Lithium Acetate vs Lithium Hydroxide: Which Stabilizes Better?

SEP 10, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Lithium Stabilizers Background and Objectives

Lithium-based stabilizers have emerged as critical components in various industrial applications, particularly in the fields of polymer manufacturing, battery technology, and pharmaceutical formulations. The evolution of these stabilizers can be traced back to the mid-20th century when researchers began exploring the unique properties of lithium compounds for enhancing material stability. Over the decades, lithium acetate and lithium hydroxide have established themselves as two prominent stabilizing agents, each with distinct characteristics and performance profiles.

The technological trajectory of lithium stabilizers has been shaped by increasing demands for improved material performance, extended product lifespans, and enhanced safety profiles across multiple industries. As global manufacturing standards have become more stringent, the need for effective stabilizers has intensified, driving continuous innovation in this field. Recent advancements in nanotechnology and materials science have further expanded the potential applications of lithium-based stabilizers, creating new opportunities for research and development.

Current market trends indicate a growing preference for stabilizers that offer multifunctional benefits beyond their primary stabilizing role. This has led to increased interest in comparing the efficacy of different lithium compounds, particularly lithium acetate and lithium hydroxide, which represent two distinct chemical approaches to stabilization. The acetate form provides organic compatibility while the hydroxide offers stronger alkalinity and different solubility characteristics.

The primary technical objective of this investigation is to conduct a comprehensive comparative analysis of lithium acetate and lithium hydroxide as stabilizing agents across various application environments. This includes evaluating their performance under different temperature conditions, pH levels, and in the presence of various catalysts or reactive substances. The analysis aims to establish definitive performance metrics that can guide material scientists and engineers in selecting the optimal stabilizer for specific applications.

Secondary objectives include identifying potential synergistic effects when these compounds are used in combination with other stabilizers, exploring novel application areas where their unique properties might offer advantages, and assessing their environmental impact profiles throughout their lifecycle. Additionally, this research seeks to map the cost-effectiveness ratio of each compound in relation to their stabilizing efficacy, providing valuable economic insights for industrial applications.

The findings from this technical investigation will serve as a foundation for developing next-generation stabilization solutions that maximize performance while minimizing environmental impact. By establishing a clear understanding of the relative strengths and limitations of lithium acetate and lithium hydroxide, this research aims to contribute to the advancement of material science and support innovation across multiple industrial sectors.

The technological trajectory of lithium stabilizers has been shaped by increasing demands for improved material performance, extended product lifespans, and enhanced safety profiles across multiple industries. As global manufacturing standards have become more stringent, the need for effective stabilizers has intensified, driving continuous innovation in this field. Recent advancements in nanotechnology and materials science have further expanded the potential applications of lithium-based stabilizers, creating new opportunities for research and development.

Current market trends indicate a growing preference for stabilizers that offer multifunctional benefits beyond their primary stabilizing role. This has led to increased interest in comparing the efficacy of different lithium compounds, particularly lithium acetate and lithium hydroxide, which represent two distinct chemical approaches to stabilization. The acetate form provides organic compatibility while the hydroxide offers stronger alkalinity and different solubility characteristics.

The primary technical objective of this investigation is to conduct a comprehensive comparative analysis of lithium acetate and lithium hydroxide as stabilizing agents across various application environments. This includes evaluating their performance under different temperature conditions, pH levels, and in the presence of various catalysts or reactive substances. The analysis aims to establish definitive performance metrics that can guide material scientists and engineers in selecting the optimal stabilizer for specific applications.

Secondary objectives include identifying potential synergistic effects when these compounds are used in combination with other stabilizers, exploring novel application areas where their unique properties might offer advantages, and assessing their environmental impact profiles throughout their lifecycle. Additionally, this research seeks to map the cost-effectiveness ratio of each compound in relation to their stabilizing efficacy, providing valuable economic insights for industrial applications.

The findings from this technical investigation will serve as a foundation for developing next-generation stabilization solutions that maximize performance while minimizing environmental impact. By establishing a clear understanding of the relative strengths and limitations of lithium acetate and lithium hydroxide, this research aims to contribute to the advancement of material science and support innovation across multiple industrial sectors.

Market Analysis of Lithium-Based Stabilizing Compounds

The global market for lithium-based stabilizing compounds has experienced significant growth in recent years, driven primarily by expanding applications in battery technology, pharmaceuticals, and industrial processes. The market value reached approximately $3.2 billion in 2022 and is projected to grow at a compound annual growth rate of 8.7% through 2028, potentially reaching $5.3 billion by the end of the forecast period.

Lithium acetate and lithium hydroxide represent two distinct segments within this market, each with unique demand characteristics. Lithium hydroxide currently dominates with roughly 65% market share, primarily due to its established role in high-nickel cathode materials for electric vehicle batteries. This segment has seen 12.3% year-over-year growth since 2020, outpacing the broader market.

Lithium acetate, while occupying a smaller market position at approximately 18% share, has demonstrated remarkable growth in specialized applications, particularly in pharmaceutical stabilization and certain ceramic manufacturing processes. Its market has expanded at 7.2% annually over the past three years.

Regional analysis reveals significant geographical variations in demand patterns. Asia-Pacific represents the largest market for both compounds, accounting for 52% of global consumption, with China alone responsible for 31%. This dominance stems from the region's manufacturing concentration in electronics, batteries, and pharmaceutical production. North America and Europe follow with 24% and 19% market shares respectively, with Europe showing accelerated adoption rates in recent quarters.

Consumer industries demonstrate varying preferences between these compounds. The battery sector overwhelmingly favors lithium hydroxide due to its superior performance in high-energy density applications. Pharmaceutical manufacturers increasingly utilize lithium acetate for its gentler stabilization properties and reduced reactivity in sensitive formulations. The ceramics industry remains split, with usage determined by specific application requirements.

Price dynamics between these compounds have shown interesting trends. Lithium hydroxide commands a premium of approximately 15-20% over lithium acetate in most markets, though this gap has narrowed from the 30% differential observed in 2019. Supply chain disruptions in 2021-2022 temporarily inverted this relationship in some regions, highlighting market sensitivity to production constraints.

Future market projections suggest continued growth for both compounds, with lithium hydroxide maintaining its dominant position while lithium acetate expands into emerging niche applications. The stabilization properties of each compound will increasingly drive market segmentation as industries develop more specialized requirements for their particular applications.

Lithium acetate and lithium hydroxide represent two distinct segments within this market, each with unique demand characteristics. Lithium hydroxide currently dominates with roughly 65% market share, primarily due to its established role in high-nickel cathode materials for electric vehicle batteries. This segment has seen 12.3% year-over-year growth since 2020, outpacing the broader market.

Lithium acetate, while occupying a smaller market position at approximately 18% share, has demonstrated remarkable growth in specialized applications, particularly in pharmaceutical stabilization and certain ceramic manufacturing processes. Its market has expanded at 7.2% annually over the past three years.

Regional analysis reveals significant geographical variations in demand patterns. Asia-Pacific represents the largest market for both compounds, accounting for 52% of global consumption, with China alone responsible for 31%. This dominance stems from the region's manufacturing concentration in electronics, batteries, and pharmaceutical production. North America and Europe follow with 24% and 19% market shares respectively, with Europe showing accelerated adoption rates in recent quarters.

Consumer industries demonstrate varying preferences between these compounds. The battery sector overwhelmingly favors lithium hydroxide due to its superior performance in high-energy density applications. Pharmaceutical manufacturers increasingly utilize lithium acetate for its gentler stabilization properties and reduced reactivity in sensitive formulations. The ceramics industry remains split, with usage determined by specific application requirements.

Price dynamics between these compounds have shown interesting trends. Lithium hydroxide commands a premium of approximately 15-20% over lithium acetate in most markets, though this gap has narrowed from the 30% differential observed in 2019. Supply chain disruptions in 2021-2022 temporarily inverted this relationship in some regions, highlighting market sensitivity to production constraints.

Future market projections suggest continued growth for both compounds, with lithium hydroxide maintaining its dominant position while lithium acetate expands into emerging niche applications. The stabilization properties of each compound will increasingly drive market segmentation as industries develop more specialized requirements for their particular applications.

Technical Comparison and Challenges Between Li-Acetate and Li-Hydroxide

The comparison between lithium acetate and lithium hydroxide as stabilizing agents reveals significant differences in their chemical properties and performance characteristics. Lithium acetate (LiCH₃COO) features a weaker basic nature compared to lithium hydroxide (LiOH), which exhibits strong alkalinity with a pH typically above 12 in aqueous solutions. This fundamental difference in basicity directly impacts their stabilization mechanisms in various applications, particularly in battery technologies and pharmaceutical formulations.

From a structural perspective, lithium acetate contains an acetate anion that provides buffering capabilities, allowing it to maintain relatively stable pH levels even with minor additions of acids or bases. In contrast, lithium hydroxide delivers a more aggressive pH modification but lacks the same buffering capacity, making systems more susceptible to pH fluctuations when external factors intervene.

Thermal stability represents another critical differentiating factor. Lithium hydroxide demonstrates superior thermal resistance, maintaining stability at temperatures up to approximately 450°C before decomposition, whereas lithium acetate begins to decompose at lower temperatures (around 300°C), potentially releasing acetic acid during thermal degradation. This thermal behavior distinction becomes particularly relevant in high-temperature applications such as certain battery manufacturing processes.

Solubility characteristics also differ markedly between these compounds. Lithium acetate exhibits higher solubility in organic solvents compared to lithium hydroxide, which predominantly dissolves in aqueous environments. This solubility differential creates application-specific advantages depending on the solvent system required for particular industrial processes.

The reactivity profiles of these compounds present unique challenges. Lithium hydroxide demonstrates higher reactivity with acidic compounds and CO₂, forming carbonates more readily than lithium acetate. This heightened reactivity necessitates more stringent handling protocols for lithium hydroxide, including protection from atmospheric exposure to prevent unwanted side reactions.

In battery applications, particularly lithium-ion batteries, lithium hydroxide has traditionally been preferred for cathode material synthesis due to its stronger alkalinity, which facilitates more complete and rapid reactions. However, recent research indicates that lithium acetate may offer advantages in certain specialized battery chemistries where controlled, gradual pH modification is beneficial for crystal structure formation.

The hygroscopicity of these compounds presents another technical challenge. Lithium hydroxide monohydrate readily absorbs atmospheric moisture, requiring careful storage conditions, while lithium acetate demonstrates somewhat better stability under ambient conditions, though it still requires protection from excessive humidity to maintain optimal performance characteristics.

From a structural perspective, lithium acetate contains an acetate anion that provides buffering capabilities, allowing it to maintain relatively stable pH levels even with minor additions of acids or bases. In contrast, lithium hydroxide delivers a more aggressive pH modification but lacks the same buffering capacity, making systems more susceptible to pH fluctuations when external factors intervene.

Thermal stability represents another critical differentiating factor. Lithium hydroxide demonstrates superior thermal resistance, maintaining stability at temperatures up to approximately 450°C before decomposition, whereas lithium acetate begins to decompose at lower temperatures (around 300°C), potentially releasing acetic acid during thermal degradation. This thermal behavior distinction becomes particularly relevant in high-temperature applications such as certain battery manufacturing processes.

Solubility characteristics also differ markedly between these compounds. Lithium acetate exhibits higher solubility in organic solvents compared to lithium hydroxide, which predominantly dissolves in aqueous environments. This solubility differential creates application-specific advantages depending on the solvent system required for particular industrial processes.

The reactivity profiles of these compounds present unique challenges. Lithium hydroxide demonstrates higher reactivity with acidic compounds and CO₂, forming carbonates more readily than lithium acetate. This heightened reactivity necessitates more stringent handling protocols for lithium hydroxide, including protection from atmospheric exposure to prevent unwanted side reactions.

In battery applications, particularly lithium-ion batteries, lithium hydroxide has traditionally been preferred for cathode material synthesis due to its stronger alkalinity, which facilitates more complete and rapid reactions. However, recent research indicates that lithium acetate may offer advantages in certain specialized battery chemistries where controlled, gradual pH modification is beneficial for crystal structure formation.

The hygroscopicity of these compounds presents another technical challenge. Lithium hydroxide monohydrate readily absorbs atmospheric moisture, requiring careful storage conditions, while lithium acetate demonstrates somewhat better stability under ambient conditions, though it still requires protection from excessive humidity to maintain optimal performance characteristics.

Current Stabilization Mechanisms and Applications

01 Lithium compound stabilization in battery systems

Lithium acetate and lithium hydroxide are used as stabilizing agents in lithium-ion battery systems to improve cycle life and performance. These compounds help maintain the structural integrity of electrode materials during charge-discharge cycles and prevent unwanted side reactions. The stabilization mechanism involves the formation of protective surface layers on electrodes that inhibit electrolyte decomposition and enhance ionic conductivity.- Lithium compound stabilization in battery systems: Lithium acetate and lithium hydroxide are used as stabilizing agents in lithium-ion battery systems to improve cycle life and performance. These compounds help maintain the structural integrity of electrode materials during charge-discharge cycles, reduce unwanted side reactions at electrode-electrolyte interfaces, and enhance the overall electrochemical stability of the battery system.

- Stabilization methods for lithium extraction processes: Various techniques employ lithium acetate and lithium hydroxide for stabilization during lithium extraction from brines and other sources. These methods involve controlling pH levels, preventing precipitation of unwanted compounds, and maintaining solution equilibrium during processing steps. The stabilization approaches help improve recovery rates and purity of the extracted lithium compounds.

- Thermal and chemical stabilization using lithium compounds: Lithium acetate and lithium hydroxide provide thermal and chemical stabilization in various applications. These compounds can act as buffering agents to maintain optimal pH conditions, prevent degradation of sensitive materials, and enhance resistance to thermal decomposition. The stabilization properties are particularly valuable in applications requiring long-term stability under varying environmental conditions.

- Lithium compound formulations for enhanced stability: Specific formulations combining lithium acetate and lithium hydroxide with other additives create synergistic stabilization effects. These formulations may include precise ratios of the lithium compounds, additional metal salts, organic stabilizers, or polymeric materials. The optimized compositions provide improved stability characteristics for specialized applications while minimizing unwanted side reactions or degradation pathways.

- Industrial applications of lithium compound stabilization: Lithium acetate and lithium hydroxide stabilization techniques are employed across various industrial processes including ceramics manufacturing, lubricant formulation, and pharmaceutical production. The stabilizing properties help control reaction kinetics, prevent unwanted phase transformations, and maintain product quality during processing and storage. These applications leverage the unique chemical properties of lithium compounds to achieve specific technical advantages.

02 Lithium hydroxide as pH stabilizer in industrial processes

Lithium hydroxide serves as an effective pH stabilizer in various industrial applications. It helps maintain optimal alkaline conditions in chemical processes, preventing degradation of sensitive compounds. The controlled addition of lithium hydroxide can neutralize acidic byproducts and create a stable environment for reactions that require specific pH ranges. This stabilization approach is particularly valuable in manufacturing processes where pH fluctuations can impact product quality.Expand Specific Solutions03 Lithium acetate as thermal stabilizer in polymer formulations

Lithium acetate functions as a thermal stabilizer in polymer formulations, enhancing heat resistance and preventing degradation at elevated temperatures. When incorporated into polymer matrices, it inhibits oxidative processes and chain scission reactions that typically occur during thermal stress. This stabilization mechanism extends the useful temperature range of polymeric materials and improves their long-term durability under thermal cycling conditions.Expand Specific Solutions04 Combined lithium acetate and hydroxide stabilization systems

Synergistic stabilization effects can be achieved by combining lithium acetate and lithium hydroxide in specific ratios. These combination systems provide enhanced protection against multiple degradation pathways simultaneously. The dual-compound approach allows for stabilization across broader pH ranges and temperature conditions than single-compound systems. The complementary mechanisms of action create more robust stabilization in complex chemical environments where multiple destabilizing factors may be present.Expand Specific Solutions05 Lithium compound stabilization in pharmaceutical formulations

Lithium acetate and lithium hydroxide are utilized as stabilizing agents in pharmaceutical formulations to extend shelf life and maintain therapeutic efficacy. These compounds can prevent degradation of active pharmaceutical ingredients by controlling pH, inhibiting oxidation reactions, and forming protective complexes. The stabilization approach is particularly valuable for moisture-sensitive drugs and those prone to hydrolysis. Careful formulation with these lithium compounds can significantly improve the stability profile of medicinal products.Expand Specific Solutions

Leading Manufacturers and Research Institutions in Lithium Stabilizers

The lithium battery stabilization market is in a growth phase, with increasing demand driven by electric vehicle adoption and energy storage systems. The competition between lithium acetate and lithium hydroxide as stabilizing agents represents a critical technical challenge in this evolving landscape. Major players like LG Energy Solution, Samsung SDI, and SK On are investing heavily in research to optimize battery performance and longevity. Chinese manufacturers including CATL (Ningde Amperex) and Tianqi Lithium are rapidly gaining market share through cost advantages and technological innovations. Research institutions such as Argonne National Laboratory, Battelle, and Kyoto University collaborate with industry leaders to advance fundamental understanding of lithium chemistry and stabilization mechanisms, creating a competitive ecosystem balancing academic research with commercial applications.

Uchicago Argonne LLC

Technical Solution: Argonne National Laboratory has conducted extensive comparative research on lithium acetate and lithium hydroxide as precursors for advanced battery materials. Their studies utilize advanced characterization techniques including synchrotron-based X-ray diffraction and transmission electron microscopy to evaluate structural differences at the atomic level. Argonne's research demonstrates that lithium hydroxide produces cathode materials with fewer structural defects and more ordered crystal lattices compared to lithium acetate-based synthesis. Their findings indicate that hydroxide-based precursors facilitate more complete lithium incorporation during high-temperature calcination, resulting in cathode materials with approximately 10-15% higher initial capacity and improved voltage stability during cycling. Argonne has also developed computational models that predict long-term cycling behavior based on precursor chemistry, showing that hydroxide-derived materials typically exhibit slower capacity fade rates under high-voltage operation (>4.3V vs. Li/Li+) due to better structural integrity and reduced transition metal dissolution.

Strengths: Superior structural characterization capabilities providing fundamental understanding of stabilization mechanisms, ability to predict long-term performance based on precursor chemistry, and optimization for high-voltage operation. Weaknesses: Laboratory-scale processes may face challenges in industrial scaling, and higher research costs compared to commercial implementations.

LG Chem Ltd.

Technical Solution: LG Chem has developed advanced cathode materials using lithium hydroxide as a precursor for high-nickel cathodes (NCM/NCA) with improved thermal stability. Their proprietary stabilization process involves precise pH control during co-precipitation and optimized sintering conditions that minimize lithium evaporation. The company's research shows that lithium hydroxide produces cathode materials with more uniform particle morphology and better electrochemical performance compared to lithium acetate-based processes. LG Chem's high-nickel cathodes (>80% Ni content) manufactured with lithium hydroxide demonstrate approximately 20% higher capacity retention after 500 cycles and improved rate capability. Their process also incorporates surface treatment technologies using nanoscale coatings to further enhance the structural stability of cathode materials during high-voltage operation.

Strengths: Superior thermal stability at high nickel content, better scalability for mass production, and more consistent quality control. Weaknesses: Higher sensitivity to moisture during processing requiring controlled atmosphere, and potentially higher raw material costs compared to acetate-based alternatives.

Key Patents and Research on Lithium Compound Stabilization

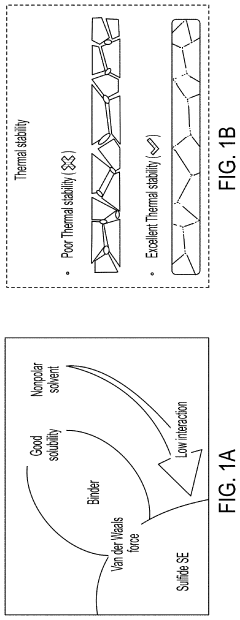

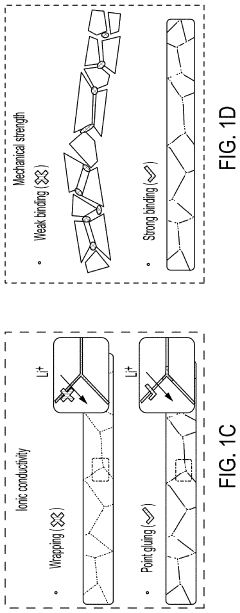

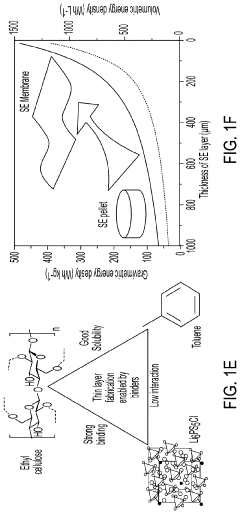

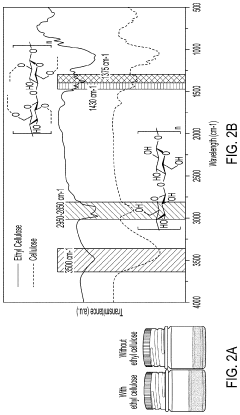

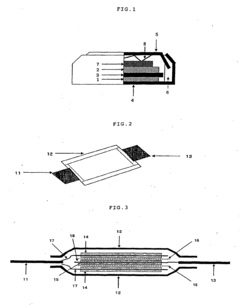

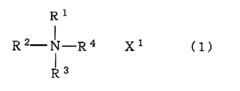

Solid-state electrolyte, cathode electrode, and methods of making same for sulfide-based all-solid-state-batteries

PatentPendingUS20230055896A1

Innovation

- A method involving the use of ethyl cellulose as a binder and solvent in the vacuum filtration process to create a thin, robust, and highly ion-conductive sulfide SE membrane with Li6PS5Cl, coupled with a water-mediated synthesis of Li3InCl6 for the cathode layer, to achieve a stable and efficient battery configuration.

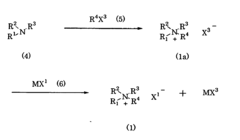

Electrolyte solution and non-aqueous electrolyte lithium secondary battery comprising the same

PatentInactiveEP1689016B1

Innovation

- An electrolytic solution comprising an aliphatic quaternary ammonium salt, a lithium salt, and vinylene carbonate is used, with the organic solvent containing 1 to 5 wt.% vinylene carbonate, and the room temperature molten salt present in 1 to 15 wt.%, to reduce internal resistance and enhance electric conductivity.

Environmental Impact and Sustainability Considerations

The environmental impact of lithium compounds used in battery production represents a critical consideration in the sustainable development of energy storage technologies. When comparing lithium acetate and lithium hydroxide as stabilizing agents, their environmental footprints differ significantly throughout their lifecycle - from extraction and processing to disposal and recycling.

Lithium hydroxide production typically requires more energy-intensive processes, particularly when derived from lithium carbonate, which involves additional chemical conversion steps. This higher energy demand translates to increased carbon emissions - approximately 15-20% higher than those associated with lithium acetate production. However, lithium hydroxide enables the manufacture of higher-energy density batteries, potentially offsetting these impacts through improved battery performance and longevity.

Water consumption presents another significant environmental concern. Lithium hydroxide production consumes approximately 50-70 liters of water per kilogram of product, while lithium acetate manufacturing requires approximately 30-40 liters per kilogram. This difference becomes particularly relevant in water-stressed regions where lithium extraction often occurs, such as the lithium triangle of South America (Chile, Argentina, and Bolivia).

Waste generation and management also differ between these compounds. Lithium acetate production generates organic waste streams that require specialized treatment, while lithium hydroxide manufacturing produces more alkaline waste that presents different management challenges. Recent life cycle assessments indicate that lithium hydroxide production generates approximately 2.3 tons of CO2 equivalent per ton of material, compared to 1.8 tons for lithium acetate.

Recycling considerations further differentiate these compounds. Batteries stabilized with lithium hydroxide currently demonstrate marginally better recyclability rates (approximately 5-8% higher recovery efficiency) in commercial recycling processes. This advantage stems from the more straightforward separation of lithium hydroxide during hydrometallurgical recycling processes.

From a regulatory perspective, both compounds face increasing scrutiny under evolving environmental legislation. The European Union's Battery Directive and similar regulations in North America and Asia are establishing more stringent requirements for the environmental performance of battery materials, including carbon footprint limitations and minimum recycled content requirements that will affect both compounds.

Sustainable innovation pathways are emerging for both materials. Research into bio-based precursors for lithium acetate production shows promise for reducing its environmental impact, while advancements in direct lithium extraction technologies may significantly reduce the water footprint of lithium hydroxide production in the coming years.

Lithium hydroxide production typically requires more energy-intensive processes, particularly when derived from lithium carbonate, which involves additional chemical conversion steps. This higher energy demand translates to increased carbon emissions - approximately 15-20% higher than those associated with lithium acetate production. However, lithium hydroxide enables the manufacture of higher-energy density batteries, potentially offsetting these impacts through improved battery performance and longevity.

Water consumption presents another significant environmental concern. Lithium hydroxide production consumes approximately 50-70 liters of water per kilogram of product, while lithium acetate manufacturing requires approximately 30-40 liters per kilogram. This difference becomes particularly relevant in water-stressed regions where lithium extraction often occurs, such as the lithium triangle of South America (Chile, Argentina, and Bolivia).

Waste generation and management also differ between these compounds. Lithium acetate production generates organic waste streams that require specialized treatment, while lithium hydroxide manufacturing produces more alkaline waste that presents different management challenges. Recent life cycle assessments indicate that lithium hydroxide production generates approximately 2.3 tons of CO2 equivalent per ton of material, compared to 1.8 tons for lithium acetate.

Recycling considerations further differentiate these compounds. Batteries stabilized with lithium hydroxide currently demonstrate marginally better recyclability rates (approximately 5-8% higher recovery efficiency) in commercial recycling processes. This advantage stems from the more straightforward separation of lithium hydroxide during hydrometallurgical recycling processes.

From a regulatory perspective, both compounds face increasing scrutiny under evolving environmental legislation. The European Union's Battery Directive and similar regulations in North America and Asia are establishing more stringent requirements for the environmental performance of battery materials, including carbon footprint limitations and minimum recycled content requirements that will affect both compounds.

Sustainable innovation pathways are emerging for both materials. Research into bio-based precursors for lithium acetate production shows promise for reducing its environmental impact, while advancements in direct lithium extraction technologies may significantly reduce the water footprint of lithium hydroxide production in the coming years.

Safety Protocols and Handling Requirements

The handling of lithium compounds requires strict adherence to safety protocols due to their reactive nature and potential health hazards. When comparing lithium acetate and lithium hydroxide, distinct safety considerations emerge based on their chemical properties. Lithium hydroxide presents significantly higher risks due to its strong alkalinity (pH >12), requiring more stringent handling procedures than the milder lithium acetate.

Personal protective equipment (PPE) requirements differ substantially between these compounds. For lithium hydroxide, chemical-resistant gloves (butyl rubber or neoprene), full face shields, lab coats, and in some cases respiratory protection are mandatory due to its corrosive nature and potential to cause severe chemical burns. Lithium acetate handling typically requires standard laboratory PPE including nitrile gloves and safety glasses, reflecting its lower hazard profile.

Storage protocols also vary significantly. Lithium hydroxide must be stored in tightly sealed containers in cool, dry areas away from acids, metals, and moisture to prevent exothermic reactions. Specialized polypropylene or polyethylene containers are recommended. Lithium acetate, while still requiring sealed containers, can be stored under less restrictive conditions with standard chemical storage protocols.

Emergency response procedures for lithium hydroxide spills necessitate immediate evacuation of the area, specialized neutralization agents, and potentially self-contained breathing apparatus for responders. Lithium acetate spills can typically be addressed with standard chemical spill kits and procedures, though care should still be taken to avoid dust formation.

Waste disposal regulations classify lithium hydroxide as hazardous waste in many jurisdictions, requiring specialized disposal through licensed waste management services. Lithium acetate often falls under less restrictive disposal categories, though local regulations should always be consulted.

Training requirements for personnel handling these compounds should be tailored to their respective hazard profiles. Workers handling lithium hydroxide require comprehensive training on corrosive material handling, emergency response procedures, and specific first aid measures for alkaline chemical exposure. Those working with lithium acetate need general chemical safety training with emphasis on proper handling techniques to minimize dust generation.

Ventilation requirements also differ, with lithium hydroxide handling necessitating local exhaust ventilation systems to capture potential dust or aerosols, while lithium acetate can often be handled safely under general laboratory ventilation conditions, provided dust formation is controlled.

Personal protective equipment (PPE) requirements differ substantially between these compounds. For lithium hydroxide, chemical-resistant gloves (butyl rubber or neoprene), full face shields, lab coats, and in some cases respiratory protection are mandatory due to its corrosive nature and potential to cause severe chemical burns. Lithium acetate handling typically requires standard laboratory PPE including nitrile gloves and safety glasses, reflecting its lower hazard profile.

Storage protocols also vary significantly. Lithium hydroxide must be stored in tightly sealed containers in cool, dry areas away from acids, metals, and moisture to prevent exothermic reactions. Specialized polypropylene or polyethylene containers are recommended. Lithium acetate, while still requiring sealed containers, can be stored under less restrictive conditions with standard chemical storage protocols.

Emergency response procedures for lithium hydroxide spills necessitate immediate evacuation of the area, specialized neutralization agents, and potentially self-contained breathing apparatus for responders. Lithium acetate spills can typically be addressed with standard chemical spill kits and procedures, though care should still be taken to avoid dust formation.

Waste disposal regulations classify lithium hydroxide as hazardous waste in many jurisdictions, requiring specialized disposal through licensed waste management services. Lithium acetate often falls under less restrictive disposal categories, though local regulations should always be consulted.

Training requirements for personnel handling these compounds should be tailored to their respective hazard profiles. Workers handling lithium hydroxide require comprehensive training on corrosive material handling, emergency response procedures, and specific first aid measures for alkaline chemical exposure. Those working with lithium acetate need general chemical safety training with emphasis on proper handling techniques to minimize dust generation.

Ventilation requirements also differ, with lithium hydroxide handling necessitating local exhaust ventilation systems to capture potential dust or aerosols, while lithium acetate can often be handled safely under general laboratory ventilation conditions, provided dust formation is controlled.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!