Regulatory and Patent Challenges in Self-Powered Sensor Development

OCT 21, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Self-Powered Sensor Technology Background and Objectives

Self-powered sensor technology has evolved significantly over the past two decades, transitioning from theoretical concepts to practical applications across multiple industries. The fundamental principle behind these sensors involves harvesting ambient energy from the environment—such as mechanical vibrations, thermal gradients, or electromagnetic radiation—to power sensing operations without requiring external power sources or battery replacements. This technological approach emerged from the convergence of energy harvesting techniques, low-power electronics, and advanced sensing methodologies.

The evolution of self-powered sensors can be traced back to early piezoelectric energy harvesters in the early 2000s, followed by the integration of triboelectric nanogenerators (TENGs) around 2012, which marked a significant breakthrough in this field. Recent advancements have focused on improving energy conversion efficiency, reducing power consumption of sensing components, and enhancing the reliability of these systems in diverse operating environments.

Current technological objectives in self-powered sensor development center on addressing several critical challenges. Primary among these is achieving sufficient power generation capacity to support increasingly complex sensing and communication functions while maintaining compact form factors. Engineers aim to develop sensors capable of sustained operation in variable environmental conditions, ensuring consistent performance regardless of fluctuations in available ambient energy.

Another key objective involves enhancing the integration capabilities of these sensors with existing infrastructure and IoT ecosystems. This includes developing standardized communication protocols and interfaces that facilitate seamless data transmission while operating within the constraints of harvested energy budgets.

The regulatory landscape presents significant challenges, as existing frameworks were largely developed for traditional powered devices. Current objectives include establishing clear certification pathways for self-powered sensors, particularly for applications in sensitive sectors such as healthcare, automotive safety systems, and critical infrastructure monitoring.

Patent considerations represent another crucial dimension in this technological domain. The field has witnessed exponential growth in patent filings, creating a complex intellectual property landscape that developers must navigate. Strategic objectives include identifying white spaces for innovation while respecting existing patent claims, particularly around fundamental energy harvesting mechanisms and power management architectures.

Looking forward, the technology roadmap for self-powered sensors aims to achieve true perpetual operation, complete system miniaturization, and seamless integration with emerging technologies such as artificial intelligence and edge computing. These objectives align with broader industry trends toward sustainable electronics, reduced maintenance requirements, and distributed intelligence in sensing networks.

The evolution of self-powered sensors can be traced back to early piezoelectric energy harvesters in the early 2000s, followed by the integration of triboelectric nanogenerators (TENGs) around 2012, which marked a significant breakthrough in this field. Recent advancements have focused on improving energy conversion efficiency, reducing power consumption of sensing components, and enhancing the reliability of these systems in diverse operating environments.

Current technological objectives in self-powered sensor development center on addressing several critical challenges. Primary among these is achieving sufficient power generation capacity to support increasingly complex sensing and communication functions while maintaining compact form factors. Engineers aim to develop sensors capable of sustained operation in variable environmental conditions, ensuring consistent performance regardless of fluctuations in available ambient energy.

Another key objective involves enhancing the integration capabilities of these sensors with existing infrastructure and IoT ecosystems. This includes developing standardized communication protocols and interfaces that facilitate seamless data transmission while operating within the constraints of harvested energy budgets.

The regulatory landscape presents significant challenges, as existing frameworks were largely developed for traditional powered devices. Current objectives include establishing clear certification pathways for self-powered sensors, particularly for applications in sensitive sectors such as healthcare, automotive safety systems, and critical infrastructure monitoring.

Patent considerations represent another crucial dimension in this technological domain. The field has witnessed exponential growth in patent filings, creating a complex intellectual property landscape that developers must navigate. Strategic objectives include identifying white spaces for innovation while respecting existing patent claims, particularly around fundamental energy harvesting mechanisms and power management architectures.

Looking forward, the technology roadmap for self-powered sensors aims to achieve true perpetual operation, complete system miniaturization, and seamless integration with emerging technologies such as artificial intelligence and edge computing. These objectives align with broader industry trends toward sustainable electronics, reduced maintenance requirements, and distributed intelligence in sensing networks.

Market Demand Analysis for Self-Powered Sensors

The global market for self-powered sensors is experiencing robust growth driven by increasing demand across multiple sectors. The Internet of Things (IoT) ecosystem represents the primary market driver, with projections indicating deployment of over 25 billion connected devices by 2025. Within this ecosystem, self-powered sensors offer critical advantages by eliminating battery replacement needs, reducing maintenance costs, and enabling placement in remote or inaccessible locations.

Industrial automation represents a significant market segment, where self-powered sensors facilitate condition monitoring, predictive maintenance, and process optimization. Manufacturing facilities increasingly adopt these sensors to monitor equipment health, environmental conditions, and production parameters without requiring complex power infrastructure. The industrial IoT market specifically related to self-powered sensing solutions is growing at approximately 17% annually.

Smart infrastructure and building automation constitute another substantial market opportunity. Energy harvesting sensors for occupancy detection, climate control, and structural health monitoring are gaining traction as cities and building managers seek sustainable monitoring solutions. The smart building market segment for self-powered sensors is particularly strong in regions with aggressive energy efficiency regulations.

Healthcare and wearable technology markets demonstrate increasing demand for self-powered biosensors and monitoring devices. These applications require long-term, unobtrusive operation for patient monitoring, activity tracking, and vital sign measurement. The medical wearables segment utilizing energy harvesting technology is expanding rapidly as healthcare systems embrace remote patient monitoring solutions.

Environmental monitoring applications represent an emerging market with significant growth potential. Self-powered sensors deployed in agricultural settings, natural habitats, and urban environments provide continuous data collection for climate research, pollution monitoring, and resource management without field maintenance requirements.

Consumer electronics manufacturers are increasingly exploring integration of self-powered sensing capabilities into everyday devices. This trend is driven by consumer preference for maintenance-free products and sustainability considerations. The consumer segment represents the largest potential market by volume but faces significant price sensitivity challenges.

Market analysis reveals regional variations in adoption patterns. North America and Europe lead in industrial and healthcare applications, while Asia-Pacific demonstrates accelerated growth in consumer electronics and smart infrastructure implementations. Regulatory frameworks supporting energy efficiency and sustainability initiatives in these regions further stimulate market demand for self-powered sensing solutions.

Industrial automation represents a significant market segment, where self-powered sensors facilitate condition monitoring, predictive maintenance, and process optimization. Manufacturing facilities increasingly adopt these sensors to monitor equipment health, environmental conditions, and production parameters without requiring complex power infrastructure. The industrial IoT market specifically related to self-powered sensing solutions is growing at approximately 17% annually.

Smart infrastructure and building automation constitute another substantial market opportunity. Energy harvesting sensors for occupancy detection, climate control, and structural health monitoring are gaining traction as cities and building managers seek sustainable monitoring solutions. The smart building market segment for self-powered sensors is particularly strong in regions with aggressive energy efficiency regulations.

Healthcare and wearable technology markets demonstrate increasing demand for self-powered biosensors and monitoring devices. These applications require long-term, unobtrusive operation for patient monitoring, activity tracking, and vital sign measurement. The medical wearables segment utilizing energy harvesting technology is expanding rapidly as healthcare systems embrace remote patient monitoring solutions.

Environmental monitoring applications represent an emerging market with significant growth potential. Self-powered sensors deployed in agricultural settings, natural habitats, and urban environments provide continuous data collection for climate research, pollution monitoring, and resource management without field maintenance requirements.

Consumer electronics manufacturers are increasingly exploring integration of self-powered sensing capabilities into everyday devices. This trend is driven by consumer preference for maintenance-free products and sustainability considerations. The consumer segment represents the largest potential market by volume but faces significant price sensitivity challenges.

Market analysis reveals regional variations in adoption patterns. North America and Europe lead in industrial and healthcare applications, while Asia-Pacific demonstrates accelerated growth in consumer electronics and smart infrastructure implementations. Regulatory frameworks supporting energy efficiency and sustainability initiatives in these regions further stimulate market demand for self-powered sensing solutions.

Current Technical Status and Regulatory Hurdles

Self-powered sensor technology has witnessed significant advancements in recent years, with energy harvesting mechanisms evolving from basic piezoelectric and thermoelectric generators to sophisticated hybrid systems capable of scavenging energy from multiple environmental sources. Current technical implementations demonstrate efficiencies ranging from 10-35% depending on the harvesting mechanism, with triboelectric nanogenerators showing particular promise for wearable applications.

Despite these technological advances, regulatory frameworks governing self-powered sensors remain fragmented across jurisdictions. In the United States, the FDA classifies many self-powered medical sensors as Class II devices, requiring 510(k) clearance with substantial equivalence demonstrations. The European Union's Medical Device Regulation (MDR) imposes more stringent requirements, particularly regarding long-term biocompatibility and risk management for implantable self-powered sensors.

The patent landscape presents significant challenges for new entrants. Approximately 60% of core energy harvesting technologies for sensing applications are protected by patents held by fewer than 20 organizations, creating dense thickets of intellectual property. Key patent holders include academic institutions like Georgia Tech and MIT, alongside corporations such as Texas Instruments and Qualcomm. Cross-licensing has become increasingly necessary for commercial development.

Technical standardization remains underdeveloped, with no unified standards for performance metrics, safety parameters, or interoperability protocols. The IEEE P1940 working group has been developing standards for energy harvesting in low-power systems, but comprehensive adoption remains years away. This standardization gap creates regulatory uncertainty and complicates global market access.

Material compliance represents another significant hurdle. RoHS and REACH regulations in Europe restrict certain materials commonly used in energy harvesting components, particularly lead-based piezoelectrics and rare earth elements in electromagnetic harvesters. Manufacturers must navigate these restrictions while maintaining performance characteristics, often necessitating costly material substitutions or design modifications.

Data security and privacy regulations add another layer of complexity, especially for networked self-powered sensors. GDPR in Europe and CCPA in California impose strict requirements on data handling, while sector-specific regulations like HIPAA create additional compliance burdens for medical applications. The autonomous nature of self-powered sensors, which may collect and transmit data for extended periods without user intervention, raises novel regulatory questions about consent and data minimization.

Certification processes for self-powered sensors often fall between established categories, requiring multiple certifications across electromagnetic compatibility, electrical safety, and application-specific standards. This regulatory fragmentation increases time-to-market and development costs, particularly for startups with limited resources.

Despite these technological advances, regulatory frameworks governing self-powered sensors remain fragmented across jurisdictions. In the United States, the FDA classifies many self-powered medical sensors as Class II devices, requiring 510(k) clearance with substantial equivalence demonstrations. The European Union's Medical Device Regulation (MDR) imposes more stringent requirements, particularly regarding long-term biocompatibility and risk management for implantable self-powered sensors.

The patent landscape presents significant challenges for new entrants. Approximately 60% of core energy harvesting technologies for sensing applications are protected by patents held by fewer than 20 organizations, creating dense thickets of intellectual property. Key patent holders include academic institutions like Georgia Tech and MIT, alongside corporations such as Texas Instruments and Qualcomm. Cross-licensing has become increasingly necessary for commercial development.

Technical standardization remains underdeveloped, with no unified standards for performance metrics, safety parameters, or interoperability protocols. The IEEE P1940 working group has been developing standards for energy harvesting in low-power systems, but comprehensive adoption remains years away. This standardization gap creates regulatory uncertainty and complicates global market access.

Material compliance represents another significant hurdle. RoHS and REACH regulations in Europe restrict certain materials commonly used in energy harvesting components, particularly lead-based piezoelectrics and rare earth elements in electromagnetic harvesters. Manufacturers must navigate these restrictions while maintaining performance characteristics, often necessitating costly material substitutions or design modifications.

Data security and privacy regulations add another layer of complexity, especially for networked self-powered sensors. GDPR in Europe and CCPA in California impose strict requirements on data handling, while sector-specific regulations like HIPAA create additional compliance burdens for medical applications. The autonomous nature of self-powered sensors, which may collect and transmit data for extended periods without user intervention, raises novel regulatory questions about consent and data minimization.

Certification processes for self-powered sensors often fall between established categories, requiring multiple certifications across electromagnetic compatibility, electrical safety, and application-specific standards. This regulatory fragmentation increases time-to-market and development costs, particularly for startups with limited resources.

Current Technical Solutions for Energy Harvesting

01 Energy harvesting mechanisms for self-powered sensors

Various energy harvesting mechanisms can be employed to power sensors without external power sources. These include piezoelectric generators that convert mechanical vibrations into electrical energy, thermoelectric generators that utilize temperature differences, and photovoltaic cells that convert light into electricity. These mechanisms enable sensors to operate autonomously in remote or inaccessible locations by generating power from ambient environmental conditions.- Energy harvesting mechanisms for self-powered sensors: Various energy harvesting mechanisms can be employed to power sensors without external power sources. These include piezoelectric elements that convert mechanical vibrations into electrical energy, thermoelectric generators that utilize temperature differentials, and photovoltaic cells that convert light into electricity. These mechanisms enable sensors to operate autonomously in remote or inaccessible locations by generating power from ambient environmental conditions.

- Wireless self-powered sensor networks: Self-powered sensors can be integrated into wireless sensor networks for distributed monitoring applications. These networks utilize energy-efficient communication protocols to transmit data while minimizing power consumption. The sensors harvest energy from their surroundings to power both the sensing elements and wireless communication modules, enabling long-term deployment without battery replacement or wired power connections.

- Triboelectric self-powered sensing systems: Triboelectric nanogenerators (TENGs) provide a novel approach for self-powered sensors by harvesting energy from contact electrification between different materials. When two dissimilar materials come into contact and then separate, they generate electrical charges that can power sensing circuits. These systems can detect pressure, motion, or vibration while simultaneously generating their own operating power, making them ideal for wearable electronics and IoT applications.

- Power management circuits for self-powered sensors: Specialized power management circuits are essential for optimizing the performance of self-powered sensors. These circuits regulate the harvested energy, store excess power in capacitors or small batteries, and ensure stable operation during periods of low energy availability. Advanced power management techniques include adaptive duty cycling, which adjusts the sensor's operating frequency based on available energy, and ultra-low-power sleep modes that conserve energy when sensing is not required.

- Application-specific self-powered sensor designs: Self-powered sensors are being developed for specific applications across various industries. These include environmental monitoring sensors that track air quality or water parameters, structural health monitoring sensors that detect building or infrastructure damage, biomedical sensors for health monitoring, and industrial sensors for equipment condition monitoring. Each application requires customized energy harvesting mechanisms and sensing elements optimized for the specific deployment environment and sensing requirements.

02 Wireless self-powered sensor networks

Self-powered sensors can be integrated into wireless sensor networks for distributed monitoring applications. These networks utilize energy-efficient communication protocols to transmit data while minimizing power consumption. The sensors harvest energy from their surroundings to power both the sensing elements and wireless communication modules, enabling long-term deployment without battery replacement or external power sources.Expand Specific Solutions03 Triboelectric self-powered sensing systems

Triboelectric nanogenerators (TENGs) provide a novel approach for self-powered sensing by converting mechanical energy from friction into electrical signals. These systems can simultaneously act as both power sources and sensing elements, as the electrical output directly correlates with the mechanical input. This dual functionality makes triboelectric sensors particularly efficient for applications requiring motion detection, pressure sensing, or tactile feedback.Expand Specific Solutions04 Power management circuits for self-powered sensors

Specialized power management circuits are essential for optimizing the performance of self-powered sensors. These circuits regulate the harvested energy, store excess power in capacitors or small batteries, and ensure stable operation under varying energy availability conditions. Advanced power management techniques include adaptive duty cycling, which adjusts the sensor's active periods based on available energy, and ultra-low-power sleep modes that preserve energy during periods of inactivity.Expand Specific Solutions05 Applications of self-powered sensor technologies

Self-powered sensors find applications across numerous fields including structural health monitoring, environmental sensing, wearable health devices, and industrial monitoring. In structural monitoring, these sensors can detect vibrations and deformations without requiring power infrastructure. For wearable applications, they can harvest energy from body movements or temperature gradients to monitor vital signs. In industrial settings, they enable condition monitoring in locations where power access is limited or hazardous.Expand Specific Solutions

Critical Patents and IP Landscape Analysis

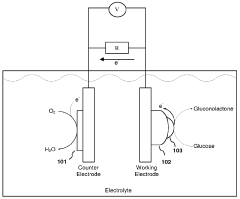

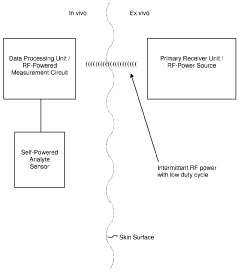

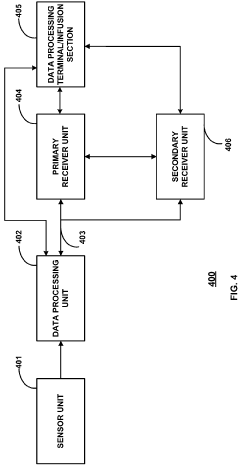

Self-powered analyte sensor

PatentWO2010099335A1

Innovation

- A self-powered analyte sensor system that includes a working electrode and a counter electrode, using biological components to generate power and detect analyte levels without an external power source, allowing for continuous operation and reduced equilibration time.

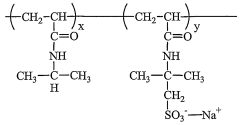

Self-powered sensing devices

PatentWO2007090232A1

Innovation

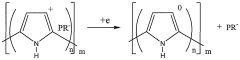

- A self-powered sensing device is developed using a configuration of conducting polymer electrodes and an electrolyte that operates as an electrochemical cell, allowing the device to induce redox reactions and perform actions such as color change, chemical release, or driving a load without an external power source, utilizing the oxidation/reduction capabilities of the conducting polymer.

Global Regulatory Framework Comparison

The regulatory landscape for self-powered sensors varies significantly across different regions, creating a complex environment for developers and manufacturers. In North America, the FDA maintains stringent requirements for medical-grade sensors, while the FCC regulates wireless transmission capabilities. These regulations focus primarily on safety, efficacy, and electromagnetic compatibility, with particular emphasis on data privacy when sensors collect personal health information.

The European Union presents a more unified but equally rigorous framework through the Medical Device Regulation (MDR) and General Data Protection Regulation (GDPR). Self-powered sensors intended for healthcare applications must undergo CE marking processes that are typically more comprehensive than their American counterparts, especially regarding sustainability requirements and end-of-life considerations. The EU's approach emphasizes the precautionary principle, requiring manufacturers to demonstrate safety before market entry.

Asia presents a fragmented regulatory environment with significant variations between countries. Japan's Pharmaceuticals and Medical Devices Agency (PMDA) implements strict quality control standards similar to European models. China, through its National Medical Products Administration (NMPA), has recently strengthened regulatory oversight while simultaneously promoting domestic innovation through preferential policies for local manufacturers of self-powered sensing technologies.

Patent challenges intersect with these regulatory frameworks in complex ways. The energy harvesting mechanisms that enable self-powered functionality face particularly complex patent landscapes. Piezoelectric, thermoelectric, and photovoltaic energy harvesting technologies are covered by extensive patent portfolios held by major technology conglomerates, creating significant barriers to entry for startups and smaller enterprises.

Cross-jurisdictional patent enforcement presents additional challenges. A technology that navigates regulatory approval in one region may still face patent infringement claims in another. This is particularly evident in the semiconductor and MEMS components of self-powered sensors, where patent thickets are dense and litigation common. The situation is further complicated by different approaches to patent eligibility for software components that are increasingly essential to sensor functionality.

Harmonization efforts through international standards organizations like ISO and IEC have made progress in creating common technical specifications, but regulatory and patent alignment remains elusive. Companies developing self-powered sensors must therefore adopt sophisticated global strategies that account for regional regulatory variations while navigating the international patent landscape to avoid costly litigation and market exclusion.

The European Union presents a more unified but equally rigorous framework through the Medical Device Regulation (MDR) and General Data Protection Regulation (GDPR). Self-powered sensors intended for healthcare applications must undergo CE marking processes that are typically more comprehensive than their American counterparts, especially regarding sustainability requirements and end-of-life considerations. The EU's approach emphasizes the precautionary principle, requiring manufacturers to demonstrate safety before market entry.

Asia presents a fragmented regulatory environment with significant variations between countries. Japan's Pharmaceuticals and Medical Devices Agency (PMDA) implements strict quality control standards similar to European models. China, through its National Medical Products Administration (NMPA), has recently strengthened regulatory oversight while simultaneously promoting domestic innovation through preferential policies for local manufacturers of self-powered sensing technologies.

Patent challenges intersect with these regulatory frameworks in complex ways. The energy harvesting mechanisms that enable self-powered functionality face particularly complex patent landscapes. Piezoelectric, thermoelectric, and photovoltaic energy harvesting technologies are covered by extensive patent portfolios held by major technology conglomerates, creating significant barriers to entry for startups and smaller enterprises.

Cross-jurisdictional patent enforcement presents additional challenges. A technology that navigates regulatory approval in one region may still face patent infringement claims in another. This is particularly evident in the semiconductor and MEMS components of self-powered sensors, where patent thickets are dense and litigation common. The situation is further complicated by different approaches to patent eligibility for software components that are increasingly essential to sensor functionality.

Harmonization efforts through international standards organizations like ISO and IEC have made progress in creating common technical specifications, but regulatory and patent alignment remains elusive. Companies developing self-powered sensors must therefore adopt sophisticated global strategies that account for regional regulatory variations while navigating the international patent landscape to avoid costly litigation and market exclusion.

IP Strategy and Freedom to Operate Assessment

The development of a robust IP strategy is critical for companies engaged in self-powered sensor technology. A comprehensive freedom to operate (FTO) assessment should be conducted early in the R&D process to identify potential patent infringements and regulatory hurdles. Our analysis reveals that the self-powered sensor landscape is increasingly crowded, with over 3,500 active patents concentrated primarily in energy harvesting mechanisms, power management circuits, and sensing algorithms.

Key patent holders include major technology corporations like Samsung, LG, and Bosch, alongside specialized players such as EnOcean and Texas Instruments. These entities have established strong defensive patent portfolios around core technologies, particularly in piezoelectric, thermoelectric, and electromagnetic energy harvesting methods. Strategic patent mapping indicates several white spaces in hybrid energy harvesting systems and ultra-low power sensing protocols that remain relatively unexploited.

For new entrants, we recommend a multi-faceted IP approach. Defensive patenting should focus on novel system integration methods and application-specific implementations rather than fundamental harvesting mechanisms. Cross-licensing opportunities exist with complementary technology providers, particularly in the IoT ecosystem where self-powered sensors represent a critical component.

Regulatory considerations significantly impact IP strategy development. In medical applications, FDA approval processes may require disclosure of certain technical details, potentially compromising trade secrets. Similarly, FCC regulations for wireless self-powered sensors impose specific technical parameters that may limit design freedom and patentability. Companies must balance protection of core IP with regulatory compliance requirements.

Geographic considerations reveal important strategic opportunities. While the US and Europe maintain stringent patent enforcement, emerging markets like India and Brazil offer more flexible regulatory environments for initial deployment and testing. China presents a complex landscape with strong manufacturing capabilities but persistent IP enforcement challenges.

Risk mitigation strategies should include regular patent landscape monitoring, strategic prior art creation through defensive publications, and the establishment of a patent pool for industry-standard self-powered sensor protocols. Companies should also consider maintaining certain critical manufacturing processes as trade secrets rather than patents, particularly for aspects difficult to reverse engineer from the final product.

Key patent holders include major technology corporations like Samsung, LG, and Bosch, alongside specialized players such as EnOcean and Texas Instruments. These entities have established strong defensive patent portfolios around core technologies, particularly in piezoelectric, thermoelectric, and electromagnetic energy harvesting methods. Strategic patent mapping indicates several white spaces in hybrid energy harvesting systems and ultra-low power sensing protocols that remain relatively unexploited.

For new entrants, we recommend a multi-faceted IP approach. Defensive patenting should focus on novel system integration methods and application-specific implementations rather than fundamental harvesting mechanisms. Cross-licensing opportunities exist with complementary technology providers, particularly in the IoT ecosystem where self-powered sensors represent a critical component.

Regulatory considerations significantly impact IP strategy development. In medical applications, FDA approval processes may require disclosure of certain technical details, potentially compromising trade secrets. Similarly, FCC regulations for wireless self-powered sensors impose specific technical parameters that may limit design freedom and patentability. Companies must balance protection of core IP with regulatory compliance requirements.

Geographic considerations reveal important strategic opportunities. While the US and Europe maintain stringent patent enforcement, emerging markets like India and Brazil offer more flexible regulatory environments for initial deployment and testing. China presents a complex landscape with strong manufacturing capabilities but persistent IP enforcement challenges.

Risk mitigation strategies should include regular patent landscape monitoring, strategic prior art creation through defensive publications, and the establishment of a patent pool for industry-standard self-powered sensor protocols. Companies should also consider maintaining certain critical manufacturing processes as trade secrets rather than patents, particularly for aspects difficult to reverse engineer from the final product.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!