Comparing Colloidal Silica and Alumina in Slurry Formulations

SEP 10, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Colloidal Abrasives Background and Objectives

Colloidal abrasives have evolved significantly over the past several decades, transforming from simple polishing agents to sophisticated engineered materials with precisely controlled properties. The development trajectory of colloidal silica and alumina has been particularly noteworthy, with continuous improvements in particle size distribution, surface modification capabilities, and stability characteristics. These advancements have enabled increasingly precise material removal processes across multiple industries, from semiconductor manufacturing to optical component production.

The evolution of colloidal abrasives has been driven by the semiconductor industry's relentless pursuit of smaller feature sizes and higher device densities. As Moore's Law pushed manufacturers toward nanometer-scale features, traditional mechanical polishing methods proved inadequate, leading to the development of chemical-mechanical planarization (CMP) processes utilizing engineered colloidal particles. This technological progression has established distinct performance profiles for silica and alumina-based slurries.

Current market trends indicate a growing divergence in application domains for these two primary colloidal abrasive types. Colloidal silica has demonstrated superior performance in applications requiring high selectivity and minimal surface defects, while alumina-based formulations typically offer higher removal rates and cost advantages in less demanding applications. Understanding these differentiated value propositions is essential for strategic technology development.

The primary objective of this technical investigation is to conduct a comprehensive comparative analysis of colloidal silica and alumina in slurry formulations across multiple dimensions: physical properties, chemical interactions, performance metrics, and economic considerations. This analysis aims to establish clear selection criteria for specific applications and identify opportunities for hybrid or novel formulations that leverage the strengths of both materials.

Additionally, this research seeks to map the relationship between colloidal particle characteristics (size, shape, surface charge, etc.) and performance outcomes in various polishing scenarios. By establishing these correlations, we aim to develop predictive models that can accelerate formulation development and optimization processes, reducing empirical testing requirements and associated costs.

The investigation will also explore emerging trends in colloidal abrasive technology, including environmentally sustainable formulations, reduced water consumption approaches, and integration with advanced process control systems. These forward-looking assessments will inform long-term research and development strategies, ensuring alignment with both technological capabilities and evolving market requirements.

The evolution of colloidal abrasives has been driven by the semiconductor industry's relentless pursuit of smaller feature sizes and higher device densities. As Moore's Law pushed manufacturers toward nanometer-scale features, traditional mechanical polishing methods proved inadequate, leading to the development of chemical-mechanical planarization (CMP) processes utilizing engineered colloidal particles. This technological progression has established distinct performance profiles for silica and alumina-based slurries.

Current market trends indicate a growing divergence in application domains for these two primary colloidal abrasive types. Colloidal silica has demonstrated superior performance in applications requiring high selectivity and minimal surface defects, while alumina-based formulations typically offer higher removal rates and cost advantages in less demanding applications. Understanding these differentiated value propositions is essential for strategic technology development.

The primary objective of this technical investigation is to conduct a comprehensive comparative analysis of colloidal silica and alumina in slurry formulations across multiple dimensions: physical properties, chemical interactions, performance metrics, and economic considerations. This analysis aims to establish clear selection criteria for specific applications and identify opportunities for hybrid or novel formulations that leverage the strengths of both materials.

Additionally, this research seeks to map the relationship between colloidal particle characteristics (size, shape, surface charge, etc.) and performance outcomes in various polishing scenarios. By establishing these correlations, we aim to develop predictive models that can accelerate formulation development and optimization processes, reducing empirical testing requirements and associated costs.

The investigation will also explore emerging trends in colloidal abrasive technology, including environmentally sustainable formulations, reduced water consumption approaches, and integration with advanced process control systems. These forward-looking assessments will inform long-term research and development strategies, ensuring alignment with both technological capabilities and evolving market requirements.

Market Analysis of Slurry Formulations

The global market for chemical mechanical planarization (CMP) slurry formulations has been experiencing robust growth, driven primarily by the semiconductor industry's continuous advancement toward smaller node sizes and more complex architectures. The market value reached approximately $2.3 billion in 2022 and is projected to grow at a CAGR of 7.8% through 2028, potentially reaching $3.6 billion by the end of the forecast period.

Colloidal silica-based slurries currently dominate the market with roughly 65% market share, valued at $1.5 billion. This dominance stems from silica's established performance in traditional silicon oxide and tungsten CMP processes. However, alumina-based slurries, currently holding about 25% market share ($575 million), are gaining traction due to their superior performance in certain advanced applications, particularly in metal polishing processes where higher removal rates are required.

Regional analysis reveals that Asia Pacific commands the largest market share at 68%, with Taiwan, South Korea, and China being the primary contributors. This dominance correlates directly with the concentration of semiconductor manufacturing facilities in these regions. North America follows with 18% market share, while Europe accounts for approximately 12%.

End-user segmentation shows that integrated device manufacturers (IDMs) and foundries constitute the largest consumer segment (78%), followed by memory manufacturers (15%). The remaining market is distributed among various specialty applications including MEMS, photonics, and advanced packaging solutions.

A significant market trend is the increasing demand for slurry formulations tailored for specific applications. Custom formulations now represent approximately 35% of the market, up from 22% five years ago. This shift reflects the growing complexity of semiconductor manufacturing processes and the need for highly specialized solutions.

Price sensitivity analysis indicates that while colloidal silica slurries generally command lower price points ($15-25 per liter), alumina-based formulations typically sell at premium prices ($25-40 per liter) due to their specialized applications and performance advantages in certain processes. However, this price differential is gradually narrowing as manufacturing processes for alumina slurries become more efficient.

Market forecasts suggest that alumina-based slurries will experience faster growth (9.5% CAGR) compared to silica-based formulations (6.2% CAGR) over the next five years. This differential growth rate is attributed to the increasing adoption of advanced node technologies that require the superior performance characteristics of alumina in specific applications.

Colloidal silica-based slurries currently dominate the market with roughly 65% market share, valued at $1.5 billion. This dominance stems from silica's established performance in traditional silicon oxide and tungsten CMP processes. However, alumina-based slurries, currently holding about 25% market share ($575 million), are gaining traction due to their superior performance in certain advanced applications, particularly in metal polishing processes where higher removal rates are required.

Regional analysis reveals that Asia Pacific commands the largest market share at 68%, with Taiwan, South Korea, and China being the primary contributors. This dominance correlates directly with the concentration of semiconductor manufacturing facilities in these regions. North America follows with 18% market share, while Europe accounts for approximately 12%.

End-user segmentation shows that integrated device manufacturers (IDMs) and foundries constitute the largest consumer segment (78%), followed by memory manufacturers (15%). The remaining market is distributed among various specialty applications including MEMS, photonics, and advanced packaging solutions.

A significant market trend is the increasing demand for slurry formulations tailored for specific applications. Custom formulations now represent approximately 35% of the market, up from 22% five years ago. This shift reflects the growing complexity of semiconductor manufacturing processes and the need for highly specialized solutions.

Price sensitivity analysis indicates that while colloidal silica slurries generally command lower price points ($15-25 per liter), alumina-based formulations typically sell at premium prices ($25-40 per liter) due to their specialized applications and performance advantages in certain processes. However, this price differential is gradually narrowing as manufacturing processes for alumina slurries become more efficient.

Market forecasts suggest that alumina-based slurries will experience faster growth (9.5% CAGR) compared to silica-based formulations (6.2% CAGR) over the next five years. This differential growth rate is attributed to the increasing adoption of advanced node technologies that require the superior performance characteristics of alumina in specific applications.

Current Challenges in Silica vs Alumina Colloids

Despite significant advancements in slurry formulation technology, both colloidal silica and alumina continue to face substantial challenges that limit their optimal performance in various applications. The primary challenge with colloidal silica lies in its inherent instability across varying pH conditions. While silica colloids demonstrate excellent stability in alkaline environments (pH > 8), they tend to agglomerate rapidly when exposed to acidic conditions, significantly reducing their effectiveness in applications requiring lower pH ranges.

Colloidal silica also exhibits sensitivity to electrolyte concentration, with even modest increases in ionic strength potentially triggering gelation or precipitation. This characteristic severely restricts its application in environments with fluctuating salt concentrations or when formulating multi-component slurries where ionic interactions are unavoidable.

Conversely, alumina colloids present a different set of challenges. They typically achieve optimal stability in acidic conditions (pH 3-5) but become increasingly unstable as pH rises toward neutral or alkaline values. This pH-dependent behavior creates significant formulation constraints when developing slurries for applications requiring neutral or basic conditions.

Surface modification of both colloid types remains problematic. Current functionalization methods often compromise the colloidal stability or alter other critical properties such as particle size distribution and surface charge density. The trade-off between enhanced functionality and maintained stability continues to challenge formulation scientists.

Temperature sensitivity represents another significant hurdle, particularly for silica colloids. Many silica-based slurries exhibit irreversible property changes when subjected to temperature fluctuations during processing or storage, leading to inconsistent performance and reduced shelf life. Alumina colloids generally demonstrate better thermal stability but may still undergo irreversible aggregation at elevated temperatures.

Reproducibility in large-scale production presents ongoing difficulties for both colloid types. Batch-to-batch variations in particle size distribution, surface charge, and stability parameters frequently occur, complicating quality control processes and potentially affecting end-product performance.

The interaction between these colloidal particles and other slurry components (dispersants, surfactants, binders) remains incompletely understood. Competitive adsorption phenomena and unexpected synergistic or antagonistic effects frequently emerge during formulation, making predictive modeling of slurry behavior challenging.

Finally, environmental and health concerns are increasingly influencing formulation decisions. Regulatory pressure to reduce or eliminate certain traditional stabilizers and additives has created new challenges in maintaining performance while meeting sustainability requirements. This is particularly relevant for silica colloids, where some conventional stabilization approaches face increasing scrutiny from environmental and occupational health perspectives.

Colloidal silica also exhibits sensitivity to electrolyte concentration, with even modest increases in ionic strength potentially triggering gelation or precipitation. This characteristic severely restricts its application in environments with fluctuating salt concentrations or when formulating multi-component slurries where ionic interactions are unavoidable.

Conversely, alumina colloids present a different set of challenges. They typically achieve optimal stability in acidic conditions (pH 3-5) but become increasingly unstable as pH rises toward neutral or alkaline values. This pH-dependent behavior creates significant formulation constraints when developing slurries for applications requiring neutral or basic conditions.

Surface modification of both colloid types remains problematic. Current functionalization methods often compromise the colloidal stability or alter other critical properties such as particle size distribution and surface charge density. The trade-off between enhanced functionality and maintained stability continues to challenge formulation scientists.

Temperature sensitivity represents another significant hurdle, particularly for silica colloids. Many silica-based slurries exhibit irreversible property changes when subjected to temperature fluctuations during processing or storage, leading to inconsistent performance and reduced shelf life. Alumina colloids generally demonstrate better thermal stability but may still undergo irreversible aggregation at elevated temperatures.

Reproducibility in large-scale production presents ongoing difficulties for both colloid types. Batch-to-batch variations in particle size distribution, surface charge, and stability parameters frequently occur, complicating quality control processes and potentially affecting end-product performance.

The interaction between these colloidal particles and other slurry components (dispersants, surfactants, binders) remains incompletely understood. Competitive adsorption phenomena and unexpected synergistic or antagonistic effects frequently emerge during formulation, making predictive modeling of slurry behavior challenging.

Finally, environmental and health concerns are increasingly influencing formulation decisions. Regulatory pressure to reduce or eliminate certain traditional stabilizers and additives has created new challenges in maintaining performance while meeting sustainability requirements. This is particularly relevant for silica colloids, where some conventional stabilization approaches face increasing scrutiny from environmental and occupational health perspectives.

Comparative Assessment of Current Slurry Technologies

01 Preparation methods of colloidal silica and alumina

Various methods are employed to prepare colloidal silica and alumina with controlled properties. These methods include sol-gel processes, precipitation techniques, and hydrothermal synthesis. The preparation conditions such as temperature, pH, and reactant concentrations significantly influence the particle size, morphology, and stability of the resulting colloids. These preparation methods can be optimized to produce colloidal silica and alumina with specific surface areas and pore structures suitable for different applications.- Preparation and properties of colloidal silica and alumina: Colloidal silica and alumina can be prepared through various methods to achieve specific particle sizes and properties. These colloids typically consist of nano-sized particles dispersed in a liquid medium, with controlled surface charges and stability characteristics. The preparation methods may involve precipitation, sol-gel processes, or hydrothermal treatments to achieve desired properties such as surface area, particle size distribution, and zeta potential. These fundamental properties determine their effectiveness in various applications.

- Applications in coating and surface treatments: Colloidal silica and alumina are widely used in coating applications to enhance surface properties of various substrates. These colloids can be applied to surfaces to improve hardness, scratch resistance, and durability. They are particularly valuable in creating protective layers on materials such as metals, glass, ceramics, and polymers. The coating process typically involves applying the colloid to the substrate followed by drying or curing to form a thin, uniform layer that provides enhanced surface characteristics.

- Use in catalyst and adsorbent systems: Colloidal silica and alumina serve as important components in catalyst and adsorbent systems due to their high surface area and active sites. These materials can function as catalyst supports or as catalysts themselves in various chemical reactions. The controlled porosity and surface chemistry of these colloids make them effective for selective adsorption processes. By modifying their surface properties, these materials can be tailored for specific catalytic applications in petroleum refining, chemical synthesis, and environmental remediation.

- Composite materials incorporating colloidal silica and alumina: Colloidal silica and alumina can be incorporated into various composite materials to enhance their mechanical, thermal, and chemical properties. These composites may include polymer matrices, ceramic systems, or hybrid materials where the colloids serve as reinforcing agents or functional additives. The incorporation of these colloids can improve strength, heat resistance, flame retardancy, and dimensional stability of the resulting composites. The uniform dispersion of the colloids within the matrix is crucial for achieving optimal performance enhancements.

- Stabilization and formulation techniques: Various stabilization and formulation techniques are employed to maintain the colloidal stability of silica and alumina dispersions. These techniques may involve pH adjustment, addition of dispersants, surface modification, or electrostatic stabilization to prevent agglomeration and sedimentation. Proper formulation ensures long-term stability and consistent performance in applications. The stability of these colloids is critical for their shelf life and effectiveness in various industrial processes, including papermaking, wastewater treatment, and precision polishing applications.

02 Surface modification of colloidal silica and alumina

Surface modification of colloidal silica and alumina particles enhances their compatibility with various matrices and improves their performance in specific applications. Modification techniques include functionalization with organic groups, coating with polymers, or treatment with coupling agents. These modifications can alter surface charge, hydrophobicity, and reactivity of the colloidal particles, leading to improved dispersion stability and enhanced interactions with other materials in composite systems.Expand Specific Solutions03 Applications in coatings and films

Colloidal silica and alumina are widely used in coating formulations to enhance properties such as scratch resistance, hardness, and optical clarity. When incorporated into films and coatings, these colloidal particles can improve adhesion, thermal stability, and barrier properties. The nanoscale dimensions of colloidal silica and alumina allow for the creation of transparent coatings with enhanced mechanical properties without compromising optical clarity, making them valuable in protective coatings for electronics, automotive finishes, and architectural applications.Expand Specific Solutions04 Use in composite materials

Colloidal silica and alumina serve as reinforcing agents in various composite materials, enhancing mechanical strength, thermal stability, and dimensional stability. When dispersed in polymer matrices, ceramic bodies, or cementitious materials, these colloidal particles can significantly improve properties such as tensile strength, modulus, and impact resistance. The uniform dispersion of colloidal silica and alumina in the matrix material is crucial for achieving optimal performance in composite applications ranging from advanced ceramics to polymer nanocomposites.Expand Specific Solutions05 Environmental and catalytic applications

Colloidal silica and alumina play important roles in environmental remediation and catalytic processes due to their high surface area and reactive surface sites. These materials can be used as adsorbents for pollutant removal, supports for catalysts, or as catalysts themselves in various chemical reactions. The controlled porosity and surface chemistry of colloidal silica and alumina make them effective in applications such as water purification, air filtration, and heterogeneous catalysis for industrial chemical processes and emissions control.Expand Specific Solutions

Leading Manufacturers and Suppliers Analysis

The colloidal silica and alumina slurry formulation market is in a growth phase, with increasing applications in semiconductor polishing, ceramics manufacturing, and petrochemical industries. The market is estimated to reach several billion dollars by 2025, driven by demand for high-precision surface finishing technologies. Technologically, the field shows varying maturity levels across applications, with semiconductor CMP being most advanced. Key players demonstrate different specialization patterns: China Petroleum & Chemical Corp. and PetroChina focus on petrochemical applications; Cabot Microelectronics, Versum Materials, and Fujimi lead in semiconductor processing; while Saint-Gobain, Sasol, and Anhui Quechen Silicon Chemical specialize in advanced ceramic formulations. Western companies currently dominate intellectual property, though Chinese firms are rapidly advancing their technological capabilities.

Saint-Gobain Ceramics & Plastics, Inc.

Technical Solution: Saint-Gobain has developed proprietary colloidal silica and alumina slurry systems for precision polishing applications across multiple industries. Their technology centers on engineered particles with controlled morphology and surface chemistry, achieving removal rates up to 40% higher than conventional formulations while maintaining surface finish quality. The company utilizes a unique sol-gel synthesis process that produces highly uniform particles with specific crystalline structures optimized for different substrate materials. Their alumina-based slurries feature alpha-alumina particles with controlled angularity for aggressive stock removal, while their silica formulations incorporate spherical particles for superior surface finishing. Saint-Gobain has also pioneered environmentally friendly formulations with biodegradable dispersants and pH stabilizers that reduce waste treatment requirements while maintaining performance characteristics comparable to traditional formulations.

Strengths: Exceptional particle uniformity leading to predictable material removal rates; versatile formulations applicable across multiple industries; environmentally conscious compositions reducing waste treatment costs. Weaknesses: Some formulations require specialized mixing equipment to maintain suspension stability; higher initial cost compared to conventional abrasives; may require process adjustments when transitioning from traditional slurries.

PPG Industries Ohio, Inc.

Technical Solution: PPG Industries has developed specialized colloidal silica and alumina slurry formulations for precision polishing applications across multiple industries including automotive, aerospace, and electronics. Their technology centers on engineered particles with controlled size distributions (typically 5-500nm) and surface modifications that enhance suspension stability and material removal characteristics. PPG's proprietary manufacturing process produces particles with specific morphologies optimized for different substrate materials and surface finish requirements. Their silica-based formulations incorporate spherical particles with narrow size distributions for superior surface finishing, while their alumina slurries feature controlled crystalline structures for more aggressive material removal. The company has also developed hybrid formulations that combine silica and alumina with proprietary additives to achieve specific performance characteristics for challenging materials. PPG's recent innovations include environmentally friendly formulations with reduced heavy metal content and biodegradable dispersants that maintain performance while reducing environmental impact.

Strengths: Wide range of formulations covering diverse applications; excellent batch-to-batch consistency ensuring predictable performance; environmentally conscious compositions reducing regulatory concerns. Weaknesses: Some specialized formulations require precise process control parameters; higher cost compared to conventional abrasives; may require specialized handling and storage conditions to maintain stability.

Key Patents and Innovations in Colloidal Abrasives

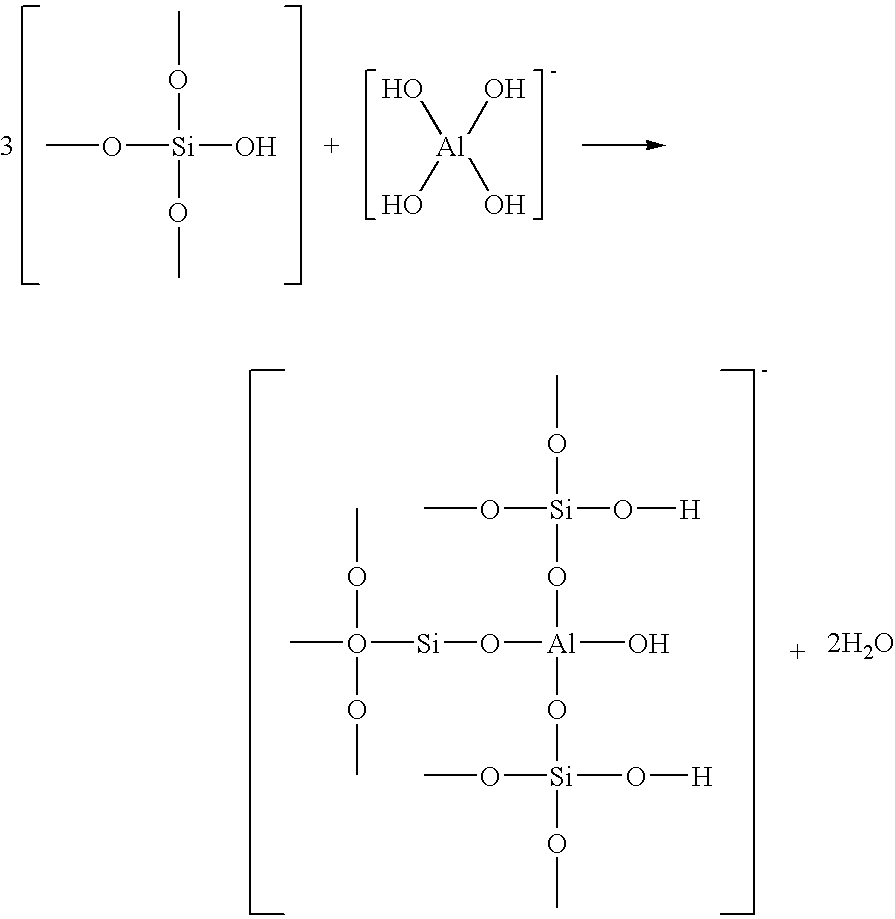

Aqueous slurry containing metallate-modified silica particles

PatentInactiveUS20070037892A1

Innovation

- Anionically modifying silica abrasive particles with metallate anions such as aluminate, stannate, zincate, and plumbate to enhance their negative surface charge, thereby increasing stability and removal rates while maintaining low defectivity and selectivity towards tantalum nitride/tantalum barriers.

A silica and a silica-based slurry

PatentInactiveEP1397458A1

Innovation

- A silica-based slurry with aggregated primary particles having an average diameter of at least 7 nanometers and an aggregate size of less than one micron, characterized by a high hydroxyl content and specific surface area, is developed. This silica is prepared through a process involving the precipitation of alkali metal silicate with controlled hydroxide concentration and aging conditions to enhance its surface roughness and dispersion properties.

Environmental Impact and Sustainability Considerations

The environmental impact of slurry formulations containing colloidal silica versus alumina represents a critical consideration in modern industrial applications. Colloidal silica demonstrates several environmental advantages, including lower energy requirements during production compared to alumina. The manufacturing process for colloidal silica typically consumes 15-30% less energy than alumina production, resulting in a reduced carbon footprint across the supply chain. Additionally, silica-based slurries often require fewer harsh chemicals during formulation and application, minimizing the release of potentially harmful substances into wastewater streams.

Waste management considerations also favor colloidal silica in many applications. Post-process residues from silica-based slurries tend to be more amenable to conventional treatment methods, with studies indicating up to 25% higher recovery rates during recycling efforts compared to alumina slurries. This translates to reduced landfill burden and decreased environmental contamination risk from disposal activities.

However, alumina slurries present their own sustainability advantages in specific contexts. The higher durability and efficiency of alumina in certain polishing applications can result in extended product lifecycles and reduced material consumption over time. Recent research indicates that high-purity alumina slurries can achieve up to 40% longer operational lifespans in semiconductor manufacturing environments, potentially offsetting their higher initial environmental impact through reduced replacement frequency.

Water consumption patterns differ significantly between these materials. Colloidal silica formulations typically require 10-20% less water during both production and application phases. This water conservation benefit becomes particularly significant in regions facing water scarcity challenges or in industries with high-volume slurry requirements such as chemical-mechanical planarization processes in semiconductor manufacturing.

Regulatory compliance trajectories also influence sustainability considerations. Emerging environmental regulations in key manufacturing regions increasingly favor materials with lower toxicity profiles and reduced persistent environmental impacts. Colloidal silica generally faces fewer regulatory restrictions due to its lower ecotoxicity, particularly regarding aquatic ecosystems where studies have demonstrated 30-50% lower impact metrics compared to certain alumina formulations.

Life cycle assessment (LCA) data indicates that the environmental impact ratio between these materials varies significantly based on application context. While colloidal silica typically demonstrates superior environmental performance in consumer electronics applications, alumina may present advantages in high-temperature industrial processes where its thermal stability reduces energy requirements during operation. This application-specific variability necessitates careful evaluation of environmental tradeoffs based on intended use scenarios and regional environmental priorities.

Waste management considerations also favor colloidal silica in many applications. Post-process residues from silica-based slurries tend to be more amenable to conventional treatment methods, with studies indicating up to 25% higher recovery rates during recycling efforts compared to alumina slurries. This translates to reduced landfill burden and decreased environmental contamination risk from disposal activities.

However, alumina slurries present their own sustainability advantages in specific contexts. The higher durability and efficiency of alumina in certain polishing applications can result in extended product lifecycles and reduced material consumption over time. Recent research indicates that high-purity alumina slurries can achieve up to 40% longer operational lifespans in semiconductor manufacturing environments, potentially offsetting their higher initial environmental impact through reduced replacement frequency.

Water consumption patterns differ significantly between these materials. Colloidal silica formulations typically require 10-20% less water during both production and application phases. This water conservation benefit becomes particularly significant in regions facing water scarcity challenges or in industries with high-volume slurry requirements such as chemical-mechanical planarization processes in semiconductor manufacturing.

Regulatory compliance trajectories also influence sustainability considerations. Emerging environmental regulations in key manufacturing regions increasingly favor materials with lower toxicity profiles and reduced persistent environmental impacts. Colloidal silica generally faces fewer regulatory restrictions due to its lower ecotoxicity, particularly regarding aquatic ecosystems where studies have demonstrated 30-50% lower impact metrics compared to certain alumina formulations.

Life cycle assessment (LCA) data indicates that the environmental impact ratio between these materials varies significantly based on application context. While colloidal silica typically demonstrates superior environmental performance in consumer electronics applications, alumina may present advantages in high-temperature industrial processes where its thermal stability reduces energy requirements during operation. This application-specific variability necessitates careful evaluation of environmental tradeoffs based on intended use scenarios and regional environmental priorities.

Performance Metrics and Quality Control Standards

Establishing robust performance metrics and quality control standards is essential for evaluating colloidal silica and alumina slurry formulations in precision polishing applications. The industry has developed comprehensive measurement protocols that enable objective comparison between these two abrasive materials.

Material removal rate (MRR) serves as a primary performance indicator, typically measured in nanometers per minute or angstroms per minute. For colloidal silica, MRR values generally range from 50-200 nm/min depending on particle size and concentration, while alumina typically achieves 100-300 nm/min under similar conditions. These measurements must be conducted under standardized pressure, rotation speed, and temperature parameters to ensure reproducibility.

Surface roughness metrics, including Ra (arithmetic average), Rq (root mean square), and Rz (maximum height), provide critical quality indicators. The industry standard for semiconductor applications typically requires Ra values below 0.5 nm for final polishing steps. Colloidal silica generally produces surfaces with Ra values of 0.1-0.3 nm, while alumina typically yields 0.2-0.5 nm, though these values vary significantly with particle morphology and process conditions.

Defectivity measurements constitute another crucial performance category, quantified through light scattering techniques and expressed as defects per unit area. The semiconductor industry typically requires defect densities below 0.1 defects/cm² for critical applications. Standardized testing protocols involve controlled contamination challenges followed by particle counting using laser scanning or optical inspection systems.

Chemical-mechanical selectivity ratios must be carefully monitored, particularly in multi-material systems. These ratios compare removal rates between different materials (e.g., silicon dioxide vs. silicon nitride) and are critical for achieving planarization in complex structures. Standardized test structures with known material interfaces are employed to generate reproducible selectivity data.

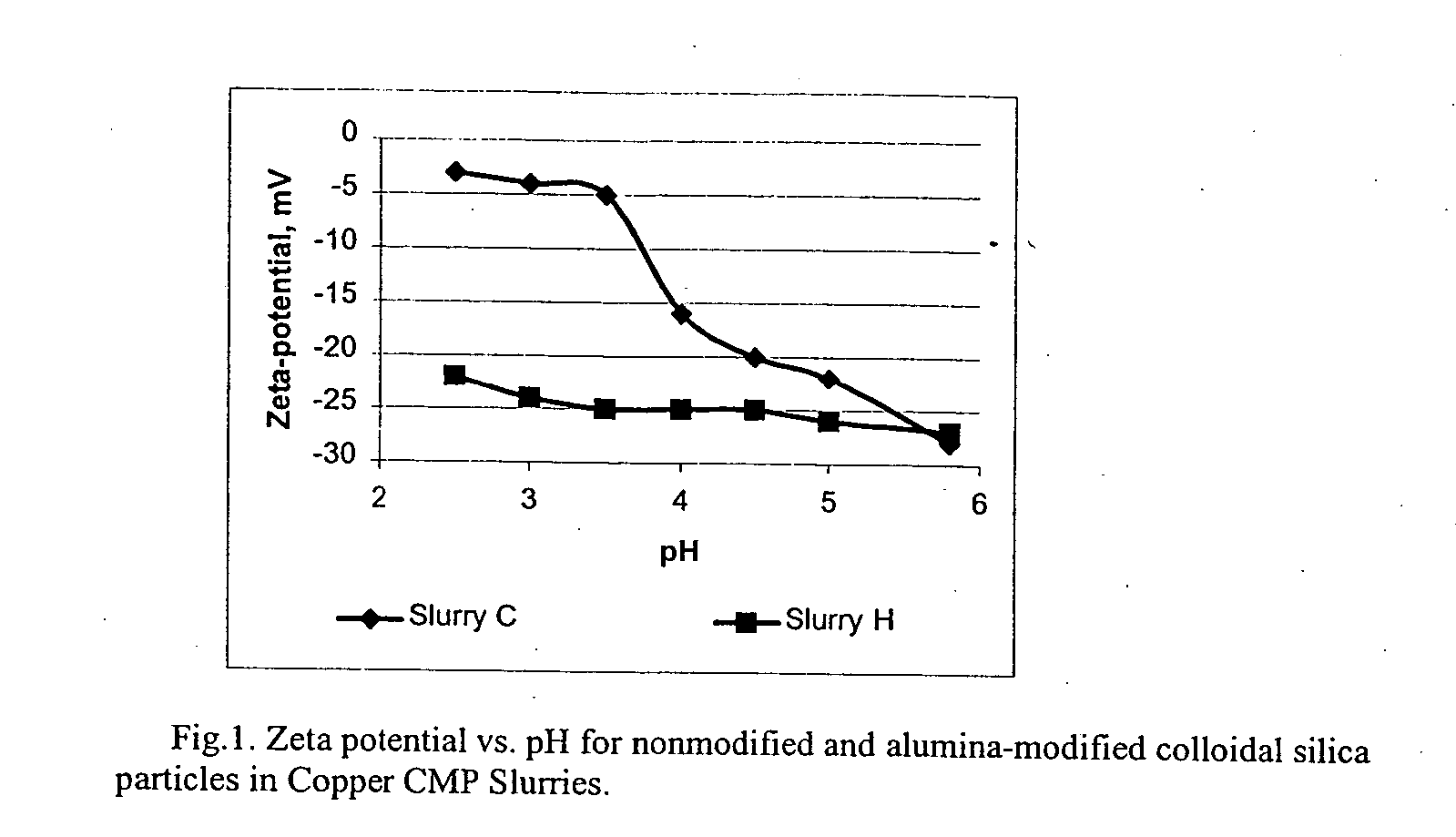

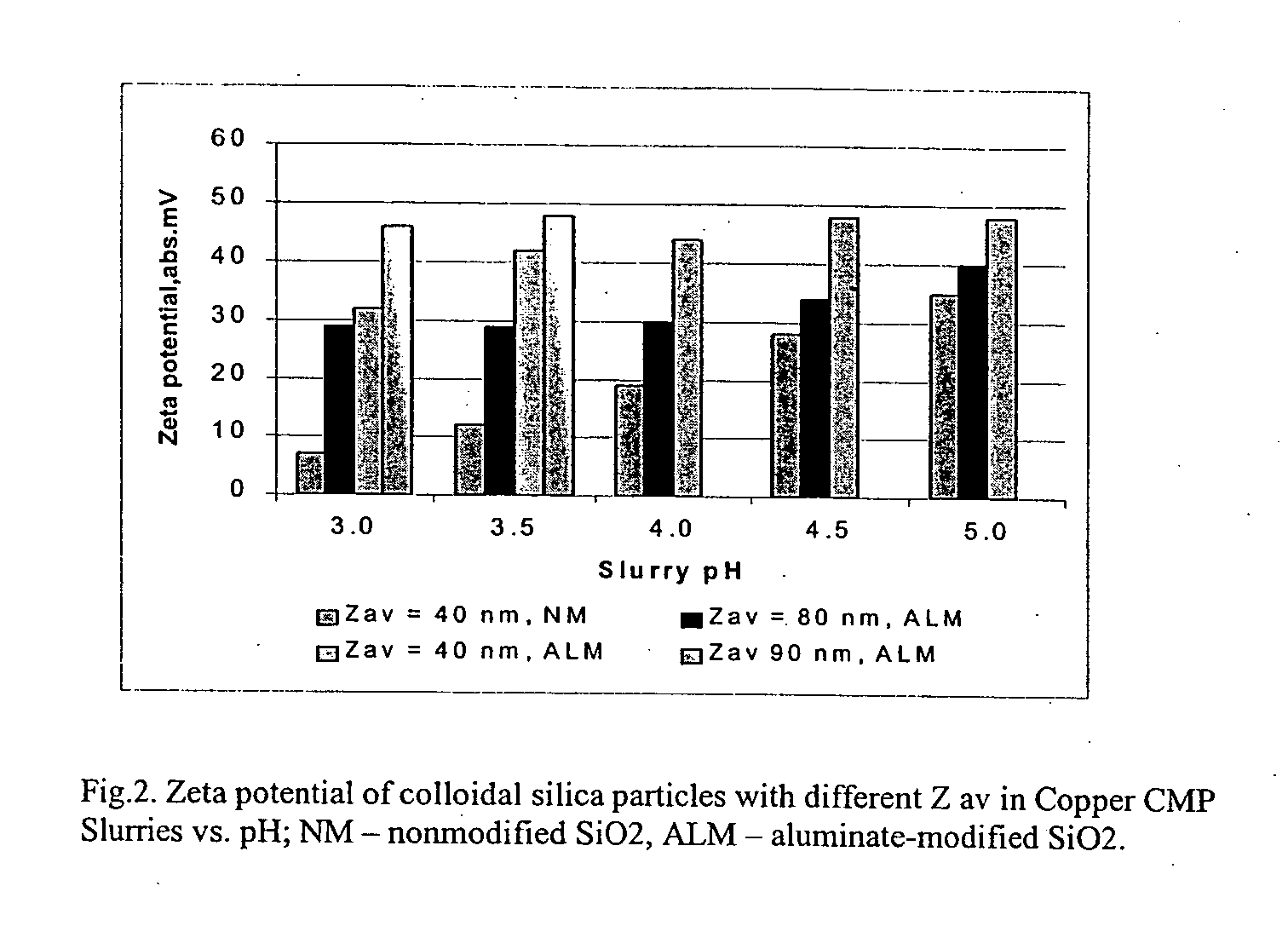

Slurry stability parameters, including zeta potential, particle size distribution, and pH drift over time, require regular monitoring through established protocols. Industry standards typically specify zeta potential values between -30mV and -50mV for colloidal silica and +30mV to +50mV for alumina to ensure adequate electrostatic stabilization. Particle size distribution measurements must demonstrate less than 10% variation over the slurry's shelf life.

Environmental impact metrics have gained increasing importance, with standardized protocols now measuring parameters such as biological oxygen demand (BOD), chemical oxygen demand (COD), and heavy metal content. Regulatory frameworks increasingly require these measurements as part of quality control documentation.

Material removal rate (MRR) serves as a primary performance indicator, typically measured in nanometers per minute or angstroms per minute. For colloidal silica, MRR values generally range from 50-200 nm/min depending on particle size and concentration, while alumina typically achieves 100-300 nm/min under similar conditions. These measurements must be conducted under standardized pressure, rotation speed, and temperature parameters to ensure reproducibility.

Surface roughness metrics, including Ra (arithmetic average), Rq (root mean square), and Rz (maximum height), provide critical quality indicators. The industry standard for semiconductor applications typically requires Ra values below 0.5 nm for final polishing steps. Colloidal silica generally produces surfaces with Ra values of 0.1-0.3 nm, while alumina typically yields 0.2-0.5 nm, though these values vary significantly with particle morphology and process conditions.

Defectivity measurements constitute another crucial performance category, quantified through light scattering techniques and expressed as defects per unit area. The semiconductor industry typically requires defect densities below 0.1 defects/cm² for critical applications. Standardized testing protocols involve controlled contamination challenges followed by particle counting using laser scanning or optical inspection systems.

Chemical-mechanical selectivity ratios must be carefully monitored, particularly in multi-material systems. These ratios compare removal rates between different materials (e.g., silicon dioxide vs. silicon nitride) and are critical for achieving planarization in complex structures. Standardized test structures with known material interfaces are employed to generate reproducible selectivity data.

Slurry stability parameters, including zeta potential, particle size distribution, and pH drift over time, require regular monitoring through established protocols. Industry standards typically specify zeta potential values between -30mV and -50mV for colloidal silica and +30mV to +50mV for alumina to ensure adequate electrostatic stabilization. Particle size distribution measurements must demonstrate less than 10% variation over the slurry's shelf life.

Environmental impact metrics have gained increasing importance, with standardized protocols now measuring parameters such as biological oxygen demand (BOD), chemical oxygen demand (COD), and heavy metal content. Regulatory frameworks increasingly require these measurements as part of quality control documentation.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!