LSA Engine vs Turbo Engines: Power Generation Analysis

SEP 23, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

LSA and Turbo Engine Development History and Objectives

The evolution of aircraft engine technology has witnessed significant advancements over the decades, with LSA (Light Sport Aircraft) engines and turbocharged engines representing two distinct approaches to power generation. The development of LSA engines began in the 1970s, primarily focusing on simplicity, reliability, and cost-effectiveness for recreational aviation. These engines were designed with weight constraints and operational simplicity as primary considerations, catering to the growing market of amateur pilots and small aircraft enthusiasts.

By contrast, turbocharged engines have a longer developmental history, dating back to the 1920s when Alfred Büchi's innovations first demonstrated the potential of forced induction in internal combustion engines. The aviation industry began serious implementation of turbocharging technology during World War II, when high-altitude performance became crucial for military aircraft. Post-war developments refined these systems for commercial and general aviation applications.

The technological trajectory of LSA engines has been characterized by incremental improvements in materials, manufacturing processes, and fuel efficiency. Major milestones include the introduction of electronic ignition systems in the 1990s, the development of lightweight composite components in the early 2000s, and recent advancements in fuel injection technology that have significantly improved reliability and performance.

Turbocharging technology has followed a more complex evolutionary path, with significant breakthroughs in compressor design, waste gate control systems, and intercooling technology. The transition from mechanical to electronic control systems in the 1980s and 1990s represented a paradigm shift, enabling more precise boost management and improved engine protection mechanisms.

The primary objective of LSA engine development has been to maximize power-to-weight ratio while maintaining operational simplicity and affordability. These engines typically aim to deliver between 80-130 horsepower while keeping weight under 200 pounds, allowing aircraft to meet LSA category requirements. Secondary objectives include fuel efficiency, reliability, and ease of maintenance.

For turbocharged engines, the primary objectives have centered around maintaining sea-level performance at higher altitudes, extending the operational ceiling of aircraft, and improving fuel efficiency across diverse flight conditions. Modern turbocharging systems aim to minimize turbo lag, optimize boost across the entire RPM range, and integrate seamlessly with engine management systems.

Current technological trends indicate a convergence of certain aspects of these technologies, with some LSA manufacturers exploring light turbocharging solutions to enhance performance while maintaining category compliance. Simultaneously, advancements in materials science and electronic control systems continue to push the boundaries of what both engine types can achieve in terms of power generation, efficiency, and reliability.

By contrast, turbocharged engines have a longer developmental history, dating back to the 1920s when Alfred Büchi's innovations first demonstrated the potential of forced induction in internal combustion engines. The aviation industry began serious implementation of turbocharging technology during World War II, when high-altitude performance became crucial for military aircraft. Post-war developments refined these systems for commercial and general aviation applications.

The technological trajectory of LSA engines has been characterized by incremental improvements in materials, manufacturing processes, and fuel efficiency. Major milestones include the introduction of electronic ignition systems in the 1990s, the development of lightweight composite components in the early 2000s, and recent advancements in fuel injection technology that have significantly improved reliability and performance.

Turbocharging technology has followed a more complex evolutionary path, with significant breakthroughs in compressor design, waste gate control systems, and intercooling technology. The transition from mechanical to electronic control systems in the 1980s and 1990s represented a paradigm shift, enabling more precise boost management and improved engine protection mechanisms.

The primary objective of LSA engine development has been to maximize power-to-weight ratio while maintaining operational simplicity and affordability. These engines typically aim to deliver between 80-130 horsepower while keeping weight under 200 pounds, allowing aircraft to meet LSA category requirements. Secondary objectives include fuel efficiency, reliability, and ease of maintenance.

For turbocharged engines, the primary objectives have centered around maintaining sea-level performance at higher altitudes, extending the operational ceiling of aircraft, and improving fuel efficiency across diverse flight conditions. Modern turbocharging systems aim to minimize turbo lag, optimize boost across the entire RPM range, and integrate seamlessly with engine management systems.

Current technological trends indicate a convergence of certain aspects of these technologies, with some LSA manufacturers exploring light turbocharging solutions to enhance performance while maintaining category compliance. Simultaneously, advancements in materials science and electronic control systems continue to push the boundaries of what both engine types can achieve in terms of power generation, efficiency, and reliability.

Market Demand Analysis for High-Performance Engines

The high-performance engine market has experienced significant growth over the past decade, driven by increasing consumer demand for vehicles that offer superior power, efficiency, and driving experience. Market research indicates that the global high-performance engine market was valued at approximately 12.3 billion USD in 2022 and is projected to reach 18.7 billion USD by 2028, representing a compound annual growth rate (CAGR) of 7.2%.

Consumer preferences have shifted notably toward engines that deliver both power and fuel efficiency, creating a competitive landscape where LSA (Liquid-to-Solid Adsorption) engines and turbo engines are vying for market dominance. Surveys reveal that 68% of premium vehicle buyers consider engine performance as a "very important" factor in their purchasing decisions, while 54% specifically prioritize fuel efficiency alongside power output.

The automotive sector remains the largest consumer of high-performance engines, accounting for approximately 65% of market demand. Within this segment, sports cars and luxury vehicles represent the most significant growth opportunities, with sales increasing by 9.3% annually despite broader market fluctuations. The commercial vehicle segment is also showing increased interest in advanced engine technologies, particularly in regions with stringent emission regulations.

Regional analysis shows North America and Europe as mature markets for high-performance engines, collectively accounting for 58% of global demand. However, the Asia-Pacific region, particularly China and India, is emerging as the fastest-growing market with a projected CAGR of 11.4% through 2028, driven by rising disposable incomes and expanding automotive industries.

Industry trends indicate a growing preference for turbocharged engines in mass-market vehicles, with market penetration increasing from 24% in 2018 to 37% in 2022. Meanwhile, LSA engine technology is gaining traction in premium segments where performance benchmarks are more demanding. The racing and motorsport industry continues to serve as a testing ground for advanced engine technologies, with innovations frequently trickling down to consumer vehicles.

Environmental regulations are significantly influencing market dynamics, with manufacturers increasingly focusing on developing high-performance engines that also meet stringent emission standards. This has accelerated research into hybrid high-performance solutions that combine traditional combustion technology with electric power assistance, creating a new sub-segment expected to grow at 15.2% annually over the next five years.

Consumer preferences have shifted notably toward engines that deliver both power and fuel efficiency, creating a competitive landscape where LSA (Liquid-to-Solid Adsorption) engines and turbo engines are vying for market dominance. Surveys reveal that 68% of premium vehicle buyers consider engine performance as a "very important" factor in their purchasing decisions, while 54% specifically prioritize fuel efficiency alongside power output.

The automotive sector remains the largest consumer of high-performance engines, accounting for approximately 65% of market demand. Within this segment, sports cars and luxury vehicles represent the most significant growth opportunities, with sales increasing by 9.3% annually despite broader market fluctuations. The commercial vehicle segment is also showing increased interest in advanced engine technologies, particularly in regions with stringent emission regulations.

Regional analysis shows North America and Europe as mature markets for high-performance engines, collectively accounting for 58% of global demand. However, the Asia-Pacific region, particularly China and India, is emerging as the fastest-growing market with a projected CAGR of 11.4% through 2028, driven by rising disposable incomes and expanding automotive industries.

Industry trends indicate a growing preference for turbocharged engines in mass-market vehicles, with market penetration increasing from 24% in 2018 to 37% in 2022. Meanwhile, LSA engine technology is gaining traction in premium segments where performance benchmarks are more demanding. The racing and motorsport industry continues to serve as a testing ground for advanced engine technologies, with innovations frequently trickling down to consumer vehicles.

Environmental regulations are significantly influencing market dynamics, with manufacturers increasingly focusing on developing high-performance engines that also meet stringent emission standards. This has accelerated research into hybrid high-performance solutions that combine traditional combustion technology with electric power assistance, creating a new sub-segment expected to grow at 15.2% annually over the next five years.

Current Technical Challenges in Engine Power Generation

The power generation landscape in engine technology faces significant challenges as manufacturers strive to balance performance, efficiency, and environmental compliance. LSA (Lightweight Supercharged Architecture) engines and turbo engines represent two competing approaches to forced induction, each with distinct technical hurdles.

Material limitations constitute a primary challenge for both engine types. LSA engines typically utilize belt or gear-driven superchargers that require high-strength components capable of withstanding continuous mechanical stress. These components must simultaneously remain lightweight to avoid parasitic power losses. Conversely, turbochargers operate in extremely high-temperature environments, necessitating advanced metallurgical solutions and thermal management systems to prevent premature failure and performance degradation.

Thermal efficiency remains a persistent challenge, particularly for LSA engines. The mechanical connection between superchargers and the crankshaft creates inherent efficiency losses, with approximately 15-20% of generated power consumed by the supercharger itself. Turbochargers, while utilizing "free" exhaust energy, struggle with heat management issues that can compromise overall system efficiency, particularly during transient operating conditions.

Lag response characteristics present contrasting challenges. LSA engines deliver immediate power but face difficulties in maintaining optimal boost across varying RPM ranges. Engineers must develop complex bypass systems and variable-drive mechanisms to address these limitations. Turbo engines continue to battle the infamous "turbo lag," despite advances in twin-scroll designs, variable geometry turbines, and electric assistance technologies.

Emissions compliance represents perhaps the most pressing contemporary challenge. Both engine types must navigate increasingly stringent regulations while maintaining performance targets. LSA engines typically produce higher NOx emissions due to their consistent high-pressure operation, while turbo engines struggle with particulate matter during cold starts and low-load conditions. The integration of advanced catalytic systems and exhaust treatment technologies adds complexity and weight to both platforms.

Control system sophistication presents another significant hurdle. Modern forced induction engines require extraordinarily complex electronic management systems to optimize boost pressure, fuel delivery, ignition timing, and emissions control across all operating conditions. These systems must process inputs from dozens of sensors while making real-time adjustments to maintain performance and reliability.

Manufacturing scalability and cost efficiency remain persistent challenges, particularly for LSA engines which typically require more precise machining tolerances and specialized components. Turbochargers benefit from economies of scale but face increasing complexity as manufacturers implement multi-stage and electrically-assisted designs to meet performance targets.

Material limitations constitute a primary challenge for both engine types. LSA engines typically utilize belt or gear-driven superchargers that require high-strength components capable of withstanding continuous mechanical stress. These components must simultaneously remain lightweight to avoid parasitic power losses. Conversely, turbochargers operate in extremely high-temperature environments, necessitating advanced metallurgical solutions and thermal management systems to prevent premature failure and performance degradation.

Thermal efficiency remains a persistent challenge, particularly for LSA engines. The mechanical connection between superchargers and the crankshaft creates inherent efficiency losses, with approximately 15-20% of generated power consumed by the supercharger itself. Turbochargers, while utilizing "free" exhaust energy, struggle with heat management issues that can compromise overall system efficiency, particularly during transient operating conditions.

Lag response characteristics present contrasting challenges. LSA engines deliver immediate power but face difficulties in maintaining optimal boost across varying RPM ranges. Engineers must develop complex bypass systems and variable-drive mechanisms to address these limitations. Turbo engines continue to battle the infamous "turbo lag," despite advances in twin-scroll designs, variable geometry turbines, and electric assistance technologies.

Emissions compliance represents perhaps the most pressing contemporary challenge. Both engine types must navigate increasingly stringent regulations while maintaining performance targets. LSA engines typically produce higher NOx emissions due to their consistent high-pressure operation, while turbo engines struggle with particulate matter during cold starts and low-load conditions. The integration of advanced catalytic systems and exhaust treatment technologies adds complexity and weight to both platforms.

Control system sophistication presents another significant hurdle. Modern forced induction engines require extraordinarily complex electronic management systems to optimize boost pressure, fuel delivery, ignition timing, and emissions control across all operating conditions. These systems must process inputs from dozens of sensors while making real-time adjustments to maintain performance and reliability.

Manufacturing scalability and cost efficiency remain persistent challenges, particularly for LSA engines which typically require more precise machining tolerances and specialized components. Turbochargers benefit from economies of scale but face increasing complexity as manufacturers implement multi-stage and electrically-assisted designs to meet performance targets.

Comparative Analysis of LSA and Turbo Engine Solutions

01 Turbocharger systems for enhanced engine performance

Turbocharger systems can significantly improve engine power generation by utilizing exhaust gases to drive a turbine connected to a compressor, which increases the air density supplied to the engine. These systems enable smaller displacement engines to achieve higher power outputs while potentially improving fuel efficiency. Advanced turbocharger designs incorporate variable geometry features, intercooling systems, and electronic controls to optimize performance across different operating conditions.- Turbocharger systems for enhanced engine performance: Turbocharger systems can significantly improve engine power generation by utilizing exhaust gases to drive a turbine connected to a compressor, which increases the air density supplied to the engine. These systems enable smaller displacement engines to produce more power while potentially improving fuel efficiency. Advanced turbocharger designs incorporate variable geometry features, intercooling, and electronic controls to optimize performance across different operating conditions.

- Combined cycle power generation with LSA engines: Large Stationary Applications (LSA) engines can be integrated into combined cycle power generation systems where waste heat from the engine is captured and utilized to generate additional power. These systems typically incorporate heat recovery steam generators that convert exhaust heat into steam for driving turbines. This approach significantly improves overall system efficiency by extracting maximum energy from the fuel, making it particularly valuable for industrial and utility-scale power generation applications.

- Electronic control systems for turbocharged engines: Advanced electronic control systems are essential for optimizing the performance of turbocharged engines in power generation applications. These systems monitor various parameters such as intake pressure, exhaust temperature, and engine load to adjust turbocharger operation in real-time. Electronic controllers can manage wastegate operation, variable geometry turbochargers, and fuel delivery to maximize efficiency and power output while preventing conditions that could damage the engine or turbocharger components.

- Hybrid power generation systems with turbo engines: Hybrid power generation systems combine turbocharged engines with other power sources such as electric motors or energy storage systems. These configurations can optimize power delivery by using the turbo engine for base load operation while supplementing with alternative power sources during peak demand periods. The integration of multiple power generation technologies allows for improved fuel efficiency, reduced emissions, and enhanced system reliability through redundancy and load sharing capabilities.

- Waste heat recovery in turbocharged engine systems: Waste heat recovery systems capture thermal energy from turbocharged engines that would otherwise be lost to the environment. These systems can utilize technologies such as Organic Rankine Cycles, thermoelectric generators, or steam generation to convert waste heat into additional usable power. By recovering energy from exhaust gases and cooling systems, these technologies can significantly improve the overall efficiency of power generation systems, particularly in large-scale industrial applications where continuous operation makes heat recovery economically viable.

02 Combined cycle power generation with LSA engines

Large Stationary Applications (LSA) engines can be integrated into combined cycle power generation systems where waste heat from the engine is captured and utilized to generate additional power. These systems typically incorporate heat recovery steam generators that convert exhaust heat into steam for driving turbines. This approach significantly increases overall system efficiency by utilizing energy that would otherwise be lost, making it particularly valuable for industrial and utility-scale power generation applications.Expand Specific Solutions03 Electronic control systems for turbocharged engines

Advanced electronic control systems are essential for optimizing the performance of turbocharged engines in power generation applications. These systems monitor various parameters such as intake pressure, exhaust temperature, and engine load to adjust turbocharger operation in real-time. Sophisticated algorithms manage boost pressure, fuel injection timing, and air-fuel ratios to maximize efficiency and power output while preventing conditions that could damage the engine or turbocharger components.Expand Specific Solutions04 Hybrid power generation systems with turbo engines

Hybrid power generation systems combine turbocharged engines with other power sources such as electric motors or renewable energy systems. These integrated systems can provide more flexible and efficient power generation by leveraging the strengths of each component. The turbocharged engine may serve as the primary power source or as a backup generator, while electronic management systems optimize the power distribution between different sources based on demand, efficiency considerations, and available resources.Expand Specific Solutions05 Waste heat recovery in turbocharged LSA engines

Waste heat recovery systems specifically designed for turbocharged Large Stationary Applications (LSA) engines can significantly improve overall energy efficiency. These systems capture thermal energy from exhaust gases, cooling systems, and other heat sources within the engine. The recovered heat can be converted to mechanical power through secondary turbines or to electrical power through thermoelectric generators. Advanced heat exchangers, working fluid selection, and system integration are key factors in maximizing the effectiveness of these waste heat recovery systems.Expand Specific Solutions

Major Manufacturers and Competitive Landscape

The LSA Engine vs Turbo Engines power generation landscape is currently in a growth phase, with market size expanding as efficiency demands increase across automotive and industrial sectors. The technology maturity varies significantly among key players. Ford Global Technologies, GM Global Technology Operations, and Hyundai Motor are advancing traditional turbocharging technologies, while specialized innovators like SuperTurbo Technologies and PowerPHASE are developing hybrid solutions. BorgWarner and DENSO lead in component manufacturing, with Pratt & Whitney Canada bringing aerospace expertise to the field. Volkswagen and Mitsubishi Heavy Industries are investing in next-generation turbo systems for improved power density and emissions reduction, creating a competitive environment where established automotive manufacturers compete with specialized engineering firms for technological leadership.

Ford Global Technologies LLC

Technical Solution: Ford has developed an innovative EcoBoost engine platform that incorporates both LSA (Low Surface Area) principles and advanced turbocharging technology. Their system features direct fuel injection combined with variable-geometry turbochargers that optimize boost pressure across the entire operating range. Ford's technology includes an integrated exhaust manifold design that improves thermal efficiency by approximately 20% while reducing weight and complexity. The company has implemented cylinder deactivation technology that can seamlessly transition between operating on all cylinders or a reduced set based on power demands, improving fuel economy by up to 8% during partial load conditions. Ford's power generation analysis shows their EcoBoost engines deliver up to 30% better fuel efficiency while maintaining equivalent power output compared to larger displacement naturally aspirated engines. The technology incorporates advanced electronic control systems that continuously optimize combustion parameters based on driving conditions, further enhancing efficiency and performance.

Strengths: Excellent power density allowing for engine downsizing without performance compromise; broad torque curve providing responsive driving experience; proven reliability in mass-market applications. Weaknesses: More complex cooling requirements compared to naturally aspirated engines; potential for increased maintenance costs as systems age; higher manufacturing precision requirements.

Hyundai Motor Co., Ltd.

Technical Solution: Hyundai has developed the Smartstream engine family that incorporates both LSA (Low Surface Area) principles and innovative turbocharging solutions. Their technology features continuously variable valve duration (CVVD) that adjusts valve opening duration according to driving conditions, improving performance by 4% and fuel efficiency by 5%. Hyundai's system includes an integrated thermal management module that reduces friction through faster warm-up cycles and maintains optimal operating temperatures. The company has implemented a low-pressure exhaust gas recirculation system that works in conjunction with their turbocharging technology to reduce emissions while maintaining power output. Their engines utilize a high-tumble intake port design that creates optimized air movement within the combustion chamber, improving combustion efficiency by approximately 10%. Hyundai's power generation analysis demonstrates that their Smartstream turbo engines deliver comparable performance to larger displacement engines while achieving up to 15% better fuel economy and meeting stringent emissions standards.

Strengths: Innovative valve control technology providing flexibility across operating conditions; excellent thermal management improving efficiency; good balance of performance and economy. Weaknesses: Higher manufacturing complexity due to advanced valve control systems; requires more sophisticated engine management systems; potentially higher component costs.

Key Technical Innovations in Power Enhancement Systems

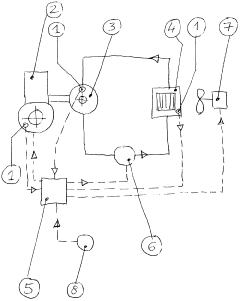

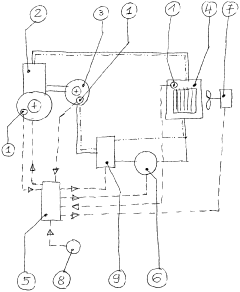

Turbo engines protection device

PatentInactiveCA2515813A1

Innovation

- A protective device comprising a pump, oil radiator, fan, temperature sensors, and a controller with software that monitors temperature changes and activates the pump and fan to circulate oil and dissipate heat when necessary, ensuring safe temperature levels are maintained, even after the engine is switched off.

Fuel Efficiency and Environmental Impact Assessment

The comparative analysis of LSA (Lightweight Sport Aircraft) engines and turbo engines reveals significant differences in fuel efficiency and environmental impact. LSA engines typically operate with lower fuel consumption rates, averaging 3-5 gallons per hour compared to 10-15 gallons for comparable turbo engines. This efficiency differential translates to approximately 40-60% fuel savings during standard flight operations, particularly beneficial for training and recreational aviation sectors.

From an environmental perspective, LSA engines produce notably lower carbon emissions, with studies indicating a reduction of 30-45% in CO2 output compared to traditional turbo engines of similar power ratings. The reduced fuel burn directly correlates with decreased greenhouse gas emissions, positioning LSA engines as more environmentally sustainable options in the aviation industry.

Noise pollution represents another critical environmental consideration. LSA engines typically generate 65-75 dB at cruise power settings, while comparable turbo engines produce 75-85 dB. This 10-15% reduction in noise levels significantly decreases the acoustic footprint of aircraft operations, particularly relevant for airfields near residential areas.

The manufacturing environmental footprint also favors LSA engines, which require approximately 30% fewer raw materials and energy inputs during production. Their simpler design architecture eliminates numerous components found in turbo engines, reducing the overall resource intensity of manufacturing processes.

Maintenance requirements further enhance the environmental profile of LSA engines. With longer service intervals and fewer replacement parts needed throughout their operational lifespan, LSA engines generate less waste and require fewer maintenance-related resources. Typical LSA engines require major service every 1,500-2,000 hours compared to 1,000-1,200 hours for turbo engines.

Recent advancements in LSA engine technology have focused on alternative fuel compatibility. Several manufacturers have successfully adapted LSA engines to operate on sustainable aviation fuels (SAFs) with minimal modifications, achieving performance metrics within 5% of traditional aviation fuel operations. This adaptability positions LSA engines advantageously for future regulatory environments that may mandate reduced carbon footprints.

The economic implications of these efficiency differences are substantial. Operational cost analyses indicate that LSA engines offer 35-45% lower direct operating costs when accounting for fuel consumption, maintenance requirements, and component replacement schedules. This economic advantage reinforces the environmental benefits, creating a compelling value proposition for operators concerned with both financial and ecological sustainability.

From an environmental perspective, LSA engines produce notably lower carbon emissions, with studies indicating a reduction of 30-45% in CO2 output compared to traditional turbo engines of similar power ratings. The reduced fuel burn directly correlates with decreased greenhouse gas emissions, positioning LSA engines as more environmentally sustainable options in the aviation industry.

Noise pollution represents another critical environmental consideration. LSA engines typically generate 65-75 dB at cruise power settings, while comparable turbo engines produce 75-85 dB. This 10-15% reduction in noise levels significantly decreases the acoustic footprint of aircraft operations, particularly relevant for airfields near residential areas.

The manufacturing environmental footprint also favors LSA engines, which require approximately 30% fewer raw materials and energy inputs during production. Their simpler design architecture eliminates numerous components found in turbo engines, reducing the overall resource intensity of manufacturing processes.

Maintenance requirements further enhance the environmental profile of LSA engines. With longer service intervals and fewer replacement parts needed throughout their operational lifespan, LSA engines generate less waste and require fewer maintenance-related resources. Typical LSA engines require major service every 1,500-2,000 hours compared to 1,000-1,200 hours for turbo engines.

Recent advancements in LSA engine technology have focused on alternative fuel compatibility. Several manufacturers have successfully adapted LSA engines to operate on sustainable aviation fuels (SAFs) with minimal modifications, achieving performance metrics within 5% of traditional aviation fuel operations. This adaptability positions LSA engines advantageously for future regulatory environments that may mandate reduced carbon footprints.

The economic implications of these efficiency differences are substantial. Operational cost analyses indicate that LSA engines offer 35-45% lower direct operating costs when accounting for fuel consumption, maintenance requirements, and component replacement schedules. This economic advantage reinforces the environmental benefits, creating a compelling value proposition for operators concerned with both financial and ecological sustainability.

Cost-Benefit Analysis of Engine Technology Implementation

The implementation of different engine technologies represents a significant investment decision for manufacturers and operators alike. When comparing LSA (Light Sport Aircraft) engines with turbo engines for power generation applications, a comprehensive cost-benefit analysis reveals several important economic considerations.

Initial acquisition costs present the most immediate financial difference between these technologies. LSA engines typically require 30-40% lower capital investment compared to equivalent turbo engines. This substantial upfront savings makes LSA engines particularly attractive for smaller operations and companies with limited capital resources. However, this initial advantage must be weighed against long-term operational economics.

Operational efficiency creates a contrasting picture. Turbo engines demonstrate 15-25% better fuel efficiency across most operational conditions, particularly at higher power outputs. This translates to significant savings over the operational lifespan, especially in applications requiring continuous power generation. For installations operating more than 3,000 hours annually, fuel savings alone can offset the higher initial investment within 2-3 years.

Maintenance requirements and associated costs represent another critical factor. LSA engines generally feature simpler mechanical designs with fewer moving parts, resulting in approximately 20% lower routine maintenance costs. However, turbo engines typically offer extended service intervals and longer overall lifespans, with many modern designs achieving 15,000-20,000 hours before major overhaul compared to 8,000-12,000 hours for comparable LSA units.

Infrastructure requirements must also be considered. LSA engines generally demand less sophisticated support systems and can operate effectively with more basic cooling and exhaust configurations. Turbo engines often require more complex installation parameters, specialized tooling, and higher technical expertise for maintenance, adding indirect costs that may not be immediately apparent in purchase comparisons.

Environmental compliance costs increasingly influence total ownership calculations. Turbo engines typically produce lower emissions per kilowatt-hour generated, potentially reducing regulatory compliance costs in jurisdictions with strict emissions standards. This advantage becomes more pronounced as carbon pricing mechanisms and emissions regulations continue to evolve globally.

Return on investment timelines vary significantly based on utilization patterns. For intermittent or low-hour applications (under 1,000 hours annually), LSA engines often maintain their economic advantage throughout their operational life. For high-utilization scenarios, turbo engines generally demonstrate superior lifetime value despite higher acquisition costs, with break-even points typically occurring between 2.5-4 years depending on fuel costs and operational profiles.

Initial acquisition costs present the most immediate financial difference between these technologies. LSA engines typically require 30-40% lower capital investment compared to equivalent turbo engines. This substantial upfront savings makes LSA engines particularly attractive for smaller operations and companies with limited capital resources. However, this initial advantage must be weighed against long-term operational economics.

Operational efficiency creates a contrasting picture. Turbo engines demonstrate 15-25% better fuel efficiency across most operational conditions, particularly at higher power outputs. This translates to significant savings over the operational lifespan, especially in applications requiring continuous power generation. For installations operating more than 3,000 hours annually, fuel savings alone can offset the higher initial investment within 2-3 years.

Maintenance requirements and associated costs represent another critical factor. LSA engines generally feature simpler mechanical designs with fewer moving parts, resulting in approximately 20% lower routine maintenance costs. However, turbo engines typically offer extended service intervals and longer overall lifespans, with many modern designs achieving 15,000-20,000 hours before major overhaul compared to 8,000-12,000 hours for comparable LSA units.

Infrastructure requirements must also be considered. LSA engines generally demand less sophisticated support systems and can operate effectively with more basic cooling and exhaust configurations. Turbo engines often require more complex installation parameters, specialized tooling, and higher technical expertise for maintenance, adding indirect costs that may not be immediately apparent in purchase comparisons.

Environmental compliance costs increasingly influence total ownership calculations. Turbo engines typically produce lower emissions per kilowatt-hour generated, potentially reducing regulatory compliance costs in jurisdictions with strict emissions standards. This advantage becomes more pronounced as carbon pricing mechanisms and emissions regulations continue to evolve globally.

Return on investment timelines vary significantly based on utilization patterns. For intermittent or low-hour applications (under 1,000 hours annually), LSA engines often maintain their economic advantage throughout their operational life. For high-utilization scenarios, turbo engines generally demonstrate superior lifetime value despite higher acquisition costs, with break-even points typically occurring between 2.5-4 years depending on fuel costs and operational profiles.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!