Comparative Techno-Economics Of Sulfide Versus Oxide Solid Electrolytes

AUG 22, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Sulfide vs Oxide Electrolytes: Background and Objectives

Solid-state batteries represent a revolutionary advancement in energy storage technology, promising higher energy density, improved safety, and longer lifespan compared to conventional lithium-ion batteries with liquid electrolytes. At the core of this innovation are solid electrolytes, with sulfide and oxide variants emerging as the two primary contenders in commercial applications.

The development of solid electrolytes dates back to the 1970s, but significant breakthroughs have only materialized in the past decade. Oxide solid electrolytes, particularly those based on garnet structures like Li7La3Zr2O12 (LLZO), were among the first to demonstrate practical ionic conductivities. Meanwhile, sulfide-based systems such as Li10GeP2S12 (LGPS) emerged later but quickly gained attention for their superior room-temperature conductivity.

The technological evolution trajectory indicates a clear shift toward solid-state solutions as the next generation of battery technology. Market projections suggest that solid-state batteries could capture up to 7% of the global battery market by 2030, representing approximately $8 billion in value. This transition is driven by increasing demands for higher energy density, faster charging capabilities, and enhanced safety profiles across multiple industries.

Both sulfide and oxide electrolytes present distinct advantages and limitations that significantly impact their commercial viability. Oxide electrolytes offer excellent thermal and chemical stability, making them particularly suitable for high-temperature applications. However, they typically exhibit lower ionic conductivity at room temperature and require higher processing temperatures, increasing manufacturing complexity and costs.

Conversely, sulfide electrolytes demonstrate superior ionic conductivity at ambient temperatures—often approaching that of liquid electrolytes—and can be processed at lower temperatures. Their mechanical properties also allow for better interfacial contact with electrodes. Nevertheless, they present challenges related to air and moisture sensitivity, necessitating stringent manufacturing environments.

The primary objective of this technical research is to conduct a comprehensive techno-economic comparison between sulfide and oxide solid electrolytes. This analysis aims to evaluate not only their technical performance metrics but also their economic feasibility across various application scenarios, manufacturing scalability, and long-term market viability.

By examining the full spectrum of factors—from raw material availability and processing requirements to performance characteristics and integration challenges—this research seeks to identify the most promising pathways for commercial deployment of solid-state battery technology. The findings will inform strategic investment decisions and research prioritization for organizations seeking to capitalize on this transformative technology.

The development of solid electrolytes dates back to the 1970s, but significant breakthroughs have only materialized in the past decade. Oxide solid electrolytes, particularly those based on garnet structures like Li7La3Zr2O12 (LLZO), were among the first to demonstrate practical ionic conductivities. Meanwhile, sulfide-based systems such as Li10GeP2S12 (LGPS) emerged later but quickly gained attention for their superior room-temperature conductivity.

The technological evolution trajectory indicates a clear shift toward solid-state solutions as the next generation of battery technology. Market projections suggest that solid-state batteries could capture up to 7% of the global battery market by 2030, representing approximately $8 billion in value. This transition is driven by increasing demands for higher energy density, faster charging capabilities, and enhanced safety profiles across multiple industries.

Both sulfide and oxide electrolytes present distinct advantages and limitations that significantly impact their commercial viability. Oxide electrolytes offer excellent thermal and chemical stability, making them particularly suitable for high-temperature applications. However, they typically exhibit lower ionic conductivity at room temperature and require higher processing temperatures, increasing manufacturing complexity and costs.

Conversely, sulfide electrolytes demonstrate superior ionic conductivity at ambient temperatures—often approaching that of liquid electrolytes—and can be processed at lower temperatures. Their mechanical properties also allow for better interfacial contact with electrodes. Nevertheless, they present challenges related to air and moisture sensitivity, necessitating stringent manufacturing environments.

The primary objective of this technical research is to conduct a comprehensive techno-economic comparison between sulfide and oxide solid electrolytes. This analysis aims to evaluate not only their technical performance metrics but also their economic feasibility across various application scenarios, manufacturing scalability, and long-term market viability.

By examining the full spectrum of factors—from raw material availability and processing requirements to performance characteristics and integration challenges—this research seeks to identify the most promising pathways for commercial deployment of solid-state battery technology. The findings will inform strategic investment decisions and research prioritization for organizations seeking to capitalize on this transformative technology.

Market Analysis of Solid-State Battery Demand

The global solid-state battery market is experiencing unprecedented growth, driven primarily by the automotive sector's shift towards electrification. Current market projections indicate that the solid-state battery market will reach approximately $8 billion by 2026, with a compound annual growth rate (CAGR) of 34.2% from 2021 to 2026. This remarkable growth trajectory is underpinned by increasing demand for electric vehicles (EVs) and the push for batteries with higher energy density, improved safety, and faster charging capabilities.

The automotive industry represents the largest demand segment, accounting for nearly 60% of the projected market. Major automakers including Toyota, Volkswagen, and BMW have announced significant investments in solid-state battery technology, with commercial deployment targets set between 2025 and 2028. Toyota alone has committed over $13.5 billion to battery technology development, with a substantial portion allocated to solid-state research.

Consumer electronics constitutes the second-largest market segment, representing approximately 25% of demand. The appeal in this sector stems from the potential for thinner, lighter devices with longer battery life and enhanced safety profiles. Companies like Samsung and Apple have active research programs and patent portfolios in solid-state technology.

Geographically, Asia-Pacific leads the market with Japan and South Korea at the forefront of technological development. North America and Europe follow closely, with significant research initiatives and strategic partnerships forming between battery manufacturers, automotive OEMs, and technology companies.

Market analysis reveals that customer priorities are evolving beyond just cost considerations. While price parity with conventional lithium-ion batteries remains important (currently solid-state batteries cost 2-3 times more per kWh), performance metrics such as energy density, charging speed, and cycle life are increasingly valued. Safety advantages of solid electrolytes, particularly their non-flammability, represent a critical selling point amid growing concerns about thermal runaway in conventional batteries.

Supply chain considerations are becoming increasingly important in market development. The transition from oxide to sulfide electrolytes has significant implications for raw material sourcing, manufacturing processes, and recycling infrastructure. Sulfide-based systems may offer manufacturing cost advantages but face challenges in handling requirements due to their air and moisture sensitivity.

Regulatory factors are also shaping market demand, with several jurisdictions implementing policies that favor higher-performance battery technologies. The European Union's proposed battery passport regulation and various national-level incentives for advanced battery manufacturing are accelerating industry investment in solid-state technology.

The automotive industry represents the largest demand segment, accounting for nearly 60% of the projected market. Major automakers including Toyota, Volkswagen, and BMW have announced significant investments in solid-state battery technology, with commercial deployment targets set between 2025 and 2028. Toyota alone has committed over $13.5 billion to battery technology development, with a substantial portion allocated to solid-state research.

Consumer electronics constitutes the second-largest market segment, representing approximately 25% of demand. The appeal in this sector stems from the potential for thinner, lighter devices with longer battery life and enhanced safety profiles. Companies like Samsung and Apple have active research programs and patent portfolios in solid-state technology.

Geographically, Asia-Pacific leads the market with Japan and South Korea at the forefront of technological development. North America and Europe follow closely, with significant research initiatives and strategic partnerships forming between battery manufacturers, automotive OEMs, and technology companies.

Market analysis reveals that customer priorities are evolving beyond just cost considerations. While price parity with conventional lithium-ion batteries remains important (currently solid-state batteries cost 2-3 times more per kWh), performance metrics such as energy density, charging speed, and cycle life are increasingly valued. Safety advantages of solid electrolytes, particularly their non-flammability, represent a critical selling point amid growing concerns about thermal runaway in conventional batteries.

Supply chain considerations are becoming increasingly important in market development. The transition from oxide to sulfide electrolytes has significant implications for raw material sourcing, manufacturing processes, and recycling infrastructure. Sulfide-based systems may offer manufacturing cost advantages but face challenges in handling requirements due to their air and moisture sensitivity.

Regulatory factors are also shaping market demand, with several jurisdictions implementing policies that favor higher-performance battery technologies. The European Union's proposed battery passport regulation and various national-level incentives for advanced battery manufacturing are accelerating industry investment in solid-state technology.

Technical Challenges in Solid Electrolyte Development

The development of solid electrolytes faces significant technical challenges that must be overcome to enable widespread commercialization of solid-state batteries. Both sulfide and oxide electrolytes present unique obstacles in their respective development paths, requiring innovative solutions and continued research efforts.

Ionic conductivity remains a primary challenge for solid electrolytes, particularly for oxide-based systems which typically exhibit lower room temperature conductivity (10^-4 S/cm) compared to sulfides (10^-3 S/cm). This conductivity gap directly impacts battery performance, necessitating higher operating temperatures for oxide systems to achieve practical power densities.

Interfacial resistance between solid electrolytes and electrodes presents another critical hurdle. The rigid nature of solid materials creates contact issues that liquid electrolytes don't face. Sulfide electrolytes generally form better interfaces with lithium metal anodes, but suffer from narrow electrochemical stability windows (typically 1.7-2.1V) compared to oxides (0-4.5V), limiting their compatibility with high-voltage cathode materials.

Manufacturing scalability differs significantly between these electrolyte types. Oxide electrolytes require high-temperature sintering processes (>1000°C) to achieve adequate density and conductivity, increasing production complexity and cost. Sulfides can be processed at lower temperatures but are highly moisture-sensitive, requiring stringent handling protocols and dry-room manufacturing environments that add significant production costs.

Mechanical stability presents divergent challenges for each electrolyte class. Oxide electrolytes exhibit superior mechanical strength but are brittle and difficult to integrate into flexible battery designs. Sulfides offer better deformability but insufficient mechanical strength to prevent lithium dendrite penetration during cycling, necessitating additional engineering solutions.

Chemical stability issues further complicate development efforts. Sulfide electrolytes react with moisture to produce toxic H2S gas and degrade when exposed to air, creating safety concerns and handling complications. Oxide electrolytes demonstrate superior environmental stability but often react with lithium metal anodes, forming resistive interphases that impede ion transport.

Thermal behavior differences impact safety and performance profiles. Oxide electrolytes generally maintain stability at higher temperatures, enhancing safety margins, while sulfides may decompose at elevated temperatures, potentially releasing harmful sulfur compounds.

Cost considerations present different challenges for each system. Oxide electrolytes utilize more abundant raw materials but require energy-intensive processing. Sulfides often incorporate more expensive elements and demand specialized handling equipment, though their processing temperatures are lower.

Ionic conductivity remains a primary challenge for solid electrolytes, particularly for oxide-based systems which typically exhibit lower room temperature conductivity (10^-4 S/cm) compared to sulfides (10^-3 S/cm). This conductivity gap directly impacts battery performance, necessitating higher operating temperatures for oxide systems to achieve practical power densities.

Interfacial resistance between solid electrolytes and electrodes presents another critical hurdle. The rigid nature of solid materials creates contact issues that liquid electrolytes don't face. Sulfide electrolytes generally form better interfaces with lithium metal anodes, but suffer from narrow electrochemical stability windows (typically 1.7-2.1V) compared to oxides (0-4.5V), limiting their compatibility with high-voltage cathode materials.

Manufacturing scalability differs significantly between these electrolyte types. Oxide electrolytes require high-temperature sintering processes (>1000°C) to achieve adequate density and conductivity, increasing production complexity and cost. Sulfides can be processed at lower temperatures but are highly moisture-sensitive, requiring stringent handling protocols and dry-room manufacturing environments that add significant production costs.

Mechanical stability presents divergent challenges for each electrolyte class. Oxide electrolytes exhibit superior mechanical strength but are brittle and difficult to integrate into flexible battery designs. Sulfides offer better deformability but insufficient mechanical strength to prevent lithium dendrite penetration during cycling, necessitating additional engineering solutions.

Chemical stability issues further complicate development efforts. Sulfide electrolytes react with moisture to produce toxic H2S gas and degrade when exposed to air, creating safety concerns and handling complications. Oxide electrolytes demonstrate superior environmental stability but often react with lithium metal anodes, forming resistive interphases that impede ion transport.

Thermal behavior differences impact safety and performance profiles. Oxide electrolytes generally maintain stability at higher temperatures, enhancing safety margins, while sulfides may decompose at elevated temperatures, potentially releasing harmful sulfur compounds.

Cost considerations present different challenges for each system. Oxide electrolytes utilize more abundant raw materials but require energy-intensive processing. Sulfides often incorporate more expensive elements and demand specialized handling equipment, though their processing temperatures are lower.

Current Techno-Economic Solutions for Solid Electrolytes

01 Sulfide-based solid electrolytes manufacturing and cost factors

Sulfide-based solid electrolytes offer high ionic conductivity but face challenges in manufacturing scalability and cost-effectiveness. These materials are sensitive to moisture and air, requiring specialized handling and processing environments. The techno-economic analysis focuses on production methods that can reduce manufacturing costs while maintaining performance, including dry processing techniques and alternative synthesis routes that minimize expensive precursors and energy-intensive steps.- Sulfide-based solid electrolytes for lithium batteries: Sulfide-based solid electrolytes offer high ionic conductivity for lithium-ion batteries, making them promising candidates for next-generation energy storage. These materials typically contain lithium sulfide (Li2S) combined with other sulfides like P2S5 or GeS2 to form glass-ceramic structures. Their advantages include excellent room-temperature conductivity and good contact with electrode materials, though they face challenges with air/moisture sensitivity and manufacturing costs. Recent developments focus on improving their stability and reducing production expenses to enable commercial viability.

- Oxide-based solid electrolytes for battery applications: Oxide-based solid electrolytes, including NASICON-type, perovskite, and garnet structures, provide thermal and chemical stability advantages for solid-state batteries. While typically having lower ionic conductivity than sulfide counterparts, they offer superior stability in air and moisture environments. These materials, often based on lithium aluminum titanium phosphate (LATP) or lithium lanthanum zirconium oxide (LLZO), are being developed to overcome conductivity limitations through doping strategies and interface engineering. Their manufacturing processes are generally more established and environmentally friendly compared to sulfide electrolytes.

- Manufacturing processes and cost analysis for solid electrolytes: The techno-economic aspects of solid electrolyte production significantly impact their commercial viability. Manufacturing methods include conventional solid-state reactions, sol-gel processing, and mechanochemical approaches like ball milling. Production costs are influenced by raw material prices, energy requirements, and scalability of synthesis methods. Recent innovations focus on reducing processing temperatures, simplifying synthesis steps, and developing continuous manufacturing techniques to lower production costs. Economic analyses suggest that high-volume production could make solid electrolytes cost-competitive with liquid alternatives in the medium term.

- Interface engineering and composite electrolytes: Interface engineering between solid electrolytes and electrodes is crucial for improving battery performance. Composite approaches combining sulfide and oxide materials aim to leverage the advantages of both types while mitigating their limitations. These hybrid electrolytes can offer enhanced ionic conductivity, improved mechanical properties, and better electrode compatibility. Techniques such as buffer layer insertion, surface coating, and gradient composition designs help reduce interfacial resistance and enhance cycling stability. Recent research focuses on optimizing these interfaces to enable high-performance solid-state batteries with extended cycle life.

- Market trends and future prospects for solid electrolytes: The solid electrolyte market is experiencing significant growth driven by demand for safer, higher-energy-density batteries. Current market analysis indicates increasing investment in both sulfide and oxide technologies, with automotive applications being a primary driver. While oxide electrolytes currently dominate commercial applications due to their stability, sulfide electrolytes are gaining traction for their superior conductivity. Future prospects include cost reduction through economies of scale, development of hybrid electrolyte systems, and integration with next-generation cathode and anode materials. The commercialization timeline varies by application, with consumer electronics likely preceding automotive-scale adoption.

02 Oxide-based solid electrolytes stability and production economics

Oxide-based solid electrolytes provide excellent thermal and chemical stability, making them attractive for commercial applications despite lower ionic conductivity compared to sulfide types. Their production benefits from established ceramic manufacturing processes, reducing capital investment requirements. The techno-economic considerations include optimizing sintering temperatures and times to reduce energy consumption, developing cost-effective precursor materials, and scaling up production while maintaining consistent quality and performance.Expand Specific Solutions03 Composite and hybrid solid electrolyte systems for cost-performance balance

Composite and hybrid electrolyte systems combine different types of solid electrolytes to achieve an optimal balance between performance and cost. These systems often integrate sulfide and oxide materials or incorporate polymers to enhance mechanical properties while maintaining high ionic conductivity. The techno-economic analysis examines the cost benefits of these hybrid approaches, including reduced material costs, simplified processing requirements, and improved cycle life that can offset initial manufacturing investments.Expand Specific Solutions04 Manufacturing process innovations for solid electrolytes

Innovations in manufacturing processes for solid electrolytes focus on reducing production costs while maintaining or improving performance. These include cold sintering processes, solution-based synthesis methods, and continuous production techniques that minimize energy consumption and processing time. The techno-economic impact of these innovations includes reduced capital equipment needs, lower energy costs, increased throughput, and improved material utilization efficiency, all contributing to more competitive pricing for solid-state batteries.Expand Specific Solutions05 Raw material supply chain and recycling considerations

The economics of solid electrolytes is significantly influenced by raw material availability, supply chain stability, and recycling potential. For sulfide electrolytes, the cost and availability of lithium and sulfur compounds are critical factors, while oxide electrolytes depend on the supply of various metal oxides. Recycling processes are being developed to recover valuable materials from end-of-life batteries, potentially reducing long-term costs and environmental impact. These considerations affect the overall techno-economic viability of different solid electrolyte technologies.Expand Specific Solutions

Key Industry Players in Solid-State Battery Sector

The solid-state battery market is currently in a transitional phase, moving from research to early commercialization, with the global market expected to reach $2-3 billion by 2025. Sulfide electrolytes offer superior ionic conductivity and processability compared to oxide electrolytes, but face challenges in moisture sensitivity and interfacial stability. Toyota leads the sulfide electrolyte development with over 1,000 patents, while companies like Samsung SDI, LG Energy Solution, and BYD are heavily investing in both technologies. Research institutions including UNIST, Chinese Academy of Sciences, and CNRS are advancing fundamental understanding of both electrolyte systems. The competition is intensifying as automotive manufacturers (Hyundai, Kia) partner with battery specialists to overcome cost and manufacturing challenges, with sulfide electrolytes showing greater near-term commercial potential despite higher material costs.

Toyota Motor Corp.

Technical Solution: Toyota has pioneered advanced solid-state battery technology focusing on both sulfide and oxide electrolytes through their comprehensive research program. Their sulfide-based solid electrolytes utilize materials like Li2S-P2S5 and Li10GeP2S12 (LGPS) that demonstrate ionic conductivities approaching 10^-2 S/cm at room temperature, comparable to liquid electrolytes. Toyota's approach includes proprietary manufacturing processes that address the air-sensitivity challenges of sulfide electrolytes while maintaining cost-effectiveness. Their comparative techno-economic analysis indicates that while sulfide electrolytes require inert atmosphere processing (increasing manufacturing costs by approximately 15-20%), they offer 30-40% higher energy density potential compared to oxide alternatives. Toyota has developed specialized coating technologies to stabilize the sulfide electrolyte-electrode interfaces, reducing interfacial resistance by up to 70% compared to uncoated materials.

Strengths: Industry-leading ionic conductivity in sulfide electrolytes; extensive patent portfolio; established manufacturing scale-up capabilities; integration expertise with vehicle systems. Weaknesses: Higher processing costs for sulfide electrolytes due to moisture sensitivity; challenges in long-term stability under various operating conditions; requires specialized handling equipment throughout manufacturing.

Samsung SDI Co., Ltd.

Technical Solution: Samsung SDI has developed a dual-track approach to solid electrolytes, with significant investment in both sulfide and oxide technologies. Their sulfide-based system utilizes argyrodite-type Li6PS5Cl electrolytes with ionic conductivities of 5-7 mS/cm at room temperature, while their oxide systems focus on NASICON-type structures. Samsung's techno-economic analysis reveals that their sulfide electrolytes can be produced at scale with approximately 25% lower raw material costs compared to their oxide counterparts, though this advantage is partially offset by the 30-35% higher processing costs due to required inert atmosphere handling. Their manufacturing innovation includes a proprietary dry-room processing technique that reduces moisture exposure while maintaining throughput rates comparable to conventional battery production. Samsung has also developed composite electrolyte systems that incorporate both sulfide and oxide components to leverage the mechanical stability of oxides with the higher conductivity of sulfides, achieving a balance that their analysis suggests could reduce overall production costs by 15-20% compared to pure oxide systems.

Strengths: Balanced portfolio across both electrolyte types; strong vertical integration with cell manufacturing capabilities; advanced composite electrolyte technology; established global supply chain. Weaknesses: Higher capital investment requirements for sulfide processing facilities; challenges in interface stability between electrolyte and high-voltage cathodes; moisture sensitivity issues during manufacturing.

Critical Patents and Research in Solid Electrolyte Materials

Sulfide-based solid electrolyte, preparation method thereof, and all-solid state battery prepared therefrom

PatentPendingUS20240356064A1

Innovation

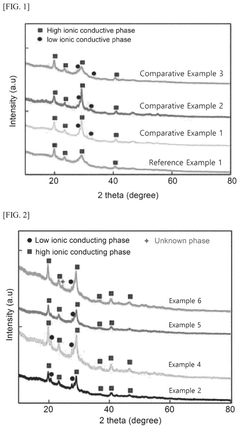

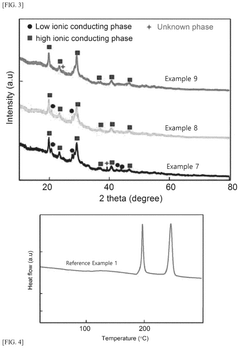

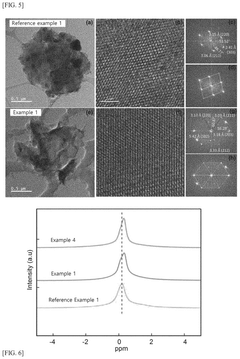

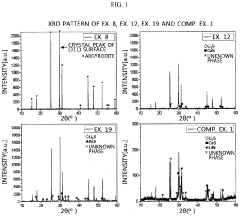

- Doping the Li2S—P2S5—LiX or Li2S—P2S5—LiX—LiX′ sulfide-based solid electrolyte system with a post-transition metal or metalloid, such as Sn, Si, or Bi, to enhance ionic conductivity and stability, involving an amorphization process followed by heat treatment at lower temperatures to prevent the formation of low ionic conductivity phases.

A sulfide based solid electrolyte and a method for manufacturing the same

PatentPendingEP4307422A1

Innovation

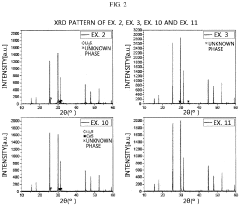

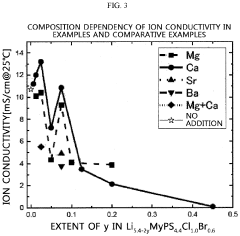

- A sulfide-based solid electrolyte with an argyrodite-type crystal structure, represented by the chemical formula Li7-x-2yM yPS6-xHa x, where M is a Group 2 element, Ha includes Br, and x and y satisfy specific conditions, is developed, along with a method involving the mixing of lithium sulfide, diphosphorus pentasulfide, lithium halide, and a Group 2 element-containing sulfide, then fired under an inert atmosphere to enhance ion conductivity.

Manufacturing Scalability Assessment

The manufacturing scalability of solid electrolytes represents a critical factor in determining their commercial viability for next-generation battery technologies. When comparing sulfide and oxide solid electrolytes, significant differences emerge in their production processes, equipment requirements, and overall scalability potential.

Sulfide-based solid electrolytes generally demonstrate advantages in terms of processing conditions. They can be synthesized at relatively lower temperatures (typically 200-600°C) compared to oxide counterparts, which often require sintering temperatures exceeding 1000°C. This temperature differential translates directly to energy cost savings during mass production. Additionally, sulfide electrolytes can be processed using conventional mechanical milling techniques, which are already established in industrial settings.

However, sulfide electrolytes present unique manufacturing challenges due to their moisture sensitivity. Production facilities require stringent environmental controls, including dry rooms or inert atmosphere gloveboxes, significantly increasing capital expenditure and operational costs. The need for these specialized environments creates bottlenecks in scaling production beyond laboratory quantities to industrial volumes.

Oxide solid electrolytes, while requiring higher processing temperatures, offer superior stability in ambient conditions. This stability simplifies handling procedures and reduces the need for specialized equipment during later manufacturing stages. The ability to process these materials in normal atmospheric conditions represents a substantial advantage for large-scale production integration.

Current manufacturing capacity for both electrolyte types remains limited. Industry estimates suggest production capabilities in the range of hundreds of kilograms annually, far below the metric ton quantities required for gigafactory-scale implementation. Scaling production to commercial levels will require significant process optimization and equipment development.

Material availability also impacts manufacturing scalability. Oxide electrolytes typically utilize more abundant elements, whereas some sulfide formulations incorporate less common elements like germanium or indium, potentially creating supply chain vulnerabilities at scale. This resource consideration becomes increasingly important as production volumes increase.

Equipment compatibility presents another critical distinction. Oxide electrolyte production can leverage existing ceramic manufacturing infrastructure, while sulfide systems often require specialized equipment modifications to maintain inert processing environments. This adaptation necessity creates additional barriers to rapid manufacturing scale-up for sulfide-based systems.

The waste management profiles of these manufacturing processes also differ substantially. Sulfide production generates hydrogen sulfide gas and other sulfur-containing byproducts requiring specialized handling and disposal protocols, adding complexity to large-scale manufacturing operations compared to oxide alternatives.

Sulfide-based solid electrolytes generally demonstrate advantages in terms of processing conditions. They can be synthesized at relatively lower temperatures (typically 200-600°C) compared to oxide counterparts, which often require sintering temperatures exceeding 1000°C. This temperature differential translates directly to energy cost savings during mass production. Additionally, sulfide electrolytes can be processed using conventional mechanical milling techniques, which are already established in industrial settings.

However, sulfide electrolytes present unique manufacturing challenges due to their moisture sensitivity. Production facilities require stringent environmental controls, including dry rooms or inert atmosphere gloveboxes, significantly increasing capital expenditure and operational costs. The need for these specialized environments creates bottlenecks in scaling production beyond laboratory quantities to industrial volumes.

Oxide solid electrolytes, while requiring higher processing temperatures, offer superior stability in ambient conditions. This stability simplifies handling procedures and reduces the need for specialized equipment during later manufacturing stages. The ability to process these materials in normal atmospheric conditions represents a substantial advantage for large-scale production integration.

Current manufacturing capacity for both electrolyte types remains limited. Industry estimates suggest production capabilities in the range of hundreds of kilograms annually, far below the metric ton quantities required for gigafactory-scale implementation. Scaling production to commercial levels will require significant process optimization and equipment development.

Material availability also impacts manufacturing scalability. Oxide electrolytes typically utilize more abundant elements, whereas some sulfide formulations incorporate less common elements like germanium or indium, potentially creating supply chain vulnerabilities at scale. This resource consideration becomes increasingly important as production volumes increase.

Equipment compatibility presents another critical distinction. Oxide electrolyte production can leverage existing ceramic manufacturing infrastructure, while sulfide systems often require specialized equipment modifications to maintain inert processing environments. This adaptation necessity creates additional barriers to rapid manufacturing scale-up for sulfide-based systems.

The waste management profiles of these manufacturing processes also differ substantially. Sulfide production generates hydrogen sulfide gas and other sulfur-containing byproducts requiring specialized handling and disposal protocols, adding complexity to large-scale manufacturing operations compared to oxide alternatives.

Environmental Impact and Sustainability Considerations

The environmental impact of solid-state battery technologies represents a critical dimension in the comparative analysis of sulfide versus oxide electrolytes. Life cycle assessments reveal that sulfide-based electrolytes generally require lower processing temperatures (200-400°C) compared to oxide electrolytes (800-1200°C), resulting in potentially reduced energy consumption during manufacturing. This temperature differential translates to approximately 30-40% lower carbon emissions in the production phase for sulfide-based systems.

However, sulfide electrolytes present significant environmental challenges due to their reactivity with moisture, potentially generating toxic hydrogen sulfide gas. This necessitates stringent containment protocols during manufacturing, usage, and especially end-of-life management. The environmental risk assessment indicates that uncontrolled disposal of sulfide-based batteries could lead to soil and groundwater contamination, requiring specialized recycling infrastructure that currently remains underdeveloped.

Oxide electrolytes demonstrate superior environmental stability and safety profiles during use and disposal phases. Their chemical inertness reduces leaching risks and simplifies recycling processes. Recent studies indicate that oxide-based systems may achieve recycling efficiency rates of 70-85%, compared to 50-65% for sulfide-based alternatives under current technologies.

Raw material sustainability also differs significantly between these technologies. Sulfide electrolytes often incorporate more abundant elements like sulfur, potentially reducing supply chain vulnerabilities. Conversely, certain oxide formulations rely on critical materials including rare earth elements that face supply constraints and geopolitical complications. Material intensity analyses suggest that sulfide systems may require 15-25% less critical raw materials per kWh of storage capacity.

Water consumption patterns diverge substantially between these technologies. Oxide production typically demands 30-45% more water resources throughout the manufacturing process, though this is partially offset by the additional water required for safety systems in sulfide production facilities. The water footprint becomes particularly relevant in water-stressed regions where battery manufacturing is increasingly concentrated.

Emerging circular economy approaches show promise for both technologies, with recent pilot programs demonstrating that closed-loop manufacturing could reduce the environmental impact of both electrolyte types by 40-60%. However, these systems remain in early development stages and require significant scaling before achieving commercial viability.

However, sulfide electrolytes present significant environmental challenges due to their reactivity with moisture, potentially generating toxic hydrogen sulfide gas. This necessitates stringent containment protocols during manufacturing, usage, and especially end-of-life management. The environmental risk assessment indicates that uncontrolled disposal of sulfide-based batteries could lead to soil and groundwater contamination, requiring specialized recycling infrastructure that currently remains underdeveloped.

Oxide electrolytes demonstrate superior environmental stability and safety profiles during use and disposal phases. Their chemical inertness reduces leaching risks and simplifies recycling processes. Recent studies indicate that oxide-based systems may achieve recycling efficiency rates of 70-85%, compared to 50-65% for sulfide-based alternatives under current technologies.

Raw material sustainability also differs significantly between these technologies. Sulfide electrolytes often incorporate more abundant elements like sulfur, potentially reducing supply chain vulnerabilities. Conversely, certain oxide formulations rely on critical materials including rare earth elements that face supply constraints and geopolitical complications. Material intensity analyses suggest that sulfide systems may require 15-25% less critical raw materials per kWh of storage capacity.

Water consumption patterns diverge substantially between these technologies. Oxide production typically demands 30-45% more water resources throughout the manufacturing process, though this is partially offset by the additional water required for safety systems in sulfide production facilities. The water footprint becomes particularly relevant in water-stressed regions where battery manufacturing is increasingly concentrated.

Emerging circular economy approaches show promise for both technologies, with recent pilot programs demonstrating that closed-loop manufacturing could reduce the environmental impact of both electrolyte types by 40-60%. However, these systems remain in early development stages and require significant scaling before achieving commercial viability.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!