Oleoresin Application in Waterproof Coatings: Success Metrics

SEP 10, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Oleoresin Waterproofing Technology Background and Objectives

Oleoresin, a natural resinous substance extracted from various plants, particularly pine trees, has a rich historical background in waterproofing applications dating back centuries. Traditional societies utilized these sticky, hydrophobic substances to seal boats, protect wooden structures, and create water-resistant coverings. The evolution of oleoresin technology has progressed significantly from these rudimentary applications to sophisticated modern formulations that enhance waterproofing performance in contemporary coating systems.

The global shift toward sustainable and bio-based materials has reinvigorated interest in oleoresin technologies. As petroleum-based waterproofing solutions face increasing environmental scrutiny, oleoresins present a renewable alternative with promising performance characteristics. This renewed focus aligns with broader industry trends toward green chemistry and reduced environmental impact across the construction and protective coatings sectors.

Current technological developments in oleoresin waterproofing focus on overcoming historical limitations such as color stability, UV resistance, and long-term durability. Research efforts are concentrated on modifying natural oleoresins through chemical processes to enhance their compatibility with modern coating systems while preserving their inherent hydrophobic properties. These modifications aim to improve cross-linking capabilities, adhesion characteristics, and resistance to environmental degradation.

The primary technical objectives for oleoresin application in waterproof coatings include developing standardized extraction and refinement processes to ensure consistent quality, creating stable formulations that maintain performance over extended periods, and establishing reliable metrics to quantify waterproofing effectiveness. Additional goals involve reducing production costs to achieve market competitiveness with synthetic alternatives and optimizing application methods for various substrate materials.

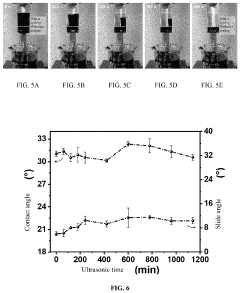

Success metrics for oleoresin-based waterproofing technologies are multifaceted, encompassing performance parameters such as water contact angle measurements, water vapor transmission rates, and resistance to hydrostatic pressure. Durability metrics include weathering resistance, thermal stability, and chemical resistance. Environmental metrics focus on biodegradability, VOC emissions, and overall carbon footprint compared to petroleum-based alternatives.

The technological trajectory suggests a convergence of traditional oleoresin knowledge with advanced material science, potentially yielding hybrid systems that combine the environmental benefits of bio-based materials with the performance advantages of synthetic polymers. This integration represents a promising direction for next-generation waterproofing solutions that balance technical performance with sustainability requirements.

The global shift toward sustainable and bio-based materials has reinvigorated interest in oleoresin technologies. As petroleum-based waterproofing solutions face increasing environmental scrutiny, oleoresins present a renewable alternative with promising performance characteristics. This renewed focus aligns with broader industry trends toward green chemistry and reduced environmental impact across the construction and protective coatings sectors.

Current technological developments in oleoresin waterproofing focus on overcoming historical limitations such as color stability, UV resistance, and long-term durability. Research efforts are concentrated on modifying natural oleoresins through chemical processes to enhance their compatibility with modern coating systems while preserving their inherent hydrophobic properties. These modifications aim to improve cross-linking capabilities, adhesion characteristics, and resistance to environmental degradation.

The primary technical objectives for oleoresin application in waterproof coatings include developing standardized extraction and refinement processes to ensure consistent quality, creating stable formulations that maintain performance over extended periods, and establishing reliable metrics to quantify waterproofing effectiveness. Additional goals involve reducing production costs to achieve market competitiveness with synthetic alternatives and optimizing application methods for various substrate materials.

Success metrics for oleoresin-based waterproofing technologies are multifaceted, encompassing performance parameters such as water contact angle measurements, water vapor transmission rates, and resistance to hydrostatic pressure. Durability metrics include weathering resistance, thermal stability, and chemical resistance. Environmental metrics focus on biodegradability, VOC emissions, and overall carbon footprint compared to petroleum-based alternatives.

The technological trajectory suggests a convergence of traditional oleoresin knowledge with advanced material science, potentially yielding hybrid systems that combine the environmental benefits of bio-based materials with the performance advantages of synthetic polymers. This integration represents a promising direction for next-generation waterproofing solutions that balance technical performance with sustainability requirements.

Market Analysis for Oleoresin-Based Waterproof Coatings

The global market for waterproof coatings has shown consistent growth over the past decade, with a compound annual growth rate (CAGR) of approximately 5-6%. This growth is primarily driven by expanding construction activities in developing regions, increasing awareness about building maintenance, and stricter regulations regarding building durability and safety. Within this broader market, oleoresin-based waterproof coatings represent an emerging segment with significant potential for expansion.

Oleoresin-based waterproof coatings currently occupy a niche position, accounting for about 3-4% of the total waterproof coatings market. However, this segment is experiencing faster growth than traditional synthetic alternatives, particularly in eco-conscious markets such as Western Europe and North America. The increasing consumer preference for sustainable and bio-based products has created a favorable environment for oleoresin applications.

The construction industry remains the primary consumer of oleoresin-based waterproof coatings, particularly for residential roofing, exterior walls, and basement waterproofing. Secondary markets include marine applications, industrial flooring, and specialized infrastructure projects where environmental considerations are paramount. Geographically, Europe leads in adoption, followed by North America and select Asian markets including Japan and South Korea.

Market research indicates that consumers are willing to pay a premium of 15-20% for bio-based waterproofing solutions compared to petroleum-based alternatives, provided performance metrics are comparable. This price elasticity is most evident in high-end residential construction and green building projects seeking certification under systems like LEED or BREEAM.

Competition in this space remains relatively limited, with fewer than ten major manufacturers specializing in oleoresin-based waterproof coatings globally. This presents both an opportunity for new entrants and a challenge in terms of supply chain development and manufacturing scale-up. The fragmented nature of the market also indicates potential for consolidation as the technology matures.

Regulatory tailwinds are significant market drivers, with several countries implementing stricter VOC (Volatile Organic Compound) regulations and offering incentives for bio-based building materials. The European Green Deal and similar initiatives worldwide are expected to further accelerate market growth for sustainable waterproofing solutions over the next five years.

Customer feedback analysis reveals that while environmental benefits are important, performance metrics remain the primary consideration for professional buyers. Durability, water resistance under pressure, UV stability, and ease of application are consistently cited as critical success factors. This suggests that market penetration strategies should emphasize performance parity or superiority rather than solely environmental advantages.

Oleoresin-based waterproof coatings currently occupy a niche position, accounting for about 3-4% of the total waterproof coatings market. However, this segment is experiencing faster growth than traditional synthetic alternatives, particularly in eco-conscious markets such as Western Europe and North America. The increasing consumer preference for sustainable and bio-based products has created a favorable environment for oleoresin applications.

The construction industry remains the primary consumer of oleoresin-based waterproof coatings, particularly for residential roofing, exterior walls, and basement waterproofing. Secondary markets include marine applications, industrial flooring, and specialized infrastructure projects where environmental considerations are paramount. Geographically, Europe leads in adoption, followed by North America and select Asian markets including Japan and South Korea.

Market research indicates that consumers are willing to pay a premium of 15-20% for bio-based waterproofing solutions compared to petroleum-based alternatives, provided performance metrics are comparable. This price elasticity is most evident in high-end residential construction and green building projects seeking certification under systems like LEED or BREEAM.

Competition in this space remains relatively limited, with fewer than ten major manufacturers specializing in oleoresin-based waterproof coatings globally. This presents both an opportunity for new entrants and a challenge in terms of supply chain development and manufacturing scale-up. The fragmented nature of the market also indicates potential for consolidation as the technology matures.

Regulatory tailwinds are significant market drivers, with several countries implementing stricter VOC (Volatile Organic Compound) regulations and offering incentives for bio-based building materials. The European Green Deal and similar initiatives worldwide are expected to further accelerate market growth for sustainable waterproofing solutions over the next five years.

Customer feedback analysis reveals that while environmental benefits are important, performance metrics remain the primary consideration for professional buyers. Durability, water resistance under pressure, UV stability, and ease of application are consistently cited as critical success factors. This suggests that market penetration strategies should emphasize performance parity or superiority rather than solely environmental advantages.

Current Challenges in Oleoresin Waterproofing Technology

Despite significant advancements in oleoresin-based waterproof coatings, several critical challenges continue to impede their widespread industrial adoption and optimal performance. The primary technical obstacle remains the inherent variability in oleoresin composition, which significantly affects coating consistency and quality control. Natural oleoresins extracted from different plant species, geographical locations, and harvesting seasons exhibit substantial chemical variations, making standardization difficult for manufacturing processes that demand precise formulations.

Stability issues present another major challenge, as oleoresins tend to undergo oxidation and polymerization over time, particularly when exposed to UV radiation and atmospheric oxygen. This degradation process alters their waterproofing properties and reduces the effective lifespan of coatings, necessitating more frequent reapplication compared to synthetic alternatives.

Compatibility with modern substrate materials poses significant integration difficulties. While oleoresins perform admirably on traditional surfaces like wood and certain masonry, they often exhibit poor adhesion to contemporary construction materials such as composites, certain metals, and engineered polymers. This limitation restricts their application scope in modern building systems and advanced industrial settings.

The processing complexity of oleoresins creates substantial manufacturing challenges. Their high viscosity and temperature sensitivity complicate handling during production, requiring specialized equipment and careful process control. Additionally, the solvents traditionally used to improve workability often conflict with increasingly stringent environmental regulations worldwide.

Scalability remains problematic due to supply chain vulnerabilities. The natural sourcing of oleoresins subjects production to seasonal variations, climate change impacts, and geopolitical disruptions in source regions. These factors create unpredictable fluctuations in both availability and pricing, making long-term planning difficult for industrial applications.

Water resistance performance, while generally good, still falls short of synthetic alternatives in extreme conditions. Current oleoresin formulations struggle to maintain optimal performance under prolonged water immersion or high-pressure water exposure, limiting their application in marine environments and critical infrastructure.

The curing process presents additional technical hurdles, as oleoresin coatings typically require longer drying times compared to synthetic alternatives. This extended curing period increases application costs and limits productivity in commercial and industrial settings where rapid turnaround is essential.

Regulatory compliance has emerged as a growing challenge, with varying international standards for volatile organic compound (VOC) emissions and chemical safety increasingly restricting traditional oleoresin formulations and processing methods. Reformulation to meet these standards often compromises performance characteristics.

Stability issues present another major challenge, as oleoresins tend to undergo oxidation and polymerization over time, particularly when exposed to UV radiation and atmospheric oxygen. This degradation process alters their waterproofing properties and reduces the effective lifespan of coatings, necessitating more frequent reapplication compared to synthetic alternatives.

Compatibility with modern substrate materials poses significant integration difficulties. While oleoresins perform admirably on traditional surfaces like wood and certain masonry, they often exhibit poor adhesion to contemporary construction materials such as composites, certain metals, and engineered polymers. This limitation restricts their application scope in modern building systems and advanced industrial settings.

The processing complexity of oleoresins creates substantial manufacturing challenges. Their high viscosity and temperature sensitivity complicate handling during production, requiring specialized equipment and careful process control. Additionally, the solvents traditionally used to improve workability often conflict with increasingly stringent environmental regulations worldwide.

Scalability remains problematic due to supply chain vulnerabilities. The natural sourcing of oleoresins subjects production to seasonal variations, climate change impacts, and geopolitical disruptions in source regions. These factors create unpredictable fluctuations in both availability and pricing, making long-term planning difficult for industrial applications.

Water resistance performance, while generally good, still falls short of synthetic alternatives in extreme conditions. Current oleoresin formulations struggle to maintain optimal performance under prolonged water immersion or high-pressure water exposure, limiting their application in marine environments and critical infrastructure.

The curing process presents additional technical hurdles, as oleoresin coatings typically require longer drying times compared to synthetic alternatives. This extended curing period increases application costs and limits productivity in commercial and industrial settings where rapid turnaround is essential.

Regulatory compliance has emerged as a growing challenge, with varying international standards for volatile organic compound (VOC) emissions and chemical safety increasingly restricting traditional oleoresin formulations and processing methods. Reformulation to meet these standards often compromises performance characteristics.

Current Oleoresin Waterproofing Technical Solutions

01 Extraction and processing methods for oleoresins

Various extraction and processing methods can be employed to obtain oleoresins with optimal properties. These methods include solvent extraction, supercritical fluid extraction, and steam distillation. The choice of extraction method significantly impacts the quality, yield, and composition of the oleoresin, which in turn affects its commercial success. Proper processing techniques can enhance the concentration of active compounds and improve stability.- Extraction and processing methods for oleoresins: Various extraction and processing methods can significantly impact the quality and yield of oleoresins. These methods include solvent extraction, supercritical fluid extraction, and steam distillation. The success of oleoresin production is measured by extraction efficiency, purity levels, and consistency of the final product. Optimization of these processes can lead to higher quality oleoresins with better market value and application potential.

- Quality assessment parameters for oleoresins: Success metrics for oleoresins include specific quality parameters such as color intensity, aroma profile, pungency levels, and active compound concentration. Standardized testing methods are employed to evaluate these parameters, ensuring consistent product quality. The stability of these characteristics over time is also a critical success metric, as it affects shelf life and application effectiveness in various industries including food, pharmaceuticals, and cosmetics.

- Market performance and commercial success indicators: Commercial success metrics for oleoresins include market penetration rates, profit margins, customer retention, and competitive positioning. Performance is evaluated through sales growth, market share expansion, and return on investment. The ability to meet specific industry demands and adapt to changing market conditions serves as a key indicator of oleoresin product success. Strategic pricing and distribution channels also contribute significantly to commercial performance.

- Sustainability and environmental impact assessment: Sustainability metrics for oleoresin production include resource efficiency, waste reduction, carbon footprint, and environmental impact. Success is measured by implementing eco-friendly extraction methods, utilizing renewable energy sources, and maintaining sustainable harvesting practices. The ability to demonstrate environmental stewardship while maintaining product quality and economic viability is increasingly becoming a critical success factor in the oleoresin industry.

- Technological innovation and product development metrics: Innovation metrics for oleoresins focus on new product development, process improvements, and technological advancements. Success is measured by patent generation, novel application development, and the ability to create differentiated products with enhanced properties. Research efficiency, time-to-market for new formulations, and the successful integration of oleoresins into advanced applications serve as key performance indicators in this category.

02 Quality assessment parameters for oleoresins

Success metrics for oleoresins include specific quality parameters such as purity levels, active compound concentration, color consistency, aroma profile, and shelf stability. These parameters are critical for determining the commercial value and application potential of oleoresins. Standardized testing methods are employed to measure these attributes, ensuring batch-to-batch consistency and meeting industry specifications.Expand Specific Solutions03 Market performance indicators for oleoresin products

Market success of oleoresin products can be measured through various business metrics including market share, profit margins, customer retention rates, and competitive positioning. These indicators help companies evaluate the commercial viability of their oleoresin offerings and make strategic decisions regarding product development and marketing. Performance tracking systems can be implemented to monitor these metrics over time and identify trends.Expand Specific Solutions04 Application-specific performance metrics for oleoresins

The success of oleoresins can be evaluated based on their performance in specific applications such as food flavoring, pharmaceuticals, cosmetics, and natural preservatives. Metrics include flavor enhancement capability, therapeutic efficacy, sensory attributes, and preservation effectiveness. Application-specific testing protocols are developed to assess these properties and ensure that the oleoresin meets the requirements of its intended use.Expand Specific Solutions05 Sustainability and production efficiency metrics

Success metrics for oleoresin production increasingly include sustainability indicators such as resource efficiency, carbon footprint, waste reduction, and ethical sourcing practices. Production efficiency metrics focus on yield optimization, energy consumption, processing time, and cost-effectiveness. These parameters are becoming more important as consumers and industries prioritize environmentally responsible products and processes.Expand Specific Solutions

Key Industry Players in Oleoresin Coating Market

The waterproof coatings market utilizing oleoresins is currently in a growth phase, with increasing demand driven by construction and infrastructure development globally. The market size is expanding steadily, estimated to reach significant value in the coming years due to rising awareness about building protection and sustainability requirements. Technologically, the field shows varying maturity levels, with established players like Henkel AG, DuPont Safety & Construction, and SOPREMA SAS leading with advanced formulations, while Asian companies including Kansai Paint and Asian Paints are rapidly gaining ground through innovation. Companies like Polyguard Products and Wacker Chemie are focusing on specialty applications, while chemical manufacturers such as Shin-Etsu Chemical and Mitsui Chemicals provide essential raw materials, creating a competitive ecosystem balancing between traditional expertise and emerging sustainable solutions.

SOPREMA SAS

Technical Solution: SOPREMA has pioneered the integration of pine and other plant-derived oleoresins into their ALSAN® waterproofing systems, creating high-performance liquid-applied membranes. Their technology utilizes a proprietary process that modifies natural oleoresins to enhance compatibility with synthetic polymers, resulting in coatings with exceptional elongation properties (>200%) and crack-bridging capabilities down to -20°C. SOPREMA's success metrics include water impermeability tests showing zero penetration under 1.5 bar pressure for 24 hours, adhesion strength exceeding 2.5 MPa on concrete substrates, and accelerated aging tests demonstrating less than 10% performance degradation after 3000 hours of QUV exposure. Their oleoresin-enhanced coatings also exhibit self-healing properties for microcracking and maintain flexibility throughout a service life of 25+ years, as verified through extensive field testing across diverse climate zones.

Strengths: Exceptional elasticity and crack-bridging ability; excellent cold-weather performance; proven long-term durability in diverse climates; environmentally responsible formulation. Weaknesses: Requires precise application conditions including temperature and humidity control; higher material cost compared to conventional bituminous membranes; limited color stability in dark shades.

Wacker Chemie AG

Technical Solution: Wacker Chemie AG has developed advanced silicone-oleoresin hybrid systems for waterproof coatings with exceptional durability. Their technology combines silicone polymers with natural and synthetic oleoresins to create highly water-repellent surfaces while maintaining breathability. The company's proprietary SILRES® BS technology incorporates modified pine and other plant-derived oleoresins that chemically bond with silicone polymers, creating a hydrophobic barrier that achieves water contact angles exceeding 140°. Their success metrics include accelerated weathering tests showing 95% performance retention after 2000 hours of UV exposure, water column pressure resistance of >1000mm, and VOC emissions reduction of 40% compared to conventional systems. Wacker's coatings demonstrate excellent adhesion to various substrates including concrete, wood, and metal, with pull-off strength values typically exceeding 2.0 N/mm².

Strengths: Superior long-term UV and weather resistance; excellent water repellency while maintaining vapor permeability; environmentally friendly with reduced VOC content. Weaknesses: Higher initial cost compared to conventional systems; requires specialized application techniques; performance may vary in extreme temperature conditions.

Key Patents and Innovations in Oleoresin Waterproofing

Method for preparing transparent fluorine-free, super-lubricating and oil-proof coating

PatentActiveUS20230242773A1

Innovation

- A transparent, fluorine-free, super-lubricating styrene copolymer coating with an interpenetrating polymer network structure is developed, using a sulfhydryl compound and hydroxyl silicon oil for chemical and physical crosslinking, which provides excellent adhesion resistance to liquids with high and low surface tension, including high viscosity oils, without the need for fluorosilane or micro-nano particles.

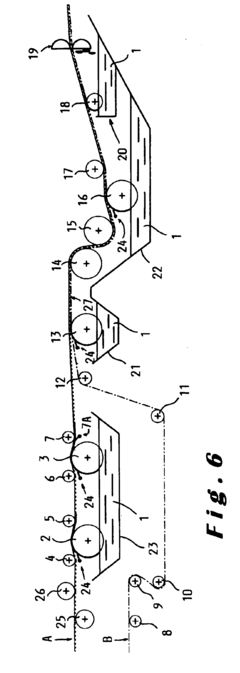

Waterproofing membrane and method for its manufacture

PatentInactiveEP1104818A1

Innovation

- Incorporating olefinic polymers with intrinsic crystallinity into the bituminous mass to stabilize oils and limit migration, and applying the bituminous mass to the lower face of fibers to prevent contamination and ensure even impregnation.

Environmental Impact and Sustainability Assessment

The environmental impact of oleoresin-based waterproof coatings represents a critical dimension in evaluating their overall viability and long-term success in commercial applications. Traditional waterproofing solutions often contain volatile organic compounds (VOCs) and synthetic polymers derived from petroleum, contributing significantly to environmental degradation and health concerns. In contrast, oleoresins, being naturally derived substances extracted primarily from coniferous trees, offer a potentially more sustainable alternative with reduced ecological footprint.

Life cycle assessment (LCA) studies indicate that oleoresin-based coatings generally demonstrate lower environmental impact across multiple categories including global warming potential, ozone depletion, and ecotoxicity. The production phase of oleoresins involves significantly lower energy consumption compared to synthetic alternatives, with some studies suggesting energy savings of up to 40-60% depending on extraction and processing methods employed.

Carbon footprint analysis reveals that oleoresin-based waterproof coatings can achieve carbon emission reductions of approximately 30-45% compared to conventional petroleum-based products. This reduction stems primarily from the renewable nature of the raw materials and the relatively simpler processing requirements. Furthermore, the biodegradability of oleoresin components means reduced end-of-life environmental impact, with decomposition rates typically 3-5 times faster than synthetic counterparts.

Water consumption metrics also favor oleoresin applications, with manufacturing processes requiring approximately 25-35% less water than conventional coating production. This advantage becomes particularly significant in water-stressed regions where manufacturing sustainability is increasingly scrutinized by regulatory bodies and consumers alike.

Toxicity assessments demonstrate that oleoresin-based coatings typically contain fewer hazardous substances, with reduced leaching of harmful compounds into soil and water systems during their service life. This characteristic is particularly valuable for applications in environmentally sensitive areas or where direct contact with water bodies is anticipated.

Regulatory compliance represents another dimension of sustainability assessment, with oleoresin-based products generally meeting stricter environmental standards with fewer formulation modifications. This compliance advantage translates to reduced reformulation costs and faster market access as environmental regulations continue to tighten globally.

Despite these advantages, challenges remain in scaling sustainable production methods for oleoresins without creating new environmental pressures. Sustainable harvesting practices must be implemented to prevent deforestation or ecosystem disruption, particularly as demand increases. Additionally, transportation impacts and regional availability of raw materials must be factored into comprehensive sustainability assessments to ensure that environmental benefits are not offset by logistical carbon emissions.

Life cycle assessment (LCA) studies indicate that oleoresin-based coatings generally demonstrate lower environmental impact across multiple categories including global warming potential, ozone depletion, and ecotoxicity. The production phase of oleoresins involves significantly lower energy consumption compared to synthetic alternatives, with some studies suggesting energy savings of up to 40-60% depending on extraction and processing methods employed.

Carbon footprint analysis reveals that oleoresin-based waterproof coatings can achieve carbon emission reductions of approximately 30-45% compared to conventional petroleum-based products. This reduction stems primarily from the renewable nature of the raw materials and the relatively simpler processing requirements. Furthermore, the biodegradability of oleoresin components means reduced end-of-life environmental impact, with decomposition rates typically 3-5 times faster than synthetic counterparts.

Water consumption metrics also favor oleoresin applications, with manufacturing processes requiring approximately 25-35% less water than conventional coating production. This advantage becomes particularly significant in water-stressed regions where manufacturing sustainability is increasingly scrutinized by regulatory bodies and consumers alike.

Toxicity assessments demonstrate that oleoresin-based coatings typically contain fewer hazardous substances, with reduced leaching of harmful compounds into soil and water systems during their service life. This characteristic is particularly valuable for applications in environmentally sensitive areas or where direct contact with water bodies is anticipated.

Regulatory compliance represents another dimension of sustainability assessment, with oleoresin-based products generally meeting stricter environmental standards with fewer formulation modifications. This compliance advantage translates to reduced reformulation costs and faster market access as environmental regulations continue to tighten globally.

Despite these advantages, challenges remain in scaling sustainable production methods for oleoresins without creating new environmental pressures. Sustainable harvesting practices must be implemented to prevent deforestation or ecosystem disruption, particularly as demand increases. Additionally, transportation impacts and regional availability of raw materials must be factored into comprehensive sustainability assessments to ensure that environmental benefits are not offset by logistical carbon emissions.

Performance Metrics and Testing Standards

To effectively evaluate the success of oleoresin applications in waterproof coatings, a comprehensive set of performance metrics and standardized testing protocols must be established. These metrics serve as quantifiable indicators that determine whether the oleoresin-based waterproof coating meets industry requirements and customer expectations.

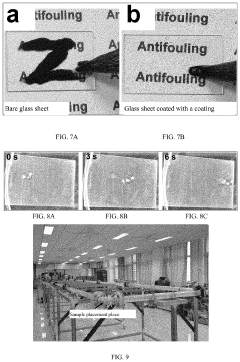

Water resistance remains the primary performance metric for these coatings, typically measured through water absorption tests (ASTM D570) and hydrostatic pressure resistance (AATCC 127). High-performing oleoresin waterproof coatings should demonstrate water absorption rates below 0.5% after 24-hour immersion and withstand hydrostatic pressure of at least 60 cm without leakage.

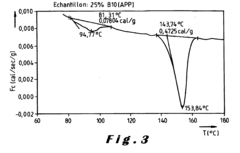

Durability metrics constitute another critical evaluation category, encompassing weathering resistance, UV stability, and thermal cycling performance. Accelerated weathering tests (ASTM G154) simulate years of outdoor exposure in condensed timeframes, while thermal cycling tests (ASTM D6944) assess coating integrity through temperature fluctuations from -40°C to 80°C. Oleoresin coatings should maintain at least 85% of their initial properties after these tests.

Adhesion strength, measured via pull-off tests (ASTM D4541) or cross-cut tests (ASTM D3359), determines how well the coating bonds to various substrates. Industry standards typically require minimum adhesion strength of 2.0 MPa for concrete surfaces and 3.0 MPa for metal substrates, with oleoresin formulations often exceeding these thresholds.

Chemical resistance represents another vital performance parameter, evaluated through exposure to acids, alkalis, solvents, and oils (ASTM D1308). Successful oleoresin waterproof coatings should show minimal degradation (less than 5% change in properties) after 7-day exposure to common chemicals.

Environmental impact metrics have gained prominence in recent years, including VOC content (EPA Method 24), biodegradability (OECD 301), and lifecycle assessment. Market-competitive oleoresin formulations now target VOC levels below 50 g/L while maintaining performance standards.

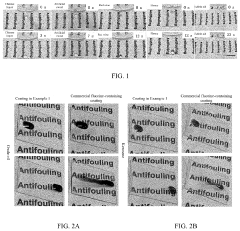

Application-specific metrics vary by industry sector. For construction applications, crack-bridging ability (ASTM C1305) and freeze-thaw resistance (ASTM C666) are paramount. Marine applications prioritize salt spray resistance (ASTM B117) and antifouling properties, while automotive coatings emphasize chip resistance (ASTM D3170) and flexibility (ASTM D522).

Cost-performance metrics complete the evaluation framework, balancing material costs, application efficiency, coverage rates, and service life. Successful oleoresin waterproof coatings typically achieve a cost-performance ratio that delivers 15-20% better long-term value than conventional petroleum-based alternatives, despite potentially higher initial costs.

Water resistance remains the primary performance metric for these coatings, typically measured through water absorption tests (ASTM D570) and hydrostatic pressure resistance (AATCC 127). High-performing oleoresin waterproof coatings should demonstrate water absorption rates below 0.5% after 24-hour immersion and withstand hydrostatic pressure of at least 60 cm without leakage.

Durability metrics constitute another critical evaluation category, encompassing weathering resistance, UV stability, and thermal cycling performance. Accelerated weathering tests (ASTM G154) simulate years of outdoor exposure in condensed timeframes, while thermal cycling tests (ASTM D6944) assess coating integrity through temperature fluctuations from -40°C to 80°C. Oleoresin coatings should maintain at least 85% of their initial properties after these tests.

Adhesion strength, measured via pull-off tests (ASTM D4541) or cross-cut tests (ASTM D3359), determines how well the coating bonds to various substrates. Industry standards typically require minimum adhesion strength of 2.0 MPa for concrete surfaces and 3.0 MPa for metal substrates, with oleoresin formulations often exceeding these thresholds.

Chemical resistance represents another vital performance parameter, evaluated through exposure to acids, alkalis, solvents, and oils (ASTM D1308). Successful oleoresin waterproof coatings should show minimal degradation (less than 5% change in properties) after 7-day exposure to common chemicals.

Environmental impact metrics have gained prominence in recent years, including VOC content (EPA Method 24), biodegradability (OECD 301), and lifecycle assessment. Market-competitive oleoresin formulations now target VOC levels below 50 g/L while maintaining performance standards.

Application-specific metrics vary by industry sector. For construction applications, crack-bridging ability (ASTM C1305) and freeze-thaw resistance (ASTM C666) are paramount. Marine applications prioritize salt spray resistance (ASTM B117) and antifouling properties, while automotive coatings emphasize chip resistance (ASTM D3170) and flexibility (ASTM D522).

Cost-performance metrics complete the evaluation framework, balancing material costs, application efficiency, coverage rates, and service life. Successful oleoresin waterproof coatings typically achieve a cost-performance ratio that delivers 15-20% better long-term value than conventional petroleum-based alternatives, despite potentially higher initial costs.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!