Life-Cycle and Logistics: Ammonia as a Hydrogen Carrier vs LH₂/LOHC

AUG 21, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Ammonia Carrier Technology Background and Objectives

Hydrogen has emerged as a promising clean energy carrier in the global transition towards decarbonization, yet its storage and transportation present significant challenges due to its low volumetric energy density and highly flammable nature. Since the early 2000s, ammonia (NH₃) has gained increasing attention as a potential hydrogen carrier, offering advantages in established handling infrastructure and higher energy density compared to liquid hydrogen (LH₂) and liquid organic hydrogen carriers (LOHC).

The evolution of ammonia as a hydrogen carrier technology can be traced back to the development of the Haber-Bosch process in the early 20th century, which revolutionized ammonia production. However, its consideration as an energy vector is relatively recent, gaining momentum in the 2010s as hydrogen economy concepts expanded. The technology has progressed from theoretical research to demonstration projects, with significant acceleration in development occurring over the past five years.

Current technological trends indicate a growing interest in green ammonia production pathways, utilizing renewable electricity for hydrogen generation via electrolysis, followed by nitrogen separation from air and subsequent ammonia synthesis. This represents a shift from traditional fossil fuel-based ammonia production, aligning with global decarbonization objectives.

The primary technical objective in ammonia carrier technology development is to establish efficient, economically viable systems for hydrogen storage and transportation that overcome the limitations of direct hydrogen handling. Specific goals include optimizing ammonia synthesis efficiency using renewable energy sources, developing more effective ammonia cracking technologies for hydrogen recovery, and minimizing energy losses throughout the full cycle.

Research aims to reduce the energy intensity of ammonia synthesis below current levels of 7-9 MWh per ton, improve catalyst performance for both synthesis and cracking processes, and develop innovative storage and transportation solutions that maximize safety while minimizing costs. Additionally, there is significant focus on addressing the toxicity concerns associated with ammonia handling through advanced safety systems and protocols.

The technology trajectory suggests convergence toward integrated systems that combine renewable energy generation, efficient ammonia synthesis, transportation infrastructure, and end-use applications including both direct ammonia utilization and hydrogen recovery. This holistic approach aims to establish ammonia as a key enabler in the hydrogen economy, particularly for long-distance energy transport scenarios where direct hydrogen logistics prove challenging.

As climate policies intensify globally, ammonia carrier technology development is accelerating, with projected technological readiness for large-scale commercial deployment anticipated within the next decade, positioning it as a critical component in the transition to sustainable energy systems.

The evolution of ammonia as a hydrogen carrier technology can be traced back to the development of the Haber-Bosch process in the early 20th century, which revolutionized ammonia production. However, its consideration as an energy vector is relatively recent, gaining momentum in the 2010s as hydrogen economy concepts expanded. The technology has progressed from theoretical research to demonstration projects, with significant acceleration in development occurring over the past five years.

Current technological trends indicate a growing interest in green ammonia production pathways, utilizing renewable electricity for hydrogen generation via electrolysis, followed by nitrogen separation from air and subsequent ammonia synthesis. This represents a shift from traditional fossil fuel-based ammonia production, aligning with global decarbonization objectives.

The primary technical objective in ammonia carrier technology development is to establish efficient, economically viable systems for hydrogen storage and transportation that overcome the limitations of direct hydrogen handling. Specific goals include optimizing ammonia synthesis efficiency using renewable energy sources, developing more effective ammonia cracking technologies for hydrogen recovery, and minimizing energy losses throughout the full cycle.

Research aims to reduce the energy intensity of ammonia synthesis below current levels of 7-9 MWh per ton, improve catalyst performance for both synthesis and cracking processes, and develop innovative storage and transportation solutions that maximize safety while minimizing costs. Additionally, there is significant focus on addressing the toxicity concerns associated with ammonia handling through advanced safety systems and protocols.

The technology trajectory suggests convergence toward integrated systems that combine renewable energy generation, efficient ammonia synthesis, transportation infrastructure, and end-use applications including both direct ammonia utilization and hydrogen recovery. This holistic approach aims to establish ammonia as a key enabler in the hydrogen economy, particularly for long-distance energy transport scenarios where direct hydrogen logistics prove challenging.

As climate policies intensify globally, ammonia carrier technology development is accelerating, with projected technological readiness for large-scale commercial deployment anticipated within the next decade, positioning it as a critical component in the transition to sustainable energy systems.

Market Analysis for Hydrogen Transport Solutions

The global hydrogen transport market is experiencing significant growth, driven by the increasing adoption of hydrogen as a clean energy carrier. Current market size estimates place the hydrogen transport solutions sector at approximately 5 billion USD in 2023, with projections indicating growth to reach 20 billion USD by 2030, representing a compound annual growth rate of around 22%. This rapid expansion reflects the urgent global transition toward decarbonization and the strategic importance of hydrogen in achieving net-zero emissions targets.

Market segmentation reveals distinct preferences across regions. Asia-Pacific, particularly Japan and South Korea, demonstrates strong interest in ammonia as a hydrogen carrier due to established infrastructure and maritime transport capabilities. Europe shows a more diversified approach, with significant investments in both liquid hydrogen (LH₂) and Liquid Organic Hydrogen Carriers (LOHC) technologies, aligned with the European Hydrogen Strategy. North America currently favors compressed and liquid hydrogen solutions, leveraging existing natural gas infrastructure.

Demand drivers for hydrogen transport solutions vary by sector. The industrial sector, particularly refining and chemical production, represents the largest current market segment, valuing stability and cost-effectiveness in hydrogen delivery systems. Transportation applications, including hydrogen fuel cell vehicles and maritime transport, prioritize energy density and safety considerations, creating specific market niches for different carrier technologies.

Market barriers include high infrastructure costs, with new hydrogen transport systems requiring substantial capital investment. Regulatory frameworks remain inconsistent across regions, creating market uncertainty. Additionally, the lack of standardization across hydrogen carrier technologies impedes interoperability and slows market development.

Competitive dynamics reveal interesting patterns among key market players. Traditional energy companies are heavily investing in ammonia-based solutions, leveraging existing infrastructure and expertise. Technology-focused startups predominantly concentrate on LOHC innovations, while industrial gas companies maintain leadership in liquid hydrogen transport solutions.

Customer preferences increasingly emphasize total cost of ownership rather than upfront costs alone. Safety considerations significantly influence market adoption rates, particularly in densely populated areas. Environmental impact assessments, including lifecycle carbon emissions, are becoming critical factors in procurement decisions, especially among environmentally conscious markets in Europe and parts of Asia.

The market outlook suggests a period of technology coexistence rather than a single dominant solution, with regional specialization based on existing infrastructure and specific application requirements. Market consolidation is anticipated within the next five years as technology winners emerge in specific application niches.

Market segmentation reveals distinct preferences across regions. Asia-Pacific, particularly Japan and South Korea, demonstrates strong interest in ammonia as a hydrogen carrier due to established infrastructure and maritime transport capabilities. Europe shows a more diversified approach, with significant investments in both liquid hydrogen (LH₂) and Liquid Organic Hydrogen Carriers (LOHC) technologies, aligned with the European Hydrogen Strategy. North America currently favors compressed and liquid hydrogen solutions, leveraging existing natural gas infrastructure.

Demand drivers for hydrogen transport solutions vary by sector. The industrial sector, particularly refining and chemical production, represents the largest current market segment, valuing stability and cost-effectiveness in hydrogen delivery systems. Transportation applications, including hydrogen fuel cell vehicles and maritime transport, prioritize energy density and safety considerations, creating specific market niches for different carrier technologies.

Market barriers include high infrastructure costs, with new hydrogen transport systems requiring substantial capital investment. Regulatory frameworks remain inconsistent across regions, creating market uncertainty. Additionally, the lack of standardization across hydrogen carrier technologies impedes interoperability and slows market development.

Competitive dynamics reveal interesting patterns among key market players. Traditional energy companies are heavily investing in ammonia-based solutions, leveraging existing infrastructure and expertise. Technology-focused startups predominantly concentrate on LOHC innovations, while industrial gas companies maintain leadership in liquid hydrogen transport solutions.

Customer preferences increasingly emphasize total cost of ownership rather than upfront costs alone. Safety considerations significantly influence market adoption rates, particularly in densely populated areas. Environmental impact assessments, including lifecycle carbon emissions, are becoming critical factors in procurement decisions, especially among environmentally conscious markets in Europe and parts of Asia.

The market outlook suggests a period of technology coexistence rather than a single dominant solution, with regional specialization based on existing infrastructure and specific application requirements. Market consolidation is anticipated within the next five years as technology winners emerge in specific application niches.

Current Challenges in Hydrogen Carrier Technologies

The hydrogen economy faces significant technical barriers in the transportation and storage of hydrogen, with various carrier technologies presenting their own unique challenges. Liquid hydrogen (LH₂) requires cryogenic temperatures of -253°C, demanding specialized infrastructure and resulting in substantial energy losses during liquefaction—approximately 30-40% of hydrogen's energy content. This energy penalty significantly impacts the overall efficiency of hydrogen as an energy vector.

Liquid Organic Hydrogen Carriers (LOHCs) offer ambient condition storage advantages but struggle with slow kinetics during hydrogen loading and unloading processes. The catalysts required for these reactions are often based on precious metals, increasing system costs. Additionally, the energy required for hydrogen release from LOHCs can consume 25-35% of the hydrogen's energy content, creating another efficiency bottleneck in the hydrogen value chain.

Ammonia as a hydrogen carrier presents its own set of challenges despite its higher volumetric hydrogen density and established handling infrastructure. The Haber-Bosch process used for ammonia synthesis is energy-intensive, consuming approximately 1-2% of global energy production annually. While carbon-free ammonia production using renewable electricity is technically feasible, it remains economically challenging at scale.

The decomposition of ammonia to release hydrogen requires temperatures of 400-700°C and efficient catalysts, creating additional energy demands. Safety concerns also persist due to ammonia's toxicity, requiring robust safety protocols and specialized training for handling personnel. These factors complicate its widespread adoption as a hydrogen carrier in consumer applications.

Infrastructure compatibility presents another significant challenge across all carrier technologies. The existing energy infrastructure is not readily adaptable to hydrogen carriers, requiring substantial investments in specialized storage tanks, pipelines, and handling equipment. For ammonia specifically, while industrial infrastructure exists, expanding this to support energy applications would require significant scaling and adaptation.

Regulatory frameworks for hydrogen carriers remain underdeveloped in many regions, creating uncertainty for investors and technology developers. Standards for safety, purity, and interoperability across different carrier systems are still evolving, potentially leading to market fragmentation and compatibility issues between different technological approaches.

Economic viability remains perhaps the most significant barrier, with high capital costs for infrastructure development and operational expenses affecting the competitiveness of hydrogen carriers against conventional energy sources. Without technological breakthroughs or policy support, achieving cost parity with fossil fuels remains challenging in the near term.

Liquid Organic Hydrogen Carriers (LOHCs) offer ambient condition storage advantages but struggle with slow kinetics during hydrogen loading and unloading processes. The catalysts required for these reactions are often based on precious metals, increasing system costs. Additionally, the energy required for hydrogen release from LOHCs can consume 25-35% of the hydrogen's energy content, creating another efficiency bottleneck in the hydrogen value chain.

Ammonia as a hydrogen carrier presents its own set of challenges despite its higher volumetric hydrogen density and established handling infrastructure. The Haber-Bosch process used for ammonia synthesis is energy-intensive, consuming approximately 1-2% of global energy production annually. While carbon-free ammonia production using renewable electricity is technically feasible, it remains economically challenging at scale.

The decomposition of ammonia to release hydrogen requires temperatures of 400-700°C and efficient catalysts, creating additional energy demands. Safety concerns also persist due to ammonia's toxicity, requiring robust safety protocols and specialized training for handling personnel. These factors complicate its widespread adoption as a hydrogen carrier in consumer applications.

Infrastructure compatibility presents another significant challenge across all carrier technologies. The existing energy infrastructure is not readily adaptable to hydrogen carriers, requiring substantial investments in specialized storage tanks, pipelines, and handling equipment. For ammonia specifically, while industrial infrastructure exists, expanding this to support energy applications would require significant scaling and adaptation.

Regulatory frameworks for hydrogen carriers remain underdeveloped in many regions, creating uncertainty for investors and technology developers. Standards for safety, purity, and interoperability across different carrier systems are still evolving, potentially leading to market fragmentation and compatibility issues between different technological approaches.

Economic viability remains perhaps the most significant barrier, with high capital costs for infrastructure development and operational expenses affecting the competitiveness of hydrogen carriers against conventional energy sources. Without technological breakthroughs or policy support, achieving cost parity with fossil fuels remains challenging in the near term.

Technical Comparison: NH₃ vs LH₂/LOHC Solutions

01 Ammonia as hydrogen carrier

Ammonia serves as an efficient hydrogen carrier with advantages in storage and transportation. It can be synthesized from hydrogen and nitrogen, and later decomposed to release hydrogen when needed. The life-cycle efficiency of ammonia as a hydrogen carrier is enhanced through catalytic processes that facilitate both its formation and decomposition under controlled conditions. Its relatively high hydrogen content and established handling infrastructure make it logistically favorable compared to other carriers.- Ammonia as hydrogen carrier: Ammonia serves as an efficient hydrogen carrier due to its high hydrogen content and established infrastructure for production, storage, and transportation. It can be synthesized from renewable energy sources and later decomposed to release hydrogen for fuel cell applications. The life-cycle efficiency of ammonia-based hydrogen storage systems benefits from relatively low production energy requirements compared to other carriers, though the conversion process still presents efficiency challenges.

- Liquid hydrogen (LH₂) storage and transportation: Liquid hydrogen storage involves cryogenic cooling to -253°C, offering high energy density but requiring significant energy input for liquefaction. The logistics chain for LH₂ includes specialized insulated containers and vessels to minimize boil-off losses during transportation and storage. While LH₂ provides pure hydrogen without conversion steps, its life-cycle efficiency is challenged by the high energy consumption of the liquefaction process and the need for continuous cooling during storage.

- Liquid Organic Hydrogen Carriers (LOHC) systems: LOHCs store hydrogen through reversible hydrogenation of organic compounds, allowing hydrogen to be transported under ambient conditions without the need for pressurization or cooling. These carrier molecules can be repeatedly hydrogenated and dehydrogenated, creating a closed-loop system. The life-cycle efficiency of LOHC systems benefits from lower energy requirements for transportation and storage compared to LH₂, though energy is required for the dehydrogenation process to release hydrogen at the point of use.

- Comparative life-cycle assessment of hydrogen carriers: Life-cycle assessments of various hydrogen carriers reveal different efficiency profiles across production, storage, transportation, and end-use phases. Ammonia typically shows advantages in transportation efficiency but penalties in conversion, while LH₂ offers direct use but high energy costs for liquefaction. LOHCs present balanced logistics benefits but require energy for hydrogen release. The overall efficiency depends on transportation distance, scale, and integration with renewable energy sources, with each carrier having optimal use cases depending on specific supply chain requirements.

- Infrastructure and safety considerations for hydrogen logistics: The development of hydrogen carrier logistics requires specialized infrastructure adapted to each carrier's properties. Ammonia leverages existing global distribution networks but presents toxicity concerns. LH₂ requires new cryogenic infrastructure with careful thermal management. LOHCs can utilize conventional liquid fuel infrastructure but need additional processing facilities. Safety protocols differ significantly between carriers, with ammonia requiring toxicity management, LH₂ needing cryogenic safety measures, and LOHCs generally offering safer handling characteristics. These factors significantly impact the practical implementation and overall efficiency of hydrogen energy systems.

02 Liquid hydrogen (LH₂) storage and transportation

Liquid hydrogen offers high energy density but presents significant challenges in its life-cycle efficiency due to the energy required for liquefaction at extremely low temperatures (-253°C). The logistics of LH₂ involve specialized cryogenic containers to minimize boil-off losses during storage and transportation. Advanced insulation technologies and efficient liquefaction processes are being developed to improve the overall energy efficiency of the LH₂ supply chain.Expand Specific Solutions03 Liquid Organic Hydrogen Carriers (LOHC) systems

LOHCs store hydrogen through reversible hydrogenation of organic compounds, allowing hydrogen to be transported in liquid form at ambient conditions. These carriers offer advantages in safety and existing infrastructure compatibility. The life-cycle efficiency of LOHC systems depends on the energy required for hydrogenation and dehydrogenation processes. Recent developments focus on catalysts that reduce energy requirements and improve reaction kinetics for both loading and unloading hydrogen.Expand Specific Solutions04 Comparative life-cycle assessment of hydrogen carriers

Comparative analyses of different hydrogen carriers reveal varying energy efficiencies across their life cycles. Ammonia typically shows higher round-trip efficiency than liquid hydrogen but lower than some LOHC systems. Factors affecting efficiency include production pathways, storage conditions, transportation distances, and end-use applications. Life-cycle assessments consider energy inputs, greenhouse gas emissions, and resource utilization throughout the entire supply chain to determine the most suitable carrier for specific applications.Expand Specific Solutions05 Hydrogen carrier logistics infrastructure

The logistics infrastructure for hydrogen carriers requires specialized equipment and facilities adapted to each carrier's properties. Ammonia leverages existing global distribution networks but needs safety measures due to its toxicity. Liquid hydrogen demands cryogenic infrastructure throughout the supply chain. LOHC systems can utilize conventional liquid fuel infrastructure with modifications. Developing efficient logistics networks involves optimizing transportation modes, storage facilities, and distribution systems to minimize energy losses and maximize economic viability.Expand Specific Solutions

Key Industry Players in Hydrogen Logistics

The ammonia vs LH₂/LOHC hydrogen carrier market is currently in an early growth phase, with global hydrogen economy projected to reach $500-700 billion by 2050. The competitive landscape features established industrial gas companies (Linde, Air Liquide) alongside emerging specialists like Hydrogenious LOHC and AMOGY. Technical maturity varies significantly across carriers: ammonia benefits from century-old production infrastructure but faces efficiency challenges in hydrogen release, while LH₂ offers high purity but struggles with storage complexity. LOHC technologies, championed by Hydrogenious, represent the newest approach with promising density characteristics. Research institutions (Fuzhou University, KAUST, Colorado School of Mines) are advancing catalysts and system integration, while energy majors (Saudi Aramco, SK Innovation) are strategically positioning across multiple carrier technologies to hedge technological uncertainty.

Linde GmbH

Technical Solution: Linde has developed a multi-carrier approach to hydrogen logistics, with significant innovations in both LH₂ and LOHC technologies. Their liquid hydrogen technology features the world's largest hydrogen liquefaction plants with capacities exceeding 30 tons per day, utilizing a proprietary cooling process that combines Claude and Brayton cycles to achieve energy consumption as low as 10 kWh/kg H₂[7]. Their cryogenic tanker fleet incorporates multi-layer vacuum insulation technology that limits boil-off to under 0.3% per day during transport. For LOHC applications, Linde has partnered with Hydrogenious to scale up systems using dibenzyltoluene carriers, while also developing their own catalysts that reduce dehydrogenation temperatures to below 280°C. Linde's comparative lifecycle assessment between carriers shows that for distances under 1,000 km, compressed hydrogen remains most efficient, while LH₂ becomes optimal between 1,000-3,000 km, and ammonia or LOHC are preferable for longer distances or longer storage durations[8].

Strengths: Industry-leading efficiency in hydrogen liquefaction; established global infrastructure for multiple carrier types; advanced materials for storage vessels reducing boil-off; comprehensive lifecycle approach optimizing carrier selection by application. Weaknesses: High capital expenditure requirements for liquefaction facilities; energy penalties still significant for all carrier types; complex logistics when managing multiple carrier technologies simultaneously.

Saudi Arabian Oil Co. (Saudi Aramco)

Technical Solution: Saudi Aramco has developed an integrated approach to hydrogen carriers with a strategic focus on ammonia as the preferred medium for international hydrogen transport. Their technology portfolio includes large-scale carbon-neutral ammonia production facilities that combine electrolysis powered by renewable energy with nitrogen separation from air. Their ammonia synthesis process operates at moderate pressures (80-100 bar) using ruthenium-based catalysts that improve conversion efficiency by approximately 15% compared to traditional Haber-Bosch systems[9]. For hydrogen release, Aramco has developed a novel ammonia cracking technology using transition metal catalysts supported on ceramic membranes that operate at temperatures of 500-550°C with hydrogen separation integrated into the cracking process. This approach achieves over 99% ammonia conversion with reduced energy requirements. Aramco has demonstrated this technology at scale through their partnership in the NEOM green hydrogen project, which will produce 1.2 million tons of green ammonia annually as a hydrogen carrier[10].

Strengths: Massive scale production capabilities reducing unit costs; integration with existing global ammonia infrastructure; potential for direct ammonia use in some applications (shipping, power generation) without reconversion to hydrogen; strategic geographic positioning for global export. Weaknesses: High energy requirements for ammonia synthesis (7-8 kWh/kg NH₃); additional energy losses during hydrogen recovery; environmental concerns regarding potential ammonia leakage; requires significant water resources for hydrogen production via electrolysis.

Critical Patents in Hydrogen Carrier Technologies

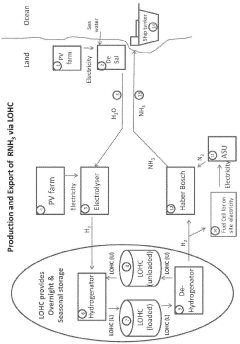

Facilitating renewable ammonia production and export via LOHC

PatentInactiveAU2015100655A4

Innovation

- A Liquid Organic Hydrogen Carrier (LOHC) storage system is used to store intermittent renewable hydrogen, converting it into a steady stream for ammonia production, utilizing hydrogenation and dehydrogenation units to maintain hydrogen in a liquid state at ambient conditions, enabling efficient storage and release for Haber Bosch processes, and powering nitrogen generation and other plant components.

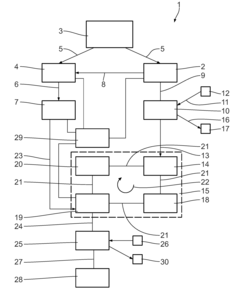

System and method for storing and releasing energy

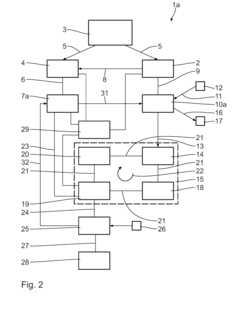

PatentActiveUS20160301093A1

Innovation

- A system comprising a hydrogen production unit, a hydrogen storage device, a heat generation unit, and a heat storage unit, where hydrogen is stored chemically bound with a carrier medium, allowing for efficient storage and release of energy using heat from the heat storage unit during energy-rich and energy-poor periods.

Environmental Impact Assessment

The environmental impact assessment of ammonia as a hydrogen carrier versus liquid hydrogen (LH₂) and liquid organic hydrogen carriers (LOHC) reveals significant differences in their ecological footprints throughout their respective life cycles. Ammonia production currently relies heavily on the Haber-Bosch process, which is energy-intensive and typically powered by fossil fuels, resulting in substantial CO₂ emissions—approximately 1.8 tons of CO₂ per ton of ammonia produced. However, the transition to green ammonia production using renewable energy sources could dramatically reduce these emissions, potentially creating a carbon-neutral carrier.

In contrast, LH₂ production through electrolysis powered by renewable energy offers a cleaner initial footprint but faces challenges in the liquefaction phase, which requires temperatures of -253°C and consumes approximately 30-40% of the energy content of the hydrogen itself. This energy penalty significantly impacts the overall environmental efficiency of LH₂ as a carrier system.

LOHC systems present a middle ground, with lower energy requirements for hydrogen binding and release compared to LH₂ liquefaction, but they introduce additional environmental considerations due to the organic carrier materials used. The synthesis and eventual disposal or recycling of these carriers must be factored into comprehensive environmental assessments.

Transportation and storage infrastructure also contribute significantly to environmental impacts. Ammonia benefits from existing global infrastructure, reducing the need for new construction and associated environmental disruptions. LH₂ requires specialized cryogenic vessels and faces continuous boil-off issues, leading to potential hydrogen losses of 0.2-0.5% per day, which represents both resource wastage and potential atmospheric emissions.

Safety considerations intersect with environmental impacts, particularly regarding leakage scenarios. Ammonia releases pose localized toxicity concerns but have limited greenhouse warming potential. Hydrogen leaks, while not directly toxic, can indirectly affect atmospheric chemistry and potentially contribute to climate effects through interaction with other atmospheric gases.

End-use applications further differentiate these carriers environmentally. Ammonia can be used directly in certain applications (power generation, shipping) without dehydrogenation, eliminating that energy-intensive step. However, when hydrogen extraction is required, the process generates nitrogen as a byproduct, which is environmentally benign but represents system inefficiency.

Life-cycle water consumption varies significantly between carriers, with electrolysis-based hydrogen production requiring approximately 9 kg of water per kg of hydrogen. Water quality impacts also differ, with potential concerns regarding LOHC degradation products in water systems versus the well-understood ammonia water chemistry.

In contrast, LH₂ production through electrolysis powered by renewable energy offers a cleaner initial footprint but faces challenges in the liquefaction phase, which requires temperatures of -253°C and consumes approximately 30-40% of the energy content of the hydrogen itself. This energy penalty significantly impacts the overall environmental efficiency of LH₂ as a carrier system.

LOHC systems present a middle ground, with lower energy requirements for hydrogen binding and release compared to LH₂ liquefaction, but they introduce additional environmental considerations due to the organic carrier materials used. The synthesis and eventual disposal or recycling of these carriers must be factored into comprehensive environmental assessments.

Transportation and storage infrastructure also contribute significantly to environmental impacts. Ammonia benefits from existing global infrastructure, reducing the need for new construction and associated environmental disruptions. LH₂ requires specialized cryogenic vessels and faces continuous boil-off issues, leading to potential hydrogen losses of 0.2-0.5% per day, which represents both resource wastage and potential atmospheric emissions.

Safety considerations intersect with environmental impacts, particularly regarding leakage scenarios. Ammonia releases pose localized toxicity concerns but have limited greenhouse warming potential. Hydrogen leaks, while not directly toxic, can indirectly affect atmospheric chemistry and potentially contribute to climate effects through interaction with other atmospheric gases.

End-use applications further differentiate these carriers environmentally. Ammonia can be used directly in certain applications (power generation, shipping) without dehydrogenation, eliminating that energy-intensive step. However, when hydrogen extraction is required, the process generates nitrogen as a byproduct, which is environmentally benign but represents system inefficiency.

Life-cycle water consumption varies significantly between carriers, with electrolysis-based hydrogen production requiring approximately 9 kg of water per kg of hydrogen. Water quality impacts also differ, with potential concerns regarding LOHC degradation products in water systems versus the well-understood ammonia water chemistry.

Infrastructure Requirements and Economic Viability

The infrastructure requirements for ammonia as a hydrogen carrier differ significantly from those for liquid hydrogen (LH₂) and liquid organic hydrogen carriers (LOHC), impacting their economic viability across the hydrogen value chain. Ammonia leverages existing global infrastructure with approximately 120 ports already equipped for ammonia handling, representing a substantial advantage over competing carriers that require new dedicated facilities.

For ammonia systems, storage costs range from $0.5-3/kg H₂, significantly lower than LH₂ storage at $4-20/kg H₂. This cost advantage stems from ammonia's ability to be stored in conventional tanks at moderate pressure (10-15 bar) and ambient temperature, whereas LH₂ demands cryogenic tanks operating at -253°C with sophisticated insulation systems.

Transportation infrastructure presents another critical comparison point. Ammonia can utilize existing pipelines, ships, and road transport systems with minimal modifications, while LH₂ requires specialized cryogenic vessels with substantial boil-off management systems. LOHC systems offer ambient condition transport advantages but face higher capital costs for the carrier material itself.

Economic analysis reveals that ammonia delivery costs range from $0.8-1.5/kg H₂ for large-scale maritime transport, compared to $2-4/kg H₂ for LH₂. However, when considering end-use applications, ammonia's economic advantage narrows due to reconversion costs, which add approximately $1.5-2.5/kg H₂ to the total delivery cost.

Capital expenditure requirements vary dramatically between carriers. Establishing new LH₂ infrastructure demands investments of $500-800 million for a typical import/export terminal, whereas comparable ammonia facilities can be developed for $200-350 million by leveraging existing infrastructure components.

Scalability factors strongly favor ammonia, with established production capacity exceeding 180 million tonnes annually worldwide. This existing scale provides immediate pathways for hydrogen transport without waiting for new infrastructure development, offering a 5-8 year time-to-market advantage over greenfield LH₂ systems.

Energy efficiency calculations reveal that ammonia's round-trip efficiency (including conversion, transport, and reconversion) ranges from 60-65%, compared to LH₂'s 65-70% and LOHC's 55-60%. However, when factoring in infrastructure availability and capital costs, ammonia often presents the most economically viable option for large-scale, long-distance hydrogen transport despite its conversion efficiency penalties.

For ammonia systems, storage costs range from $0.5-3/kg H₂, significantly lower than LH₂ storage at $4-20/kg H₂. This cost advantage stems from ammonia's ability to be stored in conventional tanks at moderate pressure (10-15 bar) and ambient temperature, whereas LH₂ demands cryogenic tanks operating at -253°C with sophisticated insulation systems.

Transportation infrastructure presents another critical comparison point. Ammonia can utilize existing pipelines, ships, and road transport systems with minimal modifications, while LH₂ requires specialized cryogenic vessels with substantial boil-off management systems. LOHC systems offer ambient condition transport advantages but face higher capital costs for the carrier material itself.

Economic analysis reveals that ammonia delivery costs range from $0.8-1.5/kg H₂ for large-scale maritime transport, compared to $2-4/kg H₂ for LH₂. However, when considering end-use applications, ammonia's economic advantage narrows due to reconversion costs, which add approximately $1.5-2.5/kg H₂ to the total delivery cost.

Capital expenditure requirements vary dramatically between carriers. Establishing new LH₂ infrastructure demands investments of $500-800 million for a typical import/export terminal, whereas comparable ammonia facilities can be developed for $200-350 million by leveraging existing infrastructure components.

Scalability factors strongly favor ammonia, with established production capacity exceeding 180 million tonnes annually worldwide. This existing scale provides immediate pathways for hydrogen transport without waiting for new infrastructure development, offering a 5-8 year time-to-market advantage over greenfield LH₂ systems.

Energy efficiency calculations reveal that ammonia's round-trip efficiency (including conversion, transport, and reconversion) ranges from 60-65%, compared to LH₂'s 65-70% and LOHC's 55-60%. However, when factoring in infrastructure availability and capital costs, ammonia often presents the most economically viable option for large-scale, long-distance hydrogen transport despite its conversion efficiency penalties.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!