Analyzing Global Trends in Isocyanate Use Strategies

JUL 10, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Isocyanate Evolution

Isocyanates have undergone significant evolution since their initial discovery in the late 19th century. The journey began with the synthesis of the first isocyanate compound by Wurtz in 1848, but it wasn't until the 1930s that their potential for polymer chemistry was fully realized. This breakthrough came with Otto Bayer's invention of polyurethane in 1937, marking the beginning of the modern isocyanate era.

The 1950s and 1960s saw rapid advancements in isocyanate technology, driven by the growing demand for versatile materials in various industries. During this period, researchers developed new synthesis methods and explored different isocyanate structures, leading to the creation of a diverse range of polyurethane products. The introduction of toluene diisocyanate (TDI) and methylene diphenyl diisocyanate (MDI) revolutionized the industry, becoming the backbone of polyurethane production.

As environmental concerns gained prominence in the 1970s and 1980s, the focus shifted towards developing more sustainable and safer isocyanate technologies. This period witnessed the emergence of water-based polyurethane systems and low-VOC formulations, addressing the need for environmentally friendly alternatives. Simultaneously, efforts were made to improve worker safety by developing less volatile and less toxic isocyanate variants.

The 1990s and early 2000s marked a period of refinement and specialization in isocyanate technology. Researchers focused on enhancing the performance characteristics of isocyanate-based materials, such as improved durability, flexibility, and chemical resistance. This era also saw the development of novel applications in fields like biomedicine and nanotechnology, expanding the reach of isocyanates beyond traditional industries.

In recent years, the evolution of isocyanates has been driven by global sustainability initiatives and stricter regulations. The industry has been moving towards bio-based isocyanates derived from renewable resources, aiming to reduce dependence on fossil fuels. Additionally, there has been a growing emphasis on developing non-isocyanate polyurethanes (NIPUs) as potential alternatives, addressing concerns about the toxicity of traditional isocyanates.

The current landscape of isocyanate technology is characterized by a balance between innovation and sustainability. Researchers are exploring advanced catalysis methods to improve isocyanate synthesis efficiency while reducing environmental impact. Concurrently, there is a push towards developing "smart" isocyanate-based materials with self-healing properties and stimuli-responsive behaviors, opening up new possibilities in adaptive and functional materials.

Looking ahead, the evolution of isocyanates is likely to continue along the path of sustainability and enhanced performance. Future developments may include the commercialization of fully bio-based isocyanates, the integration of isocyanate chemistry with emerging technologies like 3D printing, and the development of isocyanate-based materials with unprecedented properties for cutting-edge applications in aerospace, electronics, and energy storage.

The 1950s and 1960s saw rapid advancements in isocyanate technology, driven by the growing demand for versatile materials in various industries. During this period, researchers developed new synthesis methods and explored different isocyanate structures, leading to the creation of a diverse range of polyurethane products. The introduction of toluene diisocyanate (TDI) and methylene diphenyl diisocyanate (MDI) revolutionized the industry, becoming the backbone of polyurethane production.

As environmental concerns gained prominence in the 1970s and 1980s, the focus shifted towards developing more sustainable and safer isocyanate technologies. This period witnessed the emergence of water-based polyurethane systems and low-VOC formulations, addressing the need for environmentally friendly alternatives. Simultaneously, efforts were made to improve worker safety by developing less volatile and less toxic isocyanate variants.

The 1990s and early 2000s marked a period of refinement and specialization in isocyanate technology. Researchers focused on enhancing the performance characteristics of isocyanate-based materials, such as improved durability, flexibility, and chemical resistance. This era also saw the development of novel applications in fields like biomedicine and nanotechnology, expanding the reach of isocyanates beyond traditional industries.

In recent years, the evolution of isocyanates has been driven by global sustainability initiatives and stricter regulations. The industry has been moving towards bio-based isocyanates derived from renewable resources, aiming to reduce dependence on fossil fuels. Additionally, there has been a growing emphasis on developing non-isocyanate polyurethanes (NIPUs) as potential alternatives, addressing concerns about the toxicity of traditional isocyanates.

The current landscape of isocyanate technology is characterized by a balance between innovation and sustainability. Researchers are exploring advanced catalysis methods to improve isocyanate synthesis efficiency while reducing environmental impact. Concurrently, there is a push towards developing "smart" isocyanate-based materials with self-healing properties and stimuli-responsive behaviors, opening up new possibilities in adaptive and functional materials.

Looking ahead, the evolution of isocyanates is likely to continue along the path of sustainability and enhanced performance. Future developments may include the commercialization of fully bio-based isocyanates, the integration of isocyanate chemistry with emerging technologies like 3D printing, and the development of isocyanate-based materials with unprecedented properties for cutting-edge applications in aerospace, electronics, and energy storage.

Market Demand Analysis

The global market for isocyanates has experienced significant growth in recent years, driven by increasing demand across various industries. The construction sector remains a primary consumer, utilizing isocyanates in the production of polyurethane foams for insulation and sealants. This demand is further fueled by the growing emphasis on energy-efficient buildings and sustainable construction practices worldwide.

The automotive industry represents another major market for isocyanates, particularly in the manufacturing of lightweight components and interior materials. As vehicle manufacturers strive to meet stringent fuel efficiency standards and reduce emissions, the use of isocyanate-based materials in automotive applications is expected to continue rising.

In the furniture and bedding sector, isocyanates play a crucial role in the production of flexible foams for mattresses, cushions, and upholstery. The growing consumer preference for comfort and ergonomic design has led to increased demand for high-quality polyurethane foams, driving the isocyanate market in this segment.

The electronics industry has also emerged as a significant consumer of isocyanates, particularly in the production of protective coatings and encapsulants for electronic components. With the rapid expansion of the electronics market and the increasing need for durable, moisture-resistant materials, this sector is expected to contribute substantially to isocyanate demand growth.

Market analysis indicates a shift towards more environmentally friendly and sustainable isocyanate products. This trend is driven by growing environmental concerns and stricter regulations on volatile organic compounds (VOCs) and emissions. Manufacturers are investing in research and development to create bio-based isocyanates and low-emission formulations to meet these evolving market demands.

The Asia-Pacific region, particularly China and India, is expected to be the fastest-growing market for isocyanates due to rapid industrialization, urbanization, and infrastructure development. North America and Europe continue to be significant markets, with a focus on high-performance and specialty isocyanate products.

Despite the positive growth outlook, the isocyanate market faces challenges related to raw material price volatility and health concerns associated with isocyanate exposure. These factors are driving innovation in safer handling practices and alternative formulations to address market demands while ensuring worker and environmental safety.

The automotive industry represents another major market for isocyanates, particularly in the manufacturing of lightweight components and interior materials. As vehicle manufacturers strive to meet stringent fuel efficiency standards and reduce emissions, the use of isocyanate-based materials in automotive applications is expected to continue rising.

In the furniture and bedding sector, isocyanates play a crucial role in the production of flexible foams for mattresses, cushions, and upholstery. The growing consumer preference for comfort and ergonomic design has led to increased demand for high-quality polyurethane foams, driving the isocyanate market in this segment.

The electronics industry has also emerged as a significant consumer of isocyanates, particularly in the production of protective coatings and encapsulants for electronic components. With the rapid expansion of the electronics market and the increasing need for durable, moisture-resistant materials, this sector is expected to contribute substantially to isocyanate demand growth.

Market analysis indicates a shift towards more environmentally friendly and sustainable isocyanate products. This trend is driven by growing environmental concerns and stricter regulations on volatile organic compounds (VOCs) and emissions. Manufacturers are investing in research and development to create bio-based isocyanates and low-emission formulations to meet these evolving market demands.

The Asia-Pacific region, particularly China and India, is expected to be the fastest-growing market for isocyanates due to rapid industrialization, urbanization, and infrastructure development. North America and Europe continue to be significant markets, with a focus on high-performance and specialty isocyanate products.

Despite the positive growth outlook, the isocyanate market faces challenges related to raw material price volatility and health concerns associated with isocyanate exposure. These factors are driving innovation in safer handling practices and alternative formulations to address market demands while ensuring worker and environmental safety.

Technical Challenges

The global isocyanate industry faces several significant technical challenges that impact its development and application strategies. One of the primary concerns is the toxicity of isocyanates, particularly during the manufacturing process and in end-use products. This necessitates stringent safety measures and protective equipment, which can increase production costs and complexity.

Environmental concerns also pose a major challenge. The production of isocyanates often involves the use of phosgene, a highly toxic gas, which raises environmental and safety issues. Developing alternative, more environmentally friendly production methods is a key focus area for researchers and manufacturers alike.

Another technical hurdle is the moisture sensitivity of isocyanates. These compounds readily react with water, which can lead to quality issues in products and difficulties in storage and transportation. This characteristic requires careful handling and specialized packaging solutions, adding to the overall cost and complexity of isocyanate use.

The versatility of isocyanates, while beneficial, also presents challenges in terms of formulation and application. Different end-use products require specific isocyanate formulations, necessitating extensive research and development to optimize performance across various applications. This diversity in requirements can lead to increased production complexity and inventory management issues.

Regulatory pressures represent a significant technical challenge for the isocyanate industry. Increasingly stringent regulations regarding the use and handling of isocyanates, particularly in consumer products, are driving the need for innovative solutions that maintain performance while reducing potential health and environmental risks.

The development of bio-based alternatives to traditional petroleum-derived isocyanates is an emerging challenge. While promising, these alternatives often face issues related to cost-effectiveness, scalability, and performance parity with conventional isocyanates. Overcoming these hurdles requires substantial investment in research and development.

Lastly, the industry faces challenges in recycling and end-of-life management of isocyanate-based products, particularly polyurethanes. Developing efficient and economically viable recycling technologies for these materials is crucial for improving the sustainability profile of isocyanates and meeting circular economy goals.

Environmental concerns also pose a major challenge. The production of isocyanates often involves the use of phosgene, a highly toxic gas, which raises environmental and safety issues. Developing alternative, more environmentally friendly production methods is a key focus area for researchers and manufacturers alike.

Another technical hurdle is the moisture sensitivity of isocyanates. These compounds readily react with water, which can lead to quality issues in products and difficulties in storage and transportation. This characteristic requires careful handling and specialized packaging solutions, adding to the overall cost and complexity of isocyanate use.

The versatility of isocyanates, while beneficial, also presents challenges in terms of formulation and application. Different end-use products require specific isocyanate formulations, necessitating extensive research and development to optimize performance across various applications. This diversity in requirements can lead to increased production complexity and inventory management issues.

Regulatory pressures represent a significant technical challenge for the isocyanate industry. Increasingly stringent regulations regarding the use and handling of isocyanates, particularly in consumer products, are driving the need for innovative solutions that maintain performance while reducing potential health and environmental risks.

The development of bio-based alternatives to traditional petroleum-derived isocyanates is an emerging challenge. While promising, these alternatives often face issues related to cost-effectiveness, scalability, and performance parity with conventional isocyanates. Overcoming these hurdles requires substantial investment in research and development.

Lastly, the industry faces challenges in recycling and end-of-life management of isocyanate-based products, particularly polyurethanes. Developing efficient and economically viable recycling technologies for these materials is crucial for improving the sustainability profile of isocyanates and meeting circular economy goals.

Current Use Strategies

01 Polyurethane foam production

Isocyanates are widely used in the production of polyurethane foams. These foams are utilized in various applications such as insulation, cushioning, and packaging. The process involves the reaction of isocyanates with polyols and other additives to create flexible or rigid foam structures with desired properties.- Polyurethane foam production: Isocyanates are widely used in the production of polyurethane foams. These foams have applications in various industries, including automotive, construction, and furniture. The process involves reacting isocyanates with polyols and other additives to create flexible or rigid foam structures with desired properties.

- Coatings and adhesives formulation: Isocyanates play a crucial role in the formulation of high-performance coatings and adhesives. They react with hydroxyl-containing compounds to form strong, durable bonds. These formulations are used in automotive finishes, industrial coatings, and structural adhesives, offering excellent chemical and weather resistance.

- Elastomer and sealant manufacturing: Isocyanates are essential in the production of elastomers and sealants. They react with long-chain polyols to create flexible, resilient materials used in automotive parts, construction sealants, and industrial gaskets. The resulting products offer excellent mechanical properties and resistance to environmental factors.

- Textile and fiber treatment: Isocyanates are utilized in textile and fiber treatments to enhance properties such as water repellency, durability, and wrinkle resistance. They can be applied as coatings or incorporated into fiber structures during manufacturing processes, improving the performance and functionality of fabrics and textiles.

- Safety and handling strategies: Due to the reactive nature of isocyanates, proper safety and handling strategies are crucial. This includes using appropriate personal protective equipment, implementing engineering controls, and following strict storage and transportation protocols. Training programs and risk assessments are essential to ensure safe use of isocyanates in various applications.

02 Coatings and adhesives formulation

Isocyanates play a crucial role in the formulation of high-performance coatings and adhesives. They react with various compounds to form durable, chemical-resistant, and weather-resistant products. These formulations find applications in automotive, construction, and industrial sectors, providing excellent adhesion and protection properties.Expand Specific Solutions03 Elastomer and sealant manufacturing

Isocyanates are essential in the production of elastomers and sealants. These materials offer flexibility, durability, and resistance to various environmental factors. The use of isocyanates in this context allows for the creation of products with tailored properties suitable for automotive, construction, and industrial applications.Expand Specific Solutions04 Textile and fiber treatment

Isocyanates are employed in the treatment of textiles and fibers to enhance their properties. This includes improving water repellency, flame resistance, and durability of fabrics. The treatment process often involves the application of isocyanate-based compounds to the textile surface, resulting in modified fibers with superior characteristics.Expand Specific Solutions05 Composite materials reinforcement

Isocyanates are utilized in the reinforcement of composite materials. They contribute to the bonding between different components in composites, enhancing their overall strength and performance. This strategy is particularly valuable in aerospace, automotive, and construction industries, where lightweight yet strong materials are required.Expand Specific Solutions

Key Industry Players

The global isocyanate use strategies market is in a mature stage, characterized by steady growth and established players. The market size is substantial, driven by diverse applications in industries such as automotive, construction, and electronics. Technologically, the field is well-developed but continues to evolve, with major companies like BASF, Wanhua Chemical Group, and Covestro leading innovation. These firms, along with others such as Mitsui Chemicals and Evonik, are focusing on developing more sustainable and efficient isocyanate products. The competitive landscape is intense, with companies investing in R&D to maintain market share and address environmental concerns, indicating a trend towards greener chemistry in isocyanate use strategies.

BASF Corp.

Technical Solution: BASF has developed innovative isocyanate-free polyurethane systems, utilizing cyclic carbonates and amines as raw materials[1]. This technology, known as Elastollan® N, offers improved sustainability and reduced environmental impact. BASF has also introduced water-based polyurethane dispersions (PUDs) that contain no free isocyanates, catering to industries seeking low-VOC and low-odor solutions[2]. Additionally, BASF's Elastopan® range includes bio-based polyols derived from renewable resources, reducing the overall carbon footprint of their polyurethane products[3].

Strengths: Sustainable alternatives, reduced environmental impact, versatile applications. Weaknesses: Potentially higher production costs, market adaptation challenges for new technologies.

Wanhua Chemical Group Co., Ltd.

Technical Solution: Wanhua Chemical has developed a range of innovative isocyanate products, including MDI (methylene diphenyl diisocyanate) and TDI (toluene diisocyanate), which are crucial for polyurethane production[4]. The company has invested in large-scale production facilities, becoming one of the world's largest MDI producers. Wanhua has also focused on developing eco-friendly alternatives, such as water-based polyurethane adhesives and coatings, which reduce VOC emissions[5]. Their research extends to non-isocyanate polyurethanes (NIPUs) using cyclic carbonates and diamines, aiming to address environmental and health concerns associated with traditional isocyanates[6].

Strengths: Large-scale production capabilities, diverse product portfolio, focus on eco-friendly alternatives. Weaknesses: Dependence on petrochemical feedstocks, potential regulatory challenges in some markets.

Innovative Applications

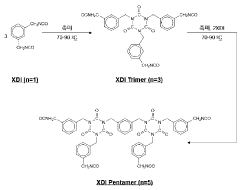

Xylene diisocyanate composition and method for producing isocyanurate

PatentWO2024144331A1

Innovation

- A xylene diisocyanate composition containing chloromethylbenzyl isocyanate in an optimized range (0.1% to 0.3% by weight) is used to enhance storage stability and reaction efficiency, preventing gelation and ensuring excellent film drying, heat resistance, and solvent compatibility, while allowing for the reuse of the xylene diisocyanate composition after reaction.

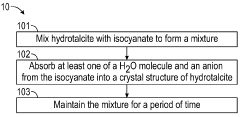

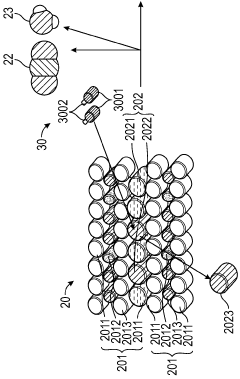

Method for extending shelf life of polymeric isocyanate with composition containing hydrotalcite

PatentWO2023200914A1

Innovation

- A composition containing a polymeric isocyanate and a hydrotalcite additive, where the hydrotalcite absorbs water and anions from the isocyanate mixture into its crystal structure, stabilizing the isocyanate and extending its shelf life by reducing polymerization.

Environmental Impact

The environmental impact of isocyanate use has become a critical concern in recent years, prompting industries to adopt more sustainable strategies. Isocyanates, widely used in the production of polyurethanes, have significant implications for both human health and the environment throughout their lifecycle.

One of the primary environmental concerns associated with isocyanates is their potential for air pollution. During manufacturing processes and application of isocyanate-based products, volatile organic compounds (VOCs) can be released into the atmosphere. These emissions contribute to the formation of ground-level ozone and smog, negatively impacting air quality and ecosystem health.

Water contamination is another crucial environmental issue related to isocyanate use. Improper disposal or accidental spills can lead to the presence of isocyanates in water bodies, potentially harming aquatic life and compromising water quality. The persistence of these chemicals in the environment further exacerbates their long-term ecological impact.

The production of isocyanates also raises concerns about resource depletion and energy consumption. The raw materials required for isocyanate synthesis, primarily derived from fossil fuels, contribute to the depletion of non-renewable resources. Additionally, the energy-intensive manufacturing processes associated with isocyanate production result in significant greenhouse gas emissions, further contributing to climate change.

In response to these environmental challenges, global trends in isocyanate use strategies are shifting towards more sustainable practices. Many industries are exploring bio-based alternatives to traditional petroleum-derived isocyanates, aiming to reduce their carbon footprint and reliance on fossil fuels. These bio-based isocyanates, derived from renewable resources such as plant oils or agricultural waste, offer a more environmentally friendly option without compromising performance.

Another emerging trend is the development of water-based polyurethane systems, which significantly reduce VOC emissions compared to solvent-based alternatives. This approach not only minimizes air pollution but also enhances workplace safety and reduces the risk of environmental contamination.

Recycling and circular economy initiatives are gaining traction in the isocyanate industry. Efforts to recover and reuse polyurethane materials are becoming more prevalent, reducing waste and the demand for virgin isocyanates. Advanced recycling technologies, such as chemical recycling, are being explored to break down polyurethane products into their constituent components, enabling the recovery of valuable raw materials.

As environmental regulations become more stringent worldwide, manufacturers are investing in improved production processes and emission control technologies. This includes the implementation of closed-loop systems, advanced filtration methods, and more efficient catalysts to minimize waste and emissions throughout the isocyanate lifecycle.

One of the primary environmental concerns associated with isocyanates is their potential for air pollution. During manufacturing processes and application of isocyanate-based products, volatile organic compounds (VOCs) can be released into the atmosphere. These emissions contribute to the formation of ground-level ozone and smog, negatively impacting air quality and ecosystem health.

Water contamination is another crucial environmental issue related to isocyanate use. Improper disposal or accidental spills can lead to the presence of isocyanates in water bodies, potentially harming aquatic life and compromising water quality. The persistence of these chemicals in the environment further exacerbates their long-term ecological impact.

The production of isocyanates also raises concerns about resource depletion and energy consumption. The raw materials required for isocyanate synthesis, primarily derived from fossil fuels, contribute to the depletion of non-renewable resources. Additionally, the energy-intensive manufacturing processes associated with isocyanate production result in significant greenhouse gas emissions, further contributing to climate change.

In response to these environmental challenges, global trends in isocyanate use strategies are shifting towards more sustainable practices. Many industries are exploring bio-based alternatives to traditional petroleum-derived isocyanates, aiming to reduce their carbon footprint and reliance on fossil fuels. These bio-based isocyanates, derived from renewable resources such as plant oils or agricultural waste, offer a more environmentally friendly option without compromising performance.

Another emerging trend is the development of water-based polyurethane systems, which significantly reduce VOC emissions compared to solvent-based alternatives. This approach not only minimizes air pollution but also enhances workplace safety and reduces the risk of environmental contamination.

Recycling and circular economy initiatives are gaining traction in the isocyanate industry. Efforts to recover and reuse polyurethane materials are becoming more prevalent, reducing waste and the demand for virgin isocyanates. Advanced recycling technologies, such as chemical recycling, are being explored to break down polyurethane products into their constituent components, enabling the recovery of valuable raw materials.

As environmental regulations become more stringent worldwide, manufacturers are investing in improved production processes and emission control technologies. This includes the implementation of closed-loop systems, advanced filtration methods, and more efficient catalysts to minimize waste and emissions throughout the isocyanate lifecycle.

Regulatory Framework

The regulatory framework surrounding isocyanate use has become increasingly complex and stringent in recent years, reflecting growing concerns about the potential health and environmental impacts of these chemicals. Globally, there is a trend towards more comprehensive and harmonized regulations, although significant regional variations persist.

In the European Union, the REACH (Registration, Evaluation, Authorization and Restriction of Chemicals) regulation plays a central role in governing isocyanate use. REACH requires manufacturers and importers to register chemicals and provide safety data, with specific provisions for substances of very high concern (SVHCs). Several isocyanates, including toluene diisocyanate (TDI) and methylene diphenyl diisocyanate (MDI), are subject to strict controls under REACH.

The United States has a multi-faceted regulatory approach, with the Environmental Protection Agency (EPA) and the Occupational Safety and Health Administration (OSHA) being key players. The EPA regulates isocyanates under the Toxic Substances Control Act (TSCA), while OSHA sets workplace exposure limits and safety standards. Recent years have seen increased scrutiny, with the EPA conducting risk evaluations for several isocyanates under the amended TSCA.

In Asia, regulatory frameworks are evolving rapidly. China, for instance, has implemented stricter environmental regulations affecting isocyanate production and use, including the revised Environmental Protection Law and new chemical registration requirements. Japan maintains a robust regulatory system through its Chemical Substances Control Law, which includes specific provisions for isocyanates.

A notable global trend is the increasing focus on worker safety and training. Many jurisdictions now mandate specific training programs for workers handling isocyanates, recognizing the potential health risks associated with exposure. This trend is exemplified by the EU's recent requirement for all workers using diisocyanates to undergo certified training.

Another emerging trend is the push towards safer alternatives and green chemistry principles. Regulators in various regions are encouraging the development and adoption of less hazardous substitutes for isocyanates, particularly in consumer products. This is driving innovation in the chemical industry and influencing product formulations across multiple sectors.

The automotive industry, a major user of isocyanate-based products, faces particular regulatory challenges. Emissions standards and end-of-life vehicle regulations in many countries are prompting reassessment of materials used in vehicle manufacturing, including isocyanate-based foams and coatings.

As global supply chains become more interconnected, there is a growing need for international coordination in isocyanate regulation. Initiatives like the Global Harmonized System of Classification and Labelling of Chemicals (GHS) are gaining traction, aiming to standardize hazard communication across borders.

In the European Union, the REACH (Registration, Evaluation, Authorization and Restriction of Chemicals) regulation plays a central role in governing isocyanate use. REACH requires manufacturers and importers to register chemicals and provide safety data, with specific provisions for substances of very high concern (SVHCs). Several isocyanates, including toluene diisocyanate (TDI) and methylene diphenyl diisocyanate (MDI), are subject to strict controls under REACH.

The United States has a multi-faceted regulatory approach, with the Environmental Protection Agency (EPA) and the Occupational Safety and Health Administration (OSHA) being key players. The EPA regulates isocyanates under the Toxic Substances Control Act (TSCA), while OSHA sets workplace exposure limits and safety standards. Recent years have seen increased scrutiny, with the EPA conducting risk evaluations for several isocyanates under the amended TSCA.

In Asia, regulatory frameworks are evolving rapidly. China, for instance, has implemented stricter environmental regulations affecting isocyanate production and use, including the revised Environmental Protection Law and new chemical registration requirements. Japan maintains a robust regulatory system through its Chemical Substances Control Law, which includes specific provisions for isocyanates.

A notable global trend is the increasing focus on worker safety and training. Many jurisdictions now mandate specific training programs for workers handling isocyanates, recognizing the potential health risks associated with exposure. This trend is exemplified by the EU's recent requirement for all workers using diisocyanates to undergo certified training.

Another emerging trend is the push towards safer alternatives and green chemistry principles. Regulators in various regions are encouraging the development and adoption of less hazardous substitutes for isocyanates, particularly in consumer products. This is driving innovation in the chemical industry and influencing product formulations across multiple sectors.

The automotive industry, a major user of isocyanate-based products, faces particular regulatory challenges. Emissions standards and end-of-life vehicle regulations in many countries are prompting reassessment of materials used in vehicle manufacturing, including isocyanate-based foams and coatings.

As global supply chains become more interconnected, there is a growing need for international coordination in isocyanate regulation. Initiatives like the Global Harmonized System of Classification and Labelling of Chemicals (GHS) are gaining traction, aiming to standardize hazard communication across borders.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!