Regulations Affecting International Self-Powered Sensor Distribution

OCT 21, 202510 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Self-Powered Sensor Regulatory Background and Objectives

Self-powered sensors have evolved significantly over the past two decades, transitioning from laboratory curiosities to commercially viable solutions deployed across various industries. These autonomous sensing devices, which harvest energy from their environment rather than relying on batteries or external power sources, represent a critical advancement in the Internet of Things (IoT) ecosystem. The technology's development trajectory has been shaped by advancements in energy harvesting techniques, including piezoelectric, thermoelectric, photovoltaic, and electromagnetic mechanisms, alongside miniaturization of electronic components and reduced power consumption requirements.

The regulatory landscape governing self-powered sensors varies substantially across international jurisdictions, creating a complex compliance environment for global distribution. Initially, regulations focused primarily on radio frequency emissions and electromagnetic compatibility. However, as these devices have proliferated, regulatory frameworks have expanded to address data privacy, cybersecurity, environmental impact, and specific industry applications such as healthcare and industrial monitoring.

A significant milestone in the regulatory evolution occurred in 2015 when the European Union introduced specific provisions for energy-autonomous sensing devices within its Radio Equipment Directive (RED). This was followed by similar frameworks in North America, Asia-Pacific regions, and emerging markets, though with notable variations in implementation requirements and compliance standards.

The primary objective of current regulatory efforts is to establish harmonized international standards that facilitate global distribution while ensuring safety, reliability, and interoperability. Regulatory bodies including the International Electrotechnical Commission (IEC), the Institute of Electrical and Electronics Engineers (IEEE), and the International Organization for Standardization (ISO) have initiated collaborative efforts to develop unified certification protocols for self-powered sensing technologies.

Key technical objectives in this domain include developing sensors with enhanced energy conversion efficiency, extended operational lifespans, and improved reliability under varying environmental conditions. Regulatory compliance must be achieved without compromising these performance parameters, presenting a significant engineering challenge.

From a market perspective, regulatory alignment aims to reduce barriers to entry for innovative self-powered sensor technologies, particularly for applications in remote monitoring, smart infrastructure, precision agriculture, and medical devices. The goal is to establish clear pathways for certification that accommodate both established manufacturers and emerging startups developing next-generation autonomous sensing solutions.

As the technology continues to mature, regulatory frameworks are increasingly focusing on end-of-life considerations, including recyclability, material recovery, and environmental impact mitigation, reflecting broader sustainability imperatives in the electronics sector.

The regulatory landscape governing self-powered sensors varies substantially across international jurisdictions, creating a complex compliance environment for global distribution. Initially, regulations focused primarily on radio frequency emissions and electromagnetic compatibility. However, as these devices have proliferated, regulatory frameworks have expanded to address data privacy, cybersecurity, environmental impact, and specific industry applications such as healthcare and industrial monitoring.

A significant milestone in the regulatory evolution occurred in 2015 when the European Union introduced specific provisions for energy-autonomous sensing devices within its Radio Equipment Directive (RED). This was followed by similar frameworks in North America, Asia-Pacific regions, and emerging markets, though with notable variations in implementation requirements and compliance standards.

The primary objective of current regulatory efforts is to establish harmonized international standards that facilitate global distribution while ensuring safety, reliability, and interoperability. Regulatory bodies including the International Electrotechnical Commission (IEC), the Institute of Electrical and Electronics Engineers (IEEE), and the International Organization for Standardization (ISO) have initiated collaborative efforts to develop unified certification protocols for self-powered sensing technologies.

Key technical objectives in this domain include developing sensors with enhanced energy conversion efficiency, extended operational lifespans, and improved reliability under varying environmental conditions. Regulatory compliance must be achieved without compromising these performance parameters, presenting a significant engineering challenge.

From a market perspective, regulatory alignment aims to reduce barriers to entry for innovative self-powered sensor technologies, particularly for applications in remote monitoring, smart infrastructure, precision agriculture, and medical devices. The goal is to establish clear pathways for certification that accommodate both established manufacturers and emerging startups developing next-generation autonomous sensing solutions.

As the technology continues to mature, regulatory frameworks are increasingly focusing on end-of-life considerations, including recyclability, material recovery, and environmental impact mitigation, reflecting broader sustainability imperatives in the electronics sector.

Global Market Demand Analysis for Self-Powered Sensors

The global market for self-powered sensors is experiencing unprecedented growth, driven by increasing demand across multiple sectors including industrial automation, healthcare, smart infrastructure, and consumer electronics. Current market valuations indicate that the self-powered sensor market reached approximately $2.5 billion in 2022, with projections suggesting a compound annual growth rate of 18-20% through 2030, potentially reaching $10 billion by the end of the decade.

Industrial applications represent the largest market segment, accounting for roughly 40% of current demand. This is primarily fueled by Industry 4.0 initiatives and the growing need for autonomous monitoring systems in manufacturing environments where traditional wired or battery-dependent sensors present maintenance challenges or safety hazards.

Healthcare applications are emerging as the fastest-growing segment, with demand increasing at nearly 25% annually. The integration of self-powered sensors in medical devices, patient monitoring systems, and point-of-care diagnostics is revolutionizing healthcare delivery, particularly in remote patient monitoring and wearable health technologies.

Regional analysis reveals that North America currently leads the market with approximately 35% share, followed closely by Europe at 30% and Asia-Pacific at 25%. However, the Asia-Pacific region is expected to overtake other regions by 2027, driven by rapid industrial automation in China, Japan, and South Korea, alongside increasing smart city initiatives.

Consumer demand for energy-efficient and maintenance-free IoT devices is creating significant pull for self-powered sensor technologies in smart homes, wearables, and personal electronics. This segment is expected to grow at 22% annually, representing a significant opportunity for market expansion.

Key market drivers include the decreasing cost of sensor technologies, advancements in energy harvesting techniques, and the expanding Internet of Things ecosystem. Environmental concerns and sustainability initiatives are also accelerating adoption as organizations seek to reduce battery waste and lower the environmental impact of their sensing infrastructure.

Regulatory factors are significantly influencing market dynamics, with different regions implementing varying standards for wireless sensors, energy harvesting technologies, and data privacy. These regulatory frameworks are creating both challenges and opportunities for global distribution, with companies needing to navigate complex compliance requirements across different markets.

Customer surveys indicate that reliability, maintenance-free operation, and extended operational lifetime are the primary factors influencing purchasing decisions for self-powered sensors, outranking initial cost considerations. This suggests a market willing to pay premium prices for solutions that offer long-term operational benefits and reduced total cost of ownership.

Industrial applications represent the largest market segment, accounting for roughly 40% of current demand. This is primarily fueled by Industry 4.0 initiatives and the growing need for autonomous monitoring systems in manufacturing environments where traditional wired or battery-dependent sensors present maintenance challenges or safety hazards.

Healthcare applications are emerging as the fastest-growing segment, with demand increasing at nearly 25% annually. The integration of self-powered sensors in medical devices, patient monitoring systems, and point-of-care diagnostics is revolutionizing healthcare delivery, particularly in remote patient monitoring and wearable health technologies.

Regional analysis reveals that North America currently leads the market with approximately 35% share, followed closely by Europe at 30% and Asia-Pacific at 25%. However, the Asia-Pacific region is expected to overtake other regions by 2027, driven by rapid industrial automation in China, Japan, and South Korea, alongside increasing smart city initiatives.

Consumer demand for energy-efficient and maintenance-free IoT devices is creating significant pull for self-powered sensor technologies in smart homes, wearables, and personal electronics. This segment is expected to grow at 22% annually, representing a significant opportunity for market expansion.

Key market drivers include the decreasing cost of sensor technologies, advancements in energy harvesting techniques, and the expanding Internet of Things ecosystem. Environmental concerns and sustainability initiatives are also accelerating adoption as organizations seek to reduce battery waste and lower the environmental impact of their sensing infrastructure.

Regulatory factors are significantly influencing market dynamics, with different regions implementing varying standards for wireless sensors, energy harvesting technologies, and data privacy. These regulatory frameworks are creating both challenges and opportunities for global distribution, with companies needing to navigate complex compliance requirements across different markets.

Customer surveys indicate that reliability, maintenance-free operation, and extended operational lifetime are the primary factors influencing purchasing decisions for self-powered sensors, outranking initial cost considerations. This suggests a market willing to pay premium prices for solutions that offer long-term operational benefits and reduced total cost of ownership.

International Regulatory Landscape and Technical Barriers

The global landscape for self-powered sensor distribution faces a complex web of regulations that vary significantly across regions, creating substantial barriers to market entry and technology deployment. In North America, the FCC imposes strict electromagnetic compatibility (EMC) requirements, with specific provisions under Part 15 for unlicensed wireless devices. These regulations mandate rigorous testing procedures and certification processes that can extend development timelines by 3-6 months and increase costs by 15-20%.

The European Union presents an even more intricate regulatory environment through its Radio Equipment Directive (RED) and Restriction of Hazardous Substances (RoHS) directives. Self-powered sensors must comply with CE marking requirements, which necessitate comprehensive technical documentation and conformity assessments. The EU's REACH regulation adds another layer of complexity by restricting certain chemical substances in electronic components, directly impacting material selection for energy harvesting mechanisms.

Asia-Pacific markets exhibit significant regulatory fragmentation. Japan's VCCI standards and China's CCC certification represent substantial technical barriers, with China requiring in-country testing at designated facilities. South Korea's KC certification and India's BIS standards further complicate regional distribution strategies, often requiring market-specific product modifications that challenge the economic viability of global product platforms.

Energy harvesting technologies face particular regulatory scrutiny regarding safety and environmental impact. Piezoelectric materials, commonly used in vibration energy harvesters, must meet varying toxicity standards across jurisdictions. Similarly, thermoelectric generators face thermal safety regulations that differ substantially between regions, necessitating multiple design iterations for global compliance.

Wireless communication protocols embedded in self-powered sensors encounter frequency allocation restrictions that vary dramatically worldwide. The 2.4 GHz ISM band, while globally available, has different power limitations and duty cycle restrictions across regions. Sub-GHz bands offer better power efficiency but face even greater regulatory fragmentation, with available frequencies varying by country and application.

Data privacy and security regulations create additional technical barriers, particularly for sensors deployed in sensitive environments. The EU's GDPR imposes strict requirements on data processing capabilities, while China's Cybersecurity Law mandates specific encryption standards and data localization. These regulations often necessitate region-specific firmware configurations, complicating global deployment strategies.

Emerging regulations around electronic waste and product lifecycle management are increasingly impacting self-powered sensor design. The EU's WEEE directive requires manufacturers to establish recycling programs, while similar initiatives in Japan and South Korea impose different collection and disposal requirements, affecting material selection and design for disassembly considerations.

The European Union presents an even more intricate regulatory environment through its Radio Equipment Directive (RED) and Restriction of Hazardous Substances (RoHS) directives. Self-powered sensors must comply with CE marking requirements, which necessitate comprehensive technical documentation and conformity assessments. The EU's REACH regulation adds another layer of complexity by restricting certain chemical substances in electronic components, directly impacting material selection for energy harvesting mechanisms.

Asia-Pacific markets exhibit significant regulatory fragmentation. Japan's VCCI standards and China's CCC certification represent substantial technical barriers, with China requiring in-country testing at designated facilities. South Korea's KC certification and India's BIS standards further complicate regional distribution strategies, often requiring market-specific product modifications that challenge the economic viability of global product platforms.

Energy harvesting technologies face particular regulatory scrutiny regarding safety and environmental impact. Piezoelectric materials, commonly used in vibration energy harvesters, must meet varying toxicity standards across jurisdictions. Similarly, thermoelectric generators face thermal safety regulations that differ substantially between regions, necessitating multiple design iterations for global compliance.

Wireless communication protocols embedded in self-powered sensors encounter frequency allocation restrictions that vary dramatically worldwide. The 2.4 GHz ISM band, while globally available, has different power limitations and duty cycle restrictions across regions. Sub-GHz bands offer better power efficiency but face even greater regulatory fragmentation, with available frequencies varying by country and application.

Data privacy and security regulations create additional technical barriers, particularly for sensors deployed in sensitive environments. The EU's GDPR imposes strict requirements on data processing capabilities, while China's Cybersecurity Law mandates specific encryption standards and data localization. These regulations often necessitate region-specific firmware configurations, complicating global deployment strategies.

Emerging regulations around electronic waste and product lifecycle management are increasingly impacting self-powered sensor design. The EU's WEEE directive requires manufacturers to establish recycling programs, while similar initiatives in Japan and South Korea impose different collection and disposal requirements, affecting material selection and design for disassembly considerations.

Current Compliance Solutions for International Distribution

01 Energy harvesting mechanisms for self-powered sensors

Various energy harvesting mechanisms can be employed to power sensors autonomously. These include piezoelectric elements that convert mechanical vibrations into electrical energy, solar cells that harness light energy, and thermoelectric generators that utilize temperature differentials. These energy harvesting technologies enable sensors to operate without external power sources, making them suitable for remote or inaccessible locations where battery replacement is challenging.- Energy harvesting mechanisms for self-powered sensors: Various energy harvesting mechanisms can be employed to power sensors autonomously. These include piezoelectric generators that convert mechanical vibrations into electrical energy, thermoelectric generators that utilize temperature differentials, and photovoltaic cells that convert light energy. These harvesting technologies enable sensors to operate independently without external power sources, making them suitable for remote or inaccessible locations.

- Wireless self-powered sensor networks: Self-powered sensors can be integrated into wireless sensor networks for distributed monitoring applications. These networks utilize energy-efficient communication protocols to transmit data while minimizing power consumption. The sensors harvest ambient energy to power both the sensing elements and wireless communication modules, enabling long-term deployment without battery replacement or maintenance.

- Motion and vibration-based self-powered sensors: Sensors that generate power from motion or vibration can be particularly useful in automotive, industrial, and wearable applications. These sensors convert kinetic energy from movement into electrical power through mechanisms such as electromagnetic induction or piezoelectric materials. The generated power is sufficient to operate the sensing circuitry and transmit data, making them ideal for monitoring moving machinery or human activity.

- Power management systems for self-powered sensors: Efficient power management is crucial for self-powered sensors to operate reliably. These systems include energy storage elements like supercapacitors or thin-film batteries, power conditioning circuits, and ultra-low-power microcontrollers. Advanced power management techniques such as duty cycling, adaptive sampling rates, and sleep modes help maximize operational lifetime by optimizing energy usage based on available harvested power.

- Environmental and structural monitoring applications: Self-powered sensors are particularly valuable for long-term environmental and structural monitoring applications. These sensors can be deployed in remote locations to monitor parameters such as temperature, humidity, strain, or vibration without requiring regular maintenance or battery replacement. The autonomous nature of these sensors makes them ideal for monitoring infrastructure like bridges, buildings, or natural environments where regular access is difficult or costly.

02 Wireless self-powered sensor networks

Self-powered sensors can be integrated into wireless sensor networks for various applications. These networks utilize energy-efficient communication protocols to transmit data while minimizing power consumption. The sensors harvest ambient energy to power both the sensing elements and wireless communication modules, enabling long-term deployment without maintenance. Such networks can be used for environmental monitoring, structural health monitoring, and industrial automation.Expand Specific Solutions03 Triboelectric and electromagnetic self-powered sensors

Triboelectric and electromagnetic principles are utilized in developing self-powered sensing systems. Triboelectric sensors generate electrical signals through contact electrification and electrostatic induction when two different materials come into contact and separate. Electromagnetic sensors use Faraday's law of induction to generate electricity from relative motion between a conductor and magnetic field. These technologies enable the development of self-powered sensors for motion detection, vibration monitoring, and human-machine interfaces.Expand Specific Solutions04 Self-powered sensors for biomedical applications

Self-powered sensors are being developed for various biomedical applications, including health monitoring, disease diagnosis, and therapeutic systems. These sensors can harvest energy from body movements, temperature gradients, or biochemical reactions within the human body. By eliminating the need for batteries, these sensors can be made smaller, more comfortable, and suitable for long-term implantation or wearable applications, enhancing patient comfort and reducing the need for invasive procedures.Expand Specific Solutions05 Power management and energy storage for self-powered sensors

Efficient power management circuits and energy storage solutions are critical components of self-powered sensor systems. These include ultra-low-power microcontrollers, power conditioning circuits, and energy storage devices like supercapacitors or thin-film batteries. Advanced power management techniques such as duty cycling, adaptive sampling, and sleep modes help optimize energy usage, ensuring that harvested energy is efficiently utilized and stored for periods when ambient energy sources are unavailable.Expand Specific Solutions

Key Regulatory Bodies and Industry Players

The global self-powered sensor market is currently in a growth phase, with increasing adoption across industries despite complex international regulatory challenges. Market size is projected to expand significantly as IoT applications proliferate, with an estimated CAGR of 12-15% through 2028. Technologically, the field shows varying maturity levels, with companies like Siemens, Qualcomm, and Huawei leading in advanced energy harvesting solutions, while State Grid Corp. of China and Thales focus on infrastructure integration. Academic institutions including Carnegie Mellon University and Chongqing University are driving fundamental research innovations. Regulatory fragmentation across regions remains the primary challenge, with companies like Skyworks Solutions and Alps Alpine developing adaptive sensor platforms to address diverse compliance requirements in international markets.

Skyworks Solutions, Inc.

Technical Solution: Skyworks has developed specialized RF-compliant self-powered sensor solutions designed for global deployment. Their technology focuses on ultra-efficient RF energy harvesting combined with regulatory-aware transmission systems. Skyworks' sensors incorporate adaptive front-end modules that automatically configure to meet regional spectrum regulations, ensuring compliant operation across different jurisdictions. Their platform features a proprietary low-power regulatory compliance engine that continuously monitors operational parameters against stored regulatory requirements, adjusting sensor behavior accordingly. Skyworks has implemented a comprehensive certification management system that maintains documentation for multiple international standards, facilitating deployment across diverse markets. Their sensors utilize advanced power management techniques that balance performance requirements with regulatory constraints, optimizing energy usage while maintaining compliance. Additionally, Skyworks has developed specialized antenna designs that can be dynamically tuned to operate within region-specific frequency allocations.

Strengths: Industry-leading RF design expertise; extensive experience with international wireless regulations; advanced semiconductor manufacturing capabilities; strong relationships with certification bodies. Weaknesses: More limited energy harvesting options compared to some competitors; solutions primarily focused on RF aspects rather than comprehensive sensor systems; potentially higher component costs for advanced RF capabilities.

Hitachi Energy Ltd.

Technical Solution: Hitachi Energy has developed a comprehensive regulatory-compliant self-powered sensor ecosystem for international deployment in energy infrastructure. Their solution features adaptive power harvesting technology that can operate across diverse environmental conditions while meeting regional regulatory requirements. Hitachi's sensors incorporate a multi-layered compliance architecture that addresses electromagnetic compatibility, hazardous location certifications, and data privacy regulations simultaneously. Their platform includes region-specific firmware modules that configure sensor operation according to local regulatory frameworks, with particular emphasis on critical infrastructure protection requirements. Hitachi Energy has implemented a blockchain-based compliance verification system that creates immutable records of regulatory certifications and testing results, facilitating transparent compliance demonstration to authorities worldwide. Their sensors also feature adaptive transmission protocols that automatically adjust to comply with regional spectrum usage regulations.

Strengths: Extensive experience in energy infrastructure deployments; strong relationships with energy sector regulatory bodies; advanced energy harvesting technologies optimized for industrial environments; comprehensive certification portfolio. Weaknesses: Solutions primarily optimized for energy sector applications; higher implementation complexity; potentially challenging integration with third-party systems.

Critical Standards and Certification Requirements

Self-powered sensor system

PatentInactiveEP2685220A3

Innovation

- A self-powered sensor system is designed with an autonomous sensor unit that combines vibration energy harvesting and analogue signal processing circuitry to generate both digital output signals and electrical power signals, reducing the need for separate units and components like ADCs and microprocessors, thereby minimizing energy consumption and implementation area.

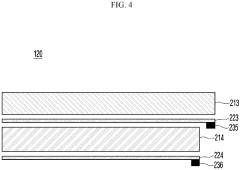

Self-powered sensor and sensing system including the same

PatentActiveUS11670734B2

Innovation

- A self-powered sensor is developed, integrating a solar cell and a sensor in a single structure, where multiple layers emit and receive light across different infrared wavelength bands, with connectors transferring generated current or power, eliminating the need for a separate battery.

Cross-Border Trade Agreements Impact Assessment

The global landscape of trade agreements significantly impacts the distribution and deployment of self-powered sensor technologies across international borders. Current major trade frameworks such as the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP), the European Union's Single Market regulations, and the United States-Mexico-Canada Agreement (USMCA) contain specific provisions affecting electronic components and IoT devices. These agreements establish varying requirements for technical standards, data privacy, and customs procedures that directly influence sensor distribution strategies.

Tariff structures present a complex challenge for self-powered sensor manufacturers. While some agreements like the Information Technology Agreement (ITA) under the World Trade Organization framework have eliminated duties on many electronic components, self-powered sensors often fall into regulatory gray areas. Their dual nature as both electronic devices and energy generation systems means they may be subject to different classification schemes and corresponding duty rates depending on the importing jurisdiction.

Regulatory harmonization efforts have shown promising developments in recent years. The International Electrotechnical Commission (IEC) has established working groups specifically addressing standards for self-powered sensing technologies, which are increasingly being referenced in trade agreements. However, significant disparities remain between regions, with the European Union typically imposing stricter requirements regarding materials compliance (particularly under RoHS and REACH regulations) compared to emerging markets.

Non-tariff barriers represent perhaps the most significant trade agreement challenge for the self-powered sensor industry. Technical Barriers to Trade (TBT) provisions within agreements often require extensive conformity assessment procedures that can delay market entry and increase compliance costs. For example, wireless transmission capabilities in self-powered sensors trigger additional telecommunications certification requirements in most jurisdictions, with particularly stringent processes in markets like China, Russia, and Brazil.

Recent trade tensions between major economies have created additional uncertainty. The technology sector has been disproportionately affected by trade disputes between the United States and China, with sensors and related components frequently appearing on restricted export lists. Companies developing advanced self-powered sensor technologies must navigate these geopolitical complexities when establishing global distribution networks.

Looking forward, emerging trade agreements are increasingly incorporating specific provisions for next-generation technologies. The Digital Economy Partnership Agreement (DEPA) between Singapore, New Zealand, and Chile represents a new model that specifically addresses data flows from IoT devices, potentially creating more favorable conditions for self-powered sensor deployment across participating economies.

Tariff structures present a complex challenge for self-powered sensor manufacturers. While some agreements like the Information Technology Agreement (ITA) under the World Trade Organization framework have eliminated duties on many electronic components, self-powered sensors often fall into regulatory gray areas. Their dual nature as both electronic devices and energy generation systems means they may be subject to different classification schemes and corresponding duty rates depending on the importing jurisdiction.

Regulatory harmonization efforts have shown promising developments in recent years. The International Electrotechnical Commission (IEC) has established working groups specifically addressing standards for self-powered sensing technologies, which are increasingly being referenced in trade agreements. However, significant disparities remain between regions, with the European Union typically imposing stricter requirements regarding materials compliance (particularly under RoHS and REACH regulations) compared to emerging markets.

Non-tariff barriers represent perhaps the most significant trade agreement challenge for the self-powered sensor industry. Technical Barriers to Trade (TBT) provisions within agreements often require extensive conformity assessment procedures that can delay market entry and increase compliance costs. For example, wireless transmission capabilities in self-powered sensors trigger additional telecommunications certification requirements in most jurisdictions, with particularly stringent processes in markets like China, Russia, and Brazil.

Recent trade tensions between major economies have created additional uncertainty. The technology sector has been disproportionately affected by trade disputes between the United States and China, with sensors and related components frequently appearing on restricted export lists. Companies developing advanced self-powered sensor technologies must navigate these geopolitical complexities when establishing global distribution networks.

Looking forward, emerging trade agreements are increasingly incorporating specific provisions for next-generation technologies. The Digital Economy Partnership Agreement (DEPA) between Singapore, New Zealand, and Chile represents a new model that specifically addresses data flows from IoT devices, potentially creating more favorable conditions for self-powered sensor deployment across participating economies.

Environmental Sustainability and Disposal Regulations

The global deployment of self-powered sensors faces a complex web of environmental regulations that vary significantly across jurisdictions. These regulations primarily focus on two critical aspects: the environmental impact during operation and the management of sensor components at end-of-life. The European Union's Restriction of Hazardous Substances (RoHS) Directive and Waste Electrical and Electronic Equipment (WEEE) Directive represent the most stringent regulatory frameworks, mandating strict limits on hazardous materials and requiring manufacturers to establish collection and recycling systems.

In North America, regulations are less centralized but increasingly stringent. The U.S. Environmental Protection Agency (EPA) enforces the Resource Conservation and Recovery Act (RCRA) which governs hazardous waste disposal, while individual states like California implement additional requirements through programs such as the Electronic Waste Recycling Act. These regulations impact the design specifications and material selection for self-powered sensors intended for distribution in these markets.

Asian markets present varying regulatory landscapes. Japan's Home Appliance Recycling Law and China's Restriction of Hazardous Substances (China RoHS) establish frameworks similar to European standards, while developing economies often have less comprehensive regulations but are rapidly evolving their environmental policies. This regulatory diversity creates significant compliance challenges for global sensor deployment strategies.

The energy harvesting components in self-powered sensors present unique regulatory considerations. Solar cells contain potentially toxic materials like cadmium telluride or copper indium gallium selenide, while piezoelectric elements may incorporate lead zirconate titanate. Battery components, particularly those containing lithium, face strict transportation and disposal regulations under international agreements such as the Basel Convention on hazardous waste movement.

Recent regulatory trends indicate a shift toward circular economy principles, with extended producer responsibility (EPR) becoming increasingly common. These frameworks require manufacturers to consider the entire lifecycle of their products, from design to disposal. The EU's Circular Economy Action Plan exemplifies this approach, promoting design for disassembly and material recovery.

Compliance strategies for international sensor distribution must incorporate modular design approaches that allow for regional customization while maintaining core functionality. Material passports documenting component composition facilitate proper recycling and disposal. Forward-thinking manufacturers are implementing take-back programs that exceed regulatory requirements, positioning themselves advantageously as regulations continue to tighten globally.

The economic implications of these regulations are substantial, with compliance costs estimated between 1-3% of product development budgets. However, proactive environmental design can yield competitive advantages through access to environmentally conscious markets and reduced exposure to future regulatory risks. The most successful sensor deployment strategies incorporate regulatory compliance as a fundamental design parameter rather than a post-development consideration.

In North America, regulations are less centralized but increasingly stringent. The U.S. Environmental Protection Agency (EPA) enforces the Resource Conservation and Recovery Act (RCRA) which governs hazardous waste disposal, while individual states like California implement additional requirements through programs such as the Electronic Waste Recycling Act. These regulations impact the design specifications and material selection for self-powered sensors intended for distribution in these markets.

Asian markets present varying regulatory landscapes. Japan's Home Appliance Recycling Law and China's Restriction of Hazardous Substances (China RoHS) establish frameworks similar to European standards, while developing economies often have less comprehensive regulations but are rapidly evolving their environmental policies. This regulatory diversity creates significant compliance challenges for global sensor deployment strategies.

The energy harvesting components in self-powered sensors present unique regulatory considerations. Solar cells contain potentially toxic materials like cadmium telluride or copper indium gallium selenide, while piezoelectric elements may incorporate lead zirconate titanate. Battery components, particularly those containing lithium, face strict transportation and disposal regulations under international agreements such as the Basel Convention on hazardous waste movement.

Recent regulatory trends indicate a shift toward circular economy principles, with extended producer responsibility (EPR) becoming increasingly common. These frameworks require manufacturers to consider the entire lifecycle of their products, from design to disposal. The EU's Circular Economy Action Plan exemplifies this approach, promoting design for disassembly and material recovery.

Compliance strategies for international sensor distribution must incorporate modular design approaches that allow for regional customization while maintaining core functionality. Material passports documenting component composition facilitate proper recycling and disposal. Forward-thinking manufacturers are implementing take-back programs that exceed regulatory requirements, positioning themselves advantageously as regulations continue to tighten globally.

The economic implications of these regulations are substantial, with compliance costs estimated between 1-3% of product development budgets. However, proactive environmental design can yield competitive advantages through access to environmentally conscious markets and reduced exposure to future regulatory risks. The most successful sensor deployment strategies incorporate regulatory compliance as a fundamental design parameter rather than a post-development consideration.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!