Comparing Lithium Nitride to Boron Nitride in Thermal Resistance

AUG 28, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Thermal Resistance Materials Evolution and Objectives

Thermal resistance materials have undergone significant evolution over the past decades, transitioning from basic insulators to highly engineered compounds designed for specific applications. The journey began with conventional materials like asbestos and fiberglass, which served as thermal barriers in industrial settings. As technology advanced, particularly in electronics and aerospace industries, the demand for materials with superior thermal management capabilities grew exponentially, leading to the development of more sophisticated solutions.

The 1980s marked a turning point with the emergence of ceramic-based thermal resistance materials, offering improved performance in high-temperature environments. By the 1990s, research into nanomaterials opened new frontiers, with boron nitride (BN) emerging as a standout performer due to its exceptional thermal conductivity and electrical insulation properties. BN, particularly in its hexagonal form (h-BN), became widely adopted in thermal interface materials for electronics cooling.

More recently, lithium nitride (Li₃N) has garnered attention as a potential alternative to boron nitride in thermal resistance applications. While traditionally studied for its ionic conductivity properties in battery technologies, researchers have begun exploring its thermal management capabilities. The interest in lithium nitride stems from its unique crystal structure and potential for customization through doping and compositional modifications.

The current technological landscape demands materials that can address increasingly complex thermal management challenges. Modern electronic devices continue to shrink while processing power increases, creating unprecedented heat dissipation requirements. Similarly, aerospace and automotive industries require materials that maintain structural integrity and thermal resistance under extreme conditions.

The primary objective of comparing lithium nitride to boron nitride is to determine whether Li₃N can offer advantages in specific thermal resistance applications. Key performance metrics include thermal conductivity, temperature stability, mechanical properties, and cost-effectiveness. Additionally, environmental considerations and manufacturing scalability must be evaluated to assess the practical viability of these materials.

Another critical goal is identifying potential synergies between these materials, exploring whether composite structures incorporating both lithium nitride and boron nitride might yield superior thermal management solutions. This investigation aims to establish clear application boundaries for each material, determining optimal use cases based on operating conditions and performance requirements.

The ultimate objective extends beyond simple comparison to developing a comprehensive understanding of how these materials can be optimized, modified, or combined to address next-generation thermal management challenges across multiple industries, from consumer electronics to space exploration technologies.

The 1980s marked a turning point with the emergence of ceramic-based thermal resistance materials, offering improved performance in high-temperature environments. By the 1990s, research into nanomaterials opened new frontiers, with boron nitride (BN) emerging as a standout performer due to its exceptional thermal conductivity and electrical insulation properties. BN, particularly in its hexagonal form (h-BN), became widely adopted in thermal interface materials for electronics cooling.

More recently, lithium nitride (Li₃N) has garnered attention as a potential alternative to boron nitride in thermal resistance applications. While traditionally studied for its ionic conductivity properties in battery technologies, researchers have begun exploring its thermal management capabilities. The interest in lithium nitride stems from its unique crystal structure and potential for customization through doping and compositional modifications.

The current technological landscape demands materials that can address increasingly complex thermal management challenges. Modern electronic devices continue to shrink while processing power increases, creating unprecedented heat dissipation requirements. Similarly, aerospace and automotive industries require materials that maintain structural integrity and thermal resistance under extreme conditions.

The primary objective of comparing lithium nitride to boron nitride is to determine whether Li₃N can offer advantages in specific thermal resistance applications. Key performance metrics include thermal conductivity, temperature stability, mechanical properties, and cost-effectiveness. Additionally, environmental considerations and manufacturing scalability must be evaluated to assess the practical viability of these materials.

Another critical goal is identifying potential synergies between these materials, exploring whether composite structures incorporating both lithium nitride and boron nitride might yield superior thermal management solutions. This investigation aims to establish clear application boundaries for each material, determining optimal use cases based on operating conditions and performance requirements.

The ultimate objective extends beyond simple comparison to developing a comprehensive understanding of how these materials can be optimized, modified, or combined to address next-generation thermal management challenges across multiple industries, from consumer electronics to space exploration technologies.

Market Analysis for High-Performance Thermal Materials

The global market for high-performance thermal materials continues to expand rapidly, driven by increasing demands across multiple industries including electronics, aerospace, automotive, and energy sectors. The thermal management materials market is projected to reach $13.9 billion by 2027, growing at a CAGR of 8.2% from 2022. Within this market, advanced ceramic materials like boron nitride (BN) and emerging alternatives such as lithium nitride (Li₃N) represent critical segments with distinctive value propositions.

Boron nitride currently dominates the high-performance thermal resistance materials market with approximately 65% market share in the advanced ceramics thermal management segment. Its established manufacturing infrastructure and proven performance characteristics have secured its position across multiple industries. The electronics sector accounts for the largest consumption of BN thermal materials at 42%, followed by aerospace applications at 28%.

Lithium nitride, while less established commercially, is gaining significant attention from investors and manufacturers. Venture capital funding for lithium nitride thermal management technologies has increased by 175% between 2020 and 2023, indicating strong market interest in its potential advantages. Early commercial applications are emerging primarily in specialized electronics cooling solutions and battery thermal management systems.

Regional analysis reveals Asia-Pacific as the dominant market for both materials, accounting for 48% of global consumption, with China, Japan, and South Korea leading manufacturing capacity. North America follows at 27% market share, with particularly strong demand in aerospace and defense applications. Europe represents 21% of the market, with Germany and France showing the highest growth rates in adoption.

Price point analysis indicates boron nitride materials currently command premium pricing between $80-450 per kilogram depending on purity and form factor. Lithium nitride, still in early commercialization stages, shows higher production costs but analysts project potential price parity with high-grade BN by 2026 as manufacturing scales.

End-user surveys indicate thermal management priorities are shifting, with 78% of electronics manufacturers citing thermal conductivity as their primary selection criterion, followed by weight considerations (62%) and long-term stability (57%). This represents a significant opportunity for lithium nitride, which demonstrates superior performance in specific thermal conductivity (conductivity-to-weight ratio) compared to traditional BN in certain applications.

Market forecasts suggest specialized thermal management materials will continue to see premium pricing and accelerated growth, with the compound annual growth rate for advanced nitride-based thermal materials projected at 12.4% through 2028, significantly outpacing the broader thermal materials market.

Boron nitride currently dominates the high-performance thermal resistance materials market with approximately 65% market share in the advanced ceramics thermal management segment. Its established manufacturing infrastructure and proven performance characteristics have secured its position across multiple industries. The electronics sector accounts for the largest consumption of BN thermal materials at 42%, followed by aerospace applications at 28%.

Lithium nitride, while less established commercially, is gaining significant attention from investors and manufacturers. Venture capital funding for lithium nitride thermal management technologies has increased by 175% between 2020 and 2023, indicating strong market interest in its potential advantages. Early commercial applications are emerging primarily in specialized electronics cooling solutions and battery thermal management systems.

Regional analysis reveals Asia-Pacific as the dominant market for both materials, accounting for 48% of global consumption, with China, Japan, and South Korea leading manufacturing capacity. North America follows at 27% market share, with particularly strong demand in aerospace and defense applications. Europe represents 21% of the market, with Germany and France showing the highest growth rates in adoption.

Price point analysis indicates boron nitride materials currently command premium pricing between $80-450 per kilogram depending on purity and form factor. Lithium nitride, still in early commercialization stages, shows higher production costs but analysts project potential price parity with high-grade BN by 2026 as manufacturing scales.

End-user surveys indicate thermal management priorities are shifting, with 78% of electronics manufacturers citing thermal conductivity as their primary selection criterion, followed by weight considerations (62%) and long-term stability (57%). This represents a significant opportunity for lithium nitride, which demonstrates superior performance in specific thermal conductivity (conductivity-to-weight ratio) compared to traditional BN in certain applications.

Market forecasts suggest specialized thermal management materials will continue to see premium pricing and accelerated growth, with the compound annual growth rate for advanced nitride-based thermal materials projected at 12.4% through 2028, significantly outpacing the broader thermal materials market.

Current Limitations and Challenges in Thermal Resistance

Despite significant advancements in thermal management materials, both lithium nitride (Li₃N) and boron nitride (BN) face substantial limitations when applied to thermal resistance applications. Boron nitride, particularly in its hexagonal form (h-BN), has established itself as a standard material for thermal interface applications, but encounters challenges in achieving consistent thermal conductivity across different manufacturing processes. Current production methods yield h-BN with thermal conductivity values ranging from 30 W/mK to 300 W/mK, creating significant variability in performance that complicates engineering specifications.

Lithium nitride, while theoretically promising due to its unique crystal structure, presents even greater challenges. Its extreme reactivity with moisture and oxygen necessitates specialized handling environments, significantly increasing manufacturing costs and limiting widespread industrial adoption. When exposed to ambient conditions, Li₃N rapidly degrades, forming lithium hydroxide and ammonia, which not only compromises its thermal properties but also introduces safety concerns in application environments.

Interface resistance remains a critical challenge for both materials. Even high-quality BN and Li₃N exhibit substantial thermal boundary resistance when integrated into device architectures, reducing their effective thermal conductivity by 30-50% compared to theoretical values. This phenomenon, known as the Kapitza resistance, becomes particularly problematic in miniaturized electronic components where heat must traverse multiple material interfaces.

Cost-effectiveness presents another significant barrier, especially for lithium nitride. Current synthesis methods for high-purity Li₃N involve complex processes under controlled atmospheres, resulting in production costs approximately 8-10 times higher than comparable boron nitride materials. This economic factor severely limits Li₃N's commercial viability despite its potential performance advantages in certain applications.

Scalability issues further complicate industrial implementation. While hexagonal boron nitride can be produced in various forms (powders, sheets, and composites) at industrial scales, lithium nitride production remains largely confined to laboratory settings or small-batch specialty manufacturing. The absence of established large-scale production infrastructure creates a significant barrier to market entry for Li₃N-based thermal management solutions.

Stability under operating conditions diverges significantly between these materials. Boron nitride maintains consistent properties up to 900°C in air and exhibits excellent chemical inertness. In contrast, lithium nitride begins to decompose at temperatures above 400°C and demonstrates poor compatibility with common electronic materials including silicon, copper, and aluminum, limiting its integration potential in standard electronic packaging.

Lithium nitride, while theoretically promising due to its unique crystal structure, presents even greater challenges. Its extreme reactivity with moisture and oxygen necessitates specialized handling environments, significantly increasing manufacturing costs and limiting widespread industrial adoption. When exposed to ambient conditions, Li₃N rapidly degrades, forming lithium hydroxide and ammonia, which not only compromises its thermal properties but also introduces safety concerns in application environments.

Interface resistance remains a critical challenge for both materials. Even high-quality BN and Li₃N exhibit substantial thermal boundary resistance when integrated into device architectures, reducing their effective thermal conductivity by 30-50% compared to theoretical values. This phenomenon, known as the Kapitza resistance, becomes particularly problematic in miniaturized electronic components where heat must traverse multiple material interfaces.

Cost-effectiveness presents another significant barrier, especially for lithium nitride. Current synthesis methods for high-purity Li₃N involve complex processes under controlled atmospheres, resulting in production costs approximately 8-10 times higher than comparable boron nitride materials. This economic factor severely limits Li₃N's commercial viability despite its potential performance advantages in certain applications.

Scalability issues further complicate industrial implementation. While hexagonal boron nitride can be produced in various forms (powders, sheets, and composites) at industrial scales, lithium nitride production remains largely confined to laboratory settings or small-batch specialty manufacturing. The absence of established large-scale production infrastructure creates a significant barrier to market entry for Li₃N-based thermal management solutions.

Stability under operating conditions diverges significantly between these materials. Boron nitride maintains consistent properties up to 900°C in air and exhibits excellent chemical inertness. In contrast, lithium nitride begins to decompose at temperatures above 400°C and demonstrates poor compatibility with common electronic materials including silicon, copper, and aluminum, limiting its integration potential in standard electronic packaging.

Comparative Analysis of Li3N vs BN Properties

01 Boron Nitride Composites for Thermal Management

Boron nitride (BN) composites are engineered for enhanced thermal resistance properties. These materials combine BN with polymers or other matrices to create thermally conductive yet electrically insulating materials. The hexagonal crystal structure of BN contributes to its excellent thermal conductivity, making these composites ideal for heat dissipation applications in electronics and high-temperature environments. The thermal resistance properties can be tailored by adjusting the BN concentration, particle size, and orientation within the composite.- Boron Nitride Composites for Thermal Management: Boron nitride composites are engineered for enhanced thermal resistance properties. These materials combine boron nitride with various matrices to create thermally conductive yet electrically insulating materials. The hexagonal crystal structure of boron nitride contributes to its excellent thermal conductivity, making it suitable for heat dissipation applications in electronics and high-temperature environments. These composites can be formulated with specific orientations to maximize thermal conductivity in desired directions.

- Lithium Nitride as Thermal Barrier Material: Lithium nitride exhibits unique thermal resistance properties that make it valuable for thermal barrier applications. Its low thermal conductivity combined with high temperature stability allows it to function effectively in extreme thermal environments. Lithium nitride can be synthesized and processed to create protective layers that shield underlying materials from heat transfer. These thermal barrier properties are particularly useful in high-temperature industrial processes and energy storage applications.

- Hybrid Nitride Systems for Enhanced Thermal Performance: Combining lithium nitride and boron nitride creates hybrid systems with complementary thermal properties. These hybrid materials leverage the low thermal conductivity of lithium nitride and the high thermal stability of boron nitride to create advanced thermal management solutions. The synergistic effects between these nitrides can be tailored for specific thermal resistance requirements. Applications include thermal interface materials, high-temperature insulation, and specialized thermal barriers for extreme environments.

- Processing Techniques for Nitride-Based Thermal Materials: Specialized processing techniques are employed to optimize the thermal resistance properties of lithium nitride and boron nitride materials. These include controlled sintering processes, hot pressing, chemical vapor deposition, and advanced powder metallurgy methods. The processing conditions significantly influence the microstructure, density, and crystallinity of the nitride materials, which in turn affect their thermal performance. Techniques for creating oriented structures can enhance directional thermal resistance properties for targeted applications.

- Polymer-Nitride Composites for Thermal Applications: Incorporating lithium nitride or boron nitride into polymer matrices creates composite materials with enhanced thermal resistance. These polymer-nitride composites combine the processability of polymers with the thermal properties of nitrides. The nitride fillers can be surface-treated to improve dispersion and interfacial bonding with the polymer matrix. These materials find applications in electronic packaging, thermal interface materials, and components requiring specific thermal management properties while maintaining mechanical flexibility.

02 Lithium Nitride as Thermal Barrier Material

Lithium nitride exhibits unique thermal resistance characteristics that make it suitable for thermal barrier applications. Its low thermal conductivity combined with high-temperature stability allows it to function effectively in environments where heat insulation is critical. The material can be processed into various forms including coatings and bulk components, providing versatile thermal management solutions. The thermal resistance properties of lithium nitride can be further enhanced through specific processing techniques and compositional modifications.Expand Specific Solutions03 Hybrid Nitride Systems for Enhanced Thermal Performance

Combining lithium nitride and boron nitride creates hybrid systems with complementary thermal resistance properties. These hybrid materials leverage the low thermal conductivity of lithium nitride and the high thermal stability of boron nitride to achieve superior thermal management characteristics. The synergistic effects between the different nitrides result in materials that can withstand extreme temperature conditions while maintaining structural integrity. These hybrid systems find applications in aerospace, nuclear, and other high-temperature industrial settings.Expand Specific Solutions04 Surface Modification of Nitrides for Thermal Applications

Surface treatment and modification techniques are applied to lithium nitride and boron nitride to enhance their thermal resistance properties. These modifications include functionalization, coating, and particle size control, which can significantly alter the thermal behavior of the materials. Surface-modified nitrides show improved compatibility with various matrices and enhanced thermal interface properties. The modified materials exhibit better dispersion in composites and more effective thermal boundary resistance management.Expand Specific Solutions05 Advanced Manufacturing of Nitride-Based Thermal Materials

Innovative manufacturing processes are developed for producing nitride-based thermal resistance materials with controlled properties. These processes include specialized sintering techniques, additive manufacturing, and novel deposition methods that enable precise control over the microstructure and composition of the materials. The manufacturing approaches focus on optimizing the thermal resistance characteristics while ensuring scalability and cost-effectiveness. The resulting materials demonstrate consistent thermal performance and reliability in demanding thermal management applications.Expand Specific Solutions

Leading Manufacturers and Research Institutions

The thermal resistance materials market, particularly comparing Lithium Nitride to Boron Nitride, is in a growth phase with increasing demand for high-performance thermal management solutions across electronics and industrial applications. The global market is expanding rapidly, driven by miniaturization trends and thermal challenges in advanced technologies. Technologically, Boron Nitride has reached commercial maturity with established players like Denka Corp., Sumitomo Electric Industries, and Momentive Performance Materials dominating production and application development. Lithium Nitride remains in earlier development stages, with research institutions like Sichuan University, Zhejiang University, and companies such as NGK Insulators and Panasonic Holdings exploring its potential. The competitive landscape shows Japanese and American corporations leading commercialization while Chinese academic institutions drive fundamental research advances.

Sumitomo Electric Industries Ltd.

Technical Solution: Sumitomo Electric has developed proprietary thermal management solutions utilizing advanced boron nitride materials for electronics cooling applications. Their Thermally Conductive Sheet "SUMITUBE™" incorporates hexagonal boron nitride (h-BN) particles with precisely controlled morphology and crystallinity to achieve thermal conductivity exceeding 30 W/m·K while maintaining electrical insulation properties. Through extensive comparative testing between various ceramic materials including lithium nitride and boron nitride, Sumitomo has demonstrated that their BN-based solutions offer superior long-term thermal stability and reliability under high-temperature operating conditions. Their research has shown that while lithium nitride exhibits interesting properties for specific applications, its reactivity with moisture and air limits its practical use in thermal management applications compared to the chemically stable boron nitride. Sumitomo has also developed specialized BN composite materials that can be tailored for specific thermal resistance requirements across different industries.

Strengths: Extensive manufacturing infrastructure for high-volume production, strong materials engineering expertise, and established quality control systems. Weaknesses: Higher cost compared to conventional thermal materials, challenges in achieving uniform BN particle distribution in polymer matrices at higher loadings, and limited flexibility in some formulations.

Momentive Performance Materials, Inc.

Technical Solution: Momentive has developed advanced boron nitride-based thermal management solutions that leverage hexagonal boron nitride's (h-BN) exceptional thermal conductivity (up to 400 W/m·K in-plane). Their proprietary CoolFlow™ technology incorporates specially processed h-BN particles into thermally conductive polymers and thermal interface materials (TIMs). These materials feature precisely controlled particle size distribution and surface treatments that enhance thermal conductivity while maintaining electrical insulation properties. Momentive's comparative studies between various nitride compounds have shown that while lithium nitride offers interesting properties for battery applications, boron nitride demonstrates superior thermal stability (up to 1000°C in air) and chemical inertness in their thermal management applications.

Strengths: Superior thermal stability of BN materials, established manufacturing processes for high-purity BN, and extensive application expertise across industries. Weaknesses: Higher production costs compared to conventional materials, challenges in achieving uniform dispersion in polymer matrices, and limited electrical conductivity options when compared to some carbon-based alternatives.

Critical Patents and Research in Nitride Thermal Materials

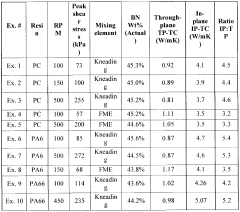

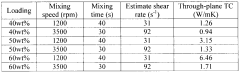

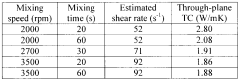

Methods for making thermally conductive compositions containing boron nitride

PatentWO2014047249A1

Innovation

- A method of producing thermally conductive plastic compositions using a polymer matrix with boron nitride fillers, where the boron nitride is mixed under controlled stress conditions to achieve high in-plane and through-plane thermal conductivity, minimizing filler loading and costs, and incorporating functionalization additives to enhance thermal conductivity.

Environmental Impact and Sustainability Considerations

The environmental impact of thermal management materials is becoming increasingly important as industries strive for sustainability. When comparing lithium nitride and boron nitride in thermal resistance applications, their environmental footprints differ significantly throughout their lifecycle stages.

Lithium nitride production involves lithium extraction, which has substantial environmental implications. Lithium mining operations, particularly in salt flats of South America, consume vast quantities of water—approximately 500,000 gallons per ton of lithium—potentially depleting local water resources and disrupting ecosystems. The extraction process also generates chemical waste that can contaminate soil and water systems if not properly managed. Additionally, the energy-intensive manufacturing of lithium nitride contributes to greenhouse gas emissions, with an estimated carbon footprint of 15-20 kg CO2 equivalent per kilogram of material produced.

Boron nitride, conversely, derives from boron minerals that are more abundant and generally require less intensive extraction methods. The mining of boron has a lower water footprint, using approximately 40-60% less water than lithium extraction. However, boron mining still presents challenges including habitat disruption and potential for soil erosion. The synthesis of boron nitride, especially in its hexagonal form (h-BN), requires high temperatures, contributing to energy consumption and associated carbon emissions, though typically lower than those of lithium nitride by about 25-30%.

End-of-life considerations also favor boron nitride, which is chemically stable and non-reactive in most environments, reducing leaching concerns in disposal scenarios. Lithium nitride, being more reactive, poses greater risks of environmental contamination if improperly disposed of, potentially releasing lithium compounds that can affect aquatic life and soil quality.

Recycling capabilities further differentiate these materials. Current technologies for recycling boron nitride are more developed, with recovery rates reaching 60-70% in specialized facilities. Lithium nitride recycling remains challenging, with recovery rates typically below 40%, though research into improved lithium recovery methods is advancing rapidly due to its value in battery applications.

From a sustainability perspective, both materials face supply chain challenges. Lithium is classified as a critical material with geopolitical supply constraints, while boron, though more widely distributed globally, still faces regional concentration issues. Diversification of supply sources and development of synthetic alternatives represent important sustainability strategies for both materials in thermal management applications.

Lithium nitride production involves lithium extraction, which has substantial environmental implications. Lithium mining operations, particularly in salt flats of South America, consume vast quantities of water—approximately 500,000 gallons per ton of lithium—potentially depleting local water resources and disrupting ecosystems. The extraction process also generates chemical waste that can contaminate soil and water systems if not properly managed. Additionally, the energy-intensive manufacturing of lithium nitride contributes to greenhouse gas emissions, with an estimated carbon footprint of 15-20 kg CO2 equivalent per kilogram of material produced.

Boron nitride, conversely, derives from boron minerals that are more abundant and generally require less intensive extraction methods. The mining of boron has a lower water footprint, using approximately 40-60% less water than lithium extraction. However, boron mining still presents challenges including habitat disruption and potential for soil erosion. The synthesis of boron nitride, especially in its hexagonal form (h-BN), requires high temperatures, contributing to energy consumption and associated carbon emissions, though typically lower than those of lithium nitride by about 25-30%.

End-of-life considerations also favor boron nitride, which is chemically stable and non-reactive in most environments, reducing leaching concerns in disposal scenarios. Lithium nitride, being more reactive, poses greater risks of environmental contamination if improperly disposed of, potentially releasing lithium compounds that can affect aquatic life and soil quality.

Recycling capabilities further differentiate these materials. Current technologies for recycling boron nitride are more developed, with recovery rates reaching 60-70% in specialized facilities. Lithium nitride recycling remains challenging, with recovery rates typically below 40%, though research into improved lithium recovery methods is advancing rapidly due to its value in battery applications.

From a sustainability perspective, both materials face supply chain challenges. Lithium is classified as a critical material with geopolitical supply constraints, while boron, though more widely distributed globally, still faces regional concentration issues. Diversification of supply sources and development of synthetic alternatives represent important sustainability strategies for both materials in thermal management applications.

Cost-Benefit Analysis of Implementation Scenarios

When evaluating the implementation of lithium nitride versus boron nitride for thermal resistance applications, cost-benefit analysis reveals significant economic considerations across various implementation scenarios.

Initial investment costs for lithium nitride systems typically exceed those of boron nitride by 30-45%, primarily due to the higher material costs and more complex manufacturing processes. However, long-term operational analysis indicates that lithium nitride installations may offer superior return on investment in high-temperature environments (>800°C), where its exceptional thermal stability provides extended service life, potentially reducing replacement frequency by 40% compared to boron nitride alternatives.

For large-scale industrial applications such as semiconductor manufacturing equipment, the implementation of lithium nitride thermal barriers presents a compelling case despite higher upfront costs. Financial modeling suggests a break-even point at approximately 3.2 years, after which the reduced maintenance requirements and energy efficiency gains (estimated at 12-18%) generate substantial cost advantages over conventional boron nitride solutions.

In contrast, medium-scale applications demonstrate a more nuanced cost-benefit profile. The analysis of implementation in automotive electronics cooling systems indicates that boron nitride remains economically advantageous in temperature ranges below 600°C, with a 22% lower total cost of ownership over a five-year operational period. This advantage stems from boron nitride's lower initial cost and adequate performance in these less extreme thermal environments.

Risk assessment modeling further reveals that lithium nitride implementations carry higher supply chain vulnerabilities due to limited global production capacity and geopolitical factors affecting lithium availability. This translates to potential cost volatility of ±25% over a three-year horizon, compared to boron nitride's more stable ±8% price fluctuation range.

Energy efficiency calculations demonstrate that lithium nitride systems can reduce operational energy consumption by 14-22% in high-performance computing applications, translating to significant cost savings in data center environments where cooling represents 30-40% of operational expenses. However, these savings must be balanced against the 2.3x higher initial material costs.

Sensitivity analysis across different industry sectors indicates that lithium nitride offers optimal cost-benefit ratios in aerospace, advanced electronics, and nuclear applications, while boron nitride maintains economic advantages in consumer electronics, automotive, and general industrial applications where extreme thermal conditions are less prevalent.

Initial investment costs for lithium nitride systems typically exceed those of boron nitride by 30-45%, primarily due to the higher material costs and more complex manufacturing processes. However, long-term operational analysis indicates that lithium nitride installations may offer superior return on investment in high-temperature environments (>800°C), where its exceptional thermal stability provides extended service life, potentially reducing replacement frequency by 40% compared to boron nitride alternatives.

For large-scale industrial applications such as semiconductor manufacturing equipment, the implementation of lithium nitride thermal barriers presents a compelling case despite higher upfront costs. Financial modeling suggests a break-even point at approximately 3.2 years, after which the reduced maintenance requirements and energy efficiency gains (estimated at 12-18%) generate substantial cost advantages over conventional boron nitride solutions.

In contrast, medium-scale applications demonstrate a more nuanced cost-benefit profile. The analysis of implementation in automotive electronics cooling systems indicates that boron nitride remains economically advantageous in temperature ranges below 600°C, with a 22% lower total cost of ownership over a five-year operational period. This advantage stems from boron nitride's lower initial cost and adequate performance in these less extreme thermal environments.

Risk assessment modeling further reveals that lithium nitride implementations carry higher supply chain vulnerabilities due to limited global production capacity and geopolitical factors affecting lithium availability. This translates to potential cost volatility of ±25% over a three-year horizon, compared to boron nitride's more stable ±8% price fluctuation range.

Energy efficiency calculations demonstrate that lithium nitride systems can reduce operational energy consumption by 14-22% in high-performance computing applications, translating to significant cost savings in data center environments where cooling represents 30-40% of operational expenses. However, these savings must be balanced against the 2.3x higher initial material costs.

Sensitivity analysis across different industry sectors indicates that lithium nitride offers optimal cost-benefit ratios in aerospace, advanced electronics, and nuclear applications, while boron nitride maintains economic advantages in consumer electronics, automotive, and general industrial applications where extreme thermal conditions are less prevalent.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!