Patents Licensing and Freedom to Operate in the MicroLED IP Landscape

AUG 25, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

MicroLED IP Evolution and Objectives

MicroLED technology has evolved significantly since its inception in the early 2000s, with the first practical demonstrations emerging from research institutions like the University of Illinois and companies such as Sony. The evolution of MicroLED intellectual property has followed a trajectory from fundamental display architecture patents to increasingly specialized manufacturing techniques and applications. This progression reflects the industry's recognition of MicroLED's potential to overcome limitations of traditional display technologies through superior brightness, energy efficiency, and longevity.

The initial patent landscape was dominated by basic technology claims covering pixel structures and array configurations. As the field matured, IP development shifted toward mass transfer techniques, a critical manufacturing challenge that continues to shape the competitive landscape today. The period between 2010-2015 marked a significant acceleration in patent filings, coinciding with major acquisitions such as Apple's purchase of LuxVue Technology, which signaled the technology's commercial potential.

Current IP objectives in the MicroLED space focus on several key areas that will determine market leadership. Manufacturing scalability remains paramount, with companies seeking protectable innovations in mass transfer processes that can efficiently place millions of microscopic LEDs with high precision and yield. Another critical objective involves reducing production costs to enable broader market adoption beyond premium applications.

Integration technologies represent another vital IP frontier, with significant patent activity around driver circuitry, interconnection methods, and system architecture. These patents aim to optimize the performance advantages of MicroLED while addressing technical challenges in power distribution and thermal management. Additionally, companies are pursuing IP protection for novel applications beyond traditional displays, including transparent displays, flexible/foldable implementations, and augmented reality devices.

The geographical distribution of MicroLED patents reveals an evolving competitive landscape. While early fundamental patents originated primarily from U.S. and European research institutions, recent years have seen aggressive filing activity from East Asian companies, particularly in South Korea, Taiwan, and China. This shift reflects the strategic importance of MicroLED technology to the global display industry and the increasing competition for freedom to operate.

Looking forward, the MicroLED IP landscape is expected to continue evolving toward application-specific innovations and manufacturing optimizations. As the technology approaches wider commercialization, licensing strategies and patent pools will likely emerge as critical mechanisms for managing the complex web of interdependent intellectual property rights that characterize this promising display technology.

The initial patent landscape was dominated by basic technology claims covering pixel structures and array configurations. As the field matured, IP development shifted toward mass transfer techniques, a critical manufacturing challenge that continues to shape the competitive landscape today. The period between 2010-2015 marked a significant acceleration in patent filings, coinciding with major acquisitions such as Apple's purchase of LuxVue Technology, which signaled the technology's commercial potential.

Current IP objectives in the MicroLED space focus on several key areas that will determine market leadership. Manufacturing scalability remains paramount, with companies seeking protectable innovations in mass transfer processes that can efficiently place millions of microscopic LEDs with high precision and yield. Another critical objective involves reducing production costs to enable broader market adoption beyond premium applications.

Integration technologies represent another vital IP frontier, with significant patent activity around driver circuitry, interconnection methods, and system architecture. These patents aim to optimize the performance advantages of MicroLED while addressing technical challenges in power distribution and thermal management. Additionally, companies are pursuing IP protection for novel applications beyond traditional displays, including transparent displays, flexible/foldable implementations, and augmented reality devices.

The geographical distribution of MicroLED patents reveals an evolving competitive landscape. While early fundamental patents originated primarily from U.S. and European research institutions, recent years have seen aggressive filing activity from East Asian companies, particularly in South Korea, Taiwan, and China. This shift reflects the strategic importance of MicroLED technology to the global display industry and the increasing competition for freedom to operate.

Looking forward, the MicroLED IP landscape is expected to continue evolving toward application-specific innovations and manufacturing optimizations. As the technology approaches wider commercialization, licensing strategies and patent pools will likely emerge as critical mechanisms for managing the complex web of interdependent intellectual property rights that characterize this promising display technology.

Market Demand Analysis for MicroLED Technologies

The MicroLED display market is experiencing robust growth, driven by increasing demand for superior display technologies across multiple sectors. Current market projections indicate that the global MicroLED market is expected to reach $19.4 billion by 2026, growing at a CAGR of approximately 89.3% from 2021. This exceptional growth trajectory reflects the technology's potential to disrupt traditional display markets dominated by LCD and OLED technologies.

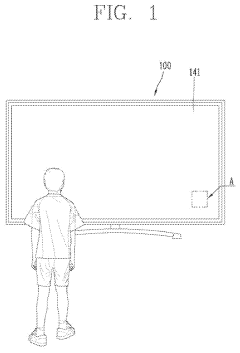

Consumer electronics represents the largest market segment for MicroLED technology, with smartphones, smartwatches, AR/VR headsets, and televisions being primary applications. Apple's acquisition of LuxVue in 2014 and subsequent patent filings signal strong interest from major consumer electronics manufacturers. Samsung and Sony have already commercialized MicroLED televisions, albeit at premium price points, indicating growing consumer interest despite current cost barriers.

The automotive sector presents another significant growth opportunity for MicroLED displays. Advanced driver-assistance systems (ADAS) and in-vehicle infotainment systems require high-brightness, durable displays capable of operating in variable lighting conditions. MicroLED's attributes of high brightness, low power consumption, and reliability make it particularly suitable for automotive applications, with market adoption expected to accelerate as manufacturing costs decrease.

Healthcare and defense sectors are emerging as promising markets for MicroLED technology. Medical imaging devices benefit from MicroLED's superior contrast and color accuracy, while military applications leverage its high brightness and energy efficiency for heads-up displays and portable devices. These specialized markets are less price-sensitive and more focused on performance characteristics, potentially providing early adoption pathways.

Regional analysis reveals Asia-Pacific as the dominant manufacturing hub, with significant investments in MicroLED production facilities in South Korea, Taiwan, and China. North America leads in intellectual property development and high-end applications, while Europe shows growing interest in automotive and industrial applications.

Market surveys indicate that consumers are increasingly willing to pay premium prices for superior display quality, particularly for larger screen sizes. However, price sensitivity remains a critical factor for mass-market adoption. Industry analysts predict that as manufacturing processes mature and economies of scale are achieved, MicroLED displays will reach price parity with premium OLED displays by 2025-2027, potentially triggering widespread market adoption.

The intellectual property landscape significantly impacts market dynamics, with over 7,800 patent families related to MicroLED technology. This complex patent ecosystem necessitates strategic licensing agreements and potential cross-licensing arrangements among key industry players to enable market growth and prevent IP-related bottlenecks in commercialization efforts.

Consumer electronics represents the largest market segment for MicroLED technology, with smartphones, smartwatches, AR/VR headsets, and televisions being primary applications. Apple's acquisition of LuxVue in 2014 and subsequent patent filings signal strong interest from major consumer electronics manufacturers. Samsung and Sony have already commercialized MicroLED televisions, albeit at premium price points, indicating growing consumer interest despite current cost barriers.

The automotive sector presents another significant growth opportunity for MicroLED displays. Advanced driver-assistance systems (ADAS) and in-vehicle infotainment systems require high-brightness, durable displays capable of operating in variable lighting conditions. MicroLED's attributes of high brightness, low power consumption, and reliability make it particularly suitable for automotive applications, with market adoption expected to accelerate as manufacturing costs decrease.

Healthcare and defense sectors are emerging as promising markets for MicroLED technology. Medical imaging devices benefit from MicroLED's superior contrast and color accuracy, while military applications leverage its high brightness and energy efficiency for heads-up displays and portable devices. These specialized markets are less price-sensitive and more focused on performance characteristics, potentially providing early adoption pathways.

Regional analysis reveals Asia-Pacific as the dominant manufacturing hub, with significant investments in MicroLED production facilities in South Korea, Taiwan, and China. North America leads in intellectual property development and high-end applications, while Europe shows growing interest in automotive and industrial applications.

Market surveys indicate that consumers are increasingly willing to pay premium prices for superior display quality, particularly for larger screen sizes. However, price sensitivity remains a critical factor for mass-market adoption. Industry analysts predict that as manufacturing processes mature and economies of scale are achieved, MicroLED displays will reach price parity with premium OLED displays by 2025-2027, potentially triggering widespread market adoption.

The intellectual property landscape significantly impacts market dynamics, with over 7,800 patent families related to MicroLED technology. This complex patent ecosystem necessitates strategic licensing agreements and potential cross-licensing arrangements among key industry players to enable market growth and prevent IP-related bottlenecks in commercialization efforts.

Global MicroLED Patent Landscape and Barriers

The MicroLED patent landscape has evolved significantly over the past decade, with a complex web of intellectual property rights distributed across multiple global players. Currently, over 8,000 patent families related to MicroLED technology exist worldwide, creating substantial barriers to market entry. This fragmented IP ecosystem necessitates careful navigation for companies seeking to commercialize MicroLED products without infringement risks.

Major patent concentration exists in three geographical regions: East Asia (particularly South Korea, Japan, and Taiwan), North America (dominated by the United States), and Europe. South Korean companies like Samsung and LG hold substantial portfolios focused on display architecture and manufacturing processes. Japanese entities primarily control patents related to LED epitaxial growth and substrate technologies, while Taiwanese companies have concentrated on transfer and integration techniques.

The patent landscape reveals several critical bottlenecks that impede widespread MicroLED commercialization. Mass transfer technology represents the most significant barrier, with companies like Apple, X-Celeprint, and eLux holding key patents for different transfer methodologies. These patents cover essential processes for moving millions of tiny LED chips from growth substrates to display backplanes with high precision and yield.

Another substantial barrier exists in defect correction and repair technologies. Companies including Samsung and BOE have established strong patent positions around methods to identify, replace, or compensate for defective pixels—a critical requirement given the millions of individual emitters in a single display.

Color conversion technologies constitute a third major barrier, with patents covering quantum dot integration, phosphor-based conversion, and color filter approaches. Companies like Nanosys and QD Vision control significant IP in this domain, creating licensing dependencies for manufacturers pursuing certain color implementation strategies.

The patent thicket is further complicated by overlapping claims and potential submarine patents that may emerge as the technology matures. Cross-licensing agreements between major players have begun to form, but smaller entities and new market entrants face significant challenges in securing freedom to operate without substantial licensing costs or litigation risks.

Defensive patent aggregation has emerged as a strategy among several industry consortia, with companies pooling resources to acquire strategic patents or develop joint defensive portfolios. This approach aims to mitigate the risk of patent assertion entities (PAEs) acquiring and weaponizing critical MicroLED IP against industry participants.

Major patent concentration exists in three geographical regions: East Asia (particularly South Korea, Japan, and Taiwan), North America (dominated by the United States), and Europe. South Korean companies like Samsung and LG hold substantial portfolios focused on display architecture and manufacturing processes. Japanese entities primarily control patents related to LED epitaxial growth and substrate technologies, while Taiwanese companies have concentrated on transfer and integration techniques.

The patent landscape reveals several critical bottlenecks that impede widespread MicroLED commercialization. Mass transfer technology represents the most significant barrier, with companies like Apple, X-Celeprint, and eLux holding key patents for different transfer methodologies. These patents cover essential processes for moving millions of tiny LED chips from growth substrates to display backplanes with high precision and yield.

Another substantial barrier exists in defect correction and repair technologies. Companies including Samsung and BOE have established strong patent positions around methods to identify, replace, or compensate for defective pixels—a critical requirement given the millions of individual emitters in a single display.

Color conversion technologies constitute a third major barrier, with patents covering quantum dot integration, phosphor-based conversion, and color filter approaches. Companies like Nanosys and QD Vision control significant IP in this domain, creating licensing dependencies for manufacturers pursuing certain color implementation strategies.

The patent thicket is further complicated by overlapping claims and potential submarine patents that may emerge as the technology matures. Cross-licensing agreements between major players have begun to form, but smaller entities and new market entrants face significant challenges in securing freedom to operate without substantial licensing costs or litigation risks.

Defensive patent aggregation has emerged as a strategy among several industry consortia, with companies pooling resources to acquire strategic patents or develop joint defensive portfolios. This approach aims to mitigate the risk of patent assertion entities (PAEs) acquiring and weaponizing critical MicroLED IP against industry participants.

Current Licensing Models and FTO Strategies

01 Patent licensing strategies for MicroLED technology

Various strategies for licensing MicroLED intellectual property are outlined, including establishing licensing agreements, determining royalty rates, and creating patent pools. These approaches enable companies to monetize their MicroLED innovations while allowing others to access the technology through structured agreements. Effective licensing strategies can help balance innovation protection with market access, creating revenue streams for patent holders while enabling broader industry development.- Patent licensing strategies for MicroLED technology: Various licensing strategies can be implemented for MicroLED technology patents, including cross-licensing agreements, patent pools, and direct licensing. These strategies enable companies to monetize their intellectual property while gaining access to necessary technologies. Effective licensing frameworks can help manage IP risks and create revenue streams while facilitating technological advancement in the MicroLED industry.

- Freedom to Operate (FTO) analysis for MicroLED implementation: Freedom to Operate analysis is crucial for companies developing MicroLED technologies to identify potential patent infringement risks. This involves comprehensive patent landscape analysis, identification of key patent holders, and assessment of potential licensing needs. FTO analyses help companies navigate the complex patent environment and develop strategies to mitigate IP risks before commercializing MicroLED products.

- IP protection and security measures for MicroLED technology: Protecting intellectual property in the MicroLED sector involves implementing robust security measures and authentication systems. This includes digital rights management, encryption technologies, and secure licensing frameworks to prevent unauthorized use of patented technologies. Companies developing MicroLED technologies need comprehensive IP protection strategies to safeguard their innovations in this competitive field.

- Patent portfolio management for MicroLED innovations: Effective management of MicroLED patent portfolios involves strategic acquisition, maintenance, and leveraging of patents. This includes regular portfolio reviews, competitive analysis, and alignment with business objectives. Companies must evaluate the strength and relevance of their MicroLED patents to maximize value and identify gaps that may require additional R&D or licensing from third parties.

- MicroLED manufacturing process patents and licensing: Patents related to MicroLED manufacturing processes cover various aspects including transfer techniques, bonding methods, and integration technologies. These patents are particularly valuable as they often represent critical bottlenecks in production. Licensing these manufacturing process patents is essential for companies looking to commercialize MicroLED displays, as they often require access to multiple patented technologies to create viable production lines.

02 Freedom to Operate (FTO) analysis for MicroLED technology

Freedom to Operate analysis involves evaluating existing patent landscapes to identify potential infringement risks before commercializing MicroLED technology. This process includes comprehensive patent searches, claim analysis, and risk assessment to determine whether a company can manufacture and sell MicroLED products without infringing third-party patents. FTO analyses help companies navigate complex patent landscapes, identify licensing needs, and develop strategies to mitigate infringement risks.Expand Specific Solutions03 IP protection and enforcement for MicroLED innovations

Protection and enforcement mechanisms for MicroLED intellectual property include patent filing strategies, monitoring for infringement, and legal remedies. Companies developing MicroLED technology must implement robust IP protection strategies, including international patent filings and trade secret protection. Enforcement mechanisms may include litigation, cease and desist notices, and negotiated settlements to address unauthorized use of protected MicroLED technologies.Expand Specific Solutions04 MicroLED manufacturing process patents

Patents covering MicroLED manufacturing processes focus on innovative fabrication techniques, assembly methods, and integration technologies. These patents protect specific approaches to producing MicroLED displays, including transfer processes, substrate preparation, and interconnection technologies. Manufacturing process patents are particularly valuable in the MicroLED industry due to the significant technical challenges in mass-producing these displays efficiently and cost-effectively.Expand Specific Solutions05 Software licensing and management for MicroLED applications

Software licensing and management systems specifically designed for MicroLED applications include control algorithms, display management software, and calibration tools. These systems often require specialized licensing approaches due to their integration with hardware components. Software licensing models for MicroLED technology may include perpetual licenses, subscription-based models, or hybrid approaches that accommodate both the software and hardware aspects of MicroLED implementations.Expand Specific Solutions

Key Patent Holders and Competitive Positioning

The MicroLED IP landscape is currently in an early growth phase, with market size expanding rapidly due to increasing applications in AR/VR, automotive displays, and smart devices. The technology is approaching commercial maturity, though challenges in mass production and cost reduction remain. Key players demonstrate varying levels of technological advancement: Samsung and LG Display lead with extensive patent portfolios and commercial prototypes; BOE Technology and Jade Bird Display are emerging with specialized MicroLED innovations; while Intel and Huawei are strategically positioning through cross-industry applications. Companies like AvicenaTech and LUMEOVA represent innovative startups focusing on niche applications. The competitive landscape is characterized by intense patent activity, with established display manufacturers competing against semiconductor giants and specialized newcomers for freedom to operate in this transformative display technology.

Samsung Electronics Co., Ltd.

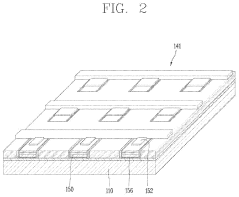

Technical Solution: Samsung Electronics has developed a comprehensive MicroLED patent portfolio covering the entire value chain from manufacturing to application. Their technical approach focuses on mass transfer techniques using elastomer stamps for precise placement of microscopic LED chips onto display substrates. Samsung has pioneered the "nozzle vacuum" transfer method that allows for simultaneous transfer of thousands of MicroLED chips with high accuracy and yield rates. Their technology includes proprietary solutions for pixel circuit designs that address current leakage issues in MicroLED displays. Samsung has also developed specialized phosphor conversion techniques to achieve full-color displays from blue MicroLED chips, significantly reducing manufacturing complexity. The company has established cross-licensing agreements with key industry players to ensure freedom to operate while protecting their core innovations[1][3].

Strengths: Extensive vertical integration from chip manufacturing to display assembly gives Samsung control over the entire supply chain. Their mass transfer technology achieves industry-leading placement accuracy and yield rates. Weaknesses: High manufacturing costs remain a challenge for consumer market penetration, and some fundamental MicroLED patents are held by competitors, requiring licensing agreements.

Mikro Mesa Technology Co Ltd

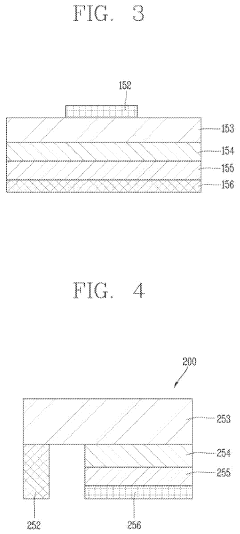

Technical Solution: Mikro Mesa Technology has developed a distinctive approach to MicroLED manufacturing focused on epitaxial growth and chip processing technologies. Their technical solution centers on a proprietary "mesa structure" fabrication process that enables the creation of ultra-small MicroLED chips with enhanced light extraction efficiency. The company has pioneered specialized etching techniques that create optimized sidewall profiles on MicroLED chips, significantly reducing light absorption and improving quantum efficiency. Their patent portfolio includes innovations in passivation layer technologies that address surface recombination issues, a critical factor in MicroLED efficiency and longevity. Mikro Mesa has also developed unique metallization processes for MicroLED contacts that reduce resistance while maintaining compatibility with mass transfer processes. Their technology includes specialized testing methodologies for wafer-level qualification of MicroLED chips before transfer, significantly improving final yield rates[4][7].

Strengths: Specialized expertise in epitaxial growth and chip processing gives them advantages in fundamental MicroLED quality and performance characteristics. Their mesa structure approach enables some of the smallest commercially viable MicroLED chips. Weaknesses: Limited vertical integration requires partnerships for display integration, and their technologies are more focused on chip-level innovations rather than complete display solutions.

Critical Patents and Technical Innovations Analysis

Method for manufacturing display device and substrate for manufacturing display device

PatentActiveUS20220077122A1

Innovation

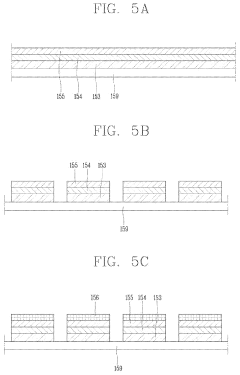

- The use of an assembly substrate with a metal shielding layer that completely shields electric fields at unnecessary positions, allowing for precise positioning and transfer of microLEDs using a combination of magnetic and electric fields, and a transfer substrate with protrusions to facilitate the separation and transfer of microLEDs onto a wiring substrate.

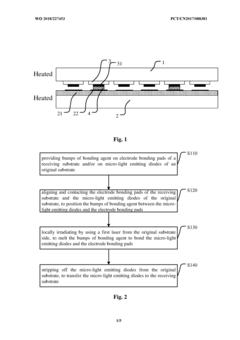

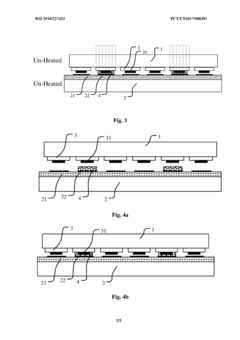

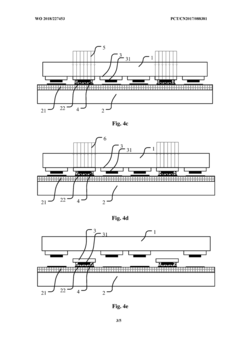

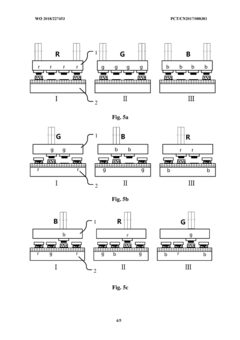

Method for transferring micro-light emitting diodes, micro-light emitting diode device and electronic device

PatentWO2018227453A1

Innovation

- Laser-assisted selective melting of bonding agent bumps for MicroLED transfer, eliminating the need for heating the entire substrate and reducing thermal mismatch issues.

- Precise alignment and bonding technique using pre-positioned bonding agent bumps on both the MicroLEDs and receiving substrate, enabling high-resolution array transfers.

- Room temperature transfer process that maintains structural integrity of both the growth substrate and receiving substrate, particularly beneficial for large high-resolution MicroLED displays.

Cross-Industry Licensing Implications

The MicroLED landscape presents a unique cross-industry licensing challenge due to the convergence of multiple technology domains. Traditional display manufacturers now find themselves navigating patent portfolios from semiconductor companies, LED manufacturers, and even consumer electronics giants. This convergence necessitates unprecedented cross-sector licensing agreements that bridge historically separate industries.

The semiconductor industry's approach to patent licensing, characterized by extensive cross-licensing agreements and patent pools, offers valuable models for the emerging MicroLED ecosystem. Companies like TSMC and Intel have established frameworks for technology sharing that balance innovation protection with market access. These models could be adapted to address the fragmented MicroLED IP landscape, where no single company holds all necessary patents for commercialization.

Consumer electronics companies face particular challenges when entering the MicroLED space. Apple, Samsung, and LG must secure licenses not only for display technologies but also for semiconductor manufacturing processes and materials science innovations. This multi-domain licensing requirement increases complexity and costs, potentially slowing market entry for companies without established licensing relationships across these sectors.

Automotive and aerospace industries represent growing markets for MicroLED displays, introducing additional licensing considerations. These sectors have distinct reliability requirements and certification standards that may necessitate specialized licensing terms beyond those typical in consumer electronics. Companies like BMW and Airbus must navigate both display technology licenses and industry-specific compliance requirements.

The global nature of MicroLED supply chains further complicates licensing strategies. Different jurisdictions maintain varying approaches to patent enforcement and licensing requirements. Companies must develop region-specific licensing strategies while maintaining global product consistency, particularly challenging when core technologies may be protected differently across major markets like the US, EU, and Asia.

Standard-essential patents (SEPs) are emerging as a critical consideration in MicroLED licensing. As industry standards develop for interfaces, testing methodologies, and performance metrics, companies holding SEPs will gain significant leverage in cross-industry negotiations. Organizations like JEDEC and VESA may play increasing roles in facilitating fair, reasonable, and non-discriminatory (FRAND) licensing terms across industry boundaries.

The evolution of MicroLED technology will likely drive new licensing models that accommodate both vertical integration and specialized expertise. Companies may increasingly pursue strategic licensing partnerships that span traditional industry boundaries, creating new ecosystems of collaboration rather than conventional competitor relationships.

The semiconductor industry's approach to patent licensing, characterized by extensive cross-licensing agreements and patent pools, offers valuable models for the emerging MicroLED ecosystem. Companies like TSMC and Intel have established frameworks for technology sharing that balance innovation protection with market access. These models could be adapted to address the fragmented MicroLED IP landscape, where no single company holds all necessary patents for commercialization.

Consumer electronics companies face particular challenges when entering the MicroLED space. Apple, Samsung, and LG must secure licenses not only for display technologies but also for semiconductor manufacturing processes and materials science innovations. This multi-domain licensing requirement increases complexity and costs, potentially slowing market entry for companies without established licensing relationships across these sectors.

Automotive and aerospace industries represent growing markets for MicroLED displays, introducing additional licensing considerations. These sectors have distinct reliability requirements and certification standards that may necessitate specialized licensing terms beyond those typical in consumer electronics. Companies like BMW and Airbus must navigate both display technology licenses and industry-specific compliance requirements.

The global nature of MicroLED supply chains further complicates licensing strategies. Different jurisdictions maintain varying approaches to patent enforcement and licensing requirements. Companies must develop region-specific licensing strategies while maintaining global product consistency, particularly challenging when core technologies may be protected differently across major markets like the US, EU, and Asia.

Standard-essential patents (SEPs) are emerging as a critical consideration in MicroLED licensing. As industry standards develop for interfaces, testing methodologies, and performance metrics, companies holding SEPs will gain significant leverage in cross-industry negotiations. Organizations like JEDEC and VESA may play increasing roles in facilitating fair, reasonable, and non-discriminatory (FRAND) licensing terms across industry boundaries.

The evolution of MicroLED technology will likely drive new licensing models that accommodate both vertical integration and specialized expertise. Companies may increasingly pursue strategic licensing partnerships that span traditional industry boundaries, creating new ecosystems of collaboration rather than conventional competitor relationships.

Legal Risk Mitigation Strategies for MicroLED Implementation

In the complex landscape of MicroLED technology implementation, organizations must develop comprehensive legal risk mitigation strategies to navigate the dense patent environment. A multi-layered approach begins with thorough Freedom to Operate (FTO) analyses, which should be conducted early in the product development cycle and updated regularly as the IP landscape evolves. These analyses must cover not only core MicroLED technologies but also peripheral technologies involved in manufacturing, integration, and application.

Strategic patent portfolio development serves as both shield and sword in this environment. Companies should focus on building defensive patent portfolios that create barriers around their core innovations while simultaneously developing strategic patents that can serve as bargaining chips in licensing negotiations. This balanced approach provides leverage when engaging with major patent holders in the ecosystem.

Cross-licensing agreements represent a pragmatic solution for operating in the fragmented MicroLED patent landscape. By establishing mutually beneficial arrangements with key IP holders, companies can secure necessary rights while reducing litigation risks. Patent pools specifically designed for MicroLED technologies are emerging as efficient mechanisms for streamlining licensing processes and reducing transaction costs across the industry.

Design-around strategies require close collaboration between legal and technical teams to identify alternative technical approaches that achieve similar functionality without infringing existing patents. This approach demands continuous monitoring of patent filings and regular reassessment of product designs against evolving IP constraints.

Geographic considerations play a crucial role in risk mitigation planning. Companies should develop market-specific strategies that account for regional variations in patent enforcement, litigation environments, and regulatory frameworks. This may include selective market entry based on IP risk assessment or tailored product modifications for specific jurisdictions.

Indemnification provisions in supplier agreements provide an additional layer of protection. These contractual safeguards should clearly allocate IP risk between parties and establish processes for addressing potential infringement claims. For smaller entities, patent insurance policies can offer financial protection against unexpected litigation, though coverage terms must be carefully evaluated against the specific risk profile of MicroLED implementation.

Maintaining institutional knowledge through comprehensive documentation of design decisions, technical alternatives considered, and patent analyses conducted is essential for defending against future infringement allegations and demonstrating good-faith efforts to respect intellectual property rights.

Strategic patent portfolio development serves as both shield and sword in this environment. Companies should focus on building defensive patent portfolios that create barriers around their core innovations while simultaneously developing strategic patents that can serve as bargaining chips in licensing negotiations. This balanced approach provides leverage when engaging with major patent holders in the ecosystem.

Cross-licensing agreements represent a pragmatic solution for operating in the fragmented MicroLED patent landscape. By establishing mutually beneficial arrangements with key IP holders, companies can secure necessary rights while reducing litigation risks. Patent pools specifically designed for MicroLED technologies are emerging as efficient mechanisms for streamlining licensing processes and reducing transaction costs across the industry.

Design-around strategies require close collaboration between legal and technical teams to identify alternative technical approaches that achieve similar functionality without infringing existing patents. This approach demands continuous monitoring of patent filings and regular reassessment of product designs against evolving IP constraints.

Geographic considerations play a crucial role in risk mitigation planning. Companies should develop market-specific strategies that account for regional variations in patent enforcement, litigation environments, and regulatory frameworks. This may include selective market entry based on IP risk assessment or tailored product modifications for specific jurisdictions.

Indemnification provisions in supplier agreements provide an additional layer of protection. These contractual safeguards should clearly allocate IP risk between parties and establish processes for addressing potential infringement claims. For smaller entities, patent insurance policies can offer financial protection against unexpected litigation, though coverage terms must be carefully evaluated against the specific risk profile of MicroLED implementation.

Maintaining institutional knowledge through comprehensive documentation of design decisions, technical alternatives considered, and patent analyses conducted is essential for defending against future infringement allegations and demonstrating good-faith efforts to respect intellectual property rights.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!