Deconstructing the Economics of Isocyanate Production

JUL 10, 20258 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Isocyanate Evolution

The evolution of isocyanate production has been a journey marked by significant technological advancements and economic considerations. Initially developed in the 1930s, isocyanates quickly became integral to the polymer industry, particularly in the production of polyurethanes. The early stages of isocyanate production were characterized by batch processes, which were labor-intensive and had limited scalability.

As demand grew in the post-World War II era, the focus shifted towards continuous production methods. This transition marked a crucial turning point in the economics of isocyanate production, enabling higher throughput and improved cost-efficiency. The 1960s and 1970s saw the introduction of more sophisticated catalysts and reaction systems, further enhancing yield and selectivity.

The 1980s brought about a paradigm shift with the development of gas-phase technologies for isocyanate production. This innovation significantly reduced energy consumption and minimized waste generation, addressing both economic and environmental concerns. Concurrently, advancements in process control and automation led to more consistent product quality and reduced operational costs.

In the 1990s and early 2000s, the industry witnessed a surge in research focused on alternative feedstocks and greener production routes. This was driven by the increasing volatility of petroleum prices and growing environmental awareness. Efforts to develop bio-based isocyanates gained traction, although commercial viability remained a challenge.

The past decade has seen a renewed focus on process intensification and modular plant designs. These approaches aim to reduce capital expenditure and improve flexibility in production capacity. Additionally, there has been significant progress in the development of non-phosgene routes for isocyanate synthesis, addressing safety concerns and potentially reducing production costs.

Recent years have also witnessed the integration of digital technologies in isocyanate production. Advanced analytics, machine learning, and artificial intelligence are being employed to optimize process parameters, predict maintenance needs, and enhance overall plant efficiency. This digital transformation is reshaping the economics of isocyanate production, offering new avenues for cost reduction and performance improvement.

Looking ahead, the evolution of isocyanate production is likely to be influenced by circular economy principles. Research is underway to develop efficient recycling technologies for polyurethane products, which could potentially lead to the recovery and reuse of isocyanates. This circular approach could significantly alter the economic landscape of isocyanate production in the coming decades.

As demand grew in the post-World War II era, the focus shifted towards continuous production methods. This transition marked a crucial turning point in the economics of isocyanate production, enabling higher throughput and improved cost-efficiency. The 1960s and 1970s saw the introduction of more sophisticated catalysts and reaction systems, further enhancing yield and selectivity.

The 1980s brought about a paradigm shift with the development of gas-phase technologies for isocyanate production. This innovation significantly reduced energy consumption and minimized waste generation, addressing both economic and environmental concerns. Concurrently, advancements in process control and automation led to more consistent product quality and reduced operational costs.

In the 1990s and early 2000s, the industry witnessed a surge in research focused on alternative feedstocks and greener production routes. This was driven by the increasing volatility of petroleum prices and growing environmental awareness. Efforts to develop bio-based isocyanates gained traction, although commercial viability remained a challenge.

The past decade has seen a renewed focus on process intensification and modular plant designs. These approaches aim to reduce capital expenditure and improve flexibility in production capacity. Additionally, there has been significant progress in the development of non-phosgene routes for isocyanate synthesis, addressing safety concerns and potentially reducing production costs.

Recent years have also witnessed the integration of digital technologies in isocyanate production. Advanced analytics, machine learning, and artificial intelligence are being employed to optimize process parameters, predict maintenance needs, and enhance overall plant efficiency. This digital transformation is reshaping the economics of isocyanate production, offering new avenues for cost reduction and performance improvement.

Looking ahead, the evolution of isocyanate production is likely to be influenced by circular economy principles. Research is underway to develop efficient recycling technologies for polyurethane products, which could potentially lead to the recovery and reuse of isocyanates. This circular approach could significantly alter the economic landscape of isocyanate production in the coming decades.

Market Dynamics

The isocyanate market has experienced significant growth and transformation in recent years, driven by increasing demand across various end-use industries. The global isocyanate market size was valued at approximately $30 billion in 2020 and is projected to grow at a compound annual growth rate (CAGR) of around 6% from 2021 to 2028. This growth is primarily attributed to the rising consumption of polyurethanes in automotive, construction, and furniture industries.

The automotive sector remains a key driver for isocyanate demand, particularly in the production of flexible and rigid foams for vehicle interiors, seating, and insulation. As the automotive industry shifts towards lightweight materials and improved fuel efficiency, the demand for isocyanate-based products is expected to increase further. Additionally, the construction industry's recovery post-pandemic has bolstered the demand for rigid polyurethane foams in insulation applications, contributing to market growth.

Geographically, Asia-Pacific dominates the isocyanate market, accounting for over 40% of global consumption. China, in particular, has emerged as both a major producer and consumer of isocyanates, driven by its robust manufacturing sector and growing domestic demand. North America and Europe follow as significant markets, with steady demand from established industries and increasing focus on energy-efficient building materials.

The market dynamics are also influenced by raw material prices, particularly benzene and natural gas. Fluctuations in these feedstock prices directly impact isocyanate production costs and, consequently, market prices. The volatility in crude oil prices has led to increased interest in bio-based alternatives, although these remain a small segment of the overall market.

Environmental regulations and sustainability concerns are reshaping the isocyanate industry. Stricter emissions standards and growing awareness of the health risks associated with isocyanates have prompted manufacturers to invest in safer production processes and develop low-emission products. This trend is expected to continue, potentially leading to shifts in production technologies and market preferences.

The isocyanate market is characterized by high concentration, with a few major players dominating global production. These key manufacturers are focusing on capacity expansions, technological advancements, and strategic collaborations to maintain their market positions. The industry has also witnessed a trend towards vertical integration, with companies seeking to secure raw material supplies and optimize production costs.

The automotive sector remains a key driver for isocyanate demand, particularly in the production of flexible and rigid foams for vehicle interiors, seating, and insulation. As the automotive industry shifts towards lightweight materials and improved fuel efficiency, the demand for isocyanate-based products is expected to increase further. Additionally, the construction industry's recovery post-pandemic has bolstered the demand for rigid polyurethane foams in insulation applications, contributing to market growth.

Geographically, Asia-Pacific dominates the isocyanate market, accounting for over 40% of global consumption. China, in particular, has emerged as both a major producer and consumer of isocyanates, driven by its robust manufacturing sector and growing domestic demand. North America and Europe follow as significant markets, with steady demand from established industries and increasing focus on energy-efficient building materials.

The market dynamics are also influenced by raw material prices, particularly benzene and natural gas. Fluctuations in these feedstock prices directly impact isocyanate production costs and, consequently, market prices. The volatility in crude oil prices has led to increased interest in bio-based alternatives, although these remain a small segment of the overall market.

Environmental regulations and sustainability concerns are reshaping the isocyanate industry. Stricter emissions standards and growing awareness of the health risks associated with isocyanates have prompted manufacturers to invest in safer production processes and develop low-emission products. This trend is expected to continue, potentially leading to shifts in production technologies and market preferences.

The isocyanate market is characterized by high concentration, with a few major players dominating global production. These key manufacturers are focusing on capacity expansions, technological advancements, and strategic collaborations to maintain their market positions. The industry has also witnessed a trend towards vertical integration, with companies seeking to secure raw material supplies and optimize production costs.

Production Challenges

The production of isocyanates presents several significant challenges that impact both the economic viability and environmental sustainability of the process. One of the primary hurdles is the high energy consumption required for the synthesis of isocyanates. The reaction between amines and phosgene, which is the most common method for producing isocyanates, is highly exothermic and requires careful temperature control. This necessitates sophisticated cooling systems and energy-intensive processes, contributing to increased production costs and environmental concerns.

Raw material availability and cost fluctuations pose another major challenge. Phosgene, a key reactant in isocyanate production, is highly toxic and requires stringent safety measures throughout the supply chain. This not only increases production costs but also raises regulatory compliance issues. Additionally, the volatility in the prices of other raw materials, such as toluene for toluene diisocyanate (TDI) production, can significantly impact the overall economics of isocyanate manufacturing.

The complexity of the production process itself presents technical challenges. Isocyanate synthesis involves multiple reaction steps, each requiring precise control of reaction conditions. Achieving high yields and product purity while minimizing side reactions and waste generation is a constant challenge for manufacturers. This complexity often results in the need for specialized equipment and highly skilled operators, further adding to production costs.

Environmental and safety concerns are paramount in isocyanate production. The use of hazardous materials like phosgene and the potential for isocyanate exposure during production necessitate robust safety protocols and environmental control measures. These include advanced containment systems, air treatment facilities, and extensive worker protection equipment. Compliance with increasingly stringent environmental regulations adds another layer of complexity and cost to the production process.

Waste management and byproduct utilization represent ongoing challenges in isocyanate production. The process generates various byproducts and waste streams that require proper treatment and disposal. Developing efficient recycling methods for solvents and finding value-added applications for byproducts are crucial for improving the overall economics and sustainability of isocyanate production.

Scaling up production while maintaining product quality and process efficiency is a significant challenge, especially as market demand for isocyanates continues to grow. Manufacturers must balance the need for increased capacity with the complexities of maintaining precise reaction conditions and product specifications at larger scales. This often requires substantial capital investments in new or upgraded production facilities.

Raw material availability and cost fluctuations pose another major challenge. Phosgene, a key reactant in isocyanate production, is highly toxic and requires stringent safety measures throughout the supply chain. This not only increases production costs but also raises regulatory compliance issues. Additionally, the volatility in the prices of other raw materials, such as toluene for toluene diisocyanate (TDI) production, can significantly impact the overall economics of isocyanate manufacturing.

The complexity of the production process itself presents technical challenges. Isocyanate synthesis involves multiple reaction steps, each requiring precise control of reaction conditions. Achieving high yields and product purity while minimizing side reactions and waste generation is a constant challenge for manufacturers. This complexity often results in the need for specialized equipment and highly skilled operators, further adding to production costs.

Environmental and safety concerns are paramount in isocyanate production. The use of hazardous materials like phosgene and the potential for isocyanate exposure during production necessitate robust safety protocols and environmental control measures. These include advanced containment systems, air treatment facilities, and extensive worker protection equipment. Compliance with increasingly stringent environmental regulations adds another layer of complexity and cost to the production process.

Waste management and byproduct utilization represent ongoing challenges in isocyanate production. The process generates various byproducts and waste streams that require proper treatment and disposal. Developing efficient recycling methods for solvents and finding value-added applications for byproducts are crucial for improving the overall economics and sustainability of isocyanate production.

Scaling up production while maintaining product quality and process efficiency is a significant challenge, especially as market demand for isocyanates continues to grow. Manufacturers must balance the need for increased capacity with the complexities of maintaining precise reaction conditions and product specifications at larger scales. This often requires substantial capital investments in new or upgraded production facilities.

Current Processes

01 Market analysis and economic forecasting for isocyanates

Economic analysis and forecasting tools are used to assess the isocyanate market, including supply and demand trends, pricing dynamics, and future market projections. These tools help businesses make informed decisions regarding production, investment, and strategic planning in the isocyanate industry.- Market analysis and economic forecasting for isocyanates: Economic analysis and forecasting tools are used to assess the isocyanate market, including supply and demand trends, pricing dynamics, and future market projections. These analyses help businesses make informed decisions regarding production, investment, and strategic planning in the isocyanate industry.

- Production cost optimization for isocyanates: Various methods and systems are employed to optimize the production costs of isocyanates. This includes improving manufacturing processes, reducing energy consumption, and implementing efficient supply chain management strategies to enhance overall economic performance in isocyanate production.

- Isocyanate recycling and waste management: Economic considerations in isocyanate production include recycling and waste management strategies. These approaches aim to reduce environmental impact, improve resource utilization, and potentially create additional revenue streams from by-products or recycled materials.

- Economic impact of isocyanate regulations and policies: The economic landscape of the isocyanate industry is influenced by various regulations and policies. This includes assessing the financial implications of compliance with environmental and safety standards, as well as the potential economic benefits of sustainable practices in isocyanate production and use.

- Isocyanate market segmentation and application economics: Economic analysis of different isocyanate market segments and applications, such as polyurethanes, coatings, and adhesives. This involves evaluating the economic potential of various end-use industries, identifying high-value applications, and assessing the cost-effectiveness of isocyanate-based products in different sectors.

02 Production cost optimization for isocyanates

Various methods and systems are employed to optimize the production costs of isocyanates. This includes improving manufacturing processes, reducing energy consumption, and implementing efficient supply chain management strategies to enhance overall economic performance in isocyanate production.Expand Specific Solutions03 Isocyanate recycling and waste management

Economic considerations in isocyanate production include recycling and waste management strategies. These approaches aim to reduce environmental impact, improve resource utilization, and potentially lower production costs by recovering and reusing isocyanate materials or byproducts.Expand Specific Solutions04 Economic impact of isocyanate regulations and policies

The economic aspects of isocyanate production and use are influenced by various regulations and policies. This includes assessing the financial implications of compliance with safety standards, environmental regulations, and trade policies affecting the isocyanate industry.Expand Specific Solutions05 Value chain analysis in isocyanate industry

Economic studies of the isocyanate industry involve analyzing the entire value chain, from raw material sourcing to end-product manufacturing. This comprehensive approach helps identify opportunities for cost reduction, value addition, and improved economic efficiency throughout the isocyanate production and utilization process.Expand Specific Solutions

Industry Leaders

The isocyanate production market is in a mature stage, characterized by established players and steady growth. The global market size is estimated to be in the billions of dollars, driven by demand from various industries such as automotive, construction, and furniture. Technologically, the production process is well-developed, with major companies like BASF, Covestro, and Wanhua Chemical Group leading in innovation and capacity. These firms, along with others like Mitsui Chemicals and Asahi Kasei, have invested heavily in R&D to improve efficiency and sustainability. The competitive landscape is intense, with companies focusing on product differentiation, cost optimization, and expanding their global footprint to maintain market share in this critical chemical sector.

BASF Corp.

Technical Solution: BASF has developed an innovative process for isocyanate production that focuses on sustainability and cost-effectiveness. Their approach utilizes a novel catalyst system that enables lower reaction temperatures and pressures, reducing energy consumption by up to 30% compared to conventional methods[1]. Additionally, BASF has implemented a closed-loop recycling system for unreacted raw materials, improving overall yield and minimizing waste. The company has also invested in advanced process control systems and real-time monitoring technologies to optimize production parameters, resulting in a 15% increase in production efficiency[3].

Strengths: Reduced energy consumption, improved yield, and enhanced process efficiency. Weaknesses: High initial investment costs for new technology implementation and potential challenges in scaling up the process.

Covestro Deutschland AG

Technical Solution: Covestro has pioneered a gas-phase technology for isocyanate production, which significantly reduces the use of solvents and associated costs. This process, known as gas-phase phosgenation, operates at lower temperatures and pressures, leading to a 40% reduction in energy consumption compared to traditional liquid-phase processes[2]. Covestro has also integrated renewable energy sources into their production facilities, further reducing the carbon footprint of isocyanate manufacturing. The company's approach includes the use of AI and machine learning algorithms to predict and optimize production parameters, resulting in a 20% improvement in overall equipment effectiveness (OEE)[4].

Strengths: Solvent-free process, lower energy consumption, and improved sustainability profile. Weaknesses: Complex technology that may require specialized expertise and equipment.

Key Innovations

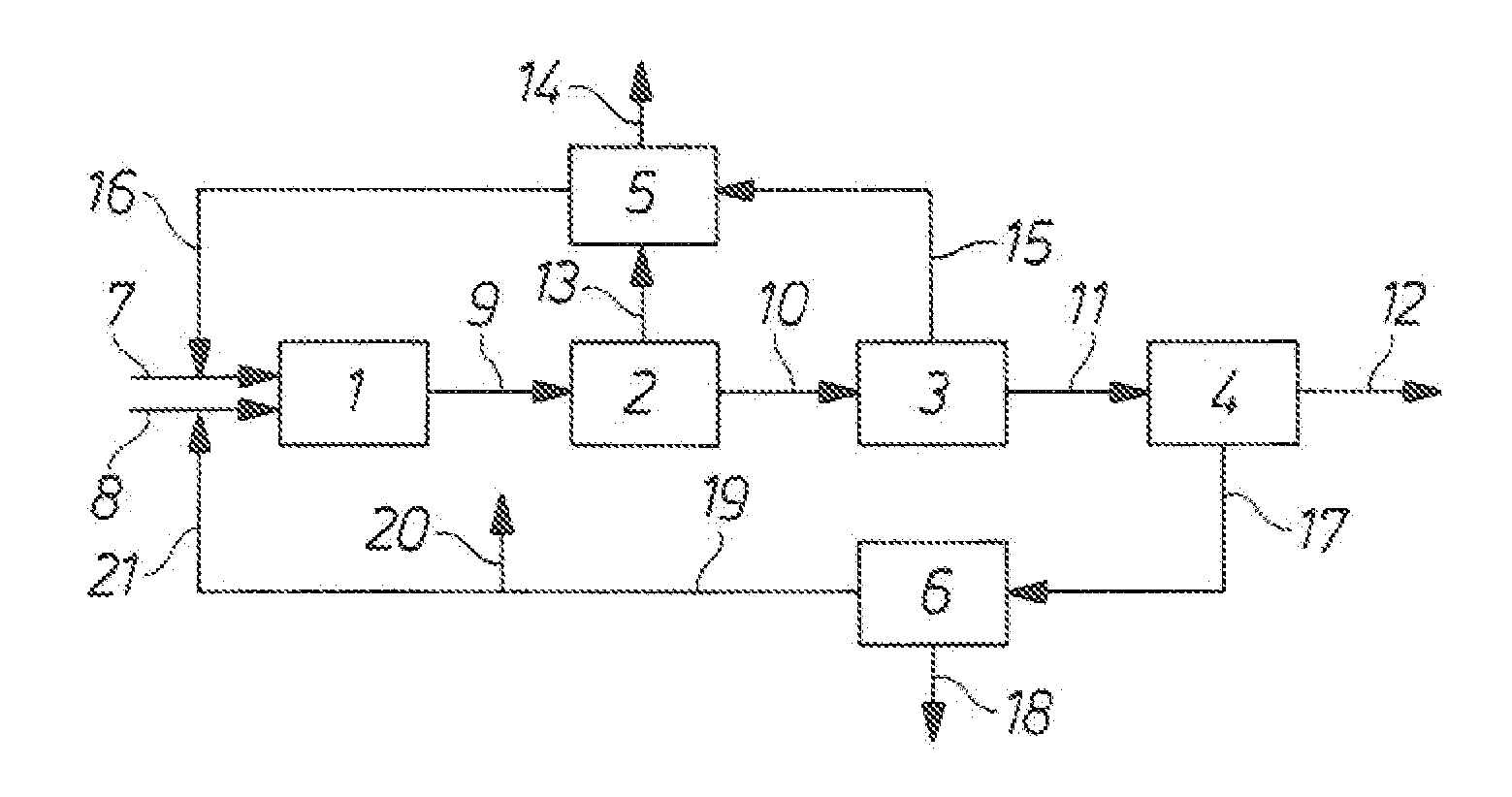

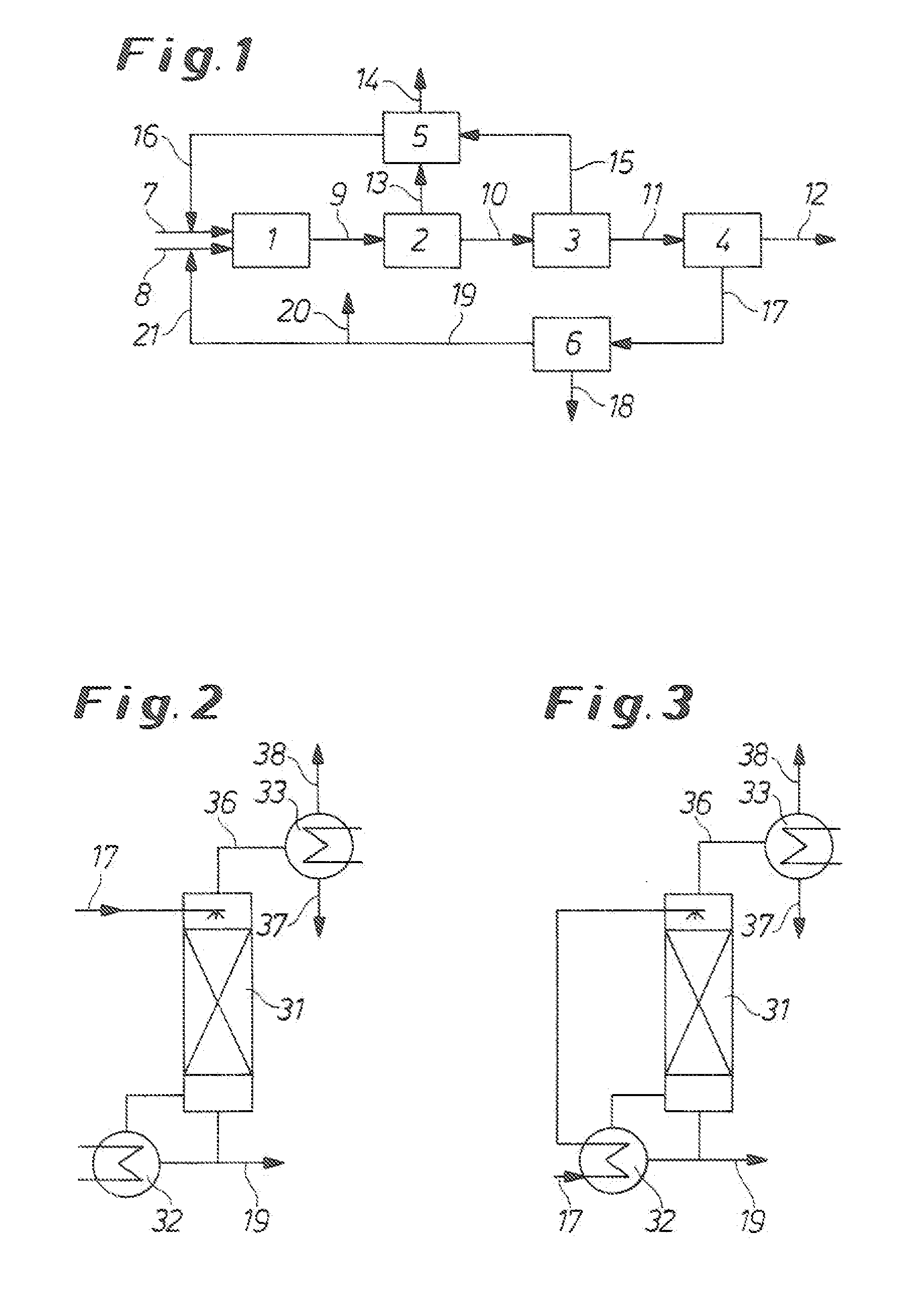

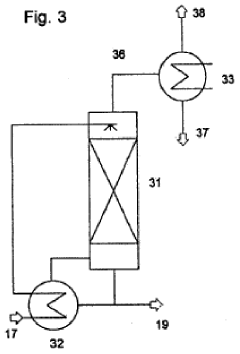

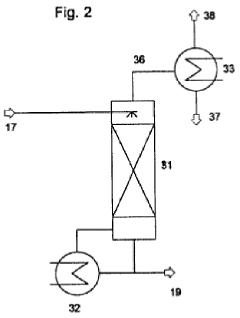

Process for the production of isocyanates

PatentInactiveUS20100298596A1

Innovation

- A process involving the recirculation of solvents with controlled phosgene and diisocyanate contents below 100 ppm, achieved through distillation, to minimize by-product formation and maintain high isocyanate quality by ensuring the solvent purity during the phosgenation process.

A process for the production of isocyanates

PatentInactiveIN908DEL2007A

Innovation

- A process involving solvent recirculation where the solvent purity is maintained below 100 ppm phosgene and 100 ppm diisocyanate, achieved through distillation, to minimize by-product formation and ensure high-quality isocyanate production.

Economic Factors

The economics of isocyanate production are influenced by a complex interplay of factors that significantly impact the industry's profitability and sustainability. Raw material costs play a crucial role in the overall economics of isocyanate production. The primary feedstocks for isocyanates, such as toluene and aniline, are derived from petroleum, making the industry susceptible to fluctuations in oil prices. As a result, producers must carefully manage their supply chains and often engage in long-term contracts to mitigate price volatility.

Energy costs represent another significant economic factor in isocyanate production. The manufacturing process is energy-intensive, requiring substantial amounts of electricity and steam for various unit operations. Producers located in regions with access to low-cost energy sources, such as natural gas or renewable energy, may have a competitive advantage in terms of production costs.

Labor costs and skilled workforce availability also contribute to the economic landscape of isocyanate production. The industry requires specialized personnel for plant operations, maintenance, and research and development. Regions with a well-established chemical industry infrastructure and access to skilled labor pools may offer more favorable economic conditions for isocyanate producers.

Capital investment requirements for isocyanate production facilities are substantial, with high fixed costs associated with plant construction and equipment. This creates significant barriers to entry for new market players and emphasizes the importance of economies of scale. Larger producers can often achieve lower unit costs through more efficient operations and better utilization of resources.

Market demand and pricing dynamics greatly influence the economics of isocyanate production. The industry is closely tied to end-use sectors such as construction, automotive, and furniture manufacturing. Economic cycles in these industries can lead to fluctuations in demand for isocyanates, impacting production volumes and pricing. Additionally, the increasing focus on sustainable and eco-friendly materials may affect future demand patterns and drive innovation in production processes.

Regulatory compliance and environmental considerations also play a significant role in the economics of isocyanate production. Stringent safety and environmental regulations require substantial investments in pollution control equipment, waste management systems, and worker safety measures. These compliance costs can impact the overall profitability of isocyanate production and may vary across different geographical regions.

Energy costs represent another significant economic factor in isocyanate production. The manufacturing process is energy-intensive, requiring substantial amounts of electricity and steam for various unit operations. Producers located in regions with access to low-cost energy sources, such as natural gas or renewable energy, may have a competitive advantage in terms of production costs.

Labor costs and skilled workforce availability also contribute to the economic landscape of isocyanate production. The industry requires specialized personnel for plant operations, maintenance, and research and development. Regions with a well-established chemical industry infrastructure and access to skilled labor pools may offer more favorable economic conditions for isocyanate producers.

Capital investment requirements for isocyanate production facilities are substantial, with high fixed costs associated with plant construction and equipment. This creates significant barriers to entry for new market players and emphasizes the importance of economies of scale. Larger producers can often achieve lower unit costs through more efficient operations and better utilization of resources.

Market demand and pricing dynamics greatly influence the economics of isocyanate production. The industry is closely tied to end-use sectors such as construction, automotive, and furniture manufacturing. Economic cycles in these industries can lead to fluctuations in demand for isocyanates, impacting production volumes and pricing. Additionally, the increasing focus on sustainable and eco-friendly materials may affect future demand patterns and drive innovation in production processes.

Regulatory compliance and environmental considerations also play a significant role in the economics of isocyanate production. Stringent safety and environmental regulations require substantial investments in pollution control equipment, waste management systems, and worker safety measures. These compliance costs can impact the overall profitability of isocyanate production and may vary across different geographical regions.

Environmental Impact

The production of isocyanates, a crucial component in polyurethane manufacturing, has significant environmental implications that warrant careful consideration. The process involves the use of hazardous chemicals and energy-intensive operations, leading to potential environmental risks and challenges.

One of the primary environmental concerns associated with isocyanate production is the emission of volatile organic compounds (VOCs) and other air pollutants. These emissions can contribute to air quality degradation, smog formation, and potential health risks for workers and nearby communities. Stringent air pollution control measures, such as thermal oxidizers and scrubbers, are often required to mitigate these impacts.

Water pollution is another critical environmental issue in isocyanate production. The process generates wastewater containing various contaminants, including unreacted raw materials, byproducts, and solvents. Proper treatment and disposal of this wastewater are essential to prevent contamination of water bodies and groundwater resources.

The energy-intensive nature of isocyanate production contributes to greenhouse gas emissions and climate change concerns. The high temperatures and pressures required in the manufacturing process result in substantial energy consumption, often derived from fossil fuel sources. Efforts to improve energy efficiency and transition to renewable energy sources are crucial for reducing the carbon footprint of isocyanate production.

Hazardous waste management is a significant challenge in the industry. The production process generates various toxic and reactive byproducts that require specialized handling and disposal. Improper management of these wastes can lead to soil contamination and long-term environmental damage.

The transportation and storage of raw materials and finished products also pose environmental risks. Accidental spills or leaks during transport or storage can result in soil and water contamination, as well as potential health hazards for exposed individuals.

In response to these environmental challenges, the isocyanate industry has been implementing various sustainability initiatives. These include the development of cleaner production technologies, improved waste management practices, and the exploration of bio-based alternatives to reduce reliance on fossil fuel-derived raw materials.

Regulatory frameworks play a crucial role in addressing the environmental impact of isocyanate production. Stringent environmental regulations, such as emission limits, waste management standards, and safety protocols, are enforced in many countries to minimize the industry's ecological footprint and protect public health.

One of the primary environmental concerns associated with isocyanate production is the emission of volatile organic compounds (VOCs) and other air pollutants. These emissions can contribute to air quality degradation, smog formation, and potential health risks for workers and nearby communities. Stringent air pollution control measures, such as thermal oxidizers and scrubbers, are often required to mitigate these impacts.

Water pollution is another critical environmental issue in isocyanate production. The process generates wastewater containing various contaminants, including unreacted raw materials, byproducts, and solvents. Proper treatment and disposal of this wastewater are essential to prevent contamination of water bodies and groundwater resources.

The energy-intensive nature of isocyanate production contributes to greenhouse gas emissions and climate change concerns. The high temperatures and pressures required in the manufacturing process result in substantial energy consumption, often derived from fossil fuel sources. Efforts to improve energy efficiency and transition to renewable energy sources are crucial for reducing the carbon footprint of isocyanate production.

Hazardous waste management is a significant challenge in the industry. The production process generates various toxic and reactive byproducts that require specialized handling and disposal. Improper management of these wastes can lead to soil contamination and long-term environmental damage.

The transportation and storage of raw materials and finished products also pose environmental risks. Accidental spills or leaks during transport or storage can result in soil and water contamination, as well as potential health hazards for exposed individuals.

In response to these environmental challenges, the isocyanate industry has been implementing various sustainability initiatives. These include the development of cleaner production technologies, improved waste management practices, and the exploration of bio-based alternatives to reduce reliance on fossil fuel-derived raw materials.

Regulatory frameworks play a crucial role in addressing the environmental impact of isocyanate production. Stringent environmental regulations, such as emission limits, waste management standards, and safety protocols, are enforced in many countries to minimize the industry's ecological footprint and protect public health.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!