Isocyanate Market Size and Growth Projections Explored

JUL 10, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Isocyanate Market Overview

Isocyanates are a group of highly reactive chemicals widely used in the production of polyurethanes, which find applications in various industries such as automotive, construction, furniture, and electronics. The global isocyanate market has been experiencing steady growth over the past decade, driven by increasing demand for polyurethane-based products across multiple sectors.

The market size of isocyanates was valued at approximately USD 38 billion in 2020 and is projected to reach USD 54 billion by 2026, growing at a compound annual growth rate (CAGR) of around 6% during the forecast period. This growth is primarily attributed to the rising demand for polyurethane foams in construction and automotive industries, as well as the increasing use of coatings and adhesives in various applications.

Asia-Pacific region dominates the isocyanate market, accounting for over 40% of the global market share. This is due to the rapid industrialization, urbanization, and economic growth in countries like China and India. North America and Europe follow as the second and third largest markets, respectively, driven by the presence of established automotive and construction industries.

The isocyanate market is segmented based on product type, with methylene diphenyl diisocyanate (MDI) and toluene diisocyanate (TDI) being the two major types. MDI holds the largest market share due to its superior properties and versatility in applications. TDI, on the other hand, is widely used in flexible foam production for furniture and bedding.

Key factors driving the growth of the isocyanate market include the increasing demand for energy-efficient and lightweight materials in the automotive sector, growing construction activities in emerging economies, and the rising popularity of bio-based polyurethanes. However, the market faces challenges such as stringent environmental regulations, health concerns associated with isocyanate exposure, and volatility in raw material prices.

The COVID-19 pandemic has had a significant impact on the isocyanate market, causing disruptions in supply chains and temporary closures of manufacturing facilities. However, the market is expected to recover and resume its growth trajectory as economies reopen and industrial activities normalize.

Looking ahead, technological advancements in production processes, the development of eco-friendly alternatives, and the expansion of application areas are expected to create new opportunities for market growth. The shift towards sustainable and bio-based isocyanates is also likely to shape the future of the industry, as manufacturers strive to meet the growing demand for environmentally friendly products.

The market size of isocyanates was valued at approximately USD 38 billion in 2020 and is projected to reach USD 54 billion by 2026, growing at a compound annual growth rate (CAGR) of around 6% during the forecast period. This growth is primarily attributed to the rising demand for polyurethane foams in construction and automotive industries, as well as the increasing use of coatings and adhesives in various applications.

Asia-Pacific region dominates the isocyanate market, accounting for over 40% of the global market share. This is due to the rapid industrialization, urbanization, and economic growth in countries like China and India. North America and Europe follow as the second and third largest markets, respectively, driven by the presence of established automotive and construction industries.

The isocyanate market is segmented based on product type, with methylene diphenyl diisocyanate (MDI) and toluene diisocyanate (TDI) being the two major types. MDI holds the largest market share due to its superior properties and versatility in applications. TDI, on the other hand, is widely used in flexible foam production for furniture and bedding.

Key factors driving the growth of the isocyanate market include the increasing demand for energy-efficient and lightweight materials in the automotive sector, growing construction activities in emerging economies, and the rising popularity of bio-based polyurethanes. However, the market faces challenges such as stringent environmental regulations, health concerns associated with isocyanate exposure, and volatility in raw material prices.

The COVID-19 pandemic has had a significant impact on the isocyanate market, causing disruptions in supply chains and temporary closures of manufacturing facilities. However, the market is expected to recover and resume its growth trajectory as economies reopen and industrial activities normalize.

Looking ahead, technological advancements in production processes, the development of eco-friendly alternatives, and the expansion of application areas are expected to create new opportunities for market growth. The shift towards sustainable and bio-based isocyanates is also likely to shape the future of the industry, as manufacturers strive to meet the growing demand for environmentally friendly products.

Market Demand Analysis

The isocyanate market has been experiencing significant growth in recent years, driven by increasing demand across various end-use industries. The construction sector, in particular, has been a major contributor to the market's expansion, with isocyanates being widely used in the production of polyurethane foams for insulation and sealants. The automotive industry has also played a crucial role in driving market demand, utilizing isocyanates in the manufacturing of lightweight components and interior materials to improve fuel efficiency and vehicle performance.

The furniture and bedding industry has shown a steady increase in isocyanate consumption, primarily for the production of flexible foams used in mattresses, cushions, and upholstery. This growth is attributed to the rising consumer preference for comfortable and durable furniture products. Additionally, the footwear industry has been adopting isocyanate-based materials for shoe soles and other components, further contributing to market expansion.

In the packaging sector, isocyanates have gained traction due to their excellent barrier properties and durability, making them ideal for use in adhesives and coatings for food packaging and industrial applications. The electronics industry has also emerged as a significant consumer of isocyanates, particularly in the production of protective coatings and encapsulants for electronic components.

The global isocyanate market size was valued at approximately $40 billion in 2020 and is projected to reach $60 billion by 2027, growing at a compound annual growth rate (CAGR) of around 6% during the forecast period. This growth is primarily attributed to the increasing demand for polyurethane products across various industries and the expanding construction and automotive sectors in emerging economies.

Regionally, Asia-Pacific has emerged as the largest and fastest-growing market for isocyanates, driven by rapid industrialization, urbanization, and infrastructure development in countries like China and India. North America and Europe continue to be significant markets, with steady demand from established industries and ongoing technological advancements in isocyanate applications.

However, the market faces challenges related to environmental concerns and stringent regulations regarding the use of certain isocyanates. This has led to increased research and development efforts focused on developing eco-friendly alternatives and improving the sustainability of isocyanate-based products. Despite these challenges, the overall market outlook remains positive, with opportunities for growth in emerging applications and the development of bio-based isocyanates to meet evolving consumer preferences and regulatory requirements.

The furniture and bedding industry has shown a steady increase in isocyanate consumption, primarily for the production of flexible foams used in mattresses, cushions, and upholstery. This growth is attributed to the rising consumer preference for comfortable and durable furniture products. Additionally, the footwear industry has been adopting isocyanate-based materials for shoe soles and other components, further contributing to market expansion.

In the packaging sector, isocyanates have gained traction due to their excellent barrier properties and durability, making them ideal for use in adhesives and coatings for food packaging and industrial applications. The electronics industry has also emerged as a significant consumer of isocyanates, particularly in the production of protective coatings and encapsulants for electronic components.

The global isocyanate market size was valued at approximately $40 billion in 2020 and is projected to reach $60 billion by 2027, growing at a compound annual growth rate (CAGR) of around 6% during the forecast period. This growth is primarily attributed to the increasing demand for polyurethane products across various industries and the expanding construction and automotive sectors in emerging economies.

Regionally, Asia-Pacific has emerged as the largest and fastest-growing market for isocyanates, driven by rapid industrialization, urbanization, and infrastructure development in countries like China and India. North America and Europe continue to be significant markets, with steady demand from established industries and ongoing technological advancements in isocyanate applications.

However, the market faces challenges related to environmental concerns and stringent regulations regarding the use of certain isocyanates. This has led to increased research and development efforts focused on developing eco-friendly alternatives and improving the sustainability of isocyanate-based products. Despite these challenges, the overall market outlook remains positive, with opportunities for growth in emerging applications and the development of bio-based isocyanates to meet evolving consumer preferences and regulatory requirements.

Industry Challenges

The isocyanate market faces several significant challenges that could impact its growth and development. One of the primary concerns is the volatility of raw material prices, particularly for key inputs such as toluene and benzene. These fluctuations can significantly affect production costs and, consequently, profit margins for manufacturers. The industry's heavy reliance on petrochemical feedstocks also makes it vulnerable to oil price fluctuations, adding another layer of uncertainty to cost structures.

Environmental and health concerns pose another major challenge for the isocyanate industry. Isocyanates are known to be potentially harmful to human health, particularly when inhaled or in contact with skin. This has led to increased regulatory scrutiny and stricter safety standards in many regions. Manufacturers must invest heavily in safety measures and equipment to ensure worker protection and environmental compliance, which can drive up operational costs.

The industry also faces challenges related to sustainability and environmental impact. As global awareness of climate change and environmental issues grows, there is increasing pressure on chemical industries to reduce their carbon footprint and develop more sustainable production processes. This necessitates significant investment in research and development to find greener alternatives or improve existing processes, which can be both costly and time-consuming.

Market saturation in certain regions and applications presents another hurdle. As the isocyanate market matures in developed economies, manufacturers are facing intensified competition and potential overcapacity. This situation can lead to price pressures and reduced profit margins, forcing companies to seek new markets or applications to maintain growth.

Technological advancements and the need for continuous innovation also pose challenges. The industry must constantly evolve to meet changing customer demands and stay ahead of competitors. This requires ongoing investment in research and development, as well as the ability to quickly adapt to new technologies and production methods.

Geopolitical tensions and trade disputes can significantly impact the global isocyanate market. Tariffs, trade barriers, and changing international relations can disrupt supply chains, affect raw material availability, and create market uncertainties. Companies must navigate these complex geopolitical landscapes while maintaining their competitive edge.

Lastly, the cyclical nature of end-use industries, such as construction and automotive, presents a challenge for isocyanate manufacturers. Demand fluctuations in these sectors can lead to unpredictable market conditions, requiring companies to carefully manage their production capacities and inventory levels to remain profitable during market downturns.

Environmental and health concerns pose another major challenge for the isocyanate industry. Isocyanates are known to be potentially harmful to human health, particularly when inhaled or in contact with skin. This has led to increased regulatory scrutiny and stricter safety standards in many regions. Manufacturers must invest heavily in safety measures and equipment to ensure worker protection and environmental compliance, which can drive up operational costs.

The industry also faces challenges related to sustainability and environmental impact. As global awareness of climate change and environmental issues grows, there is increasing pressure on chemical industries to reduce their carbon footprint and develop more sustainable production processes. This necessitates significant investment in research and development to find greener alternatives or improve existing processes, which can be both costly and time-consuming.

Market saturation in certain regions and applications presents another hurdle. As the isocyanate market matures in developed economies, manufacturers are facing intensified competition and potential overcapacity. This situation can lead to price pressures and reduced profit margins, forcing companies to seek new markets or applications to maintain growth.

Technological advancements and the need for continuous innovation also pose challenges. The industry must constantly evolve to meet changing customer demands and stay ahead of competitors. This requires ongoing investment in research and development, as well as the ability to quickly adapt to new technologies and production methods.

Geopolitical tensions and trade disputes can significantly impact the global isocyanate market. Tariffs, trade barriers, and changing international relations can disrupt supply chains, affect raw material availability, and create market uncertainties. Companies must navigate these complex geopolitical landscapes while maintaining their competitive edge.

Lastly, the cyclical nature of end-use industries, such as construction and automotive, presents a challenge for isocyanate manufacturers. Demand fluctuations in these sectors can lead to unpredictable market conditions, requiring companies to carefully manage their production capacities and inventory levels to remain profitable during market downturns.

Current Production Methods

01 Market size analysis and forecasting

Various methods and systems are used to analyze and forecast the size of the isocyanate market. These include data collection, statistical analysis, and predictive modeling techniques to estimate market trends, growth rates, and future demand. Such analyses help businesses and investors make informed decisions regarding the isocyanate industry.- Market size analysis and forecasting: Various methods and systems are used to analyze and forecast the size of the isocyanate market. These include data collection, statistical analysis, and predictive modeling techniques to estimate market trends, growth rates, and future demand.

- Supply chain and inventory management: Systems and methods for managing the supply chain and inventory of isocyanates are crucial for market size estimation. These solutions help track production, distribution, and stock levels, providing insights into market dynamics and potential growth areas.

- Pricing and demand forecasting: Advanced algorithms and machine learning techniques are employed to predict pricing trends and demand fluctuations in the isocyanate market. These tools help businesses make informed decisions about production volumes and pricing strategies.

- Market segmentation and analysis: Techniques for segmenting the isocyanate market based on various factors such as application, end-use industry, and geography. This segmentation allows for more accurate market size estimation and identification of growth opportunities in specific sectors.

- Competitive landscape assessment: Methods for analyzing the competitive landscape of the isocyanate market, including competitor profiling, market share analysis, and strategic positioning. These assessments contribute to a comprehensive understanding of market size and potential growth areas.

02 Supply chain and inventory management

Systems and methods for managing the supply chain and inventory of isocyanates are crucial for market size estimation. These solutions help track production, distribution, and stock levels, providing real-time data on market supply and demand. Efficient management of the supply chain contributes to accurate market size assessments and helps identify potential growth opportunities.Expand Specific Solutions03 Market segmentation and customer analysis

Techniques for segmenting the isocyanate market and analyzing customer behavior are essential for understanding market dynamics. These methods involve categorizing customers based on various criteria, such as industry, application, or geographic location, to identify specific market segments and their respective sizes. This information helps in tailoring products and marketing strategies to target different market segments effectively.Expand Specific Solutions04 Competitive intelligence and market positioning

Tools and methodologies for gathering competitive intelligence and assessing market positioning are vital for understanding the isocyanate market size. These approaches involve analyzing competitors, market share, and industry trends to determine a company's position within the market. Such insights help businesses identify growth opportunities and develop strategies to expand their market presence.Expand Specific Solutions05 Technology impact on market growth

Assessing the impact of technological advancements on the isocyanate market size is crucial for accurate forecasting. This includes analyzing new production methods, applications, and emerging technologies that may influence market demand. Understanding the role of technology in shaping the market helps predict future growth trends and potential shifts in market dynamics.Expand Specific Solutions

Key Market Players

The isocyanate market is in a growth phase, driven by increasing demand in various industries such as construction, automotive, and furniture. The global market size is projected to expand significantly, with key players like Wanhua Chemical Group, Covestro, and BASF leading the competition. Technological advancements are focused on improving product efficiency and environmental sustainability. Companies such as Asahi Kasei, Mitsui Chemicals, and Dow are investing in R&D to develop innovative isocyanate formulations. The market is characterized by a mix of established players and emerging companies, with a trend towards strategic partnerships and acquisitions to strengthen market positions and expand product portfolios.

Wanhua Chemical Group Co., Ltd.

Technical Solution: Wanhua Chemical Group Co., Ltd. has developed advanced isocyanate production technologies, focusing on methylene diphenyl diisocyanate (MDI) and toluene diisocyanate (TDI). Their innovative continuous production process has improved efficiency and reduced environmental impact. The company has invested in large-scale production facilities, with an annual capacity of over 2 million tons of MDI[1]. They have also developed proprietary catalysts and reactor designs that enhance product quality and yield. Wanhua's research extends to novel applications of isocyanates in polyurethane foams, coatings, and adhesives, addressing market demands for improved insulation and lightweight materials[2].

Strengths: Large-scale production capacity, proprietary technology, and diverse product portfolio. Weaknesses: Dependence on petrochemical feedstocks and potential environmental concerns associated with isocyanate production.

Asahi Kasei Corp.

Technical Solution: Asahi Kasei Corp. has focused on developing eco-friendly isocyanate technologies, particularly in the production of methylene diphenyl diisocyanate (MDI) and hexamethylene diisocyanate (HDI). Their innovative approach includes the use of bio-based raw materials and energy-efficient processes. Asahi Kasei has developed a proprietary non-phosgene route for MDI production, reducing toxic intermediates and improving safety[3]. The company has also invested in research on isocyanate-free polyurethane technologies, anticipating future market shifts. Their HDI derivatives find applications in high-performance coatings and adhesives, catering to the automotive and electronics industries[4].

Strengths: Eco-friendly production methods, diverse isocyanate portfolio, and strong presence in specialty applications. Weaknesses: Relatively smaller production capacity compared to some competitors and potential challenges in scaling up new technologies.

Innovative Formulations

Measurement of total reactive isocyanate groups in samples using bifunctional nucleophiles such as 1,8-diaminonaphthalene (DAN)

PatentInactiveEP1579207A2

Innovation

- A method using 1,8-diaminonaphthalene (DAN) as a bifunctional nucleophilic isocyanate derivatizing agent that reacts with isocyanates to form a cyclic reaction product, allowing for the detection and quantification of total isocyanate groups regardless of the specific species present, using a two-step process of derivatization and cyclization.

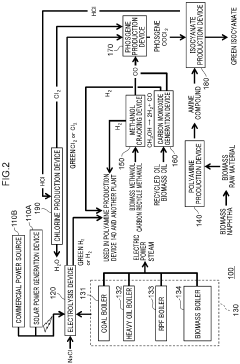

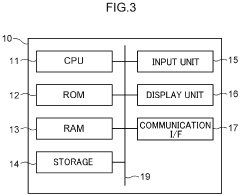

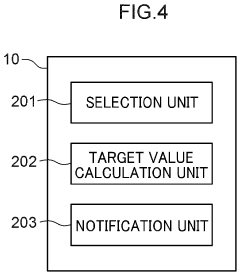

Isocyanate production system, isocyanate composition, polymerizable composition, resin, and molded article

PatentPendingEP4371974A1

Innovation

- An isocyanate production system that utilizes biomass-based energy sources, recycled materials, and carbon monoxide and hydrogen generated from renewable sources to produce phosgene and polyamine compounds, with a control device optimizing energy and material usage to minimize environmental load and carbon dioxide emissions.

Environmental Regulations

Environmental regulations play a crucial role in shaping the isocyanate market, influencing both its size and growth projections. These regulations are primarily aimed at mitigating the potential health and environmental risks associated with isocyanates, which are known for their toxicity and potential to cause respiratory issues.

In recent years, there has been a global trend towards stricter environmental regulations concerning isocyanates. The European Union, for instance, has implemented REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) regulations, which require manufacturers and importers to assess and manage the risks associated with isocyanates. This has led to increased costs for compliance and has driven innovation in safer alternatives.

The United States Environmental Protection Agency (EPA) has also tightened regulations on isocyanates, particularly in the areas of worker safety and emissions control. These regulations have prompted manufacturers to invest in improved production processes and safety measures, which can impact market growth and profitability.

In Asia, particularly in China, environmental regulations have become increasingly stringent. The Chinese government has implemented stricter controls on industrial emissions and waste management, affecting isocyanate production facilities. This regulatory landscape has led to consolidation in the industry, with smaller, non-compliant manufacturers being forced to close or upgrade their facilities.

The automotive industry, a major consumer of isocyanates, has been significantly impacted by environmental regulations. Stricter fuel efficiency standards and emissions regulations have driven demand for lightweight materials, including polyurethanes made from isocyanates. However, regulations on volatile organic compounds (VOCs) have also pushed for the development of low-VOC and water-based alternatives.

Looking ahead, the isocyanate market is expected to face continued regulatory pressure. Emerging regulations on microplastics and circular economy initiatives may further impact the market, potentially driving innovation in biodegradable alternatives or recycling technologies for isocyanate-based products.

These environmental regulations, while posing challenges, also present opportunities for market growth through innovation. Companies investing in green chemistry and sustainable production methods are likely to gain a competitive edge in the evolving regulatory landscape. As a result, the isocyanate market is projected to see a shift towards more environmentally friendly products and processes, potentially reshaping market dynamics and growth trajectories in the coming years.

In recent years, there has been a global trend towards stricter environmental regulations concerning isocyanates. The European Union, for instance, has implemented REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) regulations, which require manufacturers and importers to assess and manage the risks associated with isocyanates. This has led to increased costs for compliance and has driven innovation in safer alternatives.

The United States Environmental Protection Agency (EPA) has also tightened regulations on isocyanates, particularly in the areas of worker safety and emissions control. These regulations have prompted manufacturers to invest in improved production processes and safety measures, which can impact market growth and profitability.

In Asia, particularly in China, environmental regulations have become increasingly stringent. The Chinese government has implemented stricter controls on industrial emissions and waste management, affecting isocyanate production facilities. This regulatory landscape has led to consolidation in the industry, with smaller, non-compliant manufacturers being forced to close or upgrade their facilities.

The automotive industry, a major consumer of isocyanates, has been significantly impacted by environmental regulations. Stricter fuel efficiency standards and emissions regulations have driven demand for lightweight materials, including polyurethanes made from isocyanates. However, regulations on volatile organic compounds (VOCs) have also pushed for the development of low-VOC and water-based alternatives.

Looking ahead, the isocyanate market is expected to face continued regulatory pressure. Emerging regulations on microplastics and circular economy initiatives may further impact the market, potentially driving innovation in biodegradable alternatives or recycling technologies for isocyanate-based products.

These environmental regulations, while posing challenges, also present opportunities for market growth through innovation. Companies investing in green chemistry and sustainable production methods are likely to gain a competitive edge in the evolving regulatory landscape. As a result, the isocyanate market is projected to see a shift towards more environmentally friendly products and processes, potentially reshaping market dynamics and growth trajectories in the coming years.

Application Diversification

The isocyanate market is experiencing significant growth and diversification in its applications across various industries. This expansion is driven by the versatile properties of isocyanates, which make them suitable for a wide range of products and materials. In the construction sector, isocyanates are increasingly used in the production of rigid foam insulation, contributing to energy-efficient building solutions. The automotive industry has also embraced isocyanates for manufacturing lightweight components and durable coatings, aligning with the trend towards fuel-efficient vehicles.

The furniture and bedding industry has seen a surge in the use of flexible polyurethane foams derived from isocyanates, offering improved comfort and durability in mattresses and upholstery. In the electronics sector, isocyanates are finding new applications in the production of protective coatings and encapsulants for sensitive components, enhancing product longevity and performance.

Emerging applications in the medical field are particularly noteworthy. Isocyanates are being utilized in the development of advanced wound dressings, orthopedic supports, and biocompatible materials for implants. This diversification into healthcare products is opening up new growth avenues for the isocyanate market.

The packaging industry is another area of expanding application. Isocyanate-based adhesives and coatings are being employed to create high-performance, environmentally friendly packaging solutions that extend shelf life and improve product protection. In the textile industry, isocyanates are contributing to the development of water-resistant and breathable fabrics, catering to the growing demand for functional clothing and outdoor gear.

The diversification of isocyanate applications is also evident in the aerospace industry, where these compounds are used in the production of lightweight composite materials and high-performance coatings for aircraft components. This trend is likely to continue as the aerospace sector seeks innovative materials to improve fuel efficiency and durability.

As environmental concerns grow, there is an increasing focus on developing bio-based isocyanates and exploring their applications in sustainable products. This shift towards eco-friendly alternatives is expected to open up new market segments and drive further innovation in isocyanate applications across various industries.

The ongoing diversification of isocyanate applications is not only expanding the market size but also fostering technological advancements and cross-industry collaborations. As research and development efforts continue, it is anticipated that novel applications will emerge, further solidifying the role of isocyanates in various industrial and consumer products.

The furniture and bedding industry has seen a surge in the use of flexible polyurethane foams derived from isocyanates, offering improved comfort and durability in mattresses and upholstery. In the electronics sector, isocyanates are finding new applications in the production of protective coatings and encapsulants for sensitive components, enhancing product longevity and performance.

Emerging applications in the medical field are particularly noteworthy. Isocyanates are being utilized in the development of advanced wound dressings, orthopedic supports, and biocompatible materials for implants. This diversification into healthcare products is opening up new growth avenues for the isocyanate market.

The packaging industry is another area of expanding application. Isocyanate-based adhesives and coatings are being employed to create high-performance, environmentally friendly packaging solutions that extend shelf life and improve product protection. In the textile industry, isocyanates are contributing to the development of water-resistant and breathable fabrics, catering to the growing demand for functional clothing and outdoor gear.

The diversification of isocyanate applications is also evident in the aerospace industry, where these compounds are used in the production of lightweight composite materials and high-performance coatings for aircraft components. This trend is likely to continue as the aerospace sector seeks innovative materials to improve fuel efficiency and durability.

As environmental concerns grow, there is an increasing focus on developing bio-based isocyanates and exploring their applications in sustainable products. This shift towards eco-friendly alternatives is expected to open up new market segments and drive further innovation in isocyanate applications across various industries.

The ongoing diversification of isocyanate applications is not only expanding the market size but also fostering technological advancements and cross-industry collaborations. As research and development efforts continue, it is anticipated that novel applications will emerge, further solidifying the role of isocyanates in various industrial and consumer products.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!