal of isocyanate-containing products presents challenges. Many polyurethane products are not easily recyclable, contributing to landfill waste. The incineration of these materials, if not properly controlled, can release toxic substances into the atmosphere, further compounding environmental issues.

The environmental impact of isocyanates extends to their role in climate change. The production of isocyanates is energy-intensive, often relying on fossil fuel-based processes. This contributes to greenhouse gas emissions, aligning the industry with broader concerns about industrial contributions to global warming.

To address these environmental challenges, the isocyanate industry is increasingly focusing on sustainable practices. This includes developing bio-based alternatives, improving production efficiency to reduce emissions, and implementing more effective waste management strategies. Additionally, there is a growing emphasis on life cycle assessments to comprehensively evaluate the environmental footprint of isocyanate-based products from production to disposal.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!