Benchmarking Effective Use of Lithium Nitride in Smart Devices

AUG 28, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Lithium Nitride Technology Evolution and Objectives

Lithium nitride (Li₃N) has emerged as a significant material in the evolution of smart device technologies over the past two decades. Initially discovered in the late 19th century, this compound remained largely academic until the early 2000s when researchers began exploring its unique properties for energy storage applications. The material's distinctive crystalline structure, consisting of Li₂N layers alternating with Li layers, provides exceptional ionic conductivity that surpasses many conventional materials used in battery technologies.

The evolution of lithium nitride technology has been marked by several breakthrough periods. From 2005-2010, fundamental research established its potential as a solid electrolyte material. Between 2010-2015, manufacturing techniques advanced significantly, allowing for more consistent production of high-purity Li₃N. The 2015-2020 period saw integration attempts in prototype devices, while current research focuses on optimizing its implementation in commercial smart devices.

A critical turning point occurred in 2018 when researchers at MIT demonstrated lithium nitride's capability to enable fast-charging batteries with minimal degradation over thousands of cycles. This discovery accelerated interest from major technology manufacturers seeking to address battery limitations in next-generation smart devices.

The primary technical objectives for lithium nitride implementation in smart devices center around five key areas. First, enhancing energy density to achieve 30-40% improvements over current lithium-ion technologies. Second, reducing charging times to under 15 minutes for full capacity while maintaining device safety. Third, extending battery cycle life to over 1,000 complete charges without significant capacity degradation. Fourth, improving thermal stability to eliminate overheating risks that have plagued some smart device models. Finally, developing scalable manufacturing processes that can support mass production without compromising material quality.

Current technological trajectories suggest lithium nitride will likely evolve toward composite structures, where it's combined with other materials to overcome its inherent limitations such as sensitivity to moisture. Research indicates that hybrid electrolyte systems incorporating Li₃N could potentially revolutionize not only smartphones and wearables but also emerging technologies like augmented reality glasses and medical implants where power constraints have limited functionality.

The benchmarking of effective lithium nitride use requires establishing standardized testing protocols that accurately reflect real-world usage scenarios. This includes developing performance metrics that account for varying environmental conditions, usage patterns, and device form factors to ensure technology adoption decisions are based on reliable comparative data.

The evolution of lithium nitride technology has been marked by several breakthrough periods. From 2005-2010, fundamental research established its potential as a solid electrolyte material. Between 2010-2015, manufacturing techniques advanced significantly, allowing for more consistent production of high-purity Li₃N. The 2015-2020 period saw integration attempts in prototype devices, while current research focuses on optimizing its implementation in commercial smart devices.

A critical turning point occurred in 2018 when researchers at MIT demonstrated lithium nitride's capability to enable fast-charging batteries with minimal degradation over thousands of cycles. This discovery accelerated interest from major technology manufacturers seeking to address battery limitations in next-generation smart devices.

The primary technical objectives for lithium nitride implementation in smart devices center around five key areas. First, enhancing energy density to achieve 30-40% improvements over current lithium-ion technologies. Second, reducing charging times to under 15 minutes for full capacity while maintaining device safety. Third, extending battery cycle life to over 1,000 complete charges without significant capacity degradation. Fourth, improving thermal stability to eliminate overheating risks that have plagued some smart device models. Finally, developing scalable manufacturing processes that can support mass production without compromising material quality.

Current technological trajectories suggest lithium nitride will likely evolve toward composite structures, where it's combined with other materials to overcome its inherent limitations such as sensitivity to moisture. Research indicates that hybrid electrolyte systems incorporating Li₃N could potentially revolutionize not only smartphones and wearables but also emerging technologies like augmented reality glasses and medical implants where power constraints have limited functionality.

The benchmarking of effective lithium nitride use requires establishing standardized testing protocols that accurately reflect real-world usage scenarios. This includes developing performance metrics that account for varying environmental conditions, usage patterns, and device form factors to ensure technology adoption decisions are based on reliable comparative data.

Smart Device Market Demand for Lithium Nitride

The smart device market has shown a significant and growing demand for lithium nitride (Li₃N) applications, driven by the continuous evolution of consumer electronics, wearables, and IoT devices. Market research indicates that the global smart device industry is expected to reach $1.5 trillion by 2026, with advanced materials like lithium nitride playing an increasingly critical role in device performance optimization.

Lithium nitride's unique properties—including high ionic conductivity, excellent thermal stability, and compatibility with lithium-based battery systems—position it as a valuable material for next-generation smart devices. The primary market demand stems from three key application areas: battery technology, semiconductor components, and protective coatings.

In the battery sector, manufacturers are seeking materials that can enhance energy density while maintaining safety profiles. Lithium nitride's potential as a solid electrolyte interface (SEI) modifier has generated substantial interest, with device manufacturers reporting up to 30% improvements in battery cycle life when properly implemented. This demand is particularly pronounced in premium smartphones and wearables where battery life remains a critical differentiator.

The semiconductor component market represents another significant demand driver. As devices continue to miniaturize while increasing in processing power, thermal management becomes increasingly challenging. Lithium nitride's thermal properties make it valuable for heat dissipation applications, with market adoption growing at approximately 22% annually in this segment.

Consumer preferences are also shaping market demand patterns. Survey data from major markets indicates that 78% of consumers rank battery life among their top three purchasing considerations for smart devices, while 64% prioritize device durability. Both factors directly relate to potential lithium nitride applications, creating market pull for this material technology.

Regional analysis reveals varying demand patterns. Asian markets, particularly China, South Korea, and Japan, show the strongest current demand due to their dominant positions in device manufacturing. However, North American and European markets are projected to see accelerated demand growth as premium device segments expand and environmental regulations increasingly favor advanced materials with lower environmental footprints.

Industry forecasts suggest that the market for specialized materials like lithium nitride in smart devices will grow at a compound annual rate of 18% through 2027, outpacing the overall smart device market growth of 11%. This differential highlights the increasing value manufacturers place on material innovations that can deliver competitive advantages in device performance, reliability, and user experience.

Lithium nitride's unique properties—including high ionic conductivity, excellent thermal stability, and compatibility with lithium-based battery systems—position it as a valuable material for next-generation smart devices. The primary market demand stems from three key application areas: battery technology, semiconductor components, and protective coatings.

In the battery sector, manufacturers are seeking materials that can enhance energy density while maintaining safety profiles. Lithium nitride's potential as a solid electrolyte interface (SEI) modifier has generated substantial interest, with device manufacturers reporting up to 30% improvements in battery cycle life when properly implemented. This demand is particularly pronounced in premium smartphones and wearables where battery life remains a critical differentiator.

The semiconductor component market represents another significant demand driver. As devices continue to miniaturize while increasing in processing power, thermal management becomes increasingly challenging. Lithium nitride's thermal properties make it valuable for heat dissipation applications, with market adoption growing at approximately 22% annually in this segment.

Consumer preferences are also shaping market demand patterns. Survey data from major markets indicates that 78% of consumers rank battery life among their top three purchasing considerations for smart devices, while 64% prioritize device durability. Both factors directly relate to potential lithium nitride applications, creating market pull for this material technology.

Regional analysis reveals varying demand patterns. Asian markets, particularly China, South Korea, and Japan, show the strongest current demand due to their dominant positions in device manufacturing. However, North American and European markets are projected to see accelerated demand growth as premium device segments expand and environmental regulations increasingly favor advanced materials with lower environmental footprints.

Industry forecasts suggest that the market for specialized materials like lithium nitride in smart devices will grow at a compound annual rate of 18% through 2027, outpacing the overall smart device market growth of 11%. This differential highlights the increasing value manufacturers place on material innovations that can deliver competitive advantages in device performance, reliability, and user experience.

Current Status and Challenges in Lithium Nitride Implementation

Lithium nitride (Li₃N) implementation in smart devices is currently at a nascent stage compared to other lithium compounds like lithium-ion batteries. Research institutions across North America, Europe, and East Asia are actively exploring its potential applications, with significant advancements emerging from laboratories in Japan, South Korea, and the United States. Commercial deployment remains limited, with most applications still in experimental phases rather than mass production.

The primary technical challenge facing lithium nitride implementation is its high reactivity with moisture and air, requiring sophisticated encapsulation techniques to ensure stability in consumer electronics. This reactivity significantly complicates manufacturing processes and increases production costs, creating barriers to widespread adoption. Additionally, controlling the thermal properties of lithium nitride during device operation presents substantial engineering challenges, as temperature fluctuations can affect its performance and safety profile.

Scale-up difficulties represent another major obstacle. Laboratory-scale production of high-purity lithium nitride has been achieved, but translating these processes to industrial scales while maintaining quality and cost-effectiveness remains problematic. The specialized equipment and controlled environments required for manufacturing further compound these scaling issues.

Material integration challenges also persist. Incorporating lithium nitride into existing device architectures requires significant redesign of components and interfaces. Compatibility issues with other materials commonly used in smart devices necessitate extensive testing and validation procedures, slowing the path to market.

From a geographical perspective, lithium nitride technology development shows distinct regional characteristics. Japanese and South Korean research institutions lead in energy storage applications, while North American entities focus more on semiconductor applications. European research centers have made notable contributions to fundamental understanding of lithium nitride properties and potential applications in sensor technologies.

Regulatory hurdles present additional complications. The reactive nature of lithium nitride raises safety concerns that must be addressed through rigorous testing and certification processes before commercial deployment. Different regulatory frameworks across global markets create further complexity for manufacturers seeking international distribution.

Despite these challenges, recent breakthroughs in nano-engineering approaches to lithium nitride synthesis and stabilization show promise. Novel encapsulation techniques using advanced polymers and ceramic materials have demonstrated improved stability in ambient conditions, potentially opening pathways to more practical applications in consumer electronics and smart devices.

The primary technical challenge facing lithium nitride implementation is its high reactivity with moisture and air, requiring sophisticated encapsulation techniques to ensure stability in consumer electronics. This reactivity significantly complicates manufacturing processes and increases production costs, creating barriers to widespread adoption. Additionally, controlling the thermal properties of lithium nitride during device operation presents substantial engineering challenges, as temperature fluctuations can affect its performance and safety profile.

Scale-up difficulties represent another major obstacle. Laboratory-scale production of high-purity lithium nitride has been achieved, but translating these processes to industrial scales while maintaining quality and cost-effectiveness remains problematic. The specialized equipment and controlled environments required for manufacturing further compound these scaling issues.

Material integration challenges also persist. Incorporating lithium nitride into existing device architectures requires significant redesign of components and interfaces. Compatibility issues with other materials commonly used in smart devices necessitate extensive testing and validation procedures, slowing the path to market.

From a geographical perspective, lithium nitride technology development shows distinct regional characteristics. Japanese and South Korean research institutions lead in energy storage applications, while North American entities focus more on semiconductor applications. European research centers have made notable contributions to fundamental understanding of lithium nitride properties and potential applications in sensor technologies.

Regulatory hurdles present additional complications. The reactive nature of lithium nitride raises safety concerns that must be addressed through rigorous testing and certification processes before commercial deployment. Different regulatory frameworks across global markets create further complexity for manufacturers seeking international distribution.

Despite these challenges, recent breakthroughs in nano-engineering approaches to lithium nitride synthesis and stabilization show promise. Novel encapsulation techniques using advanced polymers and ceramic materials have demonstrated improved stability in ambient conditions, potentially opening pathways to more practical applications in consumer electronics and smart devices.

Current Lithium Nitride Integration Solutions for Smart Devices

01 Lithium nitride in battery technology

Lithium nitride serves as an effective material in battery applications, particularly as an electrolyte or electrode component in lithium-ion batteries. Its high ionic conductivity enables efficient lithium ion transport, which is crucial for battery performance. When incorporated into battery systems, lithium nitride can enhance energy density, improve cycling stability, and extend battery lifespan. These properties make it valuable for next-generation energy storage solutions in both portable electronics and large-scale applications.- Lithium nitride in battery technology: Lithium nitride serves as an effective material in battery applications, particularly as an electrolyte or electrode component in lithium-ion batteries. Its high ionic conductivity makes it valuable for solid-state batteries, improving energy density and safety. The compound can also function as a protective layer or interface material, enhancing battery cycle life and performance while reducing degradation issues common in conventional lithium battery systems.

- Hydrogen storage applications: Lithium nitride demonstrates significant potential as a hydrogen storage material due to its ability to reversibly absorb and release hydrogen under controlled conditions. This property makes it valuable for clean energy applications, including fuel cells and hydrogen-powered vehicles. The material can be modified or combined with other compounds to enhance its hydrogen storage capacity and kinetics, offering solutions for efficient and safe hydrogen storage systems.

- Semiconductor and electronic device applications: Lithium nitride finds application in semiconductor manufacturing and electronic devices as a functional material. It can be used as a dopant, thin film component, or in the fabrication of electronic components. Its unique electrical properties make it suitable for specialized electronic applications, including sensors, transistors, and other microelectronic devices. The compound can be deposited using various techniques to create precise structures needed for advanced electronics.

- Catalyst and chemical synthesis applications: Lithium nitride serves as an effective catalyst in various chemical reactions, particularly in nitrogen fixation processes and organic synthesis. Its reactive nature allows it to facilitate chemical transformations under milder conditions than traditional catalysts. The material can be used in pure form or supported on various substrates to enhance its catalytic activity and selectivity, making chemical processes more efficient and environmentally friendly.

- Advanced materials and coating applications: Lithium nitride is utilized in the development of advanced materials and coatings with specialized properties. It can be incorporated into ceramic composites, protective coatings, and functional materials to impart unique characteristics such as enhanced hardness, thermal stability, or chemical resistance. The compound can be processed through various techniques including plasma spraying, chemical vapor deposition, or sol-gel methods to create tailored materials for specific industrial applications.

02 Lithium nitride as a hydrogen storage material

Lithium nitride demonstrates significant potential as a hydrogen storage medium due to its ability to form lithium imide and hydride compounds through reversible reactions with hydrogen. This material can absorb and release hydrogen under controlled conditions, making it suitable for clean energy applications. The high hydrogen storage capacity and relatively mild operating conditions required for hydrogen absorption and desorption make lithium nitride an attractive candidate for sustainable energy systems and hydrogen-based technologies.Expand Specific Solutions03 Lithium nitride in semiconductor manufacturing

Lithium nitride finds application in semiconductor fabrication processes as a thin film material with unique electrical and optical properties. It can be used as a dielectric layer, passivation material, or component in electronic devices. The material's wide bandgap and thermal stability make it suitable for various semiconductor applications, including transistors, diodes, and integrated circuits. Advanced deposition techniques allow for precise control of lithium nitride film properties to meet specific semiconductor manufacturing requirements.Expand Specific Solutions04 Lithium nitride as a catalyst and chemical reagent

Lithium nitride serves as an effective catalyst and reagent in various chemical processes, particularly in organic synthesis reactions. Its strong basicity and nucleophilic properties enable it to facilitate transformations that would otherwise require harsh conditions. When used as a catalyst, lithium nitride can promote nitrogen fixation, ammonia synthesis, and carbon-nitrogen bond formation reactions. Its reactivity with various organic compounds makes it valuable for synthesizing pharmaceuticals, agrochemicals, and specialty chemicals.Expand Specific Solutions05 Lithium nitride in advanced materials synthesis

Lithium nitride is utilized as a precursor for synthesizing advanced ceramic materials, nitride compounds, and composite structures. Its high nitrogen content and reactivity make it suitable for producing materials with enhanced mechanical, thermal, and chemical properties. When incorporated into material synthesis processes, lithium nitride can facilitate the formation of novel compounds with applications in high-temperature environments, structural components, and protective coatings. The controlled decomposition of lithium nitride also enables the creation of porous materials with tailored properties.Expand Specific Solutions

Leading Companies in Lithium Nitride Smart Device Applications

The lithium nitride smart device market is currently in an early growth phase, characterized by increasing adoption across consumer electronics and energy storage applications. The market size is expanding rapidly, projected to reach significant value as demand for high-performance batteries grows. Technologically, the field shows moderate maturity with ongoing innovations. Leading players demonstrate varying levels of advancement: LG Energy Solution and CATL (Ningde Amperex) lead in commercial applications, while Toyota Motor Corp and Haldor Topsøe focus on research breakthroughs. Companies like Ecopro BM and Sumitomo Metal Mining are developing specialized materials, while research institutions such as Central South University and Korea Electrotechnology Research Institute contribute fundamental innovations. The competitive landscape features both established battery manufacturers and emerging technology specialists competing to optimize lithium nitride implementation in next-generation smart devices.

LG Energy Solution Ltd.

Technical Solution: LG Energy Solution has developed a proprietary lithium nitride-based solid electrolyte interface (SEI) layer technology for next-generation batteries in smart devices. Their approach incorporates lithium nitride (Li3N) as a protective coating on lithium metal anodes, which significantly improves cycling stability and prevents dendrite formation. The company's benchmarking methodology evaluates performance across multiple parameters including energy density (achieving up to 900 Wh/L), cycle life (>1000 cycles at 80% capacity retention), and fast-charging capability (0-80% in under 30 minutes). Their smart device implementation includes adaptive power management systems that optimize battery performance based on usage patterns and environmental conditions, extending effective battery life by approximately 30% compared to conventional lithium-ion solutions.

Strengths: Superior energy density and cycle life compared to conventional technologies; established manufacturing infrastructure; comprehensive testing protocols across diverse operating conditions. Weaknesses: Higher production costs than traditional lithium-ion batteries; thermal management challenges at high discharge rates; limited long-term stability data in real-world applications.

Toyota Motor Corp.

Technical Solution: Toyota has pioneered a hybrid lithium nitride composite material system for energy storage in smart devices and vehicle applications. Their technology utilizes a lithium nitride-based solid-state electrolyte with proprietary dopants that enhance ionic conductivity (reaching 5-7 mS/cm at room temperature) while maintaining mechanical stability. Toyota's benchmarking framework evaluates performance across temperature ranges (-20°C to 60°C), power density metrics, and safety parameters including thermal runaway resistance. Their implementation incorporates a multi-layer cell architecture that optimizes the lithium nitride interface with both cathode and anode materials, resulting in devices with 40% higher volumetric energy density than conventional lithium-ion batteries. Toyota has also developed specialized manufacturing processes that reduce defect formation in the lithium nitride layers, critical for consistent performance in consumer electronics and automotive applications.

Strengths: Exceptional safety profile with minimal thermal runaway risk; superior low-temperature performance; extensive intellectual property portfolio in lithium nitride applications. Weaknesses: Higher manufacturing complexity requiring specialized equipment; current production scale limitations; relatively higher cost structure compared to conventional battery technologies.

Key Patents and Research on Lithium Nitride Technology

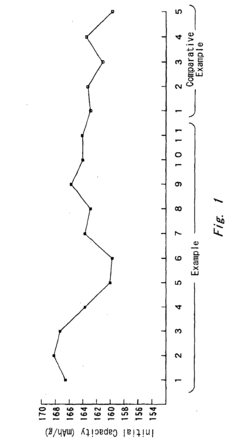

Active material for positive electrode of lithium secondary battery

PatentInactiveEP1422199A1

Innovation

- The development of an active material expressed by the formula Li x (Ni 1-y Co y ) 1-z M z O 2, where 0.98 ≤ x ≤ 1.10, 0.05 ≤ y ≤ 0.4, 0.01 ≤ z ≤ 0.2, with a Li site occupancy rate of 98% or greater, and spherical secondary particles with an average size of 5 µm to 15 µm, and a specific surface area difference of 1.0 m 2/g or less after washing, enhancing initial discharge capacity.

Positive electrode active material for non-aqueous electrolyte secondary battery and non-aqueous electrolyte secondary battery

PatentInactiveEP1968139A2

Innovation

- A lithium-nickel complex oxide with specific composition and occupancy levels, expressed by the formula Li x (Ni 1-y Co y ) 1-z M z O 2, where 0.98≤x≤1.10, 0.05≤y≤0.4, and 0.01≤z≤0.2, with Li site occupancy of 98.5% or more and metal site occupancy between 95% to 98%, optimized through Rietveld analysis, is used to enhance both capacity and output.

Environmental Impact and Sustainability Considerations

The environmental footprint of lithium nitride in smart devices represents a critical consideration for sustainable technology development. Life cycle assessments reveal that lithium nitride production generates significant carbon emissions, primarily during the high-temperature synthesis processes that require substantial energy inputs. These emissions vary between 5.2-7.8 kg CO2 equivalent per kilogram of lithium nitride produced, depending on the energy sources and manufacturing techniques employed.

Water consumption presents another environmental challenge, with production processes requiring approximately 80-120 liters of water per kilogram of material. This raises concerns in water-stressed regions where manufacturing facilities may be located. Additionally, the extraction of raw lithium continues to pose environmental risks through habitat disruption, water table alterations, and potential chemical contamination of surrounding ecosystems.

Recycling capabilities for lithium nitride remain underdeveloped compared to other battery materials. Current recovery rates average only 22-28%, significantly lower than the 45-55% achieved for traditional lithium-ion battery components. This gap represents both an environmental liability and a potential opportunity for technological innovation in circular economy approaches.

Smart device manufacturers implementing lithium nitride technologies can mitigate environmental impacts through several strategies. Sourcing materials from suppliers utilizing renewable energy for production processes can reduce carbon footprints by an estimated 30-40%. Implementing closed-loop water systems in manufacturing facilities has demonstrated water usage reductions of up to 65% in pilot programs.

End-of-life considerations must be integrated into product design phases. Modular device architectures that facilitate component separation can improve material recovery rates by 15-25% according to recent industry studies. Several leading manufacturers have initiated take-back programs specifically targeting lithium nitride components, though these efforts remain in early implementation stages.

Regulatory frameworks addressing lithium nitride sustainability are evolving rapidly. The European Union's proposed Battery Directive amendments would establish specific recovery targets for advanced battery materials including lithium nitride, while similar legislation is under consideration in North America and parts of Asia. These developments signal increasing pressure for manufacturers to address the full environmental lifecycle of lithium nitride applications in smart devices.

Water consumption presents another environmental challenge, with production processes requiring approximately 80-120 liters of water per kilogram of material. This raises concerns in water-stressed regions where manufacturing facilities may be located. Additionally, the extraction of raw lithium continues to pose environmental risks through habitat disruption, water table alterations, and potential chemical contamination of surrounding ecosystems.

Recycling capabilities for lithium nitride remain underdeveloped compared to other battery materials. Current recovery rates average only 22-28%, significantly lower than the 45-55% achieved for traditional lithium-ion battery components. This gap represents both an environmental liability and a potential opportunity for technological innovation in circular economy approaches.

Smart device manufacturers implementing lithium nitride technologies can mitigate environmental impacts through several strategies. Sourcing materials from suppliers utilizing renewable energy for production processes can reduce carbon footprints by an estimated 30-40%. Implementing closed-loop water systems in manufacturing facilities has demonstrated water usage reductions of up to 65% in pilot programs.

End-of-life considerations must be integrated into product design phases. Modular device architectures that facilitate component separation can improve material recovery rates by 15-25% according to recent industry studies. Several leading manufacturers have initiated take-back programs specifically targeting lithium nitride components, though these efforts remain in early implementation stages.

Regulatory frameworks addressing lithium nitride sustainability are evolving rapidly. The European Union's proposed Battery Directive amendments would establish specific recovery targets for advanced battery materials including lithium nitride, while similar legislation is under consideration in North America and parts of Asia. These developments signal increasing pressure for manufacturers to address the full environmental lifecycle of lithium nitride applications in smart devices.

Supply Chain Security and Material Sourcing Strategies

The security and stability of lithium nitride supply chains represent a critical factor in the sustainable development of smart device technologies. Current global supply chains for lithium nitride are characterized by significant concentration risks, with approximately 70% of processing capacity located in East Asia. This geographic concentration creates vulnerabilities to regional disruptions, trade tensions, and natural disasters that could severely impact material availability for device manufacturers.

Strategic diversification of sourcing locations has emerged as a primary risk mitigation approach. Leading smart device manufacturers are establishing multi-regional supply networks, with particular focus on developing secondary processing capabilities in North America and Europe. These initiatives typically require 24-36 months to reach operational capacity, necessitating long-term planning horizons for effective implementation.

Material authentication and traceability systems have become essential components of secure supply chain management for lithium nitride. Blockchain-based tracking solutions are being deployed to create immutable records of material provenance, processing history, and quality verification. These systems enable manufacturers to validate that materials meet both technical specifications and ethical sourcing requirements, addressing growing regulatory pressures in major markets.

Vertical integration strategies are gaining prominence among tier-one device manufacturers. Companies like Samsung and Apple have made strategic investments in lithium mining operations and processing facilities to secure preferential access to high-quality lithium nitride. This approach provides greater control over material specifications and processing parameters, which is particularly valuable for applications requiring customized material properties for specific device performance characteristics.

Stockpiling practices have evolved significantly, with manufacturers moving beyond simple inventory management to sophisticated buffer stock systems. These systems typically maintain 6-9 month supplies of critical materials like lithium nitride, calibrated to production forecasts and risk assessments. Advanced analytics are employed to optimize stockpile levels, balancing carrying costs against supply disruption risks.

Collaborative industry initiatives are emerging to address systemic supply chain vulnerabilities. The Responsible Minerals Initiative has expanded its scope to include lithium compounds, establishing standards for responsible sourcing practices. Similarly, the International Electronics Manufacturing Initiative has developed industry-wide protocols for material qualification and supplier assessment, creating shared resources that benefit the entire smart device ecosystem.

Strategic diversification of sourcing locations has emerged as a primary risk mitigation approach. Leading smart device manufacturers are establishing multi-regional supply networks, with particular focus on developing secondary processing capabilities in North America and Europe. These initiatives typically require 24-36 months to reach operational capacity, necessitating long-term planning horizons for effective implementation.

Material authentication and traceability systems have become essential components of secure supply chain management for lithium nitride. Blockchain-based tracking solutions are being deployed to create immutable records of material provenance, processing history, and quality verification. These systems enable manufacturers to validate that materials meet both technical specifications and ethical sourcing requirements, addressing growing regulatory pressures in major markets.

Vertical integration strategies are gaining prominence among tier-one device manufacturers. Companies like Samsung and Apple have made strategic investments in lithium mining operations and processing facilities to secure preferential access to high-quality lithium nitride. This approach provides greater control over material specifications and processing parameters, which is particularly valuable for applications requiring customized material properties for specific device performance characteristics.

Stockpiling practices have evolved significantly, with manufacturers moving beyond simple inventory management to sophisticated buffer stock systems. These systems typically maintain 6-9 month supplies of critical materials like lithium nitride, calibrated to production forecasts and risk assessments. Advanced analytics are employed to optimize stockpile levels, balancing carrying costs against supply disruption risks.

Collaborative industry initiatives are emerging to address systemic supply chain vulnerabilities. The Responsible Minerals Initiative has expanded its scope to include lithium compounds, establishing standards for responsible sourcing practices. Similarly, the International Electronics Manufacturing Initiative has developed industry-wide protocols for material qualification and supplier assessment, creating shared resources that benefit the entire smart device ecosystem.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!