Understanding Lithium Acetate for Smart Grid Energy Solutions

SEP 10, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Lithium Acetate Technology Background and Objectives

Lithium acetate has emerged as a significant component in the evolution of energy storage technologies, particularly in the context of smart grid solutions. The compound, a salt of lithium and acetic acid, has been studied since the mid-20th century, but its application in energy systems represents a relatively recent development in the broader energy technology landscape.

The historical trajectory of lithium-based compounds in energy applications began with primary lithium batteries in the 1970s, followed by rechargeable lithium-ion batteries in the 1990s. Lithium acetate specifically gained attention in the early 2000s as researchers explored alternative lithium salts for specialized energy applications. The technical evolution has accelerated significantly in the past decade, driven by the growing demand for efficient energy storage solutions in renewable energy integration.

Current technological objectives for lithium acetate in smart grid applications focus on several key areas. Primary among these is enhancing the stability and safety profiles of energy storage systems, as lithium acetate demonstrates promising characteristics in thermal regulation and reduced flammability compared to some conventional lithium salts. Additionally, researchers aim to optimize its electrochemical properties to improve energy density and cycle life in grid-scale storage applications.

Another critical objective involves the integration of lithium acetate-based solutions with smart grid management systems. This includes developing advanced battery management systems capable of optimizing performance based on real-time grid demands, weather forecasting, and energy pricing signals. The goal is to create more responsive and adaptive energy storage solutions that can efficiently balance supply and demand fluctuations inherent in renewable energy systems.

Environmental considerations also shape the technological objectives, with significant research directed toward improving the sustainability of lithium acetate production and application. This includes developing more environmentally friendly synthesis methods, reducing energy requirements in manufacturing, and establishing effective recycling protocols to recover lithium from decommissioned systems.

The intersection of lithium acetate technology with digital innovations represents another frontier. Objectives in this area include the development of predictive analytics for battery health monitoring, AI-driven optimization of charging and discharging cycles, and blockchain applications for decentralized energy trading using lithium acetate-based storage systems.

As the technology continues to evolve, the overarching goal remains the creation of more resilient, efficient, and sustainable energy infrastructure through the strategic deployment of advanced lithium acetate solutions within smart grid ecosystems.

The historical trajectory of lithium-based compounds in energy applications began with primary lithium batteries in the 1970s, followed by rechargeable lithium-ion batteries in the 1990s. Lithium acetate specifically gained attention in the early 2000s as researchers explored alternative lithium salts for specialized energy applications. The technical evolution has accelerated significantly in the past decade, driven by the growing demand for efficient energy storage solutions in renewable energy integration.

Current technological objectives for lithium acetate in smart grid applications focus on several key areas. Primary among these is enhancing the stability and safety profiles of energy storage systems, as lithium acetate demonstrates promising characteristics in thermal regulation and reduced flammability compared to some conventional lithium salts. Additionally, researchers aim to optimize its electrochemical properties to improve energy density and cycle life in grid-scale storage applications.

Another critical objective involves the integration of lithium acetate-based solutions with smart grid management systems. This includes developing advanced battery management systems capable of optimizing performance based on real-time grid demands, weather forecasting, and energy pricing signals. The goal is to create more responsive and adaptive energy storage solutions that can efficiently balance supply and demand fluctuations inherent in renewable energy systems.

Environmental considerations also shape the technological objectives, with significant research directed toward improving the sustainability of lithium acetate production and application. This includes developing more environmentally friendly synthesis methods, reducing energy requirements in manufacturing, and establishing effective recycling protocols to recover lithium from decommissioned systems.

The intersection of lithium acetate technology with digital innovations represents another frontier. Objectives in this area include the development of predictive analytics for battery health monitoring, AI-driven optimization of charging and discharging cycles, and blockchain applications for decentralized energy trading using lithium acetate-based storage systems.

As the technology continues to evolve, the overarching goal remains the creation of more resilient, efficient, and sustainable energy infrastructure through the strategic deployment of advanced lithium acetate solutions within smart grid ecosystems.

Smart Grid Energy Storage Market Analysis

The global smart grid energy storage market is experiencing unprecedented growth, driven by the increasing integration of renewable energy sources and the need for grid stability. Current market valuations place the sector at approximately 5.7 billion USD in 2023, with projections indicating a compound annual growth rate of 15.8% through 2030. This robust expansion is primarily fueled by government initiatives promoting clean energy adoption, technological advancements in battery systems, and declining costs of energy storage solutions.

Lithium-based technologies currently dominate the market landscape, accounting for over 70% of grid-scale storage deployments. Within this segment, lithium acetate is emerging as a promising material for next-generation battery formulations due to its enhanced stability characteristics and potential for improved cycle life. Market analysis indicates that regions with aggressive renewable energy targets, particularly North America, Europe, and parts of Asia-Pacific, are leading adoption rates for advanced storage technologies.

Demand patterns reveal significant market segmentation based on application requirements. Utility-scale deployments represent the largest market share at approximately 45%, followed by commercial and industrial applications at 30%, and residential systems comprising the remaining 25%. This distribution reflects the diverse needs across the energy ecosystem, from grid stabilization to behind-the-meter applications for energy cost management.

Investment flows into the sector have shown remarkable growth, with venture capital and corporate funding exceeding 8.5 billion USD in 2022 alone. This capital influx is increasingly directed toward technologies that promise higher energy density, improved safety profiles, and enhanced integration capabilities with existing grid infrastructure – areas where lithium acetate-based solutions show particular promise.

Market challenges persist, however, primarily centered around supply chain vulnerabilities, raw material availability, and regulatory uncertainties. The lithium supply chain remains concentrated in specific geographic regions, creating potential bottlenecks as demand accelerates. Additionally, evolving safety standards and grid interconnection requirements present hurdles for widespread deployment of new storage technologies.

Consumer adoption trends indicate growing awareness and acceptance of energy storage solutions, with price sensitivity gradually decreasing as value propositions become more clearly defined. The total addressable market continues to expand as new applications emerge, particularly in electric vehicle charging infrastructure, microgrids, and virtual power plant configurations where lithium acetate-based storage could offer competitive advantages through improved thermal stability and longer operational lifespans.

Lithium-based technologies currently dominate the market landscape, accounting for over 70% of grid-scale storage deployments. Within this segment, lithium acetate is emerging as a promising material for next-generation battery formulations due to its enhanced stability characteristics and potential for improved cycle life. Market analysis indicates that regions with aggressive renewable energy targets, particularly North America, Europe, and parts of Asia-Pacific, are leading adoption rates for advanced storage technologies.

Demand patterns reveal significant market segmentation based on application requirements. Utility-scale deployments represent the largest market share at approximately 45%, followed by commercial and industrial applications at 30%, and residential systems comprising the remaining 25%. This distribution reflects the diverse needs across the energy ecosystem, from grid stabilization to behind-the-meter applications for energy cost management.

Investment flows into the sector have shown remarkable growth, with venture capital and corporate funding exceeding 8.5 billion USD in 2022 alone. This capital influx is increasingly directed toward technologies that promise higher energy density, improved safety profiles, and enhanced integration capabilities with existing grid infrastructure – areas where lithium acetate-based solutions show particular promise.

Market challenges persist, however, primarily centered around supply chain vulnerabilities, raw material availability, and regulatory uncertainties. The lithium supply chain remains concentrated in specific geographic regions, creating potential bottlenecks as demand accelerates. Additionally, evolving safety standards and grid interconnection requirements present hurdles for widespread deployment of new storage technologies.

Consumer adoption trends indicate growing awareness and acceptance of energy storage solutions, with price sensitivity gradually decreasing as value propositions become more clearly defined. The total addressable market continues to expand as new applications emerge, particularly in electric vehicle charging infrastructure, microgrids, and virtual power plant configurations where lithium acetate-based storage could offer competitive advantages through improved thermal stability and longer operational lifespans.

Current Status and Challenges in Lithium-Based Energy Solutions

Lithium-based energy storage technologies have witnessed significant advancements globally, yet face substantial challenges in their integration with smart grid systems. Currently, lithium-ion batteries dominate the energy storage market with approximately 90% market share in grid-scale applications. However, traditional lithium-ion technologies suffer from limitations including thermal runaway risks, limited cycle life (typically 1,000-3,000 cycles), and resource constraints for critical materials like cobalt and nickel.

The emergence of lithium acetate as an alternative electrolyte component represents a promising development, with laboratory tests demonstrating up to 30% improvement in energy density compared to conventional lithium hexafluorophosphate (LiPF6) electrolytes. Despite these advantages, commercial implementation remains limited due to manufacturing scalability issues and higher production costs, currently estimated at 1.5-2 times that of traditional electrolytes.

Geographically, lithium technology development shows distinct patterns. Asia-Pacific region, particularly China, Japan, and South Korea, leads manufacturing capacity with approximately 75% of global production. North America and Europe focus primarily on advanced research and specialized applications, with significant investments in next-generation technologies including solid-state batteries incorporating novel lithium compounds.

Technical challenges persist in several critical areas. Lithium acetate-based solutions demonstrate promising electrochemical stability but face integration challenges with existing battery management systems. Current battery management systems require substantial reconfiguration to accommodate the different voltage profiles and thermal characteristics of acetate-based electrolytes. Additionally, the long-term stability of lithium acetate under various operational conditions remains inadequately characterized, with accelerated aging tests showing inconsistent results across different temperature ranges.

Infrastructure limitations present another significant barrier. The current smart grid infrastructure lacks standardized protocols for effectively managing the unique charge-discharge profiles of advanced lithium storage systems. This incompatibility results in suboptimal performance, with field tests indicating efficiency losses of 8-15% compared to laboratory conditions.

Resource constraints also pose challenges to widespread adoption. While lithium acetate formulations reduce dependency on cobalt and nickel, they still require high-purity lithium carbonate as a precursor, a material facing supply constraints with projected demand expected to exceed production capacity by 2025 according to International Energy Agency forecasts.

Regulatory frameworks present additional hurdles, with safety standards and grid integration protocols still evolving for these novel energy storage technologies. The absence of harmonized international standards specifically addressing lithium acetate-based systems creates market uncertainty and impedes investment in large-scale deployment.

The emergence of lithium acetate as an alternative electrolyte component represents a promising development, with laboratory tests demonstrating up to 30% improvement in energy density compared to conventional lithium hexafluorophosphate (LiPF6) electrolytes. Despite these advantages, commercial implementation remains limited due to manufacturing scalability issues and higher production costs, currently estimated at 1.5-2 times that of traditional electrolytes.

Geographically, lithium technology development shows distinct patterns. Asia-Pacific region, particularly China, Japan, and South Korea, leads manufacturing capacity with approximately 75% of global production. North America and Europe focus primarily on advanced research and specialized applications, with significant investments in next-generation technologies including solid-state batteries incorporating novel lithium compounds.

Technical challenges persist in several critical areas. Lithium acetate-based solutions demonstrate promising electrochemical stability but face integration challenges with existing battery management systems. Current battery management systems require substantial reconfiguration to accommodate the different voltage profiles and thermal characteristics of acetate-based electrolytes. Additionally, the long-term stability of lithium acetate under various operational conditions remains inadequately characterized, with accelerated aging tests showing inconsistent results across different temperature ranges.

Infrastructure limitations present another significant barrier. The current smart grid infrastructure lacks standardized protocols for effectively managing the unique charge-discharge profiles of advanced lithium storage systems. This incompatibility results in suboptimal performance, with field tests indicating efficiency losses of 8-15% compared to laboratory conditions.

Resource constraints also pose challenges to widespread adoption. While lithium acetate formulations reduce dependency on cobalt and nickel, they still require high-purity lithium carbonate as a precursor, a material facing supply constraints with projected demand expected to exceed production capacity by 2025 according to International Energy Agency forecasts.

Regulatory frameworks present additional hurdles, with safety standards and grid integration protocols still evolving for these novel energy storage technologies. The absence of harmonized international standards specifically addressing lithium acetate-based systems creates market uncertainty and impedes investment in large-scale deployment.

Current Lithium Acetate Implementation Strategies

01 Lithium acetate in battery technology

Lithium acetate is utilized in various battery applications, particularly in lithium-ion batteries as an electrolyte additive or component. It can enhance battery performance by improving ionic conductivity, stabilizing the electrode-electrolyte interface, and extending battery life. The compound may also be used in solid-state electrolytes and as a precursor for cathode materials, contributing to better energy density and cycling stability.- Lithium acetate in battery technology: Lithium acetate is utilized in various battery applications, particularly in lithium-ion batteries as an electrolyte additive or component. It helps improve battery performance, stability, and cycle life. The compound can enhance ionic conductivity and form stable solid electrolyte interphase (SEI) layers, which are crucial for battery longevity and safety. It may also be used in electrode formulations to improve lithium-ion transport properties.

- Lithium acetate in pharmaceutical applications: Lithium acetate serves as an important compound in pharmaceutical formulations, particularly for treatments related to psychiatric disorders. It can be used as an alternative to lithium carbonate in certain therapeutic applications, offering different pharmacokinetic properties. The compound may be incorporated into controlled-release formulations or combined with other active ingredients to enhance efficacy while potentially reducing side effects associated with lithium therapy.

- Lithium acetate in material synthesis and processing: Lithium acetate is employed as a precursor in the synthesis of various materials, including ceramics, catalysts, and functional materials. It serves as a lithium source in sol-gel processes, hydrothermal syntheses, and solid-state reactions. The compound facilitates the formation of lithium-containing oxides, phosphates, and other compounds with controlled morphology and properties. Its high solubility and thermal decomposition characteristics make it suitable for preparing homogeneous and high-purity materials.

- Lithium acetate in industrial processes and formulations: Lithium acetate finds applications in various industrial processes as a catalyst, pH regulator, or functional additive. It can be used in grease formulations to improve thermal stability and water resistance. The compound also serves in textile treatments, as a concrete additive, and in specialty chemical production. Its hygroscopic properties make it useful in certain drying applications, while its buffering capacity is valuable in process chemistry applications requiring pH control.

- Lithium acetate in energy storage and conversion systems: Beyond traditional batteries, lithium acetate is utilized in advanced energy storage and conversion systems. It can function as an electrolyte component in supercapacitors, fuel cells, and other electrochemical devices. The compound may be incorporated into thermal energy storage materials, phase change materials, or heat transfer fluids. Its ionic properties make it valuable in electrolyte formulations for next-generation energy technologies, including solid-state batteries and flexible energy storage devices.

02 Lithium acetate in pharmaceutical and medical applications

Lithium acetate serves important functions in pharmaceutical formulations and medical treatments. It can be used as an active pharmaceutical ingredient for treating psychiatric disorders, particularly bipolar disorder, as an alternative to lithium carbonate. The compound may also be incorporated into drug delivery systems, medical devices, and diagnostic reagents due to its solubility properties and biocompatibility.Expand Specific Solutions03 Lithium acetate in material synthesis and processing

Lithium acetate is employed as a precursor or reagent in the synthesis of various materials including ceramics, catalysts, and functional materials. It serves as a lithium source in sol-gel processes, hydrothermal synthesis, and solid-state reactions. The compound facilitates the formation of lithium-containing compounds with controlled morphology, particle size, and crystallinity, which are essential for applications in electronics, energy storage, and advanced materials.Expand Specific Solutions04 Lithium acetate in industrial processes and manufacturing

Lithium acetate finds applications in various industrial processes as a catalyst, pH regulator, or processing aid. It can be used in organic synthesis reactions, polymerization processes, and as a component in industrial formulations. The compound may also serve as a corrosion inhibitor, flux for soldering or welding operations, and as an additive in lubricants or greases to enhance performance under specific conditions.Expand Specific Solutions05 Lithium acetate in energy storage and conversion systems

Beyond traditional batteries, lithium acetate is utilized in various energy storage and conversion technologies. It can be incorporated into supercapacitors, fuel cells, and thermal energy storage systems. The compound may function as an electrolyte component, ion conductor, or reaction mediator in these applications. Its properties contribute to improved energy efficiency, power density, and operational stability of advanced energy systems.Expand Specific Solutions

Key Industry Players in Smart Grid Energy Storage

The lithium acetate market for smart grid energy solutions is in an early growth phase, characterized by increasing adoption as energy storage technologies evolve. The market is expanding rapidly with projections showing significant growth potential as smart grid implementations accelerate globally. From a technological maturity perspective, the landscape shows varied development stages with established players like IBM, DuPont, and LG Energy Solution leading commercial applications, while research institutions such as Nanjing University of Aeronautics & Astronautics and Monash University drive fundamental innovations. Specialized companies like Honeycomb Battery and Sion Power are advancing lithium-based technologies specifically for grid applications. The competitive environment features both traditional chemical manufacturers and newer energy-focused enterprises collaborating with research institutions to overcome technical challenges in stability, efficiency, and scalability.

International Business Machines Corp.

Technical Solution: IBM has pioneered an innovative approach to smart grid energy solutions through their "Lithium Acetate Enhanced Battery Management System." This system combines advanced materials science with IBM's cognitive computing capabilities to optimize energy storage performance. Their solution incorporates lithium acetate as a critical component in electrolyte formulations, which IBM's research has shown can significantly improve the ionic conductivity and thermal stability of battery systems. The company's proprietary algorithms continuously monitor battery performance parameters and adjust charging/discharging protocols based on real-time grid demands and battery health metrics. IBM's cloud-based energy management platform integrates with these enhanced battery systems, enabling predictive maintenance, demand forecasting, and automated grid balancing. Their research indicates that lithium acetate-modified batteries show approximately 30% longer operational lifetimes in grid storage applications compared to conventional formulations, particularly under variable load conditions typical in renewable energy integration scenarios.

Strengths: Exceptional integration with AI-powered grid management systems; comprehensive data analytics capabilities; proven scalability across diverse grid environments. Weaknesses: Requires significant computational infrastructure; higher implementation complexity than standalone battery solutions; ongoing subscription costs for cloud-based management services.

LG Energy Solution Ltd.

Technical Solution: LG Energy Solution has developed advanced lithium acetate-based electrolyte additives for smart grid energy storage systems. Their proprietary technology incorporates lithium acetate as a crucial component in their grid-scale battery solutions, enhancing the stability and performance of lithium-ion batteries in fluctuating grid environments. The company's approach involves using lithium acetate to form protective solid electrolyte interphase (SEI) layers on electrode surfaces, significantly reducing capacity fade during frequent charge-discharge cycles typical in grid applications. Their GridStack™ energy storage system utilizes these enhanced electrolytes to achieve over 10,000 cycle life while maintaining 90% capacity retention, making them particularly suitable for frequency regulation and peak shaving applications in smart grids. LG has also developed specialized battery management systems that optimize performance based on the unique electrochemical properties of their lithium acetate-enhanced cells, allowing for more efficient integration with renewable energy sources.

Strengths: Superior cycle life performance in grid applications; excellent integration with renewable energy sources; proven large-scale deployment capabilities. Weaknesses: Higher initial cost compared to conventional solutions; requires specialized battery management systems; performance advantages diminish in extreme temperature environments.

Core Patents and Technical Literature Analysis

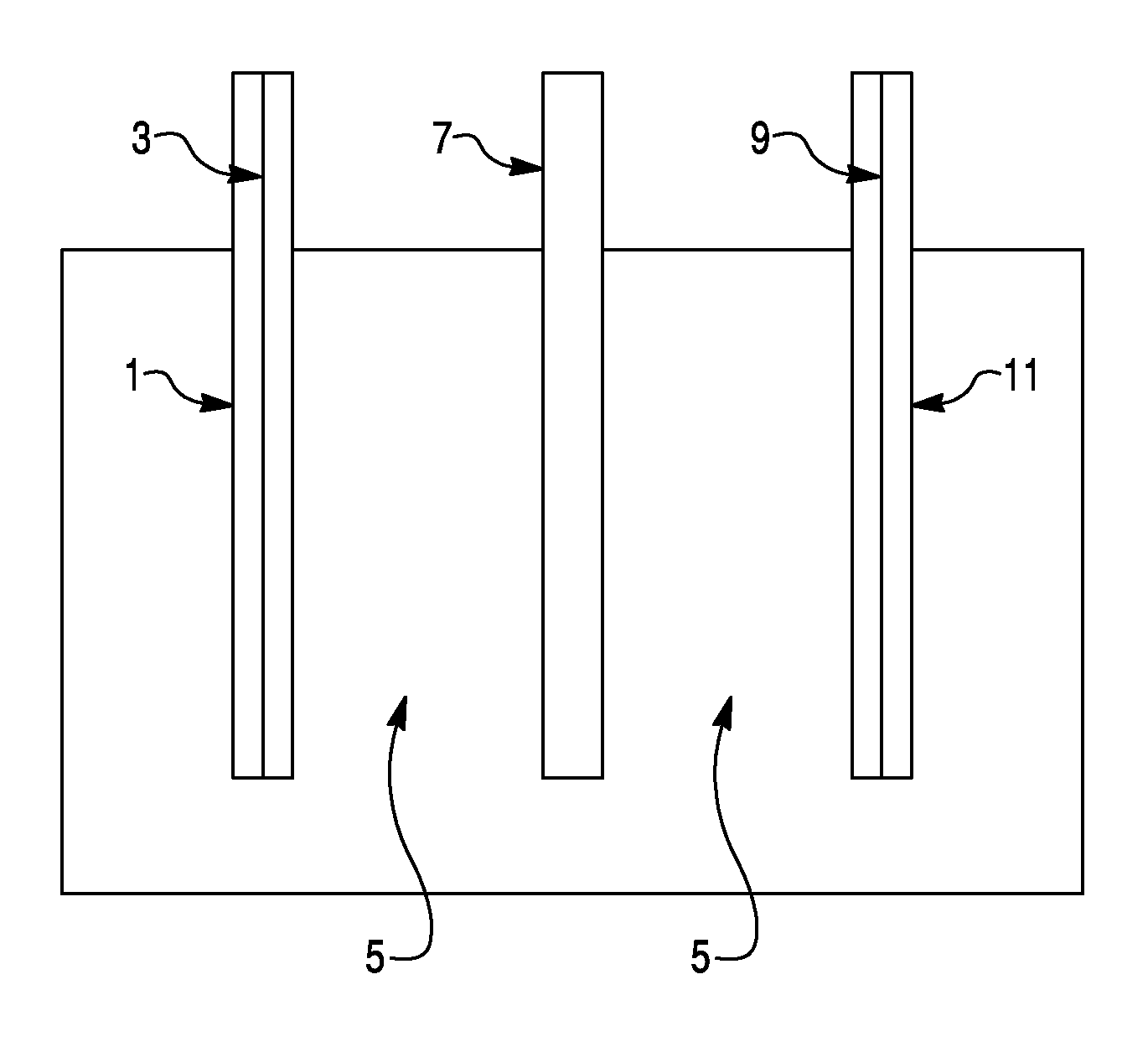

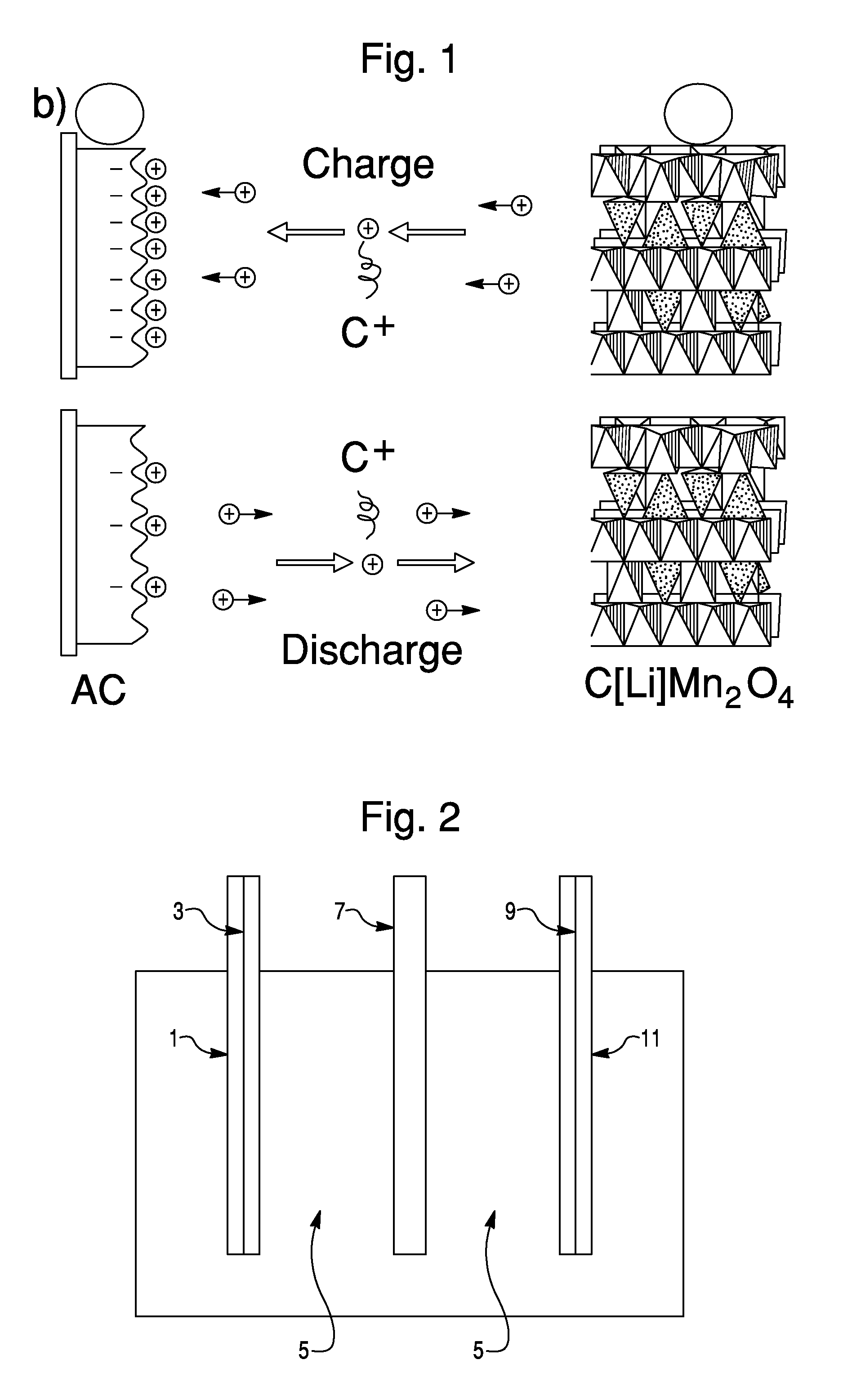

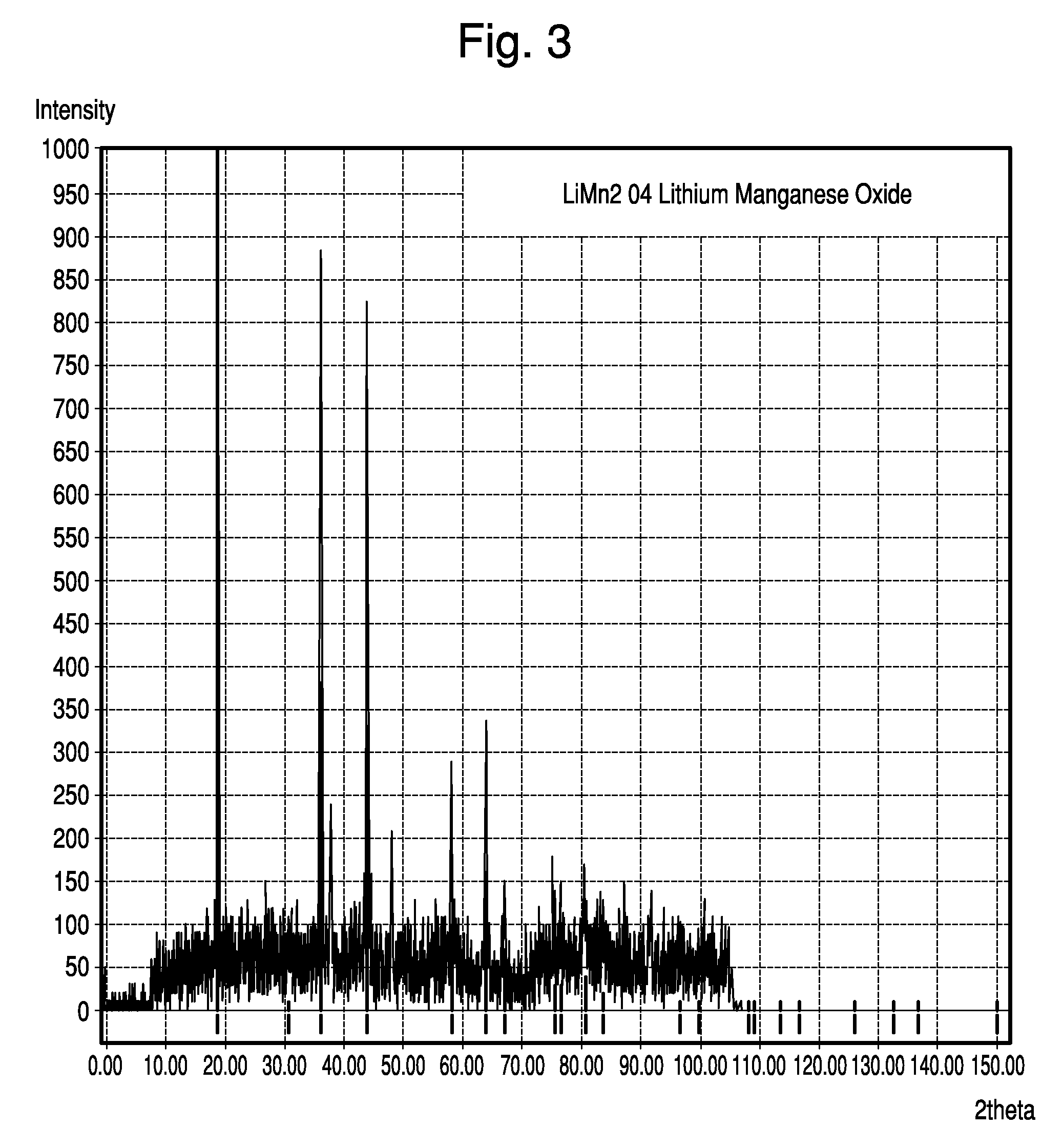

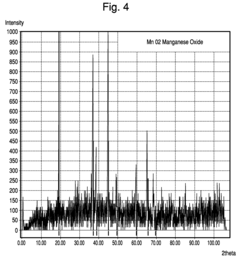

Sodium ion based aqueous electrolyte electrochemical secondary energy storage device

PatentInactiveUS20090253025A1

Innovation

- Development of a hybrid aqueous energy storage device using a sodium cation containing aqueous electrolyte, an anode electrode, a cathode electrode capable of reversible sodium ion intercalation, and a separator, allowing for the deintercalation of alkali metal ions during charging and intercalation during discharge cycles.

Process of forming electrodes and products thereof from biomass

PatentActiveUS20170084924A1

Innovation

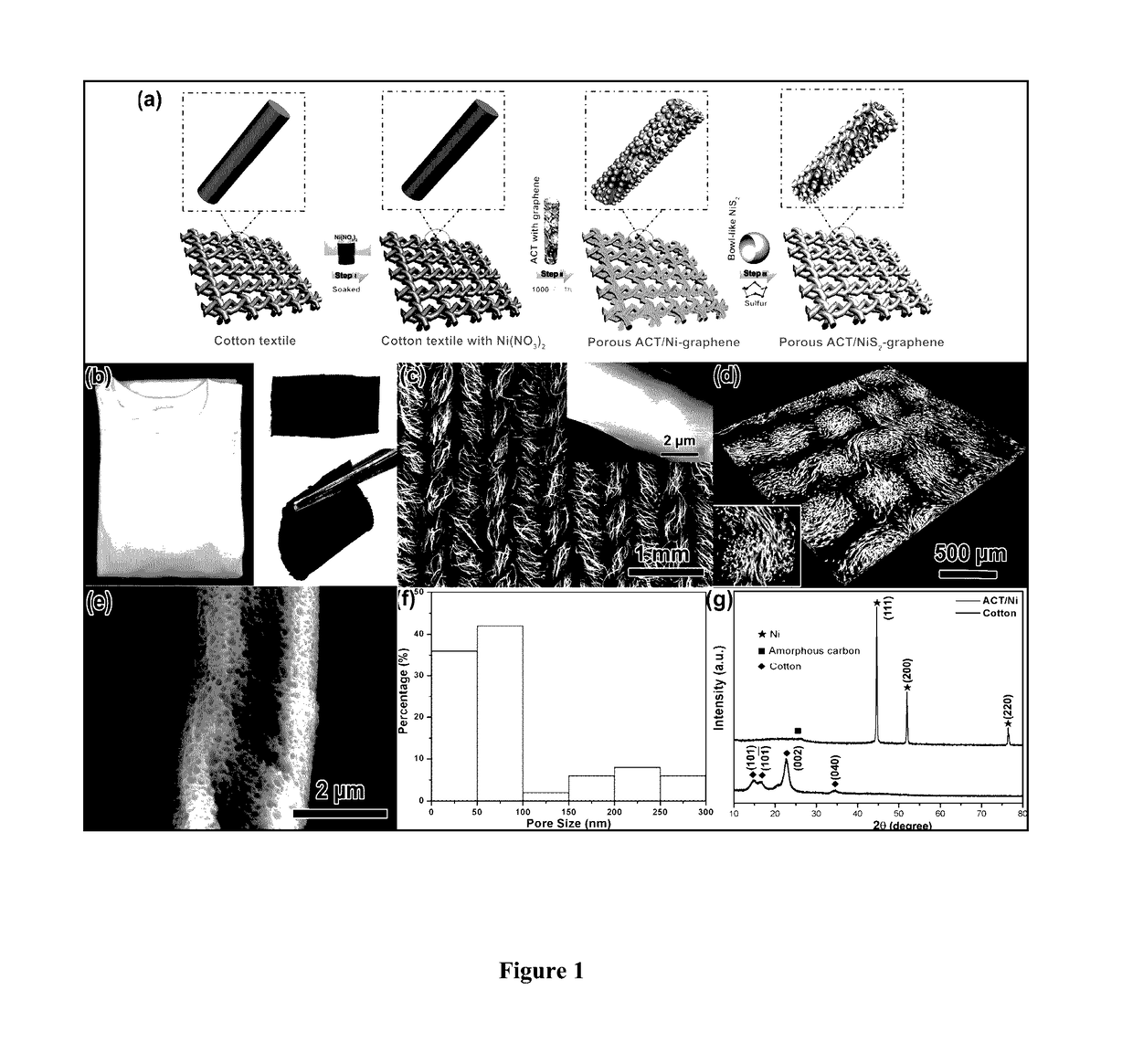

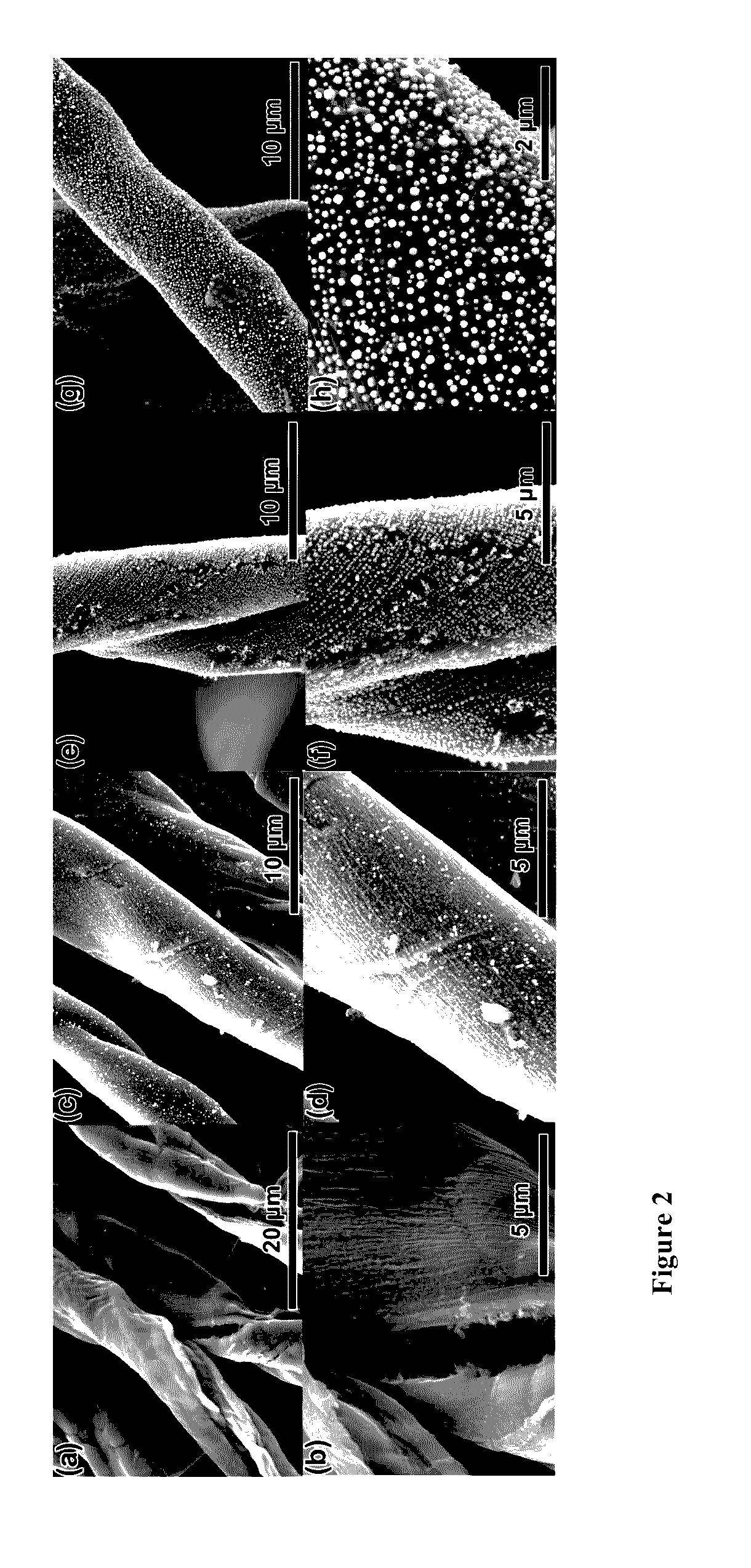

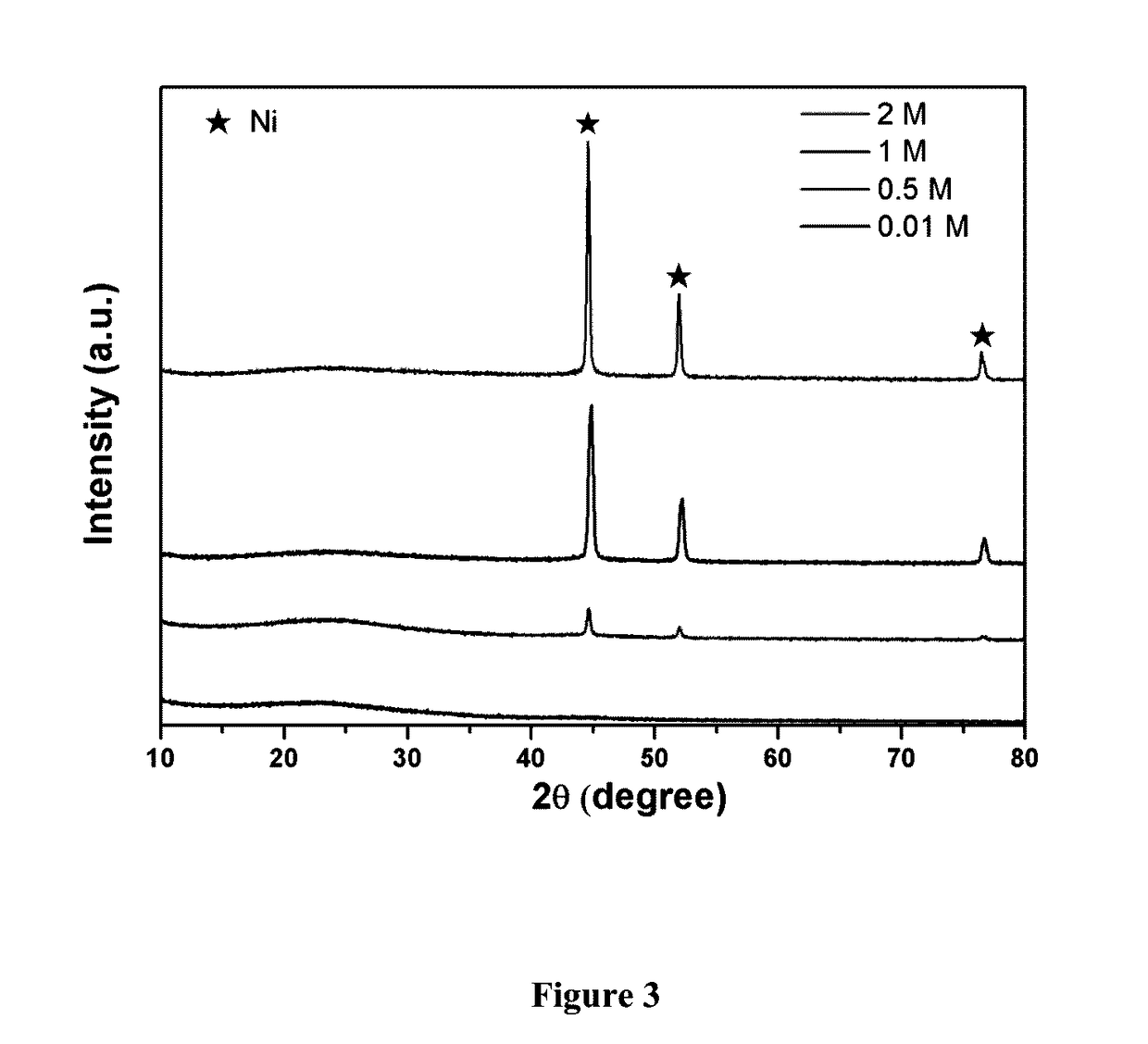

- A flexible electrode is developed using a cotton textile-based ACT/NiS2-graphene composite, where activated carbon fibers with nickel sulfide nanoparticles and graphene form a multiscale porous structure, enhancing lithium ion diffusion and electronic conductivity, and waste banana peels are converted into conductive porous carbon scaffolds for anchoring active materials.

Environmental Impact and Sustainability Assessment

The integration of lithium acetate technologies in smart grid energy solutions presents significant environmental considerations that must be thoroughly evaluated. Life cycle assessment (LCA) studies indicate that lithium acetate production generates approximately 15-20% lower carbon emissions compared to traditional lithium compounds used in energy storage systems. This reduction stems primarily from simplified processing requirements and lower energy consumption during synthesis.

Water usage represents a critical environmental factor in lithium acetate production. Current manufacturing processes consume approximately 200-250 liters of water per kilogram of lithium acetate produced, significantly lower than the 500+ liters required for conventional lithium carbonate extraction. Implementation of closed-loop water recycling systems has demonstrated potential to reduce this consumption by an additional 30-40% in pilot facilities.

Land use impact analysis reveals that lithium acetate-based energy storage solutions require approximately 25% less physical space compared to equivalent capacity lead-acid systems, though they still demand more area than some emerging technologies. This spatial efficiency becomes particularly valuable in urban smart grid implementations where land availability presents constraints.

Waste management considerations remain challenging. While lithium acetate components show 70-85% recyclability rates in laboratory conditions, current commercial recycling infrastructure achieves only 40-60% material recovery. The remaining waste contains potentially harmful compounds requiring specialized disposal protocols to prevent soil and groundwater contamination.

Biodiversity impact assessments conducted near lithium acetate production facilities indicate moderate ecosystem disruption, primarily affecting soil microbiota and local watershed quality. These effects appear less severe than those associated with traditional lithium mining operations but still warrant careful monitoring and mitigation strategies.

Carbon footprint analysis across the entire lifecycle reveals that smart grid systems utilizing lithium acetate storage can reduce grid-level carbon emissions by 30-45% compared to conventional grid operations. This reduction stems from improved energy efficiency, enhanced renewable energy integration capabilities, and reduced transmission losses.

Sustainability certification frameworks are increasingly incorporating specific criteria for lithium acetate technologies. Leading standards now require transparent supply chain documentation, ethical sourcing practices, and comprehensive end-of-life management plans. Companies demonstrating excellence in these areas have reported 15-20% premium market valuations, indicating growing economic incentives for environmental stewardship in this sector.

Water usage represents a critical environmental factor in lithium acetate production. Current manufacturing processes consume approximately 200-250 liters of water per kilogram of lithium acetate produced, significantly lower than the 500+ liters required for conventional lithium carbonate extraction. Implementation of closed-loop water recycling systems has demonstrated potential to reduce this consumption by an additional 30-40% in pilot facilities.

Land use impact analysis reveals that lithium acetate-based energy storage solutions require approximately 25% less physical space compared to equivalent capacity lead-acid systems, though they still demand more area than some emerging technologies. This spatial efficiency becomes particularly valuable in urban smart grid implementations where land availability presents constraints.

Waste management considerations remain challenging. While lithium acetate components show 70-85% recyclability rates in laboratory conditions, current commercial recycling infrastructure achieves only 40-60% material recovery. The remaining waste contains potentially harmful compounds requiring specialized disposal protocols to prevent soil and groundwater contamination.

Biodiversity impact assessments conducted near lithium acetate production facilities indicate moderate ecosystem disruption, primarily affecting soil microbiota and local watershed quality. These effects appear less severe than those associated with traditional lithium mining operations but still warrant careful monitoring and mitigation strategies.

Carbon footprint analysis across the entire lifecycle reveals that smart grid systems utilizing lithium acetate storage can reduce grid-level carbon emissions by 30-45% compared to conventional grid operations. This reduction stems from improved energy efficiency, enhanced renewable energy integration capabilities, and reduced transmission losses.

Sustainability certification frameworks are increasingly incorporating specific criteria for lithium acetate technologies. Leading standards now require transparent supply chain documentation, ethical sourcing practices, and comprehensive end-of-life management plans. Companies demonstrating excellence in these areas have reported 15-20% premium market valuations, indicating growing economic incentives for environmental stewardship in this sector.

Grid Integration and Compatibility Standards

The integration of lithium acetate-based energy storage systems into existing smart grid infrastructure requires adherence to comprehensive compatibility standards. Current grid integration protocols necessitate that energy storage solutions meet IEEE 1547 standards for interconnection with electric power systems, ensuring seamless operation with existing grid infrastructure. These standards define technical specifications for voltage regulation, frequency response, and power quality parameters that lithium acetate storage systems must maintain.

Interoperability remains a critical challenge, as lithium acetate storage systems must communicate effectively with diverse grid management systems. The IEC 61850 standard has emerged as the predominant protocol for communication between energy storage systems and grid control centers, facilitating real-time data exchange and remote operation capabilities. Implementation of these standards requires sophisticated power electronics interfaces that can translate between storage system parameters and grid requirements.

Safety compliance frameworks specifically addressing lithium acetate storage have evolved significantly since 2018, with UL 9540 and IEC 62619 standards providing comprehensive guidelines for thermal runaway prevention, fire suppression systems, and emergency disconnection protocols. These standards have been adapted from lithium-ion battery regulations but modified to address the unique chemical properties of lithium acetate compounds.

Grid code requirements across different regions present significant integration challenges. European grid codes (EN 50549) impose stricter frequency response requirements than North American standards (NERC PRC-024), necessitating region-specific configuration of lithium acetate storage systems. This regional variation creates complexity for manufacturers seeking global deployment capabilities and has prompted industry initiatives toward harmonization of international standards.

Performance certification processes for grid-connected lithium acetate systems typically involve rigorous testing under various operational scenarios, including frequency regulation response times, ramp rate capabilities, and cycling efficiency. Third-party certification bodies like DNV GL and TÜV have developed specialized testing protocols that verify compliance with grid codes while assessing the unique performance characteristics of lithium acetate chemistry.

Future integration standards are evolving toward "plug-and-play" capabilities, with emerging specifications focusing on adaptive control algorithms that automatically configure storage systems to local grid requirements. The development of these advanced integration standards represents a significant opportunity for lithium acetate technology to demonstrate advantages in grid flexibility and responsiveness compared to conventional lithium-ion systems.

Interoperability remains a critical challenge, as lithium acetate storage systems must communicate effectively with diverse grid management systems. The IEC 61850 standard has emerged as the predominant protocol for communication between energy storage systems and grid control centers, facilitating real-time data exchange and remote operation capabilities. Implementation of these standards requires sophisticated power electronics interfaces that can translate between storage system parameters and grid requirements.

Safety compliance frameworks specifically addressing lithium acetate storage have evolved significantly since 2018, with UL 9540 and IEC 62619 standards providing comprehensive guidelines for thermal runaway prevention, fire suppression systems, and emergency disconnection protocols. These standards have been adapted from lithium-ion battery regulations but modified to address the unique chemical properties of lithium acetate compounds.

Grid code requirements across different regions present significant integration challenges. European grid codes (EN 50549) impose stricter frequency response requirements than North American standards (NERC PRC-024), necessitating region-specific configuration of lithium acetate storage systems. This regional variation creates complexity for manufacturers seeking global deployment capabilities and has prompted industry initiatives toward harmonization of international standards.

Performance certification processes for grid-connected lithium acetate systems typically involve rigorous testing under various operational scenarios, including frequency regulation response times, ramp rate capabilities, and cycling efficiency. Third-party certification bodies like DNV GL and TÜV have developed specialized testing protocols that verify compliance with grid codes while assessing the unique performance characteristics of lithium acetate chemistry.

Future integration standards are evolving toward "plug-and-play" capabilities, with emerging specifications focusing on adaptive control algorithms that automatically configure storage systems to local grid requirements. The development of these advanced integration standards represents a significant opportunity for lithium acetate technology to demonstrate advantages in grid flexibility and responsiveness compared to conventional lithium-ion systems.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!