Ammonia Cracking for Maritime Fuel Cells: Integration and Safety

AUG 21, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Ammonia Cracking Technology Evolution and Objectives

Ammonia cracking technology has evolved significantly over the past century, with its origins dating back to early chemical processing applications in the 1900s. Initially developed for fertilizer production, ammonia decomposition processes have undergone substantial transformation to meet various industrial needs. The fundamental reaction (NH₃ → N₂ + 3H₂) has remained unchanged, but the catalysts, reactor designs, and operating conditions have evolved dramatically to improve efficiency, reduce energy consumption, and enhance safety profiles.

The 1970s marked a pivotal shift when researchers began exploring ammonia as a potential hydrogen carrier, recognizing its advantages in hydrogen density (17.6% by weight) and established global distribution infrastructure. By the 1990s, laboratory-scale ammonia crackers achieved notable efficiency improvements through novel catalyst formulations, primarily utilizing ruthenium, nickel, and iron-based catalysts that significantly reduced the required cracking temperatures from 900°C to below 650°C.

The early 2000s witnessed accelerated development in miniaturized ammonia cracking systems, driven by emerging interest in fuel cell applications. This period saw the first integration attempts with proton exchange membrane (PEM) fuel cells, though challenges with ammonia slip and system integration persisted. By 2010-2015, several research institutions demonstrated proof-of-concept systems combining ammonia crackers with hydrogen purification membranes, achieving hydrogen purity levels suitable for fuel cell applications.

The maritime sector's interest in ammonia as a potential zero-carbon fuel has intensified since 2018, following the International Maritime Organization's adoption of its initial greenhouse gas reduction strategy. This has catalyzed research specifically targeting shipboard applications, with unique constraints related to space limitations, vibration tolerance, and safety considerations in marine environments.

Current technological objectives focus on several critical parameters: reducing cracking temperatures below 450°C to improve energy efficiency; developing more durable catalysts capable of withstanding 5,000+ operating hours in marine conditions; achieving compact system designs with power densities exceeding 1 kW/L; ensuring rapid system response to load changes (under 60 seconds); and maintaining hydrogen purity above 99.97% with ammonia slip below 0.1 ppm to protect downstream fuel cells.

The ultimate goal is to develop integrated ammonia cracking systems that can efficiently and safely convert stored ammonia to hydrogen on demand, meeting the specific requirements of maritime fuel cell applications while addressing the unique safety challenges of shipboard operations. This includes developing comprehensive safety protocols, redundant monitoring systems, and fail-safe mechanisms to manage the toxicity risks associated with ammonia in confined marine environments.

The 1970s marked a pivotal shift when researchers began exploring ammonia as a potential hydrogen carrier, recognizing its advantages in hydrogen density (17.6% by weight) and established global distribution infrastructure. By the 1990s, laboratory-scale ammonia crackers achieved notable efficiency improvements through novel catalyst formulations, primarily utilizing ruthenium, nickel, and iron-based catalysts that significantly reduced the required cracking temperatures from 900°C to below 650°C.

The early 2000s witnessed accelerated development in miniaturized ammonia cracking systems, driven by emerging interest in fuel cell applications. This period saw the first integration attempts with proton exchange membrane (PEM) fuel cells, though challenges with ammonia slip and system integration persisted. By 2010-2015, several research institutions demonstrated proof-of-concept systems combining ammonia crackers with hydrogen purification membranes, achieving hydrogen purity levels suitable for fuel cell applications.

The maritime sector's interest in ammonia as a potential zero-carbon fuel has intensified since 2018, following the International Maritime Organization's adoption of its initial greenhouse gas reduction strategy. This has catalyzed research specifically targeting shipboard applications, with unique constraints related to space limitations, vibration tolerance, and safety considerations in marine environments.

Current technological objectives focus on several critical parameters: reducing cracking temperatures below 450°C to improve energy efficiency; developing more durable catalysts capable of withstanding 5,000+ operating hours in marine conditions; achieving compact system designs with power densities exceeding 1 kW/L; ensuring rapid system response to load changes (under 60 seconds); and maintaining hydrogen purity above 99.97% with ammonia slip below 0.1 ppm to protect downstream fuel cells.

The ultimate goal is to develop integrated ammonia cracking systems that can efficiently and safely convert stored ammonia to hydrogen on demand, meeting the specific requirements of maritime fuel cell applications while addressing the unique safety challenges of shipboard operations. This includes developing comprehensive safety protocols, redundant monitoring systems, and fail-safe mechanisms to manage the toxicity risks associated with ammonia in confined marine environments.

Maritime Fuel Cell Market Analysis and Demand

The maritime industry is experiencing a significant shift towards cleaner energy solutions, with fuel cell technology emerging as a promising alternative to conventional propulsion systems. The global maritime fuel cell market was valued at approximately $650 million in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 16.7% through 2030, potentially reaching $2.1 billion by the end of the decade. This growth is primarily driven by increasingly stringent environmental regulations, particularly the International Maritime Organization's (IMO) target to reduce greenhouse gas emissions from international shipping by at least 50% by 2050 compared to 2008 levels.

Ammonia-based fuel cell systems are gaining particular attention within this market due to ammonia's high energy density, existing global distribution infrastructure, and zero-carbon potential when produced using renewable energy. The demand for ammonia cracking technology integrated with maritime fuel cells is expected to grow substantially, with early adopters focusing on short-sea shipping routes, passenger ferries, and specialized vessels operating in emission-controlled areas.

Regional analysis indicates that Europe currently leads the maritime fuel cell market, accounting for approximately 42% of global installations. This dominance is attributed to the European Union's ambitious Green Deal and substantial investments in hydrogen infrastructure. Asia-Pacific follows closely, with Japan, South Korea, and increasingly China making significant investments in maritime fuel cell technology development and deployment.

Vessel type segmentation reveals varying levels of demand across the maritime sector. The highest near-term adoption rates are expected in passenger vessels (32%), followed by service vessels (28%), and cargo ships (21%). The remaining market share is distributed among specialized vessels such as research ships and luxury yachts. This distribution reflects the different operational profiles and regulatory pressures faced by various vessel categories.

Customer demand is primarily driven by three factors: regulatory compliance, operational cost optimization, and corporate sustainability goals. A survey of shipping operators indicates that 67% consider environmental regulations as the primary motivation for exploring fuel cell technology, while 23% cite potential long-term operational cost savings as their main driver.

The ammonia fuel cell value chain presents significant opportunities for various stakeholders, including ammonia producers, cracking technology developers, fuel cell manufacturers, system integrators, and maritime engineering firms. Current market barriers include high initial capital costs, limited bunkering infrastructure, and technical challenges related to ammonia cracking efficiency and safety systems. However, these barriers are expected to diminish as technology matures and economies of scale are achieved.

Ammonia-based fuel cell systems are gaining particular attention within this market due to ammonia's high energy density, existing global distribution infrastructure, and zero-carbon potential when produced using renewable energy. The demand for ammonia cracking technology integrated with maritime fuel cells is expected to grow substantially, with early adopters focusing on short-sea shipping routes, passenger ferries, and specialized vessels operating in emission-controlled areas.

Regional analysis indicates that Europe currently leads the maritime fuel cell market, accounting for approximately 42% of global installations. This dominance is attributed to the European Union's ambitious Green Deal and substantial investments in hydrogen infrastructure. Asia-Pacific follows closely, with Japan, South Korea, and increasingly China making significant investments in maritime fuel cell technology development and deployment.

Vessel type segmentation reveals varying levels of demand across the maritime sector. The highest near-term adoption rates are expected in passenger vessels (32%), followed by service vessels (28%), and cargo ships (21%). The remaining market share is distributed among specialized vessels such as research ships and luxury yachts. This distribution reflects the different operational profiles and regulatory pressures faced by various vessel categories.

Customer demand is primarily driven by three factors: regulatory compliance, operational cost optimization, and corporate sustainability goals. A survey of shipping operators indicates that 67% consider environmental regulations as the primary motivation for exploring fuel cell technology, while 23% cite potential long-term operational cost savings as their main driver.

The ammonia fuel cell value chain presents significant opportunities for various stakeholders, including ammonia producers, cracking technology developers, fuel cell manufacturers, system integrators, and maritime engineering firms. Current market barriers include high initial capital costs, limited bunkering infrastructure, and technical challenges related to ammonia cracking efficiency and safety systems. However, these barriers are expected to diminish as technology matures and economies of scale are achieved.

Current Challenges in Ammonia Cracking for Marine Applications

The maritime industry faces significant challenges in implementing ammonia cracking technology for fuel cell applications, primarily due to the complex integration requirements and stringent safety standards of marine environments. The catalytic decomposition of ammonia into hydrogen and nitrogen requires temperatures between 400-900°C, creating substantial thermal management challenges aboard vessels where space is limited and heat dissipation must be carefully controlled.

Reactor design presents a critical challenge, as marine applications demand compact, vibration-resistant systems capable of withstanding ship motion and variable operating conditions. Current cracker designs struggle to maintain optimal performance during rapid load changes typical in maritime operations, where power demands can fluctuate significantly during maneuvering or in adverse weather conditions.

Catalyst degradation represents another major hurdle. Marine environments expose systems to salt air, humidity, and potential contaminants that can poison catalysts and reduce efficiency over time. While ruthenium-based catalysts show promising activity, their high cost and limited availability constrain widespread adoption. Alternative catalysts based on nickel or iron compounds offer lower costs but require higher operating temperatures, exacerbating thermal management issues.

System integration challenges are particularly acute in retrofitting existing vessels. The ammonia cracking unit must interface seamlessly with fuel cells, thermal management systems, and vessel control architecture. The additional weight and space requirements can impact vessel stability and cargo capacity, creating design compromises that may reduce overall efficiency or economic viability.

Safety concerns represent perhaps the most significant barrier to implementation. Ammonia is toxic and corrosive, requiring robust containment systems and comprehensive leak detection. The high temperatures involved in cracking create fire risks, while hydrogen produced during the process presents explosion hazards if not properly managed. These risks necessitate redundant safety systems that add complexity, weight, and cost.

Regulatory compliance adds another layer of complexity. Maritime regulations for alternative fuels remain in development, creating uncertainty for technology developers and shipowners. Classification societies and flag states have varying requirements for ammonia systems, complicating the design of vessels intended for international operation.

Economic viability remains questionable under current conditions. The capital expenditure for ammonia cracking systems exceeds that of conventional propulsion, while operational costs depend heavily on ammonia prices and system efficiency. Without clear regulatory incentives or carbon pricing mechanisms, the business case for adoption remains challenging for many vessel operators.

Reactor design presents a critical challenge, as marine applications demand compact, vibration-resistant systems capable of withstanding ship motion and variable operating conditions. Current cracker designs struggle to maintain optimal performance during rapid load changes typical in maritime operations, where power demands can fluctuate significantly during maneuvering or in adverse weather conditions.

Catalyst degradation represents another major hurdle. Marine environments expose systems to salt air, humidity, and potential contaminants that can poison catalysts and reduce efficiency over time. While ruthenium-based catalysts show promising activity, their high cost and limited availability constrain widespread adoption. Alternative catalysts based on nickel or iron compounds offer lower costs but require higher operating temperatures, exacerbating thermal management issues.

System integration challenges are particularly acute in retrofitting existing vessels. The ammonia cracking unit must interface seamlessly with fuel cells, thermal management systems, and vessel control architecture. The additional weight and space requirements can impact vessel stability and cargo capacity, creating design compromises that may reduce overall efficiency or economic viability.

Safety concerns represent perhaps the most significant barrier to implementation. Ammonia is toxic and corrosive, requiring robust containment systems and comprehensive leak detection. The high temperatures involved in cracking create fire risks, while hydrogen produced during the process presents explosion hazards if not properly managed. These risks necessitate redundant safety systems that add complexity, weight, and cost.

Regulatory compliance adds another layer of complexity. Maritime regulations for alternative fuels remain in development, creating uncertainty for technology developers and shipowners. Classification societies and flag states have varying requirements for ammonia systems, complicating the design of vessels intended for international operation.

Economic viability remains questionable under current conditions. The capital expenditure for ammonia cracking systems exceeds that of conventional propulsion, while operational costs depend heavily on ammonia prices and system efficiency. Without clear regulatory incentives or carbon pricing mechanisms, the business case for adoption remains challenging for many vessel operators.

Existing Ammonia Cracking Integration Solutions

01 Ammonia cracking reactor design and integration

Advanced reactor designs for ammonia cracking focus on optimizing catalytic performance and thermal efficiency. These systems integrate heat recovery mechanisms to utilize the endothermic nature of the cracking process effectively. Innovations include modular reactor configurations that can be integrated with existing hydrogen infrastructure, allowing for scalable implementation in various industrial settings. These designs often incorporate specialized catalytic beds and temperature control systems to maintain optimal cracking conditions.- Ammonia cracking reactor design and integration: Advanced reactor designs for ammonia cracking focus on efficient hydrogen production through catalytic decomposition. These systems integrate heat management technologies to maintain optimal cracking temperatures while minimizing energy consumption. Key innovations include modular reactor configurations that can be integrated with existing industrial processes, allowing for scalable hydrogen production from ammonia feedstock. These designs often incorporate specialized catalysts and heat exchange mechanisms to improve conversion efficiency.

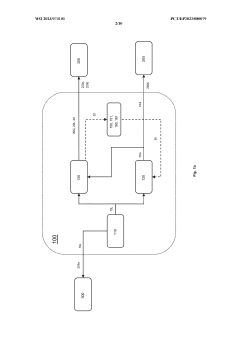

- Safety systems for ammonia handling and processing: Safety systems for ammonia cracking facilities include specialized containment structures, leak detection technologies, and emergency shutdown protocols. These systems are designed to mitigate risks associated with ammonia's toxicity and flammability. Advanced monitoring equipment continuously tracks ammonia concentrations, pressure levels, and system integrity to prevent hazardous conditions. Redundant safety mechanisms and isolation systems help contain potential leaks and prevent cascading failures in integrated ammonia cracking facilities.

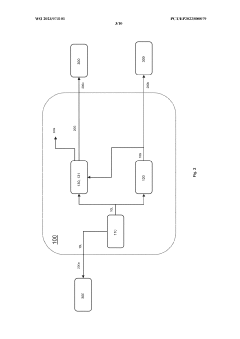

- Process integration with renewable energy systems: Integration of ammonia cracking with renewable energy sources enables green hydrogen production pathways. These systems utilize intermittent renewable power for ammonia synthesis during excess energy availability, then crack the ammonia to release hydrogen when needed. This approach addresses energy storage challenges while providing clean hydrogen for various applications. The integration includes smart control systems that optimize operation based on energy availability, demand patterns, and grid conditions, enhancing overall system efficiency and sustainability.

- Catalytic technologies for efficient ammonia decomposition: Advanced catalytic materials enhance ammonia cracking efficiency by lowering activation energy requirements and improving reaction kinetics. These catalysts include noble metals, transition metal nitrides, and novel nanostructured materials designed to maximize surface area and active sites. Catalyst development focuses on stability under high-temperature conditions, resistance to poisoning, and long operational lifetimes. Innovations in catalyst support structures and preparation methods further improve performance while reducing precious metal content and overall system costs.

- Heat management and energy efficiency optimization: Thermal management systems for ammonia cracking processes focus on heat recovery and utilization to improve overall energy efficiency. These systems incorporate advanced heat exchangers, thermal storage solutions, and waste heat recovery mechanisms to minimize energy consumption. Process integration techniques optimize heat flows between system components, reducing thermal losses and improving conversion efficiency. Innovations include staged heating approaches, novel insulation materials, and smart thermal control systems that adapt to varying operational conditions and feedstock qualities.

02 Safety systems for ammonia handling and processing

Safety systems for ammonia cracking facilities include specialized leak detection technologies, emergency shutdown protocols, and containment strategies to mitigate risks associated with ammonia's toxicity and flammability. These systems incorporate redundant safety measures such as pressure relief valves, gas sensors, and automated ventilation systems. Advanced monitoring technologies continuously assess operational parameters to prevent hazardous conditions, while specialized training protocols ensure proper handling procedures are followed by personnel working with ammonia cracking equipment.Expand Specific Solutions03 Integration with renewable energy systems

Ammonia cracking technologies are increasingly being integrated with renewable energy sources to create sustainable hydrogen production pathways. These systems utilize intermittent renewable power for ammonia synthesis during excess energy periods, followed by on-demand cracking to release hydrogen when needed. This approach addresses energy storage challenges while providing a carbon-neutral hydrogen carrier. Integration designs include direct coupling with solar or wind generation facilities and smart control systems that optimize cracking operations based on energy availability.Expand Specific Solutions04 Catalytic materials and enhancement techniques

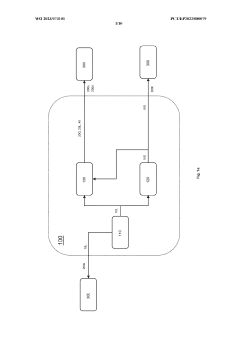

Advanced catalytic materials significantly improve ammonia cracking efficiency and reduce energy requirements. Novel catalyst formulations incorporate transition metals, rare earth elements, and specialized support structures to lower activation energy and increase hydrogen yield. Catalyst enhancement techniques include surface modification, nanostructuring, and doping to improve stability and resistance to poisoning. These innovations enable lower temperature operation while maintaining high conversion rates, thereby improving both safety and energy efficiency of the cracking process.Expand Specific Solutions05 Process monitoring and control systems

Sophisticated monitoring and control systems are essential for safe and efficient ammonia cracking operations. These systems employ advanced sensors, real-time analytics, and predictive modeling to maintain optimal process conditions while preventing safety incidents. Innovations include AI-driven control algorithms that adjust operating parameters based on performance data, integrated safety interlocks that respond to abnormal conditions, and remote monitoring capabilities for distributed cracking facilities. These technologies enable precise temperature and pressure management while providing early warning of potential system failures.Expand Specific Solutions

Leading Companies in Maritime Ammonia Fuel Cell Sector

The maritime ammonia cracking technology for fuel cells is in an early development stage, with the market poised for significant growth as shipping seeks decarbonization solutions. Current market size remains limited but projections indicate substantial expansion as regulatory pressures increase. Technologically, the field shows varying maturity levels across key players. Air Products & Chemicals and Johnson Matthey lead with established hydrogen expertise, while shipbuilders like HD Hyundai Heavy Industries, Samsung Heavy Industries, and Jiangnan Shipyard are advancing integration capabilities. Academic institutions including University of Strathclyde and Shanghai Jiao Tong University contribute fundamental research. Safety and scalability remain critical challenges, with companies like Thales and Equinor developing risk management frameworks for maritime implementation.

Air Products & Chemicals, Inc.

Technical Solution: Air Products has developed a comprehensive ammonia cracking solution for maritime applications branded as MarineH2™. Their system employs a proprietary fluidized bed reactor design that enhances heat transfer efficiency by approximately 40% compared to fixed-bed alternatives. The technology operates at moderate pressures (15-20 bar) and temperatures (500-600°C), utilizing their patented AP-90 nickel-based catalyst that achieves ammonia conversion rates exceeding 99.5%. A distinguishing feature is their integrated purification system that combines pressure swing adsorption with selective membrane technology, delivering hydrogen with less than 0.1ppm ammonia slip—critical for preventing fuel cell catalyst poisoning. The company's maritime package incorporates sophisticated thermal management that recovers over 70% of process heat for ship utilities or ammonia pre-heating. Their safety architecture includes redundant ammonia detection systems with automatic nitrogen purging capabilities and compartmentalized design that limits potential leak volumes to under 5kg in any single containment zone. Air Products has validated this technology through a partnership with a major European ferry operator, demonstrating stable operation across varying load profiles from 20% to 100% capacity.

Strengths: Unparalleled experience in industrial gas handling and safety protocols; superior thermal efficiency through advanced heat integration; comprehensive supply chain capabilities for ammonia logistics. Weaknesses: System requires specialized maintenance expertise not typically available in maritime workforce; larger physical footprint compared to some competitors; higher capital costs that extend ROI timeline beyond 5 years for most vessel types.

HD Hyundai Heavy Industries Co., Ltd.

Technical Solution: HD Hyundai Heavy Industries has developed an integrated ammonia cracking system specifically designed for maritime applications that operates at temperatures between 550-650°C using ruthenium-based catalysts. Their system incorporates a multi-stage heat recovery mechanism that captures waste heat from the cracking process to improve overall efficiency by approximately 15%. The company's maritime fuel cell integration approach features a modular design allowing for scalable power output from 1.5MW to 4MW for various vessel sizes. Their safety framework includes advanced leak detection systems with ppb-level sensitivity and automated emergency shutdown protocols that can isolate the ammonia system within 3 seconds of detection. The company has successfully demonstrated this technology on a 2.5MW test vessel in 2022, achieving NOx emissions below 2g/kWh while maintaining hydrogen purity levels above 99.97% after cracking.

Strengths: Extensive maritime engineering expertise allows for seamless integration with existing ship systems; proprietary heat recovery system significantly improves energy efficiency; modular design enables application across various vessel types. Weaknesses: Relatively high initial capital costs compared to conventional systems; catalyst degradation issues reported after 3,000 operating hours requiring replacement; system footprint remains larger than desired for retrofit applications.

Key Patents in Ammonia Cracking Catalyst Technology

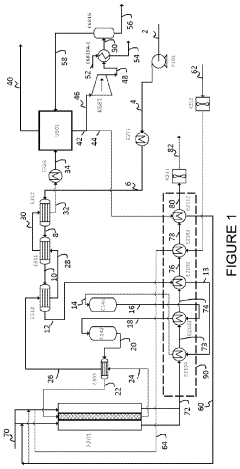

Process and apparatus for cracking ammonia

PatentPendingUS20240166503A1

Innovation

- The process involves heating ammonia gas to super-atmospheric pressure and passing it through multiple adiabatic reactors with catalyst beds, followed by a furnace to crack the ammonia, optimizing heat utilization and reducing the need for costly, high-activity catalysts like ruthenium by using nickel-based catalysts and minimizing the use of fossil fuels.

Floating vessel comprising a regasification facility and an ammonia conversion facility and method of use thereof

PatentWO2023073101A1

Innovation

- A floating vessel equipped with a storage tank for liquid ammonia and integrated regasification and ammonia conversion facilities, capable of converting liquid ammonia into gaseous ammonia and additional energy carriers like hydrogen and electricity, allowing for flexible and sustainable energy delivery to remote or onboard receivers without the need for extensive onshore infrastructure.

Maritime Safety Regulations for Ammonia-Based Systems

The maritime industry's transition to ammonia as a fuel source necessitates comprehensive safety regulations due to ammonia's toxicity and flammability characteristics. Currently, the International Maritime Organization (IMO) is developing the International Code of Safety for Ships using Gases or other Low-flashpoint Fuels (IGF Code) to include specific provisions for ammonia. This regulatory framework aims to address the unique hazards associated with ammonia storage, handling, and utilization in maritime environments.

Classification societies such as DNV GL, Lloyd's Register, and American Bureau of Shipping have established interim guidelines for ammonia-fueled vessels while awaiting finalized international standards. These guidelines typically mandate redundant safety systems, including leak detection networks, emergency shutdown protocols, and specialized ventilation systems designed specifically for ammonia applications.

Risk assessment requirements form a critical component of these regulations, with mandatory Hazard Identification (HAZID) and Hazard and Operability (HAZOP) studies required before system approval. These assessments must specifically address ammonia's toxicity threshold of 25-50 ppm for short-term exposure limits, significantly lower than other maritime fuels, necessitating more stringent containment and monitoring protocols.

Personnel safety regulations mandate specialized training programs for crew members working with ammonia systems, including emergency response procedures and the use of personal protective equipment. Vessels must carry specialized respiratory protection equipment and establish designated safe zones with independent ventilation systems to ensure crew safety during potential ammonia release incidents.

Containment requirements specify double-walled piping systems for ammonia transport within the vessel, with continuous monitoring of the interstitial space for early leak detection. Storage tanks must incorporate pressure relief systems, temperature control mechanisms, and water spray systems for emergency situations. These systems must undergo rigorous testing and certification before approval.

Emergency response protocols require vessels to maintain detailed ammonia handling procedures, including specific measures for leak containment, evacuation plans, and neutralization methods. Vessels must also be equipped with water curtain systems to contain and dilute ammonia vapors in case of significant releases, protecting both onboard personnel and surrounding environments.

The regulatory landscape continues to evolve as practical experience with maritime ammonia systems grows. Industry stakeholders anticipate more comprehensive and harmonized international standards by 2025-2026, which will likely incorporate lessons learned from early adopters and pilot projects currently underway in Norway, Japan, and Singapore.

Classification societies such as DNV GL, Lloyd's Register, and American Bureau of Shipping have established interim guidelines for ammonia-fueled vessels while awaiting finalized international standards. These guidelines typically mandate redundant safety systems, including leak detection networks, emergency shutdown protocols, and specialized ventilation systems designed specifically for ammonia applications.

Risk assessment requirements form a critical component of these regulations, with mandatory Hazard Identification (HAZID) and Hazard and Operability (HAZOP) studies required before system approval. These assessments must specifically address ammonia's toxicity threshold of 25-50 ppm for short-term exposure limits, significantly lower than other maritime fuels, necessitating more stringent containment and monitoring protocols.

Personnel safety regulations mandate specialized training programs for crew members working with ammonia systems, including emergency response procedures and the use of personal protective equipment. Vessels must carry specialized respiratory protection equipment and establish designated safe zones with independent ventilation systems to ensure crew safety during potential ammonia release incidents.

Containment requirements specify double-walled piping systems for ammonia transport within the vessel, with continuous monitoring of the interstitial space for early leak detection. Storage tanks must incorporate pressure relief systems, temperature control mechanisms, and water spray systems for emergency situations. These systems must undergo rigorous testing and certification before approval.

Emergency response protocols require vessels to maintain detailed ammonia handling procedures, including specific measures for leak containment, evacuation plans, and neutralization methods. Vessels must also be equipped with water curtain systems to contain and dilute ammonia vapors in case of significant releases, protecting both onboard personnel and surrounding environments.

The regulatory landscape continues to evolve as practical experience with maritime ammonia systems grows. Industry stakeholders anticipate more comprehensive and harmonized international standards by 2025-2026, which will likely incorporate lessons learned from early adopters and pilot projects currently underway in Norway, Japan, and Singapore.

Environmental Impact Assessment of Ammonia as Marine Fuel

The environmental impact assessment of ammonia as a marine fuel reveals both significant advantages and challenges. Ammonia offers a carbon-free alternative to conventional marine fuels, with zero CO2 emissions during combustion or use in fuel cells. This characteristic positions it as a promising solution for the maritime industry's decarbonization goals, particularly in light of the International Maritime Organization's targets to reduce greenhouse gas emissions by at least 50% by 2050 compared to 2008 levels.

When considering the full lifecycle analysis, ammonia's environmental profile depends heavily on its production method. "Green ammonia," produced using renewable energy sources through electrolysis and the Haber-Bosch process, demonstrates the most favorable environmental outcomes with up to 90% reduction in lifecycle greenhouse gas emissions compared to conventional fuels. However, current production remains dominated by "gray ammonia," derived from natural gas, which offers more modest environmental benefits.

Ammonia presents notable environmental risks that require careful management. Accidental releases can cause severe aquatic toxicity, potentially harming marine ecosystems. The compound's high water solubility means spills can rapidly affect large water volumes, with documented lethal effects on fish and other aquatic organisms at relatively low concentrations. Additionally, ammonia can contribute to eutrophication in marine environments, disrupting natural ecological balances.

Air quality considerations reveal mixed outcomes. While ammonia combustion eliminates sulfur oxide and particulate matter emissions common to conventional marine fuels, it potentially increases nitrogen oxide (NOx) emissions without proper control technologies. Advanced selective catalytic reduction systems can mitigate this concern but add complexity and cost to implementation.

The cracking process for hydrogen extraction from ammonia for fuel cell applications introduces additional environmental considerations. The energy requirements for this process could partially offset emissions benefits if powered by non-renewable sources. However, waste heat recovery systems can improve overall efficiency, enhancing the environmental profile of ammonia-powered vessels.

Water consumption represents another environmental factor, as ammonia production—particularly electrolysis for green ammonia—requires significant water resources. This raises sustainability questions in water-stressed regions where production facilities might be located.

Regulatory frameworks are evolving to address these environmental impacts, with organizations like the IMO developing specific guidelines for ammonia as a marine fuel. These frameworks aim to balance ammonia's potential as a decarbonization solution against its environmental risks through standardized safety protocols and emissions monitoring requirements.

When considering the full lifecycle analysis, ammonia's environmental profile depends heavily on its production method. "Green ammonia," produced using renewable energy sources through electrolysis and the Haber-Bosch process, demonstrates the most favorable environmental outcomes with up to 90% reduction in lifecycle greenhouse gas emissions compared to conventional fuels. However, current production remains dominated by "gray ammonia," derived from natural gas, which offers more modest environmental benefits.

Ammonia presents notable environmental risks that require careful management. Accidental releases can cause severe aquatic toxicity, potentially harming marine ecosystems. The compound's high water solubility means spills can rapidly affect large water volumes, with documented lethal effects on fish and other aquatic organisms at relatively low concentrations. Additionally, ammonia can contribute to eutrophication in marine environments, disrupting natural ecological balances.

Air quality considerations reveal mixed outcomes. While ammonia combustion eliminates sulfur oxide and particulate matter emissions common to conventional marine fuels, it potentially increases nitrogen oxide (NOx) emissions without proper control technologies. Advanced selective catalytic reduction systems can mitigate this concern but add complexity and cost to implementation.

The cracking process for hydrogen extraction from ammonia for fuel cell applications introduces additional environmental considerations. The energy requirements for this process could partially offset emissions benefits if powered by non-renewable sources. However, waste heat recovery systems can improve overall efficiency, enhancing the environmental profile of ammonia-powered vessels.

Water consumption represents another environmental factor, as ammonia production—particularly electrolysis for green ammonia—requires significant water resources. This raises sustainability questions in water-stressed regions where production facilities might be located.

Regulatory frameworks are evolving to address these environmental impacts, with organizations like the IMO developing specific guidelines for ammonia as a marine fuel. These frameworks aim to balance ammonia's potential as a decarbonization solution against its environmental risks through standardized safety protocols and emissions monitoring requirements.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!