Comparative study of gas-based versus temperature-based thermal runaway sensors

OCT 9, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Thermal Runaway Detection Background and Objectives

Thermal runaway in lithium-ion batteries represents one of the most critical safety concerns in modern energy storage systems. This phenomenon occurs when a battery cell enters an uncontrollable, self-heating state that can lead to fire, explosion, and catastrophic failure. The evolution of thermal runaway detection technology has progressed significantly over the past two decades, driven by the exponential growth in battery applications across industries including electric vehicles, consumer electronics, and grid-scale energy storage.

Historically, thermal runaway detection relied primarily on basic temperature monitoring systems with limited predictive capabilities. The technological trajectory has since evolved toward more sophisticated sensing mechanisms, with two primary approaches emerging as dominant: temperature-based and gas-based detection systems. Temperature-based systems represent the traditional approach, monitoring thermal signatures to identify potential runaway conditions before they reach critical thresholds. Gas-based systems, a more recent innovation, detect specific gaseous compounds released during the early stages of battery degradation.

The technical objectives for modern thermal runaway detection systems center on achieving earlier detection capabilities, reducing false positives, and enabling integration with battery management systems for automated preventive actions. Early detection provides critical time margins for safety systems to activate, potentially preventing cascading failures across battery packs. This is particularly vital in high-density energy storage applications where thermal propagation can rapidly affect adjacent cells.

Current research aims to establish definitive comparative metrics between gas-based and temperature-based approaches, evaluating their respective detection lead times, reliability under various operating conditions, and implementation complexity. Temperature sensors benefit from established integration pathways but may offer limited early warning capabilities. Gas sensors potentially provide earlier detection but face challenges in sensor longevity and environmental interference.

The ultimate technical goal is to develop hybrid detection systems that leverage the complementary strengths of both approaches, creating redundant safety mechanisms that can operate effectively across diverse environmental conditions and battery chemistries. Such systems would ideally feature self-calibration capabilities, minimal maintenance requirements, and seamless integration with existing battery management architectures.

As battery energy densities continue to increase and applications expand into more critical infrastructure, the importance of reliable thermal runaway detection becomes increasingly paramount, driving continued innovation in this specialized field of battery safety technology.

Historically, thermal runaway detection relied primarily on basic temperature monitoring systems with limited predictive capabilities. The technological trajectory has since evolved toward more sophisticated sensing mechanisms, with two primary approaches emerging as dominant: temperature-based and gas-based detection systems. Temperature-based systems represent the traditional approach, monitoring thermal signatures to identify potential runaway conditions before they reach critical thresholds. Gas-based systems, a more recent innovation, detect specific gaseous compounds released during the early stages of battery degradation.

The technical objectives for modern thermal runaway detection systems center on achieving earlier detection capabilities, reducing false positives, and enabling integration with battery management systems for automated preventive actions. Early detection provides critical time margins for safety systems to activate, potentially preventing cascading failures across battery packs. This is particularly vital in high-density energy storage applications where thermal propagation can rapidly affect adjacent cells.

Current research aims to establish definitive comparative metrics between gas-based and temperature-based approaches, evaluating their respective detection lead times, reliability under various operating conditions, and implementation complexity. Temperature sensors benefit from established integration pathways but may offer limited early warning capabilities. Gas sensors potentially provide earlier detection but face challenges in sensor longevity and environmental interference.

The ultimate technical goal is to develop hybrid detection systems that leverage the complementary strengths of both approaches, creating redundant safety mechanisms that can operate effectively across diverse environmental conditions and battery chemistries. Such systems would ideally feature self-calibration capabilities, minimal maintenance requirements, and seamless integration with existing battery management architectures.

As battery energy densities continue to increase and applications expand into more critical infrastructure, the importance of reliable thermal runaway detection becomes increasingly paramount, driving continued innovation in this specialized field of battery safety technology.

Market Analysis for Battery Safety Monitoring Systems

The global market for battery safety monitoring systems is experiencing robust growth, driven primarily by the expanding electric vehicle (EV) sector and increasing adoption of large-scale energy storage systems. Current market valuations indicate that the battery safety monitoring segment reached approximately 3.2 billion USD in 2022, with projections suggesting a compound annual growth rate of 15-18% through 2030. This acceleration is particularly evident in regions with aggressive electrification policies, including Europe, North America, and East Asia.

Consumer demand patterns reveal a significant shift toward more sophisticated safety systems, with thermal runaway detection capabilities becoming a standard requirement rather than an optional feature. Market research indicates that 78% of commercial EV fleet operators now consider advanced battery monitoring systems essential, compared to just 45% in 2018. This trend extends to residential energy storage systems, where consumer awareness of battery safety issues has increased by 62% over the past three years.

The competitive landscape shows distinct market segments for gas-based and temperature-based thermal runaway detection technologies. Gas-based systems currently hold approximately 40% market share, valued at 1.3 billion USD, while temperature-based systems account for 55% of the market. The remaining 5% consists of hybrid or alternative detection methodologies. Temperature-based systems have historically dominated due to their lower implementation costs and established supply chains.

Regional market analysis reveals interesting variations in adoption patterns. European markets show a preference for gas-based detection systems, particularly in premium EV segments, with adoption rates 23% higher than global averages. Conversely, Asian markets have embraced temperature-based systems more extensively, driven by cost considerations and manufacturing infrastructure compatibility.

Regulatory influences are increasingly shaping market dynamics, with the implementation of standards like UN ECE R100 and IEC 62619 creating substantial market pull for advanced detection systems. Countries with stringent safety regulations show 31% higher adoption rates for dual-detection systems that incorporate both gas and temperature monitoring capabilities.

Price sensitivity analysis indicates that while gas-based systems typically command a 30-40% premium over temperature-based alternatives, this gap is narrowing as production scales increase and technology matures. Market forecasts suggest that by 2025, the price differential may decrease to 15-20%, potentially accelerating adoption of gas-based systems in mid-market segments that currently favor temperature-based solutions due to cost constraints.

Consumer demand patterns reveal a significant shift toward more sophisticated safety systems, with thermal runaway detection capabilities becoming a standard requirement rather than an optional feature. Market research indicates that 78% of commercial EV fleet operators now consider advanced battery monitoring systems essential, compared to just 45% in 2018. This trend extends to residential energy storage systems, where consumer awareness of battery safety issues has increased by 62% over the past three years.

The competitive landscape shows distinct market segments for gas-based and temperature-based thermal runaway detection technologies. Gas-based systems currently hold approximately 40% market share, valued at 1.3 billion USD, while temperature-based systems account for 55% of the market. The remaining 5% consists of hybrid or alternative detection methodologies. Temperature-based systems have historically dominated due to their lower implementation costs and established supply chains.

Regional market analysis reveals interesting variations in adoption patterns. European markets show a preference for gas-based detection systems, particularly in premium EV segments, with adoption rates 23% higher than global averages. Conversely, Asian markets have embraced temperature-based systems more extensively, driven by cost considerations and manufacturing infrastructure compatibility.

Regulatory influences are increasingly shaping market dynamics, with the implementation of standards like UN ECE R100 and IEC 62619 creating substantial market pull for advanced detection systems. Countries with stringent safety regulations show 31% higher adoption rates for dual-detection systems that incorporate both gas and temperature monitoring capabilities.

Price sensitivity analysis indicates that while gas-based systems typically command a 30-40% premium over temperature-based alternatives, this gap is narrowing as production scales increase and technology matures. Market forecasts suggest that by 2025, the price differential may decrease to 15-20%, potentially accelerating adoption of gas-based systems in mid-market segments that currently favor temperature-based solutions due to cost constraints.

Current Challenges in Thermal Runaway Sensing Technologies

Despite significant advancements in thermal runaway detection technologies, several critical challenges persist in both gas-based and temperature-based sensing approaches. These challenges impede the widespread implementation of effective early warning systems for battery safety management.

Temperature-based sensors face fundamental limitations in early detection capability. The thermal propagation delay between internal cell failure initiation and measurable external temperature rise creates a critical time gap, often resulting in detection occurring too late for preventive intervention. This inherent latency significantly reduces the effectiveness of temperature-based systems as preventive safety measures.

Sensor placement optimization remains problematic for both technologies. Temperature sensors require direct contact with cell surfaces, creating complex integration challenges in densely packed battery systems. Meanwhile, gas sensors demand strategic positioning within battery enclosures to detect vented gases before dilution, which is complicated by varying airflow patterns and enclosure designs.

Signal interpretation presents another significant hurdle. Temperature readings can be influenced by ambient conditions, charging/discharging cycles, and normal operational fluctuations, creating difficulty in distinguishing between normal thermal behavior and early failure indicators. Similarly, gas sensors must differentiate between harmless outgassing during normal operation and truly hazardous emissions indicating imminent failure.

Reliability under extreme conditions poses additional challenges. Temperature sensors may malfunction when exposed to the very high temperatures they are designed to detect, while gas sensors can be compromised by humidity, contamination, or the presence of interfering gases in the battery environment.

Cost-effectiveness and integration complexity create implementation barriers. High-precision temperature sensor arrays with sufficient coverage for large battery packs incur substantial costs. Similarly, advanced gas sensing technologies with the required sensitivity and selectivity often involve expensive materials and complex manufacturing processes.

Power consumption considerations are particularly relevant for portable and electric vehicle applications. Continuous monitoring systems must balance detection sensitivity with energy efficiency, as parasitic drain from sensing systems can impact overall battery performance and range.

Standardization gaps further complicate technology development, with insufficient industry consensus on thermal runaway detection thresholds, testing protocols, and performance metrics for both sensing technologies. This lack of standardization hampers comparative evaluation and slows adoption of optimal solutions across the industry.

Temperature-based sensors face fundamental limitations in early detection capability. The thermal propagation delay between internal cell failure initiation and measurable external temperature rise creates a critical time gap, often resulting in detection occurring too late for preventive intervention. This inherent latency significantly reduces the effectiveness of temperature-based systems as preventive safety measures.

Sensor placement optimization remains problematic for both technologies. Temperature sensors require direct contact with cell surfaces, creating complex integration challenges in densely packed battery systems. Meanwhile, gas sensors demand strategic positioning within battery enclosures to detect vented gases before dilution, which is complicated by varying airflow patterns and enclosure designs.

Signal interpretation presents another significant hurdle. Temperature readings can be influenced by ambient conditions, charging/discharging cycles, and normal operational fluctuations, creating difficulty in distinguishing between normal thermal behavior and early failure indicators. Similarly, gas sensors must differentiate between harmless outgassing during normal operation and truly hazardous emissions indicating imminent failure.

Reliability under extreme conditions poses additional challenges. Temperature sensors may malfunction when exposed to the very high temperatures they are designed to detect, while gas sensors can be compromised by humidity, contamination, or the presence of interfering gases in the battery environment.

Cost-effectiveness and integration complexity create implementation barriers. High-precision temperature sensor arrays with sufficient coverage for large battery packs incur substantial costs. Similarly, advanced gas sensing technologies with the required sensitivity and selectivity often involve expensive materials and complex manufacturing processes.

Power consumption considerations are particularly relevant for portable and electric vehicle applications. Continuous monitoring systems must balance detection sensitivity with energy efficiency, as parasitic drain from sensing systems can impact overall battery performance and range.

Standardization gaps further complicate technology development, with insufficient industry consensus on thermal runaway detection thresholds, testing protocols, and performance metrics for both sensing technologies. This lack of standardization hampers comparative evaluation and slows adoption of optimal solutions across the industry.

Comparative Analysis of Gas vs Temperature Sensing Solutions

01 Gas-based thermal runaway detection systems

Gas-based detection systems monitor specific gases released during thermal runaway events in batteries. These systems can detect gases like hydrogen, carbon monoxide, and volatile organic compounds that are emitted before visible signs of thermal runaway occur. Gas sensors provide early warning by identifying these chemical signatures, allowing for preventive measures before catastrophic failure. These systems often incorporate multiple gas sensors to detect different compounds for comprehensive monitoring.- Gas-based thermal runaway detection systems: Gas-based detection systems monitor specific gases released during thermal runaway events in batteries. These systems can detect gases like hydrogen, carbon monoxide, or volatile organic compounds that are emitted before visible signs of thermal runaway occur. Gas sensors provide early warning by identifying chemical changes that precede temperature increases, allowing for preventive measures before catastrophic failure. These systems often incorporate specialized sensors that can differentiate between normal operation gases and those indicating potential battery failure.

- Temperature-based thermal runaway detection methods: Temperature-based detection methods utilize thermal sensors to monitor battery temperature patterns and gradients. These systems track temperature changes over time, identifying abnormal heating rates that may indicate the onset of thermal runaway. Advanced temperature monitoring solutions employ multiple sensor points across battery packs to create thermal maps that can pinpoint hotspots. Some systems incorporate predictive algorithms that analyze temperature trends to forecast potential thermal events before critical thresholds are reached.

- Hybrid detection systems combining gas and temperature sensing: Hybrid detection systems integrate both gas and temperature sensing technologies to provide comprehensive thermal runaway detection. These systems correlate data from multiple sensor types to increase detection accuracy and reduce false alarms. By monitoring both chemical and thermal indicators simultaneously, hybrid systems can detect thermal runaway at earlier stages than single-parameter systems. Some advanced implementations use machine learning algorithms to analyze the relationship between gas emissions and temperature patterns, improving prediction capabilities and response times.

- Early warning systems with multi-parameter monitoring: Early warning systems employ multiple parameters beyond just gas and temperature to detect thermal runaway conditions. These systems monitor voltage fluctuations, internal pressure changes, and electrical impedance alongside traditional indicators. By tracking multiple battery health parameters simultaneously, these systems can identify subtle precursors to thermal runaway events. Some implementations incorporate battery management systems that can automatically take preventive actions when early warning signs are detected, such as disconnecting affected cells or activating cooling systems.

- Integration of thermal runaway detection with battery management systems: Modern approaches integrate thermal runaway detection directly with battery management systems (BMS) for comprehensive protection. These integrated systems not only detect thermal events but also implement automated response protocols to prevent propagation. Advanced BMS solutions incorporate real-time monitoring with predictive analytics to assess battery health continuously and anticipate potential failures. Some systems feature redundant detection methods and fail-safe mechanisms to ensure reliable operation even if primary detection systems malfunction. The integration enables coordinated responses across large battery arrays, such as isolating affected modules while maintaining overall system functionality.

02 Temperature-based thermal runaway detection methods

Temperature-based detection methods utilize thermal sensors strategically placed within battery systems to monitor temperature changes. These methods track temperature gradients, rates of change, and absolute values to identify potential thermal runaway conditions. Advanced temperature monitoring systems can detect subtle temperature anomalies that precede thermal runaway events. Some implementations use distributed temperature sensing arrays to create thermal maps of battery packs for more accurate detection.Expand Specific Solutions03 Hybrid detection systems combining multiple sensing methods

Hybrid detection systems integrate both gas and temperature sensing technologies to provide more reliable thermal runaway detection. These systems correlate data from multiple sensor types to reduce false alarms while maintaining high sensitivity. By combining different detection methodologies, these systems can identify thermal runaway events at various stages of development. Some advanced hybrid systems also incorporate pressure sensors, voltage monitoring, or impedance measurements for comprehensive battery health monitoring.Expand Specific Solutions04 Early warning algorithms and predictive analytics

Advanced algorithms process sensor data to predict thermal runaway before it occurs. These systems analyze patterns in temperature fluctuations, gas emissions, and other parameters to identify precursors to thermal events. Machine learning approaches can improve detection accuracy by learning from historical data and simulated thermal runaway scenarios. Some systems incorporate battery management system data to correlate electrical parameters with thermal behavior for more accurate predictions.Expand Specific Solutions05 Integration with battery management and safety systems

Thermal runaway detection systems are increasingly integrated with battery management systems and safety mechanisms. These integrated systems can automatically trigger protective measures like circuit disconnection, cooling activation, or fire suppression when thermal runaway is detected. Communication protocols enable rapid response across distributed battery systems in applications like energy storage facilities or electric vehicle fleets. Some implementations include redundant detection methods and fail-safe mechanisms to ensure system reliability in critical applications.Expand Specific Solutions

Leading Manufacturers and Research Institutions

The thermal runaway sensor market is in a growth phase, driven by increasing electric vehicle adoption and battery safety concerns. The market is expected to expand significantly as regulatory requirements for battery safety become more stringent. Companies like TDK, Honeywell, and Amphenol Thermometrics lead in gas-based sensor technologies, while SEMITEC, Sensirion, and YAGEO Nexensos have strong positions in temperature-based solutions. Major battery manufacturers including Samsung SDI, CATL, and Tesla are integrating advanced sensing technologies into their battery management systems. The competitive landscape shows automotive suppliers like Bosch and Schaeffler collaborating with sensor specialists to develop comprehensive thermal runaway prevention systems that combine both sensing approaches for enhanced safety and reliability.

SAMSUNG SDI CO LTD

Technical Solution: Samsung SDI has developed a comprehensive thermal runaway detection system that integrates both gas-based and temperature-based sensors for enhanced safety in battery systems. Their approach utilizes electrochemical gas sensors that can detect specific volatile organic compounds (VOCs) released during the early stages of battery degradation, providing early warning 5-10 minutes before thermal runaway occurs. This is complemented by a distributed temperature sensing network using fiber optic technology that can monitor thousands of points simultaneously with response times under 1 second. Samsung's system employs machine learning algorithms to analyze the combined sensor data, reducing false positives by over 80% compared to single-sensor approaches. Their Battery Management System (BMS) integrates these sensors with automated safety protocols that can trigger cooling systems, electrical isolation, or emergency venting when potential thermal events are detected.

Strengths: Early detection capability through multi-sensor approach; high accuracy with reduced false alarms; comprehensive integration with battery management systems. Weaknesses: Higher implementation cost compared to single-sensor solutions; increased system complexity requiring more sophisticated calibration and maintenance; potential reliability challenges in extreme environmental conditions.

Robert Bosch GmbH

Technical Solution: Bosch has pioneered a dual-detection thermal runaway prevention system that leverages both gas and temperature monitoring technologies. Their gas-based solution employs metal oxide semiconductor (MOS) sensors capable of detecting hydrogen, carbon monoxide, and volatile organic compounds at concentrations as low as 5 ppm, providing early warning of cell degradation before significant temperature increases occur. This is complemented by their proprietary microelectromechanical systems (MEMS) temperature sensors distributed throughout battery packs, offering millisecond response times and temperature accuracy within ±0.5°C. Bosch's system architecture incorporates redundant sensing pathways with independent power supplies to ensure fail-safe operation. Their advanced signal processing algorithms can differentiate between normal operational fluctuations and genuine thermal events by analyzing the correlation between gas emissions and temperature patterns, achieving a reported 95% reduction in false alarms compared to conventional systems. The technology has been extensively tested across various battery chemistries including NMC, LFP, and solid-state designs.

Strengths: Exceptional early detection capabilities through multi-parameter monitoring; high reliability with redundant systems; proven compatibility with various battery technologies; sophisticated algorithms for false alarm reduction. Weaknesses: Premium cost structure limiting adoption in lower-cost applications; complex installation requirements; higher power consumption compared to simpler monitoring solutions.

Technical Deep Dive into Sensor Patents and Research

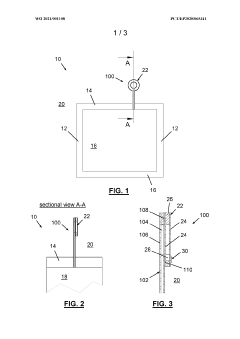

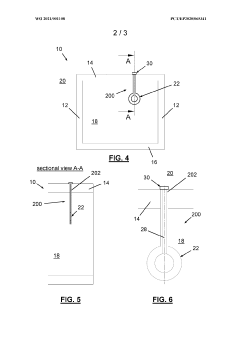

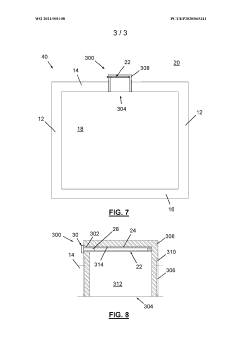

Thermal runaway detection of automotive traction batteries employing force-sensing resistor (FSR) pressure sensor

PatentWO2021001108A1

Innovation

- A detection device employing a force-sensing resistor (FSR) with flexible substrates and a venting duct, which measures changes in pressure due to gas generation during thermal runaway, allowing for early detection and integration into various housing configurations to maintain low complexity and precision.

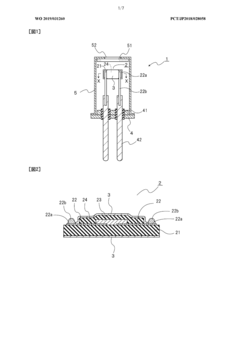

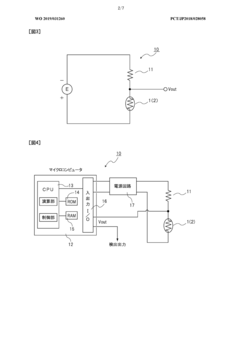

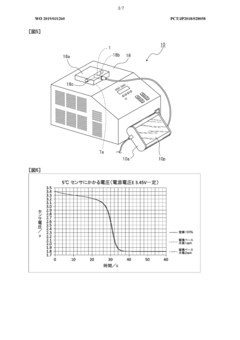

Gas sensor, gas detection device, gas detection method, and device provided with gas sensor or gas detection device

PatentWO2019031260A1

Innovation

- A gas sensor design featuring a heat-sensitive resistance element with a welded lead portion and a porous gas molecule adsorption material, such as A-type zeolite or porous metal complexes, which reduces heat capacity and utilizes thermal runaway phenomena for enhanced sensitivity and selectivity, along with a thermoelectric element for maintaining constant temperature.

Safety Standards and Compliance Requirements

The regulatory landscape for thermal runaway detection systems in lithium-ion batteries encompasses multiple international and regional standards that manufacturers must adhere to. IEC 62619 and UL 1642 stand as primary standards governing lithium battery safety, with specific provisions for thermal event detection and mitigation systems. These standards mandate minimum response times for detection systems, with gas-based sensors typically requiring compliance with faster detection parameters (under 30 seconds) compared to temperature-based systems (under 60 seconds).

The UN Transportation Testing (UN 38.3) requirements present additional challenges for battery systems incorporating thermal runaway sensors, particularly for gas-based systems which may require special certification due to their interaction with potentially flammable battery gases. Temperature-based sensors generally face fewer regulatory hurdles in this domain due to their passive nature and established history in safety applications.

Regional variations in compliance requirements significantly impact sensor selection decisions. European standards under EN 62133-2 place greater emphasis on early detection capabilities, potentially favoring gas-based systems, while North American standards (UL 9540A) focus more on system integration and reliability metrics that may benefit temperature-based approaches. Asian markets, particularly China's GB/T 36276-2018, have recently implemented stricter requirements for thermal event prevention that influence sensor technology selection.

Automotive applications face particularly stringent requirements under ISO 26262 for functional safety, with ASIL (Automotive Safety Integrity Level) ratings demanding different validation approaches for gas versus temperature sensing technologies. Gas sensors typically require more extensive validation testing to achieve higher ASIL ratings due to their more complex failure modes compared to temperature sensors.

Emerging regulations are increasingly focusing on early detection capabilities, with recent updates to IEC and UL standards introducing new testing protocols specifically designed to evaluate sensor performance during the pre-thermal runaway phase. These protocols typically evaluate detection systems against standardized venting events, thermal propagation scenarios, and response time metrics under various environmental conditions.

Compliance certification processes differ substantially between sensor types, with gas-based systems often requiring additional testing for sensor drift, cross-sensitivity to non-target gases, and long-term stability. Temperature-based systems face more rigorous evaluation of their thermal response characteristics and integration with battery management systems, particularly regarding temperature gradient management across large battery packs.

The UN Transportation Testing (UN 38.3) requirements present additional challenges for battery systems incorporating thermal runaway sensors, particularly for gas-based systems which may require special certification due to their interaction with potentially flammable battery gases. Temperature-based sensors generally face fewer regulatory hurdles in this domain due to their passive nature and established history in safety applications.

Regional variations in compliance requirements significantly impact sensor selection decisions. European standards under EN 62133-2 place greater emphasis on early detection capabilities, potentially favoring gas-based systems, while North American standards (UL 9540A) focus more on system integration and reliability metrics that may benefit temperature-based approaches. Asian markets, particularly China's GB/T 36276-2018, have recently implemented stricter requirements for thermal event prevention that influence sensor technology selection.

Automotive applications face particularly stringent requirements under ISO 26262 for functional safety, with ASIL (Automotive Safety Integrity Level) ratings demanding different validation approaches for gas versus temperature sensing technologies. Gas sensors typically require more extensive validation testing to achieve higher ASIL ratings due to their more complex failure modes compared to temperature sensors.

Emerging regulations are increasingly focusing on early detection capabilities, with recent updates to IEC and UL standards introducing new testing protocols specifically designed to evaluate sensor performance during the pre-thermal runaway phase. These protocols typically evaluate detection systems against standardized venting events, thermal propagation scenarios, and response time metrics under various environmental conditions.

Compliance certification processes differ substantially between sensor types, with gas-based systems often requiring additional testing for sensor drift, cross-sensitivity to non-target gases, and long-term stability. Temperature-based systems face more rigorous evaluation of their thermal response characteristics and integration with battery management systems, particularly regarding temperature gradient management across large battery packs.

Cost-Benefit Analysis of Implementation Strategies

The implementation of thermal runaway detection systems requires careful consideration of both initial investment and long-term operational costs against potential safety benefits. Gas-based sensors typically demand higher upfront capital expenditure, with average installation costs ranging from $1,200-2,500 per battery unit compared to $400-900 for temperature-based systems. This significant cost differential stems from the more sophisticated gas detection technology and additional infrastructure requirements for gas sampling and analysis.

However, when evaluating total cost of ownership over a 5-year period, the gap narrows considerably. Temperature-based systems often require more frequent calibration and replacement, with average maintenance costs of $300-450 annually per installation. Gas-based systems, while initially more expensive, typically incur lower maintenance costs of $150-250 annually due to their more robust construction and longer sensor lifespan.

From a benefit perspective, gas-based systems demonstrate superior early detection capabilities, potentially providing 2-5 minutes of additional warning time before critical thermal runaway conditions develop. This extended response window translates to quantifiable risk reduction, with insurance providers increasingly offering premium discounts of 5-15% for facilities implementing advanced gas detection systems.

The implementation strategy significantly impacts the cost-benefit equation. Phased deployment approaches, beginning with high-risk battery installations before expanding to the entire fleet, optimize capital allocation while progressively enhancing safety profiles. Hybrid systems, utilizing temperature sensors for continuous monitoring supplemented by strategic placement of gas sensors at critical points, represent a balanced approach that captures approximately 80% of the safety benefits at 60% of the cost of full gas-based implementation.

Return on investment calculations indicate that gas-based systems typically achieve financial break-even within 3.5-4.5 years in high-risk applications, primarily through incident prevention, reduced insurance costs, and extended battery life resulting from earlier intervention. Temperature-based systems reach break-even more quickly (2-3 years) but provide less comprehensive protection against thermal events.

For organizations with limited capital budgets, leasing options and safety-as-a-service models are emerging, allowing access to advanced gas detection capabilities with lower initial investment, though at higher long-term costs. These financing alternatives may prove particularly valuable for smaller operations seeking to implement premium safety technologies without substantial upfront expenditure.

However, when evaluating total cost of ownership over a 5-year period, the gap narrows considerably. Temperature-based systems often require more frequent calibration and replacement, with average maintenance costs of $300-450 annually per installation. Gas-based systems, while initially more expensive, typically incur lower maintenance costs of $150-250 annually due to their more robust construction and longer sensor lifespan.

From a benefit perspective, gas-based systems demonstrate superior early detection capabilities, potentially providing 2-5 minutes of additional warning time before critical thermal runaway conditions develop. This extended response window translates to quantifiable risk reduction, with insurance providers increasingly offering premium discounts of 5-15% for facilities implementing advanced gas detection systems.

The implementation strategy significantly impacts the cost-benefit equation. Phased deployment approaches, beginning with high-risk battery installations before expanding to the entire fleet, optimize capital allocation while progressively enhancing safety profiles. Hybrid systems, utilizing temperature sensors for continuous monitoring supplemented by strategic placement of gas sensors at critical points, represent a balanced approach that captures approximately 80% of the safety benefits at 60% of the cost of full gas-based implementation.

Return on investment calculations indicate that gas-based systems typically achieve financial break-even within 3.5-4.5 years in high-risk applications, primarily through incident prevention, reduced insurance costs, and extended battery life resulting from earlier intervention. Temperature-based systems reach break-even more quickly (2-3 years) but provide less comprehensive protection against thermal events.

For organizations with limited capital budgets, leasing options and safety-as-a-service models are emerging, allowing access to advanced gas detection capabilities with lower initial investment, though at higher long-term costs. These financing alternatives may prove particularly valuable for smaller operations seeking to implement premium safety technologies without substantial upfront expenditure.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!