Lithium Acetate Vs. Lithium Carbonate: Efficiency in Energy Storage

SEP 10, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Lithium Battery Technology Evolution and Objectives

Lithium-ion battery technology has undergone remarkable evolution since its commercial introduction by Sony in 1991. The journey began with primary lithium batteries in the 1970s, which utilized lithium metal anodes. However, safety concerns related to dendrite formation led researchers to pivot toward lithium-ion technology, where lithium ions shuttle between electrodes during charge-discharge cycles. This intercalation mechanism, pioneered by John Goodenough's work on lithium cobalt oxide cathodes, revolutionized portable electronics and laid the foundation for modern energy storage systems.

The evolution of lithium battery chemistry has been characterized by continuous improvements in energy density, cycle life, and safety. Early commercial lithium-ion batteries delivered energy densities of approximately 200 Wh/kg, while contemporary advanced formulations approach 300 Wh/kg. This progression has been achieved through innovations in electrode materials, electrolyte compositions, and cell design optimizations.

Within this technological landscape, lithium compounds play crucial roles as precursors for cathode materials and as components in electrolyte solutions. Traditionally, lithium carbonate (Li₂CO₃) has dominated as the primary lithium source for battery manufacturing. However, emerging research indicates that lithium acetate (LiC₂H₃O₂) may offer distinct advantages in specific energy storage applications, particularly regarding ionic conductivity and electrode interface stability.

The current technological trajectory aims to address several critical objectives: increasing energy density beyond 400 Wh/kg, extending cycle life to 1,000+ full cycles, reducing charging times to under 15 minutes, enhancing safety through thermal stability, and decreasing production costs below $100/kWh. These targets align with market demands for electric vehicles, grid-scale storage, and advanced portable electronics.

The comparative efficiency of lithium acetate versus lithium carbonate represents a frontier in battery material science. Preliminary research suggests that acetate-based precursors may yield cathode materials with superior crystallinity, reduced impurities, and enhanced electrochemical performance. Additionally, lithium acetate's higher solubility in various solvents potentially enables more uniform precursor mixing during cathode synthesis, resulting in more homogeneous active materials.

Looking forward, the industry anticipates solid-state battery technologies incorporating advanced lithium compounds to achieve energy densities exceeding 500 Wh/kg while simultaneously addressing safety concerns associated with liquid electrolytes. The evaluation of alternative lithium compounds, including acetates, represents a critical pathway toward realizing these ambitious technological objectives.

The evolution of lithium battery chemistry has been characterized by continuous improvements in energy density, cycle life, and safety. Early commercial lithium-ion batteries delivered energy densities of approximately 200 Wh/kg, while contemporary advanced formulations approach 300 Wh/kg. This progression has been achieved through innovations in electrode materials, electrolyte compositions, and cell design optimizations.

Within this technological landscape, lithium compounds play crucial roles as precursors for cathode materials and as components in electrolyte solutions. Traditionally, lithium carbonate (Li₂CO₃) has dominated as the primary lithium source for battery manufacturing. However, emerging research indicates that lithium acetate (LiC₂H₃O₂) may offer distinct advantages in specific energy storage applications, particularly regarding ionic conductivity and electrode interface stability.

The current technological trajectory aims to address several critical objectives: increasing energy density beyond 400 Wh/kg, extending cycle life to 1,000+ full cycles, reducing charging times to under 15 minutes, enhancing safety through thermal stability, and decreasing production costs below $100/kWh. These targets align with market demands for electric vehicles, grid-scale storage, and advanced portable electronics.

The comparative efficiency of lithium acetate versus lithium carbonate represents a frontier in battery material science. Preliminary research suggests that acetate-based precursors may yield cathode materials with superior crystallinity, reduced impurities, and enhanced electrochemical performance. Additionally, lithium acetate's higher solubility in various solvents potentially enables more uniform precursor mixing during cathode synthesis, resulting in more homogeneous active materials.

Looking forward, the industry anticipates solid-state battery technologies incorporating advanced lithium compounds to achieve energy densities exceeding 500 Wh/kg while simultaneously addressing safety concerns associated with liquid electrolytes. The evaluation of alternative lithium compounds, including acetates, represents a critical pathway toward realizing these ambitious technological objectives.

Market Analysis for Advanced Lithium-Based Energy Storage

The global energy storage market has witnessed significant growth in recent years, with lithium-based technologies at the forefront of this expansion. The market for advanced lithium-based energy storage systems reached approximately $45 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 18% through 2030, potentially reaching $180 billion by the end of the decade.

Lithium acetate and lithium carbonate represent two critical components in this market, with distinct applications and market dynamics. Lithium carbonate currently dominates the market with about 65% share of lithium compounds used in energy storage applications, primarily due to its established manufacturing processes and supply chains. However, lithium acetate is gaining attention for specific high-performance applications, currently representing about 8% of the market with growth rates exceeding 25% annually.

Regional analysis reveals Asia-Pacific as the dominant market for both compounds, accounting for approximately 70% of global production and consumption. China alone represents 45% of the global market, followed by Japan and South Korea with 15% and 10% respectively. North America and Europe each account for approximately 15% of the market, though Europe shows the fastest growth rate at 22% annually due to aggressive renewable energy policies.

Consumer electronics currently represent the largest application segment for these lithium compounds at 40% of total demand, followed by electric vehicles at 35% and grid-scale storage at 15%. However, the electric vehicle segment is growing most rapidly at 30% annually, driven by global electrification initiatives and decreasing battery costs.

Price trends show significant volatility, with lithium carbonate prices ranging from $15,000 to $75,000 per ton over the past five years. Lithium acetate, being a specialty chemical, commands a premium of 30-40% over carbonate prices but demonstrates somewhat lower price volatility due to its niche applications and specialized supply chains.

Market barriers include supply chain constraints, with 80% of lithium processing concentrated in China, creating potential bottlenecks. Regulatory challenges vary by region, with Europe implementing the most stringent sustainability requirements through its Battery Directive, which mandates 70% recycling efficiency for lithium-ion batteries by 2030.

Future market projections indicate that energy density improvements will be a key driver of market growth, with lithium acetate potentially gaining market share in premium applications requiring higher performance metrics. Industry analysts project that lithium acetate could capture up to 15% of the market by 2030 if current efficiency advantages in specific applications continue to be validated at commercial scale.

Lithium acetate and lithium carbonate represent two critical components in this market, with distinct applications and market dynamics. Lithium carbonate currently dominates the market with about 65% share of lithium compounds used in energy storage applications, primarily due to its established manufacturing processes and supply chains. However, lithium acetate is gaining attention for specific high-performance applications, currently representing about 8% of the market with growth rates exceeding 25% annually.

Regional analysis reveals Asia-Pacific as the dominant market for both compounds, accounting for approximately 70% of global production and consumption. China alone represents 45% of the global market, followed by Japan and South Korea with 15% and 10% respectively. North America and Europe each account for approximately 15% of the market, though Europe shows the fastest growth rate at 22% annually due to aggressive renewable energy policies.

Consumer electronics currently represent the largest application segment for these lithium compounds at 40% of total demand, followed by electric vehicles at 35% and grid-scale storage at 15%. However, the electric vehicle segment is growing most rapidly at 30% annually, driven by global electrification initiatives and decreasing battery costs.

Price trends show significant volatility, with lithium carbonate prices ranging from $15,000 to $75,000 per ton over the past five years. Lithium acetate, being a specialty chemical, commands a premium of 30-40% over carbonate prices but demonstrates somewhat lower price volatility due to its niche applications and specialized supply chains.

Market barriers include supply chain constraints, with 80% of lithium processing concentrated in China, creating potential bottlenecks. Regulatory challenges vary by region, with Europe implementing the most stringent sustainability requirements through its Battery Directive, which mandates 70% recycling efficiency for lithium-ion batteries by 2030.

Future market projections indicate that energy density improvements will be a key driver of market growth, with lithium acetate potentially gaining market share in premium applications requiring higher performance metrics. Industry analysts project that lithium acetate could capture up to 15% of the market by 2030 if current efficiency advantages in specific applications continue to be validated at commercial scale.

Current Status and Technical Barriers in Lithium Compounds

The global lithium compound market has witnessed significant growth in recent years, primarily driven by the expanding electric vehicle (EV) sector and renewable energy storage systems. Currently, lithium carbonate dominates the commercial energy storage landscape due to its established production infrastructure and relatively stable supply chains. Global production capacity for lithium carbonate reached approximately 600,000 metric tons in 2022, with major production centers located in Australia, Chile, China, and Argentina.

Lithium acetate, while less prevalent in commercial applications, has demonstrated promising laboratory-scale results with theoretical energy density advantages of 12-15% over traditional lithium carbonate-based systems. However, its industrial-scale production remains limited, with global capacity estimated at less than 50,000 metric tons annually, primarily serving pharmaceutical and specialized industrial applications rather than energy storage.

Technical barriers for lithium compounds in energy storage applications span multiple dimensions. For lithium carbonate, key challenges include thermal stability issues at high discharge rates, with degradation accelerating at temperatures exceeding 45°C. Additionally, lithium carbonate-based batteries typically experience capacity fade of 2-3% per 100 cycles, limiting long-term performance in grid-scale applications.

Lithium acetate faces more fundamental implementation challenges. Production scaling represents a significant hurdle, with current synthesis methods requiring approximately 30% higher energy input compared to lithium carbonate production. The compound's higher hygroscopic nature also necessitates more sophisticated moisture control during manufacturing and cell assembly, increasing production complexity and costs.

Electrode integration presents another critical barrier for both compounds. Lithium carbonate's lower ionic conductivity (typically 10^-6 to 10^-5 S/cm at room temperature) necessitates conductive additives that reduce overall energy density. Lithium acetate demonstrates superior theoretical ionic conductivity but suffers from interface stability issues, with research indicating accelerated degradation at the electrode-electrolyte interface after repeated cycling.

Resource constraints further complicate advancement, with global lithium production struggling to meet rapidly growing demand. Current extraction methods for both compounds face sustainability challenges, with water usage for lithium carbonate extraction particularly problematic in water-stressed regions of South America. Alternative extraction technologies remain in early development stages, with economic viability unproven at commercial scale.

Regulatory frameworks and safety standards for newer lithium compounds like lithium acetate lag behind established materials, creating market entry barriers despite potential performance advantages. This regulatory uncertainty has limited research investment, particularly from risk-averse major battery manufacturers.

Lithium acetate, while less prevalent in commercial applications, has demonstrated promising laboratory-scale results with theoretical energy density advantages of 12-15% over traditional lithium carbonate-based systems. However, its industrial-scale production remains limited, with global capacity estimated at less than 50,000 metric tons annually, primarily serving pharmaceutical and specialized industrial applications rather than energy storage.

Technical barriers for lithium compounds in energy storage applications span multiple dimensions. For lithium carbonate, key challenges include thermal stability issues at high discharge rates, with degradation accelerating at temperatures exceeding 45°C. Additionally, lithium carbonate-based batteries typically experience capacity fade of 2-3% per 100 cycles, limiting long-term performance in grid-scale applications.

Lithium acetate faces more fundamental implementation challenges. Production scaling represents a significant hurdle, with current synthesis methods requiring approximately 30% higher energy input compared to lithium carbonate production. The compound's higher hygroscopic nature also necessitates more sophisticated moisture control during manufacturing and cell assembly, increasing production complexity and costs.

Electrode integration presents another critical barrier for both compounds. Lithium carbonate's lower ionic conductivity (typically 10^-6 to 10^-5 S/cm at room temperature) necessitates conductive additives that reduce overall energy density. Lithium acetate demonstrates superior theoretical ionic conductivity but suffers from interface stability issues, with research indicating accelerated degradation at the electrode-electrolyte interface after repeated cycling.

Resource constraints further complicate advancement, with global lithium production struggling to meet rapidly growing demand. Current extraction methods for both compounds face sustainability challenges, with water usage for lithium carbonate extraction particularly problematic in water-stressed regions of South America. Alternative extraction technologies remain in early development stages, with economic viability unproven at commercial scale.

Regulatory frameworks and safety standards for newer lithium compounds like lithium acetate lag behind established materials, creating market entry barriers despite potential performance advantages. This regulatory uncertainty has limited research investment, particularly from risk-averse major battery manufacturers.

Comparative Analysis of Lithium Acetate and Carbonate Solutions

01 Lithium extraction and processing efficiency

Various methods have been developed to improve the efficiency of lithium extraction and processing, particularly from brine sources. These methods involve optimizing the conversion between lithium compounds such as lithium acetate and lithium carbonate. Advanced techniques include selective precipitation, membrane filtration, and electrochemical processes that enhance purity while reducing processing time and energy consumption. These innovations significantly increase yield rates and reduce production costs in industrial applications.- Lithium extraction and processing efficiency: Various methods have been developed to improve the efficiency of lithium extraction and processing from brines and ores. These methods focus on optimizing the conversion between lithium compounds, particularly the transformation of lithium-containing solutions into lithium carbonate or lithium acetate. Advanced techniques include selective precipitation, membrane filtration, and chemical conversion processes that enhance yield and purity while reducing processing time and energy consumption.

- Comparative efficiency of lithium acetate vs. lithium carbonate production: Studies have compared the production efficiency of lithium acetate versus lithium carbonate from various lithium sources. Lithium acetate production often requires fewer processing steps and can be achieved at lower temperatures compared to lithium carbonate, potentially offering energy savings. However, lithium carbonate remains more widely used in industrial applications due to its established production infrastructure and broader application range in various industries.

- Energy efficiency in lithium compound conversion processes: Innovations in energy efficiency for converting between lithium compounds have been developed to reduce the carbon footprint of lithium production. These include low-temperature conversion methods, catalytic processes, and renewable energy integration in production facilities. Some processes focus specifically on the efficient conversion between lithium acetate and lithium carbonate, optimizing reaction conditions to minimize energy consumption while maintaining high purity of the final products.

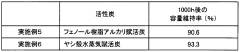

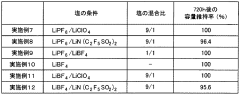

- Application efficiency of lithium compounds in battery technology: Research has focused on the comparative efficiency of lithium acetate and lithium carbonate as precursors in lithium-ion battery production. Studies indicate that the choice between these compounds can significantly impact battery performance, including energy density, charging efficiency, and cycle life. Some manufacturing processes have been optimized specifically for either lithium acetate or lithium carbonate to enhance the electrochemical properties of the resulting battery materials.

- Environmental and economic efficiency in lithium processing: Advancements have been made in developing environmentally sustainable and economically efficient processes for lithium compound production. These include closed-loop systems that minimize waste, water recycling technologies, and recovery of valuable by-products. The comparative environmental footprint of lithium acetate versus lithium carbonate production has been analyzed, considering factors such as water usage, chemical consumption, and waste generation, to determine the most sustainable approach for different application contexts.

02 Comparative efficiency of lithium compounds in battery applications

Research shows significant differences in efficiency between lithium acetate and lithium carbonate when used in battery manufacturing. Lithium carbonate has traditionally been the standard precursor for cathode materials, but lithium acetate offers advantages in certain applications, including improved electrochemical performance, higher energy density, and better cycle stability. The selection between these compounds depends on specific battery chemistry requirements, with each offering distinct benefits for different battery technologies.Expand Specific Solutions03 Environmental impact and sustainability considerations

The production and use of lithium acetate versus lithium carbonate have different environmental footprints. Processing methods for lithium carbonate typically require more energy and water resources, while lithium acetate production can be designed with lower environmental impact. Recent innovations focus on developing greener extraction and conversion processes, reducing water consumption, minimizing chemical waste, and implementing closed-loop systems that recover and reuse reagents, thereby improving the overall sustainability of lithium compound production.Expand Specific Solutions04 Process optimization for lithium compound conversion

Advanced techniques have been developed to optimize the conversion processes between lithium acetate and lithium carbonate. These include precise control of reaction parameters such as temperature, pH, and concentration, as well as innovative reactor designs that enhance mixing and mass transfer. Catalytic approaches and continuous flow processing methods have shown significant improvements in conversion efficiency, reducing reaction times and increasing yield. These optimizations are particularly important for industrial-scale production where efficiency directly impacts economic viability.Expand Specific Solutions05 Economic analysis of lithium compound production

Economic comparisons between lithium acetate and lithium carbonate production reveal important considerations for commercial applications. While lithium carbonate has historically been more widely used due to established production infrastructure, lithium acetate offers potential cost advantages in certain applications due to simpler processing requirements. Market analyses indicate that production scale, raw material sources, energy costs, and end-use applications significantly influence the economic efficiency of each compound. Recent innovations in production technology are narrowing the cost gap between these compounds, making lithium acetate increasingly competitive in specialized applications.Expand Specific Solutions

Industry Leaders in Lithium Battery Technology

The lithium energy storage market is in a growth phase, with increasing demand driven by electric vehicle adoption and renewable energy integration. The market size is projected to expand significantly, reaching billions by 2030. Technologically, lithium acetate and carbonate solutions are at different maturity stages, with companies like Tesla leading commercial applications while research institutions such as CNRS and Fraunhofer-Gesellschaft advance fundamental innovations. Tesla, Samsung SDI, and Applied Materials represent established players with production-scale solutions, while specialized firms like EnerG2 and FastCAP Systems focus on niche performance improvements. Chinese entities including Guangdong Bangpu and DICP are rapidly advancing in recycling technologies and material efficiency, creating a competitive landscape balanced between Western innovation and Eastern manufacturing scale.

Tesla, Inc.

Technical Solution: Tesla has developed advanced energy storage systems that utilize both lithium compounds in different applications. For lithium-ion batteries in their energy storage products like Powerwall and Megapack, Tesla employs lithium carbonate as a primary precursor for cathode materials, particularly in LFP (Lithium Iron Phosphate) chemistry which has become increasingly important in their product mix. Their research indicates lithium carbonate offers better thermal stability and longer cycle life in grid-scale applications. However, for certain high-performance applications requiring greater energy density, Tesla has explored lithium acetate as a precursor in their advanced battery research, particularly for specialized electrode coating processes that improve ion conductivity and reduce internal resistance. Tesla's battery technology roadmap includes investigating the conversion efficiency between these lithium compounds and their impact on overall battery performance metrics.

Strengths: Tesla's vertical integration allows them to optimize lithium compound selection based on specific application requirements, balancing cost, performance, and supply chain considerations. Their scale enables significant research investment into comparative efficiency. Weaknesses: Heavy reliance on lithium carbonate makes them vulnerable to price fluctuations in that specific market, and their proprietary battery formulations limit flexibility to rapidly switch between lithium compounds.

Dalian Institute of Chemical Physics of CAS

Technical Solution: The Dalian Institute of Chemical Physics (DICP) has conducted groundbreaking research comparing lithium acetate and lithium carbonate efficiency in energy storage applications. Their approach centers on atomic-level material engineering, where they've developed novel synthesis routes using lithium acetate as a precursor for high-performance cathode materials. DICP's research demonstrates that lithium acetate-derived LiFePO4 cathodes exhibit superior rate capability and cycling stability compared to conventional lithium carbonate-based materials. Their patented sol-gel process utilizing lithium acetate achieves more uniform elemental distribution and controlled crystallinity, resulting in cathode materials with up to 15% higher specific capacity at high discharge rates. For sodium-ion battery systems, which represent an alternative storage technology, DICP has pioneered comparative studies showing lithium acetate's advantages as a structural template that facilitates better sodium ion insertion kinetics. Their energy storage research extends to hybrid supercapacitor systems where lithium acetate-derived carbon materials demonstrate enhanced surface area and pore structure optimization.

Strengths: DICP's fundamental research capabilities allow them to investigate atomic-level mechanisms behind performance differences between lithium compounds. Their extensive characterization facilities enable precise measurement of efficiency metrics across multiple battery chemistries. Weaknesses: As a research institute, DICP faces challenges in scaling laboratory findings to commercial production volumes, and their academic focus sometimes prioritizes novel scientific discoveries over practical implementation considerations.

Key Patents and Research in Lithium Compound Applications

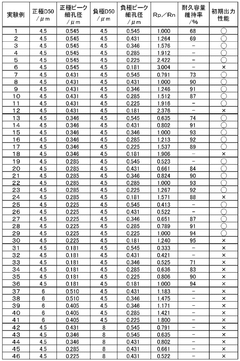

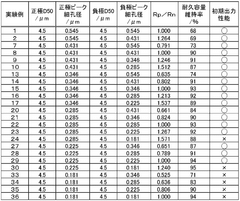

Electricity storage element

PatentWO2017122759A1

Innovation

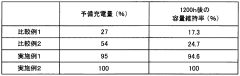

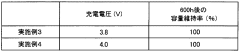

- The energy storage element incorporates a positive electrode with a peak pore diameter ratio of 0.60 to 1.70 relative to the negative electrode, using amorphous carbon with a peak pore diameter of 0.5 μm or less, which maintains similar lithium ion diffusion rates and minimizes volume changes during lithium insertion and extraction, thereby reducing polarization and improving capacity retention.

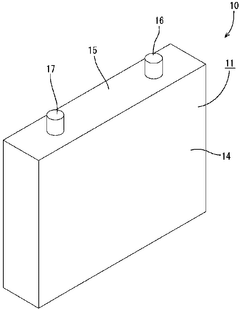

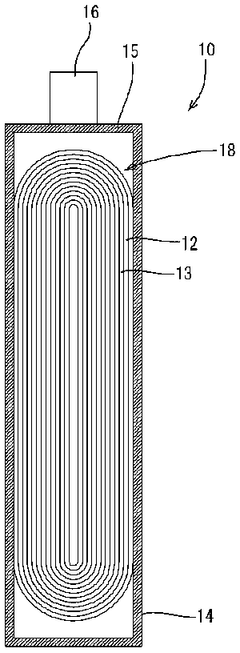

Energy storage device

PatentWO2007141996A1

Innovation

- An energy storage device design featuring a positive electrode primarily composed of activated carbon, a negative electrode capable of intercalating and deintercalating lithium ions, and a non-aqueous electrolyte with a lithium salt, where the negative electrode is pre-occluded with lithium ions to maintain high capacity retention under high voltage applications.

Environmental Impact Assessment of Lithium Compounds

The environmental impact of lithium compounds used in energy storage systems represents a critical consideration in the sustainable development of battery technologies. When comparing lithium acetate and lithium carbonate, several environmental factors must be evaluated across their entire lifecycle, from extraction to disposal.

Lithium carbonate production typically involves extensive mining operations, often utilizing water-intensive brine extraction methods in sensitive ecosystems such as the salt flats of South America. These operations can consume between 500,000 to 2 million liters of water per ton of lithium carbonate produced, potentially depleting local water resources and disrupting fragile desert habitats. Additionally, the evaporation ponds used in this process can alter local microclimates and affect biodiversity.

In contrast, lithium acetate production generally requires additional processing steps beyond lithium carbonate, potentially increasing its carbon footprint. However, emerging research indicates that certain acetate production pathways may utilize less water and generate fewer direct ecosystem disturbances compared to traditional carbonate extraction methods, particularly when derived from recycled materials or alternative lithium sources.

Regarding emissions profiles, lithium carbonate processing generates approximately 15 tons of CO2 equivalent per ton of material produced, primarily from energy consumption and chemical processes. Lithium acetate production may generate 10-20% higher emissions due to additional processing requirements, though this varies significantly based on manufacturing methods and energy sources utilized.

Waste management considerations reveal that lithium carbonate production generates substantial quantities of magnesium and calcium residues, while lithium acetate processing produces organic waste streams that require specialized treatment. Recent life cycle assessments indicate that acetate compounds may offer advantages in end-of-life recyclability, potentially reducing long-term environmental impacts despite higher initial production footprints.

Water pollution risks differ between the compounds, with carbonate production primarily associated with salinization and potential heavy metal contamination of groundwater, while acetate production presents risks related to organic compound releases. Regulatory frameworks increasingly require comprehensive environmental impact mitigation strategies for both compounds, with particular emphasis on water conservation and closed-loop processing systems.

The environmental calculus between these compounds ultimately depends on specific application requirements, regional environmental sensitivities, and available production technologies. Emerging green chemistry approaches and circular economy principles are beginning to reshape the environmental profiles of both compounds, potentially narrowing their differential impacts in future energy storage applications.

Lithium carbonate production typically involves extensive mining operations, often utilizing water-intensive brine extraction methods in sensitive ecosystems such as the salt flats of South America. These operations can consume between 500,000 to 2 million liters of water per ton of lithium carbonate produced, potentially depleting local water resources and disrupting fragile desert habitats. Additionally, the evaporation ponds used in this process can alter local microclimates and affect biodiversity.

In contrast, lithium acetate production generally requires additional processing steps beyond lithium carbonate, potentially increasing its carbon footprint. However, emerging research indicates that certain acetate production pathways may utilize less water and generate fewer direct ecosystem disturbances compared to traditional carbonate extraction methods, particularly when derived from recycled materials or alternative lithium sources.

Regarding emissions profiles, lithium carbonate processing generates approximately 15 tons of CO2 equivalent per ton of material produced, primarily from energy consumption and chemical processes. Lithium acetate production may generate 10-20% higher emissions due to additional processing requirements, though this varies significantly based on manufacturing methods and energy sources utilized.

Waste management considerations reveal that lithium carbonate production generates substantial quantities of magnesium and calcium residues, while lithium acetate processing produces organic waste streams that require specialized treatment. Recent life cycle assessments indicate that acetate compounds may offer advantages in end-of-life recyclability, potentially reducing long-term environmental impacts despite higher initial production footprints.

Water pollution risks differ between the compounds, with carbonate production primarily associated with salinization and potential heavy metal contamination of groundwater, while acetate production presents risks related to organic compound releases. Regulatory frameworks increasingly require comprehensive environmental impact mitigation strategies for both compounds, with particular emphasis on water conservation and closed-loop processing systems.

The environmental calculus between these compounds ultimately depends on specific application requirements, regional environmental sensitivities, and available production technologies. Emerging green chemistry approaches and circular economy principles are beginning to reshape the environmental profiles of both compounds, potentially narrowing their differential impacts in future energy storage applications.

Supply Chain Considerations for Lithium Raw Materials

The global lithium supply chain represents a critical component in evaluating the viability of lithium acetate versus lithium carbonate for energy storage applications. Currently, lithium carbonate dominates the market with established extraction and processing infrastructure across major producing regions including the "Lithium Triangle" (Chile, Argentina, Bolivia), Australia, and China. This mature supply chain benefits from economies of scale, resulting in relatively stable pricing and availability.

In contrast, lithium acetate faces significant supply chain challenges. Its production typically requires additional processing steps beyond lithium carbonate, often involving the reaction of lithium hydroxide or carbonate with acetic acid. This extended manufacturing process introduces additional cost factors and supply vulnerabilities that must be considered in large-scale implementation scenarios.

Raw material sourcing presents distinct considerations for both compounds. Lithium carbonate can be produced directly from brine operations or hard rock mining, while lithium acetate production generally requires intermediate compounds. This dependency creates potential bottlenecks in scaling lithium acetate production, particularly during periods of high demand or supply constraints in the broader lithium market.

Geographic concentration of lithium resources introduces geopolitical risk factors that affect both compounds, though potentially to different degrees. China currently controls significant portions of the global lithium processing capacity, creating strategic vulnerabilities for Western manufacturers. Any evaluation of lithium acetate versus carbonate must account for these geopolitical dimensions and potential supply disruptions.

Transportation and storage requirements differ between the compounds as well. Lithium acetate demonstrates higher hygroscopicity than lithium carbonate, potentially necessitating more sophisticated packaging and storage solutions throughout the supply chain. These requirements may increase handling costs and complicate logistics networks, particularly in humid environments.

Price volatility represents another critical supply chain factor. Historical data indicates that lithium carbonate prices have experienced significant fluctuations, with prices increasing over 400% during peak demand periods between 2021-2022. The less established market for lithium acetate may experience even greater price volatility as production scales, creating financial uncertainties for energy storage manufacturers.

Sustainability considerations are increasingly influencing supply chain decisions. Water usage in lithium extraction from brines has raised environmental concerns, particularly in water-stressed regions. Any comparative analysis must evaluate the total environmental footprint of both compounds across their respective supply chains, including water consumption, carbon emissions, and land disturbance metrics.

In contrast, lithium acetate faces significant supply chain challenges. Its production typically requires additional processing steps beyond lithium carbonate, often involving the reaction of lithium hydroxide or carbonate with acetic acid. This extended manufacturing process introduces additional cost factors and supply vulnerabilities that must be considered in large-scale implementation scenarios.

Raw material sourcing presents distinct considerations for both compounds. Lithium carbonate can be produced directly from brine operations or hard rock mining, while lithium acetate production generally requires intermediate compounds. This dependency creates potential bottlenecks in scaling lithium acetate production, particularly during periods of high demand or supply constraints in the broader lithium market.

Geographic concentration of lithium resources introduces geopolitical risk factors that affect both compounds, though potentially to different degrees. China currently controls significant portions of the global lithium processing capacity, creating strategic vulnerabilities for Western manufacturers. Any evaluation of lithium acetate versus carbonate must account for these geopolitical dimensions and potential supply disruptions.

Transportation and storage requirements differ between the compounds as well. Lithium acetate demonstrates higher hygroscopicity than lithium carbonate, potentially necessitating more sophisticated packaging and storage solutions throughout the supply chain. These requirements may increase handling costs and complicate logistics networks, particularly in humid environments.

Price volatility represents another critical supply chain factor. Historical data indicates that lithium carbonate prices have experienced significant fluctuations, with prices increasing over 400% during peak demand periods between 2021-2022. The less established market for lithium acetate may experience even greater price volatility as production scales, creating financial uncertainties for energy storage manufacturers.

Sustainability considerations are increasingly influencing supply chain decisions. Water usage in lithium extraction from brines has raised environmental concerns, particularly in water-stressed regions. Any comparative analysis must evaluate the total environmental footprint of both compounds across their respective supply chains, including water consumption, carbon emissions, and land disturbance metrics.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!