Tartaric Acid vs Succinic Acid: Industrial Application

AUG 26, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Organic Acids Background and Development Objectives

Organic acids have been integral components in various industrial applications for centuries, with tartaric and succinic acids standing as prominent examples of these versatile compounds. Tartaric acid, naturally occurring in many fruits, particularly grapes, was first isolated in 1769 by Carl Wilhelm Scheele. Its historical significance in wine production dates back to ancient civilizations, where it played a crucial role in fermentation processes. Succinic acid, initially derived from amber through distillation, was first identified in the 17th century, though its industrial significance emerged much later.

The evolution of these organic acids has been marked by significant technological advancements in production methods. Traditional extraction from natural sources has gradually given way to more sophisticated biotechnological and chemical synthesis approaches. The mid-20th century witnessed a paradigm shift with the development of fermentation technologies that enabled more efficient and environmentally sustainable production of both acids.

Recent decades have seen accelerated innovation in this field, driven by growing environmental concerns and the push toward green chemistry principles. The development of bio-based production methods using renewable feedstocks represents a significant trend, aligning with global sustainability goals and circular economy principles. These advancements have expanded the application spectrum of both acids beyond their traditional uses.

The primary technical objectives in this domain focus on enhancing production efficiency, reducing environmental impact, and exploring novel applications. For tartaric acid, research aims to optimize extraction methods from wine industry by-products and develop synthetic pathways with improved stereoselectivity. For succinic acid, the focus has shifted toward perfecting bio-based production routes that can compete economically with petroleum-derived alternatives.

Another critical objective involves improving the purity profiles of these acids for high-value applications in pharmaceuticals and food industries, where stringent quality requirements must be met. Additionally, research efforts are directed toward developing innovative formulations and derivatives that can extend the functional properties of these acids.

The convergence of biotechnology, green chemistry, and materials science is expected to drive the next wave of innovation in organic acid applications. As industries increasingly prioritize sustainability, both tartaric and succinic acids are positioned to play expanded roles in the development of bio-based materials, environmentally friendly catalysts, and specialty chemicals. Understanding their comparative advantages and limitations in various industrial contexts represents a key objective for technology forecasting and strategic development in this field.

The evolution of these organic acids has been marked by significant technological advancements in production methods. Traditional extraction from natural sources has gradually given way to more sophisticated biotechnological and chemical synthesis approaches. The mid-20th century witnessed a paradigm shift with the development of fermentation technologies that enabled more efficient and environmentally sustainable production of both acids.

Recent decades have seen accelerated innovation in this field, driven by growing environmental concerns and the push toward green chemistry principles. The development of bio-based production methods using renewable feedstocks represents a significant trend, aligning with global sustainability goals and circular economy principles. These advancements have expanded the application spectrum of both acids beyond their traditional uses.

The primary technical objectives in this domain focus on enhancing production efficiency, reducing environmental impact, and exploring novel applications. For tartaric acid, research aims to optimize extraction methods from wine industry by-products and develop synthetic pathways with improved stereoselectivity. For succinic acid, the focus has shifted toward perfecting bio-based production routes that can compete economically with petroleum-derived alternatives.

Another critical objective involves improving the purity profiles of these acids for high-value applications in pharmaceuticals and food industries, where stringent quality requirements must be met. Additionally, research efforts are directed toward developing innovative formulations and derivatives that can extend the functional properties of these acids.

The convergence of biotechnology, green chemistry, and materials science is expected to drive the next wave of innovation in organic acid applications. As industries increasingly prioritize sustainability, both tartaric and succinic acids are positioned to play expanded roles in the development of bio-based materials, environmentally friendly catalysts, and specialty chemicals. Understanding their comparative advantages and limitations in various industrial contexts represents a key objective for technology forecasting and strategic development in this field.

Market Analysis of Tartaric and Succinic Acid Applications

The global market for tartaric acid was valued at approximately $425 million in 2022, with projections indicating growth to reach $600 million by 2030, representing a CAGR of 4.5%. This growth is primarily driven by increasing applications in the food and beverage industry, particularly in wine production where tartaric acid serves as a crucial additive for pH adjustment and flavor enhancement. The wine industry alone accounts for nearly 40% of global tartaric acid consumption.

Meanwhile, the succinic acid market has demonstrated more robust growth, valued at $182 million in 2022 with forecasts suggesting expansion to $480 million by 2030, reflecting a CAGR of 12.8%. This accelerated growth can be attributed to the rising demand for bio-based succinic acid as a sustainable alternative to petroleum-derived chemicals in various industrial applications.

Regional analysis reveals that Europe dominates the tartaric acid market with approximately 35% market share, largely due to its extensive wine production industry. North America follows with 25% market share, while Asia-Pacific represents the fastest-growing region with increasing food and beverage manufacturing capabilities.

For succinic acid, Asia-Pacific leads the market with 40% share, driven by rapid industrialization in China and India. North America holds 30% of the market, particularly due to growing investments in bio-based chemical production and sustainability initiatives.

End-user segmentation shows that tartaric acid finds primary applications in food and beverages (45%), pharmaceuticals (25%), and construction (15%). The remaining 15% is distributed across cosmetics and other industrial applications. Succinic acid demonstrates a different distribution pattern, with chemicals and materials accounting for 35%, food additives 20%, pharmaceuticals 18%, agriculture 15%, and other applications comprising the remaining 12%.

Price trend analysis indicates that tartaric acid has maintained relatively stable pricing between $3.5-4.2 per kilogram over the past five years, with occasional fluctuations due to grape harvest variations. Conversely, succinic acid has experienced a downward price trend from $6-7 per kilogram to $3.5-5 per kilogram as bio-based production technologies have matured and production capacity has increased.

Market challenges for tartaric acid include supply chain vulnerabilities due to dependence on wine industry by-products, while succinic acid faces competition from established petroleum-based alternatives and the need for further cost reduction in bio-based production methods.

Meanwhile, the succinic acid market has demonstrated more robust growth, valued at $182 million in 2022 with forecasts suggesting expansion to $480 million by 2030, reflecting a CAGR of 12.8%. This accelerated growth can be attributed to the rising demand for bio-based succinic acid as a sustainable alternative to petroleum-derived chemicals in various industrial applications.

Regional analysis reveals that Europe dominates the tartaric acid market with approximately 35% market share, largely due to its extensive wine production industry. North America follows with 25% market share, while Asia-Pacific represents the fastest-growing region with increasing food and beverage manufacturing capabilities.

For succinic acid, Asia-Pacific leads the market with 40% share, driven by rapid industrialization in China and India. North America holds 30% of the market, particularly due to growing investments in bio-based chemical production and sustainability initiatives.

End-user segmentation shows that tartaric acid finds primary applications in food and beverages (45%), pharmaceuticals (25%), and construction (15%). The remaining 15% is distributed across cosmetics and other industrial applications. Succinic acid demonstrates a different distribution pattern, with chemicals and materials accounting for 35%, food additives 20%, pharmaceuticals 18%, agriculture 15%, and other applications comprising the remaining 12%.

Price trend analysis indicates that tartaric acid has maintained relatively stable pricing between $3.5-4.2 per kilogram over the past five years, with occasional fluctuations due to grape harvest variations. Conversely, succinic acid has experienced a downward price trend from $6-7 per kilogram to $3.5-5 per kilogram as bio-based production technologies have matured and production capacity has increased.

Market challenges for tartaric acid include supply chain vulnerabilities due to dependence on wine industry by-products, while succinic acid faces competition from established petroleum-based alternatives and the need for further cost reduction in bio-based production methods.

Technical Comparison and Production Challenges

Tartaric acid and succinic acid represent two significant organic acids with diverse industrial applications, yet they exhibit distinct chemical properties that influence their performance in various sectors. Tartaric acid (C4H6O6) is a dicarboxylic acid naturally occurring in many fruits, particularly grapes, while succinic acid (C4H6O4) can be derived from both petroleum-based processes and bio-based fermentation methods.

From a technical perspective, tartaric acid demonstrates superior performance in food applications due to its stronger acidic profile (pKa1 = 2.98, pKa2 = 4.34) compared to succinic acid (pKa1 = 4.2, pKa2 = 5.6). This higher acidity makes tartaric acid more effective as a pH regulator and flavor enhancer in food products. Additionally, tartaric acid's optical activity—existing in D, L, and meso forms—provides unique applications in chiral separations and pharmaceutical synthesis that succinic acid cannot offer.

Conversely, succinic acid exhibits greater thermal stability, making it more suitable for high-temperature industrial processes. Its molecular structure allows for more versatile polymerization reactions, positioning it as a superior building block for biodegradable polymers and resins. The lower oxygen content in succinic acid (40% vs. 64% in tartaric acid) results in different reactivity patterns that benefit certain chemical synthesis pathways.

Production challenges for both acids present significant hurdles for industrial scale-up. Traditional tartaric acid production relies on wine industry by-products, creating supply chain dependencies and seasonal availability issues. The extraction and purification processes require substantial energy inputs, with approximately 2.5-3.0 kWh per kilogram of tartaric acid produced. Crystallization challenges during purification can reduce yield efficiency by 15-20%.

Succinic acid faces different production challenges. Petroleum-based production methods generate considerable environmental concerns with carbon footprints approximately 4-5 times higher than bio-based alternatives. Bio-based fermentation routes, while more sustainable, struggle with consistency in feedstock quality and fermentation efficiency. Current bio-based production methods achieve only 60-75% of theoretical yields, with downstream processing accounting for 60-70% of total production costs.

Water consumption represents another critical comparison point, with tartaric acid production requiring approximately 40-50 liters per kilogram, while succinic acid bio-production consumes 20-30 liters per kilogram. Energy efficiency metrics similarly favor succinic acid production, particularly when utilizing renewable feedstocks and optimized fermentation processes.

Recent technological innovations are gradually addressing these challenges, with continuous flow reactors improving tartaric acid extraction efficiency by 25-30%, and engineered microorganisms enhancing succinic acid fermentation yields by up to 40% compared to wild-type strains. These advancements are progressively narrowing the cost gap between these two industrially significant organic acids.

From a technical perspective, tartaric acid demonstrates superior performance in food applications due to its stronger acidic profile (pKa1 = 2.98, pKa2 = 4.34) compared to succinic acid (pKa1 = 4.2, pKa2 = 5.6). This higher acidity makes tartaric acid more effective as a pH regulator and flavor enhancer in food products. Additionally, tartaric acid's optical activity—existing in D, L, and meso forms—provides unique applications in chiral separations and pharmaceutical synthesis that succinic acid cannot offer.

Conversely, succinic acid exhibits greater thermal stability, making it more suitable for high-temperature industrial processes. Its molecular structure allows for more versatile polymerization reactions, positioning it as a superior building block for biodegradable polymers and resins. The lower oxygen content in succinic acid (40% vs. 64% in tartaric acid) results in different reactivity patterns that benefit certain chemical synthesis pathways.

Production challenges for both acids present significant hurdles for industrial scale-up. Traditional tartaric acid production relies on wine industry by-products, creating supply chain dependencies and seasonal availability issues. The extraction and purification processes require substantial energy inputs, with approximately 2.5-3.0 kWh per kilogram of tartaric acid produced. Crystallization challenges during purification can reduce yield efficiency by 15-20%.

Succinic acid faces different production challenges. Petroleum-based production methods generate considerable environmental concerns with carbon footprints approximately 4-5 times higher than bio-based alternatives. Bio-based fermentation routes, while more sustainable, struggle with consistency in feedstock quality and fermentation efficiency. Current bio-based production methods achieve only 60-75% of theoretical yields, with downstream processing accounting for 60-70% of total production costs.

Water consumption represents another critical comparison point, with tartaric acid production requiring approximately 40-50 liters per kilogram, while succinic acid bio-production consumes 20-30 liters per kilogram. Energy efficiency metrics similarly favor succinic acid production, particularly when utilizing renewable feedstocks and optimized fermentation processes.

Recent technological innovations are gradually addressing these challenges, with continuous flow reactors improving tartaric acid extraction efficiency by 25-30%, and engineered microorganisms enhancing succinic acid fermentation yields by up to 40% compared to wild-type strains. These advancements are progressively narrowing the cost gap between these two industrially significant organic acids.

Current Industrial Applications and Solutions

01 Production methods of tartaric acid and succinic acid

Various methods for producing tartaric acid and succinic acid are described, including fermentation processes, chemical synthesis routes, and enzymatic conversions. These methods often involve specific microorganisms, catalysts, or reaction conditions to optimize yield and purity. Some processes focus on sustainable production using renewable resources as starting materials, while others aim to improve efficiency and reduce environmental impact.- Production methods of tartaric acid and succinic acid: Various methods for producing tartaric acid and succinic acid have been developed, including fermentation processes, chemical synthesis, and enzymatic conversions. These methods often involve specific microorganisms or catalysts to achieve efficient production. The processes may include steps such as purification, crystallization, and separation techniques to obtain high-purity acids suitable for industrial applications.

- Applications in food and beverage industry: Tartaric acid and succinic acid are widely used in the food and beverage industry as acidulants, flavor enhancers, and preservatives. They contribute to the taste profile of various products and help maintain pH stability. These acids are particularly valuable in wine production, fruit-based products, and confectionery items where they provide tartness and enhance flavor profiles while extending shelf life.

- Pharmaceutical and cosmetic applications: Both tartaric acid and succinic acid have important applications in pharmaceutical and cosmetic formulations. They serve as excipients, pH adjusters, and active ingredients in various medicinal preparations. In cosmetics, these acids function as skin conditioning agents, pH regulators, and chelating agents. Their natural origin makes them attractive ingredients for products marketed as natural or organic.

- Industrial and chemical applications: Tartaric acid and succinic acid are utilized in various industrial processes as building blocks for polymers, plasticizers, and specialty chemicals. They serve as precursors in the synthesis of biodegradable polymers and environmentally friendly materials. These acids also function as chelating agents, pH regulators, and catalysts in chemical manufacturing processes across multiple industries.

- Sustainable production and bio-based applications: Recent innovations focus on sustainable production methods for tartaric acid and succinic acid from renewable resources. Bio-based production using agricultural waste, microbial fermentation, and green chemistry approaches has gained significant attention. These sustainable acids are increasingly used in biodegradable plastics, environmentally friendly detergents, and as platform chemicals for various green chemistry applications.

02 Applications in food and beverage industry

Tartaric acid and succinic acid are widely used as acidulants, flavor enhancers, and preservatives in the food and beverage industry. They contribute to the taste profile of various products, adjust pH levels, and extend shelf life. These acids are particularly valuable in wine production, fruit-based products, and confectionery applications where they provide tartness and help maintain product stability.Expand Specific Solutions03 Pharmaceutical and cosmetic applications

Both tartaric acid and succinic acid have important applications in pharmaceutical formulations and cosmetic products. They serve as excipients, pH adjusters, and active ingredients in various medicinal preparations. In cosmetics, these acids function as skin conditioning agents, pH regulators, and chelating agents. Their natural origin makes them attractive ingredients for products marketed as natural or organic.Expand Specific Solutions04 Industrial applications and chemical intermediates

Tartaric acid and succinic acid serve as important chemical intermediates and building blocks for various industrial applications. They are used in the synthesis of polymers, resins, plasticizers, and specialty chemicals. Succinic acid, in particular, has gained attention as a bio-based platform chemical for producing biodegradable plastics and other sustainable materials. These acids also find applications in metal treatment, textile processing, and as catalysts in chemical reactions.Expand Specific Solutions05 Purification and crystallization techniques

Various methods for purifying and crystallizing tartaric acid and succinic acid are described, including recrystallization, precipitation, and chromatographic techniques. These processes aim to obtain high-purity acids suitable for specific applications. The crystallization conditions, such as temperature, solvent selection, and cooling rates, significantly influence the crystal morphology, size distribution, and purity of the final product. Some techniques focus on recovering these acids from industrial byproducts or waste streams.Expand Specific Solutions

Leading Manufacturers and Market Competition

The industrial application landscape of tartaric acid versus succinic acid is currently in a growth phase, with the market expanding at a steady rate due to increasing demand in food, pharmaceutical, and chemical sectors. The global market for these acids is estimated to reach several billion dollars by 2025, with tartaric acid maintaining a more established position in traditional applications while succinic acid emerges as a promising bio-based alternative. Technologically, companies like Changmao Biochemical and Anhui Hailan have achieved commercial maturity in tartaric acid production, while BASF, Roquette Frères, and CJ CheilJedang are advancing bio-based succinic acid technologies. Academic institutions including Jiangnan University and Nanjing Tech University are collaborating with industry players to develop more sustainable and cost-effective production methods, indicating a shift toward greener manufacturing processes.

BASF Corp.

Technical Solution: BASF has developed comprehensive industrial applications for both tartaric acid and succinic acid. For tartaric acid, they've created specialized formulations for wine production, pharmaceuticals, and construction chemicals. Their patented process utilizes natural L-(+)-tartaric acid in polymer production as chiral building blocks. For succinic acid, BASF pioneered bio-based production through fermentation of renewable feedstocks, reducing carbon footprint by up to 60% compared to petroleum-based alternatives. Their proprietary catalytic process converts bio-succinic acid to 1,4-butanediol (BDO), polyester polyols, and other derivatives with applications in biodegradable plastics, polyurethanes, and solvents. BASF's integrated value chain approach enables them to offer complete solutions from raw materials to finished products across multiple industries.

Strengths: Extensive R&D capabilities with global manufacturing infrastructure; integrated value chain approach; leadership in sustainable chemistry. Weaknesses: Higher production costs for bio-based succinic acid compared to petroleum-based routes; dependence on agricultural feedstock prices for bio-based production.

Changmao Biochemical Engineering Co., Ltd.

Technical Solution: Changmao Biochemical has established itself as a global leader in tartaric acid production, controlling approximately 60% of the world market. Their proprietary technology utilizes wine lees and other by-products from wine production as raw materials, implementing a circular economy approach. Their patented purification process achieves 99.9% optical purity for L-(+)-tartaric acid, critical for pharmaceutical applications. For succinic acid, Changmao has developed a hybrid chemical-biological process that combines fermentation with catalytic refinement, reducing production costs by approximately 30% compared to traditional methods. Their integrated biorefinery concept enables simultaneous production of multiple organic acids (tartaric, succinic, fumaric) from the same feedstock, maximizing resource efficiency. Changmao's continuous flow reactors improve yield and reduce energy consumption by 25% compared to batch processing.

Strengths: Market leadership in tartaric acid; cost-effective integrated production systems; strong position in both food and industrial applications. Weaknesses: Limited global manufacturing footprint outside Asia; higher dependency on wine industry fluctuations for tartaric acid production.

Key Patents and Technical Innovations

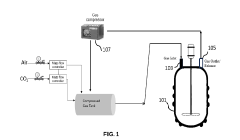

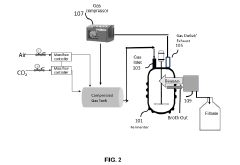

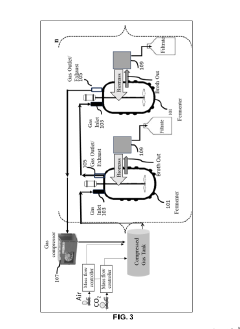

Compositions and method for making succinic acid

PatentPendingIN202241067481A

Innovation

- A system and method utilizing CO2 as a secondary carbon source and recycling both CO2 and biomass to enhance succinic acid production, replacing bicarbonate salts and minimizing waste, with a self-sustainable process involving a fermentation vessel, gas recycling, and cell separation for efficient succinic acid production.

Environmental Impact and Sustainability Considerations

The environmental impact of tartaric and succinic acid production and use represents a critical consideration in their industrial applications. Traditional tartaric acid production from wine industry by-products involves chemical processes that generate significant waste streams and require substantial energy inputs. The extraction and purification steps often utilize harmful solvents and chemicals that pose environmental risks if not properly managed. In contrast, bio-based succinic acid production has emerged as a more environmentally friendly alternative, with potential carbon footprint reductions of up to 50% compared to petroleum-based production methods.

Life cycle assessments (LCA) of both acids reveal important sustainability differences. Tartaric acid's environmental profile is heavily influenced by its sourcing - naturally derived tartaric acid from wine by-products demonstrates better sustainability metrics than synthetically produced alternatives. However, the seasonal availability and geographical limitations of wine production create supply chain challenges that can increase the overall environmental footprint through transportation emissions.

Succinic acid's bio-based production pathways offer significant environmental advantages through renewable feedstock utilization and carbon sequestration potential. Modern fermentation processes can utilize agricultural waste streams as feedstock, creating valuable circular economy opportunities. Additionally, each ton of bio-based succinic acid produced can sequester up to 1 ton of CO2, effectively making it a carbon-negative process under optimal conditions.

Water usage represents another critical environmental factor. Tartaric acid extraction typically requires 15-20 cubic meters of water per ton produced, while optimized succinic acid fermentation processes have reduced water requirements to approximately 8-12 cubic meters per ton. This water efficiency becomes increasingly important in water-stressed regions where industrial production occurs.

Waste management challenges differ significantly between the two acids. Tartaric acid production generates acidic waste streams requiring neutralization and specialized disposal, while succinic acid's fermentation processes produce biological waste that can often be repurposed as agricultural amendments or energy feedstock through anaerobic digestion.

Regulatory frameworks increasingly favor sustainable production methods, with carbon taxation and environmental compliance costs creating economic incentives for greener processes. Companies utilizing bio-based succinic acid can potentially benefit from carbon credits and sustainability certifications that enhance market positioning. The growing consumer and industrial demand for environmentally responsible products further strengthens the business case for sustainable acid production pathways.

Life cycle assessments (LCA) of both acids reveal important sustainability differences. Tartaric acid's environmental profile is heavily influenced by its sourcing - naturally derived tartaric acid from wine by-products demonstrates better sustainability metrics than synthetically produced alternatives. However, the seasonal availability and geographical limitations of wine production create supply chain challenges that can increase the overall environmental footprint through transportation emissions.

Succinic acid's bio-based production pathways offer significant environmental advantages through renewable feedstock utilization and carbon sequestration potential. Modern fermentation processes can utilize agricultural waste streams as feedstock, creating valuable circular economy opportunities. Additionally, each ton of bio-based succinic acid produced can sequester up to 1 ton of CO2, effectively making it a carbon-negative process under optimal conditions.

Water usage represents another critical environmental factor. Tartaric acid extraction typically requires 15-20 cubic meters of water per ton produced, while optimized succinic acid fermentation processes have reduced water requirements to approximately 8-12 cubic meters per ton. This water efficiency becomes increasingly important in water-stressed regions where industrial production occurs.

Waste management challenges differ significantly between the two acids. Tartaric acid production generates acidic waste streams requiring neutralization and specialized disposal, while succinic acid's fermentation processes produce biological waste that can often be repurposed as agricultural amendments or energy feedstock through anaerobic digestion.

Regulatory frameworks increasingly favor sustainable production methods, with carbon taxation and environmental compliance costs creating economic incentives for greener processes. Companies utilizing bio-based succinic acid can potentially benefit from carbon credits and sustainability certifications that enhance market positioning. The growing consumer and industrial demand for environmentally responsible products further strengthens the business case for sustainable acid production pathways.

Regulatory Framework for Food and Industrial Chemicals

The regulatory landscape governing tartaric acid and succinic acid spans multiple jurisdictions and frameworks, with significant implications for their industrial applications. In the United States, the Food and Drug Administration (FDA) classifies tartaric acid as Generally Recognized as Safe (GRAS), permitting its use in food products under 21 CFR 184.1099, with specific limitations on concentration depending on food categories. Similarly, succinic acid holds GRAS status under 21 CFR 184.1091, though with different application parameters.

The European Food Safety Authority (EFSA) regulates these acids under Regulation (EC) No 1333/2008 on food additives, designating tartaric acid as E334 and succinic acid as E363. The European framework imposes stricter limitations on succinic acid applications compared to tartaric acid, particularly in beverage formulations where tartaric acid enjoys broader approval.

In pharmaceutical applications, both acids must comply with pharmacopeia standards, including the United States Pharmacopeia (USP) and European Pharmacopoeia (Ph. Eur.), which establish stringent purity criteria. Tartaric acid's longer history in pharmaceutical formulations has resulted in more established regulatory pathways compared to succinic acid.

For industrial chemical applications beyond food and pharmaceuticals, the Registration, Evaluation, Authorization and Restriction of Chemicals (REACH) regulation in Europe requires comprehensive safety data for both acids when produced or imported above one tonne annually. The U.S. Toxic Substances Control Act (TSCA) similarly governs industrial chemical uses, with both acids listed on the TSCA Inventory.

Sustainability considerations have introduced additional regulatory dimensions. Bio-based succinic acid production receives preferential regulatory treatment under various green chemistry initiatives, including the EU's Circular Economy Action Plan. These frameworks provide incentives for bio-based production methods while imposing additional documentation requirements to verify sustainability claims.

International trade of these acids is subject to harmonized tariff schedules and import regulations that vary by country. Japan's regulatory framework through the Ministry of Health, Labour and Welfare applies particularly stringent purity requirements for food-grade applications of both acids, while China's National Medical Products Administration has established specific parameters for pharmaceutical applications.

Regulatory compliance costs differ significantly between the acids, with tartaric acid's established status resulting in lower compliance burdens compared to succinic acid's emerging applications, which often require additional safety studies and documentation.

The European Food Safety Authority (EFSA) regulates these acids under Regulation (EC) No 1333/2008 on food additives, designating tartaric acid as E334 and succinic acid as E363. The European framework imposes stricter limitations on succinic acid applications compared to tartaric acid, particularly in beverage formulations where tartaric acid enjoys broader approval.

In pharmaceutical applications, both acids must comply with pharmacopeia standards, including the United States Pharmacopeia (USP) and European Pharmacopoeia (Ph. Eur.), which establish stringent purity criteria. Tartaric acid's longer history in pharmaceutical formulations has resulted in more established regulatory pathways compared to succinic acid.

For industrial chemical applications beyond food and pharmaceuticals, the Registration, Evaluation, Authorization and Restriction of Chemicals (REACH) regulation in Europe requires comprehensive safety data for both acids when produced or imported above one tonne annually. The U.S. Toxic Substances Control Act (TSCA) similarly governs industrial chemical uses, with both acids listed on the TSCA Inventory.

Sustainability considerations have introduced additional regulatory dimensions. Bio-based succinic acid production receives preferential regulatory treatment under various green chemistry initiatives, including the EU's Circular Economy Action Plan. These frameworks provide incentives for bio-based production methods while imposing additional documentation requirements to verify sustainability claims.

International trade of these acids is subject to harmonized tariff schedules and import regulations that vary by country. Japan's regulatory framework through the Ministry of Health, Labour and Welfare applies particularly stringent purity requirements for food-grade applications of both acids, while China's National Medical Products Administration has established specific parameters for pharmaceutical applications.

Regulatory compliance costs differ significantly between the acids, with tartaric acid's established status resulting in lower compliance burdens compared to succinic acid's emerging applications, which often require additional safety studies and documentation.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!