Catalyst Deactivation Pathways: Sulfur, Water, and Airborne Impurities

AUG 21, 202510 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Catalyst Deactivation Mechanisms and Research Objectives

Catalysts play a pivotal role in modern industrial processes, enabling efficient chemical transformations across sectors including petrochemicals, pharmaceuticals, and environmental remediation. However, catalyst deactivation remains a significant challenge that impacts process economics and sustainability. The primary deactivation pathways involving sulfur, water, and airborne impurities represent some of the most pervasive issues in catalytic systems.

Sulfur poisoning constitutes one of the most severe deactivation mechanisms, particularly in hydroprocessing and automotive catalysts. Sulfur compounds chemisorb onto active metal sites, forming stable metal-sulfur bonds that effectively block catalytic centers. This phenomenon is especially problematic in petroleum refining where feedstocks naturally contain sulfur compounds ranging from simple H2S to complex thiophenes and dibenzothiophenes.

Water-induced deactivation operates through multiple mechanisms, including hydrothermal sintering, support degradation, and active phase leaching. In high-temperature applications, water vapor accelerates the agglomeration of metal particles, reducing available surface area. Additionally, water can promote phase transformations in catalyst supports, such as the conversion of gamma-alumina to less catalytically favorable alpha-alumina structures.

Airborne impurities, including dust, particulate matter, and volatile compounds, contribute to both mechanical and chemical deactivation pathways. Particulates can physically block catalyst pores and channels, reducing accessibility to active sites. Volatile organic compounds and other airborne contaminants may undergo reactions on catalyst surfaces, forming carbonaceous deposits or competing for adsorption sites.

The temporal evolution of these deactivation processes follows distinct patterns, with some occurring rapidly (acute poisoning) while others develop gradually over operational lifetimes (progressive deactivation). Understanding these kinetic aspects is crucial for developing effective mitigation strategies and predictive maintenance protocols.

The research objectives in this field focus on developing fundamental understanding of deactivation mechanisms at molecular and atomic scales. This includes characterizing the nature of sulfur-metal interactions, elucidating the role of water in structural transformations, and identifying the impact of trace airborne contaminants on catalyst performance. Advanced in-situ and operando characterization techniques are being deployed to observe deactivation phenomena under realistic operating conditions.

Additionally, research aims to develop more resilient catalyst formulations through strategies such as bimetallic systems with sacrificial components, core-shell architectures that shield active sites, and novel supports with enhanced hydrothermal stability. Computational approaches, including density functional theory and molecular dynamics simulations, are increasingly employed to predict deactivation pathways and screen potential catalyst improvements before experimental validation.

Sulfur poisoning constitutes one of the most severe deactivation mechanisms, particularly in hydroprocessing and automotive catalysts. Sulfur compounds chemisorb onto active metal sites, forming stable metal-sulfur bonds that effectively block catalytic centers. This phenomenon is especially problematic in petroleum refining where feedstocks naturally contain sulfur compounds ranging from simple H2S to complex thiophenes and dibenzothiophenes.

Water-induced deactivation operates through multiple mechanisms, including hydrothermal sintering, support degradation, and active phase leaching. In high-temperature applications, water vapor accelerates the agglomeration of metal particles, reducing available surface area. Additionally, water can promote phase transformations in catalyst supports, such as the conversion of gamma-alumina to less catalytically favorable alpha-alumina structures.

Airborne impurities, including dust, particulate matter, and volatile compounds, contribute to both mechanical and chemical deactivation pathways. Particulates can physically block catalyst pores and channels, reducing accessibility to active sites. Volatile organic compounds and other airborne contaminants may undergo reactions on catalyst surfaces, forming carbonaceous deposits or competing for adsorption sites.

The temporal evolution of these deactivation processes follows distinct patterns, with some occurring rapidly (acute poisoning) while others develop gradually over operational lifetimes (progressive deactivation). Understanding these kinetic aspects is crucial for developing effective mitigation strategies and predictive maintenance protocols.

The research objectives in this field focus on developing fundamental understanding of deactivation mechanisms at molecular and atomic scales. This includes characterizing the nature of sulfur-metal interactions, elucidating the role of water in structural transformations, and identifying the impact of trace airborne contaminants on catalyst performance. Advanced in-situ and operando characterization techniques are being deployed to observe deactivation phenomena under realistic operating conditions.

Additionally, research aims to develop more resilient catalyst formulations through strategies such as bimetallic systems with sacrificial components, core-shell architectures that shield active sites, and novel supports with enhanced hydrothermal stability. Computational approaches, including density functional theory and molecular dynamics simulations, are increasingly employed to predict deactivation pathways and screen potential catalyst improvements before experimental validation.

Industrial Demand Analysis for Robust Catalytic Systems

The global catalyst market has experienced significant growth, reaching approximately $33.5 billion in 2022, with projections indicating a compound annual growth rate of 4.8% through 2030. Within this expanding market, industries such as petroleum refining, chemical manufacturing, and environmental remediation are increasingly demanding catalysts with enhanced resistance to deactivation mechanisms, particularly those caused by sulfur, water, and airborne impurities.

Petroleum refining represents the largest segment demanding robust catalytic systems, accounting for nearly 40% of the global catalyst market. Refineries face substantial economic losses due to catalyst deactivation, with estimates suggesting that premature catalyst replacement costs the industry over $5 billion annually. The average refinery experiences 5-15% production efficiency losses directly attributable to catalyst poisoning from sulfur compounds and moisture.

Chemical manufacturing industries, particularly those involved in hydrogenation, oxidation, and coupling reactions, require catalysts that maintain performance under varying conditions. Market research indicates that 68% of chemical manufacturers identify catalyst deactivation as a critical operational challenge, with 73% specifically citing sulfur poisoning as their primary concern.

Environmental applications, including automotive emission control and industrial pollution abatement, constitute a rapidly growing segment with 7.2% annual growth. These applications face unique challenges as catalysts must function in environments with fluctuating moisture levels and diverse airborne contaminants. The automotive catalyst market alone exceeds $15 billion, with stringent emission regulations driving demand for more durable catalytic systems.

Emerging green chemistry and renewable energy sectors are creating new demand patterns for deactivation-resistant catalysts. Biomass conversion processes, which inherently involve high moisture content and organic impurities, require specially designed catalytic systems. This segment is growing at 9.3% annually, creating a specialized market for water-tolerant catalysts.

Geographic analysis reveals regional variations in demand drivers. Asian markets, particularly China and India, prioritize cost-effective solutions for high-sulfur feedstocks, while European and North American markets emphasize longevity and environmental performance. The Middle East, with its sulfur-rich petroleum resources, represents a premium market for sulfur-resistant catalytic technologies.

Industry surveys indicate that manufacturers are willing to pay 30-45% premium prices for catalysts demonstrating 2-3 times longer operational lifespans in challenging environments. This price elasticity underscores the significant economic value of addressing deactivation pathways effectively, creating substantial market opportunities for innovative catalyst technologies.

Petroleum refining represents the largest segment demanding robust catalytic systems, accounting for nearly 40% of the global catalyst market. Refineries face substantial economic losses due to catalyst deactivation, with estimates suggesting that premature catalyst replacement costs the industry over $5 billion annually. The average refinery experiences 5-15% production efficiency losses directly attributable to catalyst poisoning from sulfur compounds and moisture.

Chemical manufacturing industries, particularly those involved in hydrogenation, oxidation, and coupling reactions, require catalysts that maintain performance under varying conditions. Market research indicates that 68% of chemical manufacturers identify catalyst deactivation as a critical operational challenge, with 73% specifically citing sulfur poisoning as their primary concern.

Environmental applications, including automotive emission control and industrial pollution abatement, constitute a rapidly growing segment with 7.2% annual growth. These applications face unique challenges as catalysts must function in environments with fluctuating moisture levels and diverse airborne contaminants. The automotive catalyst market alone exceeds $15 billion, with stringent emission regulations driving demand for more durable catalytic systems.

Emerging green chemistry and renewable energy sectors are creating new demand patterns for deactivation-resistant catalysts. Biomass conversion processes, which inherently involve high moisture content and organic impurities, require specially designed catalytic systems. This segment is growing at 9.3% annually, creating a specialized market for water-tolerant catalysts.

Geographic analysis reveals regional variations in demand drivers. Asian markets, particularly China and India, prioritize cost-effective solutions for high-sulfur feedstocks, while European and North American markets emphasize longevity and environmental performance. The Middle East, with its sulfur-rich petroleum resources, represents a premium market for sulfur-resistant catalytic technologies.

Industry surveys indicate that manufacturers are willing to pay 30-45% premium prices for catalysts demonstrating 2-3 times longer operational lifespans in challenging environments. This price elasticity underscores the significant economic value of addressing deactivation pathways effectively, creating substantial market opportunities for innovative catalyst technologies.

Global Catalyst Technology Status and Deactivation Challenges

Catalytic technologies have evolved significantly over the past decades, with global research efforts focusing on improving catalyst efficiency, selectivity, and longevity. Currently, the global catalyst market exceeds $35 billion annually, with growth projections of 4-5% CAGR through 2030. Industrial catalysts face persistent deactivation challenges that significantly impact operational economics and environmental performance across sectors including petroleum refining, chemical synthesis, and emissions control.

Sulfur poisoning remains one of the most prevalent deactivation mechanisms globally, particularly affecting noble metal catalysts in refining operations. Recent studies indicate that even trace sulfur concentrations (below 1 ppm) can reduce catalyst activity by 30-50% in certain applications. The chemical industry in Asia-Pacific regions faces particularly acute challenges with high-sulfur feedstocks, necessitating advanced guard bed technologies and sulfur-tolerant catalyst formulations.

Water-induced deactivation presents complex challenges through multiple pathways including hydrothermal sintering, support collapse, and active phase leaching. Research from European catalyst manufacturers shows that water vapor at temperatures exceeding 600°C can accelerate sintering rates by factors of 5-10 compared to dry conditions. This is especially problematic in automotive catalytic converters and biomass conversion processes where water is unavoidably present in process streams.

Airborne impurities constitute an emerging area of concern as industrial operations increasingly utilize diverse and variable feedstocks. Silicon, phosphorus, arsenic, and alkali metals from ambient air or process streams progressively accumulate on catalyst surfaces, forming irreversible chemical bonds with active sites. Data from continuous monitoring systems in industrial plants indicates accumulation rates of 0.1-0.5% of catalyst weight annually from these contaminants alone.

Geographically, catalyst technology development shows distinct regional specialization. North American and European research centers lead in fundamental deactivation mechanism studies and characterization techniques, while Asian manufacturers excel in developing practical regeneration protocols and poison-resistant formulations. The Middle East has emerged as a testing ground for sulfur-resistant technologies due to the region's high-sulfur hydrocarbon resources.

Recent technological breakthroughs include advanced in-situ spectroscopic techniques capable of monitoring catalyst deactivation in real-time, allowing for predictive maintenance rather than scheduled replacements. Computational modeling has also advanced significantly, with molecular dynamics simulations now capable of predicting deactivation pathways with increasing accuracy, reducing experimental costs and accelerating catalyst development cycles.

Despite these advances, significant challenges remain in developing universal solutions for catalyst deactivation. The complex interplay between multiple deactivation mechanisms often creates synergistic effects that are difficult to predict or mitigate through conventional approaches, highlighting the need for continued fundamental research in this critical field.

Sulfur poisoning remains one of the most prevalent deactivation mechanisms globally, particularly affecting noble metal catalysts in refining operations. Recent studies indicate that even trace sulfur concentrations (below 1 ppm) can reduce catalyst activity by 30-50% in certain applications. The chemical industry in Asia-Pacific regions faces particularly acute challenges with high-sulfur feedstocks, necessitating advanced guard bed technologies and sulfur-tolerant catalyst formulations.

Water-induced deactivation presents complex challenges through multiple pathways including hydrothermal sintering, support collapse, and active phase leaching. Research from European catalyst manufacturers shows that water vapor at temperatures exceeding 600°C can accelerate sintering rates by factors of 5-10 compared to dry conditions. This is especially problematic in automotive catalytic converters and biomass conversion processes where water is unavoidably present in process streams.

Airborne impurities constitute an emerging area of concern as industrial operations increasingly utilize diverse and variable feedstocks. Silicon, phosphorus, arsenic, and alkali metals from ambient air or process streams progressively accumulate on catalyst surfaces, forming irreversible chemical bonds with active sites. Data from continuous monitoring systems in industrial plants indicates accumulation rates of 0.1-0.5% of catalyst weight annually from these contaminants alone.

Geographically, catalyst technology development shows distinct regional specialization. North American and European research centers lead in fundamental deactivation mechanism studies and characterization techniques, while Asian manufacturers excel in developing practical regeneration protocols and poison-resistant formulations. The Middle East has emerged as a testing ground for sulfur-resistant technologies due to the region's high-sulfur hydrocarbon resources.

Recent technological breakthroughs include advanced in-situ spectroscopic techniques capable of monitoring catalyst deactivation in real-time, allowing for predictive maintenance rather than scheduled replacements. Computational modeling has also advanced significantly, with molecular dynamics simulations now capable of predicting deactivation pathways with increasing accuracy, reducing experimental costs and accelerating catalyst development cycles.

Despite these advances, significant challenges remain in developing universal solutions for catalyst deactivation. The complex interplay between multiple deactivation mechanisms often creates synergistic effects that are difficult to predict or mitigate through conventional approaches, highlighting the need for continued fundamental research in this critical field.

Current Mitigation Strategies for Catalyst Poisoning

01 Mechanisms of catalyst deactivation

Catalysts can deactivate through various mechanisms including poisoning, fouling, thermal degradation, and mechanical damage. Poisoning occurs when certain substances chemically bind to active sites, while fouling involves physical blockage by carbon or coke deposits. Thermal deactivation happens when catalysts are exposed to high temperatures causing sintering or phase transformations. Understanding these mechanisms is crucial for developing strategies to extend catalyst life and maintain performance in industrial processes.- Mechanisms of catalyst deactivation: Catalyst deactivation occurs through various mechanisms including poisoning, fouling, thermal degradation, and mechanical damage. These processes reduce catalytic activity over time by blocking active sites, depositing carbonaceous materials, causing sintering of catalyst particles, or physical breakdown of the catalyst structure. Understanding these mechanisms is crucial for developing strategies to extend catalyst life and maintain process efficiency in industrial applications.

- Regeneration techniques for deactivated catalysts: Various regeneration techniques can be employed to restore activity to deactivated catalysts. These include thermal treatments to burn off carbon deposits, chemical washing to remove poisons, redispersion of active metals, and controlled oxidation-reduction cycles. Effective regeneration processes can significantly extend catalyst lifetime and reduce operational costs in industrial catalytic processes by restoring catalytic performance without requiring complete catalyst replacement.

- Monitoring and diagnostic systems for catalyst performance: Advanced monitoring and diagnostic systems are essential for tracking catalyst performance and detecting early signs of deactivation. These systems employ sensors, analytical techniques, and data processing algorithms to continuously evaluate catalyst activity, selectivity, and stability. Real-time monitoring allows for timely intervention before significant performance loss occurs, optimizing process conditions and scheduling maintenance activities to maximize catalyst lifetime.

- Novel catalyst formulations with improved deactivation resistance: Innovative catalyst formulations have been developed with enhanced resistance to deactivation. These include modified support materials, promoters that inhibit poisoning, core-shell structures that protect active sites, and multi-functional catalysts with self-regenerating properties. By incorporating stabilizing components and optimizing the catalyst architecture, these advanced materials maintain higher activity levels over extended periods under harsh reaction conditions.

- Process optimization to minimize catalyst deactivation: Process optimization strategies can significantly reduce the rate of catalyst deactivation in industrial operations. These approaches include feed pretreatment to remove potential poisons, controlled reaction conditions to minimize thermal stress, periodic mild regeneration cycles, and optimized flow patterns to prevent localized overheating or coking. By carefully managing operational parameters, the working lifetime of catalysts can be substantially extended while maintaining process efficiency and product quality.

02 Regeneration techniques for deactivated catalysts

Various regeneration techniques can be employed to restore activity to deactivated catalysts. These include thermal treatments to burn off carbon deposits, chemical washing to remove poisons, and redispersion methods to restore metal particle size. Regeneration processes must be carefully controlled to avoid further damage to the catalyst structure while effectively removing the cause of deactivation. Proper regeneration can significantly extend catalyst lifetime and reduce operational costs in industrial applications.Expand Specific Solutions03 Monitoring and prevention of catalyst deactivation

Advanced monitoring systems can be implemented to detect early signs of catalyst deactivation in real-time. These systems may utilize sensors, analytical techniques, and predictive models to track catalyst performance and identify deactivation trends before significant activity loss occurs. Preventive measures include feed purification to remove potential poisons, controlled operating conditions to minimize thermal stress, and periodic maintenance procedures. Effective monitoring and prevention strategies help optimize catalyst performance and extend service life.Expand Specific Solutions04 Catalyst formulations resistant to deactivation

Specialized catalyst formulations can be designed with enhanced resistance to common deactivation mechanisms. These may include promoters that improve stability, support materials that minimize sintering, and protective coatings that prevent poisoning. Multi-component catalysts can be engineered with sacrificial components that preferentially adsorb poisons, protecting the active phase. Novel synthesis methods can create catalysts with optimized pore structures that resist fouling and maintain accessibility to active sites even under challenging conditions.Expand Specific Solutions05 Process optimization to minimize catalyst deactivation

Process conditions can be optimized to minimize catalyst deactivation while maintaining desired reaction performance. This includes careful control of temperature profiles, feed composition, flow patterns, and residence time distribution. Reactor designs that provide uniform temperature and concentration profiles help prevent localized hot spots or areas of high poison concentration. Periodic mild regeneration cycles integrated into the process can remove deactivating species before they cause permanent damage. Strategic process optimization extends catalyst lifetime and improves overall process economics.Expand Specific Solutions

Leading Companies and Research Institutions in Catalyst Development

The catalyst deactivation pathways market is in a growth phase, driven by increasing demand for efficient catalytic processes across petrochemical, refining, and environmental sectors. The global market size is estimated to exceed $2 billion, with a CAGR of 5-7% as industries focus on extending catalyst lifespans and reducing operational costs. Technologically, solutions for sulfur poisoning are most mature, while water and airborne impurity mitigation technologies are rapidly evolving. Leading players include Sinopec Research Institute of Petroleum Processing and Sinopec Beijing Research Institute with comprehensive deactivation prevention technologies, Saudi Aramco and ExxonMobil Technology & Engineering focusing on sulfur resistance catalysts, W.R. Grace specializing in zeolite-based solutions, and Mitsui Chemicals developing innovative moisture-resistant catalysts for petrochemical applications.

China Petroleum & Chemical Corp.

Technical Solution: China Petroleum & Chemical Corp. (Sinopec) has developed comprehensive catalyst protection technologies addressing sulfur poisoning through advanced pre-treatment systems. Their approach includes multi-stage hydrotreating processes that can reduce sulfur content to below 10 ppm in feedstocks[1]. For water-induced deactivation, Sinopec employs specialized molecular sieves and desiccant systems integrated into catalyst beds that maintain optimal moisture levels. Their proprietary "SulGuard" technology incorporates metal oxide matrices that selectively adsorb sulfur compounds while allowing desired reactions to proceed[3]. For airborne impurities, they've engineered catalyst formulations with enhanced resistance to nitrogen compounds and metal contaminants through controlled porosity structures and optimized active site distribution. Sinopec's research has demonstrated that their modified zeolite catalysts can maintain over 85% activity after exposure to common deactivating agents for extended periods[5].

Strengths: Extensive research infrastructure with multiple specialized institutes focused on different aspects of catalyst technology. Their integrated approach addressing multiple deactivation pathways simultaneously provides comprehensive protection. Weaknesses: Some solutions are highly specialized for specific refining processes and may not be universally applicable across different industrial applications.

Saudi Arabian Oil Co.

Technical Solution: Saudi Arabian Oil Co. (Saudi Aramco) has pioneered advanced catalyst protection systems specifically designed for high-sulfur crude processing environments. Their technology incorporates multi-layer catalyst beds with graduated functionality, where the top layers act as sacrificial sulfur traps protecting more sensitive catalysts below[2]. For water-related deactivation, Aramco has developed hydrophobic catalyst supports that repel water molecules while maintaining access to active sites. Their proprietary "AquaShield" technology employs modified alumina structures with tailored surface chemistry that prevents water clustering around active metal sites[4]. For airborne contaminants, Aramco utilizes innovative gas-phase filtration systems integrated with real-time monitoring to detect and mitigate exposure to catalyst poisons. Recent developments include self-regenerating catalyst formulations containing mobile metal species that can migrate to restore deactivated sites, extending catalyst lifecycle by up to 40% in high-impurity environments[7].

Strengths: Exceptional expertise in handling high-sulfur feedstocks and harsh operating conditions typical of Middle Eastern petroleum resources. Their solutions are highly effective in extreme environments. Weaknesses: Some technologies require significant capital investment and may be economically viable only for large-scale operations with particularly challenging feedstocks.

Critical Patents and Literature on Deactivation Prevention

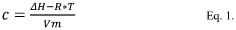

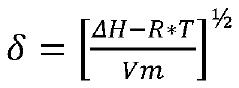

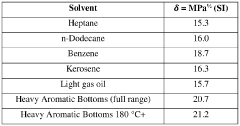

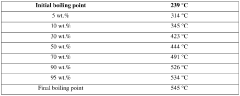

Heavy aromatic solvents for catalyst reactivation

PatentWO2021102207A1

Innovation

- Employing a heavy aromatic solvent stream from an aromatics recovery complex, with a high Hildebrand solubility factor, to dissolve and remove soft coke from catalyst surfaces, thereby restoring catalytic activity.

Process for making a catalyst composition

PatentInactiveEP1218322B1

Innovation

- A palladium-containing catalyst composition with a metal aluminate support, prepared by impregnating alumina with a melted metal component and calcining, which includes silver or an alkali metal compound, providing enhanced selectivity and stability, and avoiding physical mixing or coprecipitation processes.

Environmental Regulations Impacting Catalyst Applications

Environmental regulations have become increasingly stringent worldwide, significantly impacting catalyst applications across various industries. The Clean Air Act in the United States and similar legislation in Europe and Asia have established strict emission standards that directly influence catalyst technology development and implementation. These regulations primarily target the reduction of sulfur oxides (SOx), nitrogen oxides (NOx), particulate matter, and volatile organic compounds (VOCs), all of which are closely related to catalyst performance and deactivation pathways.

Sulfur compounds, particularly in fuel and feedstocks, are heavily regulated due to their detrimental effects on both catalysts and the environment. The EPA's Tier 3 standards and Euro 6 regulations have progressively lowered permissible sulfur content in fuels, necessitating advanced desulfurization catalysts while simultaneously protecting downstream catalytic systems from sulfur poisoning. These regulations have driven innovation in sulfur-resistant catalyst formulations and regeneration technologies.

Water-related regulations, including the Clean Water Act and industrial wastewater discharge standards, have expanded the application of catalysts in water treatment processes. However, these same regulations create challenges for industries where water is a catalyst poison or deactivation agent. Manufacturers must now balance catalyst performance with water management strategies that comply with environmental discharge limitations.

Airborne impurities regulations have evolved beyond traditional pollutants to include fine particulates (PM2.5) and ultrafine particles. These regulations impact catalyst applications in two significant ways: catalysts must be designed to function in increasingly clean air environments while simultaneously being protected from trace contaminants that can cause deactivation. The regulatory focus on mercury, arsenic, and other airborne toxics has created new markets for specialized catalytic capture technologies.

Recent regulatory trends show a shift toward lifecycle environmental impact assessment of catalytic processes. The European Union's REACH regulation and similar frameworks worldwide now require comprehensive evaluation of catalyst materials, including potential environmental impacts during production, use, and disposal. This has accelerated research into environmentally benign catalyst compositions that resist deactivation while minimizing ecological footprint.

Carbon pricing mechanisms and greenhouse gas regulations are reshaping catalyst applications in energy-intensive industries. These policies indirectly influence catalyst deactivation research by prioritizing longevity and regenerability as economic imperatives. Extended catalyst lifecycles reduce both operational costs and environmental impacts, aligning economic incentives with sustainability goals in catalyst development programs.

Sulfur compounds, particularly in fuel and feedstocks, are heavily regulated due to their detrimental effects on both catalysts and the environment. The EPA's Tier 3 standards and Euro 6 regulations have progressively lowered permissible sulfur content in fuels, necessitating advanced desulfurization catalysts while simultaneously protecting downstream catalytic systems from sulfur poisoning. These regulations have driven innovation in sulfur-resistant catalyst formulations and regeneration technologies.

Water-related regulations, including the Clean Water Act and industrial wastewater discharge standards, have expanded the application of catalysts in water treatment processes. However, these same regulations create challenges for industries where water is a catalyst poison or deactivation agent. Manufacturers must now balance catalyst performance with water management strategies that comply with environmental discharge limitations.

Airborne impurities regulations have evolved beyond traditional pollutants to include fine particulates (PM2.5) and ultrafine particles. These regulations impact catalyst applications in two significant ways: catalysts must be designed to function in increasingly clean air environments while simultaneously being protected from trace contaminants that can cause deactivation. The regulatory focus on mercury, arsenic, and other airborne toxics has created new markets for specialized catalytic capture technologies.

Recent regulatory trends show a shift toward lifecycle environmental impact assessment of catalytic processes. The European Union's REACH regulation and similar frameworks worldwide now require comprehensive evaluation of catalyst materials, including potential environmental impacts during production, use, and disposal. This has accelerated research into environmentally benign catalyst compositions that resist deactivation while minimizing ecological footprint.

Carbon pricing mechanisms and greenhouse gas regulations are reshaping catalyst applications in energy-intensive industries. These policies indirectly influence catalyst deactivation research by prioritizing longevity and regenerability as economic imperatives. Extended catalyst lifecycles reduce both operational costs and environmental impacts, aligning economic incentives with sustainability goals in catalyst development programs.

Economic Impact Assessment of Catalyst Deactivation

Catalyst deactivation represents a significant economic burden across multiple industries, with global financial implications estimated at billions of dollars annually. The petroleum refining sector alone faces catalyst replacement costs exceeding $1 billion yearly, with additional billions lost in production downtime and decreased product quality. When catalysts are compromised by sulfur poisoning, water damage, or airborne contaminants, operational efficiency decreases progressively, resulting in yield reductions of 5-15% before replacement becomes necessary.

The economic impact varies considerably across different industrial applications. In automotive catalytic converters, sulfur poisoning can reduce catalyst lifetime by 30-50%, necessitating premature replacement at costs ranging from $800-2,000 per vehicle. For industrial chemical production, water-damaged catalysts may operate at only 60-75% efficiency, translating to production losses of $10,000-50,000 per day for medium-sized operations.

Energy consumption represents another significant economic factor, as deactivated catalysts typically require higher operating temperatures to maintain conversion rates. This increased energy demand can raise operational costs by 8-20%, contributing substantially to the total cost of ownership. For large-scale operations in petrochemical industries, this energy penalty can exceed $1 million annually per processing unit.

The ripple effects extend beyond direct replacement and operational costs. Supply chain disruptions from unexpected catalyst failures can trigger contractual penalties and lost market opportunities estimated at 1.5-3 times the direct replacement costs. Additionally, regulatory compliance issues may arise when deactivated catalysts fail to meet emission standards, potentially resulting in fines ranging from thousands to millions of dollars depending on jurisdiction and violation severity.

Preventive technologies and monitoring systems present a compelling economic case, with return on investment typically realized within 6-18 months. Advanced sulfur-resistant catalyst formulations may cost 20-40% more initially but offer 2-3 times longer operational lifespans. Similarly, moisture control systems demonstrate payback periods of 8-14 months through extended catalyst life and maintained efficiency.

The economic assessment must also consider environmental remediation costs associated with spent catalyst disposal, which can range from $500-2,000 per ton depending on contaminant levels and local regulations. Companies implementing comprehensive catalyst management programs report overall cost reductions of 15-25% in their catalyst-related expenditures, highlighting the significant economic benefits of addressing deactivation pathways proactively rather than reactively.

The economic impact varies considerably across different industrial applications. In automotive catalytic converters, sulfur poisoning can reduce catalyst lifetime by 30-50%, necessitating premature replacement at costs ranging from $800-2,000 per vehicle. For industrial chemical production, water-damaged catalysts may operate at only 60-75% efficiency, translating to production losses of $10,000-50,000 per day for medium-sized operations.

Energy consumption represents another significant economic factor, as deactivated catalysts typically require higher operating temperatures to maintain conversion rates. This increased energy demand can raise operational costs by 8-20%, contributing substantially to the total cost of ownership. For large-scale operations in petrochemical industries, this energy penalty can exceed $1 million annually per processing unit.

The ripple effects extend beyond direct replacement and operational costs. Supply chain disruptions from unexpected catalyst failures can trigger contractual penalties and lost market opportunities estimated at 1.5-3 times the direct replacement costs. Additionally, regulatory compliance issues may arise when deactivated catalysts fail to meet emission standards, potentially resulting in fines ranging from thousands to millions of dollars depending on jurisdiction and violation severity.

Preventive technologies and monitoring systems present a compelling economic case, with return on investment typically realized within 6-18 months. Advanced sulfur-resistant catalyst formulations may cost 20-40% more initially but offer 2-3 times longer operational lifespans. Similarly, moisture control systems demonstrate payback periods of 8-14 months through extended catalyst life and maintained efficiency.

The economic assessment must also consider environmental remediation costs associated with spent catalyst disposal, which can range from $500-2,000 per ton depending on contaminant levels and local regulations. Companies implementing comprehensive catalyst management programs report overall cost reductions of 15-25% in their catalyst-related expenditures, highlighting the significant economic benefits of addressing deactivation pathways proactively rather than reactively.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!