Oleoresin vs Essential Oils: Key Differences Explained

SEP 10, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Oleoresin and Essential Oil Background and Objectives

Oleoresin and essential oils represent two distinct yet related natural plant extracts that have been utilized by humans for thousands of years. Historically, oleoresins were first documented in ancient Egyptian civilization around 3000 BCE, where they were used for embalming practices and religious ceremonies. Essential oils similarly have ancient origins, with archaeological evidence suggesting their use in early Mesopotamian, Egyptian, and Chinese civilizations for medicinal and aromatic purposes.

The technological evolution of extraction methods has significantly shaped both industries. Traditional oleoresin extraction relied on simple solvent extraction or mechanical pressing, while essential oil production historically depended on primitive distillation techniques. The 19th century marked a significant turning point with the introduction of steam distillation for essential oils and improved solvent extraction methods for oleoresins, enhancing both yield and quality.

From a chemical perspective, oleoresins are complex mixtures containing essential oils, resins, fatty acids, and other plant compounds. They typically appear as viscous, semi-solid substances with concentrated flavors and aromas. In contrast, essential oils are volatile, aromatic compounds composed primarily of terpenes and terpenoids, presenting as clear liquids that evaporate readily at room temperature.

The fundamental distinction between these two extracts lies in their composition and physical properties. Oleoresins retain a broader spectrum of plant compounds including non-volatile components, resulting in greater stability and longer shelf life. Essential oils, being more volatile, offer intense but less stable aromatic profiles with different bioactive properties.

Current technological trends in this field focus on developing more sustainable and efficient extraction methods. Supercritical CO2 extraction has emerged as an environmentally friendly alternative for both oleoresin and essential oil production. Additionally, ultrasound-assisted extraction and microwave-assisted extraction represent innovative approaches that reduce processing time and energy consumption while preserving the integrity of sensitive compounds.

The technical objectives for advancement in this field include developing extraction technologies that maximize yield while preserving bioactive compounds, creating standardized analytical methods for quality assessment, and establishing sustainable sourcing practices to address increasing demand without depleting natural resources. Furthermore, there is growing interest in understanding the synergistic effects between different compounds present in these natural extracts to optimize their applications in various industries.

The technological evolution of extraction methods has significantly shaped both industries. Traditional oleoresin extraction relied on simple solvent extraction or mechanical pressing, while essential oil production historically depended on primitive distillation techniques. The 19th century marked a significant turning point with the introduction of steam distillation for essential oils and improved solvent extraction methods for oleoresins, enhancing both yield and quality.

From a chemical perspective, oleoresins are complex mixtures containing essential oils, resins, fatty acids, and other plant compounds. They typically appear as viscous, semi-solid substances with concentrated flavors and aromas. In contrast, essential oils are volatile, aromatic compounds composed primarily of terpenes and terpenoids, presenting as clear liquids that evaporate readily at room temperature.

The fundamental distinction between these two extracts lies in their composition and physical properties. Oleoresins retain a broader spectrum of plant compounds including non-volatile components, resulting in greater stability and longer shelf life. Essential oils, being more volatile, offer intense but less stable aromatic profiles with different bioactive properties.

Current technological trends in this field focus on developing more sustainable and efficient extraction methods. Supercritical CO2 extraction has emerged as an environmentally friendly alternative for both oleoresin and essential oil production. Additionally, ultrasound-assisted extraction and microwave-assisted extraction represent innovative approaches that reduce processing time and energy consumption while preserving the integrity of sensitive compounds.

The technical objectives for advancement in this field include developing extraction technologies that maximize yield while preserving bioactive compounds, creating standardized analytical methods for quality assessment, and establishing sustainable sourcing practices to address increasing demand without depleting natural resources. Furthermore, there is growing interest in understanding the synergistic effects between different compounds present in these natural extracts to optimize their applications in various industries.

Market Demand Analysis for Natural Extracts

The global market for natural extracts has witnessed substantial growth in recent years, driven by increasing consumer preference for natural ingredients across various industries. The natural extracts market, encompassing both oleoresins and essential oils, was valued at approximately $12.2 billion in 2022 and is projected to reach $19.8 billion by 2028, growing at a CAGR of 8.4% during the forecast period.

Consumer awareness regarding the harmful effects of synthetic ingredients has significantly boosted demand for natural alternatives. This shift is particularly evident in the food and beverage industry, where manufacturers are reformulating products to include natural flavors, colors, and preservatives. The clean label movement has further accelerated this trend, with 78% of global consumers indicating they prefer products with recognizable, natural ingredients.

The pharmaceutical and nutraceutical sectors represent another major demand driver for natural extracts. The global nutraceutical market is expanding at 7.5% annually, with natural extracts playing a crucial role in formulations. Oleoresins, with their concentrated bioactive compounds, are increasingly sought after for their therapeutic properties and longer shelf life compared to raw herbs.

In the cosmetics and personal care industry, demand for natural extracts has surged as consumers seek sustainable and chemical-free products. The natural cosmetics segment grew by 9.2% in 2022, outpacing the overall cosmetics market growth of 4.1%. Essential oils, particularly those with aromatherapeutic properties, have gained significant traction in this sector.

Regional analysis reveals that North America and Europe currently dominate the market for premium natural extracts, while Asia-Pacific represents the fastest-growing region with increasing disposable income and changing consumer preferences. The demand for certified organic extracts is growing at double the rate of conventional extracts, reflecting heightened consumer concern about pesticide residues and sustainable sourcing.

Supply chain challenges present significant market considerations. Climate change, agricultural practices, and geopolitical factors affect the availability and pricing of raw materials for both oleoresins and essential oils. This has prompted industry players to invest in vertical integration and sustainable sourcing programs to ensure consistent supply.

The COVID-19 pandemic has accelerated certain market trends, particularly increased consumer focus on immunity-boosting natural ingredients and heightened awareness of product origins. Post-pandemic, this consciousness has persisted, with 65% of consumers indicating they pay more attention to the source and quality of ingredients than before the pandemic.

Consumer awareness regarding the harmful effects of synthetic ingredients has significantly boosted demand for natural alternatives. This shift is particularly evident in the food and beverage industry, where manufacturers are reformulating products to include natural flavors, colors, and preservatives. The clean label movement has further accelerated this trend, with 78% of global consumers indicating they prefer products with recognizable, natural ingredients.

The pharmaceutical and nutraceutical sectors represent another major demand driver for natural extracts. The global nutraceutical market is expanding at 7.5% annually, with natural extracts playing a crucial role in formulations. Oleoresins, with their concentrated bioactive compounds, are increasingly sought after for their therapeutic properties and longer shelf life compared to raw herbs.

In the cosmetics and personal care industry, demand for natural extracts has surged as consumers seek sustainable and chemical-free products. The natural cosmetics segment grew by 9.2% in 2022, outpacing the overall cosmetics market growth of 4.1%. Essential oils, particularly those with aromatherapeutic properties, have gained significant traction in this sector.

Regional analysis reveals that North America and Europe currently dominate the market for premium natural extracts, while Asia-Pacific represents the fastest-growing region with increasing disposable income and changing consumer preferences. The demand for certified organic extracts is growing at double the rate of conventional extracts, reflecting heightened consumer concern about pesticide residues and sustainable sourcing.

Supply chain challenges present significant market considerations. Climate change, agricultural practices, and geopolitical factors affect the availability and pricing of raw materials for both oleoresins and essential oils. This has prompted industry players to invest in vertical integration and sustainable sourcing programs to ensure consistent supply.

The COVID-19 pandemic has accelerated certain market trends, particularly increased consumer focus on immunity-boosting natural ingredients and heightened awareness of product origins. Post-pandemic, this consciousness has persisted, with 65% of consumers indicating they pay more attention to the source and quality of ingredients than before the pandemic.

Technical Challenges in Extraction Methodologies

The extraction of oleoresins and essential oils presents significant technical challenges that vary based on the source material, desired compounds, and intended applications. Traditional extraction methods for oleoresins, such as solvent extraction using hexane or ethanol, often result in residual solvent contamination, requiring extensive post-processing purification steps. This challenge is particularly pronounced when extracting from resinous plant materials like pine or frankincense, where the viscous nature of the source material complicates efficient solvent penetration and subsequent separation.

Essential oil extraction faces different technical hurdles, primarily related to the volatile nature of the target compounds. Steam distillation, while effective for many plant materials, can cause thermal degradation of heat-sensitive compounds, altering the chemical profile and potentially diminishing therapeutic properties. The engineering challenge of maintaining optimal temperature control throughout the distillation process remains significant, especially at industrial scales where temperature gradients can develop within large distillation vessels.

Supercritical fluid extraction (SFE), particularly using CO2, has emerged as an advanced solution for both oleoresin and essential oil extraction. However, this technology presents its own set of challenges, including high equipment costs, complex pressure management requirements, and the need for specialized technical expertise. The precise control of pressure and temperature parameters necessary to achieve selective extraction of target compounds requires sophisticated engineering solutions and real-time monitoring systems.

Water solubility disparities between oleoresins and essential oils create additional extraction complexities. Essential oils, being largely hydrophobic, require specialized collection systems during hydrodistillation processes. Conversely, oleoresins often contain both water-soluble and lipophilic components, necessitating multi-stage extraction protocols that significantly increase processing time and operational costs.

Scale-up challenges represent another critical barrier in extraction technology development. Laboratory-scale processes that demonstrate excellent yields and purity profiles often encounter efficiency losses when implemented at industrial scales. This scaling issue is particularly evident in microwave-assisted and ultrasonic extraction methods, where energy transfer dynamics change substantially with increased batch sizes.

Emerging technologies like pulsed electric field extraction and enzyme-assisted extraction show promise in addressing some of these challenges, but introduce new technical hurdles related to equipment standardization, process validation, and regulatory compliance. The optimization of these novel extraction methodologies requires interdisciplinary expertise spanning electrical engineering, biochemistry, and process engineering.

Essential oil extraction faces different technical hurdles, primarily related to the volatile nature of the target compounds. Steam distillation, while effective for many plant materials, can cause thermal degradation of heat-sensitive compounds, altering the chemical profile and potentially diminishing therapeutic properties. The engineering challenge of maintaining optimal temperature control throughout the distillation process remains significant, especially at industrial scales where temperature gradients can develop within large distillation vessels.

Supercritical fluid extraction (SFE), particularly using CO2, has emerged as an advanced solution for both oleoresin and essential oil extraction. However, this technology presents its own set of challenges, including high equipment costs, complex pressure management requirements, and the need for specialized technical expertise. The precise control of pressure and temperature parameters necessary to achieve selective extraction of target compounds requires sophisticated engineering solutions and real-time monitoring systems.

Water solubility disparities between oleoresins and essential oils create additional extraction complexities. Essential oils, being largely hydrophobic, require specialized collection systems during hydrodistillation processes. Conversely, oleoresins often contain both water-soluble and lipophilic components, necessitating multi-stage extraction protocols that significantly increase processing time and operational costs.

Scale-up challenges represent another critical barrier in extraction technology development. Laboratory-scale processes that demonstrate excellent yields and purity profiles often encounter efficiency losses when implemented at industrial scales. This scaling issue is particularly evident in microwave-assisted and ultrasonic extraction methods, where energy transfer dynamics change substantially with increased batch sizes.

Emerging technologies like pulsed electric field extraction and enzyme-assisted extraction show promise in addressing some of these challenges, but introduce new technical hurdles related to equipment standardization, process validation, and regulatory compliance. The optimization of these novel extraction methodologies requires interdisciplinary expertise spanning electrical engineering, biochemistry, and process engineering.

Current Extraction and Processing Solutions

01 Extraction methods for oleoresins and essential oils

Various extraction methods can be employed to obtain oleoresins and essential oils from plant materials. These methods include solvent extraction, steam distillation, supercritical fluid extraction, and cold pressing. Each method offers different advantages in terms of yield, purity, and preservation of volatile compounds. The choice of extraction method can significantly impact the quality and composition of the final product.- Extraction methods for oleoresins and essential oils: Various extraction methods can be employed to obtain oleoresins and essential oils from plant materials. These include solvent extraction, steam distillation, supercritical fluid extraction, and cold pressing. Each method offers different advantages in terms of yield, purity, and preservation of volatile compounds. The choice of extraction method depends on the source material and the desired properties of the final product.

- Applications in food and flavor industry: Oleoresins and essential oils are widely used in the food and flavor industry as natural flavoring agents, preservatives, and colorants. They provide concentrated flavor profiles and aromatic properties that enhance food products. These natural extracts can replace synthetic additives, meeting consumer demand for clean label ingredients while extending shelf life and improving sensory characteristics of various food products.

- Pharmaceutical and therapeutic applications: Oleoresins and essential oils possess various therapeutic properties including antimicrobial, anti-inflammatory, antioxidant, and analgesic effects. These natural extracts are formulated into pharmaceutical preparations, nutraceuticals, and traditional medicines. They can be administered through various routes including oral, topical, and inhalation methods to treat different health conditions and promote overall wellbeing.

- Encapsulation and delivery systems: Advanced technologies for encapsulation and delivery of oleoresins and essential oils improve their stability, bioavailability, and controlled release properties. Microencapsulation, nanoencapsulation, and other carrier systems protect these volatile compounds from degradation due to environmental factors such as light, heat, and oxygen. These delivery systems enhance the efficacy and extend the shelf life of products containing oleoresins and essential oils.

- Cosmetic and personal care applications: Oleoresins and essential oils are incorporated into various cosmetic and personal care products due to their fragrance, preservative properties, and skin benefits. They are used in perfumes, skincare formulations, hair care products, and aromatherapy applications. These natural extracts can provide moisturizing, anti-aging, and skin-soothing effects while offering natural alternatives to synthetic ingredients in beauty and personal care formulations.

02 Applications in food and flavor industry

Oleoresins and essential oils are widely used in the food and flavor industry as natural flavoring agents, preservatives, and colorants. They provide concentrated flavor profiles and aromatic properties that enhance food products. These natural extracts can replace synthetic additives, meeting consumer demand for clean label products. Their application extends to beverages, confectionery, savory products, and various processed foods.Expand Specific Solutions03 Pharmaceutical and therapeutic applications

Oleoresins and essential oils possess various therapeutic properties including antimicrobial, anti-inflammatory, antioxidant, and analgesic effects. These natural extracts are incorporated into pharmaceutical formulations, nutraceuticals, and traditional medicine preparations. They are used to treat various ailments including respiratory conditions, digestive disorders, skin problems, and pain management. Research continues to explore their potential in modern medicine and drug development.Expand Specific Solutions04 Formulation and stability enhancement

Formulating oleoresins and essential oils presents challenges due to their volatility, oxidation susceptibility, and limited water solubility. Various techniques are employed to enhance their stability and bioavailability, including microencapsulation, emulsification, and complexation with cyclodextrins. These formulation approaches protect the active compounds from degradation, control their release, and improve their integration into various product matrices.Expand Specific Solutions05 Cosmetic and personal care applications

Oleoresins and essential oils are valuable ingredients in cosmetic and personal care products due to their fragrance, skin benefits, and natural origin. They are incorporated into perfumes, skincare formulations, hair care products, and aromatherapy preparations. These natural extracts can provide various skin benefits including moisturization, anti-aging effects, and skin barrier protection. Their natural origin aligns with the growing consumer preference for plant-based cosmetic ingredients.Expand Specific Solutions

Key Industry Players and Competitive Landscape

The oleoresin versus essential oils market is currently in a growth phase, with increasing demand driven by natural product preferences across food, cosmetics, and pharmaceutical industries. The global market size for these botanical extracts exceeds $15 billion, with essential oils holding the larger share but oleoresins growing faster at 7-8% annually. Technologically, extraction methods are evolving from traditional steam distillation toward more efficient supercritical CO2 processes. Leading players include established multinationals like L'Oréal, Procter & Gamble, and The Coca-Cola Co. utilizing these ingredients in consumer products, alongside specialized producers such as Takasago International, Kemin Industries, and Novus International who focus on extraction technology innovation and product development for specific applications in flavors, fragrances, and functional ingredients.

L'Oréal SA

Technical Solution: L'Oréal has developed a sophisticated "Phyto-Fraction" technology platform that differentially extracts and utilizes both essential oils and oleoresins for cosmetic applications. Their approach employs a sequential extraction methodology that first isolates volatile aromatic compounds using low-temperature vacuum distillation, preserving delicate notes often lost in conventional steam distillation. This is followed by a proprietary solvent extraction process using green solvents to obtain oleoresins with specific bioactive profiles. L'Oréal's innovation includes a novel microemulsion delivery system that enhances the bioavailability of both essential oil and oleoresin components when applied topically. Their technology incorporates advanced liposomal encapsulation that stabilizes volatile compounds while allowing controlled release of active components from oleoresins. L'Oréal has also pioneered analytical methods that can characterize the complete phytochemical profile of both extract types, enabling standardized formulations with consistent sensory and functional properties.

Strengths: Advanced delivery systems enhancing bioavailability of active compounds; sophisticated analytical capabilities ensuring consistent product performance; expertise in formulating stable products combining both extract types. Weaknesses: Technology primarily optimized for cosmetic applications rather than broader industrial uses; higher production costs compared to single-extract approaches; complex formulation requirements for certain applications.

Kemin Industries, Inc.

Technical Solution: Kemin has developed an integrated extraction and stabilization platform called "OleoShield" that addresses the fundamental differences between essential oils and oleoresins in industrial applications. Their technology employs a proprietary multi-stage extraction process that first isolates volatile compounds through modified molecular distillation, followed by targeted solvent extraction optimized for specific non-volatile bioactive compounds. Kemin's innovation includes a novel antioxidant system specifically designed to stabilize both phenolic compounds in oleoresins and terpenes in essential oils, extending shelf-life significantly beyond industry standards. Their process incorporates molecular encapsulation technology that protects sensitive compounds from degradation while enhancing water dispersibility - a critical factor for both types of extracts. Kemin has also developed analytical methods that can precisely quantify both volatile and non-volatile bioactive components, enabling standardized products with consistent efficacy profiles.

Strengths: Superior stabilization technology extending product shelf-life in challenging applications; comprehensive analytical capabilities ensuring consistent bioactive profiles; versatile application across food, feed, and health industries. Weaknesses: Higher production costs compared to conventional extraction methods; complex formulation requirements for certain applications; technology requires specialized handling and storage conditions.

Critical Patents and Innovations in Natural Extract Technology

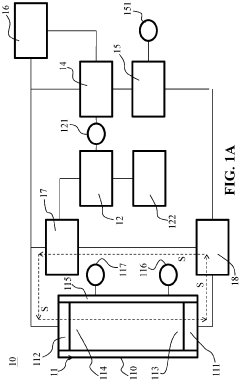

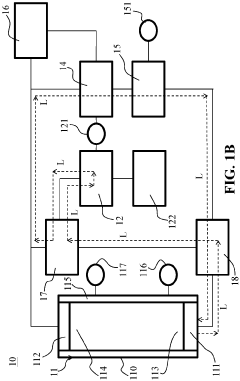

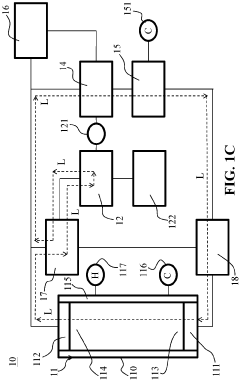

Improved extraction apparatus and method thereof

PatentActiveEP4166211A1

Innovation

- A system comprising a circulation pump, discharge pump, extraction module, reservoir, evaporators, and condensers using C1 to C4 fluorinated hydrocarbons, which operates in short and long loop circulation modes to efficiently extract active components from plant materials, with the option of additional vapor and heat pumps for enhanced vaporization and liquefaction.

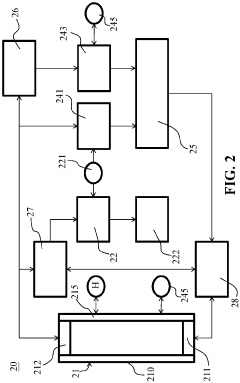

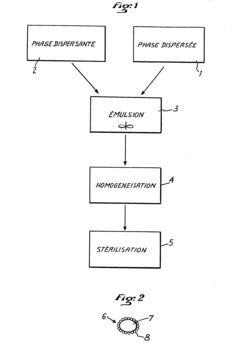

Process for diffusing essential oils and oleoresins from spices in a vehicle solution

PatentInactiveEP0238385A1

Innovation

- A process involving the formation of a homogeneous solution of fatty oil, essential oil, and oleoresin, mixed with a colloidal carrier solution, emulsified, and then homogenized into microparticles using high-pressure techniques to ensure uniform distribution and sterilization, preventing reconstitution and maintaining homogeneity.

Regulatory Framework for Natural Extract Products

The regulatory landscape governing natural extract products varies significantly across global markets, creating a complex framework that manufacturers and distributors must navigate. For oleoresins and essential oils, regulatory compliance encompasses multiple dimensions including product classification, quality standards, labeling requirements, and safety assessments.

In the United States, the FDA regulates oleoresins and essential oils differently based on their intended use. When marketed for therapeutic purposes, they fall under drug regulations requiring extensive safety and efficacy documentation. When used as food additives, they must comply with GRAS (Generally Recognized As Safe) standards or food additive regulations. The FDA's 21 CFR Part 182 specifically addresses many plant-derived extracts used in food applications.

The European Union implements more stringent regulations through the European Medicines Agency (EMA) and European Food Safety Authority (EFSA). The EU Regulation No. 1334/2008 governs flavorings and certain food ingredients with flavoring properties, directly impacting oleoresins used in food applications. Essential oils marketed with therapeutic claims must comply with the Traditional Herbal Medicinal Products Directive (THMPD).

Quality standards represent another critical regulatory component. The International Organization for Standardization (ISO) has developed specific standards for essential oils (ISO/TC 54), while the United States Pharmacopeia (USP) and European Pharmacopoeia (Ph. Eur.) provide quality specifications for both oleoresins and essential oils used in pharmaceutical applications.

Labeling requirements differ substantially between regions. In the EU, the Cosmetic Products Regulation requires listing of all components of essential oils that are classified as allergens, while the US FDA requires complete ingredient disclosure for cosmetics containing these natural extracts. For food applications, both regions mandate declaration of these ingredients on product labels.

Environmental and sustainability regulations increasingly impact the natural extract industry. The Convention on International Trade in Endangered Species of Wild Fauna and Flora (CITES) restricts trade in certain plant species used for essential oil and oleoresin production, while the Nagoya Protocol governs access to genetic resources and benefit-sharing.

Regulatory compliance costs and timelines vary significantly between oleoresins and essential oils due to their different chemical complexity and safety profiles. Essential oils, with their higher concentration of volatile compounds, often face more rigorous safety assessments, particularly for dermal applications where sensitization potential must be evaluated.

In the United States, the FDA regulates oleoresins and essential oils differently based on their intended use. When marketed for therapeutic purposes, they fall under drug regulations requiring extensive safety and efficacy documentation. When used as food additives, they must comply with GRAS (Generally Recognized As Safe) standards or food additive regulations. The FDA's 21 CFR Part 182 specifically addresses many plant-derived extracts used in food applications.

The European Union implements more stringent regulations through the European Medicines Agency (EMA) and European Food Safety Authority (EFSA). The EU Regulation No. 1334/2008 governs flavorings and certain food ingredients with flavoring properties, directly impacting oleoresins used in food applications. Essential oils marketed with therapeutic claims must comply with the Traditional Herbal Medicinal Products Directive (THMPD).

Quality standards represent another critical regulatory component. The International Organization for Standardization (ISO) has developed specific standards for essential oils (ISO/TC 54), while the United States Pharmacopeia (USP) and European Pharmacopoeia (Ph. Eur.) provide quality specifications for both oleoresins and essential oils used in pharmaceutical applications.

Labeling requirements differ substantially between regions. In the EU, the Cosmetic Products Regulation requires listing of all components of essential oils that are classified as allergens, while the US FDA requires complete ingredient disclosure for cosmetics containing these natural extracts. For food applications, both regions mandate declaration of these ingredients on product labels.

Environmental and sustainability regulations increasingly impact the natural extract industry. The Convention on International Trade in Endangered Species of Wild Fauna and Flora (CITES) restricts trade in certain plant species used for essential oil and oleoresin production, while the Nagoya Protocol governs access to genetic resources and benefit-sharing.

Regulatory compliance costs and timelines vary significantly between oleoresins and essential oils due to their different chemical complexity and safety profiles. Essential oils, with their higher concentration of volatile compounds, often face more rigorous safety assessments, particularly for dermal applications where sensitization potential must be evaluated.

Sustainability and Environmental Impact Assessment

The environmental impact of oleoresin and essential oil production represents a critical consideration in their commercial application. Oleoresin extraction typically employs organic solvents such as hexane, which raises significant environmental concerns regarding chemical waste disposal and potential groundwater contamination. The solvent recovery process, while economically necessary, consumes substantial energy and may release volatile organic compounds (VOCs) into the atmosphere if not properly managed. Conversely, traditional steam distillation methods for essential oils generally present a lower environmental risk profile, though they remain energy-intensive operations.

Water usage patterns differ markedly between these two extraction methodologies. Essential oil production through hydrodistillation requires significant water volumes, potentially straining local water resources in arid regions. Oleoresin extraction, while less water-intensive during the primary extraction phase, generates contaminated wastewater requiring specialized treatment before environmental release.

Carbon footprint assessments reveal that both industries face sustainability challenges. The energy requirements for solvent recovery in oleoresin production and the heating demands of steam distillation contribute substantially to greenhouse gas emissions. Recent life cycle assessments indicate that producing one kilogram of essential oil may generate between 25-40 kg CO2 equivalent, while oleoresin production averages 15-30 kg CO2 equivalent per kilogram, though these figures vary significantly based on production scale and technological efficiency.

Biodiversity impacts present another dimension for consideration. Oleoresin harvesting, particularly from tree species like pine or frankincense, can be conducted through sustainable tapping methods that preserve the source organism. Essential oil production, especially for high-value botanicals, has occasionally driven overharvesting of wild plant populations, threatening biodiversity in certain ecosystems. The cultivation expansion for commercial essential oil crops has, in some regions, contributed to habitat conversion and monoculture development.

Industry response to these environmental challenges has accelerated in recent years. Leading producers have implemented closed-loop solvent recovery systems, renewable energy integration, and water recycling technologies. Certification programs such as USDA Organic, Forest Stewardship Council (FSC), and Rainforest Alliance have established sustainability benchmarks for both industries. Supercritical CO2 extraction represents a promising alternative technology that eliminates conventional solvent concerns, though its higher capital costs currently limit widespread adoption.

The regulatory landscape continues to evolve, with the European Union's REACH regulations and similar frameworks in other jurisdictions imposing increasingly stringent environmental compliance requirements on both oleoresin and essential oil producers. These regulatory pressures, combined with growing consumer demand for environmentally responsible products, are driving significant sustainability innovations throughout both supply chains.

Water usage patterns differ markedly between these two extraction methodologies. Essential oil production through hydrodistillation requires significant water volumes, potentially straining local water resources in arid regions. Oleoresin extraction, while less water-intensive during the primary extraction phase, generates contaminated wastewater requiring specialized treatment before environmental release.

Carbon footprint assessments reveal that both industries face sustainability challenges. The energy requirements for solvent recovery in oleoresin production and the heating demands of steam distillation contribute substantially to greenhouse gas emissions. Recent life cycle assessments indicate that producing one kilogram of essential oil may generate between 25-40 kg CO2 equivalent, while oleoresin production averages 15-30 kg CO2 equivalent per kilogram, though these figures vary significantly based on production scale and technological efficiency.

Biodiversity impacts present another dimension for consideration. Oleoresin harvesting, particularly from tree species like pine or frankincense, can be conducted through sustainable tapping methods that preserve the source organism. Essential oil production, especially for high-value botanicals, has occasionally driven overharvesting of wild plant populations, threatening biodiversity in certain ecosystems. The cultivation expansion for commercial essential oil crops has, in some regions, contributed to habitat conversion and monoculture development.

Industry response to these environmental challenges has accelerated in recent years. Leading producers have implemented closed-loop solvent recovery systems, renewable energy integration, and water recycling technologies. Certification programs such as USDA Organic, Forest Stewardship Council (FSC), and Rainforest Alliance have established sustainability benchmarks for both industries. Supercritical CO2 extraction represents a promising alternative technology that eliminates conventional solvent concerns, though its higher capital costs currently limit widespread adoption.

The regulatory landscape continues to evolve, with the European Union's REACH regulations and similar frameworks in other jurisdictions imposing increasingly stringent environmental compliance requirements on both oleoresin and essential oil producers. These regulatory pressures, combined with growing consumer demand for environmentally responsible products, are driving significant sustainability innovations throughout both supply chains.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!