Benchmark Conformal Coating Application Costs and Results

SEP 17, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Conformal Coating Technology Background and Objectives

Conformal coating technology has evolved significantly over the past five decades, transitioning from simple protective layers to sophisticated engineered materials with multiple functionalities. Originally developed for military and aerospace applications in the 1960s, these coatings were designed to protect electronic assemblies from harsh environmental conditions including moisture, dust, chemicals, and temperature extremes. The technology has since expanded into numerous commercial and industrial applications, becoming a critical component in ensuring the reliability and longevity of electronic devices across various sectors.

The evolution of conformal coating materials has progressed from basic acrylic and epoxy formulations to advanced silicone, polyurethane, and parylene variants, each offering specific performance characteristics suited to different operating environments. Recent advancements have focused on developing coatings with enhanced properties such as flame retardancy, thermal conductivity, and electromagnetic interference (EMI) shielding capabilities, reflecting the increasing complexity of electronic systems and their deployment in more demanding environments.

Application methodologies have similarly advanced, moving from manual brushing and dipping processes to automated spray systems, selective coating robots, and vapor deposition techniques. This technological progression has been driven by the miniaturization of electronic components, increasing circuit densities, and the need for more precise, consistent coating application with minimal material waste.

The primary objective of benchmarking conformal coating application costs and results is to establish industry standards and best practices that optimize the balance between protection performance and economic efficiency. This involves comprehensive evaluation of material costs, application equipment investments, process cycle times, labor requirements, quality metrics, and long-term reliability outcomes across different coating technologies and application methods.

Additionally, this benchmarking aims to quantify the relationship between coating thickness, coverage uniformity, and protective performance to determine optimal application parameters for various operating environments and reliability requirements. Understanding these relationships is crucial for developing cost-effective coating strategies that meet specific product performance needs without unnecessary expenditure.

In the context of increasing global competition and pressure to reduce manufacturing costs while maintaining or improving product reliability, this benchmarking effort seeks to identify opportunities for process optimization, material selection improvements, and application technology advancements that can deliver superior protection at competitive costs. The findings will guide future research directions and investment decisions in conformal coating technologies, supporting the industry's continuous improvement efforts.

The evolution of conformal coating materials has progressed from basic acrylic and epoxy formulations to advanced silicone, polyurethane, and parylene variants, each offering specific performance characteristics suited to different operating environments. Recent advancements have focused on developing coatings with enhanced properties such as flame retardancy, thermal conductivity, and electromagnetic interference (EMI) shielding capabilities, reflecting the increasing complexity of electronic systems and their deployment in more demanding environments.

Application methodologies have similarly advanced, moving from manual brushing and dipping processes to automated spray systems, selective coating robots, and vapor deposition techniques. This technological progression has been driven by the miniaturization of electronic components, increasing circuit densities, and the need for more precise, consistent coating application with minimal material waste.

The primary objective of benchmarking conformal coating application costs and results is to establish industry standards and best practices that optimize the balance between protection performance and economic efficiency. This involves comprehensive evaluation of material costs, application equipment investments, process cycle times, labor requirements, quality metrics, and long-term reliability outcomes across different coating technologies and application methods.

Additionally, this benchmarking aims to quantify the relationship between coating thickness, coverage uniformity, and protective performance to determine optimal application parameters for various operating environments and reliability requirements. Understanding these relationships is crucial for developing cost-effective coating strategies that meet specific product performance needs without unnecessary expenditure.

In the context of increasing global competition and pressure to reduce manufacturing costs while maintaining or improving product reliability, this benchmarking effort seeks to identify opportunities for process optimization, material selection improvements, and application technology advancements that can deliver superior protection at competitive costs. The findings will guide future research directions and investment decisions in conformal coating technologies, supporting the industry's continuous improvement efforts.

Market Analysis of Conformal Coating Applications

The global conformal coating market has experienced significant growth in recent years, driven primarily by the increasing demand for electronic components across various industries. As of 2023, the market is valued at approximately 1.2 billion USD, with projections indicating a compound annual growth rate (CAGR) of 5.8% through 2028. This growth trajectory is largely attributed to the expanding electronics manufacturing sector, particularly in regions like Asia-Pacific and North America.

The automotive industry represents the largest application segment for conformal coatings, accounting for roughly 32% of the total market share. This dominance stems from the growing integration of electronic systems in modern vehicles and the need to protect these components from harsh operating environments. The consumer electronics sector follows closely behind at 28%, driven by the proliferation of smartphones, tablets, and wearable devices that require protection against moisture, dust, and chemical contaminants.

Aerospace and defense applications constitute about 18% of the market, where conformal coatings are essential for ensuring the reliability of mission-critical electronic systems operating in extreme conditions. The medical device industry, representing approximately 12% of the market, has shown the fastest growth rate at 7.2% annually, reflecting the increasing miniaturization and complexity of medical electronics.

Regionally, Asia-Pacific dominates the conformal coating market with a 45% share, primarily due to the concentration of electronics manufacturing facilities in countries like China, Japan, South Korea, and Taiwan. North America accounts for 28% of the market, while Europe represents 22%, with both regions showing steady growth driven by automotive and aerospace applications.

From a materials perspective, acrylic conformal coatings lead the market with a 35% share due to their cost-effectiveness and ease of application. Silicone coatings follow at 25%, valued for their excellent thermal stability and flexibility. Polyurethane coatings represent 20% of the market, while epoxy and parylene coatings account for 12% and 8% respectively, with parylene showing the highest price premium due to its superior barrier properties.

Application methods significantly impact both costs and performance results. Spray coating remains the most widely used method (40% market share), offering a balance between cost and coverage quality. Dipping processes account for 25% of applications, while selective coating represents 20%. Emerging technologies like automated selective coating systems are gaining traction, promising to reduce material waste by up to 30% while improving application precision.

The automotive industry represents the largest application segment for conformal coatings, accounting for roughly 32% of the total market share. This dominance stems from the growing integration of electronic systems in modern vehicles and the need to protect these components from harsh operating environments. The consumer electronics sector follows closely behind at 28%, driven by the proliferation of smartphones, tablets, and wearable devices that require protection against moisture, dust, and chemical contaminants.

Aerospace and defense applications constitute about 18% of the market, where conformal coatings are essential for ensuring the reliability of mission-critical electronic systems operating in extreme conditions. The medical device industry, representing approximately 12% of the market, has shown the fastest growth rate at 7.2% annually, reflecting the increasing miniaturization and complexity of medical electronics.

Regionally, Asia-Pacific dominates the conformal coating market with a 45% share, primarily due to the concentration of electronics manufacturing facilities in countries like China, Japan, South Korea, and Taiwan. North America accounts for 28% of the market, while Europe represents 22%, with both regions showing steady growth driven by automotive and aerospace applications.

From a materials perspective, acrylic conformal coatings lead the market with a 35% share due to their cost-effectiveness and ease of application. Silicone coatings follow at 25%, valued for their excellent thermal stability and flexibility. Polyurethane coatings represent 20% of the market, while epoxy and parylene coatings account for 12% and 8% respectively, with parylene showing the highest price premium due to its superior barrier properties.

Application methods significantly impact both costs and performance results. Spray coating remains the most widely used method (40% market share), offering a balance between cost and coverage quality. Dipping processes account for 25% of applications, while selective coating represents 20%. Emerging technologies like automated selective coating systems are gaining traction, promising to reduce material waste by up to 30% while improving application precision.

Current Challenges in Conformal Coating Technologies

The conformal coating industry faces several significant technical challenges that impact both application costs and performance results. These challenges stem from evolving electronic design requirements, environmental regulations, and manufacturing efficiency demands.

Material limitations represent a primary obstacle in the field. Traditional coating materials such as acrylics, silicones, and polyurethanes each present distinct disadvantages. Acrylics offer limited chemical resistance, silicones suffer from adhesion issues, while polyurethanes demonstrate poor reworkability. These material constraints directly affect coating performance in harsh environments and can significantly increase maintenance costs over product lifecycles.

Application precision challenges persist across the industry. As electronic components continue to miniaturize, selective coating becomes increasingly difficult. Current automated systems struggle with complex board geometries and high-density component layouts. This results in coating material waste, inconsistent coverage, and potential reliability issues. Industry data indicates that precision errors account for approximately 15-20% of coating defects in high-volume manufacturing environments.

Curing technology limitations present another substantial hurdle. UV-curable coatings offer rapid processing but struggle with shadow areas where components block light exposure. Thermal curing methods consume significant energy and floor space while potentially subjecting sensitive components to thermal stress. Moisture-cure systems, while effective, introduce unpredictable curing times dependent on ambient conditions.

Quality control and inspection methodologies remain inadequate for modern manufacturing needs. Current inspection techniques often rely on visual assessment under UV light or basic thickness measurements, which cannot reliably detect microcracks, delamination, or incomplete coverage in complex assemblies. This inspection gap leads to field failures and warranty claims that could otherwise be prevented.

Environmental and regulatory pressures continue to intensify. VOC emissions from solvent-based coatings face increasingly strict regulations worldwide. While water-based alternatives exist, they typically demonstrate inferior performance characteristics and longer curing times. The industry must balance environmental compliance with performance requirements.

Cost-effectiveness remains elusive across the conformal coating ecosystem. Equipment investments for automated application systems range from $50,000 to over $500,000, creating significant barriers to entry for smaller manufacturers. Operational costs including material waste, energy consumption, and quality control further impact total application costs, which can range from $0.10 to $5.00 per board depending on complexity and volume.

Material limitations represent a primary obstacle in the field. Traditional coating materials such as acrylics, silicones, and polyurethanes each present distinct disadvantages. Acrylics offer limited chemical resistance, silicones suffer from adhesion issues, while polyurethanes demonstrate poor reworkability. These material constraints directly affect coating performance in harsh environments and can significantly increase maintenance costs over product lifecycles.

Application precision challenges persist across the industry. As electronic components continue to miniaturize, selective coating becomes increasingly difficult. Current automated systems struggle with complex board geometries and high-density component layouts. This results in coating material waste, inconsistent coverage, and potential reliability issues. Industry data indicates that precision errors account for approximately 15-20% of coating defects in high-volume manufacturing environments.

Curing technology limitations present another substantial hurdle. UV-curable coatings offer rapid processing but struggle with shadow areas where components block light exposure. Thermal curing methods consume significant energy and floor space while potentially subjecting sensitive components to thermal stress. Moisture-cure systems, while effective, introduce unpredictable curing times dependent on ambient conditions.

Quality control and inspection methodologies remain inadequate for modern manufacturing needs. Current inspection techniques often rely on visual assessment under UV light or basic thickness measurements, which cannot reliably detect microcracks, delamination, or incomplete coverage in complex assemblies. This inspection gap leads to field failures and warranty claims that could otherwise be prevented.

Environmental and regulatory pressures continue to intensify. VOC emissions from solvent-based coatings face increasingly strict regulations worldwide. While water-based alternatives exist, they typically demonstrate inferior performance characteristics and longer curing times. The industry must balance environmental compliance with performance requirements.

Cost-effectiveness remains elusive across the conformal coating ecosystem. Equipment investments for automated application systems range from $50,000 to over $500,000, creating significant barriers to entry for smaller manufacturers. Operational costs including material waste, energy consumption, and quality control further impact total application costs, which can range from $0.10 to $5.00 per board depending on complexity and volume.

Cost-Benefit Analysis of Current Coating Solutions

01 Cost-effective conformal coating application methods

Various application methods can significantly impact the cost-effectiveness of conformal coating processes. Techniques such as spray coating, dip coating, and selective coating offer different balances between material usage, equipment investment, and labor costs. Automated systems can reduce labor costs and improve consistency, while selective coating technologies minimize material waste by precisely targeting areas requiring protection. The choice of application method should consider production volume, required coating precision, and available infrastructure.- Cost-effective conformal coating application methods: Various application methods can significantly impact the cost-effectiveness of conformal coating processes. Techniques such as spray coating, dip coating, and selective coating offer different balances between material usage, equipment investment, and labor costs. Automated systems generally provide higher throughput and consistency compared to manual application, reducing long-term operational costs despite higher initial investment. The selection of application method should consider production volume, required coating precision, and component geometry to optimize cost efficiency.

- Material selection impact on coating performance and cost: The choice of conformal coating material significantly affects both performance outcomes and overall costs. Acrylic, silicone, polyurethane, epoxy, and parylene coatings each offer distinct protection levels, application requirements, and price points. While some materials like silicone provide excellent moisture and temperature resistance at higher costs, others like acrylics offer more economical solutions with adequate protection for less demanding environments. Material selection should balance protection requirements against budget constraints, considering factors such as curing time, reworkability, and environmental compliance.

- Protection effectiveness against environmental factors: Conformal coatings provide varying degrees of protection against environmental stressors including moisture, dust, chemicals, and temperature fluctuations. The effectiveness of protection directly correlates with coating thickness, material properties, and application quality. Testing results show that properly applied coatings can significantly extend electronic component lifespan in harsh environments, with some formulations providing protection in extreme conditions such as submersion or chemical exposure. Enhanced protection generally requires more specialized coating materials and application processes, resulting in higher costs but potentially lower failure rates and maintenance expenses.

- Process optimization for improved yield and reduced costs: Optimizing the conformal coating process can substantially improve yield rates while reducing material waste and processing time. Key optimization areas include surface preparation techniques, masking methods, coating thickness control, and curing parameters. Automated inspection systems help ensure coating quality while minimizing rework. Process refinements such as precise viscosity control, temperature management during application and curing, and fixture design can significantly impact coating uniformity and adhesion. Implementing statistical process control methods enables continuous improvement of coating operations, balancing quality requirements with cost constraints.

- Emerging technologies and cost-benefit analysis: New conformal coating technologies offer potential advantages in performance, environmental impact, and total cost of ownership. Developments include UV-curable formulations with rapid processing times, nano-enhanced coatings with improved protection characteristics, and water-based solutions with reduced VOC emissions. While these advanced technologies often carry premium pricing, their benefits may include faster production cycles, reduced energy consumption, longer component life, and lower warranty claims. A comprehensive cost-benefit analysis should consider not only immediate material and application costs but also long-term reliability improvements, regulatory compliance advantages, and potential reductions in field failures.

02 Material selection impact on coating performance and cost

The selection of conformal coating materials significantly affects both cost and performance outcomes. Acrylic, silicone, polyurethane, epoxy, and parylene coatings each offer different protection levels, application requirements, and price points. Material properties such as dielectric strength, moisture resistance, chemical resistance, and temperature stability must be balanced against material costs. Higher-performance materials typically command premium prices but may reduce long-term failure rates and warranty claims, potentially offering better total cost of ownership despite higher initial investment.Expand Specific Solutions03 Environmental and regulatory compliance considerations

Environmental regulations and compliance requirements significantly impact conformal coating costs and processes. The transition from solvent-based to water-based or UV-curable coatings may require process modifications and equipment investments but can reduce environmental compliance costs and workplace hazards. VOC (Volatile Organic Compound) regulations in different regions may necessitate different formulations or application methods. Proper waste management and emissions control systems represent additional cost factors that must be considered when evaluating total coating process expenses.Expand Specific Solutions04 Protection effectiveness and reliability improvements

Conformal coatings provide critical protection for electronic assemblies against moisture, dust, chemicals, and mechanical stress, directly impacting product reliability and lifespan. The effectiveness of protection correlates with coating thickness uniformity, adhesion quality, and absence of defects such as bubbles or delamination. Advanced coating formulations can offer enhanced protection against specific environmental challenges like high humidity, salt spray, or extreme temperatures. Proper surface preparation and curing processes are essential for achieving optimal protection results, with inadequate processes potentially leading to premature failures despite material investments.Expand Specific Solutions05 Testing and quality control methodologies

Comprehensive testing and quality control procedures are essential for ensuring conformal coating effectiveness while managing costs. Inspection techniques range from visual examination to advanced methods like fluorescence inspection under UV light, automated optical inspection, and cross-sectioning. Reliability testing such as thermal cycling, humidity exposure, and salt spray tests help validate coating performance under expected operating conditions. While robust testing adds to initial production costs, it reduces field failures and warranty claims. Automated inspection systems can increase initial capital expenditure but improve detection rates and reduce labor costs associated with manual inspection.Expand Specific Solutions

Leading Manufacturers and Suppliers Analysis

The conformal coating application market is currently in a growth phase, with increasing demand driven by electronics miniaturization and reliability requirements across industries. The market size is expanding steadily, projected to reach significant value as applications extend beyond traditional electronics into automotive and medical sectors. Technologically, the field shows varying maturity levels, with established players like PPG Industries, BASF, and DuPont offering conventional solutions while newer entrants such as HzO introduce innovative nano-coating technologies. Companies including Nordson and 3M are advancing application equipment and materials, while Asian manufacturers like Chugoku Marine Paints and Mitsui Chemicals are strengthening their market positions through specialized formulations. The competitive landscape features both diversified chemical conglomerates and coating specialists competing on performance, cost-efficiency, and environmental compliance.

PPG Industries Ohio, Inc.

Technical Solution: PPG has developed sophisticated benchmarking methodologies for conformal coating applications that balance performance requirements with cost optimization. Their approach includes detailed analysis of material properties, application methods, and environmental factors to determine the most cost-effective coating solutions for specific applications. PPG's conformal coating technologies include water-based formulations that reduce VOC emissions while providing excellent protection against moisture, chemicals, and thermal cycling. Their benchmarking process incorporates accelerated aging tests that correlate with real-world performance to predict long-term reliability and maintenance costs. PPG has also developed specialized cost modeling tools that account for material efficiency, application speed, energy consumption, and waste management to provide comprehensive cost comparisons across different coating technologies and application methods.

Strengths: Environmentally friendly formulations with reduced VOCs; excellent balance between performance and cost; comprehensive lifecycle cost analysis methodology. Weaknesses: Some water-based formulations may have longer cure times; performance in extreme environments may not match solvent-based alternatives in all applications.

Nordson Corp.

Technical Solution: Nordson has established industry-leading benchmarking protocols for conformal coating applications focused on precision dispensing technologies. Their automated selective coating systems feature patented closed-loop feedback mechanisms that continuously monitor and adjust coating parameters to maintain optimal material usage. Nordson's benchmarking approach integrates production metrics with financial analysis, providing detailed cost breakdowns per unit area and component type. Their technology includes vision-guided application systems that can reduce material waste by up to 30% compared to traditional methods while maintaining consistent coverage quality. Nordson's cost benchmarking tools incorporate equipment utilization rates, maintenance requirements, and production throughput to generate comprehensive ROI models for different coating technologies and application methods.

Strengths: Exceptional precision in selective coating applications; advanced vision systems for quality control; comprehensive cost modeling tools that factor in equipment utilization and maintenance. Weaknesses: Higher initial capital investment for automated systems; requires technical expertise for optimal system configuration and operation.

Key Patents and Innovations in Coating Materials

Method of conformal coating using noncontact dispensing

PatentInactiveEP1678989A1

Innovation

- A noncontact dispensing method using a jetting system that propels viscous conformal coating material through a nozzle with forward momentum to form droplets, allowing for precise control over the application of small areas and geometries without overspray, eliminating the need for masking.

Method of producing matched coating composition and device used therefor

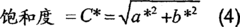

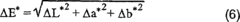

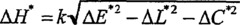

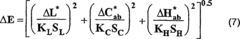

PatentInactiveCN1784592A

Innovation

- By measuring the reflectance of the target paint using a spectrophotometer, calculating its color value (L, a, b or L, C, h), selecting and optimizing the colorant combination, balancing the combination to include non-colorant components, according to the specific application Optimize combinations to produce matching coating compositions.

Environmental Compliance and Sustainability Factors

Environmental regulations and sustainability considerations have become increasingly critical factors in conformal coating processes across industries. The volatile organic compound (VOC) emissions from traditional solvent-based conformal coatings face stringent regulations in many regions, with the European Union's RoHS (Restriction of Hazardous Substances) and REACH (Registration, Evaluation, Authorization and Restriction of Chemicals) directives setting global benchmarks for compliance.

Cost analyses reveal that environmental compliance represents 8-12% of total conformal coating application costs, encompassing waste management, emission control systems, and regulatory documentation. Companies failing to meet these requirements risk substantial penalties, with fines ranging from $10,000 to over $100,000 depending on violation severity and jurisdiction.

The industry has responded with significant innovations in water-based and UV-curable coating formulations that dramatically reduce VOC emissions while maintaining performance standards. These environmentally friendly alternatives typically command a 15-25% price premium over conventional solvent-based options but offer long-term cost advantages through reduced waste disposal expenses and simplified regulatory compliance.

Energy consumption represents another critical sustainability factor, with traditional thermal curing processes requiring significant energy inputs. Benchmark data indicates that UV-curing technologies can reduce energy consumption by 60-80% compared to conventional thermal curing methods, with corresponding reductions in carbon footprint and operating costs.

Waste reduction strategies have demonstrated measurable financial benefits in conformal coating operations. Precision application technologies such as selective coating and automated spray systems can reduce material waste by 30-50% compared to manual dipping or brushing methods, simultaneously addressing both cost efficiency and environmental impact concerns.

Life cycle assessment (LCA) studies of conformal coating processes indicate that environmental optimization often aligns with economic benefits. Companies implementing comprehensive sustainability programs report average cost reductions of 7-12% over five-year implementation periods, primarily through reduced material consumption, energy savings, and streamlined compliance processes.

The market increasingly rewards environmental leadership, with OEMs in automotive, aerospace, and consumer electronics sectors establishing supplier sustainability requirements. Benchmark data shows that companies with documented sustainability programs secure 15-20% more contract opportunities in these high-value sectors compared to competitors lacking formal environmental initiatives.

Cost analyses reveal that environmental compliance represents 8-12% of total conformal coating application costs, encompassing waste management, emission control systems, and regulatory documentation. Companies failing to meet these requirements risk substantial penalties, with fines ranging from $10,000 to over $100,000 depending on violation severity and jurisdiction.

The industry has responded with significant innovations in water-based and UV-curable coating formulations that dramatically reduce VOC emissions while maintaining performance standards. These environmentally friendly alternatives typically command a 15-25% price premium over conventional solvent-based options but offer long-term cost advantages through reduced waste disposal expenses and simplified regulatory compliance.

Energy consumption represents another critical sustainability factor, with traditional thermal curing processes requiring significant energy inputs. Benchmark data indicates that UV-curing technologies can reduce energy consumption by 60-80% compared to conventional thermal curing methods, with corresponding reductions in carbon footprint and operating costs.

Waste reduction strategies have demonstrated measurable financial benefits in conformal coating operations. Precision application technologies such as selective coating and automated spray systems can reduce material waste by 30-50% compared to manual dipping or brushing methods, simultaneously addressing both cost efficiency and environmental impact concerns.

Life cycle assessment (LCA) studies of conformal coating processes indicate that environmental optimization often aligns with economic benefits. Companies implementing comprehensive sustainability programs report average cost reductions of 7-12% over five-year implementation periods, primarily through reduced material consumption, energy savings, and streamlined compliance processes.

The market increasingly rewards environmental leadership, with OEMs in automotive, aerospace, and consumer electronics sectors establishing supplier sustainability requirements. Benchmark data shows that companies with documented sustainability programs secure 15-20% more contract opportunities in these high-value sectors compared to competitors lacking formal environmental initiatives.

Quality Assurance and Testing Methodologies

Quality assurance and testing methodologies are critical components in evaluating conformal coating applications, ensuring both cost-effectiveness and performance reliability. Comprehensive testing protocols typically include visual inspection, thickness measurement, and adhesion testing as fundamental verification methods. These procedures help identify common defects such as bubbles, delamination, or insufficient coverage that could compromise the protective function of the coating.

Advanced testing methodologies incorporate environmental stress testing, including thermal cycling, humidity exposure, and salt spray tests to simulate real-world conditions. These accelerated aging tests provide valuable data on long-term performance expectations and help quantify the return on investment for different coating solutions. Industry standards such as IPC-CC-830, MIL-I-46058C, and IEC 60068 establish baseline requirements that manufacturers must meet to ensure quality and reliability.

Automated optical inspection (AOI) systems have revolutionized quality control processes by enabling high-throughput, non-destructive evaluation of coated assemblies. These systems can detect coating anomalies with precision exceeding human visual inspection capabilities, significantly reducing the risk of field failures while optimizing labor costs associated with quality control.

Electrical testing methodologies, including insulation resistance measurement and dielectric withstanding voltage tests, verify the electrical protection properties of conformal coatings. These tests are particularly important for applications in harsh environments where moisture ingress could lead to electrical failures. Surface insulation resistance (SIR) testing provides quantitative data on a coating's ability to prevent conductive path formation under humidity conditions.

Cross-sectional analysis techniques offer insights into coating penetration and coverage uniformity, especially in high-density assemblies with complex geometries. This destructive testing method, while limited to sample units, provides critical information about coating behavior in challenging areas such as under components or in tight spaces.

Cost-benefit analysis of quality assurance programs must balance the expense of comprehensive testing against the risk of field failures. Data indicates that investment in robust testing methodologies typically yields significant returns through reduced warranty claims and enhanced product reliability. Companies implementing statistical process control (SPC) in their coating operations report up to 30% reduction in quality-related costs while maintaining or improving protection performance.

Emerging technologies such as spectroscopic analysis and 3D scanning are expanding testing capabilities, offering more detailed characterization of coating properties and enabling more precise benchmarking between different application methods and materials. These advanced methodologies, while initially more expensive to implement, provide deeper insights that can drive optimization of both coating performance and application costs.

Advanced testing methodologies incorporate environmental stress testing, including thermal cycling, humidity exposure, and salt spray tests to simulate real-world conditions. These accelerated aging tests provide valuable data on long-term performance expectations and help quantify the return on investment for different coating solutions. Industry standards such as IPC-CC-830, MIL-I-46058C, and IEC 60068 establish baseline requirements that manufacturers must meet to ensure quality and reliability.

Automated optical inspection (AOI) systems have revolutionized quality control processes by enabling high-throughput, non-destructive evaluation of coated assemblies. These systems can detect coating anomalies with precision exceeding human visual inspection capabilities, significantly reducing the risk of field failures while optimizing labor costs associated with quality control.

Electrical testing methodologies, including insulation resistance measurement and dielectric withstanding voltage tests, verify the electrical protection properties of conformal coatings. These tests are particularly important for applications in harsh environments where moisture ingress could lead to electrical failures. Surface insulation resistance (SIR) testing provides quantitative data on a coating's ability to prevent conductive path formation under humidity conditions.

Cross-sectional analysis techniques offer insights into coating penetration and coverage uniformity, especially in high-density assemblies with complex geometries. This destructive testing method, while limited to sample units, provides critical information about coating behavior in challenging areas such as under components or in tight spaces.

Cost-benefit analysis of quality assurance programs must balance the expense of comprehensive testing against the risk of field failures. Data indicates that investment in robust testing methodologies typically yields significant returns through reduced warranty claims and enhanced product reliability. Companies implementing statistical process control (SPC) in their coating operations report up to 30% reduction in quality-related costs while maintaining or improving protection performance.

Emerging technologies such as spectroscopic analysis and 3D scanning are expanding testing capabilities, offering more detailed characterization of coating properties and enabling more precise benchmarking between different application methods and materials. These advanced methodologies, while initially more expensive to implement, provide deeper insights that can drive optimization of both coating performance and application costs.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!