Oleoresin vs Gum Rosin: Choosing the Right Resin

SEP 10, 202510 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Resin Technology Background and Objectives

Resins have been integral to human civilization for millennia, with applications ranging from ancient embalming practices to modern industrial processes. The distinction between oleoresin and gum rosin represents a fundamental technological divergence in the resin industry that continues to shape multiple sectors today. Oleoresins are natural plant exudates containing both essential oils and resin components, while gum rosin is the solid residue obtained after distilling the volatile oil components from pine oleoresin.

The evolution of resin technology has followed a trajectory from purely extractive practices to sophisticated processing methods. Historical records indicate that ancient civilizations in Egypt, Greece, and China utilized various forms of resins for medicinal, adhesive, and waterproofing applications. By the Middle Ages, naval industries had become major consumers of rosin products for ship maintenance, establishing the foundation for industrial-scale resin production.

The 20th century witnessed transformative advancements in resin technology, particularly with the development of synthetic alternatives and improved extraction methodologies. The introduction of solvent extraction techniques in the 1950s revolutionized oleoresin production, while steam distillation processes enhanced the quality and consistency of gum rosin. These technological innovations expanded application possibilities across diverse industries including adhesives, printing inks, rubber compounds, and pharmaceutical formulations.

Current technological trends in the resin sector focus on sustainability, yield optimization, and product customization. Environmentally conscious extraction methods, including supercritical CO2 extraction for oleoresins and bio-based solvent systems, represent significant steps toward reducing the ecological footprint of resin production. Simultaneously, genetic improvements in resin-producing plant species aim to enhance both yield and specific chemical compositions tailored to industrial requirements.

The primary objective of contemporary resin technology development is to establish clear selection criteria between oleoresin and gum rosin based on specific application requirements. This involves comprehensive characterization of their physicochemical properties, processing behaviors, and performance attributes across various industrial contexts. Additionally, there is growing emphasis on developing hybrid systems that combine the advantages of both resin types while minimizing their respective limitations.

Looking forward, the resin technology roadmap aims to achieve greater standardization in quality parameters, improved traceability systems, and enhanced processing efficiencies. Research initiatives are increasingly focused on understanding the molecular structures of resin components and their interaction mechanisms in complex formulations. The ultimate goal is to establish a knowledge framework that enables precise, application-specific selection between oleoresin and gum rosin, optimizing performance while considering economic and environmental factors.

The evolution of resin technology has followed a trajectory from purely extractive practices to sophisticated processing methods. Historical records indicate that ancient civilizations in Egypt, Greece, and China utilized various forms of resins for medicinal, adhesive, and waterproofing applications. By the Middle Ages, naval industries had become major consumers of rosin products for ship maintenance, establishing the foundation for industrial-scale resin production.

The 20th century witnessed transformative advancements in resin technology, particularly with the development of synthetic alternatives and improved extraction methodologies. The introduction of solvent extraction techniques in the 1950s revolutionized oleoresin production, while steam distillation processes enhanced the quality and consistency of gum rosin. These technological innovations expanded application possibilities across diverse industries including adhesives, printing inks, rubber compounds, and pharmaceutical formulations.

Current technological trends in the resin sector focus on sustainability, yield optimization, and product customization. Environmentally conscious extraction methods, including supercritical CO2 extraction for oleoresins and bio-based solvent systems, represent significant steps toward reducing the ecological footprint of resin production. Simultaneously, genetic improvements in resin-producing plant species aim to enhance both yield and specific chemical compositions tailored to industrial requirements.

The primary objective of contemporary resin technology development is to establish clear selection criteria between oleoresin and gum rosin based on specific application requirements. This involves comprehensive characterization of their physicochemical properties, processing behaviors, and performance attributes across various industrial contexts. Additionally, there is growing emphasis on developing hybrid systems that combine the advantages of both resin types while minimizing their respective limitations.

Looking forward, the resin technology roadmap aims to achieve greater standardization in quality parameters, improved traceability systems, and enhanced processing efficiencies. Research initiatives are increasingly focused on understanding the molecular structures of resin components and their interaction mechanisms in complex formulations. The ultimate goal is to establish a knowledge framework that enables precise, application-specific selection between oleoresin and gum rosin, optimizing performance while considering economic and environmental factors.

Market Demand Analysis for Oleoresin and Gum Rosin

The global resin market has witnessed significant growth in recent years, with oleoresin and gum rosin emerging as critical components across various industries. The combined market value of these resins exceeded $2 billion in 2022, with projections indicating a compound annual growth rate of 4.7% through 2030, driven primarily by expanding applications in adhesives, printing inks, and food additives.

Oleoresin, derived directly from living trees through solvent extraction, has experienced robust demand growth particularly in the food and beverage sector. This growth is attributed to the increasing consumer preference for natural food additives and flavoring agents. The pharmaceutical industry has also emerged as a significant consumer of oleoresins, utilizing them in various medicinal formulations due to their therapeutic properties. Market research indicates that the oleoresin segment is growing at approximately 5.3% annually, outpacing the overall resin market.

Gum rosin, obtained through the distillation of pine tree resin, maintains strong demand in traditional applications such as adhesives, paper sizing, and printing inks. The adhesives industry remains the largest consumer of gum rosin, accounting for roughly 40% of total consumption. Recent market shifts indicate growing demand from emerging economies, particularly in Asia-Pacific, where manufacturing sectors are expanding rapidly. China continues to be the largest producer and consumer of gum rosin globally, followed by Brazil and Indonesia.

Regional analysis reveals distinct consumption patterns. North America and Europe demonstrate increasing preference for oleoresins due to stringent environmental regulations and growing consumer awareness regarding sustainable products. Conversely, developing regions show stronger demand for gum rosin due to its cost-effectiveness and established applications in manufacturing processes.

Price volatility remains a significant factor influencing market dynamics. Gum rosin prices have fluctuated considerably over the past five years due to variations in pine tree harvests and changing weather conditions in major producing regions. Oleoresin prices, while generally more stable, have seen upward pressure due to increasing production costs and growing demand from premium market segments.

Industry experts anticipate that sustainability considerations will increasingly shape market demand. Companies are increasingly seeking environmentally responsible sourcing practices, potentially benefiting oleoresin producers who can demonstrate sustainable harvesting methods. This trend is particularly pronounced in European markets, where regulatory frameworks increasingly favor bio-based and sustainably sourced materials.

The COVID-19 pandemic temporarily disrupted supply chains but has accelerated certain market trends, including increased demand for natural ingredients in consumer products and greater emphasis on supply chain resilience, factors that may benefit domestic producers of both resin types in the long term.

Oleoresin, derived directly from living trees through solvent extraction, has experienced robust demand growth particularly in the food and beverage sector. This growth is attributed to the increasing consumer preference for natural food additives and flavoring agents. The pharmaceutical industry has also emerged as a significant consumer of oleoresins, utilizing them in various medicinal formulations due to their therapeutic properties. Market research indicates that the oleoresin segment is growing at approximately 5.3% annually, outpacing the overall resin market.

Gum rosin, obtained through the distillation of pine tree resin, maintains strong demand in traditional applications such as adhesives, paper sizing, and printing inks. The adhesives industry remains the largest consumer of gum rosin, accounting for roughly 40% of total consumption. Recent market shifts indicate growing demand from emerging economies, particularly in Asia-Pacific, where manufacturing sectors are expanding rapidly. China continues to be the largest producer and consumer of gum rosin globally, followed by Brazil and Indonesia.

Regional analysis reveals distinct consumption patterns. North America and Europe demonstrate increasing preference for oleoresins due to stringent environmental regulations and growing consumer awareness regarding sustainable products. Conversely, developing regions show stronger demand for gum rosin due to its cost-effectiveness and established applications in manufacturing processes.

Price volatility remains a significant factor influencing market dynamics. Gum rosin prices have fluctuated considerably over the past five years due to variations in pine tree harvests and changing weather conditions in major producing regions. Oleoresin prices, while generally more stable, have seen upward pressure due to increasing production costs and growing demand from premium market segments.

Industry experts anticipate that sustainability considerations will increasingly shape market demand. Companies are increasingly seeking environmentally responsible sourcing practices, potentially benefiting oleoresin producers who can demonstrate sustainable harvesting methods. This trend is particularly pronounced in European markets, where regulatory frameworks increasingly favor bio-based and sustainably sourced materials.

The COVID-19 pandemic temporarily disrupted supply chains but has accelerated certain market trends, including increased demand for natural ingredients in consumer products and greater emphasis on supply chain resilience, factors that may benefit domestic producers of both resin types in the long term.

Current State and Technical Challenges in Resin Industry

The global resin industry is currently experiencing significant growth, with the market valued at approximately $17.5 billion in 2022 and projected to reach $25.4 billion by 2028, growing at a CAGR of around 6.4%. This expansion is primarily driven by increasing demand from end-use industries such as adhesives, printing inks, rubber compounds, and food additives.

Oleoresin and gum rosin represent two distinct segments within this market, each with unique production methods and characteristics. Gum rosin, traditionally harvested through pine tree tapping, accounts for approximately 60% of global rosin production. China dominates this sector, contributing nearly 70% of worldwide gum rosin output. However, the industry faces significant sustainability challenges due to declining pine forests and labor-intensive harvesting methods.

Oleoresin production, utilizing solvent extraction from pine stumps and wood residues, has gained traction as an alternative approach. This method offers higher yield efficiency and more consistent quality but introduces environmental concerns related to chemical solvent usage and energy consumption. North American and European producers have increasingly shifted toward oleoresin production, implementing advanced extraction technologies to minimize environmental impact.

A critical technical challenge facing both segments is quality standardization. The chemical composition of resins varies significantly based on geographical origin, pine species, and processing methods. This variability creates inconsistencies in performance characteristics such as softening point, color stability, and adhesion properties, complicating formulation processes for end-users.

Another pressing challenge is the development of eco-friendly processing methods. Traditional gum rosin production generates considerable waste and requires substantial water resources, while oleoresin extraction typically involves petroleum-based solvents. Research into bio-based solvents and closed-loop extraction systems has shown promise but remains commercially limited due to cost constraints and scalability issues.

Supply chain volatility represents a significant industry-wide concern. Gum rosin production is highly susceptible to weather conditions, labor availability, and regional political stability. The oleoresin segment, while less vulnerable to these factors, faces challenges related to raw material accessibility and processing equipment costs. This volatility has led to price fluctuations exceeding 30% in recent years, complicating procurement strategies for downstream industries.

Regulatory pressures are intensifying across both segments, with particular focus on VOC emissions, worker safety standards, and sustainable forestry practices. The EU's REACH regulations and similar frameworks in North America have necessitated substantial process modifications, especially for oleoresin producers utilizing chemical solvents in their extraction processes.

Oleoresin and gum rosin represent two distinct segments within this market, each with unique production methods and characteristics. Gum rosin, traditionally harvested through pine tree tapping, accounts for approximately 60% of global rosin production. China dominates this sector, contributing nearly 70% of worldwide gum rosin output. However, the industry faces significant sustainability challenges due to declining pine forests and labor-intensive harvesting methods.

Oleoresin production, utilizing solvent extraction from pine stumps and wood residues, has gained traction as an alternative approach. This method offers higher yield efficiency and more consistent quality but introduces environmental concerns related to chemical solvent usage and energy consumption. North American and European producers have increasingly shifted toward oleoresin production, implementing advanced extraction technologies to minimize environmental impact.

A critical technical challenge facing both segments is quality standardization. The chemical composition of resins varies significantly based on geographical origin, pine species, and processing methods. This variability creates inconsistencies in performance characteristics such as softening point, color stability, and adhesion properties, complicating formulation processes for end-users.

Another pressing challenge is the development of eco-friendly processing methods. Traditional gum rosin production generates considerable waste and requires substantial water resources, while oleoresin extraction typically involves petroleum-based solvents. Research into bio-based solvents and closed-loop extraction systems has shown promise but remains commercially limited due to cost constraints and scalability issues.

Supply chain volatility represents a significant industry-wide concern. Gum rosin production is highly susceptible to weather conditions, labor availability, and regional political stability. The oleoresin segment, while less vulnerable to these factors, faces challenges related to raw material accessibility and processing equipment costs. This volatility has led to price fluctuations exceeding 30% in recent years, complicating procurement strategies for downstream industries.

Regulatory pressures are intensifying across both segments, with particular focus on VOC emissions, worker safety standards, and sustainable forestry practices. The EU's REACH regulations and similar frameworks in North America have necessitated substantial process modifications, especially for oleoresin producers utilizing chemical solvents in their extraction processes.

Comparative Analysis of Oleoresin and Gum Rosin Solutions

01 Extraction and processing methods for oleoresin and gum rosin

Various methods for extracting and processing oleoresin from pine trees and converting it into gum rosin. These processes include solvent extraction, steam distillation, and mechanical tapping techniques to obtain high-quality oleoresin. The subsequent processing involves separation of volatile terpenes from the resin to produce gum rosin with desired properties for industrial applications.- Extraction and processing methods for oleoresin and gum rosin: Various methods for extracting and processing oleoresin from pine trees and converting it into gum rosin. These processes include solvent extraction, steam distillation, and mechanical methods to separate the volatile terpenes from the solid rosin. The techniques focus on improving yield, quality, and efficiency while reducing environmental impact during the extraction and refining stages.

- Modification and derivatization of rosin compounds: Chemical modifications of gum rosin to produce derivatives with enhanced properties for specific applications. These modifications include esterification, hydrogenation, dimerization, and polymerization reactions that alter the chemical structure of rosin acids. The resulting modified rosins exhibit improved thermal stability, adhesion properties, and compatibility with other materials.

- Applications in adhesives and coatings: Formulations incorporating oleoresin and gum rosin as key components in adhesives, sealants, and coating materials. The natural tackiness, adhesion properties, and film-forming capabilities of rosin make it valuable in pressure-sensitive adhesives, hot-melt formulations, and protective coatings. These applications leverage the compatibility of rosin with various polymers and its ability to enhance adhesion to different substrates.

- Use in pharmaceutical and personal care products: Incorporation of oleoresin and gum rosin derivatives in pharmaceutical formulations and personal care products. The antimicrobial, anti-inflammatory, and film-forming properties of rosin compounds make them useful in medicinal preparations, cosmetics, and topical applications. These formulations utilize the bioactive components of rosin while addressing potential sensitization concerns through appropriate processing and purification.

- Equipment and apparatus for rosin processing: Specialized equipment and apparatus designed for the processing, refining, and handling of oleoresin and gum rosin. These include extraction vessels, distillation units, filtration systems, and storage facilities that are optimized for rosin's unique physical properties. The equipment incorporates features to manage the high viscosity, temperature sensitivity, and crystallization tendencies of rosin during industrial processing.

02 Modification and derivatization of rosin compounds

Chemical modification of rosin and its derivatives to enhance properties and expand applications. These modifications include hydrogenation, esterification, polymerization, and other chemical treatments that alter the structure of rosin acids. The resulting modified products exhibit improved thermal stability, color, and compatibility with various formulation systems.Expand Specific Solutions03 Applications in adhesives and coating formulations

Utilization of oleoresin and gum rosin as key ingredients in adhesives, sealants, and coating formulations. The tackifying properties of rosin make it valuable in pressure-sensitive adhesives, while its film-forming capabilities are exploited in varnishes and protective coatings. These natural materials provide adhesion promotion, viscosity control, and improved durability in various industrial applications.Expand Specific Solutions04 Rosin-based composites and blends

Development of composite materials and blends incorporating oleoresin and gum rosin with other polymers or additives. These compositions combine the beneficial properties of rosin with synthetic or natural polymers to create materials with enhanced performance characteristics. Applications include biodegradable plastics, reinforced composites, and specialty materials with tailored properties.Expand Specific Solutions05 Equipment and apparatus for rosin processing

Specialized equipment and apparatus designed for the processing, refining, and handling of oleoresin and gum rosin. These include extraction units, distillation equipment, melting vessels, and processing systems that enable efficient production of rosin products with consistent quality. The equipment incorporates features for temperature control, separation of impurities, and handling of the highly viscous materials.Expand Specific Solutions

Key Industry Players and Competitive Landscape

The oleoresin versus gum rosin market is currently in a growth phase, with increasing demand driven by diverse industrial applications. The global resin market is estimated to exceed $20 billion, with oleoresins gaining market share due to their superior properties and sustainability advantages. Technologically, companies like Sumitomo Chemical, Henkel, and ExxonMobil Chemical have advanced processing capabilities for oleoresins, while traditional gum rosin production is dominated by players such as Shanghai Jaour Adhesive Products and Guangxi Forestry Research Institute. Goodyear, Sumitomo Rubber, and Toyoda Gosei represent significant end-users in the automotive sector, while BASF Coatings, Asian Paints, and Hempel lead applications in coatings. The industry is witnessing a gradual shift toward oleoresins due to their enhanced performance characteristics and environmental benefits.

Henkel AG & Co. KGaA

Technical Solution: Henkel has developed sophisticated formulation technologies that leverage the distinct properties of both oleoresin and gum rosin in their adhesive products. Their TECHNOMELT® product line incorporates modified rosin derivatives as tackifiers and adhesion promoters in hot melt adhesives. Henkel's approach focuses on chemical modification of rosin through hydrogenation, dimerization, and esterification to enhance stability and compatibility with various polymer systems. For applications requiring higher bio-based content and specific performance characteristics, Henkel utilizes oleoresin-derived products that retain more of the natural terpene compounds. Their proprietary processing methods include controlled oxidation techniques that improve the adhesion properties while minimizing color degradation. Henkel has also developed specialized testing protocols to evaluate the performance of different rosin types in various adhesive formulations, allowing them to precisely match rosin characteristics to specific application requirements. Their research has shown that properly selected and modified rosin can improve adhesion strength by up to 40% in certain formulations while also enhancing heat resistance.

Strengths: Extensive formulation expertise across multiple adhesive technologies; sophisticated modification techniques to enhance rosin performance; comprehensive testing capabilities to match rosin types to specific applications. Weaknesses: Highly specialized applications may require expensive custom modifications; some formulations may be sensitive to batch-to-batch variations in natural rosin materials; potential regulatory constraints in certain markets.

Shanghai Jaour Adhesive Products Co. Ltd.

Technical Solution: Shanghai Jaour Adhesive Products has developed specialized formulation technologies that utilize both oleoresin and gum rosin in their pressure-sensitive adhesives and hot melt products. Their approach focuses on creating optimized blends of modified rosins with synthetic polymers to achieve specific performance characteristics. For their high-performance packaging adhesives, they've developed a proprietary process for modifying gum rosin through controlled polymerization and esterification, resulting in products with improved thermal stability and adhesion strength. Their research has shown that these modified rosins can increase adhesive cohesive strength by up to 35% compared to formulations using standard rosin materials. For applications requiring greater flexibility and lower application temperatures, Shanghai Jaour utilizes oleoresin-derived products that retain more of the natural terpene compounds, which act as internal plasticizers. Their technology includes specialized compatibility agents that improve the miscibility of rosin derivatives with various polymer systems, resulting in more homogeneous adhesive formulations with improved aging characteristics.

Strengths: Specialized expertise in rosin modification for adhesive applications; cost-effective formulation approaches for various performance requirements; strong understanding of rosin-polymer interactions. Weaknesses: Limited focus primarily on adhesive applications; some formulations may have restricted temperature resistance; potential batch-to-batch consistency challenges with natural rosin materials.

Technical Properties and Performance Characteristics

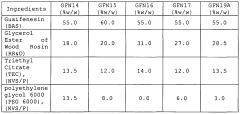

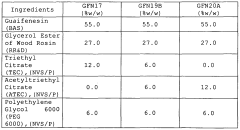

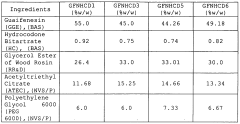

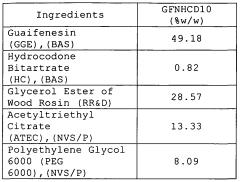

Delivery vehicles containing rosin resins

PatentWO2008150382A1

Innovation

- A delivery vehicle comprising a combination of rosin resin derivatives (RR&D) and non-volatilized solvents or plasticizers (NVS/P), which allows for the modulation of API release characteristics, providing a wide range of consistencies, hydrophobicities, and shapes suitable for various administration routes, including controlled release formulations.

Promoting uncured tack and cured adhesion for tire component rubber compositions including a tread strip

PatentInactiveEP2457741A1

Innovation

- A composition comprising rosin ester or hydrogenated rosin ester, combined with uncured sulfur curable rubber, sulfur-based curatives, reinforcing fillers, and high boiling hydrocarbon solvents is applied to the surfaces of uncured rubber components to enhance building tack and cured adhesion, eliminating the need for volatile organic solvents and petroleum-based oils.

Environmental Impact and Sustainability Considerations

The environmental impact of resin production and usage has become increasingly significant in today's sustainability-focused market landscape. When comparing oleoresin and gum rosin, their environmental footprints differ substantially throughout their lifecycle stages. Oleoresin, being directly harvested from living pine trees through tapping methods, generally represents a more sustainable option when proper harvesting techniques are employed. These techniques allow trees to heal and continue producing resin for decades, creating a renewable resource cycle that minimizes ecosystem disruption.

Gum rosin production, conversely, often involves more intensive processing methods that can generate higher carbon emissions and chemical waste. The traditional destructive harvesting methods used in some regions result in tree removal, contributing to deforestation concerns when not managed through sustainable forestry practices. However, modern gum rosin production has evolved to incorporate more environmentally responsible approaches, including plantation-based sourcing and improved processing technologies that reduce energy consumption and waste generation.

Water usage presents another critical environmental consideration. Oleoresin collection typically requires minimal water resources, while gum rosin processing can be more water-intensive, particularly during the separation and purification stages. This difference becomes especially relevant in water-stressed regions where resource management is paramount for ecological balance.

Carbon footprint assessments reveal that transportation impacts vary significantly between these resin types. Oleoresin's higher value-to-weight ratio often results in more efficient transportation economics, potentially reducing the overall carbon emissions associated with global distribution networks. Additionally, the biodegradability profile of naturally sourced oleoresin generally outperforms chemically processed alternatives, offering advantages for end-of-life environmental considerations.

Certification systems have emerged as important market differentiators, with Forest Stewardship Council (FSC) and Programme for the Endorsement of Forest Certification (PEFC) standards providing frameworks for sustainable resin sourcing. Companies increasingly leverage these certifications to demonstrate environmental commitment and meet consumer expectations for responsible materials sourcing. The growing market premium for certified sustainable resins has incentivized producers to adopt improved environmental practices throughout their supply chains.

Regulatory landscapes worldwide continue to evolve, with stricter environmental compliance requirements influencing resin production methods. The European Union's REACH regulations and similar frameworks in other regions have accelerated the transition toward greener processing technologies and more transparent supply chain documentation. These regulatory pressures, combined with corporate sustainability initiatives, are driving innovation in both oleoresin and gum rosin production systems toward more environmentally balanced approaches.

Gum rosin production, conversely, often involves more intensive processing methods that can generate higher carbon emissions and chemical waste. The traditional destructive harvesting methods used in some regions result in tree removal, contributing to deforestation concerns when not managed through sustainable forestry practices. However, modern gum rosin production has evolved to incorporate more environmentally responsible approaches, including plantation-based sourcing and improved processing technologies that reduce energy consumption and waste generation.

Water usage presents another critical environmental consideration. Oleoresin collection typically requires minimal water resources, while gum rosin processing can be more water-intensive, particularly during the separation and purification stages. This difference becomes especially relevant in water-stressed regions where resource management is paramount for ecological balance.

Carbon footprint assessments reveal that transportation impacts vary significantly between these resin types. Oleoresin's higher value-to-weight ratio often results in more efficient transportation economics, potentially reducing the overall carbon emissions associated with global distribution networks. Additionally, the biodegradability profile of naturally sourced oleoresin generally outperforms chemically processed alternatives, offering advantages for end-of-life environmental considerations.

Certification systems have emerged as important market differentiators, with Forest Stewardship Council (FSC) and Programme for the Endorsement of Forest Certification (PEFC) standards providing frameworks for sustainable resin sourcing. Companies increasingly leverage these certifications to demonstrate environmental commitment and meet consumer expectations for responsible materials sourcing. The growing market premium for certified sustainable resins has incentivized producers to adopt improved environmental practices throughout their supply chains.

Regulatory landscapes worldwide continue to evolve, with stricter environmental compliance requirements influencing resin production methods. The European Union's REACH regulations and similar frameworks in other regions have accelerated the transition toward greener processing technologies and more transparent supply chain documentation. These regulatory pressures, combined with corporate sustainability initiatives, are driving innovation in both oleoresin and gum rosin production systems toward more environmentally balanced approaches.

Regulatory Framework and Industry Standards

The regulatory landscape governing rosin products is complex and varies significantly across regions, creating a critical consideration for manufacturers and users when selecting between oleoresin and gum rosin. In the United States, the Food and Drug Administration (FDA) classifies rosin and its derivatives under different categories depending on their intended use, with food-grade rosin requiring compliance with 21 CFR 172.615 for food packaging applications. The European Union implements more stringent regulations through the REACH (Registration, Evaluation, Authorization and Restriction of Chemicals) framework, which mandates comprehensive safety assessments for both oleoresin and gum rosin.

Industry standards further differentiate these materials, with the American Society for Testing and Materials (ASTM) providing specific guidelines for rosin quality assessment. ASTM D1065 establishes standard test methods for sampling and testing rosin, while ISO 3139 defines international classification systems based on color, acid number, and softening point. These standards are particularly relevant when comparing the consistency of gum rosin versus the variable composition of oleoresin.

Environmental certifications have become increasingly important market differentiators. The Forest Stewardship Council (FSC) certification for sustainably harvested pine resin primarily benefits gum rosin producers who can demonstrate responsible forestry practices. Conversely, oleoresin producers may leverage organic certifications when their extraction processes meet the required standards for minimal chemical intervention.

Pharmaceutical applications face additional regulatory hurdles, with pharmacopeial standards such as the United States Pharmacopeia (USP) and European Pharmacopoeia (Ph. Eur.) establishing strict purity requirements. Notably, gum rosin typically faces fewer regulatory challenges in pharmaceutical applications due to its more standardized composition compared to oleoresin, which contains variable terpene profiles requiring more extensive characterization.

Labeling requirements also differ substantially between markets. In Japan, the Ministry of Health, Labour and Welfare imposes specific disclosure requirements for rosin-derived products, particularly in cosmetics and food contact materials. Similarly, China's GB standards establish distinct parameters for rosin quality that influence import/export dynamics in the global supply chain.

Compliance costs represent a significant factor in the economic equation when choosing between these materials. The regulatory burden for oleoresin is typically higher due to its complex chemical profile, requiring more extensive testing and documentation. This regulatory complexity creates market entry barriers that smaller producers must carefully consider when determining which resin type aligns with their compliance capabilities and target markets.

Industry standards further differentiate these materials, with the American Society for Testing and Materials (ASTM) providing specific guidelines for rosin quality assessment. ASTM D1065 establishes standard test methods for sampling and testing rosin, while ISO 3139 defines international classification systems based on color, acid number, and softening point. These standards are particularly relevant when comparing the consistency of gum rosin versus the variable composition of oleoresin.

Environmental certifications have become increasingly important market differentiators. The Forest Stewardship Council (FSC) certification for sustainably harvested pine resin primarily benefits gum rosin producers who can demonstrate responsible forestry practices. Conversely, oleoresin producers may leverage organic certifications when their extraction processes meet the required standards for minimal chemical intervention.

Pharmaceutical applications face additional regulatory hurdles, with pharmacopeial standards such as the United States Pharmacopeia (USP) and European Pharmacopoeia (Ph. Eur.) establishing strict purity requirements. Notably, gum rosin typically faces fewer regulatory challenges in pharmaceutical applications due to its more standardized composition compared to oleoresin, which contains variable terpene profiles requiring more extensive characterization.

Labeling requirements also differ substantially between markets. In Japan, the Ministry of Health, Labour and Welfare imposes specific disclosure requirements for rosin-derived products, particularly in cosmetics and food contact materials. Similarly, China's GB standards establish distinct parameters for rosin quality that influence import/export dynamics in the global supply chain.

Compliance costs represent a significant factor in the economic equation when choosing between these materials. The regulatory burden for oleoresin is typically higher due to its complex chemical profile, requiring more extensive testing and documentation. This regulatory complexity creates market entry barriers that smaller producers must carefully consider when determining which resin type aligns with their compliance capabilities and target markets.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!