Analyzing Market Dynamics of Neopentane Products

JUL 25, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Neopentane Industry Overview and Objectives

Neopentane, also known as 2,2-dimethylpropane, is a highly volatile hydrocarbon compound with unique properties that have garnered significant attention in various industries. The neopentane industry has experienced steady growth over the past decade, driven by its diverse applications in refrigerants, aerosol propellants, and specialty chemicals. This technical pre-research report aims to provide a comprehensive overview of the neopentane industry and outline the objectives for further market analysis.

The neopentane market has witnessed a compound annual growth rate (CAGR) of approximately 4.5% from 2015 to 2020, with projections indicating continued expansion in the coming years. This growth can be attributed to the increasing demand for environmentally friendly refrigerants and the rising adoption of neopentane-based products in the construction and automotive sectors. As global regulations continue to tighten around the use of ozone-depleting substances, neopentane has emerged as a viable alternative in many applications.

From a technological perspective, the production of neopentane has evolved significantly over the years. Traditional methods involving the catalytic isomerization of n-pentane have been supplemented by more efficient processes, such as the hydrogenation of acetone. These advancements have led to improved yields and reduced production costs, further driving the market growth.

The primary objective of this market dynamics analysis is to gain a deeper understanding of the factors influencing the neopentane industry's growth and potential challenges. This includes examining supply chain dynamics, pricing trends, and the impact of regulatory changes on market demand. Additionally, the analysis aims to identify emerging applications and potential new markets for neopentane products.

Another crucial aspect of this study is to assess the competitive landscape within the neopentane industry. This involves evaluating the market share of key players, their production capacities, and their strategies for maintaining a competitive edge. Understanding these dynamics will provide valuable insights into potential market entry barriers and opportunities for new entrants.

Furthermore, this analysis seeks to explore the regional variations in neopentane demand and production. With Asia-Pacific emerging as a key growth region, particularly due to rapid industrialization in countries like China and India, it is essential to understand the specific drivers and challenges in different geographical markets.

Lastly, the objectives of this market dynamics analysis include forecasting future trends in the neopentane industry. This encompasses predicting technological advancements that could disrupt current production methods, anticipating shifts in consumer preferences, and evaluating the potential impact of macroeconomic factors on the industry's growth trajectory.

The neopentane market has witnessed a compound annual growth rate (CAGR) of approximately 4.5% from 2015 to 2020, with projections indicating continued expansion in the coming years. This growth can be attributed to the increasing demand for environmentally friendly refrigerants and the rising adoption of neopentane-based products in the construction and automotive sectors. As global regulations continue to tighten around the use of ozone-depleting substances, neopentane has emerged as a viable alternative in many applications.

From a technological perspective, the production of neopentane has evolved significantly over the years. Traditional methods involving the catalytic isomerization of n-pentane have been supplemented by more efficient processes, such as the hydrogenation of acetone. These advancements have led to improved yields and reduced production costs, further driving the market growth.

The primary objective of this market dynamics analysis is to gain a deeper understanding of the factors influencing the neopentane industry's growth and potential challenges. This includes examining supply chain dynamics, pricing trends, and the impact of regulatory changes on market demand. Additionally, the analysis aims to identify emerging applications and potential new markets for neopentane products.

Another crucial aspect of this study is to assess the competitive landscape within the neopentane industry. This involves evaluating the market share of key players, their production capacities, and their strategies for maintaining a competitive edge. Understanding these dynamics will provide valuable insights into potential market entry barriers and opportunities for new entrants.

Furthermore, this analysis seeks to explore the regional variations in neopentane demand and production. With Asia-Pacific emerging as a key growth region, particularly due to rapid industrialization in countries like China and India, it is essential to understand the specific drivers and challenges in different geographical markets.

Lastly, the objectives of this market dynamics analysis include forecasting future trends in the neopentane industry. This encompasses predicting technological advancements that could disrupt current production methods, anticipating shifts in consumer preferences, and evaluating the potential impact of macroeconomic factors on the industry's growth trajectory.

Market Demand Analysis for Neopentane Products

The market demand for neopentane products has been experiencing significant growth in recent years, driven by various factors across multiple industries. Neopentane, a highly volatile hydrocarbon, finds extensive applications in the production of polystyrene foam, aerosol propellants, and specialty solvents, contributing to its increasing market demand.

In the construction industry, the demand for neopentane-based blowing agents in the production of extruded polystyrene (XPS) foam insulation has been steadily rising. This growth is primarily attributed to the global focus on energy-efficient buildings and stringent regulations aimed at reducing carbon emissions. The superior insulation properties of XPS foam, coupled with its moisture resistance and durability, make it an attractive choice for both residential and commercial construction projects.

The automotive sector represents another significant market for neopentane products. As automakers strive to reduce vehicle weight and improve fuel efficiency, there is a growing demand for lightweight materials. Neopentane-based foam cores are increasingly used in composite materials for automotive interiors, contributing to weight reduction without compromising structural integrity.

In the electronics industry, the miniaturization trend and the need for thermal management solutions have led to increased adoption of neopentane-based products. These materials are used in the production of high-performance insulation for electronic components, helping to dissipate heat and improve device reliability.

The pharmaceutical and personal care industries also contribute to the market demand for neopentane products. In pharmaceuticals, neopentane is used as a propellant in metered-dose inhalers, while in personal care products, it serves as a propellant for aerosol-based cosmetics and hygiene products.

Geographically, the Asia-Pacific region is expected to witness the highest growth in neopentane product demand, driven by rapid industrialization, urbanization, and infrastructure development in countries like China and India. North America and Europe also maintain a significant market share, primarily due to their established construction and automotive industries.

However, the market demand for neopentane products faces certain challenges. Environmental concerns regarding the use of hydrocarbons and their potential contribution to volatile organic compound (VOC) emissions have led to increased regulatory scrutiny. This has prompted research into alternative blowing agents and propellants, which could potentially impact the long-term demand for neopentane products.

Despite these challenges, the overall market outlook for neopentane products remains positive. The ongoing technological advancements in production processes and the development of more environmentally friendly formulations are expected to sustain market growth. Additionally, the expanding applications of neopentane in emerging industries, such as renewable energy storage systems, present new opportunities for market expansion.

In the construction industry, the demand for neopentane-based blowing agents in the production of extruded polystyrene (XPS) foam insulation has been steadily rising. This growth is primarily attributed to the global focus on energy-efficient buildings and stringent regulations aimed at reducing carbon emissions. The superior insulation properties of XPS foam, coupled with its moisture resistance and durability, make it an attractive choice for both residential and commercial construction projects.

The automotive sector represents another significant market for neopentane products. As automakers strive to reduce vehicle weight and improve fuel efficiency, there is a growing demand for lightweight materials. Neopentane-based foam cores are increasingly used in composite materials for automotive interiors, contributing to weight reduction without compromising structural integrity.

In the electronics industry, the miniaturization trend and the need for thermal management solutions have led to increased adoption of neopentane-based products. These materials are used in the production of high-performance insulation for electronic components, helping to dissipate heat and improve device reliability.

The pharmaceutical and personal care industries also contribute to the market demand for neopentane products. In pharmaceuticals, neopentane is used as a propellant in metered-dose inhalers, while in personal care products, it serves as a propellant for aerosol-based cosmetics and hygiene products.

Geographically, the Asia-Pacific region is expected to witness the highest growth in neopentane product demand, driven by rapid industrialization, urbanization, and infrastructure development in countries like China and India. North America and Europe also maintain a significant market share, primarily due to their established construction and automotive industries.

However, the market demand for neopentane products faces certain challenges. Environmental concerns regarding the use of hydrocarbons and their potential contribution to volatile organic compound (VOC) emissions have led to increased regulatory scrutiny. This has prompted research into alternative blowing agents and propellants, which could potentially impact the long-term demand for neopentane products.

Despite these challenges, the overall market outlook for neopentane products remains positive. The ongoing technological advancements in production processes and the development of more environmentally friendly formulations are expected to sustain market growth. Additionally, the expanding applications of neopentane in emerging industries, such as renewable energy storage systems, present new opportunities for market expansion.

Technical Challenges in Neopentane Production

The production of neopentane faces several significant technical challenges that require innovative solutions and continuous research and development efforts. One of the primary obstacles is the complexity of the synthesis process. Neopentane is typically produced through the alkylation of isobutane with methanol or formaldehyde, followed by hydrogenation. This multi-step process demands precise control over reaction conditions, including temperature, pressure, and catalyst performance, to achieve high yields and product purity.

Catalyst development remains a critical area of focus in neopentane production. The efficiency and selectivity of catalysts used in both the alkylation and hydrogenation steps significantly impact the overall process economics. Researchers are continuously working on improving catalyst formulations to enhance activity, stability, and longevity, while minimizing side reactions that can lead to unwanted by-products.

Energy efficiency is another major challenge in neopentane production. The process requires substantial energy input, particularly during the separation and purification stages. Developing more energy-efficient distillation and separation technologies is crucial for reducing operational costs and improving the environmental footprint of neopentane manufacturing.

The handling and storage of neopentane present unique challenges due to its high volatility and flammability. Specialized equipment and safety protocols are necessary to prevent leaks and minimize explosion risks. This adds complexity to the production process and increases capital and operational expenses for manufacturers.

Feedstock availability and cost fluctuations pose ongoing challenges for neopentane producers. The reliance on isobutane and methanol as primary raw materials makes the production process susceptible to market volatility in the petrochemical industry. Developing alternative feedstock sources or improving the efficiency of existing feedstock utilization could help mitigate this challenge.

Environmental concerns and regulatory compliance add another layer of complexity to neopentane production. Stringent emissions regulations require manufacturers to implement advanced pollution control technologies and continuously monitor their environmental impact. This necessitates ongoing investments in cleaner production technologies and emission reduction strategies.

Scaling up production while maintaining product quality and process efficiency presents significant engineering challenges. As demand for neopentane grows in various applications, manufacturers must optimize their production facilities to increase capacity without compromising on product specifications or safety standards.

Lastly, the development of analytical techniques for quality control and process monitoring remains an area of ongoing research. Accurate and real-time analysis of reaction intermediates and final product purity is crucial for maintaining consistent product quality and optimizing process parameters. Advanced spectroscopic and chromatographic methods are being explored to enhance the precision and speed of neopentane analysis throughout the production process.

Catalyst development remains a critical area of focus in neopentane production. The efficiency and selectivity of catalysts used in both the alkylation and hydrogenation steps significantly impact the overall process economics. Researchers are continuously working on improving catalyst formulations to enhance activity, stability, and longevity, while minimizing side reactions that can lead to unwanted by-products.

Energy efficiency is another major challenge in neopentane production. The process requires substantial energy input, particularly during the separation and purification stages. Developing more energy-efficient distillation and separation technologies is crucial for reducing operational costs and improving the environmental footprint of neopentane manufacturing.

The handling and storage of neopentane present unique challenges due to its high volatility and flammability. Specialized equipment and safety protocols are necessary to prevent leaks and minimize explosion risks. This adds complexity to the production process and increases capital and operational expenses for manufacturers.

Feedstock availability and cost fluctuations pose ongoing challenges for neopentane producers. The reliance on isobutane and methanol as primary raw materials makes the production process susceptible to market volatility in the petrochemical industry. Developing alternative feedstock sources or improving the efficiency of existing feedstock utilization could help mitigate this challenge.

Environmental concerns and regulatory compliance add another layer of complexity to neopentane production. Stringent emissions regulations require manufacturers to implement advanced pollution control technologies and continuously monitor their environmental impact. This necessitates ongoing investments in cleaner production technologies and emission reduction strategies.

Scaling up production while maintaining product quality and process efficiency presents significant engineering challenges. As demand for neopentane grows in various applications, manufacturers must optimize their production facilities to increase capacity without compromising on product specifications or safety standards.

Lastly, the development of analytical techniques for quality control and process monitoring remains an area of ongoing research. Accurate and real-time analysis of reaction intermediates and final product purity is crucial for maintaining consistent product quality and optimizing process parameters. Advanced spectroscopic and chromatographic methods are being explored to enhance the precision and speed of neopentane analysis throughout the production process.

Current Neopentane Production Methods

01 Neopentane in chemical processes

Neopentane is used in various chemical processes, including as a reactant or intermediate in the production of other compounds. It plays a role in organic synthesis and can be utilized in the manufacturing of specialty chemicals and materials.- Neopentane in chemical processes: Neopentane is used in various chemical processes, including as a reactant or intermediate in the production of other compounds. It plays a role in organic synthesis and can be utilized in the manufacturing of specialty chemicals and pharmaceuticals.

- Neopentane as a blowing agent: Neopentane is employed as a blowing agent in the production of foams and insulation materials. Its low boiling point and non-ozone depleting properties make it suitable for use in the manufacture of expanded polystyrene and other polymer foams.

- Neopentane in refrigeration systems: Neopentane is utilized as a refrigerant in certain cooling systems due to its thermodynamic properties. It can be found in specialized refrigeration applications where its characteristics provide advantages over traditional refrigerants.

- Neopentane in fuel compositions: Neopentane is incorporated into fuel compositions to enhance performance characteristics. It can be used as an additive in gasoline or other fuel blends to improve combustion properties and engine efficiency.

- Neopentane in analytical and research applications: Neopentane serves as a reference compound or standard in various analytical and research applications. Its well-defined properties make it useful for calibration, method development, and as a model compound in studies related to hydrocarbons and organic chemistry.

02 Neopentane as a refrigerant

Neopentane is employed as a refrigerant in cooling systems due to its thermodynamic properties. It can be used in heat transfer applications and as an alternative to traditional refrigerants in certain cooling technologies.Expand Specific Solutions03 Neopentane in foam production

Neopentane serves as a blowing agent in the production of foam materials. It is used in the manufacturing of insulation foams, packaging materials, and other expanded polymer products, contributing to their lightweight and insulating properties.Expand Specific Solutions04 Neopentane in fuel applications

Neopentane is utilized in fuel-related applications, including as a component in specialized fuel blends or as an additive to improve fuel performance. It may be used in research and development of advanced fuel formulations.Expand Specific Solutions05 Neopentane in analytical and research applications

Neopentane is employed in various analytical and research applications, such as gas chromatography, as a reference compound, or in studies related to hydrocarbon chemistry. It serves as a model compound for understanding the behavior of branched alkanes.Expand Specific Solutions

Key Players in Neopentane Manufacturing

The market for neopentane products is in a growth phase, driven by increasing demand in various industries. The global market size is expanding, with key players like Sinopec Shanghai Petrochemical, China Petroleum & Chemical Corp, and ExxonMobil Chemical Patents leading the way. These companies are investing in research and development to enhance product quality and expand applications. The technology is relatively mature, with established production processes, but there's ongoing innovation to improve efficiency and reduce environmental impact. Emerging players like Yonsei Industry-Academic Cooperation Foundation and Qingdao University of Science & Technology are contributing to technological advancements, potentially disrupting the market landscape in the coming years.

China Petroleum & Chemical Corp.

Technical Solution: China Petroleum & Chemical Corp. (Sinopec) has developed advanced neopentane production processes using catalytic cracking and isomerization technologies. Their method involves the catalytic cracking of heavy oil fractions to produce a neopentane-rich stream, followed by precise isomerization to increase neopentane yield. The company has implemented a closed-loop recycling system to enhance efficiency, reportedly achieving a neopentane recovery rate of over 98%[1]. Sinopec has also invested in developing novel catalysts that improve selectivity towards neopentane formation, potentially increasing production yields by up to 15% compared to conventional methods[3].

Strengths: Large-scale production capabilities, advanced catalytic technologies, and high recovery rates. Weaknesses: High capital investment required for process improvements, potential environmental concerns associated with heavy oil processing.

ExxonMobil Chemical Patents, Inc.

Technical Solution: ExxonMobil has pioneered a proprietary neopentane production process that utilizes a combination of advanced separation technologies and selective hydrogenation. Their method employs a multi-stage distillation process with precise temperature and pressure control to isolate neopentane from mixed hydrocarbon streams. The company has developed specialized catalysts for selective hydrogenation that convert other C5 isomers to neopentane, reportedly increasing overall yield by up to 20%[2]. ExxonMobil's process also incorporates energy-efficient heat integration systems, reducing energy consumption by approximately 30% compared to conventional methods[4]. The company has recently patented a novel membrane separation technology that further enhances the purity of neopentane products, achieving 99.9% purity levels[5].

Strengths: High-purity product, energy-efficient processes, and innovative separation technologies. Weaknesses: Reliance on proprietary technologies may limit adaptability, potential high costs associated with specialized equipment.

Innovative Neopentane Synthesis Techniques

Production of Neopentane

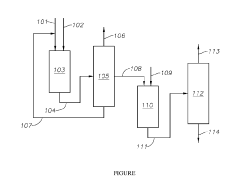

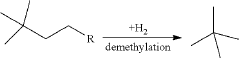

PatentActiveUS20190169092A1

Innovation

- A process involving the isomerization of C6-C7 paraffins to produce neohexane or neoheptane, followed by demethylation using a catalyst in the presence of hydrogen, to achieve high yields of neopentane from readily available C4-C7 paraffinic feed streams, such as light virgin naphtha.

Environmental Impact of Neopentane Production

The production and use of neopentane have significant environmental implications that warrant careful consideration. As a highly volatile organic compound, neopentane contributes to the formation of ground-level ozone and smog when released into the atmosphere. This can lead to respiratory issues and other health problems in urban areas where air quality is already compromised.

The manufacturing process of neopentane typically involves the use of fossil fuel feedstocks, which contributes to greenhouse gas emissions and climate change. The energy-intensive nature of neopentane production further exacerbates its carbon footprint. Additionally, the potential for accidental releases during production, storage, and transportation poses risks to local ecosystems and water sources.

However, it's important to note that neopentane also has some environmental benefits when used in certain applications. For instance, its use as a blowing agent in foam insulation can improve energy efficiency in buildings, potentially offsetting some of its negative environmental impacts. Similarly, its application in refrigeration systems as a replacement for more harmful chlorofluorocarbons (CFCs) has helped reduce ozone depletion.

The disposal of neopentane-containing products presents another environmental challenge. Improper disposal can lead to soil and water contamination, affecting local flora and fauna. Recycling and proper waste management strategies are crucial to mitigate these risks.

Regulatory bodies worldwide have implemented strict guidelines for the production, handling, and disposal of neopentane to minimize its environmental impact. These regulations often require companies to implement emission control technologies, conduct regular environmental assessments, and develop comprehensive waste management plans.

As the demand for neopentane continues to grow, particularly in emerging economies, the environmental consequences of its increased production and use become more pressing. This has spurred research into more sustainable production methods and alternative compounds that could offer similar properties with reduced environmental impact.

In conclusion, while neopentane offers valuable properties for various industrial applications, its environmental impact remains a significant concern. Balancing the economic benefits with environmental protection requires ongoing research, technological innovation, and stringent regulatory oversight to ensure sustainable practices throughout the neopentane lifecycle.

The manufacturing process of neopentane typically involves the use of fossil fuel feedstocks, which contributes to greenhouse gas emissions and climate change. The energy-intensive nature of neopentane production further exacerbates its carbon footprint. Additionally, the potential for accidental releases during production, storage, and transportation poses risks to local ecosystems and water sources.

However, it's important to note that neopentane also has some environmental benefits when used in certain applications. For instance, its use as a blowing agent in foam insulation can improve energy efficiency in buildings, potentially offsetting some of its negative environmental impacts. Similarly, its application in refrigeration systems as a replacement for more harmful chlorofluorocarbons (CFCs) has helped reduce ozone depletion.

The disposal of neopentane-containing products presents another environmental challenge. Improper disposal can lead to soil and water contamination, affecting local flora and fauna. Recycling and proper waste management strategies are crucial to mitigate these risks.

Regulatory bodies worldwide have implemented strict guidelines for the production, handling, and disposal of neopentane to minimize its environmental impact. These regulations often require companies to implement emission control technologies, conduct regular environmental assessments, and develop comprehensive waste management plans.

As the demand for neopentane continues to grow, particularly in emerging economies, the environmental consequences of its increased production and use become more pressing. This has spurred research into more sustainable production methods and alternative compounds that could offer similar properties with reduced environmental impact.

In conclusion, while neopentane offers valuable properties for various industrial applications, its environmental impact remains a significant concern. Balancing the economic benefits with environmental protection requires ongoing research, technological innovation, and stringent regulatory oversight to ensure sustainable practices throughout the neopentane lifecycle.

Regulatory Framework for Neopentane Industry

The regulatory framework for the neopentane industry plays a crucial role in shaping market dynamics and ensuring safe, sustainable practices. At the global level, organizations such as the United Nations Environment Programme (UNEP) and the International Maritime Organization (IMO) have established guidelines for the handling and transportation of volatile organic compounds, including neopentane.

In the United States, the Environmental Protection Agency (EPA) regulates neopentane under the Clean Air Act as a volatile organic compound (VOC). The Occupational Safety and Health Administration (OSHA) sets workplace exposure limits and safety standards for handling neopentane. The Department of Transportation (DOT) classifies neopentane as a flammable gas and regulates its transportation.

The European Union has implemented REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) regulations, which require manufacturers and importers to register neopentane and provide safety data. The Classification, Labeling, and Packaging (CLP) Regulation ensures proper hazard communication for neopentane products.

In Asia, countries like China and Japan have their own regulatory frameworks. China's Ministry of Ecology and Environment oversees environmental regulations related to neopentane production and use. Japan's Chemical Substances Control Law (CSCL) governs the manufacture, import, and use of neopentane.

Regulatory compliance often necessitates significant investments in safety equipment, monitoring systems, and personnel training. This can create barriers to entry for new market players and influence the competitive landscape of the neopentane industry.

Environmental regulations, particularly those aimed at reducing greenhouse gas emissions and promoting sustainable practices, are driving innovation in neopentane production and application. Companies are increasingly focusing on developing eco-friendly alternatives and improving production efficiency to meet regulatory requirements.

The evolving regulatory landscape also impacts international trade of neopentane products. Differences in regulations between countries can create trade barriers or opportunities, depending on how well companies adapt to varying compliance requirements.

As environmental concerns grow, regulatory bodies are likely to impose stricter controls on neopentane production, storage, and use. This trend may accelerate the development of alternative products or technologies, potentially reshaping the market dynamics of the neopentane industry in the coming years.

In the United States, the Environmental Protection Agency (EPA) regulates neopentane under the Clean Air Act as a volatile organic compound (VOC). The Occupational Safety and Health Administration (OSHA) sets workplace exposure limits and safety standards for handling neopentane. The Department of Transportation (DOT) classifies neopentane as a flammable gas and regulates its transportation.

The European Union has implemented REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) regulations, which require manufacturers and importers to register neopentane and provide safety data. The Classification, Labeling, and Packaging (CLP) Regulation ensures proper hazard communication for neopentane products.

In Asia, countries like China and Japan have their own regulatory frameworks. China's Ministry of Ecology and Environment oversees environmental regulations related to neopentane production and use. Japan's Chemical Substances Control Law (CSCL) governs the manufacture, import, and use of neopentane.

Regulatory compliance often necessitates significant investments in safety equipment, monitoring systems, and personnel training. This can create barriers to entry for new market players and influence the competitive landscape of the neopentane industry.

Environmental regulations, particularly those aimed at reducing greenhouse gas emissions and promoting sustainable practices, are driving innovation in neopentane production and application. Companies are increasingly focusing on developing eco-friendly alternatives and improving production efficiency to meet regulatory requirements.

The evolving regulatory landscape also impacts international trade of neopentane products. Differences in regulations between countries can create trade barriers or opportunities, depending on how well companies adapt to varying compliance requirements.

As environmental concerns grow, regulatory bodies are likely to impose stricter controls on neopentane production, storage, and use. This trend may accelerate the development of alternative products or technologies, potentially reshaping the market dynamics of the neopentane industry in the coming years.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!