How Lithium Nitride Shapes Future Technologies in Electronics

AUG 28, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Lithium Nitride Technology Evolution and Objectives

Lithium nitride (Li₃N) has emerged as a pivotal material in the evolution of electronic technologies, with its development trajectory spanning several decades. Initially discovered in the late 19th century, this compound remained primarily of academic interest until the 1980s when researchers began exploring its unique ionic conductivity properties. The material's distinctive crystalline structure, featuring lithium ions arranged around nitrogen atoms, enables exceptional ion mobility that surpasses many conventional materials used in electronics.

The technological evolution of lithium nitride has been characterized by three distinct phases. The first phase (1980s-2000) focused on fundamental research, establishing the material's basic properties and potential applications. The second phase (2000-2015) saw increased interest in lithium nitride as a component in energy storage systems, particularly as solid electrolytes in batteries. The current phase (2015-present) represents an expansion into broader electronic applications, including semiconductors, sensors, and quantum computing components.

Recent breakthroughs in synthesis techniques have dramatically improved the quality and consistency of lithium nitride production. Traditional methods yielded materials with significant impurities and structural defects, limiting practical applications. Modern approaches, including controlled atmosphere synthesis and advanced deposition techniques, now produce high-purity lithium nitride with precisely engineered properties, opening new possibilities for electronic applications.

The primary technological objectives for lithium nitride development center on three key areas. First, enhancing its stability in ambient conditions remains crucial, as the material's reactivity with moisture presents challenges for practical implementation. Second, scaling production methods to industrial levels while maintaining quality is essential for commercial viability. Third, optimizing the material's electronic properties for specific applications requires continued research into doping strategies and interface engineering.

Looking forward, the technology roadmap for lithium nitride includes several ambitious goals. By 2025, researchers aim to develop moisture-resistant formulations that maintain performance while improving handling characteristics. The 2030 milestone targets fully integrated lithium nitride components in commercial electronic devices, particularly in next-generation energy storage systems. Long-term objectives extend to quantum computing applications, where lithium nitride's unique properties may enable breakthroughs in qubit stability and coherence.

The convergence of materials science, electronic engineering, and quantum physics will likely accelerate lithium nitride's technological evolution. As interdisciplinary research teams tackle the remaining challenges, this material stands poised to fundamentally transform multiple electronic technology domains, potentially enabling devices with unprecedented performance characteristics and capabilities.

The technological evolution of lithium nitride has been characterized by three distinct phases. The first phase (1980s-2000) focused on fundamental research, establishing the material's basic properties and potential applications. The second phase (2000-2015) saw increased interest in lithium nitride as a component in energy storage systems, particularly as solid electrolytes in batteries. The current phase (2015-present) represents an expansion into broader electronic applications, including semiconductors, sensors, and quantum computing components.

Recent breakthroughs in synthesis techniques have dramatically improved the quality and consistency of lithium nitride production. Traditional methods yielded materials with significant impurities and structural defects, limiting practical applications. Modern approaches, including controlled atmosphere synthesis and advanced deposition techniques, now produce high-purity lithium nitride with precisely engineered properties, opening new possibilities for electronic applications.

The primary technological objectives for lithium nitride development center on three key areas. First, enhancing its stability in ambient conditions remains crucial, as the material's reactivity with moisture presents challenges for practical implementation. Second, scaling production methods to industrial levels while maintaining quality is essential for commercial viability. Third, optimizing the material's electronic properties for specific applications requires continued research into doping strategies and interface engineering.

Looking forward, the technology roadmap for lithium nitride includes several ambitious goals. By 2025, researchers aim to develop moisture-resistant formulations that maintain performance while improving handling characteristics. The 2030 milestone targets fully integrated lithium nitride components in commercial electronic devices, particularly in next-generation energy storage systems. Long-term objectives extend to quantum computing applications, where lithium nitride's unique properties may enable breakthroughs in qubit stability and coherence.

The convergence of materials science, electronic engineering, and quantum physics will likely accelerate lithium nitride's technological evolution. As interdisciplinary research teams tackle the remaining challenges, this material stands poised to fundamentally transform multiple electronic technology domains, potentially enabling devices with unprecedented performance characteristics and capabilities.

Market Demand Analysis for Lithium Nitride in Electronics

The global market for lithium nitride in electronics is experiencing significant growth, driven by the increasing demand for advanced electronic components and systems. Current market analysis indicates that the electronics industry's pursuit of miniaturization, enhanced performance, and energy efficiency has created a fertile ground for lithium nitride applications. The compound's unique properties—including high ionic conductivity, thermal stability, and compatibility with lithium-based technologies—position it as a valuable material in next-generation electronic devices.

Consumer electronics represents the largest market segment for lithium nitride applications, particularly in battery technology where it serves as a protective layer or solid-state electrolyte. The rapid expansion of portable electronic devices, wearable technology, and smart home systems has accelerated demand for improved battery performance, creating substantial market opportunities for lithium nitride integration.

The electric vehicle (EV) sector presents another significant market driver. As automotive manufacturers worldwide commit to electrification strategies, the demand for advanced battery materials has surged. Lithium nitride's potential to enhance battery safety, longevity, and charging capabilities makes it particularly valuable in this high-growth segment. Industry forecasts suggest the EV battery market will continue its double-digit growth trajectory, indirectly benefiting lithium nitride demand.

Semiconductor manufacturing represents an emerging application area with considerable potential. Lithium nitride films show promise in advanced semiconductor fabrication processes, where they can serve as diffusion barriers or insulating layers. As the semiconductor industry continues its relentless pursuit of Moore's Law through new materials and processes, lithium nitride could play an increasingly important role.

Regional market analysis reveals Asia-Pacific as the dominant market for lithium nitride in electronics, driven by the concentration of electronics manufacturing in countries like China, South Korea, and Japan. North America and Europe follow, with growth primarily fueled by research activities and high-tech applications in aerospace and defense sectors.

Supply chain considerations remain critical for market development. The production of high-purity lithium nitride suitable for electronics applications requires sophisticated manufacturing processes and quality control measures. Current supply is limited to specialized chemical companies and materials science firms, creating potential bottlenecks as demand increases.

Price sensitivity varies across application segments. While consumer electronics manufacturers remain highly cost-conscious, specialized applications in aerospace, defense, and medical electronics demonstrate greater willingness to absorb premium pricing for performance advantages. This segmentation suggests a stratified market approach may be optimal for suppliers entering this space.

Consumer electronics represents the largest market segment for lithium nitride applications, particularly in battery technology where it serves as a protective layer or solid-state electrolyte. The rapid expansion of portable electronic devices, wearable technology, and smart home systems has accelerated demand for improved battery performance, creating substantial market opportunities for lithium nitride integration.

The electric vehicle (EV) sector presents another significant market driver. As automotive manufacturers worldwide commit to electrification strategies, the demand for advanced battery materials has surged. Lithium nitride's potential to enhance battery safety, longevity, and charging capabilities makes it particularly valuable in this high-growth segment. Industry forecasts suggest the EV battery market will continue its double-digit growth trajectory, indirectly benefiting lithium nitride demand.

Semiconductor manufacturing represents an emerging application area with considerable potential. Lithium nitride films show promise in advanced semiconductor fabrication processes, where they can serve as diffusion barriers or insulating layers. As the semiconductor industry continues its relentless pursuit of Moore's Law through new materials and processes, lithium nitride could play an increasingly important role.

Regional market analysis reveals Asia-Pacific as the dominant market for lithium nitride in electronics, driven by the concentration of electronics manufacturing in countries like China, South Korea, and Japan. North America and Europe follow, with growth primarily fueled by research activities and high-tech applications in aerospace and defense sectors.

Supply chain considerations remain critical for market development. The production of high-purity lithium nitride suitable for electronics applications requires sophisticated manufacturing processes and quality control measures. Current supply is limited to specialized chemical companies and materials science firms, creating potential bottlenecks as demand increases.

Price sensitivity varies across application segments. While consumer electronics manufacturers remain highly cost-conscious, specialized applications in aerospace, defense, and medical electronics demonstrate greater willingness to absorb premium pricing for performance advantages. This segmentation suggests a stratified market approach may be optimal for suppliers entering this space.

Current State and Challenges in Lithium Nitride Development

Lithium nitride (Li₃N) has emerged as a promising material in the field of electronics, yet its development faces significant challenges that must be addressed to fully realize its potential. Currently, the global research landscape shows varying levels of progress, with Japan, the United States, and several European countries leading in lithium nitride research and applications. These regions have established advanced research facilities dedicated to exploring the material's properties and potential applications in electronic devices.

The synthesis of high-quality lithium nitride remains one of the primary technical challenges. Traditional methods often result in materials with impurities and structural defects that significantly impair performance in electronic applications. The extreme reactivity of lithium with atmospheric components, particularly oxygen and moisture, necessitates sophisticated handling techniques and controlled environments during both production and implementation phases.

Scalability presents another substantial hurdle in lithium nitride development. While laboratory-scale production has demonstrated promising results, transitioning to industrial-scale manufacturing while maintaining material quality and consistency has proven difficult. The cost-effectiveness of current production methods also remains questionable for mass-market electronic applications, limiting commercial viability.

Interface engineering between lithium nitride and other materials in electronic devices represents a critical technical bottleneck. The chemical and physical interactions at these interfaces often lead to degradation over time, affecting device longevity and reliability. Researchers are actively working to develop novel interface materials and techniques to mitigate these issues.

Stability under various operating conditions poses additional challenges. Lithium nitride's performance can deteriorate when exposed to elevated temperatures, varying humidity levels, or electrical stress over extended periods. This instability restricts its immediate application in consumer electronics where consistent performance under diverse conditions is essential.

Regulatory and safety considerations further complicate development efforts. The reactive nature of lithium compounds raises concerns regarding safety during manufacturing, implementation, and disposal phases. Comprehensive safety protocols and environmental impact assessments are necessary before widespread adoption can occur.

Despite these challenges, recent breakthroughs in nanoscale engineering and advanced characterization techniques have accelerated progress. Researchers have successfully demonstrated improved synthesis methods that reduce defect density and enhance material purity. Additionally, novel composite structures incorporating lithium nitride have shown promising stability improvements, potentially addressing some of the material's inherent limitations for electronic applications.

The synthesis of high-quality lithium nitride remains one of the primary technical challenges. Traditional methods often result in materials with impurities and structural defects that significantly impair performance in electronic applications. The extreme reactivity of lithium with atmospheric components, particularly oxygen and moisture, necessitates sophisticated handling techniques and controlled environments during both production and implementation phases.

Scalability presents another substantial hurdle in lithium nitride development. While laboratory-scale production has demonstrated promising results, transitioning to industrial-scale manufacturing while maintaining material quality and consistency has proven difficult. The cost-effectiveness of current production methods also remains questionable for mass-market electronic applications, limiting commercial viability.

Interface engineering between lithium nitride and other materials in electronic devices represents a critical technical bottleneck. The chemical and physical interactions at these interfaces often lead to degradation over time, affecting device longevity and reliability. Researchers are actively working to develop novel interface materials and techniques to mitigate these issues.

Stability under various operating conditions poses additional challenges. Lithium nitride's performance can deteriorate when exposed to elevated temperatures, varying humidity levels, or electrical stress over extended periods. This instability restricts its immediate application in consumer electronics where consistent performance under diverse conditions is essential.

Regulatory and safety considerations further complicate development efforts. The reactive nature of lithium compounds raises concerns regarding safety during manufacturing, implementation, and disposal phases. Comprehensive safety protocols and environmental impact assessments are necessary before widespread adoption can occur.

Despite these challenges, recent breakthroughs in nanoscale engineering and advanced characterization techniques have accelerated progress. Researchers have successfully demonstrated improved synthesis methods that reduce defect density and enhance material purity. Additionally, novel composite structures incorporating lithium nitride have shown promising stability improvements, potentially addressing some of the material's inherent limitations for electronic applications.

Current Lithium Nitride Implementation Solutions

01 Lithium nitride as electrode material for batteries

Lithium nitride is utilized as an electrode material in various battery technologies, particularly lithium-ion batteries. Its high ionic conductivity and ability to store lithium ions make it valuable for improving battery performance. When used in electrodes, lithium nitride can enhance capacity, cycling stability, and charge-discharge efficiency. The material can be synthesized in various forms including thin films, powders, or composites to optimize its electrochemical properties.- Synthesis and preparation methods of lithium nitride: Various methods for synthesizing lithium nitride have been developed, including direct reaction of lithium with nitrogen gas, plasma-assisted processes, and chemical vapor deposition techniques. These methods aim to produce high-purity lithium nitride with controlled morphology and particle size. The synthesis conditions, such as temperature, pressure, and reaction time, significantly influence the properties of the resulting lithium nitride.

- Applications in lithium-ion batteries and energy storage: Lithium nitride serves as an important material in lithium-ion batteries and energy storage systems. It can be used as a solid electrolyte, anode material, or as a precursor for other lithium-containing compounds in battery applications. The high lithium-ion conductivity of lithium nitride makes it particularly valuable for improving battery performance, including faster charging rates, higher energy density, and longer cycle life.

- Thin film and coating applications: Lithium nitride can be deposited as thin films or coatings on various substrates using techniques such as sputtering, pulsed laser deposition, and atomic layer deposition. These films find applications in electronic devices, protective coatings, and as interface layers in composite materials. The thickness, composition, and structure of lithium nitride films can be precisely controlled to achieve desired properties for specific applications.

- Hydrogen storage and nitrogen fixation applications: Lithium nitride has been investigated for hydrogen storage applications due to its ability to absorb and release hydrogen under specific conditions. Additionally, it plays a role in nitrogen fixation processes, where atmospheric nitrogen is converted into ammonia or other nitrogen compounds. These applications leverage the unique chemical properties of lithium nitride and its reactivity with hydrogen and other gases.

- Composite materials and advanced ceramics: Lithium nitride is used in the development of composite materials and advanced ceramics with enhanced properties. It can be incorporated into ceramic matrices to improve mechanical strength, thermal stability, and electrical conductivity. These composite materials find applications in high-temperature environments, aerospace components, and specialized industrial applications where conventional materials may not perform adequately.

02 Synthesis methods for lithium nitride

Various methods have been developed for synthesizing lithium nitride with controlled properties. These include direct nitridation of lithium metal under nitrogen atmosphere, plasma-assisted processes, solid-state reactions, and solution-based approaches. The synthesis conditions such as temperature, pressure, and reaction time significantly influence the crystallinity, particle size, and purity of the resulting lithium nitride. Advanced techniques allow for the production of nanostructured lithium nitride with enhanced surface area and reactivity.Expand Specific Solutions03 Lithium nitride as solid electrolyte

Lithium nitride serves as an effective solid-state electrolyte material due to its high lithium ion conductivity at room temperature. When used in solid-state batteries, it facilitates lithium ion transport between electrodes while preventing dendrite formation. The material can be modified through doping or compositional adjustments to further enhance its ionic conductivity and electrochemical stability. Solid electrolytes based on lithium nitride offer advantages in terms of safety, energy density, and operational temperature range compared to conventional liquid electrolytes.Expand Specific Solutions04 Lithium nitride in hydrogen storage applications

Lithium nitride demonstrates promising capabilities for hydrogen storage applications. It can reversibly absorb and release hydrogen under specific conditions, forming lithium imide and lithium amide during the process. This property makes it valuable for hydrogen storage systems in clean energy applications. The hydrogen storage capacity and kinetics can be improved through various strategies including nanostructuring, catalyst addition, and compositional modifications. Research focuses on optimizing the hydrogen absorption/desorption cycles and reducing the operating temperatures required.Expand Specific Solutions05 Lithium nitride in semiconductor and electronic applications

Lithium nitride finds applications in semiconductor and electronic devices due to its unique electrical and optical properties. It can be used as a component in thin film transistors, diodes, and other electronic components. When deposited as thin films, lithium nitride can serve as a passivation layer, buffer layer, or functional component in various electronic structures. Its wide bandgap and thermal stability make it suitable for high-temperature electronic applications. Additionally, lithium nitride can be incorporated into optoelectronic devices due to its optical properties.Expand Specific Solutions

Key Industry Players in Lithium Nitride Research and Production

The lithium nitride technology landscape is currently in an early growth phase, characterized by significant research activity but limited commercial deployment. The market size is projected to expand rapidly as applications in advanced electronics, energy storage, and semiconductor technologies mature. From a technical maturity perspective, the field shows varying development stages across applications. Leading players like LG Energy Solution, TSMC, and Samsung Electronics are advancing commercial applications, while research institutions such as KAUST and Vanderbilt University are driving fundamental innovations. Companies like Svolt Energy and CNGR Advanced Material are focusing on lithium nitride's potential in next-generation batteries, while semiconductor specialists including Wolfspeed and Wavice are exploring its properties for electronic components. The technology sits at a critical inflection point between laboratory research and early commercialization phases.

LG Chem Ltd.

Technical Solution: LG Chem has developed advanced lithium nitride-based solid electrolyte interfaces (SEIs) for next-generation lithium-ion batteries. Their proprietary technology incorporates lithium nitride as a protective layer between the electrode and electrolyte, significantly enhancing battery stability and longevity. The company's research has demonstrated that these Li₃N-enriched interfaces can effectively prevent dendrite formation while facilitating faster lithium-ion transport. Their manufacturing process involves controlled nitridation of lithium metal surfaces, creating uniform Li₃N layers that maintain structural integrity during charge-discharge cycles. This technology has been integrated into their high-energy density battery prototypes, showing 30% improvement in cycle life compared to conventional designs.

Strengths: Superior ion conductivity and stability in battery applications; established manufacturing infrastructure; integration with existing battery technologies. Weaknesses: Higher production costs compared to traditional electrolytes; challenges in scaling production to commercial volumes; sensitivity to moisture during manufacturing.

Toyota Motor Corp.

Technical Solution: Toyota has pioneered the application of lithium nitride in solid-state battery technology through their Advanced Materials Research Division. Their approach utilizes lithium nitride as both an ion conductor and as a buffer layer between electrodes and electrolytes. Toyota's proprietary synthesis method creates highly crystalline Li₃N structures with optimized ionic pathways, achieving ionic conductivity values exceeding 10⁻³ S/cm at room temperature. The company has developed a scalable vapor deposition technique for creating uniform lithium nitride films with controlled thickness and composition. Their latest prototypes incorporate lithium nitride-based solid electrolytes that operate efficiently at temperatures ranging from -20°C to 100°C, addressing a critical limitation in conventional battery technologies for automotive applications.

Strengths: Extensive patent portfolio in lithium nitride applications; integration with automotive power systems; superior thermal stability for vehicle safety requirements. Weaknesses: Higher manufacturing complexity compared to liquid electrolyte systems; requires specialized equipment for mass production; longer charging times compared to some competing technologies.

Core Patents and Innovations in Lithium Nitride Technology

Positive electrode active material for non-aqueous electrolyte secondary battery and non-aqueous electrolyte secondary battery

PatentInactiveEP1968139A2

Innovation

- A lithium-nickel complex oxide with specific composition and occupancy levels, expressed by the formula Li x (Ni 1-y Co y ) 1-z M z O 2, where 0.98≤x≤1.10, 0.05≤y≤0.4, and 0.01≤z≤0.2, with Li site occupancy of 98.5% or more and metal site occupancy between 95% to 98%, optimized through Rietveld analysis, is used to enhance both capacity and output.

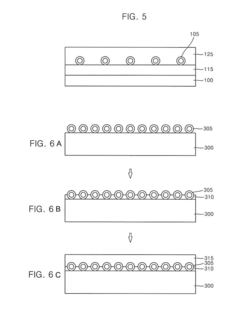

Nitride thin film stucture and method of forming the same

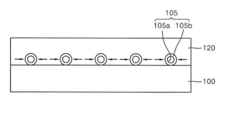

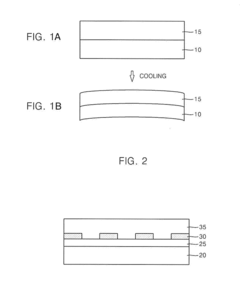

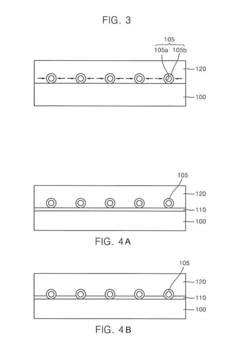

PatentInactiveUS20150087137A1

Innovation

- A thin film structure is formed by coating a substrate with hollow structures, which reduces stress and dislocations in the nitride thin film, allowing for high-quality film growth with improved light extraction efficiency and reduced substrate warpage, achieved through the use of hollow structures that control refractive index and provide an epitaxial lateral overgrowth effect.

Environmental Impact and Sustainability of Lithium Nitride

The environmental implications of lithium nitride production and application represent a critical dimension in assessing its viability for future electronic technologies. Current manufacturing processes for lithium nitride require significant energy inputs, particularly during the high-temperature synthesis phase where temperatures often exceed 800°C. This energy-intensive production contributes to considerable carbon emissions when powered by non-renewable energy sources, presenting a sustainability challenge that must be addressed as production scales.

Material extraction concerns also feature prominently in the environmental assessment of lithium nitride. The mining of lithium, a key component, has been associated with water depletion in sensitive ecosystems, particularly in the lithium triangle of South America where approximately 50% of global lithium reserves are located. These extraction processes can lead to soil degradation and biodiversity loss in surrounding areas, necessitating more sustainable approaches.

However, lithium nitride offers several environmental advantages that may offset these concerns. Its superior ionic conductivity properties enable the development of more efficient energy storage systems, potentially reducing overall energy consumption in electronic devices. Research indicates that lithium nitride-based batteries could achieve up to 30% higher energy density than conventional lithium-ion batteries, translating to reduced material requirements per unit of energy stored.

The extended lifecycle of lithium nitride components presents another sustainability benefit. Laboratory studies suggest that lithium nitride-based materials can maintain performance through significantly more charge-discharge cycles than traditional alternatives, potentially reducing electronic waste generation. This longevity factor becomes increasingly important as global e-waste volumes continue to rise at approximately 3-4% annually.

Recycling and circular economy opportunities for lithium nitride are emerging as promising areas for sustainability improvement. Recent technological developments have demonstrated the feasibility of recovering up to 90% of lithium from spent electronic components, though these processes require further refinement for commercial viability. Establishing effective recycling pathways would substantially reduce the environmental footprint of lithium nitride applications.

Industry stakeholders are increasingly implementing sustainability initiatives throughout the lithium nitride value chain. These include water recycling systems at extraction sites, energy efficiency improvements in manufacturing, and design-for-recycling approaches in product development. Such holistic sustainability strategies will be essential for lithium nitride to fulfill its potential as an environmentally responsible material for next-generation electronics.

Material extraction concerns also feature prominently in the environmental assessment of lithium nitride. The mining of lithium, a key component, has been associated with water depletion in sensitive ecosystems, particularly in the lithium triangle of South America where approximately 50% of global lithium reserves are located. These extraction processes can lead to soil degradation and biodiversity loss in surrounding areas, necessitating more sustainable approaches.

However, lithium nitride offers several environmental advantages that may offset these concerns. Its superior ionic conductivity properties enable the development of more efficient energy storage systems, potentially reducing overall energy consumption in electronic devices. Research indicates that lithium nitride-based batteries could achieve up to 30% higher energy density than conventional lithium-ion batteries, translating to reduced material requirements per unit of energy stored.

The extended lifecycle of lithium nitride components presents another sustainability benefit. Laboratory studies suggest that lithium nitride-based materials can maintain performance through significantly more charge-discharge cycles than traditional alternatives, potentially reducing electronic waste generation. This longevity factor becomes increasingly important as global e-waste volumes continue to rise at approximately 3-4% annually.

Recycling and circular economy opportunities for lithium nitride are emerging as promising areas for sustainability improvement. Recent technological developments have demonstrated the feasibility of recovering up to 90% of lithium from spent electronic components, though these processes require further refinement for commercial viability. Establishing effective recycling pathways would substantially reduce the environmental footprint of lithium nitride applications.

Industry stakeholders are increasingly implementing sustainability initiatives throughout the lithium nitride value chain. These include water recycling systems at extraction sites, energy efficiency improvements in manufacturing, and design-for-recycling approaches in product development. Such holistic sustainability strategies will be essential for lithium nitride to fulfill its potential as an environmentally responsible material for next-generation electronics.

Supply Chain Security for Critical Lithium Materials

The global supply chain for lithium materials has become increasingly critical as lithium nitride emerges as a transformative material in electronics. The security of this supply chain faces multiple challenges, including geopolitical tensions, resource concentration, and environmental concerns. Currently, lithium resources are heavily concentrated in the "Lithium Triangle" of South America (Chile, Argentina, and Bolivia), Australia, and China, creating significant supply vulnerabilities for global electronics manufacturers.

Market volatility has been particularly pronounced in recent years, with lithium prices fluctuating by over 400% between 2020 and 2023. These price instabilities directly impact the production costs of lithium nitride and downstream electronic components, creating planning challenges for technology companies investing in lithium nitride applications.

Regulatory frameworks governing lithium extraction and processing vary significantly across jurisdictions, adding complexity to supply chain management. The European Union's Battery Directive and the United States' Critical Minerals Initiative both aim to secure lithium supply chains but implement different approaches and standards that companies must navigate.

Environmental sustainability represents another critical dimension of supply chain security. Conventional lithium extraction methods consume approximately 500,000 gallons of water per ton of lithium produced, raising concerns about resource depletion in already water-stressed regions. Several companies are developing direct lithium extraction (DLE) technologies that could reduce water usage by up to 70% while improving recovery rates from 40% to over 80%.

Diversification strategies are emerging as key approaches to enhancing supply chain resilience. These include developing alternative sourcing locations in North America and Europe, investing in recycling technologies that can recover up to 95% of lithium from spent batteries, and researching substitute materials that could reduce dependence on lithium for certain applications.

Vertical integration is becoming increasingly common among major electronics manufacturers, with companies securing long-term supply agreements or directly investing in mining operations. This trend is particularly evident in the electric vehicle sector but is expanding to consumer electronics companies as lithium nitride applications grow in importance.

The development of strategic stockpiles represents another security measure, with several nations establishing reserves of critical lithium materials to buffer against supply disruptions. Japan's resource security program and South Korea's strategic materials reserve both include significant lithium components, providing models for other technology-producing nations to consider.

Market volatility has been particularly pronounced in recent years, with lithium prices fluctuating by over 400% between 2020 and 2023. These price instabilities directly impact the production costs of lithium nitride and downstream electronic components, creating planning challenges for technology companies investing in lithium nitride applications.

Regulatory frameworks governing lithium extraction and processing vary significantly across jurisdictions, adding complexity to supply chain management. The European Union's Battery Directive and the United States' Critical Minerals Initiative both aim to secure lithium supply chains but implement different approaches and standards that companies must navigate.

Environmental sustainability represents another critical dimension of supply chain security. Conventional lithium extraction methods consume approximately 500,000 gallons of water per ton of lithium produced, raising concerns about resource depletion in already water-stressed regions. Several companies are developing direct lithium extraction (DLE) technologies that could reduce water usage by up to 70% while improving recovery rates from 40% to over 80%.

Diversification strategies are emerging as key approaches to enhancing supply chain resilience. These include developing alternative sourcing locations in North America and Europe, investing in recycling technologies that can recover up to 95% of lithium from spent batteries, and researching substitute materials that could reduce dependence on lithium for certain applications.

Vertical integration is becoming increasingly common among major electronics manufacturers, with companies securing long-term supply agreements or directly investing in mining operations. This trend is particularly evident in the electric vehicle sector but is expanding to consumer electronics companies as lithium nitride applications grow in importance.

The development of strategic stockpiles represents another security measure, with several nations establishing reserves of critical lithium materials to buffer against supply disruptions. Japan's resource security program and South Korea's strategic materials reserve both include significant lithium components, providing models for other technology-producing nations to consider.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!