What are the key challenges in commercializing thermal runaway sensors

OCT 9, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Thermal Runaway Sensor Technology Background and Objectives

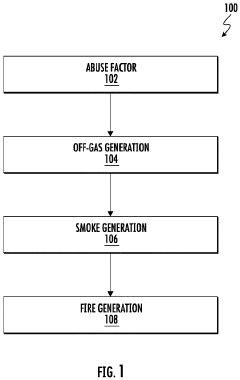

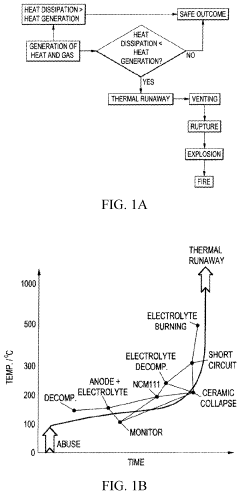

Thermal runaway, a critical safety concern in lithium-ion batteries, occurs when a battery cell enters an uncontrollable, self-heating state that can lead to fire or explosion. The development of thermal runaway sensors represents a significant technological advancement in battery safety management systems. These sensors aim to detect early warning signs of thermal instability, providing crucial time for intervention before catastrophic failure occurs.

The evolution of thermal runaway detection technology has progressed from basic temperature monitoring to sophisticated multi-parameter sensing systems. Early approaches relied primarily on external temperature measurements, which often detected thermal events too late for effective countermeasures. Modern sensor technologies have expanded to include gas detection, pressure monitoring, and electrochemical impedance spectroscopy, enabling more precise and earlier detection capabilities.

The driving force behind thermal runaway sensor development stems from the rapid proliferation of lithium-ion batteries across multiple industries. Electric vehicles, renewable energy storage systems, consumer electronics, and aerospace applications all demand increasingly robust safety measures as energy densities continue to rise. High-profile battery failure incidents have further accelerated regulatory pressure and market demand for advanced early warning systems.

Current technological objectives in this field focus on developing sensors that can reliably predict thermal runaway events minutes to hours before they occur, while maintaining cost-effectiveness for mass production. Researchers aim to create sensors with minimal false positives, high durability in harsh environments, and seamless integration with battery management systems. The ideal sensor would combine multiple detection methods to create redundant safety systems capable of identifying various failure modes.

Another critical objective is miniaturization and cost reduction without compromising performance. As batteries become more integrated into everyday products, sensors must become smaller, more energy-efficient, and economically viable for widespread implementation. This presents significant engineering challenges, particularly for applications with strict space and weight constraints.

The technological trajectory points toward intelligent sensing systems that incorporate machine learning algorithms to improve prediction accuracy over time. These systems analyze patterns in battery behavior to distinguish between normal operational fluctuations and genuine precursors to thermal events. The ultimate goal is to develop predictive capabilities that can identify potential failures days or weeks in advance, allowing for preventive maintenance rather than emergency response.

Achieving these objectives requires interdisciplinary collaboration between electrochemists, materials scientists, electrical engineers, and data analysts. The complexity of battery failure mechanisms necessitates a comprehensive approach that addresses chemical, thermal, mechanical, and electrical aspects of thermal runaway phenomena.

The evolution of thermal runaway detection technology has progressed from basic temperature monitoring to sophisticated multi-parameter sensing systems. Early approaches relied primarily on external temperature measurements, which often detected thermal events too late for effective countermeasures. Modern sensor technologies have expanded to include gas detection, pressure monitoring, and electrochemical impedance spectroscopy, enabling more precise and earlier detection capabilities.

The driving force behind thermal runaway sensor development stems from the rapid proliferation of lithium-ion batteries across multiple industries. Electric vehicles, renewable energy storage systems, consumer electronics, and aerospace applications all demand increasingly robust safety measures as energy densities continue to rise. High-profile battery failure incidents have further accelerated regulatory pressure and market demand for advanced early warning systems.

Current technological objectives in this field focus on developing sensors that can reliably predict thermal runaway events minutes to hours before they occur, while maintaining cost-effectiveness for mass production. Researchers aim to create sensors with minimal false positives, high durability in harsh environments, and seamless integration with battery management systems. The ideal sensor would combine multiple detection methods to create redundant safety systems capable of identifying various failure modes.

Another critical objective is miniaturization and cost reduction without compromising performance. As batteries become more integrated into everyday products, sensors must become smaller, more energy-efficient, and economically viable for widespread implementation. This presents significant engineering challenges, particularly for applications with strict space and weight constraints.

The technological trajectory points toward intelligent sensing systems that incorporate machine learning algorithms to improve prediction accuracy over time. These systems analyze patterns in battery behavior to distinguish between normal operational fluctuations and genuine precursors to thermal events. The ultimate goal is to develop predictive capabilities that can identify potential failures days or weeks in advance, allowing for preventive maintenance rather than emergency response.

Achieving these objectives requires interdisciplinary collaboration between electrochemists, materials scientists, electrical engineers, and data analysts. The complexity of battery failure mechanisms necessitates a comprehensive approach that addresses chemical, thermal, mechanical, and electrical aspects of thermal runaway phenomena.

Market Demand Analysis for Battery Safety Solutions

The global market for battery safety solutions is experiencing unprecedented growth, driven primarily by the rapid expansion of electric vehicles (EVs), renewable energy storage systems, and portable electronics. Current market valuations indicate the battery safety solutions market reached approximately $2.3 billion in 2022, with projections suggesting a compound annual growth rate of 15-18% through 2030. This growth trajectory is directly correlated with increasing incidents of battery thermal runaway events and subsequent regulatory pressures.

Consumer demand for battery safety solutions stems from several critical factors. First, high-profile battery failure incidents in consumer electronics and EVs have heightened public awareness and concern. The Samsung Galaxy Note 7 recall in 2016 cost the company over $5 billion and significantly damaged brand reputation, demonstrating the commercial imperative for improved safety systems. Similarly, EV manufacturers face mounting pressure following widely publicized vehicle fires, with each incident potentially impacting consumer confidence in electrification.

Insurance companies and regulatory bodies represent another significant market driver. Insurers are increasingly requiring advanced battery safety systems before providing coverage for large-scale energy storage installations. Meanwhile, regulatory frameworks are evolving rapidly, with the UN Global Technical Regulation No. 20 and IEC 62619 standards establishing more stringent safety requirements for lithium-ion batteries.

Industry analysis reveals distinct market segments with varying needs. The automotive sector currently represents the largest market share at approximately 45%, followed by grid-scale energy storage (28%) and consumer electronics (18%). Each segment presents unique requirements for thermal runaway detection systems regarding cost sensitivity, form factor constraints, and performance parameters.

Geographic market distribution shows notable regional differences. North America and Europe lead in adoption of advanced battery safety technologies, primarily due to stringent regulatory environments and higher consumer willingness to pay premium prices for safety features. The Asia-Pacific region, while representing the largest battery manufacturing base, shows more price sensitivity but is experiencing the fastest growth rate in safety solution adoption.

Market research indicates a clear willingness-to-pay differential across segments. In the premium automotive sector, manufacturers accept cost increases of $5-15 per kWh for enhanced safety systems, while mass-market vehicles remain more cost-constrained. For stationary storage applications, the acceptable cost premium ranges from $2-8 per kWh depending on installation size and location criticality.

Consumer demand for battery safety solutions stems from several critical factors. First, high-profile battery failure incidents in consumer electronics and EVs have heightened public awareness and concern. The Samsung Galaxy Note 7 recall in 2016 cost the company over $5 billion and significantly damaged brand reputation, demonstrating the commercial imperative for improved safety systems. Similarly, EV manufacturers face mounting pressure following widely publicized vehicle fires, with each incident potentially impacting consumer confidence in electrification.

Insurance companies and regulatory bodies represent another significant market driver. Insurers are increasingly requiring advanced battery safety systems before providing coverage for large-scale energy storage installations. Meanwhile, regulatory frameworks are evolving rapidly, with the UN Global Technical Regulation No. 20 and IEC 62619 standards establishing more stringent safety requirements for lithium-ion batteries.

Industry analysis reveals distinct market segments with varying needs. The automotive sector currently represents the largest market share at approximately 45%, followed by grid-scale energy storage (28%) and consumer electronics (18%). Each segment presents unique requirements for thermal runaway detection systems regarding cost sensitivity, form factor constraints, and performance parameters.

Geographic market distribution shows notable regional differences. North America and Europe lead in adoption of advanced battery safety technologies, primarily due to stringent regulatory environments and higher consumer willingness to pay premium prices for safety features. The Asia-Pacific region, while representing the largest battery manufacturing base, shows more price sensitivity but is experiencing the fastest growth rate in safety solution adoption.

Market research indicates a clear willingness-to-pay differential across segments. In the premium automotive sector, manufacturers accept cost increases of $5-15 per kWh for enhanced safety systems, while mass-market vehicles remain more cost-constrained. For stationary storage applications, the acceptable cost premium ranges from $2-8 per kWh depending on installation size and location criticality.

Current Technical Challenges in Thermal Runaway Detection

Thermal runaway detection in lithium-ion batteries presents significant technical challenges that impede widespread commercial adoption. Current detection methods primarily rely on monitoring temperature, voltage, and pressure changes, but these approaches often lack the precision and reliability needed for early detection in real-world applications.

Temperature-based detection systems face challenges in sensor placement optimization. The thermal gradient across battery cells means that sensor location critically affects detection timing. Sensors placed too far from potential hotspots may detect thermal events too late for effective intervention, while excessive sensor deployment increases system cost and complexity. This trade-off between coverage and economic viability remains unresolved in commercial applications.

Voltage monitoring techniques struggle with signal-to-noise ratio problems. Minor voltage fluctuations during normal operation can mask early indicators of thermal runaway, leading to false negatives. Conversely, aggressive detection algorithms may trigger false positives during high-load operations, reducing system reliability and user confidence. The development of robust algorithms that can distinguish between normal operational variations and genuine thermal anomalies remains technically challenging.

Gas detection methods, while promising for early warning, face implementation hurdles in sealed battery systems. Integrating gas sensors requires modifications to battery design that may compromise structural integrity or increase manufacturing complexity. Additionally, gas sensors must operate reliably in the harsh chemical environment inside batteries while maintaining sensitivity to low concentrations of target gases—a difficult engineering balance to achieve.

Response time limitations present another critical challenge. The rapid progression of thermal runaway, which can escalate from initiation to catastrophic failure within seconds to minutes, demands extremely fast detection and response systems. Current sensor technologies often exhibit latency that reduces the window for effective intervention, particularly in high-energy-density battery configurations where thermal events propagate more rapidly.

Integration challenges with battery management systems (BMS) further complicate commercialization. Thermal runaway sensors must interface seamlessly with existing BMS architectures while adding minimal computational overhead. The data processing requirements for real-time analysis of sensor inputs can strain the limited resources of embedded systems in commercial battery packs, necessitating careful optimization of detection algorithms.

Durability and longevity concerns also impede commercial adoption. Sensors must maintain calibration and functionality throughout the battery's operational lifetime—often 8-10 years for automotive applications—while withstanding vibration, temperature cycling, and electromagnetic interference. Current sensor technologies frequently demonstrate degradation rates that outpace the battery systems they monitor, creating reliability concerns for long-term deployment.

Temperature-based detection systems face challenges in sensor placement optimization. The thermal gradient across battery cells means that sensor location critically affects detection timing. Sensors placed too far from potential hotspots may detect thermal events too late for effective intervention, while excessive sensor deployment increases system cost and complexity. This trade-off between coverage and economic viability remains unresolved in commercial applications.

Voltage monitoring techniques struggle with signal-to-noise ratio problems. Minor voltage fluctuations during normal operation can mask early indicators of thermal runaway, leading to false negatives. Conversely, aggressive detection algorithms may trigger false positives during high-load operations, reducing system reliability and user confidence. The development of robust algorithms that can distinguish between normal operational variations and genuine thermal anomalies remains technically challenging.

Gas detection methods, while promising for early warning, face implementation hurdles in sealed battery systems. Integrating gas sensors requires modifications to battery design that may compromise structural integrity or increase manufacturing complexity. Additionally, gas sensors must operate reliably in the harsh chemical environment inside batteries while maintaining sensitivity to low concentrations of target gases—a difficult engineering balance to achieve.

Response time limitations present another critical challenge. The rapid progression of thermal runaway, which can escalate from initiation to catastrophic failure within seconds to minutes, demands extremely fast detection and response systems. Current sensor technologies often exhibit latency that reduces the window for effective intervention, particularly in high-energy-density battery configurations where thermal events propagate more rapidly.

Integration challenges with battery management systems (BMS) further complicate commercialization. Thermal runaway sensors must interface seamlessly with existing BMS architectures while adding minimal computational overhead. The data processing requirements for real-time analysis of sensor inputs can strain the limited resources of embedded systems in commercial battery packs, necessitating careful optimization of detection algorithms.

Durability and longevity concerns also impede commercial adoption. Sensors must maintain calibration and functionality throughout the battery's operational lifetime—often 8-10 years for automotive applications—while withstanding vibration, temperature cycling, and electromagnetic interference. Current sensor technologies frequently demonstrate degradation rates that outpace the battery systems they monitor, creating reliability concerns for long-term deployment.

Existing Commercial Thermal Runaway Detection Solutions

01 Battery thermal runaway detection sensors

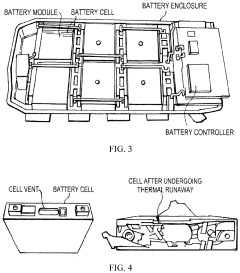

Various sensors are designed to detect thermal runaway conditions in batteries by monitoring temperature changes, gas emissions, or pressure variations. These sensors provide early warning of potential battery failures, allowing for preventive measures to be taken before catastrophic failure occurs. Advanced detection systems may incorporate multiple sensor types for more reliable monitoring of battery health and safety conditions.- Temperature monitoring systems for battery thermal runaway detection: These systems utilize various temperature sensors to monitor battery cells for early signs of thermal runaway. They typically employ temperature threshold detection algorithms that can identify abnormal temperature increases or patterns indicative of potential thermal events. The monitoring systems can be integrated directly into battery management systems to provide real-time data and trigger preventive measures when dangerous temperature conditions are detected.

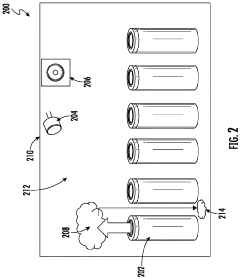

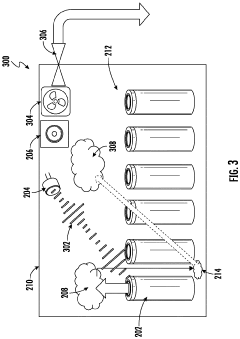

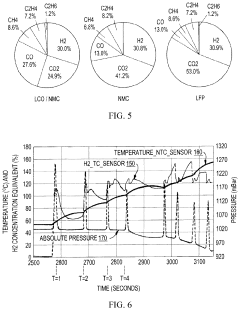

- Gas and chemical sensors for thermal runaway detection: These sensors detect specific gases or chemical compounds released during the early stages of thermal runaway. They can identify volatile organic compounds, hydrogen, carbon monoxide, or other gases that are emitted before visible signs of thermal runaway occur. This approach allows for earlier detection than temperature-based systems alone, providing additional time for safety systems to activate and mitigate potential damage.

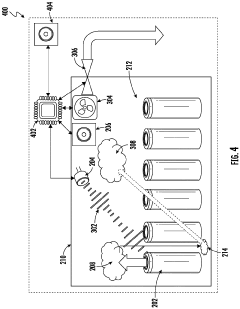

- Integrated multi-sensor detection systems: These advanced systems combine multiple sensor types (temperature, gas, pressure, voltage) to create comprehensive thermal runaway detection solutions. By fusing data from different sensor modalities, these systems can achieve higher accuracy and earlier detection while reducing false alarms. The integrated approach allows for more robust detection across various battery chemistries and operating conditions.

- Optical and imaging-based thermal runaway sensors: These systems use optical sensors, infrared cameras, or fiber optic technology to detect thermal events in batteries. They can monitor temperature distributions across battery packs and identify hotspots before they develop into full thermal runaway. Some advanced systems use machine learning algorithms to analyze thermal images and predict potential failures before they occur.

- Wireless and distributed sensor networks for battery monitoring: These systems employ networks of wireless sensors distributed throughout battery packs or energy storage systems. They enable comprehensive monitoring of large-scale battery installations while reducing wiring complexity. The distributed architecture improves reliability through redundancy and allows for more granular detection of thermal events. These networks often include cloud connectivity for remote monitoring and advanced analytics capabilities.

02 Integration of thermal sensors in battery management systems

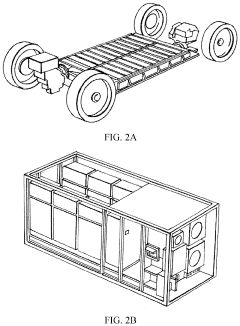

Thermal runaway sensors are integrated into comprehensive battery management systems (BMS) to provide real-time monitoring and protection. These systems combine sensor data with control algorithms to regulate battery operation, implement safety protocols, and prevent thermal events. The integration enables automated responses such as circuit disconnection, cooling activation, or emergency shutdown when abnormal thermal conditions are detected.Expand Specific Solutions03 Distributed sensor networks for large battery systems

Large-scale battery installations utilize distributed sensor networks to monitor thermal conditions across multiple cells or modules. These networks employ strategically placed sensors throughout the battery pack to create thermal maps and identify hotspots. The distributed approach enables more precise localization of potential thermal runaway events in energy storage systems, electric vehicles, or grid applications, allowing for targeted intervention.Expand Specific Solutions04 Advanced materials and designs for thermal runaway sensors

Innovative materials and sensor designs are being developed to improve the reliability and response time of thermal runaway detection. These include specialized polymers that change properties at critical temperatures, thin-film sensors that can be embedded directly into battery structures, and nano-engineered materials with enhanced thermal sensitivity. These advanced designs aim to provide earlier detection while maintaining durability in harsh battery environments.Expand Specific Solutions05 Communication and alert systems for thermal runaway detection

Communication protocols and alert systems are essential components of thermal runaway sensor implementations. These systems transmit sensor data to monitoring stations, trigger alarms, and initiate emergency responses when dangerous conditions are detected. Advanced implementations include wireless communication capabilities, cloud-based monitoring, and integration with facility management systems to ensure rapid response to potential battery failures.Expand Specific Solutions

Leading Companies in Thermal Runaway Sensing Industry

The thermal runaway sensor market is in an early growth phase, characterized by increasing demand driven by EV safety concerns. Market size is expanding rapidly as battery safety regulations tighten globally. Technologically, the field shows varying maturity levels across different sensing approaches. Leading automotive manufacturers like Tesla, Toyota, and Hyundai Mobis are investing heavily in proprietary solutions, while battery specialists including CATL, Samsung SDI, and Panasonic Energy are developing integrated sensing technologies. Electronics companies such as Texas Instruments and Renesas are focusing on semiconductor-based detection systems. The competitive landscape is fragmented between established automotive suppliers (Webasto, ElringKlinger), battery manufacturers, and specialized sensor developers, with collaboration between research institutions and industry players accelerating commercialization efforts.

Honeywell International Technologies Ltd.

Technical Solution: Honeywell has developed an integrated thermal runaway detection and mitigation system that combines advanced sensing with active countermeasures. Their solution employs a network of proprietary thin-film temperature sensors with response times under 50ms and accuracy within ±0.5°C across the operational temperature range of -40°C to 125°C[6]. The system incorporates machine learning algorithms trained on data from over 500,000 simulated and real thermal events to distinguish between normal operational heating and potential thermal runaway precursors. Honeywell's commercialization approach addresses cost challenges through automated high-volume manufacturing processes that reduce sensor production costs by approximately 70% compared to traditional hand-assembled alternatives. Their system architecture includes redundant communication pathways with 99.997% reliability to ensure warning signals reach vehicle control systems even during partial electrical failures. Additionally, Honeywell has developed specialized sensor packaging that can withstand the vibration profiles typical in automotive applications (up to 10G) while maintaining calibration accuracy[7].

Strengths: Comprehensive solution including both detection and mitigation components; high reliability through redundant systems; extensive validation through real-world and simulated testing. Weaknesses: Higher system complexity increases integration challenges; requires more extensive validation testing; potentially higher cost compared to detection-only solutions.

Contemporary Amperex Technology Co., Ltd.

Technical Solution: CATL has pioneered a thermal runaway prevention system called the "Cell-to-Chassis" (CTC) technology that incorporates distributed fiber optic sensing networks throughout battery packs. This approach enables temperature monitoring with spatial resolution of approximately 10cm and response times under 100ms[2]. Their system utilizes Bragg grating sensors that can withstand the harsh electromagnetic environment of EV battery systems while providing immunity to EMI interference. CATL's commercialization strategy focuses on integrating these sensors directly during cell manufacturing, reducing installation costs by approximately 40% compared to retrofit solutions. The company has also developed specialized coating materials that enhance sensor durability in high-temperature environments up to 600°C, allowing continuous monitoring even during thermal event progression. Their system includes predictive analytics that can identify potential failure patterns up to 5 minutes before thermal runaway occurs based on historical data collected from over 1 million battery cycles[3].

Strengths: Manufacturing integration reduces implementation costs; fiber optic technology provides EMI immunity and intrinsic safety; high temperature resistance allows monitoring throughout thermal events. Weaknesses: Requires specialized expertise for system maintenance; higher initial capital investment; more complex integration with existing battery designs compared to simpler sensor solutions.

Critical Patents and Research in Early Warning Systems

System and method for detecting thermal runaway using acoustic and gas sensors

PatentPendingEP4386934A2

Innovation

- A system incorporating an acoustic sensor, internal and external gas sensors, a fan, and an adaptable vent, connected to a processor that enables the fan and vent to direct gases away from the battery cell and compare internal and external gas sensor data to accurately detect thermal runaway, reducing false alarms and enabling early mitigation.

Thermal runaway detection system for batteries within enclosures

PatentPendingUS20240178468A1

Innovation

- A detection system comprising a primary gas detector, pressure sensor, relative humidity sensor, and temperature sensor, positioned within the battery enclosure, which uses CO2 and hydrogen sensors to rapidly identify venting gases and pressure changes, providing robust and fast detection of thermal runaway events, and communicates with a microcontroller to generate alarm signals for immediate safety measures.

Regulatory Standards and Compliance Requirements

The commercialization of thermal runaway sensors faces a complex regulatory landscape that varies significantly across regions and industries. In the automotive sector, UN Regulation No. 100 (R100) and Global Technical Regulation No. 20 (GTR 20) establish specific requirements for electric vehicle battery safety, including thermal event detection and mitigation. These regulations are increasingly incorporating explicit requirements for early detection systems, creating both compliance challenges and market opportunities for sensor manufacturers.

In North America, UL 2580 and SAE J2929 standards provide frameworks for lithium-ion battery safety in electric vehicles, while NFPA 855 addresses stationary energy storage systems. The European Union has implemented regulations through ECE R100 and the Battery Directive (2006/66/EC), with the upcoming Battery Regulation introducing more stringent safety requirements. These evolving standards create a moving target for sensor developers, requiring continuous adaptation of technology and validation protocols.

Certification processes present significant hurdles for new market entrants. Testing procedures for thermal runaway sensors must demonstrate reliability under various environmental conditions, including temperature extremes, humidity, vibration, and electromagnetic interference. The certification timeline can extend from 12 to 24 months, substantially impacting time-to-market and development costs. Additionally, the lack of standardized testing methodologies specifically for thermal runaway sensors creates uncertainty in validation approaches.

Insurance requirements add another layer of complexity, as underwriters increasingly demand proven safety systems for energy storage installations. This creates a circular challenge: insurers want field-proven technology, but deployment opportunities are limited without insurance approval. Some jurisdictions have implemented expedited certification pathways for innovative safety technologies, though these programs remain limited in scope and geographical coverage.

International harmonization efforts are underway through organizations like the International Electrotechnical Commission (IEC) and the International Organization for Standardization (ISO), which are developing standards such as IEC 62619 and ISO 6469. However, regional variations in implementation timelines and technical requirements persist, complicating global commercialization strategies. Companies must navigate these differences while maintaining cost-effective compliance across target markets.

Regulatory reporting requirements following thermal events also vary by jurisdiction, creating additional operational complexities for sensor system providers. These requirements influence system design, particularly regarding data logging capabilities, communication protocols, and integration with broader battery management systems. As regulations continue to evolve in response to high-profile thermal incidents, manufacturers must maintain flexibility in their product development roadmaps to accommodate emerging compliance requirements.

In North America, UL 2580 and SAE J2929 standards provide frameworks for lithium-ion battery safety in electric vehicles, while NFPA 855 addresses stationary energy storage systems. The European Union has implemented regulations through ECE R100 and the Battery Directive (2006/66/EC), with the upcoming Battery Regulation introducing more stringent safety requirements. These evolving standards create a moving target for sensor developers, requiring continuous adaptation of technology and validation protocols.

Certification processes present significant hurdles for new market entrants. Testing procedures for thermal runaway sensors must demonstrate reliability under various environmental conditions, including temperature extremes, humidity, vibration, and electromagnetic interference. The certification timeline can extend from 12 to 24 months, substantially impacting time-to-market and development costs. Additionally, the lack of standardized testing methodologies specifically for thermal runaway sensors creates uncertainty in validation approaches.

Insurance requirements add another layer of complexity, as underwriters increasingly demand proven safety systems for energy storage installations. This creates a circular challenge: insurers want field-proven technology, but deployment opportunities are limited without insurance approval. Some jurisdictions have implemented expedited certification pathways for innovative safety technologies, though these programs remain limited in scope and geographical coverage.

International harmonization efforts are underway through organizations like the International Electrotechnical Commission (IEC) and the International Organization for Standardization (ISO), which are developing standards such as IEC 62619 and ISO 6469. However, regional variations in implementation timelines and technical requirements persist, complicating global commercialization strategies. Companies must navigate these differences while maintaining cost-effective compliance across target markets.

Regulatory reporting requirements following thermal events also vary by jurisdiction, creating additional operational complexities for sensor system providers. These requirements influence system design, particularly regarding data logging capabilities, communication protocols, and integration with broader battery management systems. As regulations continue to evolve in response to high-profile thermal incidents, manufacturers must maintain flexibility in their product development roadmaps to accommodate emerging compliance requirements.

Cost-Performance Analysis of Sensor Implementation

The implementation of thermal runaway sensors in commercial applications presents a complex cost-performance equation that manufacturers and end-users must carefully evaluate. Current market analysis indicates that sensor unit costs range from $5-30 per cell depending on technology type, with optical fiber sensors typically commanding premium pricing due to their superior detection capabilities. When scaled to battery pack level implementation, these costs can add $500-3,000 to electric vehicle battery systems, representing a 5-15% increase in total battery pack cost.

Performance metrics must be weighed against these cost implications. High-sensitivity sensors capable of detecting temperature changes within 1-2°C offer superior early warning capabilities but come with 30-50% higher implementation costs compared to basic threshold-based detection systems. The trade-off between detection speed and false alarm rates further complicates the cost-benefit analysis, as systems with false positive rates below 0.1% typically require more sophisticated signal processing algorithms and redundant sensor arrays.

Integration complexity represents another significant cost factor. Retrofitting existing battery designs with thermal runaway sensors can increase implementation costs by 40-70% compared to designing sensor systems into new battery architectures from the ground up. This creates a significant barrier for adoption in established product lines and legacy systems, particularly in cost-sensitive market segments.

Manufacturing scalability directly impacts unit economics. Current production methods for advanced sensor types remain largely semi-automated, with limited economies of scale. Industry analysis suggests that achieving price points below $3 per sensing point would require 5-10x increases in production volume and significant manufacturing process innovations, particularly in materials deposition techniques and calibration procedures.

Lifetime value calculations further complicate the cost-performance equation. While premium sensor systems add initial costs, they potentially deliver substantial value through extended battery life (5-15% improvement) and reduced warranty claim expenses. However, these benefits remain difficult to quantify precisely in emerging applications, creating uncertainty in return-on-investment calculations that often leads to conservative implementation decisions.

The maintenance and replacement costs over product lifecycles must also be factored into total cost of ownership models. Sensors with 8+ year operational lifespans command 20-40% price premiums but may eliminate replacement costs in many applications, potentially delivering superior lifetime economics despite higher initial investment requirements.

Performance metrics must be weighed against these cost implications. High-sensitivity sensors capable of detecting temperature changes within 1-2°C offer superior early warning capabilities but come with 30-50% higher implementation costs compared to basic threshold-based detection systems. The trade-off between detection speed and false alarm rates further complicates the cost-benefit analysis, as systems with false positive rates below 0.1% typically require more sophisticated signal processing algorithms and redundant sensor arrays.

Integration complexity represents another significant cost factor. Retrofitting existing battery designs with thermal runaway sensors can increase implementation costs by 40-70% compared to designing sensor systems into new battery architectures from the ground up. This creates a significant barrier for adoption in established product lines and legacy systems, particularly in cost-sensitive market segments.

Manufacturing scalability directly impacts unit economics. Current production methods for advanced sensor types remain largely semi-automated, with limited economies of scale. Industry analysis suggests that achieving price points below $3 per sensing point would require 5-10x increases in production volume and significant manufacturing process innovations, particularly in materials deposition techniques and calibration procedures.

Lifetime value calculations further complicate the cost-performance equation. While premium sensor systems add initial costs, they potentially deliver substantial value through extended battery life (5-15% improvement) and reduced warranty claim expenses. However, these benefits remain difficult to quantify precisely in emerging applications, creating uncertainty in return-on-investment calculations that often leads to conservative implementation decisions.

The maintenance and replacement costs over product lifecycles must also be factored into total cost of ownership models. Sensors with 8+ year operational lifespans command 20-40% price premiums but may eliminate replacement costs in many applications, potentially delivering superior lifetime economics despite higher initial investment requirements.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!